Tax progression

Tax progression means the increase in the tax rate depending on the taxable income or assets. There are different views as to whether only the average tax rate or also the marginal tax rate should increase with the tax base .

history

A progressive income tax scale in the United Kingdom was first introduced by William Pitt the Younger in his state budget in December 1798. Pitt's new progressive income tax started at 2 old pence per pound (1/120) on incomes over £ 60 and rose to a maximum of 2 shillings per pound (1/10) on incomes over £ 200.

In the Prussian local tax law of July 14, 1893 ( also called " Miquel's tax reform " after the then finance minister Johannes von Miquel ), a tax progression was introduced in the German Empire . The tax rate of this income tax rose from 0.62% (for annual incomes of 900 to 1050 marks) to 4% (for annual incomes over 100,000 marks). In the following period, progressive tariffs were introduced in many European countries, for example in the USA in 1913. How much the tax rate rises depending on income, however, is very different in the different countries.

The progressive tariff was also retained in the Weimar Republic after the Erzberger Reform and also in the Federal Republic of Germany , which is reflected in the tariff calculation of Section 32a, Paragraph 1, Sentence 2 of the Income Tax Act and the remarks on the progression proviso in Section 32b of the Income Tax Act.

In addition to the progressive income tax, various proposals have also been made to structure other taxes with progressive tariffs. Examples are inheritance tax and sales tax . For inheritance tax z. B. Theodore Roosevelt, in his New Nationalism Address of 1910, proposed a tax progression with the aim of reducing the inequality of the distribution of wealth.

example

The best way to understand tax progression is to distinguish it from other taxation models:

- With the poll tax , every citizen pays the same amount of tax, regardless of the amount of income. The tax rate is decreasing depending on the income, since higher incomes are taxed proportionally lower. The tax rate is regressive .

- With a flat tax , i.e. a constant tax rate, everyone pays the same proportion of their income. If the tax rate is 10%, someone who earns 10,000 euros pays 1,000 euros in taxes and someone who earns 20,000 euros pays 2,000 euros in taxes (without taking into account a basic tax allowance).

- With a progressive tax (depending on income) increasing tax, someone who earns more than someone else pays a higher proportion of his income in taxes. So if one person earns 10,000 euros and another 20,000, the first person pays 10% tax, i.e. 1,000 euros, while the second pays 15%, i.e. 3,000 euros. Here the first 10,000 euros are taxed at 10%, but the second 10,000 euros at 20%.

justification

The question of which taxation model is preferable touches on an essential principle of democracy: equality of rights . It is therefore agreed that objective reasons are required to justify increasing tax rates.

In political and socio-economic terms, tax progression is often justified with the decreasing marginal utility of rising incomes and assets: With the rise, increasingly no more essentials, but only luxury items are consumed.

Often the higher tax rate for more earners is justified by the so-called victim theory . The victim theory transfers the law of decreasing marginal utility to taxation theory: if someone earns 50,000 euros, for example, the first euro he earns is more useful to him than the last. Therefore taxation of every additional euro earned is less burdensome. A progressive tax rate is justified in order to create an equal burden between low and high earners.

Increasingly, however, considerations of justice and the welfare state principle are cited as justifications. The German Federal Constitutional Court derives the requirement of a progressive tariff course from the principle of equality, according to which the principle of performance must apply.

Effects

The tax progression leads to a disproportionately increasing tax burden with increasing income or assets. Higher incomes are therefore not only taxed higher in absolute terms, but also in percentages. Put simply, a high earner should give up half of his income, for example, and a low earner only a tenth.

Degree of progression

Various considerations are possible as measures for assessing the degree of progression. This includes

- Difference between marginal and average tax rate

- Change in the average tax rate

- Change of marginal tax rate

- Tax amount elasticity

- Residual income elasticity

The residual income elasticity indicates by how much the income after tax deduction (net, residual income) changes approximately if the income before tax (taxable income) increases by one percent.

Redistribution

curves for calculating the Gini coefficients (general example) Dashed curve: before tax

Solid curve: after tax

Progressive income taxation reduces the unequal distribution of income to a greater or lesser extent. That leads to a redistribution . There are several measures that measure the degree of redistribution. The effective measure of progression (according to Musgrave / Thin) determines the degree of inequality from the Gini coefficient (a possible inequality indicator ). The Musgrave / Thin progression index is defined as follows for a given distribution of income before tax deduction ( ) and distribution after ( ):

The value one is the Gini coefficient given total unequal distribution of income. The related deviation of the Gini coefficient after tax in relation to the deviation of the Gini coefficient before tax thus gives the effective measure of progression .

For example, in 2008 the Gini coefficient for the German income distribution was 53.6% before taxes and 44.1% after taxes. The two Gini coefficients give an effective measure of progression of .

