Central bank balance sheet

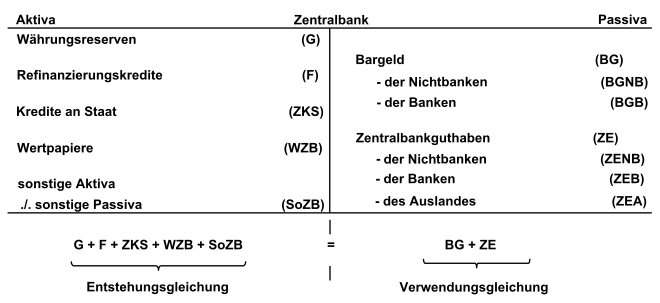

The central bank balance sheet (including central bank balance sheet , central bank balance or central central bank balance ) is the balance sheet of a central bank , the assets (assets) and liabilities are compared in focus in account form (liabilities). The central bank balance sheet reflects the special functions of a central bank within an economy . From this, the so-called monetary base , including its creation (assets) and its use (liabilities), can be determined. In particular, they explain the process of central bank money creation and destruction.

Economic importance

If you add up the positions on the assets side, you get the formation equation of central bank money or money supply Z (= monetary base). The different development components can be recognized from it:

- G: Central Bank's net external claims (external component)

- F: Central bank claims in its own currency from monetary policy operations (refinancing component)

- ZKS: State loans to the central bank (fiscal component)

- W ZB : Central bank securities (open market component)

- So For example : other assets such as government buildings, technical facilities, etc..

The balance on the liabilities side forms the so-called usage equation. This reflects the offsetting entries that arise when the central bank buys (in the sense of generating) or sells assets. She pays this on the liabilities side in the form of cash or liabilities .

- BG: banknotes in circulation

- ZE: Central bank balances (from banks, non-banks, abroad)

Building a central bank balance sheet

As with any other balance sheet , the central bank balance sheet consists of the comparison of assets and liabilities, with the two balances being identical. The asset side of a central bank balance sheet is also known as the generation side, since the generation equation of the central bank money supply (Z) can be derived from its balance sheet items . The passive side is also called the usage side, as the usage equation can be derived from it.

The structure, especially the individual balance sheet items, can vary depending on the currency area of the central bank (national such as the Bank of England or multinational such as the European Central Bank ). The central bank's monetary policy can also influence the structure of the balance sheet.

Balance sheet items of a central bank balance sheet

The following illustration of a central bank balance sheet is based on the balance sheets of the Deutsche Bundesbank and the European Central Bank. Depending on the central bank, individual positions can also have other names. In addition, individual positions cannot be included in every central bank balance sheet. The claims within the Eurosystem are a special feature of the central banks of the European System of Central Banks (ESCB). They contain, for example, the capital shares of the national central banks in the European Central Bank. Liabilities within the Eurosystem can also be found under liabilities . However, these positions can only be found in central banks within a supranational currency system.

Assets:

-

Currency reserves G (also known as net foreign claims)

- Gold and gold claims

- Claims in foreign currency to residents outside the currency area

- Demands on the IMF

- Balances with banks, securities investments, foreign loans and other assets

- Claims in foreign currency on residents in the currency area

-

Refinancing loans F (claims in local currency from monetary policy operations to credit institutions in the currency area)

- Main refinancing operations

- Longer-term refinancing operations

- Fine-tuning operations in the form of fixed-term transactions

- Structural operations in the form of temporary transactions

- Marginal lending facility

- Claims within the Eurosystem

- Participation in the European Central Bank

- Claim from the transfer of currency reserves to the European Central Bank

- Claim from the distribution of euro banknotes in circulation

- other claims within the Eurosystem

- Loans to the state ZKS (claims on public budgets)

- Securities W ZB (securities in local currency of residents in the currency area)

- other assets So ZB

Liabilities:

- Banknotes in circulation BG

- Central bank balance ZE

- Central bank balances of commercial banks ZE B (liabilities to commercial banks )

- Minimum reserves of commercial banks

- other deposits from commercial banks

- Deposit facility

- Time deposits

- Fine-tuning operations in the form of fixed-term transactions

- Central bank balances of non-banks ZE NB (liabilities to other residents in the currency area)

