Brazilian packaging market

The Brazilian packaging market is the fifth largest in the world, with sales of US $ 35 billion (1.5% of GDP) in calendar year 2014. This is roughly correlated to Brazil's economic strength, since Brazil is the seventh largest economic area in the world in terms of nominal GDP . The packaging market includes the manufacture of packaging materials from raw materials, the supply of these packaging materials to producers, packaging design and various processes for recycling and reuse. The packaging sector is strongly oriented towards environmental and nature conservation organizations and tries to meet the demands of those organizations for more environmentally friendly production. Sustainable packaging, d. H. The use of sustainable packaging materials is experiencing an economic boom and offers plenty of space for innovations and future-oriented investment opportunities.

Market development

Over the period from 2011 to 2016, the Brazilian packaging market is expected to grow by 6.2% on average. In 2016, Brazil's packaging market will generate sales of 34 billion US dollars, leaving Brazil behind Canada and drawing level with France . However, the constant growth of the Brazilian packaging market is not a unique development, because the global packaging market is growing steadily. The reasons for this are plentiful. This is due, among other things, to increasing urbanization, investments in the construction industry and the expansion of the healthcare system. The demand for environmentally friendly types of packaging has also risen sharply since the 2000s and the economic growth resulting from innovations in this area has reinforced this trend. Furthermore, the strong growth of the BRIC countries , especially in the years 2000–2008, as well as in the early years after the economic crisis, played a major role in the absolute market development. Despite the current economic weakness of the BRIC countries - especially the People's Republic of China and Brazil - the highest growth rates can be observed in these countries. In descending order, China, India , Brazil and Russia show growth rates of 7.9%, 7.7%, 6.2% and 4.9%. Those high growth rates are due in particular to rising household incomes. The rising incomes lead to an increasing demand for an ever wider range of products, which ultimately means growth for the producers of the packaging of those goods. Despite the strong annual growth for the period 2011–2016, estimates assume that sales in the packaging market between 2014 and 2016 will decrease by 2.9% due to the economic recession in the country and drop to 34 billion US $.

| Countries | 2008 sales

(Billion US $) |

Ranking

2008 |

sales 2011 (billion US $) |

Ranking

2011 |

2016 sales

(Billion US $) |

Ranking

2016 |

|---|---|---|---|---|---|---|

| United States | 129 | 1. | 141 | 1. | 164 | 1. |

| China | 50 | 2. | 80 | 2. | 117 | 2. |

| Japan | 70 | 3. | 76 | 3. | 87 | 3. |

| Germany | 33 | 4th | 37 | 4th | 42 | 4th |

| France | 27 | 5. | 30th | 6th | 34 | 5. |

| Canada | 24 | 7th | 27 | 7th | 30th | 7th |

| Brazil | 26th | 6th | 32 | 5. | 34 | 5. |

| United Kingdom | 20th | 8th. | 22nd | 8th. | 25th | 9. |

| Russia | 17th | 9. | 21st | 9. | 26th | 8th. |

| India | 9 | 10. | 17th | 10. | 25th | 10. |

| Other | 158 | X | 199 | X | 262 | X |

| total | 559 | X | 675 | X | 845 | X |

In direct comparison to 2005, the export of Brazilian packaging goods increased by 42%. Metals such as aluminum and steel in particular show a very high increase within the nine-year trend. Plastic and steel packaging were the most exported packaging types in 2013, with sales of $ 268 million and $ 183 million, respectively. Taken together, plastic packaging and steel packaging accounted for 70% of packaging exports. Wood is the only packaging material that was exported less in 2013 than in 2005. Exports fell by 32% from 21 million US dollars to 15 million US dollars. In total, Brazil exported packaging worth US $ 645 million in 2013.

