Han dynasty and Great Depression: Difference between pages

m →Gallery of art: Very nice, but please promote this somewhere else now. |

m removing language=English, per all citation templates using AWB |

||

| Line 1: | Line 1: | ||

{{redirect|The Great Depression}} |

|||

{{Expand|article|date=April 2008}} |

|||

[[Image:Lange-MigrantMother02.jpg|thumb|[[Dorothea Lange]]'s ''[[Migrant Mother]]'' depicts destitute [[Pea-pickers|pea pickers]] in [[California]], centering on [[Florence Owens Thompson]], a mother of seven children, age 32, in [[Nipomo, California]], March 1936.]] |

|||

{{Chinesetext}} |

|||

{{Infobox Former Country |

|||

The '''Great Depression''' was a worldwide economic [[Recession|downturn]] starting in most places in 1929 and ending at different times in the 1930s or early 1940s for different countries. It was the largest and most important economic depression in modern history, and is used in the 21st century as a benchmark on how far the world's economy can fall. The Great Depression originated in the United States; historians most often use as a starting date the [[stock market crash]] on October 29, 1929, known as [[Wall Street Crash of 1929|Black Tuesday]]. The end of the depression in the U.S. is associated with the onset of the [[war economy]] of [[World War II]], beginning around 1939.<ref>{{cite book |title=The Cambridge Economic History of the United States |last=L. Engerman |first=Stanley |authorlink=Stanley L. Engerman |coauthors= Gallman, Robert E. }} </ref> |

|||

|native_name = {{aut|漢朝}} |

|||

|conventional_long_name = The Han Dynasty |

|||

The depression had devastating effects both in the [[developed country|developed]] and [[developing country|developing]] world. International trade was deeply affected, as were personal [[income]]s, [[tax revenue]]s, [[price]]s, and [[profit]]s. [[Cities in the Great Depression|Cities all around the world]] were hit hard, especially those dependent on [[heavy industry]]. Construction was virtually halted in many countries. [[Farming]] and rural areas suffered as crop prices fell by 40 to 60 percent.<ref>{{cite journal|author= Cochrane, Willard W.|title=Farm Prices, Myth and Reality|year=1958|pages=15}}</ref><ref>{{cite journal|journal=[[League of Nations]]|title=World Economic Survey 1932–33|pages=43}}</ref> Facing plummeting demand with few alternate sources of jobs, areas dependent on [[Primary sector of economic activity|primary sector industries]] such as farming, [[mining]] and [[logging]] suffered the most.<ref>{{cite book |

|||

|common_name = Han |

|||

| last = Hakim |

|||

|national_motto = |

|||

| |

| first = Joy |

||

| title = A History of Us: War, Peace and all that Jazz |

|||

|region = Pacific |

|||

| publisher = [[Oxford University Press]] |

|||

|country = China |

|||

| year = 1995 |

|||

| location = [[New York]] |

|||

|status = Empire |

|||

| isbn = 0-19509484-0}}.</ref> |

|||

|government_type = Monarchy |

|||

Even shortly after the Wall Street Crash of 1929, optimism persisted. [[John D. Rockefeller]] said that "These are days when many are discouraged. In the 93 years of my life, depressions have come and gone. Prosperity has always returned and will again."<ref>{{cite web |

|||

|year_start = 207 BC |

|||

|url= http://us.history.wisc.edu/hist102/lectures/lecture18.html |

|||

|year_end = 220 |

|||

|title= Crashing Hopes: The Great Depression |

|||

| |

|||

|accessdate= 2008-03-13 |

|||

|p1 = Qin Dynasty |

|||

| |

|last= Schultz |

||

|first= Stanley K. |

|||

|s2 = Shu Han |

|||

|year= 1999 |

|||

|s3 = Eastern Wu |

|||

|work= American History 102: Civil War to the Present |

|||

|event_start = Establishment |

|||

|publisher= [[University of Wisconsin-Madison]] |

|||

|event_end = Abdication to [[Cao Wei]] |

|||

}}.</ref> |

|||

|event1 = |

|||

|date_event1 = |

|||

The Great Depression ended at different times in different countries; for subsequent history see [[Home front during World War II]]. The majority of countries set up relief programs, and most underwent some sort of political upheaval, pushing them to the left or right. In some states, the desperate citizens turned toward nationalist [[Demagogy|demagogues]] - the most infamous being [[Adolf Hitler]] - setting the stage for [[World War II]] in 1939. |

|||

|event2 = [[Battle of Gaixia]]; Han rule of China begins |

|||

|date_event2 = 202 BCE |

|||

==The snowball spiral== |

|||

|event3 = [[Xin Dynasty|Interruption of Han rule]] |

|||

The Great Depression was not a sudden total collapse. The stock market turned upward in early 1930, returning to early 1929 levels by April, though still almost 30 percent below the peak of September 1929.<ref>{{cite web|accessdate=2008-05-22|url=http://www.gold-eagle.com/editorials_98/vronsky060698.html|title=1998/99 Prognosis Based Upon 1929 Market Autopsy|publisher=Gold Eagle}}.</ref> Together, government and business actually spent more in the first half of 1930 than in the corresponding period of the previous year. But consumers, many of whom had suffered severe losses in the stock market the previous year, cut back their expenditures by ten percent, and a severe drought ravaged the agricultural heartland of the USA beginning in the northern summer of 1930. |

|||

|date_event3 = 9–24 |

|||

|event4 = |

|||

In early 1930, credit was ample and available at low rates, but people were reluctant to add new debt by borrowing.{{fact | date=October 2008}} By May 1930, auto sales had declined to below the levels of 1928. Prices in general began to decline, but wages held steady in 1930, then began to drop in 1931. Conditions were worst in farming areas, where commodity prices plunged, and in mining and logging areas, where unemployment was high and there were few other jobs. The decline in the [[Economy of the United States|American economy]] was the factor that pulled down most other countries at first, then internal weaknesses or strengths in each country made conditions worse or better. Frantic attempts to shore up the economies of individual nations through [[protectionism|protectionist]] policies, such as the 1930 U.S. [[Smoot-Hawley Tariff Act]] and retaliatory tariffs in other countries, exacerbated the collapse in global trade. By late in 1930, a steady decline set in which reached bottom by March 1933. |

|||

|date_event4 = |

|||

|event5 = |

|||

==Causes == |

|||

|date_event5 = |

|||

There were multiple causes for the first downturn in 1929, including the structural weaknesses and specific events that turned it into a major depression and the way in which the downturn spread from country to country. In relation to the 1929 downturn, historians emphasize structural factors like massive bank failures and the stock market crash, while economists (such as Peter Temin and Barry Eichengreen) point to Britain's decision to return to the Gold Standard at pre-World War I parities (US$4.86:£1). |

|||

|stat_pop1 = 59594978 |

|||

|stat_year1 = 2 |

|||

{{Main|Causes of the Great Depression}} |

|||

|image_map = Han map.jpg |

|||

|image_map_caption = The Han Dynasty in 87 BCE (not shown is the protectorate in the [[Tarim Basin]], and areas of fluctuating control north of the border shown) |

|||

Recession cycles are thought to be a normal part of living in a world of inexact balances between [[supply and demand]]. What turns a usually mild and short recession or "ordinary" [[business cycle]] into a great depression is a subject of debate and concern. Scholars have not agreed on the exact causes and their relative importance. The search for causes is closely connected to the question of how to avoid a future depression, and so the political and policy viewpoints of scholars are mixed into the analysis of historic events eight decades ago. The even larger question is whether it was largely a failure on the part of [[free market]]s or largely a failure on the part of governments to curtail widespread bank failures, the resulting panics, and reduction in the money supply. Those who believe in a large role for governments in the economy believe it was mostly a failure of the free markets and those who believe in free markets believe it was mostly a failure of government that compounded the problem. |

|||

|capital = [[Chang'an]]<small><br />([[206 BC]]–[[9 AD]])</small><br />[[Luoyang]]<small><br />(25 AD–220 AD)</small> |

|||

|common_languages = [[Chinese language|Chinese]] |

|||

Current theories may be broadly classified into three main points of view. First, there is orthodox [[classical economics]]: [[Monetarism|monetarist]], [[Austrian Economics]] and [[neoclassical economics|neoclassical economic theory]], all of which focus on the [[macroeconomic]] effects of [[money supply]] and the supply of gold which backed many currencies before the Great Depression, including [[Mass production|production]] and [[Consumption (economics)|consumption]]. |

|||

|religion = [[Taoism]], [[Confucianism]], [[Chinese folk religion]] |

|||

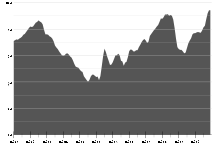

[[Image:Gdp20-40.jpg|thumb|Chart 1: USA GDP annual pattern and long-term trend, 1920-40, in billions of constant dollars<ref>{{cite book|author=Carter, Susan|title=Historical Statistics of the US: Millennial Edition|year=2006}}</ref>.]] |