- Government deposits

- other deposits in local currency

- Central bank balances abroad ZE A

- Central bank balances of commercial banks ZE B (liabilities to commercial banks )

- Liabilities within the Eurosystem

- Liabilities to the European Central Bank

- Liabilities arising from the distribution of euro banknotes in circulation

- other liabilities within the Eurosystem

- other liabilities

- accruals

- Adjustment item

- Net worth

- Equity

- Profit or loss carried forward

Currency reserves

This balance sheet item essentially comprises the gold and currency reserves of a central bank. In the past, gold reserves were mainly used to cover the value of the banknotes issued . Today you can see the gold stocks as a reserve for times of crisis . But trust in the stability of a currency's value also depends crucially on the amount of gold and foreign exchange reserves of a central bank. However, there is a risk that if several central banks were to sell gold at the same time, the gold price would fall rapidly and the reported value of the gold reserves would not correspond to the actual value. This reduction in the balance sheet on the assets side would also have to result in a reduction on the liabilities side. In order to counteract a drop in the gold price, some central banks (including the European Central Bank) concluded the so-called Central Bank Gold Agreement (CBGA) in 1999 , in which the volume of gold sales up to 2009 is regulated. On March 31, 2008, the total banknotes in circulation in the European Monetary System of € 665.749 billion were compared to a gold stock of € 201.137 billion.

When a central bank holds foreign exchange , it takes on the role of a foreign exchange bank for an economy. These currency reserves are of crucial importance in connection with exchange rates . In a system with fixed exchange rates (e.g. euro versus Lithuanian litas, Latvian lats and Danish kroner), a central bank must counter market demand by intervening and buying and selling foreign currency. However, this automatically leads to an unwanted lengthening or shortening of the balance sheet and thus to a change in the monetary base.

- Posting rate for foreign currency purchases: Currency reserves G ↑ (amount X) to banknotes in circulation BG ↑ (amount X)

- Posting record for foreign exchange sales: banknotes in circulation BG ↓ (amount X) to currency reserves G ↓ (amount X)

In systems with flexible exchange rates (e.g. euro - US dollar) there is no such constraint. However, the central bank still needs currency reserves in order to be able to carry out any intended interventions in the foreign exchange market . Countries with a relatively weak currency in particular need currency reserves to hedge their currency. It may well be the case that when assessing the solvency of a central bank or an economy, only the sum of its currency reserves (including gold reserves) serves as the basis.

Refinancing loans

The refinancing credits are part of the monetary policy instruments of a central bank. These open market operations are the classic form of central bank money creation. The central bank buys ( expansive monetary policy ) or sells ( restrictive monetary policy ) securities from or to the commercial banks (non-banks are also conceivable as partners, but in practice they play a subordinate role). As a result, the central bank increases or decreases the amount of central bank money.

If the central bank were to conduct securities transactions exclusively with non-banks, it could control the money supply directly. However, if commercial banks are involved in these transactions, the amount of money can no longer be controlled directly, since the commercial banks, for their part, influence the amount of money through the creation of deposit money.

Actually, these securities should be allocated to the securities balance sheet item. For example, the Federal Reserve Bank in the United States buys securities from commercial banks. However, since some central banks (such as the European Central Bank) operate these operations in the form of repurchase agreements , i.e. In other words , if they agree on a repurchase price and date when buying the securities, they are shown in one of the following five forms under the item Refinancing Loans , as they have the character of a loan due to the time limit .

Main refinancing operations

As the name suggests, the main refinancing operations represent the most important group. The central bank determines the amount for which it wants to buy securities. With the bulk tender procedure , the commercial banks then offer securities to the extent that they need central bank money. The interest rate is set by the central bank. With the variable rate tender procedure , the central bank sets a minimum bid interest rate (which is also the central bank's first key interest rate ). The commercial banks for their part can now submit various bids (how much central bank money at what interest rate - for example EUR 1 million at x%, EUR 2 million at y%, etc.). The central bank then distributes the amount it has determined to the commercial banks.

These transactions run regularly at certain intervals with a specified term. For example, the interval of the European Central Bank is set at one week in a tender calendar. The term for main refinancing operations is also 1 week. Every Monday she accepts the bids from the commercial banks. On Tuesdays, the commercial banks then receive their allocation from the central bank.

