Life insurance (Germany)

In German law, life insurance is an insurance contract in which the insurer's performance obligation depends on the uncertainty of the length of life of the insured person . In Germany, this primarily includes term life insurance , which only provides benefits in the event of death, pension insurance , in which the benefits are paid during the lifetime in the form of an annuity , and mixed insurance, which provides benefits in the event of death as well as survival. German insurers that offer life insurance can also take on other risks that are directly linked to a person's life , such as marriage and birth insurance, occupational disability insurance and similar insurance related to the permanent loss of work income for health reasons. In Germany, these insurances are often understood under the term "life insurance" in the broader sense, even if special legal regulations apply to individual ones. In Germany, almost all life insurance policies include a right to profit sharing .

species

Life insurance, as offered in Germany, can be divided into basic forms according to various criteria or are combinations of these:

- Differentiation according to the insured event

- Life insurance: The benefit is paid in the event of death during the insurance period; one example is term life insurance.

- Endowment insurance: The benefit is provided when the end of the insurance period is reached. In practice, this form only exists in the form of pension insurance, where each individual pension payment is an endowment insurance.

- Occupational disability insurance : insurance benefits in the event of occupational disability.

- Dowry insurance : insurance benefits in the event of marriage.

- Differentiation according to capital formation

- Term life insurance : There is no or only temporary capital formation here. The aim and purpose of term life insurance is to provide financial security for the surviving dependents (spouse, children, etc.). Examples are term life insurance and disability insurance.

- Capital-building insurance: Part of the paid-in premium is used to build up capital, which will later be paid out with certainty or with a high degree of probability. Examples are mixed insurance, life insurance, and annuity insurance.

- Differentiation according to the determination of the insurance benefit

- Conventional life insurance: The insurance benefit is agreed as a fixed amount of money in a specific currency.

- Unit-linked life insurance: The insurance benefit is agreed in unit units of a fund.

- Index-linked life insurance: the insurance benefit is agreed on the basis of a different index.

- Differentiation according to the type of insurance benefit

- Endowment insurance: One-off service through payment of a capital at a pre-agreed date.

- Exemption from contributions: The agreed benefits are due even though the contribution payment ends prematurely in the event of the death or occupational disability of the insured contributor ( Term-Fix insurance , training insurance , dowry insurance, supplementary occupational disability insurance).

- Pension insurance : ongoing payment as a survival-dependent pension.

- Differentiation according to eligibility through specific state funding procedures

- Direct insurance

- Capital-building life insurance policies (for investing capital-forming benefits )

- Insurance to build up an additional capital-covered pension scheme according to the AVmG ( Riester pension )

- Basic pension ( Rürup pension )

With these classifications it should be noted that a single life insurance contract can be complicated and can combine several basic forms. There are contracts that provide for both capital and pension benefits; death and survival components can also be combined in the contract.

Numerous additional insurance policies are also offered. The most important of these is occupational disability insurance , which in this context is referred to as supplementary occupational disability insurance (abbreviation BUZ). Other additional components are the additional insurance for accidental death, which insures a multiple of the simple death benefit in the event of accidental death, and long-term care insurance benefits.

legal framework

The law of the insurance contract is regulated in Germany in the Insurance Contract Act (VVG), which was comprehensively reformed on January 1, 2008.

insurer

Life insurers can only operate in the legal form of the German stock corporation (AG), the mutual insurance association (VVaG, character of a cooperative), as an institution or corporation under public law or as a branch of a foreign life insurer outside the EEA in Germany . Life insurers based in the EEA can sell life insurance in Germany directly from their home country or through a domestic branch in Germany. With the exception of EEA life insurers, national approval and supervision are carried out by the Federal Financial Supervisory Authority (Bafin). The supervision and management of a life insurer are essentially regulated in the respective national insurance supervision laws (VAG). In Germany, Switzerland, Austria and many other countries, a life insurer is only allowed to cover life insurance or directly related additional risks.

Obligations

The life insurer has the enforceable right to premiums (limited by the policyholder's right to exemption from premiums ). In addition, there is the possibility to defer the insurance premiums for a limited period of time or to defer them in part ( interim risk contribution ) and to grant the enforceable obligation of insurance protection. The policyholder has the opposite rights and obligations. In addition, the policyholder has secondary obligations that cannot be enforced by the life insurer (“obligations”), non-compliance with which can jeopardize the right to the insurance benefits. The refusal of the service, however, requires a causal connection with the occurrence of the insured event. Such a case occurs when a policyholder has concealed a recent serious illness in the application form. In this case the life insurer can - even after the death of the insured - withdraw from the contract in the first three years after conclusion of the contract ( insurance years ); the burden of proof lies with the policyholder. Later, the life insurer can only contest the contract because of fraudulent misrepresentation; the burden of proof then rests with the life insurer.

Conclusion of the contract

A life insurance contract is concluded between the life insurer and the policyholder in accordance with the normal provisions of private law by submitting corresponding declarations of intent.

The future policyholder must have the entire content of the contract (including all terms and conditions , in particular the General Insurance Conditions [ AVB ], here often called General Life Insurance Conditions [ ALB ]) and some additional information when submitting his declaration of intent.

