Dow Jones Industrial Average

| Dow Jones Industrial Average | |

|---|---|

|

|

|

| base data | |

| Country | United States |

| Stock exchange | New York Stock Exchange , NASDAQ |

| ISIN | US2605661048 |

| WKN | 969420 |

| symbol | DJIA |

| RIC | ^ DJI |

| Bloomberg code | INDU <INDEX> |

| category | Stock index |

| Type | Price index |

| Parent company | Dow Jones & Company |

The Dow Jones Industrial Average ( DJIA ) - also called the Dow Jones Index for short in Europe - is one of several stock indices created by the founders of the Wall Street Journal and the Dow Jones , Charles Dow (1851-1902) and Edward Jones (1856–1920), created in 1884.

Charles Dow compiled the index to measure the performance of the US stock market . After the Dow Jones Transportation Average, the Dow Jones Index on the New York Stock Exchange (NYSE) is the oldest existing stock index in the USA and is now made up of 30 of the largest US companies .

There is also what is known as the Dow Jones Industrial Average Total Return Index (DJITR). This is a performance index .

Versions

The Dow Jones Industrial Average (DJIA) is calculated in different versions, with the price index being almost exclusively taken into account in the media. The classic Dow Jones index therefore does not contain any dividend payments or subscription rights proceeds .

However, there is also the so-called Dow Jones Industrial Average Total Return Index (DJITR). In addition to the prices, the dividend payments are also included in the calculation of the index. It is therefore referred to as a performance index, i.e. a share index that, in addition to the increase in the value of the shares, also tracks the increase in capital through dividends (dividends are reinvested). The DJITR started on September 30, 1987 with a base value of 2,639.20 points.

Another index is the Dow Jones Industrial Average Net Total Return Index . This shows the rate plus the net cash dividend. The net cash dividend corresponds to the dividend less 30 percent withholding tax .

calculation

The Dow Jones Industrial Average is a price index and comprises 30 US companies on the New York Stock Exchange (NYSE). It is a purely price-weighted index, the level of which is determined exclusively from the share prices. It is calculated without dividends , subscription rights and special payments; market capitalization or the number of shares in free float are not taken into account. Stocks with a high price have a greater effect on the index than stocks with a low price.

The Dow Jones Index is calculated using the following formula:

p - rates of the individual values

d - Dow divisor

Inclusion of companies in the index and exclusions from the index are not strictly regulated and are at the discretion of the Wall Street Journal editors . The calculation is updated every second during NYSE trading hours from 9:30 am to 4:00 pm local time (3:30 pm to 10:00 pm CET).

In 1896, when the index was launched, it represented the arithmetic mean of the prices of the 12 stocks it contained at that time, which was calculated by adding up the individual stock prices and then dividing by 12. The principle is still the same today, only the divisor is clearly different. Since measures on the index structure, such as replacement of Index participants and corporate actions such as stock splits , -zusammenlegungen alone must not lead to a change in the index is the Dow divisor adjusted in turn so that the index directly by the measures do not Undergoes change. The current divisor is published in the Wall Street Journal.

The formula for calculating a new divisor based on measures taken in index or share structures is:

d new - Divisor that applies after the measures have been implemented

d old - Divisor before the measures

C old - Closing prices of the components for the trading day before the measures are implemented

C new - Closing prices of the components for the same trading day, but with the measures implemented

From October 1, 1928, the sum of the share prices of the 30 participating companies was initially divided by the value 16.67. In 1986 the divisor fell below 1 for the first time. Since June 26, 2018, its value has been 0.14748071991788. This adjustment was made when the General Electric stock was replaced by the Walgreens Boots Alliance stock in the index. A price movement of the 30 stocks by a total of 1 US dollar corresponds to an index movement of 6.7805 points (1 ÷ 0.14748071991788). The previous divisor adjustment, dated September 1, 2017, became necessary when DuPont, a company already included in the index, merged with Dow Chemical to form DuPont de Nemours , whose closing price was calculated using the fixed share exchange ratio of 1.282 new shares for one old DuPont share .

Expressiveness

The actual informative value of the Dow Jones Index - despite its popularity - is often criticized. The opening prices of the underlying stocks ( constituents ) of a day are not all available for the first index value as their trading starts at different times. Therefore, the closing price of the previous day must be used for the index opening value, which makes meaningful jumps difficult. In addition, the index is price-weighted, which leads to an overemphasis on stocks with a numerically high value.

Finally, it is a price index in which the dividends paid, which are cut off from the prices (dividend discount), are not included, as is the case with performance indices (for example the DAX ). As a result, the Dow Jones is not suitable for a long-term assessment of performance, but unlike the DAX it is suitable for a long-term view of the price development of the stocks included. Despite this criticism, the Dow Jones index is the most important stock index. Regardless of the calculation, it influences stock exchanges around the world.

Another difference to the DAX is that the composition of the Dow Jones is not based primarily on quantitative criteria such as the market value . For example, the most valuable company in the USA, Apple, with a value of 416 billion US dollars in the first quarter of 2013, has only been listed in the index since March 2015. Many, mostly young companies in the information technology sector such as Google Inc. with a market capitalization of 212 billion US dollars are still missing. In contrast, some companies whose market value is well below the 30 largest in the United States are in the Dow Jones. Rather, the composition is also based on history, so that mostly relatively old, traditional companies that have been able to assert themselves in the market for decades are part of the index. Since their prices are subject to lower fluctuations, the volatility of the Dow Jones is also significantly below that of other indices such as the DAX or the EuroStoxx 50.

history

19th century

In order to obtain a benchmark for assessing share price fluctuations, Charles Dow developed the US share index "Dow Jones Railroad Average", the predecessor of today's Dow Jones index. It was first published on July 3, 1884 in the “Customers' Afternoon Letter” and initially consisted of eleven values, including nine railway companies, a steamship company and a money transfer company.

| Surname | Branch |

|---|---|

| Chicago, Milwaukee and St. Paul Railway | Railway company |

| Chicago and North Western Railway | Railway company |

| Delaware, Lackawanna and Western Railroad | Railway company |

| Lake Shore and Michigan Southern Railway | Railway company |

| Louisville and Nashville Railroad | Railway company |

| Missouri Pacific Railway | Railway company |

| New York Central Railroad | Railway company |

| Northern Pacific Railroad | Railway company |

| Pacific Mail Steamship Company | Steamship company |

| Union Pacific Railway | Railway company |

| Western Union | Money transfer company |

Railway companies were among the largest companies in the United States at the time. Industrial companies were seen as more speculative. On February 16, 1885, Charles Dow expanded the index to 14 companies. Eleven months later, on January 2, 1886, it was reduced to twelve values. On April 9, 1894, the composition of the Dow Jones Average was changed again. The number of companies remained at twelve.

At the end of the 19th century, the US economy prospered and large industrial companies emerged through numerous takeovers. The need for information about these societies grew steadily. Therefore, Charles Dow created the Dow Jones Industrial Average , also known as the Dow Jones Index, for this area . It was first published in the Wall Street Journal on May 26, 1896, and consisted of twelve stocks. Of these twelve stocks, only General Electric was last in the index until June 25, 2018 .

| Surname | annotation |

|---|---|

| American Cotton Oil Company | Predecessor of Bestfoods , today part of Unilever |

| American Sugar Company | today Amstar Holdings |

| American Tobacco Company | existed until 1911 |

| Chicago Gas Company | later Peoples Energy Corporation |

| Distilling & Cattle Feeding Company | now Millennium Chemicals |

| General Electric | until June 25, 2018 in the index |

| Laclede Gas Light Company | is now called The Laclede Group |

| National Lead Company | is now called NL Industries |

| North American Company | existed until 1946 |

| Tennessee Coal, Iron and Railroad Company | was bought by US Steel in 1907 |

| US Leather Company | Disbanded in 1952 |

| US Rubber Company | was bought by Michelin in 1990 |

Charles Dow added up the prices of the twelve stocks and then divided the total by twelve, thus forming the arithmetic mean . The initial listing on the Dow Jones Index was 40.94 points. The index marked its all-time low only two and a half months later when it fell to 28.48 points on August 8, 1896. In the fall of 1896, the original Dow Jones Average was adjusted to the industrial companies and renamed the "Dow Jones Railroad Average" (DJRA, since 1970 Dow Jones Transportation Average ). The DJRA started on September 8, 1896 at 48.55 points. The Dow Jones Index was later calculated back on the basis of the Dow Jones Average up to 1885 (daily prices) and on the basis of various stock indices up to 1789 (monthly prices).

20th century

In 1907 Wall Street experienced a serious banking crisis. On March 14, 1907, the Dow Jones index lost 8.29 percent when the shares of the Union Pacific Railroad , largely used as collateral for funding bills, fell 50 points. On October 21, 1907, the National Bank of Commerce refused to redeem bills of exchange from the Knickerbocker Trust Company , then the third largest bank in New York. A day later, a mass rush on the Knickerbocker Trust Company sparked a general panic on Wall Street. The banks demanded their loans back, the share prices on the stock exchange collapsed. At the end of 1907, the Dow Jones Index was 37.73 percent lower than at the beginning of the year.

Because of the First World War , the stock exchange was closed for four and a half months in 1914. When the New York Stock Exchange reopened on December 12, 1914, the Dow Jones index closed at 74.56 points, 4.4 percent above the closing level of 71.42 points on July 30 of that year. In some publications, December 12, 1914 is rated by 24.39 percent as the day with the largest percentage decline in history. In reality it was a change in the composition of the index, not an actual decrease. On October 4, 1916, the Wall Street Journal published a Dow Jones index with 20 stocks for the first time. This was calculated back to a closing level of 54.62 points by December 12, 1914 and on that day was 26.7 percent below the closing level for the index with twelve stock values.