| packaging | 2005 | 2008 | 2011 | 2012 | 2013 | % Difference 2005/14 |

|---|---|---|---|---|---|---|

| plastic | 195.1 | 282.6 | 269.3 | 256.9 | 267.5 | + 37.1% |

| Wood | 21.0 | 33.3 | 20.2 | 18.8 | 14.3 | −31.9% |

| Paper and cardboard | 90.2 | 118.1 | 119.5 | 126.4 | 123.0 | + 36.3% |

| Glass | 13.1 | 46.2 | 28.8 | 18.8 | 16.9 | + 29.0% |

| steel | 127.6 | 251.8 | 221.7 | 212.3 | 183.4 | + 43.7% |

| aluminum | 5.5 | 24.9 | 17.8 | 31.6 | 40.2 | +631.0% |

| total | 452.5 | 756.9 | 677.3 | 664.8 | 645.3 | + 42.6% |

The imports of all packaging materials listed increased between 2005 and 2013. Most imported packaging consists of glass (560% growth) and steel (384% growth). Wood imports have only increased by 30%, making it the only type of packaging that has not grown by 200% or more. In total, Brazil imported packaging worth 1.2 billion US dollars in the 2013 calendar year.

| packaging | 2005 | 2008 | 2011 | 2012 | 2013 | % Change 2005/14 |

|---|---|---|---|---|---|---|

| plastic | 200.5 | 383.3 | 579.6 | 602.8 | 642.4 | + 220.4% |

| Wood | 2.0 | 2.9 | 3.2 | 2.5 | 2.6 | + 30% |

| Paper and cardboard | 59.2 | 141.5 | 245.0 | 236.0 | 252.4 | +326.4% |

| Glass | 20.1 | 31.0 | 112.8 | 131.8 | 132.7 | +560.2% |

| steel | 36.2 | 89.0 | 141.1 | 159.3 | 175.5 | +384.48% |

| aluminum | 8.7 | 27.9 | 49.8 | 31.3 | 38.7 | + 344.8% |

| total | 326.7 | 675.6 | 1131.5 | 1163.7 | 1244.3 | + 280.9% |

raw materials

Many different raw materials are used in the packaging industry. Nevertheless, corrugated cardboard and plastic are by far the most widely used materials, as they add up to over 50% of the market volume and over 40% of the market value. Although it represents 15% of the market volume, glass only accounts for 4% of the total market value. The opposite example is flexible materials , as they only contribute 3% of the market volume but 22% of the market value.

| raw material | amount | value |

|---|---|---|

| Corrugated cardboard | 31.6% | 12.7% |

| plastic | 22.6% | 29.5% |

| Glass | 15.1% | 4.3% |

| metal | 13.3% | 18.4% |

| Duplex / triplex | 6.0% | 4.0% |

| paper | 4.5% | 4.2% |

| Flexible fabrics | 3.3% | 22.4% |

| LPB | 3.6% | 4.5% |

In 2014, two thirds of packaging raw materials were used for food packaging and only one third for non-food products. Steel, Kraft and Duplex / Triplex are the only materials that are used more frequently in non- food packaging than food . Due to their light weight, materials such as aluminum or flexible fabrics are particularly popular in food. 90% of the glass is used for food packaging, mostly for beer, but also for other beverages. If you look at the relationship between value and quantity, you will notice that flexible fabrics and aluminum are the most valuable of the materials listed. In addition, the relationship between value and quantity is generally highest for food.