|||

|currency = [[Chinese coin]], [[Chinese cash]] |

|||

|leader1 = [[Emperor Gaozu of Han]] |

|||

Second, there are structural theories, most importantly [[Keynesian economics|Keynesian]], but also including those of [[institutional economics]], that point to [[underconsumption]] and overinvestment ([[economic bubble]]), [[malfeasance]] by bankers and industrialists, or incompetence by government officials. The only consensus viewpoint is that there was a large-scale lack of confidence. Unfortunately, once panic and deflation set in, many people believed they could make more money by keeping clear of the markets as prices got lower and lower and a given amount of money bought ever more goods. |

|||

|leader2 = |

|||

|leader3 = |

|||

Third, there is the [[Marxist]] critique of political economy. This emphasizes contradictions within capital itself (which is viewed as a social relation involving the appropriation of surplus value) as giving rise to an inherently unbalanced dynamic of accumulation resulting in an overaccumulation of capital, culminating in periodic crises of devaluation of capital. The origin of crisis is thus located firmly in the sphere of production, though economic crisis can be aggravated by problems of disproportionality of over-production in the manufacturing and related production sectors and the underconsumption of the masses. |

|||

|leader4 = |

|||

|year_leader1 = 202 BC–195 BC |

|||

[[Image:1930Industry.svg|thumb|US industrial production (1928-39).]] |

|||

|year_leader2 = |

|||

|year_leader3 = |

|||

===Debt=== |

|||

|year_leader4 = |

|||

[[Image:American union bank.gif|thumb|right|Crowd at New York's American Union Bank during a [[bank run]] early in the Great Depression. ]] |

|||

|title_leader = [[Emperor of China|Emperor]] |

|||

[[Debt]] is seen as one of the causes of the Great Depression{{Fact|date=September 2008}}, particularly in the [[United States]]{{Fact|date=September 2008}}. [[Macroeconomist]]s including [[Ben Bernanke]], the current chairman of the [[U.S. Federal Reserve Bank]], have revived the debt-deflation view{{Fact|date=September 2008}} of the Great Depression originated by [[Arthur Cecil Pigou]] and [[Irving Fisher]]:{{Fact|date=September 2008}} in the 1920s, American consumers and businesses relied on cheap credit{{Fact|date=September 2008}}, the former to purchase consumer goods such as automobiles and furniture, and the latter for capital investment to increase production{{Fact|date=September 2008}}. This fueled strong short-term growth but created consumer and commercial debt{{Fact|date=September 2008}}. People and businesses who were deeply in debt when [[Deflation (economics)|price deflation]] occurred or demand for their product decreased often risked default{{Fact|date=September 2008}}. Many drastically cut current spending to keep up time payments, thus lowering demand for new products. Businesses began to fail as [[Construction|construction work]] and factory orders plunged. |

|||

|deputy1 = [[Xiao He]] |

|||

|deputy2 = [[Cao Can]] |

|||

Massive layoffs occurred, resulting in US unemployment rates of over 25% by 1933. Banks which had financed this debt began to fail as debtors defaulted on debt and depositors attempted to withdraw their deposits en masse, triggering multiple [[bank run]]s. Government guarantees and Federal Reserve banking regulations to prevent such panics were ineffective or not used. Bank failures led to the loss of billions of dollars in assets.<ref name = "lhf-30s">{{cite web|accessdate=2008-05-22|url=http://www.livinghistoryfarm.org/farminginthe30s/money_08.html|title=Bank Failures |publisher=Living History Farm}}</ref> Outstanding debts became heavier, because prices and incomes fell by 20–50% but the debts remained at the same dollar amount. After the panic of 1929, and during the first 10 months of 1930, 744 US banks failed. (In all, 9,000 banks failed during the 1930s). By 1933, depositors had lost $140 billion in deposits.<ref name = "lhf-30s">{{cite web|accessdate=2008-05-22|url=http://www.livinghistoryfarm.org/farminginthe30s/money_08.html|title=Bank Failures |publisher=Living History Farm}}</ref> |

|||

|deputy3 = [[Dong Zhuo]] |

|||

|deputy4 = [[Cao Cao]] |

|||

Bank failures snowballed as desperate bankers called in loans which the borrowers did not have time or money to repay. With future profits looking poor, [[Investment|capital investment]] and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending.<ref name = "lhf-30s"/> Banks built up their capital reserves and made fewer loans, which intensified deflationary pressures. A [[Virtuous circle and vicious circle|vicious cycle]] developed and the downward spiral accelerated. This kind of self-aggravating process may have turned a 1930 recession into a 1933 great depression. |

|||

|deputy5 = [[Cao Pi]] |

|||

|deputy6 = |

|||

===Trade decline and the U.S. Smoot-Hawley Tariff Act=== |

|||

|deputy7 = |

|||

{{main|Smoot-Hawley Tariff Act}} |

|||

|year_deputy1 = 206 BC–193 BC |

|||

Many economists have argued that the sharp decline in international trade after 1930 helped to worsen the depression, especially for countries significantly dependent on foreign trade. Most historians and economists partly blame the American [[Smoot-Hawley Tariff Act]] (enacted June 17, 1930) for worsening the depression by seriously reducing international trade and causing retaliatory tariffs in other countries. Foreign trade was a small part of overall economic activity in the United States and was concentrated in a few businesses like farming; it was a much larger factor in many other countries.<ref>{{cite web|accessdate=2008-05-22|url=http://www.mtholyoke.edu/acad/intrel/depress.htm|title=The World in Depression|publisher=[[Mount Holyoke College]]}}</ref> The average ''[[ad valorem]]'' rate of duties on dutiable imports for 1921–1925 was 25.9% but under the new tariff it jumped to 50% in 1931–1935. |

|||

|year_deputy2 = – |

|||

|year_deputy3 = 189AD–192AD |

|||

In dollar terms, American exports declined from about $5.2 billion in 1929 to $1.7 billion in 1933; but prices also fell, so the physical volume of exports only fell by half. Hardest hit were farm commodities such as wheat, cotton, tobacco, and lumber. According to this theory, the collapse of farm exports caused many American farmers to default on their loans, leading to the [[bank run]]s on small rural banks that characterized the early years of the Great Depression. |

|||

|year_deputy4 = 208 AD–220 AD |

|||

|year_deputy5 = 220 AD |

|||

===U.S. Federal Reserve and money supply=== |

|||

|year_deputy6 = |

|||

[[Monetarist]]s, including [[Milton Friedman]] and current [[Federal Reserve System]] chairman [[Ben Bernanke]], argue that the Great Depression was caused by [[Contractionary monetary policy|monetary contraction]], the consequence of poor policymaking by the American [[Federal Reserve System]] and continuous crisis in the banking system.<ref>{{cite book|author= [[Ben Bernanke|Bernanke, Ben S.]]|year=2000|title=Essays on the Great Depression|publisher=[[Princeton University Press]]|page=7|isbn=0691016984}}</ref><ref> |

|||

|year_deputy7 = |

|||

{{cite web |

|||

|title_deputy = [[Chancellor of China|Chancellor]] |

|||

|url=http://www.worldnetdaily.com/index.php?fa=PAGE.view&pageId=59405 |

|||

|legislature = |

|||

|title=Bernanke: Federal Reserve caused Great Depression |

|||

|stat_year1 = |

|||

|publisher=[[WorldNetDaily]] |

|||

|stat_area1 = |

|||

|accessdate=2008-03-21 |

|||

|stat_pop1 = |

|||

|footnotes = |

|||

}} |

}} |

||

</ref> In this view, the Federal Reserve, by not acting, allowed the money supply as measured by the [[M2 (economics)|M2]] to shrink by one-third from 1929 to 1933. Friedman argued<ref>{{cite book|title=A Monetary History of the United States}}</ref> that the downward turn in the economy, starting with the stock market crash, would have been just another recession. The problem was that some large, public bank failures, particularly that of the [[New York Bank of the United States|Bank of the United States]], produced panic and widespread runs on local banks, and that the Federal Reserve sat idly by while banks fell. He claimed that, if the Fed had provided emergency lending to these key banks, or simply bought [[government bond]]s on the [[open market]] to provide liquidity and increase the quantity of money after the key banks fell, all the rest of the banks would not have fallen after the large ones did, and the money supply would not have fallen as far and as fast as it did.<ref>{{cite web|accessdate=2008-05-22|url=http://www.nybooks.com/articles/19857|title=Who Was Milton Friedman?|work=[[The New York Review of Books]]|date=2007-02-15|author=Krugman, Paul}}</ref> With significantly less money to go around, businessmen could not get new loans and could not even get their old loans renewed, forcing many to stop investing. This interpretation blames the Federal Reserve for inaction, especially the New York branch.<ref>{{cite book |

