Novo Banco

| Novo Banco, SA | |

|---|---|

| legal form |

Sociedade Anónima (Public Company) |

| founding | April 9, 1920 |

| Seat |

Lisbon , Portugal |

| management | Eduardo Stock da Cunha |

| Number of employees | 10,216 (2013) |

| Branch | Banks |

| Website | www.novobanco.pt |

The Novo Banco (formerly Banco Espírito Santo , BES) is a private commercial bank located at the Avenida da Liberdade in Lisbon , Portugal .

Like all Portuguese banks, it is subject to the banking supervision of the Portuguese Central Bank .

history

The company's roots go back to the last quarter of the 19th century. Almost 150 years ago, the Portuguese Espírito Santo family laid the foundations for a widespread corporate dynasty - an empire with shares in European banks, residential complexes in Miami and a diamond mine in Angola. The business as a commercial bank began in 1937 after the merger of Banco Espírito Santo and Banco Comercial de Lisboa . In July 1999 the name was changed to Banco Espírito Santo (BES). "Espírito Santo" means Holy Spirit in German . In this case, it refers to the surname of the founding family. The company was listed in PSI 20 on the Lisbon Stock Exchange . With a capitalization of around € 5 billion, BES is the largest private financial institution in the country. National media see BES as the “bank of the regime”. Its main foreign markets are in Spain , Angola and Brazil .

The bank invested debt ( mainly savings ) and equity in loans and securities . It also offers other banking services in Portugal and abroad. The main focus is on doing business with companies; The bank is also active in the private customer sector and in leasing . A trademark of the bank with the green logo - promoted by soccer star Cristiano Ronaldo - is actually solidity.

The bank operates the largest branch network in Portugal (631 branches across Portugal as of August 2014), and 145 abroad.

Internationally, the bank is represented in Spain with 29 branches (2014) . Other offices are in Switzerland ( Lausanne , Neuchâtel , Zurich ), Cologne , Toronto , Johannesburg , Shanghai and Mexico City . There are offices in New York City , London , Cape Verde , Venezuela , Nassau , Cayman Islands and Luxembourg .

Group

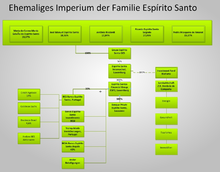

The Espírito Santo Group operated a corporate network in more than 20 countries and the holding companies were based in Switzerland and Luxembourg (ESFG). With this constellation, the group escaped the operational and fiscal control of the Portuguese state, which led to open criticism in Portugal during the 2008 financial crisis. So z. B. by the Portuguese Institute for Corporate Governance (IPCG), which saw this as a violation of the Code of Good Corporate Governance.

Together with subsidiaries, BES was part of the Espírito Santo Financial Group (ESFG) with a share of 20% . These are the subsidiaries

- Aman Bank ( Libya );

- BES Cabo Verde ;

- BES Oriente ( Macau );

- BES Vénétie ( France );

- BESA ( Angola );

- ES Bank (USA);

- ES Investment Bank (Angola, Brazil, China, Hong Kong, India, Poland, Spain, USA, UK);

- ES plc ( Ireland );

- IJAR Leasing ( Algeria );

- Moza Banco ( Mozambique );

In addition to Espírito Santo Financial Group (ESFG), which was the main shareholder with around 20% of BES, there are a number of other shareholders. These are u. a. the French Crédit Agricole (with approx. 14%), Portugal Telecom (with approx. 2%), the Brazilian private bank Bradesco with approx. 4.5%, the Bank Goldman Sachs , as well as US investment companies such as BlackRock (with approx %) and many small shareholders.

On January 3, 2011, BES was named 'Best Bank in Portugal' by Global Finance magazine for the fifth time in a row.

