National debt

As government debt is defined as the combined debt of the state , ie the liabilities of the state to third parties. The national debt is usually shown gross, which means that the state's liabilities are not netted with its state assets (or parts thereof) .

According to Eurostat , the government debt level is defined in the Maastricht Treaty as the nominal gross total debt level of the government sector after consolidation , i.e. the offsetting of claims and liabilities within the government sector. The government sector includes central government and extra budgets , federal states , municipalities and social security . According to the Maastricht convergence criteria , EU members (and in particular members of the euro system) should not exceed 60% of public debt in relation to nominal gross domestic product (the so-called debt ratio ).

General

The national debt is not only an object of knowledge in economics , but also occupies finance , business ethics , law , political science and public business administration . As one of the objects of knowledge in economics, it deals with the role of the state as a debtor as an economic subject . Fall in the state budget the government revenues and government spending in an imbalance and lead to a budget deficit , then this can only by borrowing (approximately over government bonds are) balanced if appropriate cuts in government spending in the short term can not be expected in the short term is not possible and increases in government revenues. In Germany, government debt is defined as “all of the federal government's obligations to be met in cash , provided they are not part of the current budget . The liabilities to be processed in the context of cash and budget management are therefore excluded ".

history

In its history, which can be traced back to the Roman Empire , the national debt repeatedly caused crises in the state finances . During the Roman Empire, however, governments only incurred debts in exceptional cases, whereas the high phase of national debt began in the Middle Ages . War spending, in particular, drove up national debt. Public credit developed as early as the 12th century, when in 1121 the Italian city-state of Genoa received loans from bankers at a lending rate of 25%, which rose to 100% in 1169. Edward III. took out a state loan from a consortium of the Hanseatic League in May 1340 in return for pledging the wool duties of all English ports. The establishment of a public debt market in Florence in 1345 preceded the city's bankruptcy. In 1557, due to the crisis, Spain unilaterally converted its government loans into government bonds , thereby driving several banks into bankruptcy. Philip II declared on November 29, 1596 the bankruptcy of Spain because of excessive interest payments and stopped the payments.

The mercantilism was the latest since 1689 because of its positive and comprehensive attitude towards the state activities of government debt positive about and pursued a systematic long-term government debt. The mercantilist doctrine saw borrowing as a legitimate state cover, because the expansion-oriented economic policy could only be financed with the help of loans. Mercantilist Jean Bodin did not count public credit among his seven sources of government revenue in 1583, even though he treated public credit in connection with public debt. Already Veit Ludwig von Seckendorf representing the cameralism - the German version of mercantilism - held in 1655 the state credit for "proper use" but not in "chronic deficit spending" appropriate and advocated orderly state finances. He did not completely reject the government loan. The French theologian Jean-François Melon de Pradou claimed in 1734 that the debts of the state are the debts of the right hand to the left hand, whereby the body belonging to it is not weakened at all ( French les dettes d'un Etat sont des dettes de la main droite à la main gauche, dont les corps ne se trouvera point affaibli ).

The Physiocrats turned away from debt-friendly mercantilism and took the opposite position. As a result, David Hume's national debt pessimism came to expression in 1752, because "either the nation must destroy the national debt or the national debt will destroy the nation" ( English either the nation must destroy public credit, or public credit will destroy the nation ) . The classic economists also turned away from the mercantilist debt policy. For Adam Smith , the state only supported unproductive labor with its debts, as he describes in his book The Wealth of Nations in 1776 . He is considered to be the founder of the crowding-out , through which private demand is displaced by state, credit-financed demand, because the state, through its interest-insensitive behavior, displaces private market participants from the capital market and goods market . "The enormous increase in national debt, which is currently crushing all major states and is likely to bring about their ruin, is of the same shape everywhere". On September 6, 1789, the later US President Thomas Jefferson wrote to James Madison : “No generation may take on more debts than it can repay during the time it was in existence” ( English Then no generation can contract debts greater then maybe paid during the course of it's own existence ). Immanuel Kant , in his essay On Eternal Peace of September 1795, demanded that “no national debts should be incurred in relation to external state trades” because he saw the cause of wars in state credit. Because states could wage wars with credit and states that went bankrupt because of credit would be defeated.

In 1817 David Ricardo saw in national debt the most terrible scourge ever invented to plague the nations. He provided a circular theory explanation for the equivalence of tax and credit financing, since the interest on loans to be paid by the state is financed by taxes , because the tax “only passes from those who pay it to those who receive it, ie from the taxpayer to the state believer ”. The nullity of national debts (repudiation) first appeared in May 1841 as a result of the cotton crisis in Mississippi in 1839 , because the government loan in question had not been approved by parliament. In Germany, Friedrich List in 1841 considered the state credit system to be "one of the most beautiful creations of modern statecraft and a blessing for the nations". Years later, in 1867 , Karl Marx described the view that a people would become richer with increasing national debt as the “creed of capital”. Lorenz von Stein wrote in his textbook on public finance in 1875: “A state without public debt is either too little for its future or it demands too much from its present”. Even Adolph Wagner advocated the national debt in 1879 because the state should invest and have to finance the resulting government spending.

However, the debt-friendly representatives overlooked the negative effects that could lead to moratoria or national bankruptcy . Argentina suspended debt servicing between 1829 and 1857, followed by another moratorium in April 1987, and finally in January 2001 the country declared a state of emergency , combined with the insolvency for government bonds in February 2001. Italy's national budget has been almost uninterrupted since the state was founded in May 1861 characterized by a high level of national debt. In October 1861, Mexico announced a moratorium due to the high debt, which Napoleon III. provided the pretext for French intervention in December 1861. Colombia declared no fewer than 13 national bankruptcies between 1820 and 1916.

In his book General Theory of Employment, Interest and Money in 1936, John Maynard Keynes was convinced that the state would have to counter a recession with increased government spending at the expense of temporary government debt and thus an economic recovery through countercyclical increased government demand (deficit financing, English deficit spending ).

