Speculation (economy)

Speculation ( Latin speculor , "watching, peeking, explore") is in the business with a risk -prone exploiting exchange rate , interest rate or price differences within a certain period for the purpose of profit-taking . The opposite is arbitrage , which exploits these differences at a certain point in time and is therefore risk-free.

General

In contrast to everyday language understanding in economics, the term speculation is used in a value-neutral manner. In addition to arbitrage and hedging, speculation is one of the strategies in financial management . Speculation is the holding of an open position ( long and short ) on speculative objects within a certain period of time until they are closed out (sell or buy). Objects of speculation include financial instruments ( real estate , receivables , liabilities , securities , foreign exchange , sorts , precious metals , derivatives ), commodities or works of art . The sole aim of this inventory is to make a profit . Winning a successful speculation should not only be understood as a risk premium , but also as a reward for increasing operational and informational market efficiency . Since the development of exchange rates, interest rates or prices in this period at the time of the start of business is subject to uncertainty ( market risk ), speculation is a risky transaction . The speculator therefore makes a decision under uncertainty .

It is already speculation if an open position is held and - out of pure profit interest - is not closed immediately. Because of the asymmetry of transactions - buyers and sellers are usually not identical when opening and closing the same position - there is theoretically not always only one winner and one loser. Different time horizons (holding periods), directional decisions (long / short), strategies ( arbitrage , hedge or speculation) make market participants and their success or failure confusing.

species

As a rule, speculators buy a certain speculative object and sell it at a later point in time. During the speculation period you speculate on an increase in the price of the property ( bull and bear market ). However, a speculator can also benefit from a price cut. To do this, he has to choose the type of speculation of short selling , whereby he first sells an object of speculation at a high price - although he does not yet own it - in order to acquire it at a later point in time at a lower price. When speculating by means of short sales, market participants identify overvalued speculative objects and trust that the lower fundamental value of the object will lead to a price decline until the hedging transaction is concluded.

history

Speculation is as old as the trade in goods . The Dominican Heinrich Seuse first used the word "speculate" around 1362 in connection with the speculative knowledge of God. "The creatures are like a mirror in which God shines again - and to confess this is to speculate". With financial products was speculation since the establishment of stock trading at the old Amsterdam Stock Exchange in 1530, trading in government bonds received in 1672 already speculative character out there. In 1720 there was speculative trading in government bonds in England and France.

As early as March 1776, Adam Smith , in his book The Prosperity of Nations , pointed out the stabilizing effects of speculation. Even John Stuart Mill (1848) and Alfred Marshall (1919) stressed the stabilizing nature of speculation. Mill and Marshall both assumed that speculators, out of self-interest, were better informed than the rest of the market and would therefore be able to anticipate future price developments. As a result, speculators improved the intertemporal allocation, as they buy up products in times of excess supply and sell them in times of relative scarcity and therefore have a price-equalizing effect. Mill found traders' speculation useful to the general public if they were to make a profit. For Alfred Marshall, speculation is constructive. John Maynard Keynes, on the other hand, in his famous General Theory of Employment, Interest, and Money of February 1936, attributes a destabilizing effect on the markets to speculation. Keynes distinguished between the professional speculators with a superior knowledge and the "small" speculators. Keynes characterized the intention of institutional market participants to anticipate the reaction of uninformed market participants as “third-degree speculation” . In principle, Keynes saw the stock market as a purely speculative market.

The distinction between market participants and non-speculators and the associated classic definition of speculation goes back to Nicholas Kaldor , who pointed out in 1939 that a speculator is never interested in realizing a profit through the use, transformation or transfer of the speculative object. For him, there was speculation “when goods, foreign currency or other objects are bought (sold) with the intention of selling (buying) them again at a later point in time and the transaction is only carried out because a price change is expected and not because one wants to benefit from the possession of the objects, to work on them or to trade with them ”. Milton Friedman returned in 1953 to the stabilizing effect of speculation. According to Friedman, profitable speculation increases low prices, lowers high prices and thereby levels out price fluctuations. Friedman concluded from this that speculation is not the cause of financial crises, but exogenous influences such as natural disasters , wars or wrong policies . Theoretical studies have shown that profitable speculation is possible on almost all stock exchange-like organized markets, which increases price fluctuations.

In quiet market phases, predominantly non-speculative participants act, who generate a price level based on the fundamental data, resulting in prices of equal weight. If the speculators determine the market price largely alone, the market price can "overshoot" and thus have a destabilizing effect and develop speculative bubbles . A speculative bubble causes courses / prices to move away from their fundamentally efficient equilibrium course , only to return to their initial value after the bubble has burst. The aggregated speculation said William Baumol to trend intensifying effects so they THAT CONDITION destabilizing. In 1957 Baumol tried to refute Friedman by attesting speculative purchases or sales to have procyclical (trend-enhancing) effects.

Economic functions

Speculation fulfills some useful functions, whereby a distinction must be made between economic and business functions.