|||

| last = Griffin |

|||

| first = G. Edward |

|||

| title = The Creature from Jekyll Island: A Second Look at the Federal Reserve |

|||

| publisher = [[American Media (publisher)]] |

|||

| year = 2002 |

|||

| isbn = 0912986395 |

|||

| isbn-13 = 978-0912986395 }}</ref> |

|||

One reason why the Federal Reserve did not act to limit the decline of the money supply was regulation. At that time the amount of credit the Federal Reserve could issue was limited by laws which required partial gold backing of that credit. By the late 1920s the Federal Reserve had almost hit the limit of allowable credit that could be backed by the gold in its possession. This credit was in the form of Federal Reserve demand notes. Since a "promise of gold" is not as good as "gold in the hand", during the bank panics a portion of those demand notes were redeemed for Federal Reserve gold. Since the Federal Reserve had hit its limit on allowable credit, any reduction in gold in its vaults had to be accompanied by a greater reduction in credit. Several years into the Great Depression, the private ownership of gold was declared illegal, reducing the pressure on Federal Reserve gold. |

|||

===Austrian School explanations=== |

|||

Another explanation comes from the [[Austrian School]] of economics. Theorists of the "Austrian School" who wrote about the Depression include Austrian economist [[Friedrich Hayek]] and American economist [[Murray Rothbard]], who wrote ''[[America's Great Depression]]'' (1963). In their view, the key cause of the Depression was the expansion of the money supply in the 1920s that led to an unsustainable credit-driven boom. In their view, the Federal Reserve, which was created in 1913, shoulders much of the blame. |

|||

In opinion, Hayek, writing for the Austrian Institute of Economic Research Report in February 1929<ref>{{cite journal|title=Austrian Institute of Economic Research Report|month=February | year=1929}}</ref> predicted the economic downturn, stating that "the boom will collapse within the next few months." |

|||

Ludwig von Mises also expected this financial catastrophe, and is quoted as stating "A great crash is coming, and I don't want my name in any way connected with it,"<ref>{{cite book|author= Mises, Margit von|title=My Years with Ludwig von Mises|publisher=Arlington House|year=1976|page=31}}</ref> when he turned down an important job at the Kreditanstalt Bank in early 1929. |

|||

One reason for the monetary inflation was to help [[Great Britain]], which, in the 1920s, was struggling with its plans to return to the gold standard at pre-war ([[World War I]]) parity. Returning to the gold standard at this rate meant that the British economy was facing deflationary pressure.<ref name="rothbard 2002 141">{{harvnb|Rothbard|2002|p=141}}</ref> According to Rothbard, the lack of price flexibility in Britain meant that unemployment shot up, and the American government was asked to help. The United States was receiving a net inflow of gold, and inflated further in order to help Britain return to the gold standard. [[Montagu Norman]], head of the Bank of England, had an especially good relationship with [[Benjamin Strong Jr.|Benjamin Strong]], the ''de facto'' head of the Federal Reserve. Norman pressured the heads of the central banks of France and Germany to inflate as well, but unlike Strong, they refused.<ref name="rothbard 2002 141" /> Rothbard says American inflation was meant to allow Britain to inflate as well, because under the gold standard, Britain could not inflate on its own. |

|||

In the Austrian view it was this inflation of the money supply that led to an unsustainable boom in both asset prices (stocks and bonds) and capital goods. By the time the Fed belatedly tightened in 1928, it was far too late and, in the Austrian view, a depression was inevitable. |

|||

The artificial interference in the economy was a disaster prior to the Depression, and government efforts to prop up the economy after the crash of 1929 only made things worse. According to Rothbard, government intervention delayed the market's adjustment and made the road to complete recovery more difficult.<ref>{{harvnb|Rothbard|2002|p=25}}</ref> |

|||

Furthermore, Rothbard criticizes Milton Friedman's assertion that the central bank failed to inflate the supply of money. Rothbard asserts that the Federal Reserve bought $1.1 billion of government securities from February to July 1932, raising its total holding to $1.8 billion. Total bank reserves rose by only $212 million, but Rothbard argues that this was because the American populace lost faith in the banking system and began hoarding more cash, a factor quite beyond the control of the Central Bank. The potential for a run on the banks caused local bankers to be more conservative in lending out their reserves, and this, Rothbard argues, was the cause of the Federal Reserve's inability to inflate.<ref>{{harvnb|Rothbard|2002|pp=293–294}}</ref> |

|||

{{redirect|Later Han|the [[Five Dynasties and Ten Kingdoms]] period dynasty|Later Han Dynasty (Five Dynasties)}} |

|||

The '''Han Dynasty''' ({{Zh-tspw|t= 漢朝|s=汉朝|p=Hàn Cháo|w=Han Ch'ao}}; 206 BC–220 AD) followed the [[Qin Dynasty]] and preceded the [[Three Kingdoms]] in [[China]]. The Han Dynasty was ruled by the prominent family known as the [[Liu]] clan. The reign of the Han Dynasty, lasting over 401 years, is commonly considered within China to be one of the greatest periods in the [[history of China]]. To this day, the ethnic majority of China still refer to themselves as the "[[Han Chinese|Han people]]". |

|||

[[Image:Tenantless farm Texas panhandle 1938.jpg|thumb|left|Power farming displaces tenants from the land in the western dry cotton area. Childress County, Texas, 1938.]] |

|||

During the Han Dynasty, China officially became a [[Confucianism|Confucian]] state and prospered domestically: [[agriculture]], handicrafts and [[commerce]] flourished, and the [[population]] reached over 55 million people. Meanwhile, the empire extended its political, [[Chinese culture|cultural influence]], and territory over much of [[Korea]], [[Mongolia]], [[Vietnam]], and [[Central Asia]] before it finally collapsed under a combination of domestic and external pressures. |

|||

===Business=== |

|||

The first of the two periods of the dynasty was the '''Former Han Dynasty''' ({{zh-tsp|t=前漢|s=前汉|p=Qiánhàn}}) or '''Western Han Dynasty''' ({{zh-tsp|t=西漢|s=西汉|p=Xī Hàn}}) 206 BC–[[24|24AD]], seated at [[Chang'an]]. The '''Later Han Dynasty''' ({{zh-tsp|t=後漢|s=后汉|p=Hòu Hàn}}) or '''Eastern Han Dynasty''' ({{zh-tsp|t=東漢|s=东汉|p=Dōng Hàn}}) 25–220 AD was seated at [[Luoyang]]. The western-eastern Han convention is currently used to avoid confusion with the Later Han Dynasty of the [[Period of the Five Dynasties and the Ten Kingdoms]] although the former-later nomenclature was used in history texts including [[Sima Guang]]'s ''[[Zizhi Tongjian]]''. |

|||

[[Franklin D. Roosevelt]], elected in 1932, primarily blamed the excesses of big business for causing an unstable bubble-like economy. Democrats believed the problem was that business had too much money, and the [[New Deal]] was intended as a remedy, by empowering [[Trade union|labor unions]] and farmers and by raising taxes on corporate profits. Regulation of the economy was a favorite remedy. Some New Deal regulation (the NRA and AAA) was declared unconstitutional by the [[Supreme Court of the United States|U.S. Supreme Court]]. Most New Deal regulations were abolished or scaled back in the 1970s and 1980s in a bipartisan wave of [[deregulation]].<ref>{{cite book|author= Vietor, Richard H. K.|title=Contrived Competition: Regulation and Deregulation in America|year=1994}}</ref> However the [[Securities and Exchange Commission]], [[Federal Reserve]], and [[Social Security (United States)|Social Security]] won widespread support. |

|||

===Lack of government deficit spending=== |

|||

The Han Dynasty was notable also for its military prowess. The empire expanded westward to the [[Tarim Basin]] (in modern [[Xinjiang|Xinjiang-Uyghur Autonomous Region]]), with military expeditions as far west as beyond the [[Caspian Sea]], making possible a relatively safe and secure caravan and mercantile traffic across Central Asia. The paths of caravan traffic came to be known as the "[[Silk Road]]" because the route was used to export Chinese [[silk]]. Chinese armies also invaded and annexed parts of northern Korea ([[Wiman Joseon]]) (as well as establishing colonies and trading posts that eventually integrated with the locals) and northern Vietnam toward the end of the 2nd century BC. The borders near the peripheral territories were often tense with possible conflict with other states. To ensure peace with non-Chinese powers, the Han court developed a mutually beneficial "tributary system". Non-Chinese states were allowed to remain autonomous in exchange for symbolic acceptance of Han overlordship. Tributary ties were confirmed and strengthened through intermarriages at the ruling level and periodic exchanges of gifts and goods. |

