Network effect

The network effect (also network effect or network externality ) belongs to the external effects in neoclassical economics .

It describes how the benefits of a product for a consumer change if the number of other consumers of the same product or complementary products changes. As a result, a consumer's product benefit depends on the total number of users. The consumer is generally not aware of this influence on benefits. The network owner generally perceives this effect and acts to add value to his network . The resulting change in benefit is not or only partially compensated for via the market price .

A network or network is referred to in this context ( information economy ) as a grouping of users of a certain product or compatible technology. The size of a network at a given point in time is called its installed base. Network effect goods or mesh products are called goods or products that are subject to network effects. Network effect markets denote the markets on which the effect is present.

The effect arises when a person's willingness to pay depends on the number of users of this product. This implies that one person's demand is dependent on the demand of other people.

Network effects can occur in positive and negative forms. It is a positive effect if the greater the number of consumers, the greater the benefit for everyone. If benefit reduction occurs, it is a negative network effect. In the literature primarily positive network effects are discussed.

The classic example of a positive network effect is the telephone. The usefulness of a phone to the owner increases with the number of other phone owners. Social networks like Twitter and Facebook are based on the same principle. If a critical mass is reached, the number of users increases exponentially .

Origin and history

Network effects first received more attention from Theodore Vail, the first president of the US telecommunications company Bell Telephone. His goal was to monopolize Bell Telephone in the US with the help of network effects . In 1908, when he first introduced the concept in Bell Telephone's annual report, there were more than 4,000 local and regional switchboards, most of which eventually became part of the Bell system due to the influence of the network effect.

Jeffrey Rohlfs is one of the founders of network theory. He examined positive externalities in the expansion of communication networks and formally analyzed the concept of critical mass (1974).

The economic theory of the network effect was continued between 1985 and 1995 by researchers Michael L. Katz, Carl Shapiro , Joseph Farrell, and Garth Saloner.

In 1993, Metcalfe's Law , named after Robert Metcalfe , was published in order to present network effects for the public.

At the end of 2008, Rod Beckstrom first presented the Beckstrom's law he had developed, which describes a way of determining the actual value of a network: “The value of a network equals the net value added to each user's transactions conducted through that network, summed over all users. "

Direct network effects

The conventional definition of direct (also horizontal) network effects comes from Katz / Shapiro (1986). The benefit that a consumer derives from a good depends on the number of other consumers of the good. The size of the network has a direct impact on the benefits of the network participants. The benefit that a consumer receives from consuming a good is central to the consumer decision. The benefit is determined from the factors basic benefit and network size . The basic benefit corresponds to the personal requirements for a good. This results in:

with for

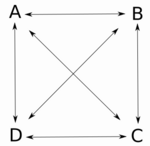

Every new network participant generally increases the overall benefit. Each additional user of the network increases the number of possible connections and thus the number of potentially accessible users. The benefit increases disproportionately as a result of the entry of a new participant, since the additional user brings more benefit than he receives himself.

The new user establishes more connections than his predecessor. There is a connection between the nodes of the network. The sum of possible connections follows from:

With

The term dominates in large networks:

Theoretically, the larger the network size, the higher the network size for the users, the higher, lower, or constant.

The congestion of a cellular network is an example of negative direct network effects in which revenue falls. Due to the overload it is no longer possible to make phone calls or SMS. Ergo, the benefit for the network participant is reduced to almost zero. The function of the cellular network to connect to other network participants is no longer available. In the case of constant network effects, the economies of scale are also constant. With growing direct networks, the advantages of positive network effects can be characterized as economies of scale on the demand side.

Direct network effects are particularly present in communication networks by means of which people communicate directly with one another.

Metcalfe's law

Due to the self-reinforcing effect of network effects, the network size is of particular importance. As a rule, goods with larger networks are more attractive for consumers and thus represent a competitive advantage . This relationship is also known as Metcalfe's Law or Rules of Squares and establishes a connection between benefits and the number of users.

The law states that the utility of a network equals where the number of users is. However, this term is approximated for large networks, so that: "[...] the value of a network goes up as a square of the number of users". Hence:

While the benefit increases proportionally to the square of the number of possible connections, the costs increase proportionally to the number of participants. The Metcalfesche law explains some of the network effects of communication technologies such. B. in the field of the Internet, telephone or fax machine. A single fax machine is useless. With every additional device in the network, the possibility of interaction and thus the benefit of this communication technology increases.

