International Financial Reporting Standards

The International Financial Reporting Standards ( IFRS ) are international accounting standards for companies issued by the International Accounting Standards Board (IASB). They are intended to regulate the preparation of internationally comparable annual and consolidated financial statements independently of national legislation . The IFRS are prescribed by many countries at least for capital market oriented companies. They consist of standards and official interpretations of these standards. For the IFRS there is a framework ( Framework ).

construction

The IFRS consist of the International Financial Reporting Standards in the narrower sense, the International Accounting Standards (IAS) of the International Accounting Standards Committee (IASC) and the interpretations of the International Financial Reporting Interpretations Committee (IFRIC).

The standards

The IFRS are a collection of rules for the accounting of commercial enterprises . In the German version, IFRS refers to both the individual standards newly created since 2003 (e.g. IFRS 3 - Business Combinations) and the entirety of all standards (IFRS and IAS) and interpretations (SIC and IFRIC). For this set of all applicable regulations, the English version uses the term IFRSs to distinguish it from the individual standard (IFRS or IAS).

The interpretations

In order to ensure a uniform interpretation and application of the individual standards, the SIC and later the IFRS Interpretations Committee (IFRS IC) was founded by the Board in 1997. The task of the IFRIS IC is to develop timely solutions to problems that arise in practice when applying IAS / IFRS.

The framework

The framework is a framework that the IASB has specified itself for the development of IFRS and interpretations, and is not an actual standard. In this respect, it is a content-related objective that is addressed to the developers of accounting issues, in particular the IASB themselves as well as national legislators and standard setters.

The framework approaches terms such as the items in the financial statements (assets and liabilities) and provides basic information on possible valuation concepts for these items, but without specifying any binding requirements. It must be emphasized that the framework itself - except in exceptional cases to close loopholes (IAS 8.11 (b)) - has no meaning for the mapping of business transactions.

As part of a basic project, the IASB is currently working on an update or new version of the framework. Individual chapters have already been adopted for this purpose, others are still in the discussion or draft stage.

language

The IFRS are written in English by the IASB. To facilitate application , some of them are translated into different languages by the International Financial Reporting Standards Foundation (IFRSF, a foundation domiciled in and under the law of the US state of Delaware, which holds the IASB in trust), the owner of the rights to the IFRS , u. a. into German .

The revision of the German version of the IFRS is called for in order to avoid disputes of interpretation and the related procedural consequences. Niehus criticizes the fact that the translation initiated by the IFRSF was linguistically poor, the terminology inconsistent and the strangeness of English legal terms unknown in German not taken into account (as of 2005). Translation errors, incompleteness and terminological errors are criticized. In addition, different versions of the text are published in the Official Journal of the European Union (EU) and in the collection of the IFRSF. German-language materials on the IFRS published by the IFRSF are not official, as there is no officially transformed version in the Official Journal and they can be changed at any time by the IFRSF. The framework of the IASB, which are attached to the EU's comments on individual regulations of the IAS-VO, would also have no legal force.

aims

Financial statements prepared in accordance with IFRS are primarily intended to provide information about the company's assets, financial position and results of operations. The conventional German accounting according to the 3rd book of the HGB aims primarily to protect creditors in annual financial statements and only secondarily to provide information on the company's asset, financial and earnings position. The overriding principles of IFRS accounting are the principle of period delimitation and the going concern principle . Comprehensibility, decision-making relevance, materiality, reliability and comparability are the qualitative requirements that the financial statements must meet.

The IFRS should

- facilitate the comparability of the financial statements of capital market-oriented companies worldwide and thus

- ensure the development of an integrated capital market that functions effectively, smoothly and efficiently,

- improve investor protection

- strengthen confidence in the financial markets and the free movement of capital in the internal market,

- Make trades usable for cross-border transactions or for admission to all stock exchanges in the world.

According to a report by Computer Zeitung on August 29, 2005, the IFRS financial statements prepared in parallel with the HGB financial statements support credit negotiations with the banks due to the increased transparency with regard to some key figures such as liquidity , equity ratio and inventory turnover .