Longer-term refinancing operations

Longer-term refinancing transactions , like the main refinancing transactions, are repurchase transactions , but they differ in terms of duration and execution interval. The basic goal is the permanent provision of central bank money. This instrument is primarily intended to provide the smaller commercial banks that are subject to minimum reserve requirements with the necessary liquidity .

Within the ESCB, the allocation to the commercial banks is carried out on the last Wednesday of each month. The term of these repurchase agreements is three months. As of April 4, 2008, together with the main refinancing operations, they formed a balance sheet item of EUR 444.530 billion and thus around 67% of the total notes in circulation of EUR 662.561 billion. This makes them the most important instrument for creating central bank money in the ESCB.

For reasons of simplification, individual central banks (formerly the Deutsche Bundesbank, for example) do not use the repurchase agreement procedure for their refinancing transactions, but rather the pledge pool procedure. In doing so, the central banks are only assigned liens over collateral eligible for refinancing. The central bank then aggregates all the collateral of a commercial bank. This has the advantage that a specific security does not have to be assigned to every refinancing transaction, but rather the pool of deposits is simply increased or decreased depending on the size of the transactions.

Fine-tuning operations in the form of fixed-term transactions

For the short-term reaction to the liquidity situation of the commercial banks, the central bank has the instrument of fine-tuning operations at its disposal. It is designed on both sides, i.e. that is, it can both add and withdraw central bank money from the market. This is necessary in order to react to the frequent fluctuations in liquidity requirements. The instruments used are temporary transactions (quick tenders), currency swaps and time deposits . As can be seen from their name, these stores are not standardized; In other words, dates and terms are regulated individually by the central banks as required. Thus, this balance sheet item is u. U. at zero.

Structural operations in the form of temporary transactions

To focus on structural, i.e. H. In order to be able to react to changes with longer lasting effects, the central banks have the means of structural operations . A permanent change in the liquidity requirement is to be implemented. Various transactions with regular and irregular terms are available as a means. In order to absorb liquidity, the European Central Bank provides for the ECB bonds as part of a tender process. So far, however, this instrument has not been used within the ESCB.

Marginal Lending Facility (Assets) / Deposit Facilities (Liabilities)

In order to be able to provide the banks with liquidity at very short notice, there is the instrument of facilities . This is also referred to as permanent facilities, since the commercial banks can use this means at any time. In contrast to the above However, the initiative comes from the banks.

The marginal lending facilities are liquidity-providing measures, i. that is, they meet short-term central bank money needs. Within the ESCB, commercial banks can submit an application by 6:30 p.m. at the latest. The term is only one business day . As with the above Here, too, instruments must be provided by commercial banks that can be refinanced. The interest rate to be paid by the commercial banks is called the marginal lending rate . This represents the maximum interest rate for overnight money , since the commercial bank would get any amount of liquidity for him from the central bank at any time. In practice, she will try to get other offers with lower interest rates on the financial market.

In order to absorb liquidity, the central bank has the deposit facility at its disposal. The commercial banks can, as in the above Procedure Deposit central bank money into your central bank account with interest. The interest rate they get for it is called the deposit rate . At the same time, it represents the lower limit of interest rate formation on the money market. However, the commercial banks will only make use of this option if they have not found a market participant in the course of the business day who is willing to pay a higher interest rate than the deposit rate.

The calculated interest rates are called the interest channel . The normal overnight rate of commercial banks is within this range. The change in the deposit rate and the marginal lending rate has so far taken place together with the change in the key interest rate and the main refinancing rate, but since January 1, 2004, it can also be changed independently of them.

Loans to the state

Within the ESCB, borrowing by the state from central banks has been generally prohibited since January 1, 1994. The background to this is that government borrowing is of crucial importance for monetary policy and its prospects for success. Many economists believe that if a government were able to borrow money from the central bank without restriction, it would lead to inflation in the long term . H. a rapid decline in the value of money. However, as there are still claims against the federal government within the European central banks that arise from adjustment items from currency conversions, this item is included in the central banks' balance sheets, but is insignificant in terms of volume.

