Energy Tax Act (Germany)

| Basic data | |

|---|---|

| Title: | Energy Tax Act |

| Previous title: | Mineral Oil Tax Act |

| Abbreviation: | EnergieStG |

| Type: | Federal law |

| Scope: | Federal Republic of Germany |

| Legal matter: | Tax law |

| References : | 612-20 |

| Original version from: | March 22, 1939 ( RGBl. I p. 566) |

| Entry into force on: | April 1, 1939 |

| Last revision from: | July 15, 2006 ( BGBl. I p. 1534 ) |

| Entry into force of the new version on: |

predominantly August 1, 2006 |

| Last change by: |

Art. 204 VO of June 19, 2020 ( Federal Law Gazette I p. 1328, 1352 ) |

| Effective date of the last change: |

June 27, 2020 (Art. 361 of June 19, 2020) |

| Please note the note on the applicable legal version. | |

The Energy Tax Act (EnergieStG) is a consumption tax law regulating the taxation of all types of energy, both fossil fuels ( mineral oils , natural gas , liquefied gases and coal ) and renewable energy products ( vegetable oils , biodiesel , bioethanol ) and synthetic hydrocarbons from biomass as heating or fuel in the Federal Republic of Germany Germany . On July 15, 2006 it replaced the Mineral Oil Tax Act (MinöStG). Its adoption was necessary in order to implement the requirements of the European Energy Tax Directive.

General

The Energy Tax Directive called for a harmonization of the minimum taxation for electricity and energy products from energy sources other than mineral oil. That is why the Energy Tax Act included hard coal , lignite , coke and lubricating oils as other fossil fuels . Electricity is regulated separately in the Electricity Tax Act. In addition, since January 1, 2004, the taxation of biofuels was also regulated in the Mineral Oil Tax Act. As a consumption tax, the energy tax is an indirect tax . The main customs offices are responsible for collecting the energy tax . They also have tax oversight. The income from the mineral oil tax is estimated at approx. € 42 billion for 2005, which according to Article 106, Paragraph 1, No. 2 of the Basic Law goes to the federal budget . The income from the mineral oil tax rose from 5.886 billion euros (11.512 billion DM) in 1970 to 41.782 billion euros in 2004.

The tax rates differentiate between heating oil and fuels for locomotion (although there is no fundamental chemical difference between diesel and heating oil). This is justified by the fact that the mineral oil tax also covers the costs of road construction and maintenance. The lower taxation of diesel fuel compared to petrol is often viewed as a hidden diesel subsidy , but a significantly higher vehicle tax is levied for diesel cars than for those with petrol engines.

Fuel used for agricultural purposes is tax-deductible ( agricultural diesel ), while the standard rate is used for diesel locomotives.

Kerosene (Jet A-1) and aviation fuel (AvGas) are tax-free for the commercial transport of people or things by air carriers.

With the law for the further development of the ecological tax reform from 2002, the tax rate reduction for natural and liquid gas used by all vehicles on public roads was updated until December 31, 2009. This reduced the price for natural gas to around 54 cents per kg (as of July 2006).

In the course of equating natural and liquefied gas, the German Bundestag decided to set the tax concessions for these two alternative fuels equally until 2018.

Mineral oil and energy tax rates in Germany (1939 to today)

Development of the mineral oil tax, since August 1, 2006 energy tax, for low-sulfur fuels in the Federal Republic of Germany, according to the Federal Ministry of Finance. All figures in cents (€ 0.01) per liter, although the amounts were fixed in whole pfennigs even after the introduction of the euro:

| Come into effect | petrol | modification | diesel | modification | Difference between gasoline and diesel |