Either the life insurer submits the contract to the future policyholder (referred to as an offer ), which he accepts in writing (by signature), or the future policyholder submits the contract to the insurer ( application ), which is accepted by the insurer ( declaration of acceptance ). In the latter case, the life insurer must provide the future policyholder with the necessary documents for the application in advance so that an application, i.e. a binding declaration of intent to conclude a contract, is actually available.

The conclusion of a contract in life insurance is made more difficult by the fact that the life insurer must first carry out the risk assessment, in particular the health assessment of the insured, before making a binding declaration of intent (offer or declaration of acceptance). Therefore, the life insurer needs information about the health of the insured person. The life insurer confirms the existence of the insurance cover by sending the certificate of the insurance contract, which is called the insurance policy. The “applicant” is the “policyholder” only after the conclusion of the contract.

Start of insurance

Three special "start dates" must all be reached in order for insurance cover to exist:

- Technical start of insurance cover: The time specified in the contract for the (earliest) start of insurance cover. The premiums due are usually determined on the assumption that insurance cover actually existed from this point in time, even if it actually begins later.

- Legal start of the contract: Insurance cover cannot begin before the insurance contract on which it is based has actually been legally concluded, i.e. has been accepted by the life insurer or the policyholder, depending on who proposes the conclusion of the contract to the other.

- Material start: A prerequisite for the start of insurance cover is the receipt of the redemption premium , the first contractually determined premium from the life insurer (insurance premiums are so-called "sending debts", i.e. the premium is paid at the "cost and risk" of the policyholder).

The start of taxation must be documented by the life insurer if tax benefits, in particular tax exemption or tax benefits for investment income, are to be used. Changes to the existing contract that are “significant in terms of their salary” (for example an increase in insurance coverage not provided for in the contract) result in a so-called tax novation : Change date = new tax start of the contract. Thereafter, the contract is treated for tax purposes as if it had only been concluded at this point in time. The tax privileges of old contracts can be completely lost.

Killing of the insured

Most contracts include a suicide clause that the life insurer must pay after three insurance years at the earliest in the event of the insured's suicide . If the suicide occurs earlier, the life insurer is exempt from the benefit according to § 161 VVG , unless the suicide occurred "in a state of pathological disturbance of mental activity that precludes the free determination of will" ( insanity ).

If the policyholder or the beneficiary kills the insured out of greed (murder), he will in no way receive a benefit under Section 162 VVG. Only uninvolved persons can be eligible.

Contract partner

As a contractual partner, a few people can play a role on the customer side.

- Policyholder: The person who enters into the contract.

- Contributor : The person who actually pays the contribution (the policyholder remains the contributor).

- insured person ( insured person ): Their life determines the maturity of the insurance benefit and their age, gender and other personal characteristics that determine life expectancy determine the contribution agreement between the life insurer and the policyholder in the life insurance contract. The insured person is not otherwise involved in the contract, but must agree to the conclusion of the insurance contract ( Section 150 VVG). In some other countries, such as the UK, the policyholder only needs to demonstrate that they have a legitimate interest in taking out life insurance on the insured's life.

- Beneficiary : When the insured event occurs, the rights to the benefit are transferred to the beneficiary, to whom the life insurer must therefore provide the benefit. This is usually the policyholder or their heirs, unless otherwise contractually stipulated. The policyholder can freely determine in the contract who should receive which benefits instead of the policyholder. The entitlement to benefit is normally revocable until the insured event occurs, so the policyholder can unilaterally change it at any time by notifying the life insurer. The policyholder can expressly and irrevocably waive his rights in favor of a third party.

Termination / retrieval / dissolution / surrender value

In the event of termination , the surrender value , insofar as such is agreed or required by law, is paid out. Towards the end of the contract, if the surrender value is above the originally agreed sum insured at the end of the contract, more favorable conditions are often granted for the contract termination, called "call-off". In this case, the total credit is usually paid out without deduction for cancellation.

A special feature also applies if the contract is terminated in the last year of the insurance contract: Here, the policyholder can be treated as if he had already paid all remaining contributions and as if the last insurance year had already expired. The policyholder will then only deduct outstanding premiums and prepayment interest (discount) from the benefit; the process is called discounting. In this case, the insurance cover remains until the contractual expiry.

Instead of terminating / dissolving the life insurance policy, the policyholder can have a lawyer check whether he has not been instructed at all or only insufficiently about the right of withdrawal. Because if this is the case, the withdrawal period does not start and the policyholder has an "eternal right of withdrawal". This was decided by the European Court of Justice (judgment 07.05.14, Az. IV ZR 76/11). If the reason for the termination is incorrect advice and the associated damage, the policyholder has the opportunity to assert his claims for damages.

Termination by the insurer

In principle, the life insurer can only terminate if the premium has arrears ( Section 38 VVG: follow-up premium). He then usually converts the insurance to a premium-free insurance.

Exemption from contributions

Life insurance can be converted into a non-contributory one. Depending on the remaining term, the premium-free sum insured is relatively considerably lower than the original sum insured. Any additional insurance is not applicable. d. R. In the case of the exemption from contributions, as with the surrender value, an imputed cancellation deduction is taken into account if it is contractually agreed.

