Save up

Saving ( English saving , French épargner ) is in economics and colloquial language the renunciation of the consumption of income or goods and services (consumption renunciation ) for the purpose of later use .

etymology

The verb save comes from the old Germanic verb “spar”, which stood for “preserve” or “preserved intact”. From this the Old High German verb “sparôn” developed for “to protect”, “to receive” or “to postpone”. In the process of saving the conservation of actually is money in front of his immediate output or postponing payments . Since the 16th century, a new connotation towards the direction of the future linked to money can be demonstrated for saving . Modifications to frugality or savers as a person also appeared during this period.

General

Saving is an economic and business process. If an economic subject ( private household , company or state ) saves, i.e. if it uses less than it could use, a performance reserve is created. This reserve of performance as a renunciation of consumption possibilities can lead to future investments or increases in the future standard of living . From a business point of view, the term savings does not only apply to saving money, but also to the temporary total or partial waiver of the consumption of goods or the use of services. For example, in a company less raw , materials or supplies for the production of the same product used without the product quality or functionality suffers herein is also a savings process to see such as the energy saving . This can be the productivity increase and as a result the economy improve.

Saving is based on the one hand on rational economic considerations, on the other hand saving is a socially recognized goal that is shaped by the norms of the social environment and by education . The attributes of savers and non-savers can be clearly distinguished. Savers are more optimistic about their economic situation, believe they are in control of their finances , and are happier with their standard of living.

Conceptual content of the saving concept

The general term “saving” can have very different meanings. Depending on the context in which the term is used, it can denote at least the following five different specific facts:

- The difference between income / period ( ) and consumption ( ) of the same period (in common abbreviation:) that can be specified in a monetary amount . In the precise categories of bookkeeping, this corresponds to the net asset formation per period (for companies this means: profit ), which results from the formation of real assets plus the net financial asset formation . The opposite of this is “depriving”, using more than you have earned, reducing your net worth. The saving of a closed economy corresponds to its investment (formation of real assets ), since the net financial wealth of a closed economy is always zero. In an open economy, the domestic investment (change in real assets) plus the current account balance of a period results .

- The difference between income / period and expenditure in the same period, which can also be specified in a monetary amount ; in the categories of double-entry bookkeeping, that is, net financial wealth formation . The opposite of this is "net monetary wealth reduction"; Spend more on consumption and / or capital investments than you have earned by selling services or your own tangible assets. The net financial investment of an open economy corresponds to its current account balance, which changes its net international investment position.

- The not so easily statistically countable activity of tying up existing liquid funds in the long term, i.e. investing them, for example by converting sight deposits into interest-bearing time deposits or corporate bonds , e.g. B. Mutual Fund Bonds. In an open economy z. B. domestic foreign exchange holdings are converted into foreign government or corporate bonds.

- The difference between the (higher) consumption expenditures of an earlier period and the (lower) consumption expenditures of a later period, which can be given in an amount of money; “Restriction” of consumption not in relation to the simultaneous income (refusal to consume), but in relation to previous consumption . The opposite of this is the increase in consumption.

- The activity that cannot be statistically read off in monetary terms, using input factors to achieve a certain production or consumption goal as sparingly , “rationally”, “efficiently” as possible . The opposite of that is the waste of funds.

In view of the ambiguity of the term, unnecessary misunderstandings or even theoretical errors often result from the fact that it is not precisely specified which of these possible meanings is meant.

history

As long as there are goods or money as a means of payment , the process of saving is also known. In the early barter trade , grain , cattle , mussels , silver and gold were used as substitutes for money . If these were not spent, or not issued in full, a savings transaction had occurred. At that time, the concept of savings was only associated with specific objects. Before the breakthrough of the money economy , saving except for the storage of crops was of extremely marginal importance. In the Middle Ages , farmers slaughtered their cattle in November and December in order to save on fodder on winter days, and cured the meat. In May 1504 urged Ludwig von Eyb the younger the Palatine Ruprecht , the Landshut War of Succession is not to save money, because there were too still have enough Bohemian mercenaries. The cinematographer Georg Obrecht demanded a kind of compulsory savings in his book in 1617, according to which fathers had to pay a 6% interest-bearing amount to a “children's savings bank” when a child was born, which was to be paid out as soon as the son was 24 and the daughter was 18 years old had achieved. The economist Johann Joachim Becher hit in 1673 before a "Besoldungs-Cassa", which should take over the function of a forced savings for all state employees.