|||

British economist [[John Maynard Keynes]] argued in ''[[General Theory of Employment Interest and Money]]'' that lower aggregate expenditures in the economy contributed to a massive decline in income and to employment that was well below the average. In this situation, the economy might have reached a perfect balance, at a cost of high unemployment. Keynesian economists called on governments during times of [[Crisis (economic)|economic crisis]] to pick up the slack by increasing [[government spending]] and/or cutting taxes. |

|||

Massive increases in [[deficit spending]], new [[Bank regulation|banking regulation]], and boosting farm prices did start turning the U.S. economy around in 1933,{{Fact|date=January 2008}} but it was a slow and painful process. The U.S. had not returned to 1929's GNP for over a decade and still had an unemployment rate of about 15% in 1940 — down from 25% in 1933. |

|||

==Emergence== |

|||

{{History of China|BC=1}} |

|||

===Inequality of wealth and income=== |

|||

[[Image:Western Han Chinese Silk.JPG|thumb|left|150px|Western Han painting on [[History of silk|silk]] was found draped over the coffin in the grave of Lady Dai (c. 168 BC) at [[Mawangdui]] near Changsha in [[Hunan]] province.]] |

|||

[[Marriner S. Eccles]], who served as [[Franklin D. Roosevelt]]'s [[Chairman of the Federal Reserve]] from November 1934 to February 1948, detailed what he believed caused the Depression in his memoirs, ''Beckoning Frontiers'' (New York, Alfred A. Knopf, 1951)<ref name=Beckoning>{{cite book | last = Eccles | first = Marriner S. | authorlink = Marriner S. Eccles | title = Beckoning Frontiers: Public and Personal Recollections | publisher = Alfred A. Knopf |edition = 1st | year = 1951 | location = New York | pages = 499 | oclc = 3720103}}</ref>: |

|||

<blockquote> |

|||

''As mass production has to be accompanied by mass consumption, mass consumption, in turn, implies a distribution of wealth -- not of existing wealth, but of wealth as it is currently produced -- to provide men with buying power equal to the amount of goods and services offered by the nation's economic machinery.'' [Emphasis in original.] |

|||

<p> |

|||

Instead of achieving that kind of distribution, a giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth. This served them as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied to themselves the kind of effective demand for their products that would justify a reinvestment of their capital accumulations in new plants. In consequence, as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped. |

|||

<p> |

|||

That is what happened to us in the twenties. We sustained high levels of employment in that period with the aid of an exceptional expansion of debt outside of the banking system. This debt was provided by the large growth of business savings as well as savings by individuals, particularly in the upper-income groups where taxes were relatively low. Private debt outside of the banking system increased about fifty per cent. This debt, which was at high interest rates, largely took the form of mortgage debt on housing, office, and hotel structures, consumer installment debt, brokers' loans, and foreign debt. The stimulation to spend by debt-creation of this sort was short-lived and could not be counted on to sustain high levels of employment for long periods of time. Had there been a better distribution of the current income from the national product -- in other words, had there been less savings by business and the higher-income groups and more income in the lower groups -- we should have had far greater stability in our economy. Had the six billion dollars, for instance, that were loaned by corporations and wealthy individuals for stock-market speculation been distributed to the public as lower prices or higher wages and with less profits to the corporations and the well-to-do, it would have prevented or greatly moderated the economic collapse that began at the end of 1929. |

|||

<p> |

|||

The time came when there were no more poker chips to be loaned on credit. Debtors thereupon were forced to curtail their consumption in an effort to create a margin that could be applied to the reduction of outstanding debts. This naturally reduced the demand for goods of all kinds and brought on what seemed to be overproduction, but was in reality underconsumption when judged in terms of the real world instead of the money world. This, in turn, brought about a fall in prices and employment. |

|||

<p> |

|||

Unemployment further decreased the consumption of goods, which further increased unemployment, thus closing the circle in a continuing decline of prices. Earnings began to disappear, requiring economies of all kinds in the wages, salaries, and time of those employed. And thus again the vicious circle of deflation was closed until one third of the entire working population was unemployed, with our national income reduced by fifty per cent, and with the aggregate debt burden greater than ever before, not in dollars, but measured by current values and income that represented the ability to pay. Fixed charges, such as taxes, railroad and other utility rates, insurance and interest charges, clung close to the 1929 level and required such a portion of the national income to meet them that the amount left for consumption of goods was not sufficient to support the population. |

|||

<p> |

|||

This then, was my reading of what brought on the depression. |

|||

<p> |

|||

</blockquote> |

|||

==Literature== |

|||

Within the first three months after [[Qin Dynasty]] [[Emperor of China|Emperor]] [[Qin Shi Huang]]'s death at Shaqiu, widespread revolts by peasants, prisoners, soldiers and descendants of the nobles of the [[Warring States|six Warring States]] sprang up all over China. [[Chen Sheng]] and [[Wu Guang]], two in a group of about 900 soldiers assigned to defend against the [[Xiongnu]], were the leaders of the first rebellion. Continuous [[insurgent|insurgence]] finally toppled the Qin dynasty in [[206 BC]]. The leader of the insurgents was [[Xiang Yu]], an outstanding military commander without political expertise, who divided the country into 19 feudal states to his own satisfaction. |

|||

The U.S. Depression has been the subject of much writing, as the country has sought to re-evaluate an era that caused emotional as well as financial trauma to its people. Perhaps the most noteworthy and famous novel written on the subject is ''[[The Grapes of Wrath]]'', published in 1939 and written by [[John Steinbeck]], who was awarded both the [[Nobel Prize]] for literature and the [[Pulitzer Prize]] for the work. The novel focuses on a poor family of sharecroppers who are forced from their home as drought, economic hardship, and changes in the [[Agriculture|agricultural industry]] occur during the Great Depression. Steinbeck's ''[[Of Mice and Men]]'' is another important novel about a journey during the Great Depression. ''The Great Depression'' is a novella written by Alon Bersharder about a sad, disgruntled temporary worker, making the title both a homage to the historical event and a pun. Additionally, Harper Lee's ''[[To Kill a Mockingbird]]'' is set during the Great Depression. Margaret Atwood's Booker prize-winning ''[[The Blind Assassin]]'' is likewise set in the Great Depression, centering on a privileged socialite's love affair with a Marxist revolutionary. |

|||

==Effects== |

|||

The ensuing war among those states signified the five years of [[Chu Han Contention]] with [[Liu Bang]], the first emperor of the Han Dynasty, as the eventual winner with the help of [[Zhang Liang (Western Han)|Zhang Liang]] and [[Han Xin]]. Initially, "Han" (the principality as created by Xiang Yu's division) consisted merely of modern [[Sichuan]], [[Chongqing]], and southern [[Shaanxi]] and was a minor humble principality, but eventually grew into an empire; the Han Dynasty was named after the principality, which was itself named after Hanzhong ({{zh-tsp|t=漢中|s=汉中|p=hànzhōng}})—modern southern Shaanxi, the region centering the modern city of [[Hanzhong]]. The beginning of the Han Dynasty can be dated either from 206 BC when the Qin dynasty crumbled and the Principality of Han was established or 202 BC when Xiang Yu committed suicide. |

|||

===Australia=== |

|||

{{main|Great Depression in Australia}} |

|||

Australia's extreme dependence on agricultural and industrial [[export]]s meant it was one of the hardest-hit countries in the [[Western world]], amongst the likes of Canada and Germany. Falling export demand and commodity prices placed massive downward pressures on wages. Further, [[unemployment]] reached a record high of almost 32% in 1932, with incidents of [[civil unrest]] becoming common. After 1932, an increase in wool and meat prices led to a gradual recovery. |

|||

===Canada=== |

|||

==Taoism and feudal system== |

|||

[[Image: |

[[Image:UnemployedMarch.jpg|thumb|right|200px|Unemployed men march in Toronto, Canada.]] |

||

{{main|Great Depression in Canada}} |

|||

The new empire retained much of the Qin administrative structure, but retreated somewhat from centralized rule by establishing vassal principalities in some areas for the sake of political convenience. After the establishment of the Han Dynasty, Emperor Gao (Liu Bang) divided the country into several "[[feudal states]]" to satisfy some of his wartime allies, though he planned to get rid of them once he had consolidated his power. |

|||

Harshly impacted by both the global economic downturn and the [[Dust Bowl]], Canadian industrial production had fallen to only 58% of the 1929 level by 1932, the second lowest level in the world after the United States, and well behind nations such as Britain, which saw it fall only to 83% of the 1929 level. Total national income fell to 55% of the 1929 level, again worse than any nation apart from the United States. |

|||

===East Asia=== |

|||

After his death, his successors from [[Emperor Han Huidi of China|Emperor Hui]] to [[Emperor Han Jingdi of China|Emperor Jing]] tried to rule China combining [[Legalism (philosophy)|Legalist]] methods with the [[Taoism|Taoist]] philosophic ideals. During this "pseudo-Taoism era", a stable centralized government over China was established through revival of the agriculture sectors and fragmentations of "feudal states" after the suppression of the [[Rebellion of the seven states]]. |

|||

The '''Great Depression in East Asia''' was of minor impact. The Japanese economy shrank by 8% 1929–31. However, Japan was fortunate to have a far sighted Minister of Finance (MoF) at the time who implemented the first version of Keynesian economic policies: first, by increasing deficit spending; and second, by devaluing the currency. The MoF believed that the deficit spending could easily be paid for when productivity improved. |

|||

The devaluation of the currency had an immediate effect. Quickly Japanese textiles began to displace British textiles in export markets. The deficit spending, however proved to be most profound. The deficit spending went into the purchase of munitions for the armed forces. By 1933, Japan was already out of the depression. By 1934 the MoF realized that the economy was in danger of overheating, and to avoid inflation, moved to reduce the deficit spending that went towards armaments and munitions. This resulted in a strong and swift negative reaction from nationalist, especially those in the Army culminating in the assassination of the MoF. This had a paralyzing, if not chilling effect on all civilian bureaucrats in the Japanese government. From 1934, the military's dominance of the government continued to grow. Instead of reducing deficit spending, the government introduced price controls and rationing schemes that reduced, but did not eliminate inflation, which would remain a problem until the end of World War II. |

|||

== Emperor Wu and Confucianism == |

|||

[[Image:ChangXingongdeng.jpg|thumb|left|A Western Han lamp with an adjustable sliding shutter, dated 172 BC, found in the tomb of [[Dou Wan]].]] |

|||

During the "''[[Taoism]] era''", China was able to maintain peace with [[Xiongnu]] by paying tribute and marrying princesses to them. During this time, the dynasty's goal was to relieve the society of harsh laws, [[wars]], and conditions from both the [[Qin Dynasty]], external threats from nomads, and early internal conflicts within the Han court. The government reduced taxation and assumed a subservient status to neighboring nomadic tribes. During this era, the government reduced its role in civilian lives ({{zh-tsp|t=與民休息|s=与民休息|p=yǔ mín xiūxi}}) and initiating a period of stability known as the ''[[Rule of Wen and Jing]]'' ({{zh-cp|c=文景之治|p=Wén-Jǐngzhīzhì}}), named after the two Emperors of this particular era. However, under [[Emperor Han Wudi of China|Emperor Wu]], who reigned over one of the most prosperous periods of the Han Dynasty, the Empire was able to reassert its power. At its height, Han China incorporated present day [[Qinghai]], [[Gansu]], and northern [[Vietnam]] into its territories. The state mounted military expeditions into Siberian lands beyond [[Lake Baikal]] in the northern extremities and established military bases on the shores of the [[Caspian Sea]] at its western extremity. |

|||

The deficit spending had a transformative effect on Japan. Japans industrial production doubled during the 1930s. Further, in 1929 the list of the largest firms in Japan was dominated by light industries, especially textile companies (many of Japan's automakers, like Toyota, have their roots in the textile industry). By 1940 light industry had been displaced by heavy industry as the largest firms inside the Japanese economy. (For more on the Japanese economy in the 1930s see "MITI and the Japanese Miracle" by Chalmers Johnson). |

|||

Emperor Wu decided that [[Taoism]] was no longer suitable for China and officially declared it a [[Confucian]] state; however, like the [[Emperors of China]] before him, he combined [[Legalism (Chinese philosophy)|Legalist]] methods with the [[Confucianism|Confucian]] ideal. This official adoption of Confucianism led not only to a [[civil service]] nomination system, but also compulsory knowledge of [[Confucian classics]] among candidates for the imperial bureaucracy, a requirement that lasted up to the abolition of the civil service examination system in 1905. Confucian scholars gained prominent status as the core of the civil service. |

|||

These events obviously set the stage for World War II. In 1929, Japan's GNP was about a sixth of the U.S. and its per capita GNP was about a third. However, during the 1930s, the U.S. economy contracted by a third. By 1939, Japan's GNP was nearly half that of the United States, and its per capita GNP was nearly equal to the United States. Face with having to face two Oceans, it was easy to see how some Japanese planners felt that they had an even chance against the U.S. What they may not have considered is that the U.S. had yet to truly kick in deficit financing for munitions until after 1940 - where upon the United States would experience it's own doubling of industrial production in four short years. |

|||

The deficit spending on munitions may have played an important role in impelling Japan's invasion and subjugation of [[Manchuria]] into a Japanese puppet-state after September 1931, thus providing Japan with raw materials and energy..{{Fact|date=October 2007}} |

|||

== Government == |

|||

{{main|Government of the Han Dynasty}} |

|||

[[Image:Earthenware architecture models, Eastern Han Dynasty, 12.JPG|thumb|right|200px|Eastern Han Dynasty tomb models of towers with ''[[dougong]]'' brackets supporting balconies, 1st–2nd century. [[Zhang Heng]] (78–139) described the large imperial park in the suburbs of [[Chang'an]] as having tall towers where archers would shoot stringed arrows from the top in order to entertain the Western Han emperors.<ref>Bulling, 312.</ref>]] |

|||

[[Image:Han commanderies and kingdoms CE 2.jpg|thumb|200px|Han Dynasty commanderies and kingdoms, AD 2]] |

|||

===France=== |

|||

The bureaucratic system of the Han Dynasty can be divided into two systems, the central and the local. As for the central bureaucrats in the capital, it was organized into a head cabinet of officials called the [[Three Lords and Nine Ministers]] (三公九卿). This cabinet was led by the [[Chancellor of China|Chancellor]] (丞相), who was included as one of the [[Three Lords|three lords]]. Officials were graded by rank and salary, were appointed to posts based on the merit of their skills rather than aristocratic clan affiliation, and were subject to dismissal, demotion, and transfer to different administrative regions.<ref name="ebrey 49">Ebrey, 49.</ref> The local official during the former Han Dynasty was different from that of the later Han Dynasty. As for the former Han, there were two administered levels, the county (郡) and the ''xian'' (縣). In the former Han Dynasty the ''xian'' was a subdivision or sub-[[prefecture]] of a county. During the Han period, there were about 1,180 of these xian, or sub-prefectures.<ref name="fairbank 106">Fairbank, 106.</ref> The entire Han Empire was heavily dependent upon its county governors (郡太守), as they could decide military policy, economic regulations, and legal matters in the county they presided over. According to historians Ebrey, Walthall, and Palais: |

|||

{{main|Great Depression in France}} |

|||

The Depression began to affect France from about 1931. France's relatively high degree of self-sufficiency meant the damage was considerably less than in nations like Germany. However, hardship and unemployment were high enough to lead to rioting and the rise of the [[socialist]] [[Popular Front (France)|Popular Front]]. |

|||

===Germany=== |

|||

{{cquote|They collected taxes, judged lawsuits, commanded troops to suppress uprisings, undertook public works such as flood control, chose their own subordinates, and recommended local men to the central government for appointments.<ref name="ebrey 49"/>}} |

|||

{{main|Great Depression in Central Europe}} |

|||

Germany's [[Weimar Republic]] was hit hard by the depression, as American loans to help rebuild the German economy now stopped. Unemployment soared, especially in larger cities, and the [[political system]] veered toward [[extremism]]. Repayment of the war reparations due by Germany were suspended in 1932 following the [[Lausanne Conference of 1932]]. By that time Germany had repaid 1/8th of the reparations. [[Adolf Hitler|Hitler]]'s [[National Socialist German Workers Party|Nazi Party]] came to power in January 1933. |

|||

===Latin America=== |

|||

The main tax exacted on the population during Han times was a [[poll tax]], fixed at a rate of 120 government-issued coins for adults.<ref name="ebrey 49"/> For adults there was also the addition of mandatory labor service for one month out of the year. Besides the poll tax, there was also the [[property tax|land tax]] administered by county and commandeer officials. This was set by the government at a relatively low rate of one-thirtieth of the collected harvest.<ref name="ebrey 49"/> |

|||

{{Main|Great Depression in Latin America}} |

|||

Because of high levels of United States investment in Latin American economies, they were severely damaged by the Depression. Within the region, [[Chile]], [[Bolivia]] and [[Peru]] were particularly badly affected. One result of the Depression in this area was the rise of [[fascist]] movements. |

|||

===Netherlands=== |

|||

With a large amount of revenue in stable times, the Han government was able to fund various public works projects and state infrastructure. In the year 3 AD, a formalized nationwide government school system was established under [[Emperor Ping of Han]], with a central school located in the capital Chang'an and local schools in the prefectures and counties.<ref>Yuan, 193.</ref> |

|||

{{main|Great Depression in the Netherlands}} |

|||

From roughly 1931 until 1937, the Netherlands suffered a deep and exceptionally long depression. This depression was partly caused by the after-effects of the [[Wall Street Crash of 1929|Stock Market Crash of 1929]] in the United States, and partly by internal factors in the Netherlands. Government policy, especially the very late dropping of the [[Gold Standard]], played a role in prolonging the depression. The Great Depression in the Netherlands led to some political instability and riots, and can be linked to the rise of the Dutch national-socialist party [[Nationaal Socialistische Beweging|NSB]]. The depression in the Netherlands eased off somewhat at the end of 1936, when the government finally dropped the [[Gold Standard]], but real economic stability did not return until after [[World War II]]. |

|||

===South Africa=== |

|||

As a result of the recorded debate ''The Discourses on Salt and Iron'' (Chinese: ''Yan Tie Lun'') about state control over non-renewable resources in China, the state decided to impose government [[monopoly|monopolies]] on salt and iron in the 1st century BC.<ref>Menzies, 721.</ref> The government monopoly on salt remained a distinctive feature of the Chinese bureaucracy in subsequent dynasties,<ref name="menzies 721 722">Menzies, 721–722.</ref> although it fell out of use at certain times when merchants were allowed to mine it, refine it, and sell it in free trade.<ref name="ebrey et al 2006 164">Ebrey et al. (2006), 164.</ref> |

|||

{{main|Great Depression in South Africa}} |

|||

As world trade slumped, demand for South African agricultural and mineral exports fell drastically. It is believed that the social discomfort caused by the depression was a contributing factor in the 1933 split between the "gesuiwerde" (purified) and "smelter" (fusionist) factions within the [[National Party (South Africa)|National Party]] and the National Party's subsequent fusion with the [[South African Party]]. |

|||

===Soviet Union=== |

|||

==Culture, society, and technology== |

|||

{{main|Economy of the Soviet Union#Economic development}} |

|||

[[Image:Earthenware figures playing liubo, Han Dynasty.JPG|left|thumb|150px|Eastern Han tomb figurines playing the ''[[liubo]]'' gambling [[board game]]]] |

|||

Having removed itself from the capitalist [[world system]] both by choice and as a result of efforts of the capitalist powers to isolate it, the Great Depression had little effect on the Soviet Union. This was a period of industrial expansion for the USSR as it recovered from revolution and civil war, and its apparent immunity to the Great Depression seemed to validate the theory of Marxism and contributed to [[Socialist]] and [[Communist]] agitation in affected nations. This in turn increased fears of Communist revolution in the [[Western_world#Political|West]], strengthening support for [[anti-Communists]], both moderate and extreme. |

|||

[[Image:Western Han Lacquer Wares and Chop Sticks.JPG|thumb|right|Western Han [[lacquerware]]s and [[chopsticks]]]] |

|||

The intellectual, literary, and artistic endeavors revived and flourished during the Han Dynasty. The Han period produced by birth China's most famous [[historian]], [[Sima Qian]] (145–90 BC), whose ''[[Records of the Grand Historian]]'' provides a detailed chronicle from the time of legendary [[Xia Dynasty|Xia]] [[emperor]] to that of the [[Emperor Han Wudi of China|Emperor Wu]] (141–87 BC). Technological advances also marked this period. One of the great Chinese inventions, [[paper]], dates from the Han Dynasty, largely attributed to the court eunuch [[Cai Lun]] (50 - 121 AD). By the first (1st) century BC, the Chinese had discovered how to forge the highly durable metal of [[steel]], by melting together [[wrought iron]] with [[cast iron]]. There were great [[mathematicians]], [[astronomers]], [[statesmen]], and technological [[inventors]] such as [[Zhang Heng]] (78 - 139 AD), who invented the world's first [[hydraulic]]-powered [[armillary sphere]].<ref name="needham volume 4 part 2 30">Needham, Volume 4, Part 2, 30.</ref><ref name="morton 70">Morton, 70.</ref> He was also largely responsible for the early development of the [[shi (poetry)|shi poetry]] style in China. Zhang Heng's work in mechanical gear systems influenced countless numbers of inventors and engineers to follow, such as [[Ma Jun]], [[Yi Xing]], [[Zhang Sixun]], [[Su Song]], etc. Zhang Heng's most famous invention was a [[seismometer]] with a swinging [[pendulum]] that signified the [[cardinal direction]] of [[earthquake]]s that struck locations hundreds of kilometres away from the positioned device.<ref name="needham volume 4 part 2 30"/><ref name="Wright 66">Wright, 66.</ref><ref name="huang 64">Huang, 64.</ref> There was also continuing development in Chinese philosophy, with figures such as [[Wang Chong]] (27 - 97 AD), whose written work represented in part the great intellectual atmosphere of the day. Among his various written achievements, Wang Chong accurately described the [[water cycle]] in [[meteorology]].<ref name="needham volume 3 468">Needham, Volume 3, 468.</ref> Zhang Heng argued that light emanating from the moon was merely the reflected light that came originally from the sun, and accurately described the reasons for [[solar eclipse]] and [[lunar eclipse]] as path obstructions of light by the celestial bodies of the earth, sun, and moon.<ref name="needham volume 3 414">Needham, Volume 3, 414.</ref> |

|||

===United Kingdom=== |

|||

[[Image:Bronze horse with lead saddle, Han Dynasty.jpg|thumb|right|200px|Han era bronze horse statue with saddle and plume, [[Freer Gallery of Art]].]] |

|||

{{main|Great Depression in the United Kingdom}} |

|||

Military technology in the Han period was advanced by the use of [[cast iron]] and [[steel]], which the 1st century [[engineer]] [[Du Shi]] had made easier by applying the [[hydraulic]] power of [[waterwheel]]s in working the [[bellows]] of the [[blast furnace]].<ref name="needham volume 4 part 2 370">Needham, Volume 4, Part 2, 370</ref> The military of the Han Dynasty also engaged in [[chemical warfare]], as written in the ''[[Hou Han Shu]]'' for the governor of Ling-ling, [[Yang Xuan]], who fought against a peasant revolt near [[Guiyang]] in 178 AD: |

|||

===United States=== |

|||

{{Cquote|The bandits were numerous, and Yang's forces very weak, so his men were filled with alarm and despondency. But he organized several dozen horse-drawn vehicles carrying bellows to blow powdered '''[[Calcium oxide|lime]]''' strongly forth, he caused [[incendiary]] rags to be tied to the tails of a number of horses, and he prepared other vehicles full of bowmen and crossbowmen. The lime chariots went forward first, and as the bellows were plied the smoke was blown forwards according to the wind, then the rags were kindled and the frightened horses rushed forwards throwing the enemy lines into confusion, after which the bowmen and crossbowmen opened fire, the drums and gongs were sounded, and the terrified enemy was utterly destroyed and dispersed.<ref name="needham volume 5 part 7 167">Needham, Volume 5, Part 7, 167.</ref>}} |

|||

{{main|Great Depression in the United States}} |

|||

====Early response==== |

|||

[[Secretary of the Treasury]] [[Andrew W. Mellon|Andrew Mellon]] advised [[Herbert Hoover|President Hoover]] that [[Shock therapy (economics)|shock treatment]] would be the best response: "Liquidate labor, liquidate stocks, liquidate the farmers, liquidate [[real estate]].... That will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people."<ref>{{cite book|author=Hoover, Herbert|title=The memoirs of Herbert Hoover|chapter=3:9}}</ref> Hoover rejected this advice, and started numerous programs, all of which failed to reverse the downturn.<Ref> Waren, ''Herbert Hoover and the Great Depression''</ref> |

|||

Hoover launched a series of programs to increase farm prices, which failed, expanded federal spending in public works such as dams, and launched the [[Reconstruction Finance Corporation]] (RFC) which aided cities, banks and railroads, and continued as a major agency under the New Deal. To provide unemployment relief he set up the Emergency Relief Agency (ERA) that operated until 1935 as the Federal Emergency Relief Agency. Quarter by quarter the economy went downhill, as prices, profits and employment fell, leading to the political realignment in 1932 that brought to power the [[New Deal]]. |

|||

There were other notable technological advancements during the Han period. This includes the hydraulic-powered [[trip hammer]] for agriculture and iron industry,<ref name="needham volume 4 part 2 184">Needham, Volume 4, Part 2, 184.</ref> the [[winnowing]] machine for agriculture,<ref name="needham volume 4 part 2 118">Needham, Volume 4, Part 2, 118.</ref> and the [[rotary]] [[Fan (mechanical)|fan]] and [[Gerolamo Cardano|Cardan suspension]] of Ding Huan (fl. 180 AD).<ref name="needham volume 4 part 2 233">Needham, Volume 4, Part 2, 233.</ref> |