Granting of rights

The policyholder can grant third parties rights to his contract. Granting of rights is only valid after notification to the life insurer (decide on access and sequence) and is documented by the latter, as this regulates to whom the life insurer can or has to pay exempting payments. As a rule, a pledgee is given the insurance certificate (including any supplements), as often only the presentation of this certificate entitles the holder to receive the benefit.

Active

According to § 168 VVG, the policyholder can effect the "exclusion of usability" for his insurance contract by notifying the life insurer. This means that your own and third-party access to the assets during the savings period is excluded, including the eligibility for ALG II entitlements ( unemployment benefit II ). This step is irreversible. This means that assignments / pledges are no longer possible or only possible with a lower priority .

With the granting of an irrevocable subscription right , the policyholder is irrevocably bound to the consent of the (now irrevocable) beneficiary for all future disposals of his life insurance, in particular the cancellation of this very granting of rights . Disposals in connection with the contract are only possible through cooperation between the policyholder and the irrevocable beneficiary. The claim of the irrevocable beneficiary is limited to the service in question. The other rights and obligations under the contract remain with the policyholder. In some cases, an irrevocable entitlement to benefit must be issued, in the case of direct insurance , if the contributions were raised by an employee for the benefit of a life insurance policy that runs on the employer as the policyholder.

Assignments such as pledges serve as collateral for loans or mortgages. The policyholder (as the creditor of the insurance benefit (assignor) assigns his rights and claims from the life insurance to the creditor (assignee)). The terms differ according to whether there is a reason for guilt (a pledge absolutely needs this). The obligee thus has all contractual rights; also the right to terminate the life insurance and pay out the surrender value (including the profit share). The life insurer does not have to bear any concerns about the appropriateness of a termination. Rather, damage incurred due to termination would have to be clarified internally between the policyholder and the pledgee, which simplifies the administrative process and the liability of the contracting life insurer.

Passive

In the event of a seizure within the meaning of the BGB , a seizure and transfer decision will be reported to the life insurer. The receipt is documented there with the date and time. At the same time, the pledgee typically revokes the payment provision (subscription right) and pronounces a payment ban. With this, all rights and claims similar to the assignment / pledging are transferred to the pledgee.

Calculation of contributions and benefits

Discount rate

The actuarial interest rate is the interest rate with which all future (expected) cash flows of a life insurance are discounted to the calculation date, i.e. the technical start for agreeing the contract values with the policyholder. In the case of capital-forming insurance, the actuarial interest rate is of particular importance, as the interest effect on the premium is particularly strong due to the capital formed. In principle, life insurers are free to choose this discount rate for calculating the contributions to be agreed in the contract. But it can life insurers ill afford higher maturity payments to agree with policyholders than those for by commercial and regulatory requirements for forming mathematical provision may be used in the annual financial statements of the life insurer. If the interest used in the premiums is higher than the maximum interest rate for the actuarial reserve ( maximum technical interest ), the life insurers have to contribute the funds required for the additional interest promises from company funds (equity) when the contract is concluded.

In Germany, the Federal Ministry of Finance stipulates a maximum technical interest rate for the actuarial reserve in the actuarial reserve regulation (DeckRV), which is therefore also a certain requirement for the calculation of the contractually agreed services and considerations. Since this maximum actuarial interest rate for the actuarial reserve is regularly adjusted to the current development of the capital markets, life insurers are also adjusting their calculation methods for new contracts to this value at about the same time. The amount is based on the ten-year average of the current yield on ten-year government bonds with a remaining term of 9-10 years. The maximum interest rate for contracts concluded on or after January 1, 2017 is 0.9%.

Without further ado, contributions calculated with a lower interest rate can be agreed. In this case, however, the actuarial reserve must be created in the corresponding amount. Such contracts are occasionally offered, in capitalization transactions (in accordance with VAG) to cover claims for lifetime working time accounts via the employer, but especially from foreign insurers. In view of the fact that interest rate guarantees always cost money, there are discussions about not including the implicit interest rate guarantees in the premiums higher than is absolutely necessary in order to be able to make an investment that is generally more profitable for the policyholder. Because of the participation in profits , these implicit interest rate guarantees are only a means of deterring the life insurer from making speculative capital investments, as he then has to bear extreme losses himself. However, such losses usually also pose significant risks to their savings for policyholders, so that higher guarantees are a double-edged sword. Life insurers therefore generally strive for moderate interest rate guarantees, which discipline the capital investment of the life insurer in the sense of a reliable investment for retirement provision, but which do not cause unnecessary risks.

The equating of the maximum technical interest rate of the DeckRV with “the interest with which life insurers must at least pay interest on the credit balance of their customers”, which is often found in the press, is wrong. There is no legal minimum interest rate, but only an indirect upper limit for the interest used internally in the original calculation of the contractually agreed contributions and benefits.