With the emergence of the first commercial savings banks during the early days , saving was institutionalized in that the savings banks with their deposit business accepted savings deposits , time deposits , sight deposits and later savings bank letters as well as other forms of investment against credit interest . The first, related forerunners of the savings banks were still called " orphan funds " or "loan funds ", such as the fund set up in 1749 by the Reichsabtei Salem to manage orphan's pensions. Through their maturity transformation , the savings banks brought the different maturity interests of savers and borrowers into line on the financial market . Subsequently, saving also spread among the banks .

Adam Smith saw in his main work The Prosperity of the Nations of March 1776, saving as a factor in increasing prosperity and assumed that saving could only come about through an incentive - the capital profit (savings interest). "But now one turns one's capital into gainful employment only for the sake of profit ...", "but the principle that drives us to save is the desire to improve our situation ...". David Ricardo understood saving as capital accumulation and assumed in October 1814 that savings are invested. Thomas Robert Malthus, on the other hand, objected in 1820 that one could also save too much, that a certain saving rate would guarantee an increase in prosperity and that saving was equated with employment . When he married in May 1837, the French general Duke of Orleans is said to have given away savings bank books totaling 40,000 francs to 1,760 children .

The unemployment of the 19th century was mainly based on the lack of capital in industry, so that the classical economists saw saving as vital for an economy, because this could meet the capital needs of industry . In 1874, Wilhelm Roscher explained the saving process with a parable about fishermen who did not consume all the fish they caught, thus saving time, building a fishing net and not having to go out to fish for a few days. In 1898, inflation was considered “forced saving” for Knut Wicksell , while in 1912 Robert Liefmann saw saving as the “conversion of income to capital”. In 1913, Wicksell recognized the exchange of two marginal benefits in saving , because "the marginal productivity of the labor and land saved is greater than that of the current, at least up to a certain limit actually not reached".

In 1929, the economist Friedrich August von Hayek assumed that the interest rate also had an allocation function that created a balance between investing and saving. The allocation function ensures that the interest directs the production factor capital into the economic sectors where it is needed most. In 1931 Hayek recognized a disturbance of the economic equilibrium in the fact that consumers invest part of their income and save, whereby he understood by "investing" money to be invested in credit institutions . In 1934 he defined saving as "keeping something or preserving it for future use". Dennis Holme Robertson pointed out in 1933 that saving does not have an immediate effect on income, but only with a delay effect . Because of this delay effect, saving is planned consumption.

In his General Theory of Employment, Interest and Money , published in February 1936, John Maynard Keynes named eight subjective reasons for saving:

- Caution ( English precaution ): as a reserve for unforeseen expenses,

- Provision ( English foresight ) to be prepared for future increased expenses,

- Calculation ( English calculation ) to interest income to use and value enhancement,

- Improvement ( English i mprovement ) to strive for an improved standard of living ,

- Independence ( English independence ) to avoid financial dependence,

- Corporate Lust ( English enterprise ) to capital for business to own activities,

- Stolz ( english pride ) to an asset bequeath to and

- Avarice ( English avarice ): the persistent shrinking from a necessary teller.

For him, saving is a reflex of the propensity to consume, which is supposed to shut down current purchasing power and has no effect on economic investment activity. Increased saving manifests itself only in a decrease in employment and income; Saving is not consumption. Following Keynes, savings are understood as the difference between total income and total consumption.

For Walter Eucken , savings existed in 1934 if longer production detours were taken while restricting current consumption. In 1942 , Adolf Weber saw saving as a rationalization of current needs in the interest of future needs. In October 1941, National Socialism introduced iron saving, a state-sponsored austerity program through which excess purchasing power was to be skimmed off and collected for warfare. After the currency reform in June 1948, there was a high pent-up demand for consumer goods in large sections of the population , which resulted in a low propensity to save. In January 1952, the savings banks introduced premium savings to improve the propensity to save .

species

A distinction is made between voluntary saving and forced saving . While voluntary saving is governed by the principle of voluntariness , compulsory saving takes place through public law or sovereign compulsion . The best-known form of compulsory saving is the levying of taxes by the state, because taxpayers cannot consume the tax portion of their income. Also forced loans belong to the group of compulsory savings, war bonds , however, can also be the voluntary tender subject. The deposit of deposits (such as the rent security ) and the investment wage are also compulsory savings - but contractually agreed forms. The repayment of loans is also to be seen as a form of compulsory saving, because the repayment installments that reduce income cannot be consumed.

In the case of voluntary saving, small-scale forms of savings have developed outside of the credit institutions. There are school, company, club and club savings ( sports , hiking or bowling clubs ). Purpose saving is voluntary saving, serves a specific intention to dispose of certain purposes and is intended for the future purchase of consumer goods or real estate ( building society savings ).