After the Second World War, the national debt took on proportions that induced the rating agencies in 1982 to rate the increasing country risks with a national rating. The national debt first reached excessive levels from March 1997 in Asia ( Asian crisis ), then from May 1998 during the Russian crisis and finally in Europe. It increased the financial risks for creditors and conjured up the danger of financial crises . Thus, financial crises were not only the result of increasing national debt, but also their cause: After financial crises, national debt rose by an average of 86%. This also applied to the PIIGS countries, which were on the verge of insolvency during the euro crisis from April 2010 as a result of the national bank bailout and structural problems (see Greek sovereign debt crisis ).

Economic importance

The assessment of national debt is controversial in economics: while David Ricardo and many of his contemporaries disapproved, from a Keynesian point of view, a temporary national debt to smooth out the economic trend can be justified.

Economic limits

Governments can only borrow to a limited extent, since above a certain level of indebtedness investors and creditors begin to doubt their ability to repay. The assessment of the creditworthiness depends primarily on the primary surplus ratio, i.e. the budget balance without taking interest payments into account, based on GDP. If the debt is high, comparatively high tax revenues or low government expenditures are necessary in order to be able to finance the interest payments.

For countries with high national debt, not only do the interest rates that investors charge on their loans increase, but the number of investors who are still willing to make money available also decreases. A heavily indebted state can get into a vicious circle of ever higher financial obligations ( interest and repayment of existing debts) and increasingly limited access to the financial market . This can end with the loss of creditworthiness or even with the insolvency of the state ( national bankruptcy ), especially if the debt is in a foreign currency .

Monetary public finance

If a state or association of states has its own currency and the central bank - unlike in countries with independent central banks - is obliged to implement the decisions of the executive, the government can make monetary policy decisions, e.g. reduce or increase the money supply. From an economic history point of view, state-controlled increases in the supply of money have often been used to repay debts and finance economic stimulus or armaments programs, for example in the economic policy of the global economic crisis or in times of war. In extreme exceptional situations that threaten the existence of a state, inflationary risks due to an increase in the amount of money are unavoidable (reparations claims after the First World War, financing of war and post-war costs) and the payment of credit debts from tax revenues is usually impossible after wars precarious situation insufficient creditworthiness for the required credit volume for economies weakened by the effects of war.

This "money press financing" can lead to a loss of credibility and creditworthiness. In addition to the desired effect of devaluing the external value, inflation can also lead to an undesirable devaluation of financial assets in the relevant currency. Because of the inflationary risks, monetary state financing in the European Union is prohibited under Article 123 of the TFEU , just as central banks in general have been designed more and more as independent institutions that have to protect the stability of the currency since the Second World War.

The policy of quantitative easing , which was applied after 2001 by the central banks of Japan , the United States and the euro zone , among others , is also viewed by critics as a form of indirect monetary government financing that hardly differs from direct financing. In addition, the monetary policy of the ECB has been pursuing the goal of generating moderate inflation, i.e. also the slow devaluation of financial assets, with interest rates approaching zero.

Public debt classifications

The national debt can be distinguished:

According to internal and external creditors

The indebtedness of a state can be classified according to whether the creditors are domestic or foreign economic entities (individuals, households, banks, companies), also called internal and external indebtedness. Behind this classification stands the simplistic idea that internal debt of the state equates to debt to itself. The idea is “simplifying” because only in the case of a theoretical equal distribution - i.e. if a state owes each of its citizens or households the same amount of state liabilities and every citizen or household also has tax liabilities of at least this same amount to the state - the National debt would only be directed against itself in such a way that consolidation or offsetting would be possible and there would be practically no national debt at all. External indebtedness, however, burdens a state without the state being able to offset it against its citizens or households, because actual third parties are the creditors.

According to your own and foreign currency

The debt of a state can be classified according to the currency in which the capital services (interest and repayment) are to be provided to the creditors. The idea behind this classification is whether a state can possibly influence the currency in which it has to provide its capital services. This would be the case with debts in a national currency and a high level of dependence of the national central bank on the state governments. Even if the central bank becomes independent, this potential for influence decreases. In the case of a common currency such as the euro, there is only a weak influence, while in the case of debt in a real third currency, no influence can be assumed.

After delimitation of the state debtor institutions

In a federal state in particular, there may be various bodies, e.g. B. give federal, state, cities and municipalities that have taken on a debt. In the same way, debts can be borrowed jointly with several countries, as is the case for projects in the EU. Furthermore, a distinction must be made as to whether debts have been taken on in the core budget of a regional authority or in an extra budget . In this context, a distinction can be made between the national debt of the public core budgets and the national debt of the general public budget (core budgets + extra budgets).

According to different measurement concepts

In Europe, for example, a distinction must be made between the published credit market debt of the public sector in terms of financial statistics, the Maastricht debt level and the colloquial debt level. Depending on the accounting style used, the measurement concept used can be based on cameral (amount of liabilities) or double data (liabilities + provisions ). Not least because of the lack of general government data, double debt levels can i. d. Usually, however, only be determined for some of the regional authorities.

According to the cause

This is mostly classified according to the financing of the cyclical and structural budget deficits through public debt. By definition, cyclical deficits are balanced with cyclical surpluses in the long term, i.e. cyclical deficits in an economic downturn are offset by cyclical surpluses in an economic upswing. If the gross domestic product is equal to the production potential , i.e. if the output gap is zero, then the cyclical deficit is zero according to its definition. In detail, the structural deficit is defined as a percentage of the potential gross domestic product as the total deficit minus the cyclical deficit. The cyclical deficit is the output gap multiplied by the difference between the elasticities of government revenues and government expenditures with regard to the automatic stabilizers . The distinction between cyclical and structural public deficits is included in the regulations on the debt brake and the European Fiscal Compact .

According to explicit and implicit national debt

The national debt presented so far is the explicit national debt . These are all liabilities directly identifiable from the state budget, such as government bonds. However, there are also future expenditures and liabilities that are often not apparent from the current state budget, but can or will burden later budgets ( implicit national debt or shadow debt ). This applies in particular to future payment obligations such as the civil service pension . This lack of transparency is favored by the cameralistics of most national budgets. In addition, the depreciation of state assets is only reflected in the change in capital assets , while the much larger depreciation requirement for public infrastructure is not taken into account. On the other hand, the Doppik requires that provisions are made in the balance sheet for future expenses and for contingent liabilities assumed under certain conditions .

Against the background of the euro crisis , the European Central Bank (ECB) has now warned of the consequences of shadow debt in the euro countries. The guarantees for other EU member states and its own banks could increase Germany's debts by 11.2% to a national debt ratio of around 90% of gross domestic product (GDP).