Imputed costs

The imputed costs of a life insurance, with names that have evolved over time, are taken into account when calculating premiums and benefits as follows:

- Administrative costs - cost surcharges as a percentage of the premium and / or the total or in the absolute amount (unit costs), traditionally intended in particular to finance ongoing expenses for insurance operations (administration), in particular the

- Collection costs - as a percentage of each premium, traditionally understood as financing the costs of premium collection

- Installment surcharges - Since the contributions are traditionally calculated in the first step on the assumption of an annual payment, the calculation of the contributions and benefits to be agreed must subsequently be adapted to the actual contractual agreements on contribution payment. If the contributions are not paid once a year in advance, there are higher administrative costs for the collection of contributions, lower investment income from investing the contributions and, to a certain extent, higher risk contributions due to the higher risked capital. As a rule, the internally calculated surcharges are 2.5 to 5% for monthly payers. However, it is often not an installment payment in the usual sense, i.e. the monthly installment of an amount that is actually due annually for the acquisition of a claim to insurance cover for one year. Rather, the monthly premium is actually used to acquire insurance cover for the month in question.

- Closing and contract setup costs - surcharges as a percentage of the premium or the sum intended to finance one-off costs or costs that only arise in the first few years (usually closing costs, such as commissions , contract documentation, risk assessment, medical examination if necessary). Since these costs are incurred directly at the beginning of the contract and therefore have to be financed, financing by means of contributions received over decades would result in high pre-financing costs, which in turn would have to be included in the calculation of contributions and services. In order to avoid this, the life insurers always agree that surrender values are so low that the actual acquisition costs are financed from the premiums as quickly as possible before the policyholders themselves are contractually entitled to the surrender value. The method used to calculate the surrender values corresponds roughly to the method used to calculate the actuarial reserves in accordance with commercial law. However, the agreement of the surrender value is subject to certain limits of the Insurance Contract Act on minimum surrender values.

In addition, the contributions contain the risk contributions to cover the insured risk, which are calculated by multiplying the likelihood of withdrawal by the benefit to be paid in the case that exceeds the assumed reserve capital.

- The part of the contribution remaining after deducting all surcharges for costs and the risk contribution is called the savings contribution and is used in calculatory terms - together with the calculated interest - to build up the maturity benefit and to cover future risk contributions above the current contributions due to age.

- In addition to the types of costs mentioned, the terms and conditions of the insurance contract may also specify fees for certain business transactions. These are predominantly business transactions that are rare and / or very complex in terms of administration ( deferral , policy loan ). The fees are specified either as an absolute amount or as a percentage of a value relevant to the process.

Surrender value

The statutory minimum surrender value is set out in Section 169 (3) VVG.

For contracts concluded after December 31, 2007, the agreed surrender values must at least correspond to the actuarial reserve determined on the basis of the calculation basis for the premium calculation. In doing so, the accounting-based closing costs are to be spread over five years and taken into account in the calculation. You always make up a certain part of the contributions paid.

For contracts concluded before January 1, 2008, surrender values were often agreed in such a way that no surrender values should be paid in the first and second insurance year.

This fact is often falsely associated with the commercial law term zillmerisation of the actuarial reserve, but is based on the definition of the surrender value in the VVG as actuarial capital or current market value.

Internal insurance rates

For the large number of persons entrusted with the conclusion of the contract by the insurer, the insurer prepares internal instructions on the content of the contracts, how the premiums are to be determined and how to proceed with the risk assessment. These internal specifications for the design of the contracts are colloquially referred to as “tariffs”, even if they are not tariffs in the legal sense. In particular, the insurer is not obliged to third parties in individual cases to submit an offer or to conclude the contract on this basis. The company management can allow deviations in individual cases. In doing so, however, the public law requirements regarding the prohibition of discrimination and the requirement of equal treatment must be observed. On the other hand, the insurer cannot invoke these “tariffs” vis-à-vis the policyholder, as they are not part of the contract. Such internal “tariffs” play a major role, particularly in life insurance, because of their complexity.

Life insurers' security assets

Life insurance assets must hold to which the policyholder in the amount of claims the insured event of bankruptcy have a preferred access to other creditors (bankruptcy privilege). These assets are known as security assets . Special investment regulations apply to this. The sole purpose of the guarantee assets is to secure the claims of policyholders in the event of insolvency. With regard to the contractual claims of the policyholders, for example from the profit sharing, the guarantee assets have no special function. In order to secure these assets against embezzlement and erosion, they are subject to a double lock with a trustee . The agents of the insurer have access to these assets only together with the trustee. The investments are to be listed in a directory that is subject to supervision by the trustee and the Federal Financial Supervisory Authority (BaFin).

The security assets are basically to be formed for all life insurance contracts of a life insurer, for example also for risk insurance or life insurance without surrender value. Possibly. another life insurer can continue the insurance contracts with these assets after the bankruptcy of the original one.

The scope of the investments that must be held in the guarantee assets is determined by the commercial law assessment of the policyholder's claim. The value of the investments in the guarantee assets determined by commercial law must at least correspond to this value.

The assets that may be held as security assets are subject to the investment principles of the VAG (Section 124) and (for insurance companies under Solvency I) also to the quantitative provisions of the ordinance on the investment of the security assets of pension funds, death benefit funds and small insurance companies ( investment ordinance ).