An alternative measure is the Reynolds-Smolensky index defined as the difference in the Gini coefficients before and after redistribution:

Interpretation of the indices:

| Tax rate | Musgrave Thin Index | Reynolds-Smolensky index |

|---|---|---|

| progressive | ||

| proportional | ||

| regressive |

Cold progression

A cold progression is an increase in the real tax burden that can only be observed over several years and is caused by inflation in conjunction with tax progression.

species

Indirect progression

In the case of a single-tier tariff ( flat tax ), the interaction of the basic tax allowance and the marginal tax rate (also known as "marginal tax") leads to an average tax rate that increases with income. With increasing taxable income, the actual tax burden (average tax rate) flattens out towards the marginal tax rate. One speaks of an indirect progression , since the marginal tax rate itself is not progressive, but only the average tax rate. The top tax rate is identical to the entry tax rate and is 10% in Bulgaria or 23% in Latvia , for example .

Step progression

With the step limit rate tariff, there are benchmarks (steps) from which a higher limit tax rate is applied for every euro above the step . Graduated marginal rate tariffs are made up of several zones with a constant (flat) marginal tax rate. Here, too, there is an income-related increase in the average tax rate , which, however, has a ripple depending on the level. This results from the way in which the average tax rate is calculated as the quotient of tax and taxable income. The number of levels is at least two ( Poland ) or three ( e.g. Austria up to 2015, then 6 levels ) and can be subdivided as finely as desired ( see Federal Tax Switzerland with up to 14 levels ). The larger the number of steps selected, the more the course approximates the linear progression.

Linear progression

With linear progression , the marginal tax rate increases linearly in one or more areas between the initial tax rate and the top tax rate . There are no sudden transitions here. The increase in both the marginal tax rate and the average tax rate is continuous ( steady ). Such a tariff is used, for example, for income tax in Germany .

With both the stepped and the linear progression, the top tax rate is usually much higher than the starting tax rate. However, the progression in the area of lower incomes is much slower than with the flat tax.

Contrary to widespread assumptions, neither the linear progression nor the stepped limit rate tariff can lead to net income losses in the event of gross increases. This follows from the mathematical design of the tax amount functions in such a way that the higher marginal tax rate only applies to the additional income.

Mathematical definition

The mathematical definitions use the following terms and variables:

= Tax amount

= taxable income

= Basic allowance

= Average tax rate

= Initial tax rate (initial marginal tax rate)

= Marginal tax rate

= linear progression factor

Proportional tariff

With the proportional tax rate and constant tax rate, the tax increases proportionally to income, without any progression effect ( ):

However, if you take into account the basic tax allowance (green lines in the pictures), the tax amount is calculated using the formula:

The indirect progression of the average tax rate follows from the relationship

Graduated progressive tariff

With the stepped progressive tax rate there are several zones in which the marginal tax rate remains constant. However, it is higher in the following zone than in the previous one (blue lines in the pictures). The boundaries of these zones (benchmarks) are marked with blue arrows in the picture above. Within a zone, the curve corresponds to the proportional tax rate.

with = basic income value, where is, and = number of the basic value directly below the zvE.

Linear progressive tariff

With the linear progressive tax rate , the marginal tax rate is increased linearly (orange lines in the pictures):

The following applies to the average tax rate with the basic tax allowance:

Even without a basic tax allowance ( GFB = 0), linear progression has a progressive effect because the progression factor continuously increases the average tax rate depending on :

The marginal tax rate results from:

Country overview

Germany

calculation

Until 1989, polynomials were used to determine the steady increase in the marginal tax rate , with the increase flattening out with higher taxable income. Since 1990, one or more straight line equations have been used that lead to one or more tariff zones with linearly increasing marginal tax rates. The straight line equations are easier to calculate. In the political discussion, the linear progression (current law) and the tiered tariff are discussed.

Tariff history

The procedures for calculating the income tax rate are described in the tariff history of the Federal Ministry of Finance with formulas and tables. The simplification of the calculation of the tax rate from 1990 is also documented there.

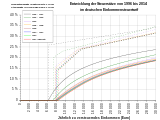

The images above show the historical development of the tax rates in the German income tax rate from 1990 to 2014 in direct comparison. The significant increase in the basic tax-free allowance from 1996 was a reaction to the judgment of the Federal Constitutional Court, which demanded the tax exemption of the subsistence level. At the same time, however, the basic tax rate was raised from 19.0% to 25.9%. In the period that followed, the basic tax rate was gradually reduced again and is 14.0% in the 2010 tariff. The top tax rate was reduced from the original 53.0% to 42.0% in the 2005 tariff, but increased to 45.0% from 2007 for high incomes over 250,000 euros.

Austria

Income tax in Austria follows a nationwide, 6-stage tariff model with an exemption.

Switzerland

In Switzerland , both the direct federal tax and the income and wealth tax of most cantons are calculated according to a progressive tariff. However, the cantonal progression in the highest incomes and assets is limited in many places in order to attract or not drive away potent taxpayers. Recently, a few very small cantons have implemented a system change to the uniform tax rate. However, this is being opposed by the Social Democrats at the federal level, who wanted to force a minimum progression rate for the cantons through a popular initiative . However, they failed in a federal referendum on November 28, 2010.