On October 1, 1928, the number of stock values was increased to 30, and the calculation was from then on using a certain divisor, which also takes stock splits into account. The index level was in line with the previous index, which consisted of 20 stocks. An adjustment was therefore not necessary.

The most momentous stock market crash experienced the world on October 24, 1929. This day is known as "Black Thursday" ( " Black Thursday ") known. In Europe, the day is known as " Black Friday " because of the time difference, as it was already after midnight here. This stock market crash is considered to be the trigger for the global economic crisis . The actual fall in prices dragged on for days, and the subsequent bear market did not reach its lowest point until July 8, 1932. On that day, the Dow Jones Index was at 41.22 points, 89.19 percent below its high on September 3, 1929 at 381.17 points. It wasn't until 25 years later, on November 23, 1954, that the index closed again at 382.74 points, above the 1929 record.

The largest increase in one day, the index achieved on March 15, 1933 with 15.34 percent. It was the first trading day on the New York Stock Exchange since 3 March 1933. Reason for stop trading were several bank holidays (National Banking Holidays), because of the inauguration of Franklin D. Roosevelt as the 32nd US president has been adopted.

On February 9, 1966, the Dow Jones index exceeded the 1,000-point mark for the first time with 1,001.11 points, but ended the trading day at 995.15 points. On November 14, 1972 it closed with 1,003.16 points for the first time above this limit. By January 11, 1973, the Dow Jones rose to a closing level of 1,051.70 points. During the 1973 oil crisis and the 1974 global recession , the index fell by 45.1 percent to 577.60 points by December 6, 1974.

The biggest fall in one day so far was Black Monday on October 19, 1987, when the value of the Dow Jones Index temporarily fell by 25.3 percent or 569.18 points during trading. At the end of the day, the index recovered somewhat. It ended the trade with a minus of 22.6 percent at 1,738.74 points. The stock market crash quickly spread to all major international trading venues. By the end of October, stock exchange prices in Hong Kong had fallen by 44.1 percent, in Australia by 42.4 percent, in Great Britain by 26.0 percent, in Germany by 21.8 percent and in Japan by 12.5 percent. 15 months after “Black Monday”, on January 24, 1989, the Dow Jones closed again at 2,256.43 points, above its level before the stock market crash.

On October 19, 1988, the United States Securities and Exchange Commission (SEC) passed the regulation on the suspension of trading in the event of exceptional volatility, "Rule 80B" (Trading Halts due to extraordinary Market Volatility). An amended version came into force on April 15, 1998.

The index rose rapidly in the 1990s. On November 21, 1995, it exceeded 5,000 points and on March 29, 1999, the value of 10,000 points. On January 14, 2000, the Dow Jones marked 11,722.98 points, an all-time high for more than half a decade.

21st century

Due to the terrorist attacks in New York , the New York Stock Exchange was closed for four trading days between September 11 and 14, 2001, as the entire financial district was evacuated. As a result of the attacks, almost all companies, dealers and banks in Manhattan lost employees or business friends. After reopening on Monday, September 17, 2001, the Dow Jones index plunged 7.13 percent.

After the speculative bubble burst in the technology sector ( dot-com bubble ), the share index fell to a low of 7,286.27 points by October 9, 2002. That was a decrease of 37.9 percent from the high on January 14, 2000. The downward slide ended on October 9, 2002. From autumn 2002 the Dow Jones began to rise again. On December 11, 2003, he again achieved a value of over 10,000 points (10,008.16). On July 19, 2007, the Dow Jones Index closed at 14,000.41 points for the first time in history above the 14,000 point mark. The share index set a new record on October 9, 2007 with 14,164.53 points.

In the course of the international financial crisis , which had its origin in the US real estate crisis in the summer of 2007, the Dow Jones began to decline again. From autumn 2008 the crisis had an increasing impact on the real economy. As a result, share prices collapsed worldwide. On October 6, 2008, the Dow Jones closed at 9,955.50 points for the first time since October 26, 2004, below the 10,000 point mark. In the course of the crisis, the volatility of the index increased. On October 13, 2008, with a plus of 11.08 percent, it achieved the largest daily percentage gain since September 21, 1932. Two days later, on October 15, 2008, the index marked the largest daily percentage loss with a minus of 7.87 percent since October 26, 1987. The Dow Jones fell to its lowest level since April 14, 1997 on March 9, 2009 when it closed trading at 6,547.05 points. Since the all-time high of October 9, 2007, this corresponds to a decline of 53.8 percent. The trading volume of all companies listed in the Dow Jones Index reached an all-time high in March 2009 with 10.56 billion shares.

March 9, 2009 marks the turning point of the downward slide. From spring 2009 the DJIA was on the way up again. On October 14, 2009, it ended trading with 10,015.86 points for the first time since October 3, 2008, again above the 10,000 point mark.

On May 6, 2010, panic selling during trading led to the most massive downturn in the Dow Jones' index in its history, measured in terms of points. At 2:30 p.m. local time (8:30 p.m. CEST), the index fell within 15 minutes to 9,869.62 points, a loss of 998.50 points or 9.19 percent. Prices recovered within minutes. The Dow Jones closed at 10,520.32 points, down 3.20 percent. On September 30, 2010, the Commodity Futures Trading Commission and the United States Securities and Exchange Commission came to the conclusion in a joint report that the so-called Flash Crash had led to a liquidity crisis when a single trader in the context of hedging transactions E 75,000 -Sold mini-contracts worth $ 4.1 billion computer-controlled only depending on the current trading volume.

On April 29, 2011, the DJIA rose to a closing level of 12,810.54 points. As of March 9, 2009, the profit has been 95.7 percent. The weakening of the global economy and the worsening of the euro crisis led to a slump in the US benchmark index. On October 3, 2011, the Dow Jones ended trading at 10,655.30 points. The loss since the peak on April 29, 2011 is 16.8 percent.

The announcement of new bond purchase programs by the European Central Bank and the US Federal Reserve , which are basically unlimited, led to a recovery in prices on the stock market. The monetary stimulus played a bigger role in the price formation than the global economic slowdown and the state of the companies. On September 14, 2012, the index closed at 13,593.37 points, 27.6 percent higher than on October 3, 2011. The trading volume of all companies listed in the Dow Jones index fell to 2.27 billion shares in August 2012 and the lowest level since March 1997. The decline in trading volume since its all-time high in March 2009 was 78.5 percent. The prices continued to rise in the course of the following years, interrupted only by minor setbacks. On February 12, 2020, the Dow Jones reached its all-time high of 29,551.42 points on a closing price basis.

After several days of sideways movement from there, triggered by the COVID-19 pandemic and the fear of its economic consequences, there was one of the strongest slumps in the history of the index Percent led.

Suspension of trading

In the event of exceptional volatility in the Dow Jones index, the United States Securities and Exchange Commission (SEC) decided to close the New York Stock Exchange (NYSE) for half an hour and after the index fell by over 350 points from more than 550 points to close for one hour. The regulation for the suspension of trading "Rule 80B" (Trading Halts due to extraordinary Market Volatility) came into force on October 19, 1988.

On October 27, 1997, trading on the stock exchange was interrupted for the first time in history after prices fell by 554.26 points. On April 15, 1998, a modified version of "Rule 80B" came into force.

According to this rule, trading was suspended for one hour if the Dow Jones Index fell by more than ten percent compared to the previous day's closing price by 2:00 p.m. local time (8:00 p.m. CET). If the index fell by ten percent between 2:00 p.m. and 2:30 p.m., the exchange closed for half an hour. If the courses fell by ten percent after 2:30 p.m., there was no interruption. Trading was also suspended for two hours if losses were more than 20 percent by 1:00 p.m. If the Dow Jones Index fell by 20 percent between 1:00 p.m. and 2:00 p.m., trading was suspended for an hour. If prices fell 20 percent after 2:00 p.m., the stock market would close for the rest of the day.

If losses fell more than 30 percent, the exchange would be closed completely for that day, regardless of what time the losses were reached. The procedure on NASDAQ was coordinated with "Rule 80B" on NYSE Euronext .

Since 2011, the broader, more modern S&P 500 has been consulted for the suspension of trading and the Dow Jones no longer has any influence on the closings of the exchanges.

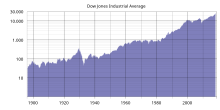

performance

The Dow Jones Index was calculated back to 1885 (daily rates) and to 1789 (monthly rates). The time series was created by chaining various stock indices with the Dow Jones.

- Independent financial market analysis before July 1831

- Cleveland Trust Company Index from July 1831 to February 1854

- Clement-Burgess Index from March 1854 to July 1871

- Cowles Index of Industrial Stocks from August 1871 to July 1897 and

- Dow Jones Industrial Average as of August 1897

The Dow Jones index performed differently in the 19th and 20th centuries. Between January 1, 1801 and December 31, 1900, the index grew by 820.1 percent (average annual return: 2.2 percent) and between January 1, 1901 and December 31, 2000 by 20,726 percent (average annual return: 5 , 5 percent). The performance in the first half of the 20th century, at 3.1 percent per year, was hardly higher than in the entire 19th century. The reasons are the effects of the Great Depression and the Second World War , which led to a twenty-year bear market (1929–1949). In the second half of the 20th century, the average annual return of 8.0 percent was well above the performance from 1801 to 1950.

The stagnation of the Dow Jones in the 1970s and the rapid development in the 1980s and 1990s can be recognized by its doubling rate. It took more than 14 years for the index to double from 1,000 points in 1972 to 2,000 points in 1987. The doubling from 2,000 to 4,000 points in 1995 took eight years. It took the Dow Jones two and a half years to double from 4,000 to 8,000 points in 1997.