The following example illustrates the situation: If there are two participants in a communication network, and , there are two connections, from to and vice versa. If another user is added, the number of connections increases to six for applies . For another user , 12 connections are already possible and so on.

Indirect network effects

Indirect (also vertical) network effects arise when the benefit is not directly attributable to the product, but to the use of applications or products based on it. This means that the benefit is not necessarily influenced by a direct relationship. A vertical network consists of different complementary goods . The benefit arises from the entire system, not from a single good or individual components of the network. This effect becomes clear using the example of a computer. The operating system, hardware and applications are components that are essential for using the computer. A fully functional network is only created when all components are present. The components influence each other. There are several component suppliers.

Indirect network effects are mostly positive, as they strengthen the benefits of the basic product.

The main causes of indirect network effects are complementary products and services as well as learning effects.

causes

Complementary products and services

Complementary products and services are jointly requested or offered. The basic product has its own benefit, but extensive benefits for the consumer can only be achieved through complementary products or services. A good becomes more useful when the broadest possible selection of complementary products and services is available. Increased demand for the basic product can lead to an increase in the number of complementary products offered, as the increased demand makes the product field more attractive for other suppliers and manufacturers. Increased production reduces costs if marginal costs decrease . If this is the case, the network gains users, which in turn leads to increased benefits for all participants and a lower price (lower cost) for all goods. The network becomes more attractive to potential users. Users and providers or manufacturers can benefit from this situation. Consumers' willingness to pay can increase with increasing benefit for the user, as well as due to the gain in attractiveness on the part of the provider or manufacturer. Increased willingness to pay can justify higher prices for the product.

If the demand for the basic product falls, the demand for complementary products or services could also fall.

Learning effects

Learning effects are also known as information spillovers .

- There are indirect network effects with innovative technologies . Before an innovative technology is launched on the market, it is not clear how it will prevail alongside competing standards and which applications will be preferred by users. There is uncertainty about the effects on the consumer.

Sony developed the Betamax video recorder in the 1970s . Betamax was originally designed for the end user as a private recording medium. At that time it was not yet clear that video recorders could also be used to play cassettes that had already been written on (such as feature films). User behavior made this possibility apparent. Betamax was unable to prevail against the competing VHS system (JVC) . It becomes clear to what extent the user behavior of the consumers can determine the development of possible applications and the properties of the technology. Consumers learn to deal with the innovative technology and there is a chance to discover new uses through its use. This represents a learning effect that the manufacturer can use to optimize his product. In addition, there are new opportunities for complementary goods. - In addition to innovative technologies, there are learning effects due to very strong innovations . Radical innovations are associated with technical uncertainty. If potential users are not yet able to assess the extent of the effectiveness of a new technology, learning effects play a central role. If the learning effect of a consumer generates new information about the product, this leads to a self-reinforcing process. Potential users receive information about the product, especially about the application areas of the new technology, which reduces uncertainty. Ultimately, the decision is made on the technology with the minimized uncertainty.

Theory of two-sided markets

The appearance of indirect network effects on both sides of a market is characteristic of a two-sided market. They relate to the other side of the market, i.e. This means that indirect network effects have an influence on the demand in the other market.

Examples of bilateral markets and platforms are media companies, shopping malls, stock exchanges, auction houses, discos or markets for software and video games. The intermediary has a special function in these two-sided markets . Intermediaries operate platforms and act as intermediaries for transactions between the market sides. In addition to physical products, the subject of the transactions is the establishment of contacts or the provision of information such as B. in media. The media grant the advertising industry access to their audience, which in turn is informed by the advertising industry.

For example, the media company Zeitung tries to set optimal prices (or quantities) on the reader and advertising market in order to maximize the profit from both sources of revenue. A newspaper represents an intermediary. In addition to the criteria of one-sided markets, the conditions for maximization are knowledge of the strength of the two-sided indirect network effects. Knowledge of the costs incurred, willingness to pay and price elasticities are the maximization criteria in a one-sided market. Which prices (or quantities) are set by the intermediary depends in particular on the ratio of the relative network effects. Relative network effects are determined by fixed and variable costs , the prohibitive price and the price elasticity of demand .

The sum of the relative indirect network effects is decisive for the effects of bilateralism . If the overall positive network effect predominates, firstly a higher amount can be implemented than in one-sided markets, and secondly a platform can only exploit the existence of indirect network effects in this case. If negative network effects outweigh the positive, the amount sold is below that in one-sided markets.