Securities

The open market component of central bank money creation is the holdings of a central bank's securities . The central bank permanently purchases securities on the open market . As described in the theory (model without commercial banks) of central bank money creation, a central bank adds liquidity to the market by exchanging securities for central bank money. It thus influences the supply of money and, via the balance between supply and demand, the interest rate, which in turn results from the prices of the securities. So if a central bank buys securities, the demand for securities increases and with it the price of these securities, the interest rate drops. Conversely, if the central bank sells securities and thus withdraws central bank money from the market, the interest rate rises.

However, since in reality there are commercial banks in almost every economy, the above mentioned. Model is not the only tool used by central banks. However, it describes very well the process of central bank money creation. The stock of securities as of April 4, 2008 within the ESCB amounted to 106.612 billion euros and was thus, at 16.5% of total banknotes in circulation, significantly smaller than the share of the refinancing component.

Other assets

In addition to the aforementioned items on central bank assets, there are other balance sheet items. This includes buildings, land and technical facilities of the central banks, but also the coins they put into circulation . However, from an economic point of view, they are of no great importance.

Banknotes in circulation

This balance sheet item is one of the special features of the central bank balance sheet. It reflects the amount of banknotes issued by a central bank . It points to the banknote monopoly , i. H. the sole right to issue banknotes to the central bank. This position does not include the coins (shown as divisional coins in the assets), which together with the banknotes make up cash .

Within the ESCB, the European Central Bank has the sole monopoly on banknotes (Art. 105a Para. 1 Treaty establishing the European Union). It grants the right to issue euro banknotes to the national central banks using a distribution key (around 7% ECB, the rest distributed among the NCBs).

Central bank balances

In this item (referred to on the ECB's balance sheet as liabilities denominated in euro from monetary policy operations to credit institutions in the euro area), the minimum reserves of commercial banks are of particular importance. They have been known as a monetary policy instrument for indirect control of the money supply since around 1930. The commercial banks are obliged to hold a certain percentage of their customer deposits in the form of central bank money in reserves of the central bank (currently 1% within the ESCB). Depending on the central bank system, these reserves earn interest at a certain rate.

Example of the creation of central bank balances due to the minimum reserve requirement:

- Customer 1 has a balance of 100 euros in his account at Bank A.

- Bank A pays customer 2 a loan of 98 euros in cash. She has to hold 2 euros in reserve at the central bank.

- Customer 2 pays his 98 euros into an account at bank B.

- Bank B pays customer 3 a credit of 96.04 euros in cash. She has to hold 1.96 euros in reserve at the central bank.

- ……

This process is called money creation . The function of the minimum reserve policy of a central bank for controlling the money supply becomes clear.

In addition to refinancing loans and securities, the minimum reserve policy is a third instrument of the accounting approach of a central bank's monetary policy. On April 4, 2008, the total of minimum reserves within the ESCB was 194.7 billion euros.

Net worth

The net assets of a central bank is vital for their independence. The independence of the European Central Bank and that of the national central banks is based on four pillars:

- institutional independence

- functional independence

- personal independence

- financial independence

Net worth plays a crucial role in connection with financial independence, as it enables the central bank to independently bear its necessary expenses. The European Central Bank and the national central banks are not allowed to raise capital from the state, as this would jeopardize their independence.

The regulations on the capital of the European Central Bank can be found in Article 28 of the ECB Statute. When it started operating, it was endowed with EUR 5 billion, with the sole subscribers being the national central banks of the ESCB. In the course of time this capital increased with the accession of further states to the ESCB. The distribution is based on the same key as when the currency reserves were brought in, namely according to economic strength (measured on the gross domestic product at market prices) and the size of the population.

The profit of the European Central Bank, which initially flows into a reserve fund with a maximum of 20%, is also distributed according to these shares. This fund may not exceed 100% of the capital of the European Central Bank. The remaining profit is distributed to the national central banks. If there is a loss in the financial year, this is initially offset by the reserve fund. If this is not enough, the Governing Council can decide that this loss is offset by the national central banks.

Income can accrue to the central banks, for example, through interest income from the investment of currency reserves or equity, profits from foreign currency sales or from fees and commissions. Expenses include personnel costs, depreciation or costs for the maintenance and acquisition of tangible assets such as administrative buildings.