At the beginning of the 21st century, the stock index slowed down again. Between January 1, 2001 and December 31, 2012, it gained 21.5 percent in value (average annual return: 1.6 percent). Overall, based on the back calculation from December 31, 1789 to December 31, 2012, the Dow Jones Industrial Average rose by 474,688 percent (average annual return: 3.9 percent).

The classic Dow Jones Industrial Average is a price index in which the dividends paid, which are discounted from the prices (dividend discount), are not included, as is the case with the DAX performance index . As a result, the DJIA is not suitable for a long-term assessment of performance, but unlike the DAX it is suitable for a long-term view of the price development of the stocks included. A comparison of the performance with the German DAX share index is therefore only possible using the performance of the Dow Jones Industrial Average Total Return Index (DJITR). Both indices started in 1987. The annual performance of the US index has since been better than that of the DAX.

The DJITR rose by 1,177.5 percent between December 31, 1987 (1,956.03 points) and December 31, 2012 (24,987.40 points). The average annual return is 10.7 percent. In the same period, the DAX rose from 1,000.00 points to 7,612.39 points (661.2 percent). The average annual return is 8.5 percent.

statistics

Highs

The overview shows the all-time highs of the Dow Jones as a price index (without dividends) and as a performance index (with dividends).

| index | Points | date |

|---|---|---|

| Price index in the course of trading | 27,398.68 | 16th July 2019 |

| Price index on a closing price basis | 27,359.16 | 15th July 2019 |

| Performance index in the course of trading | 38,927.88 | 15th August 2016 |

| Performance index based on closing price | 38,860.55 | 15th August 2016 |

Milestones

On January 12, 1906, the Dow Jones rose to a closing level of 100.25 points for the first time above the 100 point mark. On the basis of the index calculated back to 1885, the limit of 100 points was exceeded for the first time on September 22, 1916 with a final score of 100.77 points. Further milestones in the development of the Dow Jones were overcoming the 1,000-point mark in 1972 and the 10,000-point mark in 1999. In November 2020, the Dow rose above 30,000 points for the first time.

The table shows the milestones of the Dow Jones Index calculated back to 1885.

| First close over |

Closing score in points |

date |

|---|---|---|

| 50 | 50.47 | March 13, 1899 |

| 100 | 100.77 | September 22, 1916 |

| 500 | 500.24 | March 12, 1956 |

| 1,000 | 1,003.16 | November 14, 1972 |

| 1,500 | 1,511.70 | December 11, 1985 |

| 2,000 | 2,002.25 | January 8, 1987 |

| 2,500 | 2,510.04 | 17th July 1987 |

| 3,000 | 3,004.46 | April 17, 1991 |

| 3,500 | 3,500.03 | May 19, 1993 |

| 4,000 | 4,003.33 | February 23, 1995 |

| 4,500 | 4,510.69 | June 16, 1995 |

| 5,000 | 5,022.55 | November 21, 1995 |

| 6,000 | 6,010.00 | October 14, 1996 |

| 7,000 | 7,022.44 | February 13, 1997 |

| 8,000 | 8,038.88 | July 16, 1997 |

| 9,000 | 9,033.23 | April 6, 1998 |

| 10,000 | 10,006.79 | March 29, 1999 |

| 11,000 | 11,014.69 | May 3, 1999 |

| 12,000 | 12,011.73 | October 19, 2006 |

| 13,000 | 13,089.89 | April 25, 2007 |

| 14,000 | 14,000.41 | July 19, 2007 |

| First close over |

Closing score in points |

date |

|---|---|---|

| 15,000 | 15,056.20 | May 7, 2013 |

| 16,000 | 16,009.99 | November 21st 2013 |

| 17,000 | 17,068.26 | 3rd July 2014 |

| 18,000 | 18,024.17 | December 23, 2014 |

| 19,000 | 19,043.19 | 22nd November 2016 |

| 20,000 | 20,082.00 | January 25, 2017 |

| 21,000 | 21,113.67 | March 1, 2017 |

| 22,000 | 22,016.24 | 2nd August 2017 |

| 23,000 | 23,157.60 | October 18, 2017 |

| 24,000 | 24,272.35 | November 30, 2017 |

| 25,000 | 25,075.13 | 4th January 2018 |

| 26,000 | 26,115.65 | 17th January 2018 |

| 27,000 | 27,088.08 | 11th July 2019 |

| 28,000 | 28,004.89 | 15th November 2019 |

| 29,000 | 29,030.22 | January 15, 2020 |

| 30,000 | 30,218.26 | 4th December 2020 |

| 31,000 | 31,041.13 | January 7, 2021 |

| 32,000 | 32,297.02 | March 10, 2021 |

| 33,000 | 33,072.88 | March 26, 2021 |

| 34,000 | 34,035.99 | April 15, 2021 |

The best days

The largest percentage increase in a day occurred on March 15, 1933, when the Dow Jones Industrial Average rose 15.34 percent. Note that it was the first day of trading on the New York Stock Exchange since March 3, 1933. Reason for the trading halt had several bank holidays (National Banking Holidays), because of the inauguration of Franklin D. Roosevelt as the 32nd President of the United States has been adopted.

The table shows the best days of the Dow Jones Index, which was calculated back to 1885.

| rank | date | Closing score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | March 15, 1933 | 62.10 | 8.26 | 15.34 |

| 2 | Oct 6, 1931 | 99.34 | 12.86 | 14.87 |

| 3 | Oct 30, 1929 | 258.47 | 28.40 | 12.34 |

| 4th | March 24, 2020 | 20,704.91 | 2,112.98 | 11.37 |

| 5 | Sep 21 1932 | 75.16 | 7.67 | 11.36 |

| 6th | Oct 13, 2008 | 9,387.61 | 936.42 | 11.08 |

| 7th | Oct 28, 2008 | 9,065.12 | 889.35 | 10.88 |

| 8th | Oct 21, 1987 | 2,027.85 | 186.84 | 10.15 |

| 9 | Aug 3, 1932 | 58.22 | 5.06 | 9.52 |

| 10 | Feb 11, 1932 | 78.60 | 6.80 | 9.47 |

| 11 | March 13, 2020 | 23,185.62 | 1,985 | 9.36 |

| 12th | Nov 14, 1929 | 217.28 | 18.59 | 9.36 |

| 13th | Dec 18, 1931 | 80.69 | 6.90 | 9.35 |

| 14th | Feb 13, 1932 | 85.82 | 7.22 | 9.19 |

| 15th | May 6, 1932 | 59.01 | 4.91 | 9.08 |

| 16 | April 19, 1933 | 68.31 | 5.66 | 9.03 |

| 17th | Oct 8, 1931 | 105.79 | 8.47 | 8.70 |

| 18th | June 10, 1932 | 48.94 | 3.62 | 7.99 |

| 19th | Sep 5 1939 | 148.12 | 10.03 | 7.26 |

| 20th | June 3, 1931 | 130.37 | 8.67 | 7.12 |

| 21 | Jan. 6, 1932 | 76.31 | 5.07 | 7.12 |

| 22nd | March 23, 2009 | 7,775.86 | 497.48 | 6.84 |

| 23 | Oct 14, 1932 | 63.84 | 4.08 | 6.83 |

| 24 | March 15, 1907 | 59.58 | 3.74 | 6.70 |

| 25th | Nov 13, 2008 | 8,835.25 | 552.59 | 6.67 |

| 26 | July 27, 1893 | 27.00 | 1.68 | 6.64 |

| 27 | June 20, 1931 | 138.96 | 8.65 | 6.64 |

| 28 | July 24, 1933 | 94.28 | 5.86 | 6.63 |

| 29 | Nov 21, 2008 | 8,046.42 | 494.13 | 6.54 |

| 30th | Aug 2, 1893 | 28.48 | 1.74 | 6.51 |

| 31 | June 19, 1933 | 95.99 | 5.76 | 6.38 |

| 32 | May 10, 1901 | 52.50 | 3.14 | 6.36 |

| 33 | July 24, 2002 | 8,191.29 | 488.95 | 6.35 |

| 34 | Aug 6, 1932 | 66.56 | 3.96 | 6.33 |

| 35 | Nov 10, 1932 | 65.54 | 3.87 | 6.28 |

| 36 | Jan. 13, 1932 | 84.36 | 4.97 | 6.26 |

| 37 | Apr 29, 1933 | 77.66 | 4.56 | 6.24 |

| 38 | Oct 20, 1937 | 134.56 | 7.71 | 6.08 |

| 39 | 23 Sep 1931 | 115.99 | 6.59 | 6.02 |

| 40 | Oct. 20, 1987 | 1,841.01 | 102.27 | 5.88 |

| 41 | Oct. 31, 1929 | 273.51 | 15.04 | 5.82 |

| 42 | April 20, 1933 | 72.27 | 3.96 | 5.80 |

| 43 | March 10, 2009 | 6,926.49 | 379.44 | 5.80 |

| 44 | Oct 25, 1937 | 134.43 | 7.28 | 5.73 |

| 45 | May 2, 1898 | 35.60 | 1.90 | 5.65 |

| 46 | Nov 4, 1932 | 61.53 | 3.25 | 5.58 |

| 47 | March 28, 1898 | 33.21 | 1.75 | 5.56 |

| 48 | 22 Aug 1932 | 70.87 | 4.03 | 5.49 |

| 49 | December 22, 1916 | 95.09 | 4.93 | 5.47 |

| 50 | Oct 11, 1932 | 61.66 | 3.19 | 5.46 |

The worst days

The largest one-day percentage decline occurred on October 19, 1987, when the Dow Jones Industrial Average fell 22.61 percent. In some publications, December 12, 1914 is described as the worst trading day in history with 24.39 percent. In reality it was a recalculation due to a change in the composition of the index and not an actual decrease. On September 17, 2001, when the Dow Jones Index fell by 7.13 percent, trading on the stock exchange was not possible for several days because of the terrorist attacks on September 11, 2001 .