According to this, the life insurer must observe the investment principles (diversification, mix, security, return and liquidity) for capital investments and must check the capital investment regulations for every investment. Insurance companies under Solvency I must comply with quantitative requirements based on asset classes and asset ratios; in principle, no more than 35% of the guarantee assets may be invested in shares.

In addition, the so-called SCR coverage ratio (for companies under Solvency II) or solvency ratio (for companies under Solvency I) is determined from the ratio of the life insurer's own funds to the value of the investments weighted according to investment risk . Since this must be at least 100%, only a financially strong life insurer can also invest in riskier forms of investment. These regulations are also the same across Europe.

The investments of unit-linked and index-linked life insurances are to be kept separate from the other investments in the guarantee assets. The insolvency privilege applies separately to each of these parts of the guarantee assets, known as departments.

See also: Investment restrictions

Irrespective of the insurer's security assets, the policyholder's claims are secured by a cross-company security fund . All life insurers in Germany are legally obliged to be a member of this security fund. In the event of a claim, all life insurance benefits are continued unchanged. The security fund contains 1 ‰ of the total of all net technical provisions of its members and is administered by Protektor Lebensversicherungs-AG on behalf of the Federal Ministry of Finance .

Profit sharing

In Germany, all life insurance contracts are generally profit-sharing unless this has been expressly excluded in the contract ( profit sharing ).

The surplus participation is not determined on the basis of the premium calculation, but rather on the basis of commercial law evaluations of the contract, which in practice often correspond to the approaches of the premium calculation.

Since protection through life insurance contracts is often of vital importance to citizens, life insurers have to be very careful in agreeing contributions and benefits with policyholders in order to be able to guarantee the continuous fulfillment of contracts, often over many decades. As a result, if there are no significant changes in circumstances, the life insurer will generate high surpluses over the years. In economic terms, however, these are not justified by the performance of the life insurer, but by the statutory requirement of very cautious contributions. Due to this encroachment on the private autonomy of citizens, the legislature therefore determines, at the same time as the constitutionally required protection of citizens' property rights, that life insurers - unless otherwise expressly agreed - must return an appropriate part of the surpluses to policyholders. This is known as a participation feature. In order to ensure that the policyholders participate appropriately in the entire economic growth in value of the life insurer, they participate not only in the surplus recorded under commercial law, but also in increases in value that are not recorded in the valuation reserves .

Life insurers primarily generate surpluses from their capital investments, the so-called net interest income . This is the excess of all investment income of the life insurer over and above the amount that the insurer has to add to the actuarial reserve every year because of the discounting of the actuarial reserve . Investment income and the actuarial reserve result from the annual financial statements of the insurer determined according to the regulations of commercial law . Depending on the contract, surpluses from risk and costs can also play a role.

The policyholder's right to participate in these surpluses results from the contract, which must meet certain minimum requirements contained in the VVG. Most of the time, the contracts relate to the regulatory provisions enacted in the public interest . On this basis, the supervisory authority monitors that the legally required appropriate participation in the surpluses is made to a sufficient extent. According to this, the policyholders are to participate appropriately in the individual sources of surplus, provided they are positive. Otherwise the life insurer bears the loss of negative sources. Offsetting between the sources is therefore prohibited. The term appropriate is an indefinite legal term, and BaFin ensures in the public interest that these requirements are sufficiently complied with. To this end, the supervisory regulations further stipulate that the policyholder's participation in the investment income or the sources of surplus may not be less than a certain percentage. Ultimately, 90% of the insurer's investment income accruing to the policyholders must be used for the policyholders each year, 75% of the risk surpluses and 50% of the remaining surpluses.

The policyholder's share is used either in the form of an increase in individual claims through actuarial interest, through direct crediting of surplus shares to the individual policyholders, or through allocation to the provision for premium refunds, from which the allocated amounts are then credited to individual policyholders in later years.

In terms of insurance, there are numerous models for allocating surplus shares to policyholders, but they are relatively similar worldwide. In some cases, surplus shares are permanently and irrevocably allocated to the policyholders during the contract period. Another part will only be irrevocably allocated at the end of the contract and is subject to the reservation that it can be used to cover unforeseen losses (which are, however, very unlikely). For this assumption of a low risk by the policyholder, the insurer can achieve a significant reduction in the legally required equity. Since the financing of equity capital is very expensive and has to be generated by the insurance business, the insurer's share of the profits in the surpluses can be kept very low by a certain assumption of relatively unlikely risks by the policyholder. The share of policyholders in the surplus is correspondingly high.

The most common forms of specific use of the allocated surplus shares are the investment as an interest-bearing accumulation (savings credit), as a premium-free secondary insurance of the same form as the underlying contract or as a so-called survival bonus, which is only due when the agreed expiration date is reached. Sometimes the bonus shares are also paid out in cash or offset against the contributions due. There are also contracts in which the net interest income is invested in a mutual fund selected by the policyholder .