| Food | Non-food | ||||||

|---|---|---|---|---|---|---|---|

| category | material | amount (1000 t) |

% | value (Million US $) |

amount

(1000 t) |

% | value

(Million US $) |

| Flexible fabrics | 653.7 | 88.6% | 7,714.84 | 83.9 | 11.4% | 1,661.1 | |

| metal | aluminum | 444.6 | 93.2% | 3,693.7 | 32.3 | 6.8% | 268.5 |

| Tinplate | 422.0 | 64.3% | 1,182.2 | 233.9 | 35.7% | 655.2 | |

| steel | 8.7 | 2.9% | 17.8 | 289.2 | 97.1% | 593.2 | |

| paper | force | 211.7 | 43.3% | 618.4 | 277.6 | 56.7% | 849.4 |

| Duplex / triplex | 219.8 | 33.8% | 474.4 | 430.5 | 66.2% | 929.2 | |

| Cardboard box | 2,179.5 | 64.0% | 2,840.0 | 1,225.2 | 36.0% | 1,596.5 | |

| plastic | 1,946.0 | 72.6% | 7,687.5 | 734.6 | 27.4% | 2,850.6 | |

| Glass | 1,239.9 | 89.7% | 1,150.6 | 142.4 | 10.3% | 132.2 | |

| total | 7,325.9 | 68.0% | 25,379.5 | 3,449.58 | 32.0% | 9,536.0 | |

The largest end market for packaging raw materials is the beverage industry. While plastic and flexible materials are the most widely used materials for non-alcoholic beverages, most metals (especially aluminum) and glass are used for alcoholic beverages. Hard plastic is mostly used for meat and vegetables , but flexible materials are catching up more and more. For chemical and agricultural products, plastic and metal are used by far, as the products depend on durable types of packaging. The comparatively very low production costs for plastic and flexible fabrics are another reason for their popularity in the Brazilian packaging sector.

| category | product | Flexible fabrics | Metals | paper | Plastics | Glass | TOTAL |

|---|---|---|---|---|---|---|---|

| food | meat and vegetables | 1,284 | 625 | 401 | 2,228 | 136 | 4,675 |

| Cereal and flour products | 1,608 | 37 | 248 | 620 | - | 2,513 | |

| Sugar and chocolate | 640 | 77 | 296 | 307 | 18th | 1,339 | |

| Dairy and fat products | 1,290 | 261 | 53 | 965 | 77 | 2,647 | |

| beverages | Alcoholic drinks | 51 | 2.986 | 34 | 146 | 980 | 4,196 |

| Non alcoholic drinks | 3,003 | 1,024 | 62 | 3,194 | 224 | 7,507 | |

| Non-food | Electrical and automotive | 1 | 26th | 85 | 69 | - | 182 |

| Health and cosmetics | 883 | 270 | 304 | 755 | 131 | 2,343 | |

| leisure | 65 | - | 326 | 20th | - | 411 | |

| Cleaning and household | 221 | 128 | 226 | 844 | - | 1,418 | |

| Chemistry and agriculture | 480 | 1,093 | 200 | 1,162 | 1 | 2,947 | |

| total | 9,537 | 6,527 | 2,235 | 10,311 | 1,568 | 30,177 |

Packaging trends

An analysis of the Brazilian packaging market shows a number of products, the popularity of which has been increasing steadily, especially since the late 2000s. There are also five general trends surrounding the Brazilian packaging market.

Trends

In their study Brasil PackTrends 2020 (2012), the Brazilian Institute of Food and Technology (ITAL) identified five trends in the packaging industry: 1) comfort and simplicity, 2) aesthetics and identity, 3) quality and new technologies, 4) sustainability and ethics , and 5) Security and Regulation. Although the following examples relate to the Brazilian market, the trends can generally be applied to any packaging market, including the US, French and German markets.

Convenience and simplicity

Today's consumers value products that make their lives easier, that are neither time-consuming nor awkward to use. The same is true of packaging; Packaging should be easy to open, resealable and easy to dispose of. When it comes to food, the most popular types of packaging are those that make it easy to prepare the meal (e.g. by preparing it in the microwave ). Packaging should avoid being an unnecessary thorn in the side of the consumer when he wants to use his product. This also includes packaging design, especially in terms of language and representations on the packaging. The consumer should be able to find essential information easily, but at the same time not be overwhelmed with information. Furthermore, packaging manufacturers have to adapt to socio-economic change . Due to increasing urbanization, there are many more single-person households today than there were 20 years ago and this means that more products have to be packaged in individual portions and have to be easy to prepare.