The table shows the worst days of the Dow Jones Index calculated back to 1885.

| rank | date | Closing score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | Oct 19, 1987 | 1,738.74 | −508.00 | −22.61 |

| 2 | March 16, 2020 | 20,188.52 | −2,997.10 | −12.93 |

| 3 | Oct 28, 1929 | 260.64 | −38.33 | −12.82 |

| 4th | Oct. 29, 1929 | 230.07 | −30.57 | −11.73 |

| 5 | March 12, 2020 | 21,200.62 | −2,352.60 | −9.99 |

| 6th | Nov 6, 1929 | 232.13 | −25.55 | −9.92 |

| 7th | Dec 18, 1899 | 42.69 | −4.08 | −8.72 |

| 8th | Dec 20, 1895 | 29.42 | −2.74 | −8.52 |

| 9 | Aug 12, 1932 | 63.11 | −5.79 | −8.40 |

| 10 | March 14, 1907 | 55.84 | −5.05 | −8.29 |

| 11 | Oct 26, 1987 | 1,793.93 | −156.83 | −8.04 |

| 12th | Oct 15, 2008 | 8,577.91 | −733.08 | −7.87 |

| 13th | July 21, 1933 | 88.71 | −7.55 | −7.84 |

| 14th | March 9, 2020 | 23,851.02 | −2,013.76 | −7.79 |

| 15th | Oct 18, 1937 | 125.73 | −10.57 | −7.75 |

| 16 | Dec 1, 2008 | 8,149.09 | −679.95 | −7.70 |

| 17th | July 26, 1893 | 25.32 | −2.02 | −7.39 |

| 18th | Oct 9, 2008 | 8,579.19 | -678.91 | −7.33 |

| 19th | Feb. 1, 1917 | 88.52 | −6.91 | −7.24 |

| 29 | Oct 27, 1997 | 7,161.15 | −554.26 | −7.18 |

| 21 | Oct 5, 1932 | 66.07 | −5.09 | −7.15 |

| 22nd | 17 Sep 2001 | 8,920.70 | −684.81 | −7.13 |

| 23 | Sep 24 1931 | 107.79 | −8.20 | −7.07 |

| 24 | July 20, 1933 | 96.26 | −7.32 | −7.07 |

| 25th | 29 Sep 2008 | 10,365.45 | −777.68 | −6.98 |

| 26 | Oct 13, 1989 | 2,569.26 | −190.58 | −6.91 |

| 27 | July 30, 1914 | 52.32 | −3.88 | −6.90 |

| 28 | Jan. 8, 1988 | 1,911.31 | −140.58 | −6.85 |

| 29 | Nov 11, 1929 | 220.39 | −16.14 | −6.82 |

| 30th | May 14, 1940 | 128.27 | −9.36 | −6.80 |

| 31 | Oct. 5, 1931 | 86.48 | −6.29 | −6.78 |

| 32 | May 21, 1940 | 114.13 | −8.30 | −6.78 |

| 33 | July 26, 1934 | 85.51 | −6.06 | −6.62 |

| 34 | 26 Sep 1955 | 455.56 | −31.89 | −6.54 |

| 35 | Aug 31, 1998 | 7,539.07 | −512.61 | −6.37 |

| 36 | Oct 23, 1929 | 305.85 | −20.66 | −6.33 |

| 37 | May 31, 1932 | 44.74 | −2.96 | −6.21 |

| 38 | Sep 21 1933 | 97.56 | −6.43 | −6.18 |

| 39 | Dec 14, 1904 | 48.18 | −3.11 | −6.06 |

| 40 | May 9, 1901 | 49.36 | −3.18 | −6.05 |

| 41 | December 12, 1929 | 243.14 | −15.30 | −5.92 |

| 42 | March 11, 2020 | 23,553.22 | −1,464.94 | −5.86 |

| 43 | Nov 19, 1937 | 118.13 | −7.35 | −5.86 |

| 44 | Nov 23, 1932 | 59.47 | −3.69 | −5.84 |

| 45 | June 16, 1930 | 230.05 | −14.20 | −5.81 |

| 46 | Nov 4, 1929 | 257.68 | −15.83 | −5.79 |

| 47 | May 28, 1962 | 576.93 | −34.95 | −5.71 |

| 48 | Oct 22, 2008 | 8,519.21 | −514.45 | −5.69 |

| 49 | Sep 14 1932 | 65.88 | −3.97 | −5.68 |

| 50 | Apr 14, 2000 | 10,305.77 | -617.78 | −5.66 |

The best weeks

The best week in the history of the Dow Jones Index ended on August 6, 1932 with a gain of 22.67 percent, followed by the week of June 25, 1938 with an increase of 16.52 percent and the week of March 13, 1938. February 1932 with a profit of 15.27 percent.

The table shows the best weeks of the Dow Jones Index calculated back to 1885. The date refers to the last trading day of the week.

| rank | week | Closing score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | Aug 6, 1932 | 66.56 | 12.30 | 22.67 |

| 2 | June 25, 1938 | 131.94 | 18.71 | 16.52 |

| 3 | Feb 13, 1932 | 85.82 | 11.37 | 15.27 |

| 4th | Apr 22, 1933 | 72.24 | 9.36 | 14.89 |

| 5 | Oct 10, 1931 | 105.61 | 12.84 | 13.84 |

| 6th | July 30, 1932 | 54.26 | 6.42 | 13.42 |

| 7th | June 27, 1931 | 156.93 | 17.97 | 12.93 |

| 8th | Sep 24 1932 | 74.83 | 8.39 | 12.63 |

| 9 | Oct 11, 1974 | 658.17 | 73.61 | 12.59 |

| 10 | Aug 27, 1932 | 75.61 | 8.43 | 12.55 |

| 11 | March 18, 1933 | 60.56 | 6.72 | 12.48 |

| 12th | Aug 15, 1903 | 38.80 | 4.09 | 11.78 |

| 13th | May 27, 1933 | 89.61 | 9.40 | 11.72 |

| 14th | Nov 10, 1900 | 48.70 | 4.89 | 11.17 |

| 15th | Aug 20, 1982 | 869.29 | 81.24 | 10.31 |

| 16 | December 7, 1929 | 263.46 | 24.51 | 10.26 |

| 17th | Oct 28, 1933 | 92.01 | 8.37 | 10.01 |

| 18th | Nov 28, 2008 | 8,829.04 | 782.62 | 9.73 |

| 19th | Dec 10, 1932 | 61.25 | 5.42 | 9.71 |

| 20th | Nov 7, 1931 | 115.60 | 10.17 | 9.65 |

| 21 | May 7, 1898 | 36.92 | 3.22 | 9.55 |

| 22nd | Aug 5, 1993 | 28.69 | 2.48 | 9.46 |

| 23 | Sep 9 1939 | 150.91 | 12.82 | 9.28 |

| 24 | Dec 30, 1899 | 48.41 | 4.04 | 9.11 |

| 25th | Nov 12, 1932 | 68.04 | 5.63 | 9.02 |

| 26 | March 13, 2009 | 7,223.98 | 597.04 | 9.01 |

| 27 | July 16, 1932 | 45.29 | 3.66 | 8.79 |

| 28 | Oct 8, 1982 | 986.85 | 79.11 | 8.72 |

| 29 | March 21, 2003 | 8,521.97 | 662.26 | 8.43 |

| 30th | June 9, 1934 | 98.90 | 7.49 | 8.19 |

The worst weeks

The worst week in the history of the Dow Jones Index ended on October 10, 2008 with a loss of 18.15 percent, followed by the week of July 22, 1933 with a minus of 16.66 percent and the week of December 18, 1933. May 1940 with a loss of 15.48 percent.

The table shows the worst weeks of the Dow Jones Index calculated back to 1885. The date refers to the last trading day of the week.

| rank | week | Closing score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | Oct 10, 2008 | 8,451.19 | −1,874.19 | −18.15 |

| 2 | July 22, 1933 | 88.42 | −17.68 | −16.66 |

| 3 | May 18, 1940 | 122.43 | −22.42 | −15.48 |

| 4th | Oct 8, 1932 | 61.17 | −10.92 | −15.15 |

| 5 | Dec 21, 1895 | 28.29 | −4.91 | −14.79 |

| 6th | Sep 21 2001 | 8,235.81 | −1,369.70 | −14.26 |

| 7th | Oct 3, 1931 | 92.77 | −14.59 | −13.59 |

| 8th | Nov 8, 1929 | 236.53 | −36.98 | −13.52 |

| 9 | 17 Sep 1932 | 66.44 | −10.10 | −13.20 |

| 10 | Oct 23, 1987 | 1,950.76 | −295.98 | −13.17 |

| 11 | Oct 21, 1933 | 83.64 | −11.95 | −12.50 |

| 12th | Dec 12, 1931 | 78.93 | −11.21 | −12.44 |

| 13th | Feb 28, 2020 | 24,409.36 | −3,583.05 | −12.36 |

| 14th | May 8, 1915 | 62.77 | −8.74 | −12.22 |

| 15th | June 21, 1930 | 215.30 | −28.95 | −11.85 |

| 16 | Dec 8, 1928 | 257.33 | −33.47 | −11.51 |

| 17th | March 26, 1938 | 106.63 | −13.80 | −11.46 |

| 18th | March 13, 2020 | 23,185.62 | −2,679.16 | −10.40 |

| 19th | July 30, 1914 | 52.32 | −6.04 | −10.36 |

| 20th | Aug 8, 1896 | 24.36 | −2.73 | −10.08 |

| 21 | May 28, 1932 | 47.70 | −5.34 | −10.07 |

| 22nd | 19 Sep 1931 | 111.74 | −12.11 | −9.78 |

| 23 | May 14, 1932 | 52.48 | −5.56 | −9.58 |

| 24 | Apr 9, 1932 | 64.48 | −6.82 | −9.57 |

| 25th | July 18, 1896 | 27.24 | −2.87 | −9.53 |

| 26 | Oct 16, 1987 | 2,246.73 | −235.48 | −9.49 |

| 27 | Nov 20, 1937 | 120.45 | −12.60 | −9.47 |

| 28 | July 25, 1903 | 35.95 | −3.68 | −9.29 |

| 29 | Oct 11, 1930 | 193.05 | −18.05 | −8.55 |

| 30th | Oct. 31, 1929 | 273.51 | −25.46 | −8.52 |

The best months

The best month in the history of the Dow Jones Index was April 1933 with a gain of 40.18 percent, followed by August 1932 with an increase of 34.83 percent and July 1932 with a gain of 26.66 percent.