Criticism of the measurement concept

The official portrayals of public debt are criticized for the fact that, in addition to the published debt, there may be other liabilities that are not, only to a limited extent or are published in other contexts, although they are economically fully borne by the state. Such a debt, which is initiated by a government budget, but is not reported in this budget (e.g. outsourcing to secondary budgets), is referred to as hidden government debt .

In addition, the term implicit public debt is sometimes used, which mainly includes future pension payments. Bernd Raffelhüschen is of the opinion that, contrary to the principle of prudence and completeness imposed on the private sector, the published government debt usually results in a too favorable representation of the actual debt situation, since no future pension expenditure (as pension provision) is shown in the measurement of government debt.

According to the European System of National Accounts, state extra budgets and special funds are allocated to them as part of the total state budgets .

Critical positions

The effect of national debt on national and international economies can be seen in the following example. If, for example, the national debt (gross) reaches the level of the gross domestic product ( national debt ratio therefore 100%) and, assuming an interest rate of 6%, the tax revenue is 33% of the gross domestic product, the tax revenue is already burdened with 18% interest expense ( interest coverage ratio ). After servicing the debt , the state then only has around 80% of the tax revenue for its actual public finance tasks. Conversely, in the case of negative interest rates , debt can generate income for the state.

Distribution of Debt over the Generations

Critics of a debt policy argue that the national debt means that the current generation is living at the expense of future generations (generation balance sheet). According to this, national debts are postponed tax increases to the future , which are then "to be borne by the following generations".

This relationship is known in macroeconomic theory as the Barro-Ricardo equivalence proposition and contains the core statement that the permanent income of households does not change due to the new debt (= tax cut) and therefore has no effect on the expenditure (= demand) of the households, because households are already anticipating future tax payments, which are due to their current debt, by saving in the present. In this context, the question is discussed whether the securities issued by the state represent assets or correspond to ongoing taxation, since economic entities recognize that the securities will have to be repaid with future tax increases. For this reason, an increase in the budget deficit that is not accompanied by government spending cuts should lead to an increase in the savings rate of the same amount.

The Keynesian critics of this neoclassical theory, on the other hand, argue that a tax cut can certainly have an impact on demand, since it eases the liquidity constraints (inability to take out loans) of many households because they have more liquid funds at their disposal. Empirical studies show that the Barro-Ricardo equivalence cannot be unreservedly valid, since the tax cut implemented in the USA in the early 1980s (→ Reaganomics ) did not lead to an increase in the savings rate (the savings rate fell from around nine percent per year 1981 to below five percent in 1990).

Austerity measures and rationality trap

The assessment of the fight against national debt through austerity measures can be subject to a so-called rationality trap. What sounds plausible at first glance and makes sense to every private household ("I have too much debt, so I have to save."), Can have unexpected consequences for the economy: If the state cuts its spending, for example by making transfer payments to industry and Households in the form of grants and subsidies , this inevitably has an impact on the revenue side of the state budget : Households can react to the actual and / or perceived decrease in income by reducing consumption and increasing their propensity to save . As a result, the aggregate or overall economic demand falls and leads to falling or negative economic growth, which at the same time reduces the tax revenue of the state, which can effectively lead to a negative saving effect. The individual rationality (saving reduces debts) is thus in conflict with the collective rationality (if everyone saves, this could have no or negative effects on the state budget).

creditor

The state's indebtedness is split between domestic and foreign creditors. The indebtedness towards these two groups of creditors must be assessed differently. While domestic debt leads to a redistribution of wealth within the economy (see redistribution and generational problems in this article), liquidity flows into another economy in the case of interest and repayments on foreign debt . The repayment of foreign debts will deprive the economy of liquid funds in the future, but it can be argued that countries like Germany (the German state and German households together) could be net creditors from a global perspective (depending on the creditworthiness of the debtor states ), which is why a global debt reduction could contribute to an inflow of cash. The arguments of the tax increase / distribution problem and the economic theory-based warning of excessive foreign debt in net debtor countries can thus be separated from the argument of the burden on generations.

If credit institutions for their part borrow money from a central bank , the central bank indirectly lends money to the state.

Crowding out private investment

Especially if it is assumed that there is a limited supply of money or credit and, to that extent, increased demand for credit narrows the respective capital supply - thus increasing the price for granting credit, increasing the lending rate - an increased demand by the state for "money" makes it more expensive. the financing costs of companies and crowd out their planned investments, which is why competitiveness and economic growth suffer. This negative economic effect of increasing national debt is known as the crowding-out effect. However, Wilhelm Lautenbach , for example, pointed out as early as 1936 that essential basic assumptions about this thought model are only valid to a limited extent. If the state spends large amounts of loan-financed funds on domestic investments, private investments can be crowded out if (1) the degree of capacity utilization of the domestic industry for the production of capital goods is already very high and (2) no substitute can be imported. Even if production capacity is not yet exhausted and imports are possible, a crowding out can occur if higher prices for capital goods make private investments less profitable. If the investments are then neglected, a displacement has taken place. The crowding-out argument is not based on a shortage of money, but on the limited production capacity of an economy (real economic displacement).

Inflationary effects

In order to finance government spending, countries with a non-independent central bank often have the incentive to have this done solely through the central bank's money creation. If additional funds are not withdrawn elsewhere (see also shortening of the balance sheet ), the production and supply of goods stagnate or even decrease in relation to one another , this results in an inflationary trend . Especially when war financing was done by creating money through the respective central bank , as was done, for example, by the Reichsbank , this often led to hyperinflation (see German inflation 1914 to 1923 ) and subsequent currency reforms (such as 1924 and 1948 ).

The economic development of Japan in the 1930s, on the other hand, shows that financing government spending through money creation and expansion of the money supply can also lead to overcoming the crisis with moderate inflation. Income grew by 60 percent between 1931 and 1936, internal inflation was 18% over the same period, and the external value of the yen fell 40%.

Conversely, an overly restrictive monetary policy by an overly independent central bank can also lead to deflation , credit crunch and a banking crisis (such as the German banking crisis of 1931 ).