Public saving

In German budget law , the budget principles require, among other things, compliance with frugality , because the public administration is obliged to frugal budget management ( Section 7 (1) BHO ). This abstract principle of action requires the budgetary administrations to achieve a given goal with the least possible use of resources ( minimum principle ). The frugality thus implies the goal of not using all the budgeted funds for the intended purpose and thereby retaining residual expenditure.

In particular, when there are high budget deficits in heavily indebted states and heavily indebted developing countries, budget policy also focuses internationally on reducing government spending and increasing government revenues at the same time in order to consolidate government finances . This austerity policy forms the essential part of the austerity policy of states, which is usually demanded by international lenders such as the World Bank or IMF within the framework of conditionality . The aim is to reduce new government debt , and ultimately to reduce government debt .

Saving in economic theory

For Keynes, saving in the context of the consumption function ( English propensity to consume ) represents the difference between income and consumption expenditure. He regards saving and consumption as functions of income. He developed an absolute income theory , according to which the amount of savings depends in the short term on income and a relatively larger proportion of this is saved with an absolute increase in income. A relative income theory was advocated by James Duesenberry in 1949 . His savings theory - as a residue of consumption theory - assumes that consumers constantly adapt their savings behavior to a maximum income they have reached. With falling incomes, households do not respond with an immediate reduction in their consumption expenditure ( ratchet effect ) because they have become accustomed to a certain standard of living ( English habit-persistence ); as income rises, the savings rate develops independently of this. In the upswing , incomes rise, so this phase of the economic cycle is best suited for savings.

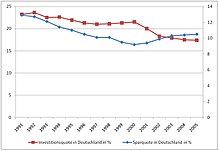

The relative share of income saved - the economic indicator of the savings rate - depends on the saving ability and willingness of the population to save, both of which are the most important prerequisites for any saving. A person is able to save if his income is so large in a certain period of time that parts of it can be withdrawn from consumption by saving without unsatisfied elementary needs. The willingness to save, on the other hand, is the inner willingness to refrain or postpone consumption. With the exception of Keynes, economic theory focuses almost exclusively on the willingness to save, which is influenced by interest rates .

The savings rate (for savings, time or demand deposits or savings bonds) is the price for giving up consumption, so that saving increases saving interest rate increases and decreases with decreasing interest rate. If more is saved than the economy wants to invest, the interest rate has to fall and will therefore reduce the incentive to save, while at the same time the incentives to invest increase.

Milton Friedman developed in 1957 as part of his consumption function theory (the theory of permanent savings english "permanent income saving theory" ), after which the saver a certain part of saving their income to that for the prevailing market rate to achieve optimal balance between present and future consumption .

Economic savings

Overall economic saving

Under the national or national saving , abbreviated usually with one understands in macroeconomics , the total income of an economy , the spending on consumption and government consumption were withdrawn shortly .

Overall economic savings can be broken down into private and public savings : where T = taxes - transfer payments (e.g. social assistance)

- Among private savings refers to the total income of an economy, the controlling and consumption were subtracted. With confidence and trust, private savings have a strong socio-psychological component, which can be expressed in an economically relevant way in the form of abstaining from consumption and saving with fear .

- Under public savings refers to the tax revenues of an economy, which the government consumption were withdrawn.

-

Private savings

- Private saving is the portion of disposable income that is not available for consumption but is put aside. The disposable income is the national income minus net taxes . Thus the private saving results from

- Private saving is the portion of disposable income that is not available for consumption but is put aside. The disposable income is the national income minus net taxes . Thus the private saving results from

-

Public savings

- State (public) savings , on the other hand, are defined as the difference between state income and state expenditure. The net taxes form the government revenue and the consumption of the public budgets form the government expenditure . Thus applies to state savings

- State (public) savings , on the other hand, are defined as the difference between state income and state expenditure. The net taxes form the government revenue and the consumption of the public budgets form the government expenditure . Thus applies to state savings

The total economic saving / national saving then results from the sum of private and state savings. According to the current literature, this is described as. In order to be able to show a direct relationship between national savings on the one hand and private and state savings on the other hand, the relationship is presented mathematically below.

Relationship between savings and investment

In a closed economy there is a direct connection between total economic savings and investments . This results from the definition of the macroeconomic demand function:

After changing the demand function you get:

If this is equated with national savings, the result is:

The equation is not an identical equation, because there is no direct connection between the savings motives of the income earners and the investment motives of the entrepreneurs . The imbalance between the two aggregates is compensated for by the interest rate. Whether investments can also be stimulated through savings processes is a question of economic dynamism. At this point we do not discuss any further contexts and refer to the article on goods market equilibrium .