The table shows the best months of the Dow Jones Index, which was calculated back to 1789.

| rank | month | Closing score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | Apr. 1933 | 77.66 | 22.26 | 40.18 |

| 2 | Aug 1932 | 73.16 | 18.90 | 34.83 |

| 3 | July 1932 | 54.26 | 11.42 | 26.66 |

| 4th | Dec 1857 | 11.92 | 2.47 | 26.14 |

| 5 | June 1938 | 133.88 | 26.14 | 24.26 |

| 6th | July 1837 | 13.83 | 2.61 | 23.26 |

| 7th | May 1843 | 7.83 | 1.31 | 20.09 |

| 8th | Nov. 1857 | 9.45 | 1.46 | 18.27 |

| 9 | Apr. 1915 | 71.78 | 10.95 | 18.00 |

| 10 | May 1842 | 7.04 | 1.04 | 17.33 |

| 11 | June 1931 | 150.18 | 21.72 | 16.91 |

| 12th | Nov. 1928 | 293.38 | 41.22 | 16.35 |

| 13th | Dec 1843 | 11.22 | 1.57 | 16.27 |

| 14th | Jan. 1837 | 16.96 | 2.35 | 16.08 |

| 15th | Jan. 1863 | 20.71 | 2.81 | 15.70 |

| 16 | Jan. 1861 | 12.27 | 1.62 | 15.21 |

| 17th | Sep 1824 | 14.38 | 1.89 | 15.13 |

| 18th | Apr. 1834 | 15.91 | 2.08 | 15.04 |

| 19th | May 1898 | 38.50 | 4.92 | 14.65 |

| 20th | Aug 1897 | 40.01 | 5.06 | 14.48 |

| 21 | Jan. 1976 | 975.28 | 122.87 | 14.41 |

| 22nd | Nov. 1904 | 52.58 | 6.56 | 14.25 |

| 23 | Jan. 1975 | 703.69 | 87.45 | 14.19 |

| 24 | Oct. 1840 | 10.70 | 1.31 | 13.95 |

| 25th | May 1835 | 23.48 | 2.87 | 13.93 |

| 26 | Jan. 1987 | 2,158.04 | 262.09 | 13.82 |

| 27 | Feb. 1836 | 21.65 | 2.60 | 13.65 |

| 28 | May 1919 | 105.50 | 12.62 | 13.59 |

| 29 | Sep 1939 | 152.54 | 18.13 | 13.49 |

| 30th | May 1933 | 88.11 | 10.45 | 13.46 |

The worst months

The worst month in the history of the Dow Jones Index was September 1931 with a loss of 30.70 percent, followed by March 1938 with a loss of 23.67 percent and April 1932 with a loss of 23.43 percent.

The table shows the worst months of the Dow Jones Index, which was calculated back to 1789.

| rank | month | Closing score in points |

Change in points |

Change in% |

|---|---|---|---|---|

| 1 | Sep 1931 | 96.61 | −42.80 | −30.70 |

| 2 | March 1938 | 98.95 | −30.69 | −23.67 |

| 3 | Apr. 1932 | 56.11 | −17.17 | −23.43 |

| 4th | Oct 1987 | 1,993.53 | −602.75 | −23.22 |

| 5 | May 1940 | 116.22 | −32.21 | −21.70 |

| 6th | Oct. 1857 | 7.99 | −2.08 | −20.66 |

| 7th | Oct. 1929 | 273.51 | -69.94 | −20.36 |

| 8th | May 1932 | 44.74 | −11.37 | −20.26 |

| 9 | July 1893 | 26.07 | −5.89 | −18.43 |

| 10 | June 1930 | 226.34 | −48.73 | −17.72 |

| 11 | Sep 1857 | 10.07 | −2.16 | −17.66 |

| 12th | Dec 1931 | 77.90 | −15.97 | −17.01 |

| 13th | Jan. 1842 | 6.78 | −1.31 | −16.19 |

| 14th | Feb. 1933 | 51.39 | −9.51 | −15.62 |

| 15th | Aug 1998 | 7,539.07 | −1,344.22 | −15.13 |

| 16 | May 1931 | 128.46 | −22.73 | −15.03 |

| 17th | Oct 1907 | 42.12 | −7.32 | −14.81 |

| 18th | Sep 1930 | 204.90 | −35.52 | −14.77 |

| 19th | June 1877 | 22.08 | −3.75 | −14.52 |

| 20th | Nov 1860 | 11.29 | −1.87 | −14.21 |

| 21 | July 1903 | 37.06 | −6.07 | −14.07 |

| 22nd | Nov 1973 | 822.25 | −134.33 | −14.04 |

| 23 | Oct 2008 | 9,336.93 | −1,513.73 | −13.95 |

| 24 | Sep 1903 | 33.44 | −5.39 | −13.88 |

| 25th | March 1841 | 8.09 | −1.30 | −13.84 |

| 26 | Oct. 1932 | 61.90 | −9.66 | −13.50 |

| 27 | Nov. 1919 | 103.60 | −15.32 | −12.88 |

| 28 | Sep 1937 | 154.57 | −22.84 | −12.87 |

| 29 | Nov. 1929 | 238.95 | −34.56 | −12.64 |

| 30th | Dec 1899 | 48.24 | −6.92 | −12.55 |

Annual development

The best year in the history of the Dow Jones Index was 1915 with a gain of 81.66 percent, followed by 1843 with an increase of 72.09 percent and 1814 with a gain of 68.58 percent. The worst year was 1931 with a loss of 52.67 percent, followed by 1807 with a loss of 46.35 percent and 1801 with a loss of 38.37 percent.

In some publications, 1914 is described as one of the worst years in history, down 30.72 percent. In reality it was a recalculation due to a change in the composition of the index. The Dow Jones Industrial Average closed that year with a decline of 5.09 percent compared to 1913.

The table shows the annual development of the Dow Jones Index calculated back to 1789.