Demand-side economies of scale and positive feedback effect

Demand-side economies of scale (including demand-side economies of scale or positive network effects) are the cause (temporary) for monopolies in markets with network effects. They influence the market dynamics and competitive strategies . Demand-side economies of scale result from the positive feedback effect . The positive feedback effect describes that a higher number of users increases the value of a network, which in turn encourages additional users to join the network. It is a self-reinforcing process. Markets with positive feedback effects are often highly concentrated. If an increasing number of users attracts additional users, in extreme cases only one company can dominate the entire market. Positive feedback effects lead to so-called winner-takes-it-all markets : “Positive feedback makes the strong grow stronger and the weak grow weaker.” The development of such a market depends on the consumers. You choose the technology or standard that is consumed by most of the users.

In addition to positive feedback effects, there are also negative feedback effects. The negative feedback effect weakens the dominant market player and strengthens the inferior market player until the market shares equalize at a certain level: "In a negative feedback system, the strong get weaker and the weak get stronger, pushing both toward a happy medium. "

The typical course of positive feedback goes through three phases: launch , takeoff, and saturation. The course is represented by the dissemination concept of an S-curve . In the launch phase, the adoption of a new product or innovative technology is slow. The product or technology is not yet fully developed and there are high costs in the form of uncertainty as to whether the market entry will be successful. If the market reaches critical mass in the takeoff phase, the uncertainty decreases. As the value of the product or technology increases, the positive feedback effect begins to accelerate and the market grows by itself. In the saturation phase, it decreases because a point is reached where almost all potential customers have the same product or the same Use technology and hardly any new users join the network.

The critical mass is decisive for the success of a product or technology. If it is not achieved, the positive feedback effect does not occur and the technology or product does not establish itself in the market.

In the software industry in particular , positive feedback effects arise from demand-side economies of scale. They also explain the market dominance of the software company Microsoft . The Microsoft Windows operating system is valued by the consumer network because it has reached critical mass in the market and is the current industry standard .

Demand-side economies of scale have the property that they are inexhaustible. If everyone uses Microsoft Windows, then potential new customers will also use Microsoft Windows. This is because the network benefit is higher than with another operating system due to the simpler data exchange due to the compatibility with the many other users.

Shapiro / Varian (1999) described the positive relationship between popularity and value of software using cycles. They differentiate between the virtuous cycle and the vicious cycle . In the case of the software provider Microsoft, one speaks of a virtuous cycle. As the number of users increases, so does the value of a product, and once the critical mass has been reached, the number of users increases almost automatically. The opposite of this is the Vicious cycle. If the critical mass is never reached, sooner or later the number of users will decrease. The value of the product for the individual decreases due to the reduced network, other previous users are lost and so on.

Monopoly formation

Markets in which strong positive network effects and feedback effects play a role tend to form monopolies : “When two or more firms compete for a market where there is strong positive feedback, only one may emerge as a winner. It's unlikely that all will survive. ”These markets are known as tippy . A market is tippy if only one of several competitors manages to achieve the critical mass and thereby asserts itself. Markets that are tippy are also winner-takes-it-all markets or loser-gets-nothing markets . These considerations are supported by observations on software markets. In the 1980s and 1990s, for example, there were still alternatives to Microsoft products, such as the word processing program WordPerfect or Lotus 1-2-3 for spreadsheets.

Problem of network effects

Path dependency

The competition in network effect markets has the characteristic of path dependency. This means that it is strongly influenced by previous decisions made by producers and consumers. Even small and possibly random events can have an impact on the success of products and technologies. The path dependency is reinforced by positive feedback effects . They cause developments on (randomly) selected paths to accelerate by themselves. A lock-in can result from them, i.e. a hardening of the chosen path. If necessary, the further development of inefficient structures can be more profitable than abolishing them, since they are already very widespread.

Lock-in effect and switching costs

The lock-in effect describes the state of “being trapped” by consumers in a system in the form of a standard or a technology. The lock-in effect is reinforced by the high costs for the user to switch to another system or network. The lock-in effect is a means used by network providers to retain their customers and continue to earn from them.

Lock-in effects due to high switching costs can arise from search costs that arise when looking for a new product, investment costs that are necessary for using the technology of the new product, learning costs when learning the function and character of the new product is effort means artificial switching costs, for example through binding contracts or bonus programs, as well as psychological switching costs if habits and ties to the old product play a role.