If one now looks at an open economy, in addition to the already valid context , the foreign trade of an economy must also be taken into account. This then results in (where NX stands for net exports). This is where the main difference between open and closed economies is based. While closed economies can only increase their capital stock by saving, in an open economy the capital stock can be increased through the acquisition of foreign assets plus your own savings and thus investment opportunities can be used earlier. Thus, by borrowing abroad, you can increase investments at home without changing your savings.

National accounts

The overall economic saving is (in the open economy) equal to the domestic investments plus the net foreign investments ,

- (NFI always corresponds to net exports ).

In the theoretical closed economy the following applies: S = I

When saving, the correct assessment of saving must be observed - see DIW :

In the national accounts (VGR) “saving” is defined in the income use account (expenditure concept) as

- Disposable income (expenditure concept)

- plus increase in company pension entitlements - this figure appears in the household and non-profit-making organizations sector

- minus the increase in company pension entitlements - this figure appears in the corporations sector - in macroeconomic terms this figure is zero.

- Less consumption (expenditure concept) - including financial services ( Financial Intermediation Services, Indirectly Measured (FISIM) )

Macroeconomic importance of saving

Saving or changing saving behavior has several effects on the economy , which are controversial among the various growth theories. In the neoclassical model , an increase in savings leads to lower capital market interest rates and thus to an increase in investments. The optimal savings are given by the so-called time preference rate . In Keynesianism , on the other hand, the lack of demand resulting from increased savings comes to the fore: This would reduce the profits from the investments already made and thus fewer in-house sources of finance ( equity ) would be available (which would also reduce the willingness of banks to lend) . In addition, it is unlikely that companies would make expansion investments if demand fell .

Delimitations

When retirement savings is a savings vehicle that will protect against emergencies ( sickness , unemployment , retirement ). The “retirement savings” motif includes protection against uncertainties , maintaining a level of consumption once it has been reached, and the flexibility of intertemporal consumption (i.e. liquidity ). Securing liquidity through savings , i.e. by not consuming consumption and reducing costs , usually does not lead to new reserves for highly indebted people , but only to avoid new borrowing . Saving should not be confused with hoarding , in which money is kept in the piggy bank, under the mattress or in the safe without investing it. Save the other hand generally remunerated with an interest and remains in the economic cycle , while the hoarding will not be reimbursed and the economic cycle is withdrawn.

See also

literature

- Paul Krugman, Maurice Obstfeld: International Economy . 7th edition. Pearson Education Germany, Munich 2006, ISBN 3-8273-7199-6 .

Web links

- Analysis of the IMF on global savings and investment behavior (in English) (PDF file; 285 kB)

- ( Page no longer available , search in web archives: April 17th, 2008, 8:34 pm )

Individual evidence

- ↑ Günther Drosdowski, Duden-Etymologie: Origin dictionary of the German language , 1989, p. 685

- ↑ Gerhard Köbler , Etymological Legal Dictionary , 1995, p. 376

- ↑ Wolfgang Pfeifer, Etymological Dictionary of German , MZ, 1993, p. 1316

- ↑ Günther Drosdowski, Duden-Etymologie: Origin dictionary of the German language , 1989, p. 686

- ↑ Fritz Voigt, The economic saving process , 1950, p. 17

- ↑ Dieter Frey / Lutz von Rosenstiel / Niels Birbaumer / Julius Kuhl / Wolfgang Schneider / Ralf Schwarzer (eds.), Enzyklopädie der Psychologie: Volume 6: Wirtschaftspsychologie , 2007, p. 123

- ↑ Dieter Frey / Lutz von Rosenstiel / Niels Birbaumer / Julius Kuhl / Wolfgang Schneider / Ralf Schwarzer (eds.), Enzyklopädie der Psychologie: Volume 6: Wirtschaftspsychologie , 2007, p. 127 ff.

- ↑ Rolf-Dieter Grass / Wolfgang Stützel , Economics - an introduction also for non-specialists. ´, Munich: Vahlen, 1988, p. 365

- ↑ Wolfgang Cezanne: General Economics . Munich: Oldenbourg Verlag 2005, p. 241 ( online )

- ↑ Johannes Schmidt, Saving - Curse or Blessing? Notes from an old problem from the perspective of balance mechanics , in: Martin Held / Gisela Kubon-Gilke / Richard Sturn (eds.), Lessons from the crisis for macroeconomics, yearbook normative and institutional basic questions of economics (Vol. 11), Marburg: Metropolis, 2012, pp. 61-65

- ↑ Felix Wilke, Saving Out of Uncertainty: The Preservation of Options for Action as a Drive for Individual Savings Decisions , 2010, p. 6