| year | Closing score in points |

Change in points |

Change in% |

|---|---|---|---|

| 1789 | 2.76 | ||

| 1790 | 3.39 | 0.63 | 22.83 |

| 1791 | 3.66 | 0.27 | 7.96 |

| 1792 | 3.20 | −0.46 | −12.57 |

| 1793 | 3.54 | 0.34 | 10.63 |

| 1794 | 4.35 | 0.81 | 22.88 |

| 1795 | 4.11 | −0.24 | −5.52 |

| 1796 | 3.55 | −0.56 | −13.63 |

| 1797 | 3.25 | −0.30 | −8.45 |

| 1798 | 3.99 | 0.74 | 22.77 |

| 1799 | 4.63 | 0.64 | 16.04 |

| 1800 | 5.63 | 1.00 | 21.60 |

| 1801 | 3.47 | −2.16 | −38.37 |

| 1802 | 3.89 | 0.42 | 12.10 |

| 1803 | 4.22 | 0.33 | 8.48 |

| 1804 | 6.26 | 2.04 | 48.34 |

| 1805 | 6.38 | 0.12 | 1.92 |

| 1806 | 6.71 | 0.33 | 5.17 |

| 1807 | 3.60 | −3.11 | −46.35 |

| 1808 | 5.55 | 1.95 | 54.17 |

| 1809 | 6.69 | 1.14 | 20.54 |

| 1810 | 5.61 | −1.08 | −16.14 |

| 1811 | 5.31 | −0.30 | −5.35 |

| 1812 | 4.59 | −0.72 | −13.56 |

| 1813 | 5.06 | 0.47 | 10.24 |

| 1814 | 8.53 | 3.47 | 68.58 |

| 1815 | 8.83 | 0.30 | 3.52 |

| 1816 | 8.68 | −0.15 | −1.70 |

| 1817 | 10.13 | 1.45 | 16.71 |

| 1818 | 11.03 | 0.90 | 8.88 |

| 1819 | 9.92 | −1.11 | −10.06 |

| 1820 | 11.35 | 1.43 | 14.42 |

| 1821 | 12.02 | 0.67 | 5.90 |

| 1822 | 11.60 | −0.42 | −3.49 |

| 1823 | 12.25 | 0.65 | 5.60 |

| 1824 | 13.04 | 0.79 | 6.45 |

| 1825 | 11.51 | −1.53 | −11.73 |

| 1826 | 11.37 | −0.14 | −1.22 |

| 1827 | 11.71 | 0.34 | 2.99 |

| 1828 | 11.07 | −0.64 | −5.47 |

| 1829 | 11.87 | 0.80 | 7.23 |

| 1830 | 13.76 | 1.89 | 15.92 |

| 1831 | 12.00 | −1.76 | −12.79 |

| 1832 | 15.91 | 3.91 | 32.58 |

| 1833 | 15.13 | −0.78 | −4.90 |

| 1834 | 17.74 | 2.61 | 17.25 |

| 1835 | 18.78 | 1.04 | 5.86 |

| 1836 | 14.61 | −4.17 | −22.20 |

| 1837 | 12.78 | −1.83 | −12.53 |

| 1838 | 11.22 | −1.56 | −12.21 |

| 1839 | 9.13 | −2.09 | −18.63 |

| 1840 | 9.91 | 0.78 | 8.54 |

| 1841 | 8.09 | −1.82 | −18.37 |

| 1842 | 6.52 | −1.57 | −19.41 |

| 1843 | 11.22 | 4.70 | 72.09 |

| 1844 | 12.52 | 1.30 | 11.59 |

| 1845 | 13.31 | 0.79 | 6.31 |

| 1846 | 13.04 | −0.27 | −2.03 |

| 1847 | 13.04 | 0.00 | 0.00 |

| 1848 | 13.04 | 0.00 | 0.00 |

| 1849 | 13.57 | 0.53 | 4.06 |

| 1850 | 17.48 | 3.91 | 28.81 |

| 1851 | 16.70 | −0.78 | −4.46 |

| 1852 | 21.13 | 4.43 | 26.53 |

| 1853 | 18.00 | −3.13 | −14.81 |

| 1854 | 12.87 | −5.13 | −28.50 |

| 1855 | 13.80 | 0.93 | 7.23 |

| 1856 | 15.94 | 2.14 | 15.51 |

| 1857 | 11.92 | −4.02 | −25.22 |

| 1858 | 9.90 | −2.02 | −16.95 |

| 1859 | 9.03 | −0.87 | −8.79 |

| 1860 | 10.65 | 1.62 | 17.94 |

| 1861 | 12.02 | 1.37 | 12.86 |

| 1862 | 17.90 | 5.88 | 48.92 |

| 1863 | 25.34 | 7.44 | 41.56 |

| 1864 | 24.12 | −1.22 | −4.81 |

| 1865 | 26.07 | 1.95 | 8.08 |

| 1866 | 25.93 | −0.14 | −0.54 |

| 1867 | 26.97 | 1.04 | 4.01 |

| 1868 | 29.44 | 2.47 | 9.16 |

| 1869 | 25.35 | -4.09 | −13.89 |

| 1870 | 26.34 | 0.99 | 3.91 |

| 1871 | 29.99 | 3.65 | 13.86 |

| 1872 | 34.85 | 4.86 | 16.21 |

| 1873 | 31.80 | −3.05 | −8.75 |

| 1874 | 33.74 | 1.94 | 6.10 |

| 1875 | 31.94 | −1.80 | −5.33 |

| 1876 | 30.27 | −1.67 | −5.23 |

| 1877 | 24.58 | −5.69 | −18.80 |

| 1878 | 25.13 | 0.55 | 2.24 |

| 1879 | 30.27 | 5.14 | 20.45 |

| 1880 | 30.13 | −0.14 | −0.46 |

| 1881 | 34.99 | 4.86 | 16.13 |

| 1882 | 32.63 | −2.36 | −6.74 |

| 1883 | 30.41 | −2.22 | −6.80 |

| 1884 | 28.46 | −1.95 | −6.41 |

| 1885 | 39.29 | 10.83 | 38.05 |

| 1886 | 41.03 | 1.74 | 4.43 |

| 1887 | 37.58 | −3.45 | −8.41 |

| 1888 | 39.39 | 1.81 | 4.82 |

| 1889 | 41.56 | 2.17 | 5.51 |

| 1890 | 35.68 | −5.88 | −14.15 |

| 1891 | 41.97 | 6.29 | 17.63 |

| 1892 | 39.21 | −2.76 | 6.58 |

| 1893 | 29.57 | −9.64 | −24.59 |

| 1894 | 29.40 | −0.17 | −0.57 |

| 1895 | 30.07 | 0.67 | 2.28 |

| 1896 | 29.56 | −0.51 | −1.70 |

| 1897 | 36.07 | 6.51 | 22.02 |

| 1898 | 44.18 | 8.11 | 22.48 |

| 1899 | 48.24 | 4.06 | 9.19 |

| 1900 | 51.62 | 3.38 | 7.01 |

| 1901 | 47.13 | −4.49 | −8.70 |

| 1902 | 46.93 | −0.20 | −0.42 |

| 1903 | 35.85 | −11.08 | −23.61 |

| 1904 | 50.82 | 14.97 | 41.76 |

| 1905 | 70.23 | 19.41 | 38.19 |

| 1906 | 68.88 | −1.35 | −1.92 |

| 1907 | 42.89 | −25.99 | −37.73 |

| 1908 | 62.89 | 20.00 | 46.63 |

| 1909 | 72.31 | 9.42 | 14.98 |

| 1910 | 59.40 | −12.91 | −17.85 |

| 1911 | 59.63 | 0.23 | 0.39 |

| 1912 | 64.15 | 4.52 | 7.58 |

| 1913 | 57.51 | −6.64 | −10.35 |

| 1914 | 54.58 | −2.93 | −5.09 |

| 1915 | 99.15 | 44.57 | 81.66 |

| 1916 | 95.00 | −4.15 | −4.19 |

| 1917 | 74.38 | −20.62 | −21.71 |

| 1918 | 82.20 | 7.82 | 10.51 |

| 1919 | 107.23 | 25.03 | 30.45 |

| 1920 | 71.95 | −35.28 | −32.90 |

| 1921 | 81.10 | 9.15 | 12.72 |

| 1922 | 98.73 | 17.63 | 21.74 |

| 1923 | 95.52 | −3.21 | −3.25 |

| 1924 | 120.51 | 24.99 | 26.16 |

| 1925 | 156.66 | 36.15 | 30.00 |

| 1926 | 157.20 | 0.54 | 0.34 |

| 1927 | 202.40 | 45.20 | 28.75 |

| 1928 | 300.00 | 97.60 | 48.22 |

| 1929 | 248.48 | −51.52 | −17.17 |

| 1930 | 164.58 | −83.90 | −33.77 |

| 1931 | 77.90 | −86.68 | −52.67 |

| 1932 | 59.93 | −17.97 | −23.07 |

| 1933 | 99.90 | 39.97 | 66.69 |

| 1934 | 104.04 | 4.14 | 4.14 |

| 1935 | 144.13 | 40.09 | 38.53 |

| 1936 | 179.90 | 35.77 | 24.82 |

| 1937 | 120.85 | −59.05 | −32.82 |

| 1938 | 154.76 | 33.91 | 28.06 |

| 1939 | 150.24 | −4.52 | −2.92 |

| 1940 | 131.13 | −19.11 | −12.72 |

| 1941 | 110.96 | −20.17 | −15.38 |

| 1942 | 119.40 | 8.44 | 7.61 |

| 1943 | 135.89 | 16.49 | 13.81 |

| 1944 | 152.32 | 16.43 | 12.09 |

| 1945 | 192.91 | 40.59 | 26.65 |

| 1946 | 177.20 | −15.71 | −8.14 |

| 1947 | 181.16 | 3.96 | 2.23 |

| 1948 | 177.30 | −3.86 | −2.13 |

| 1949 | 200.13 | 22.83 | 12.88 |

| 1950 | 235.41 | 35.28 | 17.63 |

| 1951 | 269.23 | 33.82 | 14.37 |

| 1952 | 291.90 | 22.67 | 8.42 |

| 1953 | 280.90 | −11.00 | −3.77 |

| 1954 | 404.39 | 123.49 | 43.96 |

| 1955 | 488.40 | 84.01 | 20.77 |

| 1956 | 499.47 | 11.07 | 2.27 |

| 1957 | 435.69 | −63.78 | −12.77 |

| 1958 | 583.65 | 147.96 | 33.96 |

| 1959 | 679.36 | 95.71 | 16.40 |

| 1960 | 615.89 | −63.47 | −9.34 |

| 1961 | 731.14 | 115.25 | 18.71 |

| 1962 | 652.10 | -79.04 | −10.81 |

| 1963 | 762.95 | 110.85 | 17.00 |

| 1964 | 874.13 | 111.18 | 14.57 |

| 1965 | 969.26 | 95.13 | 10.88 |

| 1966 | 785.69 | −183.57 | −18.94 |