There are various options in the Swiss tax system to break the tax progression. These include, for example, payments into pillar 3a , which reduce the taxable income and are also advantageous in terms of payout, as a reduced tax rate is applied. Another popular variant is buying into the pension fund, which is also deductible, and renovating residential property over several years. Finally, there is tax avoidance, which is legal and should not be confused with tax evasion and tax fraud.

Great Britain

In Great Britain there is a progressive taxation of both the “corporation tax”, a type of corporation tax, and the “income tax”. The main corporation tax rate is 28% and affects companies with taxable income greater than £ 1.5 million. For companies with taxable income less than £ 300,000 the tax rate is 21%. Only those with taxable income between £ 300,000 and £ 1.5 million will there be a sliding tax rate between 21% and 28%.

UK income tax is levied in four bands with three different tax rates. Income up to £ 12,500 is not taxed (“Personal Allowance”), the “Basic Rate” of 20% applies from £ 12,501, the “Higher Rate” of 40% from £ 50,001 and the “Additional Rate” of 45% for parts of the income £ 150,000 (as of 2019/20 tax year). A “basic rate” of 10%, a “higher rate” of 32.5% and an “additional rate” of 42.5% apply to dividends. A “basic rate” of 20% and a “higher rate” of 40% apply to other investment income.

In both Great Britain and the USA there is also a "payroll tax" for employees, which was originally intended as a social security contribution, but has since evolved into a tax that is - in every way but name - an income tax ( “Stealth tax”) and often causes a higher tax burden than income tax. The "payroll tax" is criticized as a degressive tax .

France

A progressive income tax ('impôt sur le revenu') was introduced in France in 1914 after years of discussion (promoted by the seven-time French finance minister Joseph Caillaux ). The law was passed on July 15, 1914; the imminent war, or war anticipated by many, accelerated this decision.

United States

In the United States , the lowest federal tax rate for corporations with taxable income less than $ 50,000 is 15% and increases to 35% for taxable income above $ 18.3 million. The corporations are also taxed by the states, but this tax is offset against federal tax.

Federal income tax is levied with gradually increasing marginal tax rates from 10% to 39.6%. From which taxable income the next higher tax rate applies, it differs according to whether you are assessed as an individual, as a married couple assessed together, as a separately assessed married couple or as a single parent. Note that most states charge additional income tax. Depending on which state you live in, a top tax rate of over 50% is possible (if you add federal and state income tax).

US income tax has a remarkably high effective tax progression. The index for income inequality (here: Gini coefficient) was 56.47% (pre-tax income) in 2006 for taxable income and fell to 48.92% for post-tax income due to the pronounced tax progression. The two Gini coefficients result in an effective progression from (after Musgrave / Thin).

See also

Web links

- Tax progression in Switzerland (PDF; 175 kB)

Individual evidence

- ↑ Michael Elicker: a proportional net income tax. ( Memento of August 27, 2013 in the Internet Archive ) (PDF; 2.0 MB) Habilitation thesis at Wendt, Verlag Dr. Otto Schmidt, 2004.

- ↑ Klaus Tipke : “An end to the income tax confusion !? - Legal reform instead of voting policy ”, Cologne 2006, page 165

- ↑ Income Tax (United Kingdom) ; A tax to beat Napoleon

- ^ Journal of Economic Perspectives - Volume 21, Number 1 - Winter 2007, How Progressive is the US Federal Tax System? A Historical and International Perspective (PDF; 203 kB)

- ↑ Teddy Roosevelt's New Nationalism. The Heritage Foundation, archived from the original on October 26, 2015 ; Retrieved October 29, 2015 .

- ↑ P. Keller: History of Dogmas of State Interventionism

- ^ Neumark, principles of just and economically rational tax policy, p. 177; Moebus, The constitutional justification of the progressive income tax and its implementation in line with the system, p. 71 ff.

- ↑ Birk, The principle of performance as a measure of tax standards, 1983, p. 142 with additional information.

- ↑ See BVerfGE 8, 51 , para. 70

- ↑ after Frank Hechtner, Free University of Berlin

- ↑ a b Peichl, A., Siegloch, S. and Pestel, N., Is Germany really that progressive? , Quarterly Issues on Economic Research, DIW Berlin, Volume 82, 01.2013, pp. 111-127 (PDF file; 296 kB).

- ↑ Income tax calculator of the Federal Ministry of Finance with tariff history ( Memento from January 11, 2015 in the Internet Archive )

- ↑ Federal Ministry of Finance : Tariff History (1958–2005) with calculation formulas ( Memento of August 13, 2011 in the Internet Archive ) (PDF) and overviews of the income tax tariff burden from 1958 ( Memento of February 19, 2014 in the Internet Archive )

- ↑ Pension 3a; Tied pension 3a , accessed on November 25, 2015.

- ↑ Francine Fimbel; Tax progression in Swiss tax law , accessed on November 25, 2015.

- ^ Income Tax rates and Personal Allowances

- ↑ full text (digitized version)

- ↑ Aux sources de l'impôt sur le revenu , Alternatives économiques , Gérard Vindt, n ° 151, September 1997

- ^ Income tax rates

- ↑ Income tax at the level of the US states in 2006 ( MS Excel ; 58 kB)

- ↑ US federal income tax in 2006