modification |

|---|---|---|---|---|---|---|

| 05.09.1939 * | 2.29 | 1.68 | 0.61 | |||

| 01/21/1951 | 7.24 | 4.95 | 4.69 | 3.01 | 2.54 | 1.93 |

| 06/01/1953 | 10.28 | 3.05 | 2.71 | −1.98 | 7.57 | 5.03 |

| 05/01/1955 | 11.33 | 1.05 | 7.77 | 5.06 | 3.56 | −4.01 |

| 04/01/1960 | 12.38 | 1.05 | 9.80 | 2.02 | 2.58 | −0.98 |

| 01/01/1964 | 16.36 | 3.98 | 15.18 | 5.38 | 1.18 | −1.40 |

| 01/01/1967 | 17.90 | 1.53 | 16.73 | 1.55 | 1.16 | −0.02 |

| 03/01/1972 | 19.94 | 2.05 | 18.80 | 2.07 | 1.14 | −0.02 |

| 07/01/1973 | 22.50 | 2.56 | 21.38 | 2.58 | 1.12 | −0.02 |

| 04/01/1981 | 26.08 | 3.58 | 22.93 | 1.55 | 3.14 | 2.02 |

| 04/01/1985 | 25.05 | −1.02 | 22.93 | 0.00 | 2.12 | −1.02 |

| 01/01/1986 | 23.52 | −1.53 | 22.93 | 0.00 | 0.59 | −1.53 |

| 04/01/1987 | 24.03 | 0.51 | 22.93 | 0.00 | 1.10 | 0.51 |

| 04/01/1988 | 24.54 | 0.51 | 22.93 | 0.00 | 1.61 | 0.51 |

| 01/01/1989 | 29.14 | 4.60 | 22.93 | 0.00 | 6.21 | 4.60 |

| 01/01/1991 | 30.68 | 1.53 | 22.93 | 0.00 | 7.75 | 1.54 |

| 07/01/1991 | 41.93 | 11.25 | 28.12 | 5.19 | 13.80 | 6.05 |

| 01/01/1994 | 50.11 | 8.18 | 31.70 | 3.58 | 18.41 | 4.61 |

| 04/01/1999 | 53.17 | 3.07 | 34.77 | 3.07 | 18.41 | 0.00 |

| 01/01/2000 | 56.24 | 3.07 | 37.84 | 3.07 | 18.41 | 0.00 |

| 01/01/2001 | 59.31 | 3.07 | 40.90 | 3.07 | 18.41 | 0.00 |

| 01/01/2002 | 62.38 | 3.07 | 43.97 | 3.07 | 18.41 | 0.00 |

| 01/01/2003 | 65.45 | 3.07 | 47.04 | 3.07 | 18.41 | 0.00 |

Comparison of the energy tax rates for different energy sources from 2007 in Germany

All information below does not include sales tax , as of June 3, 2017.

| Law section | Energy carrier and use | Tax rate from the law | Tax rate in the usual unit of measure | Comparison value per energy content calorific value | Comparative value per kg of direct CO 2 equivalent |

|---|---|---|---|---|---|

| Section 2 (1), sentence 1b | Gasoline (sulfur content less than / equal to 10 mg / kg) as a fuel | 654.50 EUR / 1000 liters | 65.45 ct / liter | about 7.4 ct / kWh (with calorific value 8.8 kWh / liter) | 28.09 ct / kg CO 2 e (with 2.33 kg CO 2 e / liter) |

| Section 2 (1), sentence 4b | Diesel or gas oil (sulfur content less than / equal to 10 mg / kg) as fuel | EUR 470.40 / 1000 liters | 47.04 ct / liter | about 4.8 ct / kWh (with calorific value 9.8 kWh / liter) | 17.886 ct / kg CO 2 e (with 2.63 kg CO 2 e / liter) |

| Section 2 (2), sentence 1 | Natural gas (CNG, LNG) as fuel until December 31, 2023 | 13.90 EUR / MWh | H-gas 19.46 ct / kg (for calorific value 14 kWh / kg, para. 1 (18)) | 1.39 ct / kWh | 3.787 ct / kg CO 2 e (with 0.367 kg CO 2 e / kWh) |

| Section 2 (2), sentence 1 | Natural gas (CNG, LNG) as a fuel in 2024 | 18.38 EUR / MWh | H-gas 25.73 ct / kg (for calorific value 14 kWh / kg, Paragraph 1 (18)) | 1.84 ct / kWh | 5.014 ct / kg CO 2 e (with 0.367 kg CO 2 e / kWh) |

| Section 2 (2), sentence 1 | Natural gas (CNG, LNG) as a fuel in 2025 | 22.85 EUR / MWh | H-gas 31.99 ct / kg (for calorific value 14 kWh / kg, paragraph 1 (18)) | 2.29 ct / kWh | 6.24 ct / kg CO 2 e (with 0.367 kg CO 2 e / kWh) |

| Section 2 (2), sentence 1 | Natural gas (CNG, LNG) as a fuel 2026 | 27.33 EUR / MWh | H-gas 38.26 ct / kg (for calorific value 14 kWh / kg, Paragraph 1 (18)) | 2.73 ct / kWh | 7.439 ct / kg CO 2 e (with 0.367 kg CO 2 e / kWh) |