Lock-in effects can be achieved through penetration strategies and follow-the-free strategies . The penetration strategy intends to gain market share as quickly as possible through low prices. This strategy is particularly popular in the software market due to the network effects.

In the case of a follow-the-free strategy, companies first give away their products in order to bind customers to their company. In a second step, revenues are to be generated through the sale of complementary services. An example in practice is the software company Adobe Inc. It initially offers Acrobat Reader , which can be used to display PDF documents, free of charge. The complementary product, the premium version of the software for creating PDF documents, is chargeable.

Penguin effect

The penguin effect describes an information or coordination problem. In the software industry in particular, this effect can be an obstacle to new standards. He describes the problem that an industry-wide standard can only be replaced with difficulty by a new and possibly better standard, although this could increase the benefit of the affected market participants. The reason is the incomplete information about whether a transition to the new standard will actually take place. Potential switchers are unsure whether the lost network benefit from the old standard can be compensated for with the gain from the new standard.

The penguin effect got its name from the following anecdote by Farrell and Saloner (1987): “Hungry penguins stand on the edge of an ice floe. Fearing predatory fish, they hope that other penguins will jump into the water first in order to explore the associated risk of falling victim to a predatory fish. As soon as some penguins have dared to take the plunge, the danger for the other penguins has decreased and the "stepping penguins" follow suit. "

The penguin effect is a major obstacle, especially in the launch phase . Young software companies are struggling with the difficulty of having to provide credible assurance that a new product will establish itself across the board and generate network effects. The aim is to avoid the penguin effect and achieve critical mass.

Shocks and contagion effects

Shocks and contagion effects can pose risks to network effects. Shock occurs suddenly and causes a change in supply or demand in an economy. A contagion effect describes the transmission of a shock or a crisis to seemingly unaffected economies. The European sovereign debt crisis , for example, was influenced by shocks and contagion effects. Greek government bonds held a high level of uncertainty as their credit ratings fell. Foreign banks that had bought Greek government bonds were hit by a shock that resulted in contagion. Other European banks were infected, which ultimately led to a crisis in the European financial network.

Unstable networks are generally more affected by negative shocks than stable ones. In very complex networks, a shock can lead to contagion and thus spread to other participants in a network. Resilience to these risks is determined by the connectivity , concentration and complexity of the networks. A network is more resistant to shocks and contagion effects, the lower the complexity and concentration and the greater the connectivity.

Snowball effect

The example of the European sovereign debt crisis also describes another risk from network effects, the snowball effect . The snowball effect states that a small effect can quickly increase through a chain reaction and spread throughout the network. This effect can have negative effects on all participants in the network.

See also

- External effect

- Information economics

- Lock-in effect

- Metcalfe's law

- Path dependency

- Network economics

- Penguin effect

- Reed's law

- positive feedback effects

- Switching costs

literature

- Helmut Bester : Theory of Industrial Economics , 4th edition (verb. Ed.), Berlin a. a .: Springer Verlag, August 2004, ISBN 978-3-540-22257-6

- P. Buxmann , H. Diefenbach, T. Hess: The software industry: Economic principles, strategies, perspectives , 2nd edition, Berlin a. a .: Springer Verlag, 2008, ISBN 978-3-540-71828-4

- Heidi Cigan: The Internet's Contribution to Progress and Growth in Germany: Economic Effects of the Internet and the Design of Access Prices , in: HWWA-Report 217 Hamburgisches Welt-Wirtschafts-Archiv (HWWA), Hamburg, 2002, ISSN 0179-2253

- Reiner Clement, Dirk Schreiber: Internet Economy: Basics and Case Studies of the Networked Economy , Wiesbaden: Springer Gabler Verlag, July 2013, ISBN 978-3-642-36718-2

- Ralf Dewenter, Justus Haucap : Competition as a task and a problem in media markets: case study from the perspective of the “theory of bilateral markets” , University of the Federal Armed Forces Hamburg: subject group in economics, discussion paper 78, April 2008

- Andreas Gröhn: A model of network effects in the software industry , Cologne: Institute for World Economy, 1997

- Andreas Röver: Network externalities as a cause of market failure , 1st edition, Bern a. a., Peter Lang Verlag, 1997, ISBN 978-3-631-31628-3