- ↑ Hans-Werner Goetz, Life in the Middle Ages: From the 7th to the 13th Century , 1986, p. 155

- ↑ Sven Rabeler, Niederadlige Lebensformen im late Mittelalter , 2006, p. 307

- ↑ Georg Obrecht, Fünff Vndifferliche Secreta Politica , 1617

- ^ Fritz Voigt, The economic saving process , 1950, p. 149

- ↑ Johann Joachim Becher, Politischer Discurs: From the real causes of the rise and fall of the cities, countries and republics , 1673

- ↑ Adam Smith, The Wealth of Nations , 1776, pp. 235-2.

- ^ David Ricardo's letter to Thomas Robert Malthus dated October 23, 1814

- ^ Thomas Robert Malthus, Principles of Political Economy , 1820, p. 325

- ^ Wilhelm Roscher, Natural History of the Monarchy, Aristocracy, Democracy , 1933/2015, p. 476

- ↑ Ulrich van Suntum, The invisible hand: Economic thinking yesterday and today , 2005, p. 151

- ^ Wilhelm Roscher, Geschichte der Nationalökonomik in Deutschland , 1874, p. 21 ff.

- ↑ Knut Wicksell, Geldzins und Güterpreise , 1898, pp. 102 and 143

- ^ Robert Liefmann, Theory of Savings and Capital Formation , in: Schmoller's Yearbook for Legislation, Administration and Economics, 1912, pp. 1565, 1579

- ↑ Knut Wicksell, Lectures on Economics based on the Marginalprinzipes , Volume 1, 1913, p. 218

- ↑ Friedrich August von Hayek: Geldtheorie und Konjunkturtheorie , in: Contributions to Konjunkturtforschung No. 1, 1929, p. 118

- ↑ Friedrich August von Hayek, Is there an absurdity in saving? , 1931, p. 75 ff.

- ↑ Friedrich August von Hayek, Is there an absurdity in saving? , 1931, p. 80

- ^ Friedrich August von Hayek, Encyclopedia of Social Sciences , 1934, p. 548

- ↑ Dennis Holme Robertson, Saving and Hoarding , in: The Economic Journal vol. 43, 1933, p. 399

- ^ John Maynard Keynes, General Theory of Employment, Interest, and Money , 1936/1955, p. 92

- ↑ John Maynard Keynes, General Theory of Employment, Interest and Money , 1936, pp. 223 ff.

- ↑ Gerhard Colm, National Economic Total Accounting , in: Erwin von Beckerath / Hermann Bente et al. (Eds.), Concise Dictionary of Social Sciences, Volume 11, 1961, p. 395

- ↑ Walter Eucken, Capital Theoretical Investigations , 1934, p. 138

- ^ Adolf Weber, Briefly summarized Economics , 1942, p. 46

- ^ Gerhard Müller / Josef Löffelholz, Bank-Lexikon: Concise dictionary for banking and savings banks , 1961, Sp. 1119 ff.

- ^ Fritz Voigt, The economic saving process , 1950, p. 148

- ↑ Klaus Grupp, Die Wirtschaftlichkeitkontrolle , 1985, p. 8 ff.

- ↑ John Maynard Keynes, General Theory of Employment, Interest and Money , 1936/1955, p. 57

- ^ John Maynard Keynes, General Theory of Employment, Interest and Money , 1936/1955, p. 78

- ↑ John Maynard Keynes, General Theory of Employment, Interest and Money , 1936/1955, pp. 96–98

- ↑ James Duesenberry, Income, Saving and the Theory of Consumer Behavior , 1949, pp. 54-81

- ↑ Fritz Huhle, Willingness to save and the ability to save as components of saving activity , in: Fritz Voigt u. a. (Ed.), Contributions to the theory of saving and economic development, Volume 1, 1958, p. 87

- ^ Anton Burghardt / Alois Brusatti, Sociology and Social Policy , 1980, p. 66

- ↑ Klaus Rose, Theory of Income Distribution , 1965, p. 56

- ↑ Ulrich van Suntum, The invisible hand: Economic thinking yesterday and today , 2005, p. 105

- ^ Milton Friedman, A Theory of the Consumption Function , 1957, p. 11

- ↑ Gerhard Müller / Josef Löffelholz, Bank-Lexikon: Concise dictionary for banking and savings banks , 1961, Sp. 1121

- ^ Paul Krugman / Maurice Obstfeld, Internationale Wirtschaft, 6th edition, 2004, p. 399

- ↑ Economic policy considerations: Saving as a prerequisite for investing?