Keynesian reasoning

In Keynesian terms , government debt is seen as an economic policy tool both to counter deflation and to overcome gaps in demand. With his economic balance mechanics , Wolfgang Stützel showed how a comprehensive debt repayment through revenue surpluses of the state would force a corresponding debt of the private sector from a Keynesian point of view, which with a negative Keynes multiplier leads to crisis and deflation. For this reason, various Keynesian economists are calling on the state to borrow in the long term in order to avoid recession and deflation in order to enable the private sector to accumulate financial assets accordingly.

The deficit spending comes in for a properly understood Keynesian policies only after a relaxation or abandonment of responsible in many cases for an economic crisis restrictive monetary policy . Before the outbreak of the global economic crisis, John Maynard Keynes argued vehemently against a foreseeable deflationary policy of the central banks and against the gold standard . In 1930 Keynes demanded that those in charge of the central banks adopt an expansive monetary policy in order to overcome the crisis. Only after the abandonment of the gold standard and the beginning of an expansive monetary policy by the central banks did Keynes also plead for a policy of deficit spending by the state to overcome mass unemployment, because in a severe deflation no feasible lowering of interest rates would be sufficient to end the crisis .

According to Keynesian theorists, the state should pursue an anti-cyclical budget policy. In order to close a demand gap, the state could bring about an economic upswing by means of higher government spending or tax cuts ( start-up financing ), with which private consumption could be promoted and industrial investment could increase (depending on the following). In return, the income and consequently the tax revenue would increase. Under certain circumstances, the debt paradox would occur : The additional tax revenue would exceed the costs of repaying the national debt.

Whether an additional increase in national debt can lead to budget-consolidating growth is a matter of dispute among experts. In the case of Japan, for example, no significant growth rates could be achieved despite years of Keynesian economic policy. If the interest demands on the part of the creditors are higher than the annual new debt when the national debt is high, a liquidity gap opens up that the state can only close by taking on additional debt, liquidating state asset positions, reducing current state expenditure or increasing taxes; see compound interest . Thus the original goals of the debt policy [either a) Keynesian stimulation or b) financing of current state activity without having to levy taxes] would be reduced to absurdity if the state-induced stimulation of demand does not lead to the desired economic growth and thus higher tax revenues or the state not correcting its spending policy on the upswing.

The extent to which high national debts can lead to economic upheavals depends on the proportions in which the national debts are borne by domestic and foreign creditors. If necessary, a state can counter domestic debt through financial policy; Foreign debts, on the other hand, are beyond direct fiscal influence.

See also: Keynesianism

Distributional Effects of National Debt

The distributional effect of national debt is controversial. A distinction must be made between several aspects:

The interest burden which the state has to pay through taxes or spending cuts and which is paid to the creditors reduces the state's leeway and thus requires political decisions. If taxes are not to be increased, the proportions of the budget that contribute to redistribution will decrease , unless other expenses are cut even more in their favor.

However, if debt-financed investments by the state, for example in infrastructure or the temporary support of companies, make sense in order to favor or secure sustainable tax income and thus more than offset the above-mentioned effect, this measure increases the state's scope for distribution. This idea can also be found in the reasons for stimulus packages in times of crisis. The evaluation of the chances of success of the respective measures or their omission is obviously difficult in many cases and is discussed extensively in politics and science.

Twin deficit

When a country has both a government budget deficit and a current account deficit , it is called a twin deficit . In this situation, the increasing national debt is partly financed through foreign loans. This is only possible as long as foreign investors have confidence that the exchange rate of the state's currency will be stable. If confidence falls, it is necessary either to raise interest rates or to curtail domestic consumption, which in turn affects economic growth. In extreme cases, the national debt contributes to the development of financial crises .

Legal limitation of national debt

Various countries have implemented legal limits on government borrowing in recent years:

- European Union : Stability and Growth Pact and Fiscal Pact

- Germany : debt brake

- Switzerland : debt brake

- USA : debt ceiling

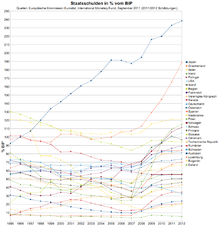

National debt in an international comparison

In order to be able to compare the national debt of different countries, it must be taken into account that the economies are of different sizes. Therefore, one puts the total debt in relation to the gross domestic product (GDP). Example: Germany's national debt was around 61% of GDP at the end of 2018, while Austria's rate was just under 74%.

According to data from the International Monetary Fund from September 2011, the debt ratio in 46 of 171 countries was above the 60% of GDP ( Maastricht criteria ), below which national debt is generally not considered to be critical. In 13 of these countries it was even over 100%. Half of the 171 countries listed by the International Monetary Fund had a debt ratio below 44%.

While the debt ratio was reduced in 91 countries between 2000 and 2007, it rose in 24 countries and remained roughly the same in 30 countries (less than five percentage points change). From 2007 to 2011, on the other hand, the debt ratio rose in 83 countries worldwide, while it fell in 39 countries and remained roughly the same in 48 countries. These differences in debt development can be traced back to the financial crisis from 2007 and the subsequent euro crisis , which directly or indirectly affected many countries around the world.

Public debt in industrialized countries

The phase of economic growth from the end of the Second World War to the early 1970s enabled most industrialized countries to reduce their debts. After that, debt rose rapidly in almost all OECD countries until 1996; after that it sank slightly again. The most important reason for the sharp rise in German national debt in the 1990s was reunification . The average of the OECD countries was 64.6% in 2001 (with large differences: Australia 20.9%, Japan 132.6%, Germany 60.2% according to OECD criteria). The financial crisis from 2007 onwards drove up debt in the euro countries to an average of almost 85 percent of GDP (before the crisis: 70 percent).