| 1967 | 905.11 | 119.42 | 15.20 |

| 1968 | 943.75 | 38.64 | 4.27 |

| 1969 | 800.36 | −143.39 | −15.19 |

| 1970 | 838.92 | 38.56 | 4.82 |

| 1971 | 890.20 | 51.28 | 6.11 |

| 1972 | 1,020.02 | 129.82 | 14.58 |

| 1973 | 850.86 | −169.16 | −16.58 |

| 1974 | 616.24 | −234.62 | −27.57 |

| 1975 | 852.41 | 236.17 | 38.32 |

| 1976 | 1,004.65 | 152.24 | 17.86 |

| 1977 | 831.17 | −173.48 | −17.27 |

| 1978 | 805.01 | −26.16 | −3.15 |

| 1979 | 838.74 | 33.73 | 4.19 |

| 1980 | 963.99 | 125.25 | 14.93 |

| 1981 | 875.00 | −88.99 | −9.23 |

| 1982 | 1,046.54 | 171.54 | 19.60 |

| 1983 | 1,258.64 | 212.10 | 20.27 |

| 1984 | 1,211.57 | −47.07 | −3.74 |

| 1985 | 1,546.67 | 335.10 | 27.66 |

| 1986 | 1,895.95 | 349.28 | 22.58 |

| 1987 | 1,938.83 | 42.88 | 2.26 |

| 1988 | 2,168.57 | 229.74 | 11.85 |

| 1989 | 2,753.20 | 584.63 | 26.96 |

| 1990 | 2,633.66 | −119.54 | −4.34 |

| 1991 | 3,168.83 | 535.17 | 20.32 |

| 1992 | 3,301.11 | 132.28 | 4.17 |

| 1993 | 3,754.09 | 452.98 | 13.72 |

| 1994 | 3,834.44 | 80.35 | 2.14 |

| 1995 | 5,117.12 | 1,282.68 | 33.45 |

| 1996 | 6,448.27 | 1,331.15 | 26.01 |

| 1997 | 7,908.25 | 1,459.98 | 22.64 |

| 1998 | 9,181.43 | 1,273.18 | 16.10 |

| 1999 | 11,497.12 | 2,315.69 | 25.22 |

| 2000 | 10,786.85 | −710.27 | −6.18 |

| 2001 | 10,021.50 | −765.35 | −7.10 |

| 2002 | 8,341.63 | −1,679.87 | −16.76 |

| 2003 | 10,453.92 | 2,112.29 | 25.32 |

| 2004 | 10,783.01 | 329.09 | 3.15 |

| 2005 | 10,717.50 | −65.51 | −0.61 |

| 2006 | 12,463.15 | 1,745.65 | 16.29 |

| 2007 | 13,264.82 | 801.67 | 6.43 |

| 2008 | 8,776.39 | −4,488.43 | −33.84 |

| 2009 | 10,428.05 | 1,651.66 | 18.82 |

| 2010 | 11,577.51 | 1,149.46 | 11.02 |

| 2011 | 12,217.56 | 640.05 | 5.53 |

| 2012 | 13,104.14 | 886.58 | 7.26 |

| 2013 | 16,576.66 | 3,472.52 | 26.50 |

| 2014 | 17,823.07 | 1,246.41 | 7.52 |

| 2015 | 17,425.03 | −398.04 | −2.23 |

| 2016 | 19,762.60 | 2,337.57 | 13.42 |

| 2017 | 24,719.22 | 4,956.62 | 25.08 |

| 2018 | 23,327.46 | −1,391.76 | −5.63 |

| 2019 | 28,538.44 | 5,210.98 | 22.34 |

| 2020 | 30,606.48 | 2,068.04 | 7.25 |

Bull markets

The longest bull market on the Dow Jones Index lasted a total of 2,836 days between 1990 and 1998. The bull market with the greatest profit occurred between 1923 and 1929. Investors gained 344.5 percent on stocks during that time. According to a study by the US analysis company Ned Davis Research, there have been 36 cyclical bull markets with an average duration of 751 days ( median = 614 days) since 1900 . The average profit was 85.6 percent (median = 69.1 percent).

According to a definition by Ned Davis Research, bull markets are price gains in the Dow Jones Index of at least 30 percent after 50 days, an increase in the index of 13 percent after 155 days or a 30 percent reversal in the geometric value line composite Index since 1965.

| Beginning | Closing score in points |

end | Closing score in points |

Change in% |

Days |

|---|---|---|---|---|---|

| Sep 24 1900 | 38.80 | June 17, 1901 | 57.33 | 47.8 | 266 |

| Nov 9, 1903 | 30.88 | Jan. 19, 1906 | 75.45 | 144.4 | 802 |

| Nov 15, 1907 | 38.83 | Nov 19, 1909 | 73.64 | 89.7 | 735 |

| 25 Sep 1911 | 53.43 | Sep 30 1912 | 68.97 | 29.1 | 371 |

| December 24, 1914 | 53.17 | Nov 21, 1916 | 110.15 | 107.2 | 698 |

| December 19, 1917 | 65.95 | Nov 3, 1919 | 119.62 | 81.4 | 684 |

| Aug 24, 1921 | 63.90 | March 20, 1923 | 105.38 | 64.9 | 573 |

| Oct. 27, 1923 | 85.76 | Sep 3 1929 | 381.17 | 344.5 | 2.138 |

| Nov 13, 1929 | 198.69 | Apr 17, 1930 | 294.07 | 48.0 | 155 |

| July 8, 1932 | 41.22 | Sep 7 1932 | 79.93 | 93.9 | 61 |

| Feb. 27, 1933 | 50.16 | Feb 5, 1934 | 110.74 | 120.8 | 343 |

| July 26, 1934 | 85.51 | March 10, 1937 | 194.40 | 127.3 | 958 |

| March 31, 1938 | 98.95 | Nov 12, 1938 | 158.41 | 60.1 | 226 |

| Apr 8, 1939 | 121.44 | Sep 12 1939 | 155.92 | 28.4 | 157 |

| Apr 28, 1942 | 92.92 | May 29, 1946 | 212.50 | 128.7 | 1,492 |

| May 17, 1947 | 163.21 | June 15, 1948 | 193.16 | 18.4 | 395 |

| June 13, 1949 | 161.60 | Jan. 5, 1953 | 293.79 | 81.8 | 1,302 |

| Sep 14 1953 | 255.49 | Apr 6, 1956 | 521.05 | 103.9 | 935 |

| Oct 22, 1957 | 419.79 | Jan. 5, 1960 | 685.47 | 63.3 | 805 |

| Oct 25, 1960 | 566.05 | Dec 13, 1961 | 734.91 | 29.8 | 414 |

| June 26, 1962 | 535.76 | Feb 9, 1966 | 995.15 | 85.7 | 1,324 |

| Oct 7, 1966 | 744.32 | December 3, 1968 | 985.21 | 32.4 | 788 |

| May 26, 1970 | 631.16 | Apr 28, 1971 | 950.82 | 50.6 | 337 |

| Nov 23, 1971 | 797.97 | Jan. 11, 1973 | 1,051.70 | 31.8 | 415 |

| Dec 6, 1974 | 577.60 | Sep 21 1976 | 1,014.79 | 75.7 | 655 |

| Feb. 28, 1978 | 742.12 | Sep 8 1978 | 907.74 | 22.3 | 192 |

| Apr 21, 1980 | 759.13 | Apr. 27, 1981 | 1,024.05 | 34.9 | 371 |

| Aug 12, 1982 | 776.92 | Nov 29, 1983 | 1,287.20 | 65.7 | 474 |

| July 24, 1984 | 1,086.57 | Aug 25, 1987 | 2,722.42 | 150.6 | 1,127 |

| Oct 19, 1987 | 1,738.74 | July 16, 1990 | 2,999.75 | 72.5 | 1,001 |

| Oct 11, 1990 | 2,365.10 | July 17, 1998 | 9,337.97 | 294.8 | 2,836 |

| Aug 31, 1998 | 7,539.07 | Jan. 14, 2000 | 11,722.98 | 55.5 | 501 |

| Sep 21 2001 | 8,235.81 | March 19, 2002 | 10,635.25 | 29.1 | 179 |

| Oct 9, 2002 | 7,286.27 | Oct 9, 2007 | 14,164.53 | 94.4 | 1,826 |

| March 9, 2009 | 6,547.05 | Apr 29, 2011 | 12,810.54 | 95.7 | 781 |

| Oct 3, 2011 | 10,655.30 |

Bear markets

The longest bear market on the Dow Jones Index lasted a total of 959 days between 1939 and 1942. The bear market with the greatest loss occurred between 1930 and 1932. During that time, investors lost 86.0 percent with stocks. According to a study by the American analysis company Ned Davis Research, there have been 36 cyclical bear markets with an average duration of 406 days (median = 363 days) since 1901. The average loss was 30.8 percent (median = 26.9 percent).

According to a definition by Ned Davis Research, bear markets are price losses of the Dow Jones Index of at least 30 percent after 50 days, a decrease in the index of 13 percent after 145 days or a 30 percent reversal in the geometric value line composite Index since 1965.

| Beginning | Closing score in points |

end | Closing score in points |

Change in% |

Days |

|---|---|---|---|---|---|

| June 17, 1901 | 57.33 | Nov 9, 1903 | 30.88 | −46.1 | 875 |

| Jan. 19, 1906 | 75.45 | Nov 15, 1907 | 38.83 | −48.5 | 665 |

| Nov 19, 1909 | 73.64 | 25 Sep 1911 | 53.43 | −27.4 | 675 |

| Sep 30 1912 | 68.97 | July 30, 1914 | 52.32 | −24.1 | 668 |

| Nov 21, 1916 | 110.15 | December 19, 1917 | 65.95 | −40.1 | 393 |

| Nov 3, 1919 | 119.62 | Aug 24, 1921 | 63.90 | −46.6 | 660 |

| March 20, 1923 | 105.38 | Oct. 27, 1923 | 85.76 | −18.6 | 221 |

| Sep 3 1929 | 381.17 | Nov 13, 1929 | 198.69 | −47.9 | 71 |

| Apr 17, 1930 | 294.07 | July 8, 1932 | 41.22 | −86.0 | 813 |

| Sep 7 1932 | 79.93 | Feb. 27, 1933 | 50.16 | −37.2 | 173 |

| Feb 5, 1934 | 110.74 | July 26, 1934 | 85.51 | −22.8 | 171 |

| March 10, 1937 | 194.40 | March 31, 1938 | 98.95 | −49.1 | 386 |

| Nov 12, 1938 | 158.41 | Apr 8, 1939 | 121.44 | −23.3 | 147 |

| Sep 12 1939 | 155.92 | Apr 28, 1942 | 92.92 | −40.4 | 959 |

| May 29, 1946 | 212.50 | May 17, 1947 | 163.21 | −23.2 | 353 |

| June 15, 1948 | 193.16 | June 13, 1949 | 161.60 | −16.3 | 363 |

| Jan. 5, 1953 | 293.79 | Sep 14 1953 | 255.49 | −13.0 | 252 |

| Apr 6, 1956 | 521.05 | Oct 22, 1957 | 419.79 | −19.4 | 564 |

| Jan. 5, 1960 | 685.47 | Oct 25, 1960 | 566.05 | −17.4 | 294 |

| Dec 13, 1961 | 734.91 | June 26, 1962 | 535.76 | −27.1 | 195 |

| Feb 9, 1966 | 995.15 | Oct 7, 1966 | 744.32 | −25.2 | 240 |

| December 3, 1968 | 985.21 | May 26, 1970 | 631.16 | −35.9 | 539 |

| Apr 28, 1971 | 950.82 | Nov 23, 1971 | 797.97 | −16.1 | 209 |

| Jan. 1, 1973 | 1,051.70 | Dec 6, 1974 | 577.60 | −45.1 | 694 |

| Sep 21 1976 | 1,014.79 | Feb. 28, 1978 | 742.12 | −26.9 | 525 |

| Sep 8 1978 | 907.74 | Apr 21, 1980 | 759.13 | −16.4 | 591 |

| Apr. 27, 1981 | 1,024.05 | Aug 12, 1982 | 776.92 | −24.1 | 472 |

| Nov 29, 1983 | 1,287.20 | July 24, 1984 | 1,086.57 | −15.6 | 238 |

| Aug 25, 1987 | 2,722.42 | Oct 19, 1987 | 1,738.74 | −36.1 | 55 |

| July 16, 1990 | 2,999.75 | Oct 11, 1990 | 2,365.10 | −21.2 | 87 |

| July 17, 1998 | 9,337.97 | Aug 31, 1998 | 7,539.07 | −19.3 | 45 |

| Jan. 14, 2000 | 11,722.98 | Sep 21 2001 | 8,235.81 | −29.7 | 616 |

| March 19, 2002 | 10,635.25 | Oct 9, 2002 | 7,286.27 | −31.5 | 204 |

| Oct 9, 2007 | 14,164.53 | March 9, 2009 | 6,547.05 | −53.8 | 517 |

| Apr 29, 2011 | 12,810.54 | Oct 3, 2011 | 10,655.30 | −16.8 | 157 |

composition

The largest company on July 6, 2013 was IBM with a weighting of 11.23 percent. The ten largest stock corporations by weighting had a share of 56.04 percent of the total weighting . The conglomerate General Electric was the last remaining of the twelve companies listed in the index introduced in 1896 and thus the longest time represented until it was replaced by Walgreens Boots Alliance on June 26, 2018 . Apple was promoted to the Dow Jones on March 18, 2015, replacing AT&T . The telecommunications company AT&T was in the index from 1916 to 2004 and from 2005.

The Dow Jones Industrial Average consists of the following companies (as of March 4, 2020):

| Surname | Branch | logo | Index weighting in% | admission |

|---|---|---|---|---|

| Boeing | Aircraft construction | 7.09 | March 12, 1987 | |

| UnitedHealth | Insurance | 7.25 | Sep 24 2012 | |

| Goldman Sachs | Investment banking | 5.23 | 23 Sep 2013 | |

| Home Depot | retail trade | 6.04 | Nov 1, 1999 | |

| 3M 1 | Conglomerate | 3.85 | Aug 9, 1976 | |

| Apple 2 | Hardware, software | 7.58 | March 18, 2015 | |

| MC Donalds | food | 5.18 | Oct. 30, 1985 | |

| IBM | Information technology | 3.36 | June 29, 1979 | |

| Caterpillar | mechanical engineering | 3.19 | May 6, 1991 | |

| Visa Inc. | Financial services | 4.86 | 23 Sep 2013 | |

| United Technologies 3 | Conglomerate | 3.48 | March 14, 1939 | |

| Travelers | Banks | 3.29 | June 8, 2009 | |

| Chevron | Oil, gas | 2.47 | Feb 19, 2008 | |

| Johnson & Johnson | Pharma, consumer goods | 3.59 | March 17, 1997 | |

| JPMorgan Chase 4 | Banks | 3.00 | May 6, 1991 | |

| Disney | Media, leisure | 2.98 | May 6, 1991 | |

| American Express | Banks | 2.90 | Aug 30, 1982 | |

| Microsoft | Hardware, software | 4.27 | Nov 1, 1999 | |

| Walmart | retail trade | 2.92 | March 17, 1997 | |

| ExxonMobil 5 | Oil, gas | 1.31 | Oct. 1, 1928 | |

| Procter & Gamble | Consumer goods | 3.12 | May 26, 1932 | |

| Nike | Sporting goods | 2.35 | 23 Sep 2013 | |

| Walgreens Boots Alliance 6 | pharmacy | 1.22 | June 26, 2018 | |

| Dow, Inc. 7 | chemistry | 1.05 | April 1, 2019 | |

| Merck | Pharma | 2.08 | June 29, 1979 | |

| Intel | Information technology | 1.47 | Nov 1, 1999 | |

| Verizon Communications | telecommunications | 1.46 | Apr 8, 2004 | |

| Coke | food | 1.48 | March 12, 1987 | |

| Cisco | Information technology | 1.04 | June 8, 2009 | |

| Pfizer | Pharma | 1.02 | Apr 8, 2004 |

|

1 1976 Admission as Minnesota Mining and Manufacturing

2 2015 Replaces AT&T

3 1939 admission as United Aircraft

|

4th 1991 admission as JP Morgan & Company

5 1928 admission as Standard Oil (NJ)

6th 2018 Replaces General Electric

7th 1935 accepted as EI du Pont de Nemours and Company

|

Further stock indices in the USA

- NYSE Composite (all NYSE companies )

- Nasdaq Composite (all NASDAQ companies )

- NASDAQ-100 (100 largest NASDAQ technology companies)

- S&P 500 (500 of the largest US public companies)

- S&P 100 (Top 100 US public companies from "S&P 500")

- Russell 2000 (2000 US small caps)

- Wilshire 5000 (all US public companies)

Web links

- Index at "S&P Dow Jones Indices" (English)

- Index at Deutsche Bank

- Index at Bloomberg (English)

- Index at Yahoo

- The Dow Jones - a stock market legend. ValueBlog.de

Individual evidence

- ^ Dow Jones Transportation Average. Dow Jones averages.

- ↑ Jblaustein.de: Foreign withholding tax ( Memento from May 18, 2013 in the Internet Archive ).

- ↑ Market Data Center. The Wall Street Journal.

- ↑ methodology. Dow Jones Indexes.

- ↑ Dow sees important change to how it's calculated. MarketWatch, September 6, 2017.

- ↑ DowDuPont merger successfully completed. Dow Global, September 1, 2017.

- ↑ FT Global 500 March 2013 - Prices and market values at March 28, 2013 (PDF; 61 kB) in ft-static.com Financial Times (English).

- ↑ a b Stock values since 1884 (PDF) Dow Jones Indexes.

- ↑ a b story. MD Leasing.

- ↑ a b c d e DJIA from 1885 (daily). MeasuringWorth.

- ↑ a b c d e Stock Price Record, by Months, 1789 to Date. In: Cycles Magazine. Volume 16, Foundation for the Study of Cycles, 1965, p. 162.

- ↑ a b c The Day Stocks Rose but the Dow Plunged. Wall Street Journal, October 1, 2008.

- ↑ World Indices ( Memento of December 28, 2009 in the Internet Archive ) Yahoo.

- ↑ a b DJIA from 1896 (daily). Stooq.

- ↑ Price drop on Wall Street - stockbrokers doubt the “fat finger” theory . Spiegel Online, May 7, 2010.

- ↑ What caused the US stock market crash in May . Handelsblatt, October 1, 2010.

- ↑ Buying up government bonds: Investors cheer Draghi's euro promise . Spiegel Online, July 26, 2012.

- ↑ Governing Council meeting: Draghi announces unlimited bond purchases . Spiegel Online, September 6, 2012.

- ↑ Fed chief: Bernanke is counting on the big flood of money . Spiegel Online, September 13, 2012.

- ↑ Bonds purchase: US Federal Reserve starts new economic program . Spiegel Online, December 12, 2012.

- ↑ a b DJIA from 1928 (daily). Yahoo.

- ↑ Rule 80B ( Memento of the original from September 25, 2011 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. NYSE Euronext.

- ^ NYSE Market Model: Circuit Breakers . Archived from the original on April 2, 2015. Retrieved March 1, 2015.

- ↑ John B. Bradshaw: A Preliminary Inquiry Into the Possibility of a Relationship Between Long Term Variations in Tidal Potential and Fluctuations in an Economic Time Series. ( Memento of the original from January 4, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 13.4 MB) In: Cycles Magazine, Foundation for the Study of Cycles, Vol. 31, No. 1, 1980.

- ↑ a b Historical courses of the DJITR. Google Finance.

- ↑ DAX from 1959 (daily). Stooq.

- ↑ DAX from 1990 (daily). Yahoo.

- ↑ Statistics. Fin facts.

- ↑ Page no longer available , search in web archives: milestones and all-time high. NYSE TV.

- ↑ a b Trading interruptions on the NYSE since 1885 ( memento of the original from September 25, 2007 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 142 kB) NYSE Euronext.

- ↑ a b Best and worst days. Wall Street Journal.

- ↑ a b c d e f Bryan Taylor: GFD Guide to Best and Worst Investment Periods. ( Memento of the original from December 19, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Global Financial Data, 2002.

- ↑ a b DJIA from 1901 (daily). EconStats.

- ↑ a b DJIA from 1901 (weekly). EconStats.

- ↑ a b DJIA from 1901 (monthly). EconStats.

- ↑ DJIA from 1975 (annually). 1floor1.

- ↑ a b What to expect from a bear market. Chicago Tribune, July 10, 2008.

- ↑ Composition. indexArb.