| Section 2 (1), sentence 7 | Natural gas (CNG, LNG) as fuel from 01.01.2027 | 31.80 EUR / MWh | H-gas 44.52 ct / kg (for calorific value 14 kWh / kg, para. 1 (18)) | 3.18 ct / kWh | 8.665 ct / kg CO 2 e (with 0.367 kg CO 2 e / kWh) |

| Section 2 (2), sentence 2 | Unmixed liquefied petroleum gas ( LPG / autogas ) as fuel until December 31, 2018 | 180.32 EUR / 1000 kg | about 9.74 ct / liter (with a density of 0.54 kg / liter) | about 1.41 ct / kWh (with calorific value 12.8 kWh / kg) | about 6.087 ct / kg CO 2 e (with 1.60 kg CO 2 e / liter) |

| Section 2 (2), sentence 2 | Unmixed liquefied petroleum gas ( LPG / autogas ) as fuel 2019 | EUR 226.06 / 1000 kg | about 12.21 ct / liter (with a density of 0.54 kg / liter) | about 1.77 ct / kWh (with calorific value 12.8 kWh / kg) | about 7.631 ct / kg CO 2 e (with 1.60 kg CO 2 e / liter) |

| Section 2 (2), sentence 2 | Unmixed liquefied petroleum gas ( LPG / autogas ) as fuel 2020 | EUR 271.79 / 1000 kg | about 14.68 ct / liter (with a density of 0.54 kg / liter) | about 2.12 ct / kWh (with calorific value 12.8 kWh / kg) | about 9.175 ct / kg CO 2 e (with 1.60 kg CO 2 e / liter) |

| Section 2 (2), sentence 2 | Unmixed liquid gas ( LPG / autogas ) as fuel in 2021 | EUR 317.53 / 1000 kg | about 17.15 ct / liter (with a density of 0.54 kg / liter) | about 2.48 ct / kWh (with calorific value 12.8 kWh / kg) | about 10.719 ct / kg CO 2 e (with 1.60 kg CO 2 e / liter) |

| Section 2 (2), sentence 2 | Unmixed liquid gas ( LPG / autogas ) as fuel in 2022 | EUR 363.94 / 1000 kg | about 19.62 ct / liter (with a density of 0.54 kg / liter) | about 2.84 ct / kWh (with calorific value 12.8 kWh / kg) | about 12.262 ct / kg CO 2 e (with 1.60 kg CO 2 e / liter) |

| Section 2 (1), sentence 8 | Unmixed liquid gas ( LPG / autogas ) as fuel from 01.01.2023 | 409.00 EUR / 1000 kg | about 22.09 ct / liter (with a density of 0.54 kg / liter) | about 3.20 ct / kWh (with calorific value 12.8 kWh / kg) | about 13.806 ct / kg CO 2 e (with 1.60 kg CO 2 e / liter) |

| Section 2 (1), sentence 5 | Heavy fuel oil | 130.00 EUR / 1000 kg | 13.00 ct / kg | about 1.19 ct / kWh (with calorific value 10.9 kWh / kg) |

When using the energy carrier to generate electricity or electricity and heat (as of 2006), without sales tax:

- Heating oil: (0.21-0.62) ct / kWh

- Natural gas: 0.55 ct / kWh

- Liquid gas: 0.43 ct / kWh

- Coal: 0.12 ct / kWh

outlook

In 2011 the European Commission (led by the Commissioner for Taxation and Customs Union , Algirdas Šemeta ) initiated a discussion on taxing fuels based on their energy content and CO 2 emissions from around 2023 . The technical background for this is the higher specific weight of diesel. Since a kilogram of diesel has a volume about 13.2% smaller than a kilogram of gasoline, a liter of diesel has a higher energy content, but it also pollutes the environment and the climate correspondingly more than a liter of gasoline. The European Commission wants to take this into account by taxing petrol and diesel according to the same standards. In addition, the minimum tax rate for both fuels (and heating fuels) is to be divided into two components: on the one hand, taxation based on the CO 2 emissions of the energy product, with an amount of 20 euros per tonne of CO 2 , and on the other hand, taxation based on the energy content, ie the actual energy contained in a product, measured in gigajoules (GJ). The minimum tax rate would be set at EUR 9.60 / GJ for fuels and EUR 0.15 / GJ for fuels. This would apply to all combustibles and fuels used for transportation and heating purposes.

According to this draft of the Commission, the EU minimum tax rate for diesel, which according to the current Energy Tax Directive is 33 cents per liter, would increase to 41.2 cents by 2023. It would still be below the current German tax rate of 47 cents. Germany would therefore not be obliged to increase the diesel tax, but would have the choice of implementing the approximation of diesel and petrol tax rates either by increasing the diesel tax, lowering the petrol tax or a combination of both. How far the EU member states go beyond the combined minimum tax rate is up to them. For example, it would also be possible to just increase the energy tax share.

Structure of the law

General provisions

- In Section 1, Paragraph 1, the scope of the law is defined as the area of the Federal Republic of Germany excluding Büsingen am Hochrhein and the island of Helgoland .

- Section 1 1 (2) uses the combined nomenclature (formerly customs tariff) todefinewhat mineral oils are in the sense of the law: mineral oils, mineral oil products, their mixtures and natural gas (including lubricating oils).

- Section 2 (1) defines the standard tax rates for various tax items. So z. B. 1000 liters of petrol (not low in sulfur) are taxed at EUR 669.80. In paragraph 2, the units of measurement of the law are precisely defined (e.g. liter = liter at +15 ° C).

- In § 3 the taxation of natural gas or liquefied petroleum gas as fuel, the tax privileges for heavy fuel oil as fuel is used for heating oil (chemically nothing but dyed diesel fuel ), and other tax relief regulated.

Regulations for energy products other than coal and natural gas

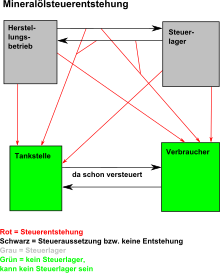

- According to § 5 , the accrual of taxes is suspended for energy products that are in a tax warehouse or in a dispatch procedure (transport between two tax warehouses or abroad).

- The § 6 and § 7 define what an energy product manufacturing plant, energy product storage (both tax warehouse) and what a depositor (third, which storage space in a tax warehouse uses), and the conditions under which they are approved by the Hauptzollamt and when these approvals may be withdrawn.

- It is important that only the energy products according to § 4 can be subject to the tax suspension procedure.

- § § 8 ff. Regulates the creation of the tax for energy products according to § 4 . It arises when it is removed from the tax warehouse for free circulation, during manufacture, if there is no permit under Section 6 (2) as a manufacturing company. Cases in which tax items are withdrawn for use as heating or fuel are also covered. The mixing of taxed fuels, e.g. B. when filling the tank of a motor vehicle at a gas station.

Examples of tax origination

- The owner of a manufacturing company removes petrol for free circulation (delivery to petrol station). Tax accrual according to § 8 , tax debtor is the owner of the manufacturing company.

- A chemistry student uses crude oil to distill gasoline to power his car in his garage. Tax accrual according to § 9 Paragraph 2, the student is liable for the tax.

- Natural gas is delivered from a gas storage facility to a regional energy supplier. Tax accrual according to Paragraph 3, tax debtor is the owner of the gas storage facility.

- A tax warehouse owner fills up his private car with stocks from the tax warehouse. The tax arises according to Paragraph 4, the tax payer is the tax warehouse owner.

- For environmental protection reasons, a landfill operator collects landfill gas (counts as production and requires a permit) and uses it in a CHP . The tax arises according to § 9 Paragraph 2, the tax debtor is the landfill operator. (The tax can be countered with an equity decree, since later use in the CHP is generally permitted.)

Provisions for energy products including coal and natural gas

- The other generation regulations depending on the energy product can be found in § § 20 to § 23 , § 32 (coal) and § 43 (natural gas) EnergieStG.

- § § 26 to § 28 , § 37 and § 44 regulate the use of mineral oils and other energy products that are tax-exempt (e.g. the mineral oil that is consumed in the manufacturing plant, limited coal for heating one's own private household, lubricating oil, aircraft fuel , Marine fuel etc.).

Tax relief

- Sections 45 ff. Name different facts for the remission, reimbursement and payment of a tax incurred. According to the Top Equalization Efficiency System Ordinance issued on the basis of Sections 50 and 66b of the Energy Tax Act , companies, for example, receive part of the electricity and energy taxes they have paid if they can provide evidence of operational energy management . The determination of the federal government according to § 55 Abs. 4 Nr. 2 EnergieStG was announced at the end of 2019 ( Federal Law Gazette I p. 2941 ).

Tax registration

Due date

- In § 11 the maturity of the energy tax is regulated for petroleum products. In principle, the tax must be paid by the tax debtor by the 10th of the month following the month after the tax accrual (e.g. taxes for the month of January by March 10th).