Aesthetics and identity

By buying a product, consumers are hoping for objective as well as subjective satisfaction. Appropriate product packaging can increase the consumer's feeling of being able to identify with a product. For example, packaging made of high-quality metal conveys a feeling of luxury, while packaging made of wood conveys an environmental awareness and above all a closeness to nature. As consumers are becoming more and more health conscious, the number of product packaging that aims to highlight the positive health effects of their products is also increasing. A trend that only emerged from 2010 is to make products into collectibles because of their packaging, so that the packaging has a higher subjective value among consumers than the actual product. A good and current example is the “Drink a Coke with…” (“Share a Coke”) marketing campaign by Coca-Cola , which started in Brazil in 2015, four years after the start of the first campaign in Australia . Current trends since 2010 show that consumers are increasingly preferring packaging that uses a simple design that does without too much text and too many colors.

Quality and New Technologies

The packaging sector offers opportunities for new technologies and new types of materials that can improve a product not only in terms of its lifespan, but also in terms of its microbiological safety. Active and intelligent product packaging is able, for example, to absorb oxygen and CO 2 , or even to heat itself. Other designs provide the consumer with indicators of product temperature or the degree of freshness and ripeness . There is also steady progress in nanotechnology . Nanotechnology can help create micro-barriers that protect products from gases , humidity or UV radiation . Furthermore, new ways are constantly being found to make product packaging and thus the overall product lighter, which is not only useful for the consumer but also for the manufacturer with the associated easier logistics. In addition, biopolymers are increasingly being used instead of polymers that are dependent on fossil raw materials . However, these new technologies very often encounter obstacles such as B. higher production costs , which in turn lead to a higher price, competitive disadvantages compared to the cheap fossil material.

Sustainability and ethics

Due to acute problems such as climate change, the environment is increasingly becoming a central topic of discussion that needs to be addressed. More and more manufacturers are committed to sustainable manufacturing processes and to keeping their carbon footprint low. The life cycle analysis of products and services is seen as the best tool to determine environmental costs. Sustainability is not only achieved by using 100% sustainable materials, but also, for example, by making product packaging smaller so that more products can be shipped at the same time and fewer transports have to be made. Sustainable product packaging also reinforces the feeling of product identification on the part of the consumer, as the product conveys a strong environmental awareness. Due to the strong increase in the use of recycled raw materials, functioning waste management and reverse logistics are becoming indispensable and at the same time a promising market for investments and innovations in services and products. In order to avoid obvious greenwashing and not to burden the relationship between producer and consumer, manufacturers are increasingly relying on official certification by renowned environmental certification institutes such as the Carbon Trust or the Forest Stewardship Council .

Security and Regulation

Packaging is a crucial factor in terms of product quality and product safety. Good product packaging should provide the consumer with all the necessary information, such as: B. preparation instructions, nutritional values , date of manufacture and expiry as well as manufacturer information. Another important issue is chemical contamination of food. The transfer of chemical contamination from food contact materials to the respective food is called migration and attempts are made to counteract it with the help of mathematical modeling and in-depth analyzes. Packaging materials must meet the conditions of the complex regulation enacted by the legislators. In 2000, four years after adopting Mercosur's regulations to control the use of food contact materials , Brazil decided to exempt food contact materials (apart from recycled materials) from Mercosur's registration obligations. However, this exemption does not apply to imported food contact materials. Furthermore, the Brazilian national health authority (ANVISA) must be informed about the import of any food contact material in order to prevent risks. In order to do justice to the rapidly growing scientific knowledge and technological advances, existing laws must be constantly revised. Together with Mercosur, the United States Food and Drug Administration (FDA) and the European Union - which harmonized legislation on the treatment of food commodities in 2004 - ANVISA is fighting for globally harmonized regulations and institutions to prevent problems associated with commodities.