Emergence

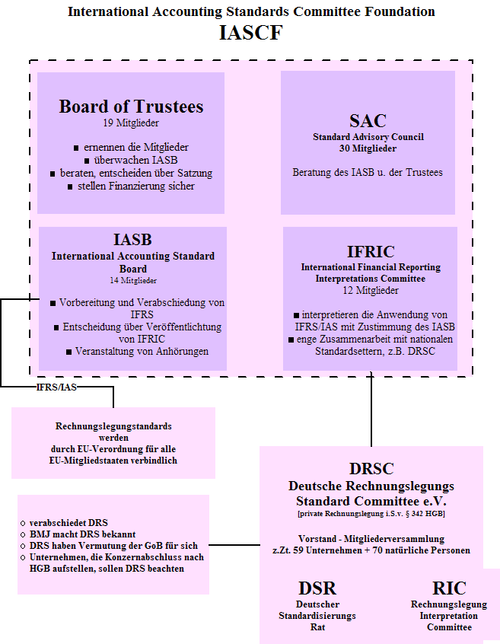

The umbrella organization is the International Financial Reporting Standards Foundation (IFRSF); it was established in March 2001 in Delaware, USA, and has two bodies : the IASB and the Board of Trustees, and two bodies: the IFRS IC and the SAC.

IFRS IC

The IFRS IC (formerly IFRIC) has the task of interpreting the application of IFRS (on behalf of and in coordination with the IASB).

SAC

The SAC (Standard Advisory Council) is available to the IASB and the Board of Trustees as a further advisory body. It consists of at least 30 members.

Commitment

Member States of the EU

The IFRS only become legally binding when they are recognized ("endorsement") by the European Commission . With Regulation No. 1725/2003 of September 29, 2003, the EU Commission adopted all international accounting standards that were available on September 14, 2002, with the exception of IAS 32 and IAS 39, as well as the corresponding interpretations. This EU regulation is binding in its entirety and directly applicable in every member state; The standards thus automatically became applicable national law for the following qualifications:

- According to Regulation (EC) No. 1606/2002 of July 19, 2002 (OJ EG L 243/1 of September 11, 2002), companies have their consolidated financial statements for fiscal years beginning on or after January 1, 2005 according to Establish IFRS if they are subject to the law of a member state and their securities (e.g. shares, but also bonds) are admitted to trading on a regulated market in one of the member states (capital market-oriented companies).

- With the Accounting Law Reform Act, the German legislator has extended the obligation to apply IFRS to companies whose securities are not yet traded, but which are in the approval process (see in particular Section 315e Paragraph 2 HGB and Section 264d HGB).

The original regulation has since been replaced by Regulation No. 1126/2008. The recognition of new or revised IFRS for use in the EU takes place in the so-called committee procedure of the EU ( comitology ). Here, the Commission submits its proposal for the recognition (or rejection) of a new or amended IFRS to an Accounting Regulatory Committee (ARC). This consists of representatives of the Member States and is chaired by the Commission. If the committee approves the Commission's proposal for recognition, the Commission prepares the entry into force of the new or amended IFRS in the EU by means of an EU regulation.

The EU regulations for the recognition of IFRS become legally binding through publication in the Official Journal of the European Union in all official languages of the European Union . According to the EU regulation, the IFRS are therefore binding in the official language of the respective member state, unlike the original English version . This means that the German version of the EU regulations for the adoption of IFRS published in the Official Journal of the European Union is binding for German companies. However, the EU regulations for the adoption of new or amended IFRSs published in the Official Journal of the EU do not contain directly legible full texts of the IFRS, but consist of instructions on changes to the IFRS adopted as an annex to Regulation (EU) No. 1126/2008 and those in the following IFRS adopted by EU regulations (amendments). Consolidated text versions of these EU regulations are therefore required for the practical application of IFRS (e.g. the consolidated text versions given in the literature sources and web links given below).

The EU translates some of the IFRS into the official languages itself. There are repeated complaints about the poor quality of this EU translation.

Voluntary application of IFRS / IAS in Germany

All other companies can voluntarily prepare their consolidated financial statements in accordance with IFRS. In addition, these companies are permitted to publish additional voluntary IFRS individual financial statements in the Federal Gazette in addition to their HGB annual financial statements . According to a survey, most medium-sized companies in Germany are preparing for the new international accounting rules. Almost 60 percent of companies have already dealt with IFRS, according to a survey by the German Chamber of Commerce and Industry and the auditing company PricewaterhouseCoopers . However, 80 percent of the 600 companies surveyed do not want to change their accounting.

Switzerland

In Switzerland , the admission office of the Swiss stock exchange ( SWX ) decided on November 11, 2002 that all domestic listed non-banks in the main segment must comply with IFRS or US GAAP from 2005 onwards. An exception was granted to the Swatch Group , which switched from IFRS to Swiss GAAP FER in the 2014 financial year .

For companies listed in secondary indices, accounting according to the technical recommendations for accounting Swiss GAAP FER, IFRS or US GAAP is required. The Swiss GAAP FER are based closely on the IFRS with less stringent regulations.