The investment income to be taken into account is determined on the basis of the commercial law valuation in the annual financial statements. The commercial law valuation does not primarily serve to determine the surpluses caused by the policyholders, but for information and security purposes. Therefore, investment income is shown only very carefully. The actual value of investments can at times be higher than the book value cautiously shown in the annual financial statements . This difference, the valuation reserve, is largely caused by the policyholders, but is not included in the participation in the surplus in a timely manner. In order to avoid a disadvantage for the policyholders who cause these values compared to future policyholders who are not involved in these values, it is legally stipulated that at the end of the contract, the policyholders who cause them are to be given an additional profit sharing in the amount of at least half of the as yet undisclosed values of the investments. This is at the expense of the surplus participation of the remaining policyholders, who instead “inherit” the valuation reserves of the outgoing policyholder.

Critical discussion

A number of topics related to life insurance have been the subject of constant discussion. Changes to the law in recent years, particularly insurance contract law, and decisions by the highest federal courts have clarified most of the issues in recent years.

Unisex tariffs

Life insurance companies want to calculate their rates based on the risk . Due to the fact that women have a significantly longer life expectancy for women in the most relevant age groups, which can be proven worldwide, their contributions to life insurance (death insurance) are lower and higher for pension insurance than for men. The obligation to actually offer differently expensive contracts for the same price could lead to anti-selection: insurers that succeed in attracting more men could offer annuity insurance more cheaply, while insurers that insure more women could do this with term life insurance. Nevertheless, the European Court of Justice ruled in 2011 that insurance companies must offer uniform tariffs for women and men (case C-236/09). On this basis, the General Equal Treatment Act was changed with effect from December 21, 2012. Since then, premium calculations differentiating between men and women may no longer be used when taking out life insurance policies.

transparency

Life insurances are obliged to inform their customers about the essential characteristics and costs of their insurance both when signing the contract and during the term. The Insurance Contract Act (VVG), which came into force on January 1, 2008, is intended to significantly increase transparency for consumers. Further information obligations were added by changes in the law in 2014.

In the case of life insurance, policyholders must be given comprehensive advice and information before concluding the contract. This also means that the insurer must specifically quantify and disclose the included acquisition and distribution costs of the respective contract. In addition, if information is provided at all on the amount of the future profit sharing, a comparative value with standardized calculations (model calculation) must also be provided. The possible maturity according to Section 154 (1) VVG must be shown on the basis of three specified interest rates, namely the maximum technical interest rate multiplied by 1.67, and this interest rate plus and minus one percentage point. Currently (January 2015) these are 1.0875%, 2.0875% and 3.0875%. It must be made clear that these are only model-like calculations, not realistic predictions or even guaranteed performance commitments.

The details are set out in the Ordinance on Information Duties for Insurance Contracts (VVG-InfoV).

Cancellation rates

Life insurance is a contract that runs for a long time. Since the customer's living conditions can change, during the contract period, which often lasts for decades, in many cases - in some sources up to half of the contracts are spoken of - premature termination of the contract, sometimes soon after the start of the contract, but sometimes only relatively close to agreed end of the contract, or exemptions from contributions and thus disadvantages for customers, especially if the termination occurs very early. In particular, the cancellation rate in the first few years of the contract is interpreted as an indicator of poor quality advice. These are very different from insurers.

Closing costs / commission / surrender value

Judgments by the Federal Court of Justice and the VVG reform ensured that the amount of the surrender value is in an appropriate relationship to the sum of the contributions already paid. This was not ensured by the legal situation that existed until 2007. As a result, there have been a series of legal proceedings over a period of over 15 years. As of 2015, the maximum amount that domestic insurers may take into account in advance in the surrender value and in the actuarial reserve for contributions covering acquisition costs will be reduced to 2.5%. This is intended to exert pressure on the commissions in broker markets. In Austria the actual commission to be paid is capped.

The background to this is that the amount and one-off payment of sales commissions can represent an incentive for insurance intermediaries to sell life insurance policies bypassing the needs of the customer solely out of commission interest . The agent is therefore a seller and not a consultant . This problem naturally exists wherever sales are made on a commission basis, for example in a large number of banking transactions (loans, capital investments), purchases (houses, cars) or other brokered transactions (rental apartments). In all of these transactions - if the commission was not already to be paid by the consumer himself - high losses occur if the transactions are terminated prematurely (in the event of loan repayment, sale of a new car or a new building after a few months), since in this case the commission is ultimately returned shall be.

This problem can be solved, for example, by more transparency about the consequences of an early change in the consumer's decision (appeal to personal responsibility) or by providing information about the economic interests of insurance intermediaries.

The payment of the acquisition commission has nothing to do with the agreements with the policyholders, including the surrender value. It is up to the insurer to decide when to pay which acquisition commission and at the same time to ensure that it adheres to the contractual agreements with the policyholder.

Participation in the valuation reserves - hidden burdens

Valuation reserves or hidden reserves or burdens arise from the difference between the balance sheet value (acquisition value / book value ) and the actual value of the objects of value ( real estate , shares or interest papers) that the insurance company has bought with the money of the life and pension insurance customers for their capital investments . In practice, life insurers' valuation reserves are subject to great fluctuations. As part of the profit participation, which until 2007 only related to the surplus recognized in profit or loss in the annual financial statements, until 2007 increases in the value of investments in the form of valuation reserves were not taken into account with the contributions of the policyholders. Based on a ruling by the Federal Constitutional Court, this was changed in the VVG reform from 2008. Since this inadvertently also recorded amounts that the insurer expected to need to provide the contractual services in the future and that the insurer is therefore entitled to according to the judgment of the Federal Constitutional Court, the participation in the valuation reserves had to be corrected by law in 2014.

Statistical data

In 2004 there were 95 million contracts in Germany with an investment of 618 billion euros, in 2008 of 686 billion euros. In the 2007 financial year, German life insurers posted gross premium income of EUR 75.17 billion (2006: EUR 74.66 billion).

Life insurance company

Here is a table of the 10 largest German life insurance companies by gross premium income in 2007:

| rank | society | Contributions in € million |

|---|---|---|

| 1 | Allianz life | 12,828 |

| 2 | AachenMünchener | 3,893 |

| 3 | Zurich German Herald | 3,641 |

| 4th | R + V life insurance | 3,379 |

| 5 | Hamburg-Mannheimer LV | 3,109 |

| 6th | Debeka life | 2,736 |

| 7th | Public welfare | 2,439 |

| 8th | Württemberg life | 2.184 |

| 9 | HDI - Gerling Life | 2,031 |

| 10 | Victoria life | 1,980 |

Main insurance portfolio

Life insurance represents a significant part of both the second (company) and the third (private) pillar of old-age provision. In addition, there are risk provisions for surviving dependents and in the event of occupational disability. Compared to 1990 there was an increase of around 30% up to 2007.

While the share of risk insurance remained largely stable, there was an opposing development in the share of capital and annuity transactions. The relatively strong increase in the number of pension insurance contracts is essentially due to a change in tax treatment with a view to promoting old-age provision. In addition, the population's awareness of the need for private pension provision has grown.

Stock of supplementary insurance

In contrast to the main insurances, the German life insurers recorded a decline of around 12.5% (approx. 5 million) in the supplementary life insurance. This development is possibly due to the change of many insured persons to a main insurance and to increased state subsidies for this.

The contrary development of accident and occupational disability insurance is also noticeable. The reason here is to switch to main accident insurance and the additional disability insurance that is required in the event of occupational disability of at least 50%.

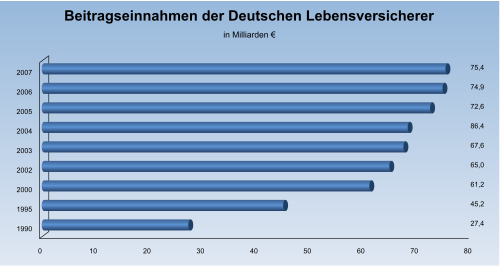

Premium income

The German life insurers recorded an increase in their premium income of around 180% (48 billion euros) between 1990 and 2007. This largely offsets the inflationary effect.

Tax treatment

During the premium payment

In the past, it was possible to claim the contributions to capital-forming life and pension insurance for tax purposes, but today contribution payments are only tax-deductible within the framework of Riester contracts and Rürup pensions (new: also for unit-linked contracts ) at the respective maximum rates. According to Section 10 (1) No. 3a EStG , contributions to risk insurance that only provide benefits in the event of death can still be taxed as special expenses.

One-time payment at the end of the contract

The following applies to contracts concluded before January 1, 2005 (grandfathering): The disbursement upon expiry of the endowment life insurance policy and the disbursement after exercising the lump-sum option for annuity insurance are tax-free, provided the contract runs for at least 12 years, the premium payment is at least 5 years there is a minimum protection against death of 60%. Pension payments only have to be taxed on the income portion. With early termination, capital gains tax is due. However, it should be noted that the minimum death protection of 60% is a regulation that was changed in 1996. For contracts concluded up to April 1, 1996, the rate was 50%; for contracts concluded up to January 1, 1995, only 10% was sufficient.

It should also be noted that payments are tax-free even if a minimum term of 12 years and a contribution payment period of at least 5 years have been agreed upon. Even if only 4 years have actually been paid into a contract, it is still tax-free if the payment is made after 12 years.

The following applies to contracts concluded after December 31, 2004: Half of the investment income (the difference between the insurance benefit and the contributions paid) is taxed at the personal tax rate when the contract expires if the term of the contract was at least 12 years and the contract expired after reaching the age of 62. When paying out, there is a deduction of 25% capital gains tax , which can be offset against the individual tax to be paid. If the aforementioned requirements are not met, the income share must be fully taxed at the personal tax rate. With flexible (current unit-linked) contracts, however, this tax burden can also be spread over several years by withdrawing partial amounts.

The aforementioned regulations have not changed due to the introduction of the final withholding tax as part of the 2008 corporate tax reform .

Giving away and bequeathing

Since January 1, 2009, the payment amount has been used as a basis for inheritance and gift tax . Until December 31, 2008, only 2/3 of the contributions paid in or the surrender value and not the amount paid out for inheritance and gift tax were used as a basis for lifetime transfers (gifts) . In the case of term life insurance, the insured death benefit is transferred to the estate in the event of benefits and is consequently subject to inheritance tax if the insured person was also the policyholder. By declaring the beneficiary to be the policyholder of term life insurance, inheritance tax can be avoided.

Capital-forming insurance

In Germany, among other things, the favorable tax treatment of income from capital-forming insurance companies in the past led to their success. If the contract begins on January 1, 2005, the investment income contained in life insurance payments is no longer tax-free, but only tax-privileged.

The German form of capital-forming life insurance is primarily intended for long-term and security-oriented investments, especially for old-age provision, and is optimized for this purpose.

In all cases where investment income only accrues in the context of pension payments, these are only taxed according to the earnings value of the pension, regardless of any investment income generated during the deferred period before the start of the pension payment. As a result, investment income from the deferral period, i.e. the contract period before the start of retirement, remains tax-free. Often there is the option to have the equivalent of the pension, the so-called lump-sum compensation, paid out in one amount (lump-sum option). In this case, the same tax rules apply as for mixed life insurance.

In the meantime, there are also mixed pension insurances in which, with the granting of a lump-sum option, no lump sum is paid in the event of survival, but a standard pension, in the event of death, however, a death benefit in the agreed amount is paid during the deferment period. These contracts have the character of death during the deferral period and then of survival character.

Above all, the Riester pension and Rürup pension are subsidized by taxes, in particular with state allowances. Then, however, there is no capital option; The Retirement Income Act also prohibits loaning these subsidized contracts, transferring them to others and using them before the age of 60. See also the pension costs , special expenses , pension bonus .

Unit-linked insurance

Whereas in the past, the contributions for unit-linked insurance, in contrast to conventional contracts, were not tax-deductible as part of pension expenses, today, unit-linked insurance as Riester pensions and Rürup pensions are conditionally tax-subsidized as part of the special expenses deduction .

Unit-linked life insurance has been offered in Germany since 1970. The first providers were the Nürnberger , Veritas (today Gothaer ) and Deutscher Herold .

AachenMünchener Lebensversicherung AG is currently the largest provider .

Criticism of taxation

Until the tax exemption of endowment insurance was abolished in 2005, banks and fund companies in particular criticized the fact that this subsidy favored life insurance over other savings plans.

Since the abolition of tax exemption, the opposite has been criticized for the fact that customers have no way of exempting life insurance income from tax by means of an exemption order . On the other hand, it is now evident that life insurers are now subject to significantly stricter precautionary rules when granting guarantees than they are for fund companies, so that life insurers are now at a disadvantage.

See also

literature

- Julia Friederike Bernreuther: The search for security. The beginning of German life insurance at the beginning of the 19th century . Dissertation, University of Erlangen-Nuremberg 2004

- Birgit Eulberg, Michael Ott-Eulberg, Raymond Halaczinsky: Life insurance in inheritance and inheritance tax law . Verlag Versicherungswirtschaft, Karlsruhe 2005, ISBN 3-89952-223-0 .

- Christian Führer, Arnd Grimmer: Introduction to Life Insurance Mathematics . Verlag Versicherungswirtschaft, Karlsruhe 2006, ISBN 3-89952-226-5 .

- Volker Kurzendörfer: Introduction to Life Insurance . 3. Edition. Verlag Versicherungswirtschaft, Karlsruhe 2000, ISBN 3-88487-859-X .

- Jens Petersen : Life insurance under civil law . In: Archives for civilist practice (AcP) . 204 Vol., 2004, pp. 832-854.

- Axel Thomas Rüttler: State funding of life insurance as a pillar of private pension provision. A comparison of developments in Great Britain and Germany with a view to statutory pension insurance . Dissertation, University of Regensburg 2003. ( full text )

Web links

- BVG judgment of July 26, 2005 on profit sharing in capital-forming life insurance

- Prof. Dr. Hans-Peter Schwintowski from the Humboldt University in Berlin on the judgment of the BVG

Individual evidence

- ^ Motive VVG, 1908, p. 213

- ↑ SH Rechtsanwälte: European Court of Justice decides on the "eternal right of withdrawal" for life insurance policies. In: SH Lawyers. SH Rechtsanwälte, accessed on October 18, 2019 .

- ↑ SH Rechtsanwälte: Compensation for incorrect advice when arranging life insurance. In: SH Lawyers. SH Rechtsanwälte, accessed on October 18, 2019 .

- ↑ Basic security: Exclusion of a life insurance policy does not constitute a breach of duty. (No longer available online.) In: www.arbeitsrecht.de. Archived from the original on March 8, 2017 ; accessed on March 8, 2017 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ 5 facts about the maximum technical interest rate. In: www.gdv.de. GDV, accessed on May 23, 2016 .

- ^ Text of the regulation on information requirements for insurance contracts

- ↑ Life insurance: Expensive termination . In: Frankfurter Allgemeine Zeitung . No. 158 , July 7, 2006, p. 19 ( FAZ.net ).

- ↑ BaFin Annual Report 2007, Table 140.

- ↑ a b c Source: GDV - Statistics of the German Life Insurers ( Memento from November 9, 2007 in the Internet Archive )

- ↑ Death benefit for the unit-linked pension Fraud or performance improvement? (PDF) Archived from the original on March 4, 2016. Retrieved July 13, 2019.