Special features in the supranational currency area of the Eurosystem

The European System of Central Banks (ESCB) has consisted of 19 central banks and the European Central Bank since January 1, 2014. The European Central Bank has the sole right to put central bank money into circulation. However, this is not done directly by it, but is carried out by the national central banks using a distribution key. They also account for their respective share of banknotes in circulation, with the European Central Bank accounting for only 7% of the total banknotes in circulation. Thus, looking at an individual central bank balance sheet within the ESCB is only conditionally suitable for getting an overview of the euro area . For this reason, the European Central Bank publishes weekly, monthly and yearly consolidated reports for the entire currency area. These reports can be found on the website of the European Central Bank and the websites of the national central banks.

literature

- Oliver Blanchard, Gerhard Illing: Macroeconomics , 4th edition, Pearson, Munich 2006, ISBN 3-8273-7209-7 ; 5th edition 2009, ISBN 978-3827373632

- Egon Görgens, Karlheinz Ruckriegel and Franz Seitz: European monetary policy: theory - empiricism - practice . UTB, 6th edition 2013, ISBN 978-3825285555

- Hans-Joachim Jarchow : Theory and Politics of Money , 11th Edition, UTB 2003, ISBN 978-3825224530

- Paul R. Krugman and Maurice Obstfeld : International Economy - Theory and Politics of Foreign Trade . Pearson Studium, Munich 2006, ISBN 3-8273-7199-6

- Gerhard Mussel: Fundamentals of the monetary system , 7th edition, Verlag Wissenschaft & Praxis, Sternenfels 2006, ISBN 3-8967-3299-4

Individual evidence

- ↑ Hans-Joachim Jarchow: Theory and Politics of Money . Pp. 300-301

- ^ Gerhard Mussel: Fundamentals of the monetary system . P. 49

- ^ Gerhard Mussel: Fundamentals of the monetary system . P. 46

- ↑ Own presentation based on the Deutsche Bundesbank balance sheet, the balance sheet of the European Central Bank and Gerhard Mussel: Fundamentals of the monetary system , p. 46

- ↑ http://www.sparkasse.at/sPortal/sparkasseat_de_0198_ACTIVE/Downloads/Treasury/Research/SP/20070503_SP_INT_de.pdf (link not available)

- ↑ a b c d Consolidated statement of the Eurosystem as of April 4, 2008 ( Memento of January 30, 2012 in the Internet Archive ), press release of the European Central Bank, April 9, 2008

- ^ Gerhard Mussel: Fundamentals of the monetary system . P. 44 ff.

- ^ Gerhard Mussel: Fundamentals of the monetary system . Pp. 210-212

- ^ A b Olivier Blanchard and Gerhard Illing: Macroeconomics . P. 131

- ^ Gerhard Mussel: Fundamentals of the monetary system . P. 209 ff.

- ^ Gerhard Mussel: Fundamentals of the monetary system . Pp. 218-221

- ^ Gerhard Mussel: Fundamentals of the monetary system . Pp. 221-222

- ↑ Egon Görgens, Karlheinz Ruckriegel, Franz Seitz: European monetary policy . Pp. 215-216

- ↑ Egon Görgens, Karlheinz Ruckriegel, Franz Seitz: European monetary policy . Pp. 216-217

- ^ Gerhard Mussel: Fundamentals of the monetary system . P. 225

- ^ Gerhard Mussel: Fundamentals of the monetary system . Pp. 227-229

- ^ Gerhard Mussel: Fundamentals of the monetary system . P. 48

- ↑ Olivier Blanchard and Gerhard Illing: Macroeconomics . P. 117 ff.

- ^ Gerhard Mussel: Fundamentals of the monetary system . Pp. 21-23

- ↑ Hans-Joachim Jarchow: Theory and Politics of Money . P. 102

- ^ Gerhard Mussel: Fundamentals of the monetary system . Pp. 24-25

- ↑ Olivier Blanchard and Gerhard Illing: Macroeconomics . P. 131 ff.

- ↑ Egon Görgens, Karlheinz Ruckriegel, Franz Seitz: European monetary policy . Pp. 88-92

- ^ Gerhard Mussel: Fundamentals of the monetary system . Pp. 88-89

- ↑ Weekly financial statements. European Central Bank , accessed November 6, 2014 .

- ↑ Individual items in the balance sheet of the European Central Bank: current items as PDF and individual items over time . European Central Bank . Retrieved November 6, 2014.

- ↑ Development of the balance sheet total of the European Central Bank since 1999