- Carl Shapiro and Hal R. Varian : Information Rules: A Strategic Guide of the Network Economy , in: Harvard Business School Press, Boston 1999

Web links

- Network effects: Theoretical basics (PDF), Technical University of Kaiserslautern: 2014, accessed on June 14, 2015

Individual evidence

- ↑ a b Volker Wiedemer: Standardization and coexistence in network effect markets. 1st edition, Lohmar / Cologne: Josef Eul Verlag, August 2007, p. 7, ISBN 978-3-89936-618-1

- ↑ Economic term network effects ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. - on page ig.cs.tu-berlin.de , task 3-Microsoft, accessed on June 14, 2015

- ^ Helmut Dietl, Susanne Royer: Management of virtual network effects in the information economy, in: Journal for Leadership and Organization, Stuttgart, Schäffer-Poeschl Verlag, 2000, p. 324

- ^ Hal R. Varian : Grundzüge der Mikroökonomik, 8th edition, Oldenbourg: Wissenschaftsverlag, February 2011

- ^ Günter Knieps: Netzökonomie: Fundamentals - Strategies - Competition Policy, Wiesbaden: Springer Gabler, 2007, p. 125, ISBN 978-3-8349-9231-4

- ↑ Knut Blind : The economics of standards: theory, evidence, policy. Cheltenham UK / Northampton MA USA: Edward Elgar Publishing, 2004, ISBN 978-1-84376-793-0

- ↑ New Model: Beckstrom's Law ( Memento of the original from March 4, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. - on page unibw.de , The economics of network and cybersecurity, accessed on June 14, 2015

- ^ Katz, Michael and Carl Shapiro : Product Compatibily Choice in a Market with Technological Progress, in: Oxford Economic Papers 38, 1986, p. 146

- ↑ a b c Network Effects: Theoretical Basics (PDF) - Technical University of Kaiserslautern: 2014, p. 2ff, accessed on June 14, 2015

- ^ A b c d e Carl Shapiro, Hal R. Varian: Information Rules: A Strategic Guide to the Network Economy, in: Harvard Business School Press, Boston, 1999, p. 175f, p. 184

- ↑ a b c d Network Effects: Theoretical Basics (PDF), Technical University of Kaiserslautern: 2014, p. 6ff, accessed on June 14, 2015

- ↑ a b Ralf Dewenter, Justus Haucap : Competition as a task and a problem in media markets: case study from the perspective of the “theory of bilateral markets” , University of the Federal Armed Forces Hamburg: subject group in economics, discussion paper 78, April 2008, pp. 3–6

- ^ Heidi Cigan: The Internet's Contribution to Progress and Growth in Germany: Economic Effects of the Internet and the Design of Access Prices, in: HWWA-Report 217, Hamburgisches Welt-Wirtschafts-Archiv (HWWA), Hamburg, 2002, p. 20, ISSN 0179-2253

- ↑ a b c Peter Buxmann , Heiner Diefenbach , Thomas Hess: The software industry: economic principles, strategies, perspectives , 2nd edition, Berlin a. a .: Springer Verlag, 2008, p. 20ff and p. 122, ISBN 978-3-540-71828-4

- ^ Paul A. David : Clio and the Economics of Qwerty , in: The American Economic Review, 75/2, Nashville, TN, USA: American Economic Association, 1985, p. 322, accessed June 16, 2015

- ^ Martin glasses: media management , 3rd edition, Munich: Verlag Franz Vahlen, 2014, p. 151

- ↑ Axel et al. Zerdick: The Internet Economy: Strategies for the Digital Economy , Berlin a. a .: Springer Verlag, 1999, pp. 191–194.

- ↑ Peter Buxmann, Heiner Diefenbach, Thomas Hess: The software industry: Economic principles, strategies, perspectives , 2nd edition, Berlin a. a .: Springer Verlag, 2008, p. 122, ISBN 978-3-540-71828-4

- ↑ Joseph Farrell, Garth Saloner: Competition, Compartibility, and Standards: The Economics of Horses, Penguins and Lemmings , in: Gabel HL (ed) Product Standardization and Competitive Strategy, North Holland, Amsterdam: Gabel HL (ed) Product Standardization and Competitive Strategy, 1987, pp. 1-22

- ↑ a b Udo Broll: National Debt, Interbank Market and Network Effects, in: Wirtschaftsstudium (wisu), Düsseldorf: Lange Verlag, 2013, pp. 556–561