There is slightly varying information from various sources on national debt. The following table shows the list of the Austrian Chamber of Commerce (as of May 2019 and source EU Commission, OECD). Numbers in italics are forecasts. Eurozone (19) European Union (28), but not Eurozone (19) not European Union (28) > 90% > 60% > 30% ≤30%

| country | 2000-2009 average |

2010-2014 average |

2000 | 2005 | 2010 | 2014 | 2015 | 2016 | 2017 | 2018 * | 2019 * | 2020 * |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

98.4 | 103.9 | 108.8 | 94.7 | 99.7 | 107.5 | 106.4 | 106.1 | 103.4 | 102.0 | 101.3 | 100.7 |

|

|

63.9 | 79.1 | 58.9 | 67.0 | 81.8 | 75.3 | 71.6 | 68.5 | 64.5 | 60.9 | 58.4 | 55.6 |

|

|

5.0 | 8.6 | 5.1 | 4.5 | 6.6 | 10.5 | 9.9 | 9.2 | 9.2 | 8.4 | 8.5 | 8.5 |

|

|

39.6 | 53.2 | 42.5 | 40.0 | 47.1 | 60.2 | 63.4 | 63.0 | 61.3 | 58.9 | 58.3 | 57.7 |

|

|

65.6 | 90.4 | 58.9 | 67.4 | 85.3 | 94.9 | 95.6 | 98.0 | 98.4 | 98.4 | 99.0 | 98.9 |

|

|

107.1 | 166.8 | 104.9 | 107.4 | 146.2 | 178.9 | 175.9 | 178.5 | 176.2 | 181.1 | 174.9 | 168.9 |

|

|

33.6 | 108.1 | 36.1 | 26.1 | 86.0 | 104.1 | 76.8 | 73.5 | 68.5 | 64.8 | 61.3 | 55.9 |

|

|

103.2 | 123.2 | 105.1 | 101.9 | 115.4 | 131.8 | 131.6 | 131.4 | 131.4 | 132.2 | 133.7 | 135.2 |

|

|

15.0 | 42.5 | 12.1 | 11.4 | 47.3 | 40.9 | 36.8 | 40.3 | 40.0 | 35.9 | 34.5 | 33.5 |

|

|

20.1 | 38.5 | 23.5 | 17.6 | 36.2 | 40.5 | 42.6 | 40.0 | 39.4 | 34.2 | 37.0 | 36.4 |

|

|

8.9 | 21.4 | 7.2 | 7.4 | 19.8 | 22.7 | 22.2 | 20.7 | 23.0 | 21.4 | 20.7 | 20.3 |

|

|

65.7 | 67.4 | 60.9 | 70.0 | 67.5 | 63.4 | 57.9 | 55.5 | 50.2 | 46.0 | 42.8 | 40.2 |

|

|

50.0 | 64.5 | 52.1 | 49.8 | 59.3 | 67.9 | 64.6 | 61.9 | 57.0 | 52.4 | 49.1 | 46.7 |

|

|

68.0 | 82.5 | 66.1 | 68.6 | 82.7 | 84.0 | 84.7 | 83.0 | 78.2 | 73.8 | 69.7 | 66.8 |

|

|

64.1 | 118.7 | 50.3 | 67.4 | 96.2 | 130.6 | 128.8 | 129.2 | 124.8 | 121.5 | 119.5 | 116.6 |

|

|

38.3 | 49.1 | 49.6 | 34.1 | 41.2 | 53.5 | 52.2 | 51.8 | 50.9 | 48.9 | 47.3 | 46.0 |

|

|

26.4 | 57.9 | 25.9 | 26.3 | 38.4 | 80.4 | 82.6 | 78.7 | 74.1 | 70.1 | 65.9 | 61.7 |

|

|

46.5 | 82.2 | 58.0 | 42.3 | 60.1 | 100.4 | 99.3 | 99.0 | 98.1 | 97.1 | 96.3 | 95.7 |

|

|

57.9 | 82.8 | 55.7 | 63.4 | 56.8 | 108.0 | 108.0 | 105.5 | 95.8 | 102.5 | 96.4 | 89.9 |

| Euro zone (19) | 68.9 | 90.6 | 68.2 | 69.3 | 85.0 | 94.4 | 92.3 | 91.4 | 89.1 | 87.1 | 85.8 | 84.3 |

|

|

35.8 | 18.3 | 71.2 | 26.8 | 15.3 | 27.1 | 26.2 | 29.6 | 25.6 | 22.6 | 20.5 | 18.4 |

|

|

41.0 | 44.4 | 52.4 | 37.4 | 42.6 | 44.3 | 39.8 | 37.2 | 35.5 | 34.1 | 33.0 | 32.5 |

|

|

39.1 | 71.0 | 35.5 | 41.2 | 57.3 | 84.0 | 83.7 | 80.5 | 77.8 | 74.6 | 70.9 | 67.6 |

|

|

44.0 | 53.4 | 36.5 | 46.4 | 53.1 | 50.4 | 51.3 | 54.2 | 50.6 | 48.9 | 48.2 | 47.4 |

|

|

18.9 | 35.6 | 22.5 | 15.9 | 29.8 | 39.2 | 37.8 | 37.3 | 35.2 | 35.0 | 36.0 | 38.4 |

|

|

46.3 | 40.1 | 50.7 | 49.1 | 38.6 | 45.5 | 44.2 | 42.4 | 40.8 | 38.8 | 34.4 | 32.4 |

|

|

26.7 | 41.7 | 17.0 | 27.9 | 37.4 | 42.2 | 40.0 | 36.8 | 34.7 | 32.7 | 31.7 | 31.1 |

|

|

61.9 | 78.6 | 55.3 | 60.5 | 80.2 | 76.7 | 76.7 | 76.0 | 73.4 | 70.8 | 69.2 | 67.7 |

|

|

41.6 | 82.5 | 37.0 | 39.8 | 75.2 | 87.0 | 87.9 | 87.9 | 87.1 | 86.8 | 85.1 | 84.2 |

|

|

61.3 | 84.5 | 60.1 | 61.5 | 79.1 | 88.3 | 86.2 | 85.0 | 83.3 | 81.5 | 80.2 | 78.8 |

|

|

57.6 | 59.1 | 63.8 | 58.1 | 54.1 | 66.1 | 68.7 | 68.7 | 66.9 | 68.1 | 66.0 | 64.0 |

|

|

41.7 | 85.7 | 37.2 | 24.5 | 85.4 | 79.7 | 65.8 | 51.9 | 42.5 | 40.6 | 38.3 | 36.2 |

|

|

- | 51.4 | - | 38.2 | 40.7 | 59.9 | 66.2 | 64.4 | 64.2 | 70.6 | 68.4 | 64.5 |

|

|

33.7 | 31.5 | 45.6 | 36.7 | 24.1 | 38.1 | 38.1 | 39.9 | 39.5 | 40.5 | 43.2 | 44.0 |