|||

[[Image:Gdp29-41.jpg|thumb|350px|GDP in constant (2000) dollars]] |

|||

====The New Deal==== |

|||

==Beginning of the Silk Road== |

|||

{{Main|New Deal}} |

|||

[[Image:Zhang Qian.jpg|thumb|200px|The 138–126 BC travels of [[Zhang Qian]] to the West, [[Mogao Caves]], 618–712 AD mural.]] |

|||

Shortly after President Roosevelt was inaugurated in 1933, drought and erosion combined to cause the [[Dust Bowl]], shifting hundreds of thousands of [[displaced persons]] off their farms in the midwest. From his inauguration onward, Roosevelt argued that restructuring of the economy would be needed to prevent another depression or avoid prolonging the current one. New Deal programs sought to stimulate [[demand]] and provide work and relief for the impoverished through increased government spending and institute financial reforms. The [[Securities Act of 1933]] comprehensively regulated the securities industry. This was followed by the [[Securities Exchange Act of 1934]] which created the [[Securities and Exchange Commission]]. Though amended, key provisions of both Acts are still in force. Federal insurance of [[Deposit account|bank deposits]] was provided by the [[Federal Deposit Insurance Corporation|FDIC]], and the [[Glass-Steagall Act]]. The institution of the [[National Recovery Administration]] (NRA) remains a controversial act to this day. The NRA made a number of sweeping changes to the American economy until it [[Schechter v. United States|was deemed unconstitutional]] by the [[Supreme Court of the United States]] in 1935. |

|||

[[Image:Brozen Canister with lacquer drawing.jpg|thumb|left|140px|A Western Han cylindrical bronze container with lacquer-painted decoration.]] |

|||

{{main|Silk Road}}{{see|Protectorate of the Western Regions|Chief Official of the Western Regions}} |

|||

Early changes by the Roosevelt administration included: |

|||

From 138 BC, Emperor Wu also dispatched [[Zhang Qian]] twice as his envoy to the [[Western Regions]], and in the process pioneered the route known as the [[Silk Road]] from Chang'an (today's [[Xi'an]], [[Shaanxi Province]]), through [[Xinjiang]] and [[Central Asia]], and on to the east coast of the [[Mediterranean Sea]]. |

|||

* Instituting regulations to fight deflationary "cut-throat competition" through the NRA. |

|||

* Setting minimum prices and [[Minimum wage|wages]], labor standards, and competitive conditions in all industries through the NRA. |

|||

* Encouraging unions that would raise wages, to increase the [[purchasing power]] of the [[working class]]. |

|||

* Cutting farm production to raise prices through the [[Agricultural Adjustment Act]] and its successors. |

|||

* Forcing businesses to work with government to set price codes through the NRA. |

|||

These reforms, together with several other relief and recovery measures are called the [[First New Deal]]. New regulations and attempts at economic stimulus through a new [[alphabet soup]] of agencies set up in 1933 and 1934 and previously extant agencies such as the [[Reconstruction Finance Corporation]] did not halt economic stagnation. By 1935, the "[[Second New Deal]]" added [[Social Security (United States)|Social Security]], a national [[Aid agency|relief agency]] (the [[Works Progress Administration]], WPA) and, through the [[National Labor Relations Board]], a strong stimulus to the growth of labor unions. Unemployment declined by over one-third in Roosevelt's first term (from 25% to 14.3%, 1933 to 1937), but faster than the economic upturn came 1938's "recession within a depression" and unemployment zoomed to 19%, then declined somewhat until the [[conscription|draft]] to fight [[World War II]] lowered it more. In 1929, federal expenditures constituted only 3% of the [[Gross domestic product|GDP]]. Expenditures as a proportion of GDP tripled{{Fact|date=September 2008}} between 1933 and 1939, accompanied by sizable deficits.{{Fact|date=September 2008}} The debt as a proportion of GNP rose under Hoover from 20% to 40%. Roosevelt kept it at 40% until the war began, when it soared to 128%. After the [[Recession of 1937]], conservatives were able to form a bipartisan [[conservative coalition]] to stop further expansion of the New Deal and, by 1943, had abolished all of the relief programs. In 1946, large-scale relaxation of government controls{{Fact|date=September 2008}} over the wartime economy, including a sharp reduction of taxes, allowed for increased innovation in consumer goods and a marked increase in consumer spending. Unemployment rates also returned to normal levels.{{Fact|date=September 2008}} |

|||

Following Zhang Qian's embassy and [[report]], commercial relations between China and Central as well as Western Asia flourished, as many Chinese missions were sent throughout the 1st century BC, initiating the development of the [[Silk Road]]: |

|||

:"The largest of these embassies to foreign states numbered several hundred persons, while even the smaller parties included over 100 members... In the course of one year anywhere from five to six to over ten parties would be sent out." ([[Shiji]], trans. Burton Watson). |

|||

====Recession of 1937==== |

|||

China also sent missions to [[Parthia]], which were followed up by reciprocal missions from Parthian envoys around 100 BC: |

|||

{{Main|Recession of 1937}} |

|||

:"When the Han envoy first visited the kingdom of [[Anxi (Parthia)|Anxi]] (Parthia), the king of Anxi dispatched a party of 20,000 horsemen to meet them on the eastern border of the kingdom... When the Han envoys set out again to return to China, the king of Anxi dispatched envoys of his own to accompany them... The emperor was delighted at this." ([[Shiji]], 123, trans. Burton Watson). |

|||

In 1937 the American economy took an unexpected nosedive, lasting through most of 1938. Production declined sharply, as did profits and employment. Unemployment jumped from 14.3% in 1937 to 19.0% in 1938. The Roosevelt administration reacted by launching a rhetorical campaign against [[Monopoly|monopoly power]], which was cast as the cause of the depression, and by appointing [[Thurman Arnold]] to act; Arnold's effectiveness ended once [[World War II]] began and corporate energies had to be directed to winning the war. |

|||

[[Image:Han Civilisation.png|thumb|The Han Dynasty in 2 CE, with military garrisons and dependent states and tribute cities as far as the [[Tarim Basin]] in [[Western Regions|the West]]]] |

|||

By AD 97 the Chinese general [[Ban Chao]] had embarked on a military expedition as far west as the landmass encompassed by present-day Ukraine in pursuit of fleeing [[Xiongnu]] insurgents, and returned eastward to establish base on the shores of the [[Caspian Sea]] with 70,000 men and established direct military contacts with the Parthian Empire, also dispatching an envoy to [[Rome]] in the person of [[Gan Ying]]. |

|||

The administration's other response to the 1937 deepening of the Great Depression had more tangible results. Ignoring the pleas of the [[United States Department of the Treasury|Treasury Department]], Roosevelt embarked on an antidote to the depression, reluctantly abandoning his efforts to balance the budget and launching a $5 billion spending program in the spring of 1938, an effort to increase mass purchasing power. Business-oriented observers explained the recession and recovery in very different terms from the Keynesians. They argued that the New Deal had been very hostile to business expansion in 1935–37, had encouraged massive strikes which had a negative impact on major industries such as automobiles, and had threatened massive antitrust legal attacks on big corporations. All those threats diminished sharply after 1938. For example, the antitrust efforts fizzled out without major cases. The CIO and AFL unions started battling each other more than with the corporations, and [[tax policy]] became more favorable to long-term growth, according to this argument. |

|||

Several [[Roman embassies to China]] are recounted in Chinese history, starting with a ''[[Hou Hanshu]]'' (History of the Later Han) account of a [[Roman Empire|Roman]] convoy set out by emperor [[Antoninus Pius]] that reached the Chinese capital [[Luoyang]] in 166 and was greeted by [[Emperor Huan of Han China|Emperor Huan]]. Good exchanges such as Chinese silk, African ivory, and Roman incense increased the contacts between the East and West. |

|||

On the other hand, according to economist [[Robert Higgs]], when looking only at the supply of consumer goods, significant [[Economic growth|GDP growth]] resumed only in 1946 (Higgs does not estimate the value to consumers of collective, intangible goods like victory in war). To Keynesians, the [[war economy]] showed just how large the fiscal stimulus required to end the downturn of the Depression was, and it led, at the time, to fears that as soon as America demobilized, it would return to Depression conditions, and industrial output would fall to pre-war levels. That incorrect Keynesian prediction that a new depression would start after the war failed to take into account massive savings and pent-up consumer demand, along with the ending of the restrictive wartime regulations in most consumer industries, and the cutting of high tax rates starting in 1946. In any case, government spending and changing regulations (first tightening them, then loosening them) appear to have contributed to the recovery, as consumer and producer behavior changed. |