Differences to national law

Germany - differences to the HGB

The main difference to the accounting regulations of the German Commercial Code (HGB) is that instead of valuation at acquisition cost, the focus is on valuation at market value and thus information for owners or shareholders. In particular, investors on the capital market should be provided with the information they need for their investment decisions. This purpose is the background of the Anglo-American principle “true and fair view / fair presentation”, which is reflected in Art. 4 Paragraph 3 of Directive 2013/34 / EU in Section 264 Paragraph 2 HGB. According to this, the company's annual financial statements must convey “a true and fair view of the company's assets, financial position and results of operations”. Hidden reserves are largely avoided under IFRS, which also makes it impossible to release them, which would improve earnings. Individual financial statements according to IFRS are - in contrast to consolidated financial statements - not exempting, so an additional commercial balance sheet must be drawn up in Germany. B. in the case of stock corporations, the distribution of profits is limited and serves as the basis for the tax balance sheet - which must be drawn up in accordance with the GoB under commercial law - and thus serves for taxation purposes. In other European countries (e.g. the Netherlands), this double effort is avoided by applying different taxation rules to the IFRS financial statements and reducing the number of options, thereby achieving a relative strategic location advantage.

As a technical difference in the codification of the regulations, the HGB is designed as a code law , which requires a far-reaching abstraction as a goal and mostly an interpretation based on the individual case. The IFRS, on the other hand, are written as principles in order to cover as many and all possible individual cases as possible. This difference is already evident in the scope and abundance of the regulations. While the relevant provisions of the Third Book of the German Commercial Code (HGB) only comprise 50 pages, depending on the time of printing, the IFRS i. d. Usually about 3,000 pages thick. However, numerous individual laws are still required to interpret the HGB, e.g. B. the KWG, ordinances and supreme court decisions. Furthermore, the literature and the interpretations of the IdW are of great importance. As a result, the internationally applicable IFRS with 3,000 pages are much shorter than HGB, which only applies in Germany and is not applicable in other countries due to its complexity. Internationally there is no body apart from the IFRIC , so that a uniform interpretation worldwide is ensured.

Switzerland - differences to accounting according to OR and Swiss GAAP FER

The accounting according to OR contains extensive freedom for the company. While the accounting according to OR focuses more on the protection of creditors (pronounced precautionary principle with the permitted formation of hidden reserves), IFRS addresses the shareholders more (true and fair view, the annual financial statements should therefore provide a picture that is as truthful as possible). Form and scope are only rudimentarily regulated in OR. Associated with this is a high degree of intransparency and extensive freedom in the event of reported profit through the creation and dissolution of hidden reserves .

Development after 2000

On the basis of the Norwalk Agreement adopted in 2002, the rapprochement between the United States Generally Accepted Accounting Principles (US-GAAP) and IFRS is progressing in several convergence projects without the aim of identifying the two sets of rules.

On July 9, 2009, the IASB adopted the IFRS for Small and Medium-sized Enterprises (IFRS for SMEs). The IASB believes that this will be the standard that will apply to 95% of all companies. It consists of 230 pages and, compared to normal IFRS, provides for fewer options, simplified recognition and valuation regulations and fewer disclosure requirements in the appendix for small and medium-sized enterprises (SMEs). In order to further relieve these companies, changes to the standard are only made every three years.

In principle, the individual states decide whether to apply the standard and for which companies it is relevant. No adoption of the standard is planned for Germany. With the Accounting Law Modernization Act (BilMoG for short; long title Law for the Modernization of Accounting Law) that came into force on May 29, 2009 , the legislature created an independent procedure for accounting for SMEs. The standard can be applied on a voluntary basis in addition to the individual financial statements under commercial law.

See also

- List of International Financial Reporting Standards

- German Audit Office for Accounting (DPR)

- German Accounting Standards Committee (DRSC)

- Unwinding (IFRS)

- United States Generally Accepted Accounting Principles

- Disclosure as an instrument of European banking supervision

literature

Consolidated text versions of the EU-recognized IFRS standards and interpretations

- Wiley-VCH: International Financial Reporting Standards (IFRS) 2017 , Wiley-VCH Verlag, 2017, ISBN 978-3-527-50899-0 (German and English text version).

- Wolf-Dieter Hoffmann, Norbert Lüdenbach: IAS / IFRS -Texte 2017/2018 (text edition) , NWB-Verlag, 2017, ISBN 978-3-482-58620-0 (German text version).