|

|

70.6 | 53.8 | 224.8 | 46.2 | 48.9 | 65.4 | 70.7 | 68.6 | 60.1 | 54.5 | 50.9 | 48.0 |

|

|

53.9 | 33.9 | 51.6 | 50.8 | 40.1 | 28.8 | 27.6 | 28.3 | 28.3 | 31.1 | 30.9 | 29.3 |

|

|

53.1 | 43.2 | 54.5 | 57.0 | 42.8 | 43.3 | 43.3 | 42.5 | 41.2 | 40.0 | 39.0 | 38.3 |

|

|

40.2 | 31.2 | 28.0 | 41.3 | 41.9 | 27.2 | 31.7 | 35.3 | 36.0 | 39.3 | 32.1 | 30.7 |

|

|

64.2 | 101.6 | 53.2 | 65.6 | 95.5 | 104.6 | 104.8 | 106.8 | 105.2 | 107.4 | 107.8 | 136.6 |

|

|

168.9 | 225.5 | 137.9 | 176.8 | 207.9 | 236.1 | 231.6 | 236.7 | 234.8 | 236.1 | 236.1 | 236.3 |

Budget deficit in industrialized countries

The general government debt is usually caused by deficits in public budgets. The following table shows a list of the Austrian Chamber of Commerce (as of May 2019, source EU Commission). Numbers in italics are forecasts. Eurozone (19) European Union (28), but not Eurozone (19) not European Union (28) more than -3.0% to -3.0% to -1.5% ≥0% (no deficit)

| country | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 * | 2019 * | 2020 * |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

-4.0 | -4.2 | -4.2 | -3.1 | -3.1 | -2.4 | -2.4 | -0.8 | -0.7 | -1.3 | -1.5 |

|

|

-3.1 | -2.0 | -0.3 | -0.4 | -5.5 | -1.7 | 0.1 | 1.2 | 2.0 | 0.8 | 1.0 |

|

|

-2.7 | -2.1 | -3.5 | -1.2 | 1.1 | -1.3 | -0.1 | 1.4 | 0.5 | 0.6 | -0.1 |

|

|

-4.2 | -1.0 | 0.0 | -0.1 | 0.6 | 0.8 | 0.9 | 1.0 | 1.7 | 1.0 | 0.8 |

|

|

0.2 | 1.2 | -0.3 | -0.2 | 0.7 | 0.1 | -0.3 | -0.4 | -0.6 | -0.3 | -0.5 |

|

|

-2.6 | -1.0 | -2.2 | -2.6 | -3.2 | -2.8 | -1.7 | -0.8 | -0.7 | -0.4 | -0.2 |

|

|

-6.9 | -5.2 | -5.0 | -4.1 | -3.9 | -3.6 | -3.5 | -2.8 | -2.5 | -3.1 | -2.2 |

|

|

-11.2 | -10.3 | -8.9 | -13.2 | -3.6 | -5.6 | 0.5 | 0.7 | 1.1 | 0.5 | -0.1 |

|

|

-32.1 | -12.8 | -8.1 | -6.2 | -3.6 | -1.9 | -0.7 | -0.3 | 0.0 | 0.0 | 0.3 |

|

|

-4.2 | -3.7 | -2.9 | -2.9 | -3.0 | -2.6 | -2.5 | -2.4 | -2.1 | -2.5 | -3.5 |

|

|

-6.3 | -7.9 | -5.3 | -5.3 | -5.1 | -3.2 | -1.0 | 0.8 | 0.2 | 0.1 | 0.5 |

|

|

-8.6 | -4.3 | -1.2 | -1.2 | -1.4 | -1.4 | 0.1 | -0.6 | -1.0 | -0.6 | -0.6 |

|

|

-6.9 | -8.9 | -3.1 | -2.6 | -0.6 | -0.3 | 0.2 | 0.5 | 0.7 | 0.3 | 0.0 |

|

|

-0.7 | 0.5 | 0.3 | 1.0 | 1.3 | 1.4 | 1.9 | 1.4 | 2.4 | 1.4 | 1.1 |

|

|

-2.4 | -2.4 | -3.5 | -2.4 | -1.7 | -1.0 | 0.9 | 3.4 | 2.0 | 1.1 | 0.9 |

|

|

-5.2 | -4.4 | -3.9 | -2.9 | -2.2 | -2.0 | 0.0 | 1.2 | 1.5 | 1.4 | 0.8 |

|

|

-4.4 | -2.6 | -2.2 | -2.0 | -2.7 | -1.0 | -1.6 | -0.8 | 0.1 | 0.3 | 0.2 |

|

|

-7.3 | -4.8 | -3.7 | -4.1 | -3.7 | -2.7 | -2.2 | -1.5 | -0.4 | -1.6 | -1.4 |

|

|

-11.2 | -7.4 | -5.7 | -4.8 | -7.2 | -4.4 | -2.0 | -3.0 | -0.5 | -0.4 | -0.1 |

|

|

-6.9 | -5.4 | -3.7 | -2.2 | -1.3 | -0.7 | -2.7 | -2.7 | -3.0 | -3.5 | -4.7 |

|

|

0.0 | -0.2 | -1.0 | -1.4 | -1.6 | 0.0 | 1.0 | 1.4 | 0.9 | 0.4 | 0.4 |

|

|

-7.5 | -4.3 | -4.3 | -2.7 | -2.7 | -2.6 | -2.2 | -0.8 | -0.7 | -0.5 | -0.6 |

|

|

-5.6 | -6.7 | -4.0 | -14.7 | -5.5 | -2.8 | -1.9 | 0.0 | 0.7 | 0.7 | 0.9 |

|

|

-9.4 | -9.6 | -10.5 | -7.0 | -6.0 | -5.3 | -4.5 | -3.1 | -2.5 | -2.3 | -2.0 |

|

|

-4.2 | -2.7 | -3.9 | -1.2 | -2.1 | -0.6 | 0.7 | 1.6 | 0.9 | 0.2 | -0.2 |

|

|

-4.5 | -5.4 | -2.4 | -2.6 | -2.6 | -1.9 | -1.6 | -2.2 | -2.2 | -1.8 | -1.6 |

|

|

-9.3 | -7.5 | -8.1 | -5.3 | -5.3 | -4.2 | -2.9 | -1.9 | -1.5 | -1.5 | -1.2 |

|

|

-4.7 | -5.7 | -5.6 | -5.1 | -9.0 | -1.3 | 0.3 | 1.8 | -4.8 | 3.0 | 2.8 |

| Euro zone (19) | -6.2 | -4.2 | -3.7 | -3.1 | -2.5 | -2.0 | -1.6 | -1.0 | -0.5 | -0.9 | -0.9 |

|

|

-6.4 | -4.6 | -4.3 | -3.3 | -2.9 | -2.3 | -1.7 | -1.0 | -0.6 | -1.0 | -1.0 |

|

|

-12.4 | -11.0 | -9.2 | -5.8 | -5.2 | -4.6 | -5.3 | -4.1 | -6.4 | -6.5 | -6.4 |

|

|

-9.1 | -9.1 | -8.3 | -7.6 | -5.4 | -3.6 | -3.5 | -3.0 | -2.9 | -2.8 | -2.5 |

Public debt in developing countries

National debt and ratings

The probability of repayment of a country's government bonds in circulation is expressed in its creditworthiness or creditworthiness. If the national debt is high, the repayment probability may decrease. There are several debt ratios to classify a country's debt as relatively high or low . A number of developed countries are rated by the private international rating agencies as very creditworthy because their economic performance, expressed in gross national product , is regarded as debt-adequate. Some industrialized countries therefore receive the highest possible rating code Aaa ( Moody’s ), AAA ( Standard & Poor’s ) and AAA ( Fitch Ratings ) from the rating agencies for their government bonds . But here, too, there is a risk of downgrading the rating due to the sometimes excessive debt policy and possibly less dynamic economic performance.

In particular, the debt sustainability is examined, which sees debt in relation to gross domestic product or government revenue. Debt sustainability is still just in place if the following criteria can be proven:

- Debt ratio below 200 - 250% of government revenue with net present value calculation ( NPV),

- Debt service coverage below 20-25% of government revenue.

For developing countries, borrowing is made more difficult by the problem of the original Sin, in addition to the generally lower creditworthiness .

See also

Web links

International:

- The World Factbook : Government Debt Ratio, alphabetically by country

- Bryan Taylor: Paying off government debt. Two Centuries of Global Experience. Global Financial Data, 2011 ( PDF file; 3.5 MB )

- Eurostat : National debt of euro area countries in% of GDP (1999–2010) - in tabular, graphical and cartographic form

- National debt in the EU (differentiated by member state)

- visualcapitalist.com , Jeff Desjardins, October 27, 2017: $ 63 Trillion of World Debt in One Visualization ("The US $ 63 trillion world debt in one graph")

Germany:

- Association of Taxpayers : Debt Clock of the Federal Republic of Germany

- Public debt in Germany (differentiated according to federal, state, municipal)

Austria:

Switzerland:

literature

- Hans Apel : State without measure. Financial policy in the dead end . Econ, Düsseldorf / Munich 1997, ISBN 3-430-11066-1 .

- Horst Böttcher: Millstones. National debt and interest charges . Servicia, Bad Soden 1996, ISBN 3-9804200-0-0 .

- David Graeber : Debt: The First 5,000 Years , Melville House 2011, ISBN 978-1-933633-86-2 .

- Friedrich Halstenberg : national debt. A daring financial strategy puts our community at risk . Klartext Verlag, 2001, ISBN 3-88474-966-8 .

- Kai A. Konrad / Holger Zschäpitz: Debt without atonement. Why the crash in public finances affects us all. CH Beck, Munich 2010, ISBN 978-3-406-60688-5 .

- Ralf Kronberger: National Debt (Crisis) (PDF) , Working Group for Economy and School, Vienna 2012, ISBN 978-3-9502430-8-6 .

Individual evidence

- ↑ Eurostat , government debt as a percentage of gross domestic product . The relevant definitions are contained in Council Regulation 479/2010, as amended by Council Regulation 679/2010.

- ↑ a b Federal Statistical Office : Explanation of terms for the areas of finance, taxes, public service

- ↑ Federal Ministry of Finance, budget account and asset account of the federal government for the financial year 2006 , annual account 2006, p. 1

- ↑ An alleged Cicero quote that is often used as historical evidence for the demand for a debt-free state budget is, however, an invention. The supposed quote is: “The state budget must be balanced. The public debt must be reduced ... the support to foreign governments must be reduced if the state is not to go bankrupt. People should learn to work again instead of living on public account ”( Wikiquote, Cicero: wrongly attributed ). Quoted e.g. B. Bodo Leibinger / Reinhard Müller / Herbert Wiesner, Public Finance , 2014, p. VI or in the FAZ of December 28, 1990, p. 3. It is actually a passage from a fictional Cicero novel by Taylor Cadwell : A Pillar of Iron , Doubleday, 1965, ch. 51, p. 483 (German: A column made of ore , 1965). S. tulliana.eu .

- ^ Alfred Manes, Staatsbankrotte , 1919, p. 26

- ↑ Institute of Bank Historical Research / Ernst Klein, German banking history: From the beginning to the end of the Old Kingdom (1806) , Volume 1, 1982, p 73

- ↑ Gerald Braunberger / Benedikt Fehr, Crash: Financial crises yesterday and today , 2008, p. 18

- ^ Alfred Manes, Staatsbankrotte , 1919, p. 55

- ↑ Fernand Braudel, Social History of the 15th to 18th Century , Volume III, 1985, pp. 338 f.

- ^ Jacob Peter Mayer, Fundamental Studies on Jean Bodin , 1979, p. 33

- ^ Jean-François Melon de Pradou, Economistes Financiers du 18me Siecle , 1734, p. 95

- ^ David Hume, Essay on Public Credit , 1752, p. 360 f.

- ^ Adam Smith, The Wealth of Nations , Book V, Chapter 3: On Public Debts, 1776/1974, 798

- ^ Adam Smith, The Wealth of Nations , Book V, Chapter 3: On Public Debts, 1776/1974, 911

- ↑ Thomas Jefferson / Lyman Henry Butterfield / Charles T. Cullen, The Papers of Thomas Jefferson: March 1789 to 30 November 1789 , 1958, p. 393

- ↑ Immanuel Kant, To Eternal Peace , 1795, p. 7 f.