Products

Stand-up pouch

Probably the most successful innovation of the 2010s is the stand-up pouch, which is mostly used for food, but also for animal feed and cosmetic products. Manufacturers of stand-up pouches have managed to constantly look for new market niches to implement their product. Despite the high annual growth rate of 6.1% in volume and 5.8% in value, the Brazilian market is lagging behind the Chilean and US markets in terms of stand-up pouch sales. This is due to the fact that the supply of key components such as zip fasteners and nylon to Brazilian manufacturers is worse than in the other two markets. This leads to higher prices for stand-up pouches than in Chile or the USA and thus to poorer sales. Among the fastest growing flexible materials, the stand-up pouch takes third place in terms of annual growth in volume and fourth place in terms of annual growth in value.

| Type | metric tons

2011 |

metric tons

2012 |

metric tons

2013 |

metric tons

2014 |

CAGR

amount |

Ranking

Growth |

Thousand US $

2011 |

Thousand US $

2012 |

Thousand US $

2013 |

Thousand US $

2014 |

CAGR

value |

Ranking

Growth value |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Blister packaging | 6,999 | 7,759 | 8,579 | 9,173 | 7.0% | 1. | 271.929 | 305.123 | 341.830 | 366.225 | 7.7% | 2. |

| Strip packaging | 840 | 929 | 1.101 | 1,067 | 6.2% | 2. | 10,746 | 12,177 | 13,607 | 13,623 | 6.1% | 3. |

| Stand-up pouch | 15,459 | 16,369 | 18,494 | 19,593 | 6.1% | 3. | 193.108 | 236.363 | 315,839 | 241,691 | 5.8% | 4th |

| Pull-out cardboard box | 4,284 | 4,419 | 4,743 | 5,175 | 4.8% | 4th | 30,138 | 31,335 | 33,553 | 37,221 | 5.4% | 5. |

| Seals | 72 | 69 | 82 | 87 | 4.8% | 5. | 640 | 626 | 734 | 778 | 5.0% | 6th |

| Peel-off lid | 7,085 | 7,277 | 7,667 | 8,425 | 4.4% | 6th | 182,572 | 166.033 | 174.814 | 327.081 | 15.7% | 1. |

| Changing cans | 584 | 589 | 659 | 679 | 3.8% | 7th | 39,226 | 38,929 | 43,087 | 44,200 | 3.0% | 9. |

| Cases | 1,717 | 1,737 | 2.015 | 1.993 | 3.8% | 8th. | 22,288 | 22,647 | 26,080 | 26,137 | 4.1% | 7th |

| parcel | 24,984 | 26,081 | 27,158 | 28,486 | 3.33% | 9. | 817.660 | 836.456 | 866.666 | 945.100 | 3.7% | 8th. |

| Jars / tumblers | 6,804 | 7,489 | 7,462 | 7,680 | 3.08% | 10. | 131,088 | 144,551 | 142,681 | 146,666 | 2.9% | 10. |

Typical products that are packaged as stand-up pouches are nut mixes, mueslis, dog and cat food, liquid soap and small amounts of liquid detergent.

Organic packaging

The development of bio-packaging is a cutting-edge goal for packaging manufacturers. On June 3rd, 2015, Coca-Cola presented its version of a 100% recyclable PET bottle - PlantBottle ™ - the first of its kind. Unlike ordinary PET, PlantBottle ™ is not based on fossil materials. For the production of the bottle, Coca-Cola sources sugar cane- ethanol-based plastic from Braskem , a Brazilian company for petrochemicals and biopolymers. Furthermore, Tetra Pak announced the production of a 100% renewable product packaging for its dairy products. This innovative packaging concept received the awards “Best carton or pouch” and “Best manufacturing or processing innovation” at the World Beverage Innovation Awards 2015, as well as the Gold Award at the Pro2Pac Excellence Awards in the United Kingdom. Like Coca-Cola, Braskem supplies Tetra Pak with sugar cane bioplastics.

The Brazilian sugar cane industry is a very promising market and an indispensable part of the Brazilian packaging market in the future. Sugar cane ethanol is produced in areas that are at least 2000 km away from the Amazon rainforest, more precisely in the coastal regions of the northeast region and in the southeast . 60% of the total production takes place in the state of São Paulo .

Recycling in Brazil

Compared to the developed OECD countries, Brazil has a relatively low recycling rate of just 2%. As in 2012 only 14% of the municipalities in Brazil offer separate garbage collection (86% of those municipalities are either in the south or in the southeast), the country is heavily dependent on its garbage collectors, who are now regarded as official workers. In addition, only 64% of the population has access to regular garbage collection. Nevertheless, the situation has improved since 2010, because while in 2010 only 443 municipalities offered separate garbage collection, in 2012 there were already 766.

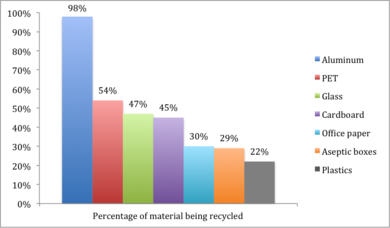

Despite the low overall recycling rate, Brazil was the world leader in aluminum recycling in 2014 with a share of 98.4%. The main reason for this extremely high percentage is the rising energy costs, which are making the production of new aluminum a very expensive process due to the rising prices for hydropower , which in turn resulted from the 2015 drought. Between March 2014 and March 2015, energy costs increased by 60%. With aluminum recycling using 95% less energy, the recycling rate has steadily increased while more and more factories specializing in the production of new aluminum have had to close. With a recycling rate of 54% in 2014, PET was the second most recycled packaging material in Brazil. However, since the production costs for new PET are much lower than in the case of aluminum, the recycling rate of PET is significantly lower than that of aluminum. Due to the very low production costs and the elaborate recycling processes, plastic (hard plastic) has the lowest recycling rate of the materials listed at 22%. In addition, more and more manufacturers are using packaging materials made from recycled raw materials. The Brazilian cosmetics label Seeja, which was launched by Brazilian top model Gisele Bündchen and is Forest Stewardship certified, uses fibers for its product packaging, which are made from 100% recycled paper. Another example is the Brazilian paper and pulp manufacturer Suzano , which has been producing cardboard made from recycled synthetic resins (PCR) since 2012 by extracting fibers from long-life packaging such as milk cartons.

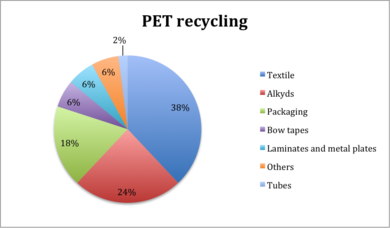

In 2012, more than a third of recycled PET was used as polyester in the textile industry. Around a quarter of recycled PETs was processed into alkyd resin (synthetic resin), which is mostly used as paint . Product packaging was the target of 18% of recycled PET.

See also

Web links

- Brasil PackTrends 2020 Online Version (English)

- Datamark Ltda

- Functionality of a "vertical form fill seal machine" for use in the packaging industry

- Brazilian Institute of Food Technology (ITAL) (Portuguese)

- CEMPRE publications, a. a. CEMPRE Review 2013

- List of plastic-based packaging materials, including properties and benefits (English)

Individual evidence

- ↑ a b c d Claire IGL Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL - Instituto de Tecnologia de Alimentos, Campinas - SP 2012, ISBN 978-85-7029-119-6 , p. 10.

- ↑ Data Mark - Market Intelligence Brazil . Retrieved December 11, 2015.

- ↑ Rosemary Han: Why the 2030 Sustainable Development Goals matter to packaging professionals . In: Packaging Digest . December 1, 2015. Accessed December 2, 2015.

- ^ Beth Gardiner: The Side Effects of Consumerism. Large Producers and Retailers Cutting Back on Packaging . In: The New York Times , November 19, 2014. Retrieved December 2, 2015.

- ↑ a b Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, p. 9.

- ↑ Silvio Cascione: Brazil's economy tailspin seen at record speed in third quarter . In: Reuters , November 27, 2015. Retrieved December 2, 2015.

- ^ Mark Spiegel: Global Fallout from China's Industrial Slowdown . Federal Reserve Bank of San Francisco. November 23, 2015. Accessed December 2, 2015.

- ↑ Sarantópoulos et al .: Brasil PackTrends 2020 2012, p. 10.

- ↑ Cley Scholz: 13 sintomas de que a economia brasileira está em recessão . In: O Estado de S. Paulo (Estadão) , August 29, 2014.

- ↑ Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, pp. 72–73.

- ↑ Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, pp. 70–71, 74.

- ↑ Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, p. 75.

- ^ Sara Spary: From Share a Coke to Mad Men: the campaigns that defined Coke under Wendy Clark . In: Marketing Magazine . November 17, 2015. Accessed December 2, 2015.

- ↑ Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, pp. 76–78.

- ↑ Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, pp. 79–80.

- ↑ Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, pp. 80–82.

- ^ A b Mitzi Ng Clark: Keller Heckman Packaging Site - Food Packaging Regulations in Latin America: Moving Towards Harmonization . April 2014. Retrieved November 30, 2015.

- ↑ Regulation (EC) No 1935/2004 . Retrieved November 30, 2015.

- ^ Legislation - European Commission . Retrieved November 30, 2015.

- ^ Neil H. Mermelstein: International harmonization of food quality & safety standards. In: Food Technology. Chicago 2012, pp. 72-75.

- ↑ Inovação | Datamark . Retrieved December 1, 2015.

- ↑ ABIEF: Brazilian Association for the Flexible Plastic Industry http://www.abief.com.br/

- ↑ Coca-Cola Introduced World's First 100% Biobased PET Bottle . Retrieved November 30, 2015.

- ↑ Coca-Cola expands PlantBottle reach, launches 100% plant-based HDPE | Packaging World . Retrieved November 30, 2015.

- ↑ I'm green ™ polyethylene - Braskem . Retrieved November 30, 2015.

- ↑ a b Tetra Pak Launches 100% Renewable Package Globally · Environmental Leader · Environmental Management News . Archived from the original on November 26, 2015. Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved November 30, 2015.

- ^ Karen Henry: Tetra Pak Launches 100% Renewable Package Globally · Environmental Leader · Environmental Management News . November 16, 2015. Archived from the original on November 26, 2015. Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved December 1, 2015.

- ↑ Interview: Tetra Pak state award win is a 'recognition of efforts' . Retrieved November 30, 2015.

- ↑ Winners and finalists of the World Beverage Innovation Awards 2015 announced . Retrieved November 30, 2015.

- ↑ Ana Gabriela Verotti Farah: Brazilian Sugarcane Industry . January 22, 2015. Accessed November 30, 2015.

- ↑ The Brazilian associations of the aluminum, PET, glass, cardboard, paper, packaging and plastic industries, in order.

- ↑ a b Andrea Novais: Recycling of waste in Brazil . May 13, 2015. Accessed December 2, 2015.

- ↑ CEMPRE Review 2013. Compromisso Empresarial de Recliclagem (CEMPRE), 2013, p. 21. (Portuguese)

- ↑ CEMPRE Review 2013. CEMPRE, 2013, p. 22.

- ↑ CEMPRE is a non-profit organization that campaigns for greater use of recycling in Brazilian industry.

- ↑ Vilarino Cleyton: Brazil breaks aluminum recycling record . In: Fox News Latino , November 10th, 2015. Archived from the original on December 11th, 2015 Info: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. . Retrieved December 2, 2015.

- ↑ UPDATE 1-Alcoa's Brazil aluminum smelter latest victim of high costs . In: Reuters , March 30, 2015. Retrieved December 2, 2015.

- ↑ RECICLAR Materiais Recicláveis . Archived from the original on December 24, 2015. Info: The archive link was automatically inserted and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved December 2, 2015.

- ↑ Sarantópoulos, et al .: Brasil PackTrends 2020. ITAL, 2012, p. 136.

- ↑ Seeja standard . Archived from the original on December 10, 2015. Info: The archive link was automatically inserted and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved December 3, 2015.

- ↑ Long life packaging is product packaging that consists of several layers to strengthen the packaging. The best known product is the milk carton.

- ↑ CEMPRE Review 2013. CEMPRE, 2013, p. 29.

- ↑ Suzano lança papel cartão feito com aparas recicladas | VEJA.com .