Comments and general presentations

- Werner Bohl, Joachim Riese, Jörg Schlüter (eds.): Beck'sches IFRS-Handbuch: Commentary on IFRS. 3. Edition. Verlag CH Beck, Munich 2009, ISBN 978-3-406-58222-6 .

- Norbert Lüdenbach, Wolf-Dieter Hoffmann: IFRS Commentary. 9th edition. Haufe-Lexware, Freiburg im Breisgau 2011, ISBN 978-3-648-00811-9 .

- Matthias Müller: IFRS. Basics for the board of directors and corporate practice. 2nd Edition. Bund Verlag, Frankfurt / M. 2010, ISBN 978-3-7663-3979-9 .

- Wolfgang Ballwieser , u. a. (Ed.): Handbook IFRS 2011 . 7th edition. Wiley-VCH Verlag, Weinheim 2011, ISBN 978-3-527-50587-6 .

- Rainer Buchholz: International accounting: The essential regulations according to IFRS and the new HGB - with tasks and solutions . 9th edition. Erich Schmidt Verlag , Berlin 2011, ISBN 978-3-503-13043-6 .

- Bernhard Pellens, u. a .: International accounting: IFRS 1 to 8, IAS 1 to 41, IFRIC interpretations, draft standards. With examples, exercises and case study . 8th edition. Schäffer-Poeschel Verlag , Stuttgart 2011, ISBN 978-3-7910-2938-2 .

- KPMG Deutsche Treuhand-Gesellschaft (Hrsg.): IFRS visuell The IFRS in structured overviews. 5th edition. Schäffer-Poeschel Verlag, Stuttgart 2012, ISBN 978-3-7910-3141-5 .

- Stephan Kudert , Peter Sorg: IFRS - made easy. Kleist, 2010, ISBN 978-3-87440-279-8

- Joachim Tanski : IFRS | Basics of international accounting , Beck, Munich 2008, ISBN 978-3-406-57806-9 .

Individual subject areas and focused presentations

- Hendrik Vater (Ed.): IFRS for Controllers and Managers. 1st edition Wiley-VCH Verlag, 2011, ISBN 978-3-527-50548-7 .

- Wilfried Funk, Jonas Rossmanith: International Accounting and International Controlling: Challenges? Fields of action? Potential for success. 2nd Edition. Gabler Verlag, Wiesbaden 2011, ISBN 978-3-8349-2346-2 .

- Jan Janssen: Accounting in medium-sized companies. Gabler Verlag, Wiesbaden 2009, ISBN 978-3-8349-1603-7 .

- Franz Klinger, Michael Müller (Ed.): IFRS & Real Estate. 2nd Edition. Lexxion, Berlin 2009.

- Carsten Zielke: IFRS for Insurers: Background and Effects , Gabler, Wiesbaden 2005, ISBN 3-409-12545-0 .

Magazines

- IRZ - Journal for International Accounting

- KoR - Journal for international and capital market oriented accounting

Web links

Consolidated text versions of the EU-recognized IFRS standards and interpretations

- Consolidated text collections of the German-language IFRS to be used in the EU

- Collection of the IAS / IFRS legal texts that have been declared binding by the EU, as of February 2014. (PDF; German)

- Wording of some standards. Homepage of the DRSC (German, English)

- Directives, regulations and other official EU statements on accounting

Overall presentations: websites of companies or individuals

- IFRS portal by Roever Broenner Susat Mazars

- IAS Plus from Deloitte

- Harry Zingel : Script International Financial Reporting Standards . (PDF; 902 kB) Status: 2009

Single topics

- Chronology of IAS (English)

Individual evidence

- ↑ IAS 1.1; for other international accounting regulations cf. International standards for public corporations

- ↑ Recognition of IFRS in various countries

- ↑ IFRS. Retrieved October 5, 2017 .

- ↑ Niehus, Rudolf J., in: The operation 2005, p 2477, November 18, 2005

- ↑ Regulation (EC) No. 1725/2003 (PDF)

- ↑ Regulation of the European Union on the adoption of certain international accounting standards (PDF) of November 3, 2008

- ^ Neue Zürcher Zeitung : The Swatch Group ticks differently from February 7, 2013

- ↑ Michael Dobler , Nina Günther: Status of the de facto convergence of IFRS and US-GAAP - An empirical analysis of the reconciliation calculations according to Form 20-F of companies from the European Union . In: Schmalenbach's journal for business research, 8/2008, pp. 809–845

- ↑ Press release by the IASB on the IFRS for SMEs ( Memento of the original from January 30, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF)