AEX index

| AEX index | |

|---|---|

| base data | |

| Country | Netherlands |

| Stock exchange | Euronext Amsterdam |

| ISIN | NL0000000107 |

| WKN | 969241 |

| symbol | A25 |

| RIC | ^ AEX |

| Bloomberg code | AEX <INDEX> |

| category | Stock index |

| Type | Price index |

| family | Euronext |

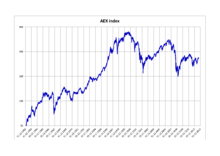

The AEX index (proper spelling: AEX index , the Amsterdam Exchange index) is the share index of the stock exchange in Amsterdam , Netherlands , which at the Euro next Amsterdam is calculated.

calculation

The AEX index is a price index. It includes up to 25 public companies that are traded on Euronext Amsterdam . The index level is determined solely on the basis of share prices and only adjusted for income from subscription rights and special payments. The calculation is updated every second during trading hours from 9:00 a.m. to 5:30 p.m. CET . The determination of the index members is based on criteria that tend to be exceptions on an international scale. What stands out is the condition that at least 10 percent of the outstanding shares must have been traded for a given value in the year - a tribute to the fact that many securities are rather thin in trading despite high market capitalization .

The focus on liquidity and free float instead of the market value is also expressed by the fact that at least a quarter of the shares outstanding must be widely diversified. When determining the free float value relevant for the weighting, a combination is made into classes: For free float between 25 and 50, 50 and 75 and 75 and 100 percent, the upper class limit is used as the weighting factor. Originally, a decision was made on every third Friday in February about which stock corporations should remain in the index and which should be replaced and whether the weighting of the individual stocks had to be adjusted. The changes are now made quarterly.

history

20th century

The leading Dutch index started on March 4, 1983 under the name EOE-index , named after the former European Options Exchange (EOE). It is defined in such a way that on January 3, 1983 the index would have assumed the value of 100 guilders ( 45.38 points converted into euros ). On October 19, 1987, the stock index suffered the largest daily loss in its history at 12.00 percent. The reason was Black Monday on the New York Stock Exchange , when the value of the Dow Jones Industrial Average plummeted 22.6 percent.

As a result, volatility increased . On October 26, 1987 the index posted the second highest daily loss with 9.27 percent and on November 1, 1987 the largest daily gain with 11.83 percent. On January 1, 1994, the EOE index was renamed AEX index . On August 7, 1997, the share index passed the 1,000-point mark for the first time (in euros: 453.78 points).

On January 4, 1999, trading in euros began on the Amsterdam Stock Exchange . The Dutch stock exchange chose a special procedure for converting the AEX to the common European currency. While all other countries in the euro zone adjusted their index calculations so that the index trend maintained its continuity, the rates in the AEX changed according to the rate of 2.20371 guilders for 1 euro set at the time. This corresponds to a division in the ratio of 21:16. This meant that all products based on the leading index also had to be adapted.

On September 4, 2000, the index marked an all-time high with a closing level of 701.56 points (in euros).

21st century

After the speculative bubble burst in the technology sector ( dot-com bubble ), the share index fell to a low of 218.44 points by March 12, 2003. That was a decrease of 68.9 percent since September 2000. March 12, 2003 means the end of the downward slide. From spring 2003 the AEX began to rise again. By July 16, 2007, the share index rose to a closing level of 561.90 points. Since the low in March 2003, the profit is 157.2 percent.

In the course of the international financial crisis , which had its origin in the US real estate crisis in the summer of 2007, the AEX began to decline again. On July 11, 2008 the index closed with 391.98 points below the limit of 400 points and on October 8, 2008 with 285.66 points below the mark of 300 points. Between the end of 1998 and the end of 2008, the AEX index was the worst index in the world after the Icelandic stock exchange (−81.72 percent) with a loss of 45.68 percent.

Due to the fear surrounding the real estate crisis, volatility increased. On October 6, 2008, the index posted the third-largest daily loss in its history with 9.27 percent. On October 13, 2008, the AEX achieved the second-largest daily profit with 10.55 percent and on November 24, 2008, the third-largest daily profit with 10.29 percent. The index hit a new low on March 9, 2009 when it closed trading at 199.25 points. Since July 16, 2007 this corresponds to a decrease of 64.5 percent.

March 9, 2009 marks the turning point of the downward trend. From spring 2009, the AEX was on the way up again. By February 18, 2011, it rose by 87.8 percent to a closing level of 374.19 points. The weakening of the global economy and the worsening of the euro crisis led to a slump in the Dutch benchmark index. On September 22, 2011, the AEX ended trading at 263.44 points. The loss since the high on February 18, 2011 is 29.6 percent.

The announcement of new bond purchase programs by the European Central Bank and the US Federal Reserve , which are basically unlimited, led to a recovery in prices on the stock market. The monetary stimulus played a bigger role in the price formation than the global economic slowdown and the state of the companies. On January 4, 2013, the index closed at 351.73 points, 33.5 percent higher than on September 22, 2011.

Highs

The overview shows the all-time highs of the AEX index.

| Points | date | |

|---|---|---|

| in the course of trading | 703.18 | Tuesday September 5, 2000 |

| on a closing price basis | 701.56 | Monday 4th September 2000 |

Milestones

The table shows the milestones of the AEX index in euros.

| First close over |

Final score in points |

date |

|---|---|---|

| 150 | 150.66 | July 8, 1993 |

| 200 | 202.86 | July 7, 1995 |

| 250 | 250.64 | April 22, 1996 |

| 300 | 300.25 | January 15, 1997 |

| 350 | 350.66 | May 1, 1997 |

| 400 | 407.09 | 3rd July 1997 |

| 450 | 450.56 | July 28, 1997 |

| 500 | 503.14 | March 13, 1998 |

| 550 | 553.53 | May 25, 1998 |

| 600 | 604.11 | November 16, 1999 |

| 650 | 653.65 | December 22, 1999 |

| 700 | 701.56 | September 4, 2000 |

The best days

The table shows the best days of the AEX index since 1983.

| rank | date | Final score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | Nov 11, 1987 | 77.32 | 8.18 | 11.83 |

| 2 | Oct 13, 2008 | 285.27 | 27.22 | 10.55 |

| 3 | Nov 24, 2008 | 245.86 | 22.93 | 10.29 |

| 4th | 13 Mar 2003 | 240.25 | 21.81 | 9.98 |

| 5 | Oct 21, 1987 | 101.38 | 8.55 | 9.21 |

| 6th | Oct 29, 2008 | 259.58 | 21.62 | 9.09 |

| 7th | Nov 12, 1987 | 84.05 | 6.73 | 8.71 |

| 8th | 19 Sep 2008 | 381.83 | 30.17 | 8.58 |

| 9 | Dec 8, 2008 | 248.12 | 18.68 | 8.14 |

| 10 | Oct 15, 2002 | 340.59 | 24.46 | 7.74 |

| 11 | July 29, 2002 | 361.87 | 25.80 | 7.68 |

| 12 | May 10, 2010 | 335.24 | 22.89 | 7.33 |

| 13 | 14 Mar 2003 | 257.33 | 17.08 | 7.11 |

| 14th | Jan. 5, 1988 | 82.08 | 5.28 | 6.87 |

| 15th | Oct 20, 2008 | 269.41 | 17.15 | 6.80 |

| 16 | Nov 4, 2008 | 291.13 | 18.12 | 6.64 |

| 17th | 26 Sep 2002 | 319.78 | 19.83 | 6.61 |

| 18th | Jan. 24, 2008 | 444.23 | 27.10 | 6.50 |

| 19th | Oct 6, 1998 | 398.50 | 22.18 | 5.89 |

| 20th | Jan. 26, 2009 | 247.88 | 13.74 | 5.87 |

| 21st | Sep 24 2001 | 419.04 | 22.81 | 5.76 |

| 22nd | Oct 12, 1998 | 408.25 | 22.03 | 5.70 |

| 23 | Apr 7, 2003 | 285.89 | 15.36 | 5.68 |

| 24 | 10 Mar 2009 | 210.44 | 11.19 | 5.62 |

| 25th | July 25, 2002 | 336.13 | 17.67 | 5.55 |

| 26th | Oct. 30, 1987 | 87.91 | 4.66 | 5.60 |

| 27 | Oct 11, 2002 | 317.75 | 16.27 | 5.40 |

| 28 | May 1, 1998 | 539.01 | 27.32 | 5.34 |

| 29 | Jan 15, 1988 | 80.96 | 4.01 | 5.21 |

| 30th | Apr 2, 2009 | 232.05 | 11.35 | 5.14 |

The worst days

The table shows the worst days on the AEX index since 1983.

| rank | date | Final score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | Oct 19, 1987 | 98.67 | −13.46 | −12.00 |

| 2 | Oct 26, 1987 | 85.51 | −8.74 | −9.28 |

| 3 | Oct 6, 2008 | 312.56 | −31.46 | −9.15 |

| 4th | 29 Sep 2008 | 323.55 | −31.03 | −8.75 |

| 5 | Oct 10, 2008 | 258.05 | −23.92 | −8.48 |

| 6th | Oct 8, 2008 | 285.66 | −23.78 | −7.69 |

| 7th | Oct 15, 2008 | 263.00 | −21.51 | −7.56 |

| 8th | Sep 14 2001 | 426.50 | −33.36 | −7.25 |

| 9 | Oct 22, 1987 | 94.04 | −7.34 | −7.24 |

| 10 | Nov 9, 1987 | 72.33 | −5.55 | −7.13 |

| 11 | July 22, 2002 | 342.83 | −25.48 | −6.92 |

| 12 | Nov 30, 1987 | 72.27 | −5.31 | −6.84 |

| 13 | Dec 1, 2008 | 235.50 | −17.05 | −6.75 |

| 14th | Nov 6, 2008 | 260.61 | −18.83 | −6.74 |

| 15th | 24 Mar 2003 | 260.34 | −17.75 | −6.38 |

| 16 | Sep 12 2001 | 452.92 | −30.61 | −6.33 |

| 17th | Sep 30 2002 | 296.36 | −19.38 | −6.14 |

| 18th | Jan. 21, 2008 | 422.45 | −27.63 | −6.14 |

| 19th | Jan. 12, 1987 | 107.53 | −6.80 | −5.95 |

| 20th | Oct 28, 1987 | 83.04 | −5.25 | −5.95 |

| 21st | Aug 1, 2002 | 342.04 | −21.55 | −5.93 |

| 22nd | Oct 20, 1987 | 92.83 | −5.84 | −5.91 |

| 23 | July 15, 2002 | 368.01 | −23.00 | −5.88 |

| 24 | Oct 16, 2008 | 248.04 | −14.96 | −5.69 |

| 25th | Dec. 28, 1987 | 76.89 | −4.42 | −5.44 |

| 26th | Jan. 13, 1999 | 507.29 | −28.95 | −5.40 |

| 27 | Feb. 24, 2003 | 267.67 | −15.23 | −5.38 |

| 28 | Oct 22, 2008 | 255.08 | −14.28 | −5.30 |

| 29 | Oct 2, 1998 | 385.08 | −21.50 | −5.29 |

| 30th | 5th Mar 2009 | 200.58 | −11.00 | −5.20 |

Annual development

The table shows the annual development of the AEX index since 1982.

| year | Final score in points |

Change in points |

Change in% |

|---|---|---|---|

| 1982 | 45.38 | ||

| 1983 | 73.21 | 27.83 | 61.33 |

| 1984 | 85.75 | 12.54 | 17.13 |

| 1985 | 121.50 | 35.75 | 41.69 |

| 1986 | 114.69 | −6.81 | −5.60 |

| 1987 | 77.87 | −36.82 | −32.10 |

| 1988 | 117.68 | 39.81 | 51.12 |

| 1989 | 136.59 | 18.91 | 16.07 |

| 1990 | 104.01 | −32.58 | −23.85 |

| 1991 | 125.72 | 21.71 | 20.87 |

| 1992 | 129.71 | 3.99 | 3.17 |

| 1993 | 187.99 | 58.28 | 44.93 |

| 1994 | 188.08 | 0.09 | 0.05 |

| 1995 | 220.24 | 32.16 | 17.10 |

| 1996 | 294.16 | 73.92 | 33.56 |

| 1997 | 414.61 | 120.45 | 40.95 |

| 1998 | 538.46 | 123.85 | 29.87 |

| 1999 | 671.41 | 132.96 | 24.69 |

| 2000 | 637.60 | −33.81 | −5.04 |

| 2001 | 506.78 | −130.82 | −20.52 |

| 2002 | 322.73 | −184.05 | −36.32 |

| 2003 | 337.65 | 14.92 | 4.62 |

| 2004 | 348.08 | 10.43 | 3.09 |

| 2005 | 436.78 | 88.70 | 25.48 |

| 2006 | 495.34 | 58.56 | 13.41 |

| 2007 | 515.77 | 20.43 | 4.12 |

| 2008 | 245.94 | −269.83 | −52.32 |

| 2009 | 335.33 | 89.39 | 36.35 |

| 2010 | 354.57 | 19.24 | 5.74 |

| 2011 | 312.47 | −42.10 | −11.87 |

| 2012 | 342.71 | 30.24 | 9.68 |

| 2013 | 401.79 | 59.08 | 17.24 |

| 2014 | 424.47 | 22.68 | 5.64 |

| 2015 | 441.82 | 17.35 | 4.09 |

| 2016 | 483.17 | 41.35 | 9.36 |

| 2017 | 544.58 | 61.41 | 12.71 |

| 2018 | 487.88 | −56.70 | −10.41 |

composition

The AEX index is made up of the following companies (as of June 1, 2020).

| Companies | Branch | Index weighting in% | logo |

|---|---|---|---|

| ABN AMRO | Banks | 0.49 | |

| Adyen | Financial service providers | 5.03 | |

| Aegon | Insurance | 0.74 | |

| Ahold Delhaize | retail trade | 4.37 | |

| AkzoNobel | chemistry | 2.64 | |

| ArcelorMittal | steel | 1.04 | |

| ASM International | mechanical engineering | 0.90 | |

| ASML | mechanical engineering | 17.87 | |

| ASR Nederland | Insurance | 0.59 | |

| DSM | chemistry | 3.68 | |

| Galapagos | Pharma | 1.37 | |

| Heineken | brewery | 3.39 | |

| IMCD | Chemical trade | 0.79 | |

| ING Group | Banks | 4.12 | |

| Just Eat Takeaway | Food delivery services | 2.17 | |

| KPN | telecommunications | 1.37 | |

| NN Group | Insurance | 1.46 | |

| Philips | electronics | 6.43 | |

| Prosus | Holdings | 5.29 | |

| Randstad Holding | Services (temporary work) | 0.75 | |

| RELX | Publishers | 7.73 | |

| Royal Dutch Shell (A) | oil and gas | 11.98 | |

| Unibail-Rodamco-Westfield | property | 1.23 | |

| Unilever | Consumer goods | 11.22 | |

| Wolters Kluwer | Publishers | 3.31 |

See also

Web links

- AEX index factsheet , Euronext

Individual evidence

- ↑ http://indices.nyx.com/sites/indices.nyx.com/files/aex_family_rules_version_13-01_jan_2013-2.pdf ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice.

- ↑ Amsterdamtrader: In the long run, we're all dead , January 7, 2009

- ↑ a b c d e f Stooq: Historical courses

- ↑ 1Stock1: AEX Index (The Netherlands) Yearly Returns

- ↑ Euronext: AEX INDEX