Crisis in 2014

In July 2014, the bank got into trouble. The causes are the financial holding Espírito Santo International (ESI) and its subsidiary Espírito Santo Financial Group (ESFG), which has a 20.1 percent stake in the bank as the main shareholder, as well as problems with loans granted by the Angolan subsidiary BESA. The umbrella holding company ESI is said to have concealed losses of 1.3 billion euros. In the first half of 2014, a half-year loss of 3.57 billion euros was reported. At the center of the whole affair is a small Swiss financial company that is now called Eurofin Holding . Its founding 15 years ago mainly served the purpose of handling financial transactions for the Espírito Santo family and their corporate network.

The cause of the crisis is the bank's past as part of a group of companies belonging to the Espírito Santo family in dire straits, which includes hotels, lands, hospitals and holdings. These holdings operated under the name Rioforte . Rioforte bonds could no longer be serviced as of July 14, 2014 and it collapsed. The bank's decline is described by professionals not only as the result of negligence, but also of criminal energy. In the wake of the crisis, the Portuguese judiciary arrested the former bank boss and patriarch Ricardo Salgado on July 24, 2014 and launched an investigation into suspected fraud, abuse of trust, forgery and money laundering.

Bank collapse

On August 1, the Council informed the European Central Bank of the Bank of Portugal said that he'll Banco Espírito Santo Hat access to ECB money. Two days later, Costa announced a tax-financed state rescue and a split of the bank. On August 4, 2014 it became known that bad loans from BES are to be outsourced to a bad bank , which will be owned by the previous shareholders of BES. The rest of the profitable part of the bank has been operating under the name Novo Banco since that day and is in the sole possession of the Fundo de Resolução (deposit protection fund of the Portuguese banks). The Novo Banco will receive grants totaling 4.9 billion euros . Of this, 400 million come directly from the deposit protection fund of the Portuguese banks. 4.5 billion come from the Portuguese state, which actually comes from a credit line from the euro rescue fund to the state of Portugal that has not yet been fully exhausted and is rededicated as a loan to the Portuguese bank rescue fund without using its own funds. There will no longer be a listing on the stock exchange.

See also

Web links

- Official website

- Tragic comedy about Espírito Santo in Portugal. Detailed background report on the BES in the NZZ Online from 23 September 2014

Individual evidence

- ↑ Archived copy ( memento of the original from August 20, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Handelsblatt , No. 148 of August 5, 2014, p. 26.

- ↑ Euronext Lisbon ( Memento of the original dated May 23, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ^ Vortex around Portugal's largest private bank. In: nzz.ch. June 22, 2014, accessed October 14, 2018 .

- ↑ Archived copy ( memento of the original from July 9, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Authorized representatives of foreign banks and securities firms In: finma.ch , accessed on February 24, 2020 (PDF; 313 kB).

- ↑ International presence ( Memento of the original from July 27, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (Portuguese)

- ↑ see also nzz / The decline of the Banco Espírto Santo

- ↑ see also www.bes.pt: Group structure ( Memento of the original from October 27, 2012 on WebCite ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Global Finance names the World's Best Trade Finance Banks 2011 (English)

- ↑ spiegel.de: Large Portuguese bank: Espírito Santo reports a loss of 3.6 billion euros

- ↑ http://www.wsj.de/article/SB10001424052702303996604580088602261734266.html

- ^ Thomas Urban, Unheilige Familienbande , Süddeutsche Zeitung, 12./13. July 2014, p. 21.

- ↑ manager-magazin.de: Portugal's crisis bank - Ex-Espirito-Santo boss Salgado in custody , July 24, 2014

- ↑ FAZ.net July 31, 2014: Portuguese bank test - The Portuguese bank Espirito Santo made a loss of 3.6 billion euros in half a year. The case becomes a test for the crisis-ridden country

- ↑ spiegel.de August 4, 2014: EU rescue package: Portugal supports Banco Espírito Santo with billions in aid

Coordinates: 38 ° 43 ′ 18.8 ″ N , 9 ° 8 ′ 52 ″ W.