- Taxes due to unauthorized manufacturing activities are due immediately.

- For coal, the regulation can be found in Section 33 .

- For natural gas, the regulation can be found in Section 39 .

Use of fuel oil for motor vehicles

Anyone who drives vehicles with heating oil is guilty of tax evasion . Solvent Yellow 124 is added to heating oil for identification and colored red.

The fuel in question is subsequently to be fully taxed. Portions of fuel that have already been taxed are not taken into account. A consumption is extrapolated for the past and taxed additionally. This can only be avoided if all legal refueling and actual consumption can be proven without gaps and without any doubt. In addition to the subsequent taxation, there is a risk of a severe fine or even criminal proceedings.

If heating oil is refueled despite the prohibition (e.g. in an emergency), the process must be reported to the responsible customs office immediately. This can also be done by telephone and at any time of the day or night. The amount filled up is taxable after registration. In any case, the report must be received before a possible inspection in order to be taken into account. As a rule, there is no further prosecution. Reasons during or after an inspection are usually not taken into account.

Heating oil can be used for engines in block-type thermal power stations and other stationary engines for generating process energy. There are also clearly defined special regulations for certain consumers, for example farmers. The use of heating oil for auxiliary and auxiliary heaters in vehicles is controversial as misuse cannot be ruled out.

See also

- Electricity Tax Act (Germany)

- Mineral oil tax in Austria

- Mineral oil tax in Switzerland

literature

- Matthias Bongartz, Sabine Schröer-Schallenberg: Excise tax law. 2nd Edition. Verlag CH Beck, Munich 2011, ISBN 978-3-406-55611-1 , pp. 240-328.

- Karen Möhlenkamp, Knut Milewski: EnergieStG. StromStG. Comment. 1st edition. Verlag CH Beck, Munich 2012, ISBN 978-3-406-63778-0 .

- Matthias Bongartz: Energy tax - electricity tax - customs tariff. Comment. Verlag Vahlen, Munich 2013, ISBN 978-3-8006-3444-6 .

- Klaus Friedrich, Cornelius Meißner: Energy taxes. Comment. Publishing house Haufe, Freiburg 2013.

- Stefan Soyk: Energy and electricity tax law. 3. Edition. Carl Heymann Verlag, Cologne 2013, ISBN 978-3-452-27271-3 .

- Roland M. Stein, Anahita Thoms: Energy taxes in practice. 2nd Edition. Bundesanzeiger Verlag, Cologne 2013, ISBN 978-3-8462-0028-5 .

Web links

- Text of the Energy Tax Act

- Text of the Energy Tax Implementing Ordinance

- Zoll.de: Tax rates for energy products

- Zoll.de: FAQ on the draft law on the new regulation of the taxation of energy products ( Memento from October 5, 2007 in the Internet Archive )

Individual evidence

- ↑ New publication of Article 3 (equalization tax on mineral oils - mineral oil tax) of the law on customs changes of April 15, 1930 (RGBl. I p. 131).

- ↑ Last version of the Mineral Oil Tax Act of December 21, 1992 ( BGBl. I p. 2150, 2185 , ber. BGBl. 1993 I p. 169 ); Applies mainly from January 1, 1993.

- ↑ Council Directive 2003/96 / EC of October 27, 2003 on the restructuring of the Community framework for the taxation of energy products and electricity. (PDF file; 198 kB)

- ↑ Why diesel taxes are lower than gasoline taxes. In: www.wallstreet-online.de. Retrieved September 28, 2015 .

- ↑ a b bundesfinanzministerium.de: Development of the energy (formerly mineral oil) and electricity tax rates in the Federal Republic of Germany (PDF, 213kB) ( Memento from October 30, 2014 in the Internet Archive )

- ↑ Glossary of the Federal Ministry of Finance: Energy Tax ( Memento from February 11, 2013 in the web archive archive.today )

- ↑ Amendment to the Energy Tax Act, last amended on May 31, 2017 , accessed on June 3, 2017

- ↑ Bavarian State Ministry for the Environment and Consumer Protection 2018 , accessed on January 15, 2020

- ↑ Umweltdatenbank.de

- ↑ SWR environmental editor

- ↑ Press release of the European Commission: Climate protection and efficiency as benchmarks for energy taxes

- ↑ EurActiv report: EU diesel tax: Brussels appeased ( Memento of April 13, 2011 in the Internet Archive )

- ↑ Press release of the EU Commission: Revision of the Energy Taxation Directive - Questions and Answers