|||

Contacts with the [[Kushan Empire]] led to the introduction of [[Buddhism]] to China from India in the first century. |

|||

==Keynesian models== |

|||

==Rise of landholding class== |

|||

In the early 1930s, before [[John Maynard Keynes]] wrote [[General Theory of Employment Interest and Money|''The General Theory'']], he was advocating [[public works]] programs and deficits as a way to get the British economy out of the Depression. Although Keynes never mentions fiscal policy in ''The General Theory'', and instead advocates the need to socialize investments, Keynes ushered in more of a theoretical revolution than a policy one. His basic idea was simple: to keep people fully employed, governments have to run deficits when the economy is slowing because the private sector will not invest enough to increase production and reverse the recession. |

|||

[[Image:HanHorse.jpg|thumb|200px|A [[terracotta]] horse head from the Late Han Dynasty ([[2nd century]]).]] |

|||

To secure funding for his triumphant campaigns against the [[Xiongnu]], Emperor Wu relinquished land control to merchants and the rich, and in effect legalized the privatization of lands. Land taxes were based on the sizes of fields instead of on income. The harvest could not always pay the taxes completely as incomes from selling harvest were often market-driven and a stable amount could not be guaranteed, especially not after harvest-reducing natural disasters. Merchants and prominent families then lured peasants to sell their lands since land accumulation guaranteed living standards of theirs and their descendants' in the agricultural society of China. Lands were hence accumulating into a new class of landholding families. The Han government in turn imposed more taxes on the remaining independent servants in order to make up the tax losses, therefore encouraging more peasants to come under the landholding elite or the landlords. This could be seen through such examples as the written evidence in the ''Yan Tie Lun'' (Discourses on Salt and Iron), written about 80 BC, where the Lord Grand Secretary is quoted in this passage in his support of nationalizing the [[salt]] and [[iron]] industries: |

|||

As the Depression wore on, Roosevelt tried public works, [[Agricultural subsidy|farm subsidies]], and other devices to restart the economy, but never completely gave up trying to balance the budget. According to the Keynesians, he needed to spend much more money; they were unable to say how much more. With [[fiscal policy]], however, government could provide the needed Keynesian spending by decreasing taxes, increasing government spending, and increasing individuals' incomes. As incomes increased, they would spend more. As they spent more, the [[multiplier effect]] would take over and expand the effect on the initial spending. The Keynesians did not estimate what the size of the multiplier was. Keynesian economists assumed poor people would spend new incomes; however, they saved much of the new money; that is, they paid back debts owed to landlords, grocers and family {{Fact|date=September 2008}}, which might have then spent the money. Keynesian ideas of the [[consumption function]] have been challenged, most notably in the 1950s by [[Milton Friedman]] and [[Franco Modigliani]]. |

|||

{{cquote|Formerly the overbearing and powerful great families, obtaining control of the profits of the mountains and lakes, mined [[iron ore]] and smelted it with great [[bellow]]s, and evaporated [[brine]] for salt. A single family would assemble a multitude, sometimes as many as a thousand men or more, for the most part wandering unattached [[plebeian]]s (fang liu ren min) who had traveled far from their own villages, abandoning the tombs (of their ancestors). Thus attaching themselves to the great families, they came together in the midst of mountain fastnesses or desolate marshes, bringing about thereby the fruition of business based on selfish intrigue (for profit) and intended to aggrandise the power of particular firms and factions.<ref name="needham volume 4 part 2 22">Needham, Volume 4, Part 2, 22.</ref>}} |

|||

== Neoclassical approach == |

|||

[[Image:Hancoin1large.jpg|thumb|200px|A bronze coin of the Han Dynasty—circa 1st century BC.]] |

|||

Recent work from a neoclassical perspective focuses on the decline in productivity that caused the initial decline in output and a prolonged recovery due to policies that affected the labor market. This work, collected by Kehoe and Prescott,<ref>{{cite book|author=Kehoe, Timothy J.; Prescott, Edward C.|title=Great Depressions of the Twentieth Century|publisher=[[Federal Reserve Bank of Minneapolis]]|year=2007}}</ref> decomposes the economic decline into a decline in the labor force, capital stock, and the productivity with which these inputs are used. This study suggests that theories of the Great Depression have to explain an initial severe decline but rapid recovery in productivity, relatively little change in the capital stock, and a prolonged depression in the labor force. This analysis rejects theories that focus on the role of savings and posit a decline in the capital stock. |

|||

==Gold standard== |

|||

Ideally the peasants pay the landlords certain periodic (usually annual) amount of income, who in turn provide protection against crimes and other hazards. In fact an increasing number of peasant population in the prosperous Han society and limited amount of lands provided the elite to elevate their standards for any new subordinate peasants. The inadequate education and often complete illiteracy of peasants forced them into a living of providing physical services, which were mostly farming in an agricultural society. The peasants, without other professions for their better living, compromised to the lowered standard and sold their harvest to pay their landlords. In fact they often had to delay the payment or borrow money from their landlords in the aftermath of natural disasters that reduced harvests. To make the situation worse, some Han rulers double-taxed the peasants. Eventually the living conditions of the peasants worsened as they solely depended on the harvest of the land they once owned. |

|||

Every major currency left the [[gold standard]] during the Great Depression. [[Great Britain]] was the first to do so. Facing speculative attacks on the [[pound sterling|pound]] and depleting gold reserves, in September 1931 the [[Bank of England]] ceased exchanging pound notes for gold and the pound was floated on foreign exchange markets. |

|||

Great Britain, Japan, and the [[Scandinavia]]n countries left the gold standard in 1931. Other countries, such as Italy and the United States, remained on the gold standard into 1932 or 1933, while a few countries in the so-called "gold bloc", led by France and including [[Poland]], [[Belgium]] and [[Switzerland]], stayed on the standard until 1935-1936. |

|||

The landholding elite and landlords, for their part, provided inaccurate information of subordinate peasants and lands to avoid paying taxes; to this very end corruption and incompetence of the Confucian [[scholar gentry]] on economics would play a vital part. Han court officials who attempted to strip lands out of the landlords faced such enormous resistance that their policies would never be put in to place. In fact only a member of the landholding families, for instance Wang Mang, was able to put his reforming ideals into effect despite failures of his "turning the clock back" policies. |

|||

[[Image:Bronze Lamp in theShape of a Phoenix.jpg|thumb|200px|A Western Han bronze lamp in a depiction of a [[fenghuang]] (phoenix)]] |

|||

The Han government kept records on people's property to assess taxes. Yet government officials and secretaries weren't the only ones documenting property. In the Han period the prototype of contractual language and privately signed [[contract]]s appear for those wishing to keep their own private documents on their property for later use in court if necessary.<ref name="brook 59">Brook, 59.</ref> However, creating signed contracts with documented witnesses and scribes was not in common use until the [[Tang Dynasty|Tang period]] (618–907), while contractual language did not "permeate Chinese life" until the [[Yuan Dynasty]] (1271–1368), according to historians Valerie Hansen and Timothy Brook.<ref name="brook 59"/> |

|||

According to later analysis, the earliness with which a country left the gold standard reliably predicted its economic recovery. For example, Great Britain and Scandinavia, which left the gold standard in 1931, recovered much earlier than France and Belgium, which remained on gold much longer. Countries such as China, which had a [[silver standard]], almost avoided the depression entirely. The connection between leaving the gold standard as a strong predictor of that country's severity of its depression and the length of time of its recovery has been shown to be consistent for dozens of countries, including developing countries. This partly explains why the experience and length of the depression differed between national economies <ref>{{citation |last=Bernanke |first=Ben |date=March 2, 2004 |title=Remarks by Governor Ben S. Bernanke: Money, Gold and the Great Depression |journal=At the H. Parker Willis Lecture in Economic Policy, Washington and Lee University, Lexington, Virginia |url=http://www.federalreserve.gov/boarddocs/speeches/2004/200403022/default.htm}}</ref>. |

|||

==Interruption of Han rule== |

|||

After 200 years, Han rule was interrupted briefly during AD [[9]]–[[24]] by [[Wang Mang]], a reformer and a member of the landholding families. The economic situation deteriorated at the end of Western Han Dynasty. Wang Mang, believing the Liu family had lost the [[Mandate of Heaven]], took power and turned the clock back with vigorous monetary and land reforms, which damaged the economy even further. |

|||

== |

==Rearmament and recovery== |

||

The massive rearmament policies to counter the threat from [[Nazi Germany]] helped stimulate the economies of Europe in 1937-39. By 1937, unemployment in Britain had fallen to 1.5 million. The mobilization of manpower following the outbreak of war in 1939 finally ended unemployment. |

|||

[[Image:Han provinces.jpg|200px|thumb|left|Han dynasty provinces AD 189 (on the verge of collapsing)]] |

|||