- ↑ David Ricardo, Principles of Political Economy , Volume 1, 1817/1959, p. 233 ff.

- ↑ David Ricardo, Principles of Political Economy , Volume 1, 1817/1959, p. 233 ff.

- ^ Alfred Manes, Staatsbankrotte , 1919, p. 57

- ^ Friedrich List, The National System of Political Economy , p. 265

- ^ Karl Marx, Das Kapital , Volume 1, 1867, p. 782 f.

- ^ Lorenz von Stein, Textbook of Public Finance , 1875, p. 716

- ^ Adolph Wagner, Finanzwissenschaft , 1890, p. 229

- ↑ Peter Lippert, National Debt in Germany, Italy and Greece , 2014, p. 36

- ↑ Ernst Löschner, Sovereign Risks and International Debt , 1983, pp. 44 ff.

- ^ John Maynard Keynes, The General Theory of Employment, Interest, And Money , 1936, p. 211

- ↑ Carmen Reinhart / Kenneth Rogoff, This Time is different , 2009, p. 232

- ↑ Kjell Hausken, Mthuli Ncube, Quantitative Easing and Its Impact in the US, Japan, the UK and Europe , Springer Science & Business Media, 2013, ISBN 978-1-4614-9646-5 , p. 1

- ^ Gareth D. Myles: Public Economics. Cambridge University Press, 2008, ISBN 9780521497695 , p. 486 ff.

- ^ Hugh Dalton : Principles of Public Finance. Allied Publishers, 1997, 4th edition, ISBN 9788170231332 , p. 180 ff.

- ↑ There is an ordinance on this at the Federal Ministry of Justice : "Ordinance on the procedure for determining the cyclical component according to Section 5 of the Article 115 Act (Article 115 Ordinance - Art115V)"

- ↑ Federal Ministry of Finance : Public Finances - Production Potential and Business Cycle Components - Calculation results and data bases from April 24, 2012

- ↑ Cf. Achim Truger, Henner Will, Institute for Macroeconomics and Economic Research (January 2012): "Prone to design and pro-cyclical: The German debt brake in a detailed analysis"

- ^ Franz Schuster : Europa im Wandel , 2013, p. 89

- ↑ Handelsblatt May 19, 2010: "Hidden Debts - The state lacks trillions" ; NZZ , Jan. 25, 2013 "The national debt iceberg"

- ↑ Pascal Gantenbein / Klaus Spremann, Zinsen, Anleihe, Kredite , 2014, p. 25

- ↑ Bond market - Germany borrows money at negative interest rates , FAZ Online, January 9, 2012.

- ↑ Schäuble makes money by getting into debt , Handelsblatt online, July 18, 2012.

- ↑ Peter Bofinger : Fundamentals of Economics. Pearson Studium, 2010, ISBN 978-3827373540 , p. 8ff

- ↑ "Returns on the decline", Handelsblatt August 5, 2010

-

^ Wilhelm Lautenbach: About credit and production. Frankfurt 1937. (first published in 1936 in the quarterly issue : Die Wirtschaftskurve. Issue III. ) P. 18:

“How does the credit system work when the state finances large expenditures through credit? Where

does the money come from? ” “ Most of the people who ask the question, and it is by no means just laypeople, think that there is some limited supply of money or credit. This notion is usually linked to the worried question whether the state might not tighten credit for the economy through its credit claims. In truth, however, it is exactly the opposite. When the state takes credit on a large scale, the entire credit economy is loosened up. The money and credit markets are becoming liquid, entrepreneurs are becoming liquid, their bank loans are decreasing, business deposits are increasing [...]. " - ↑ Olivier Blanchard, Gerhard Illing: Macroeconomics. (5th edition) Munich 2009. ( online ) p. 26.

- ^ Deutsche Bundesbank: Money and Monetary Policy , p. 146.

- ↑ Carsten Germis: The World Improvers: The Japanese Keynes . In: Frankfurter Allgemeine Zeitung . August 26, 2013, ISSN 0174-4909 ( faz.net [accessed April 23, 2016]).

-

^ Hans Gestrich: New credit policy. Stuttgart and Berlin 1936. pp. 73–95:

“It cannot be left to the discretion of a bank manager, no matter how qualified, whether they want to impose deflation on the national economy or lower exchange rate parity. In such fateful questions, only the government, which also has to bear the social and political consequences, can make the decision. Today the effectiveness and success of general economic policy are all too dependent on credit policy ... " - ↑ Wolfgang Stützel: Volkswirtschaftliche Saldenmechanik Tübingen: Mohr Siebeck, 2011, reprint of the 2nd edition, Tübingen, Mohr, 1978, p. 86

- ^ John Maynard Keynes: The Economic Consequences of Mr. Churchill In: Essays in Persuasion. WW Norton & Company , 1991, p. 259

- ^ John Maynard Keynes: The Return to the Gold Standard In: Essays in Persuasion. WW Norton & Company, 1991, p. 208

- ^ John Maynard Keynes: The Great Slump of 1930 In: Essays in Persuasion. WW Norton & Company, 1991, p. 146

- ↑ John Maynard Keynes: General Theory of Employment, Interest and Money. Duncker & Humblot, Munich / Leipzig 1936, p. 268

- ↑ See Prof. Dr. Philipp Bagus - The Danger of Foreign Debt

- ↑ Public gross debt. Eurostat , accessed 11 May 2019 .

- ↑ Biggest mountain of debt in the Federal Republic. ( Memento from March 13, 2010 in the Internet Archive ) tagesschau, March 11, 2010.

- ↑ PUBLIC DEBT: Government debt ratio (total government debt as% of GDP). (pdf) Austrian Chamber of Commerce (WKO), May 2019, accessed on June 27, 2019 .

- ↑ PUBLIC BUDGET BALANCES: General government surplus / deficit as% of GDP: absolute values. (pdf) Austrian Chamber of Commerce (WKO), May 2019, accessed on June 27, 2019 .

- ↑ IMF and World Bank: Debt Sustainability Analysis for the Heavily Indebted Poor Countries (PDF; 1.5 MB), January 1996, p. 2 (p. 4 in PDF)