Economics

Price equalization function

Speculation leads to a stabilization of the price level. Market participants buy a speculative object at a low price. Because they expect prices to rise. If prices actually rise, speculators sell and thereby lower the price. As a result, the price level converges to the equilibrium price .

The classical and modern theories of speculation are dominated in particular by the dispute over this price-stabilizing effect of speculation. Since 1963, modern theories have focused on the information efficiency of the markets as a stabilization criterion. Classical speculation theory solves the problem of price expectations by providing all speculators with perfect foresight with regard to non-speculative price developments. In any case, speculation is considered to have a stabilizing effect on prices if the amount of price fluctuations - measured against the frequency of price fluctuations - is reduced.

In the context of (intertemporal) resource allocation , financial resources are used by speculators exclusively for the purpose of speculation. You then decide against other uses such as saving , consuming or investing . However, the speculative gain should not (solely) be achieved through the exploitation of a speculative object in the sense of a change in the allocation of resources, but above all through the exploitation of the element of uncertainty. Only speculators enable the transfer of risk to other market participants, so that speculation promotes the optimal allocation of risk in the markets.

Insurance function

The insurance function (risk relief) of speculation was recognized by Keynes and John R. Hicks . The business partners of the speculators engaged themselves exclusively for the purpose of risk reduction, while the speculators act in the role of risk takers. It can be explained by the fact that the speculators take on the price change risk of their speculation as risk bearers and take it off their business partners. Manufacturers, processors and buyers of goods and raw materials need to be relieved of speculative risks, for which, as the opposite side of the market, speculation is almost exclusively available. In the insurance function, speculative market participants enable other actors to use hedging to reduce the risks that they would have to bear as a result of their activities. Without risk-taking speculators, some of the risk-averse market participants would have to bear their own risks.

Liquidity and efficiency function

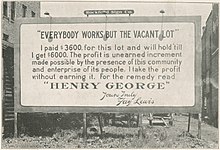

Without the security of being able to buy and sell speculative objects at any time, these objects are unsuitable for speculators, even with high price fluctuations ( liquidity function ). Therefore, the lack of liquidity makes it difficult, for example, to speculate on land and property . Speculators willing to sell must therefore find a liquid market that has enough buyers and vice versa. The market liquidity ensures a high transaction speed, which is essential for speculators. Speculation increases (at least in phases of low price fluctuations) the market liquidity. Another function of speculation is to help identify prices .

Speculation has no supply function , because assets are acquired through purchase which are only held for speculative purposes and are not intended to serve their actual purpose. The speculator is not interested in the speculative object, but only in the expected profit.

Business administration

As part of the operational resource allocation, companies use financial resources or material resources in order to achieve a price or exchange rate gain. The term resource allocation, which originates from microeconomics , is understood in business administration to mean the allocation of resources ( labor , financial resources , material resources ) to projects. These resources are used in a targeted manner as part of the resource allocation. The holding of stocks ( raw materials , consumables and supplies ) and finished products contains speculative elements (open inventory position), but these are overlaid by the actual operational purpose - production for the purpose of sale. The main goal of the company is to maximize profit from the production process , so that the holding of stocks serves exclusively the production purpose and does not have a speculative character. Speculation is non-banks before but when other open positions of current assets (securities, currencies) and liabilities ( foreign currency loans not) by hedging hedge. Medium and long-term bank balances / bank loans that are equipped with variable interest rates and therefore carry an interest rate risk are speculative . In these cases, companies speculate in order to maximize profits. The speculative profit must be adjusted by the costs of speculation ( transaction costs ) and the costs of holding the property such as storage , financing costs and insurance premiums (so-called cost of carry ). Speculation can cause economic damage if companies "allow themselves to be drawn into" speculation.

At banks , speculation is carried out as part of proprietary trading . Proprietary trading is carried out in your own name and for your own account (not for bank customers) in order to achieve short-term trading profits and thus meets the definition of speculation. Certain refinancing behaviors (assuming an interest rate risk in the event of mismatches) are also of a speculative nature; they are part of the transformation contribution. One form of speculation is trading on the financial futures market.

Negative Effects of Speculation

The market behavior of speculation is based on expectations, which may come true or be disappointed. Disappointed speculation leads to the destabilization of the markets. If there is a sufficiently high degree of homogeneous expectations in a market, market participants tend to herd behavior and positive feedback trading, which reinforces existing market trends and increases the volatility of market prices.

Speculative bubble

If speculation is now increasing due to optimistic expectations regarding the continuation of the trend, speculators even take out bank loans for additional speculation and capacity expansions occur , the fundamental values of the real economy can no longer keep up with the rates / prices assigned to them; ultimately a speculative bubble arises. Adam Smith described this situation as early as 1811 with "overtrading" (over-speculation). As a result of speculation, the stock market is increasingly moving away from the underlying fundamentals; increases in assets, wages and employment lead to higher consumption. However, it is not only the prices of the speculative objects that rise, but also the interest rate level because of the borrowing . A speculative bubble occurs when market prices deviate significantly from their fundamental values and this deviation does not go away even if investors know that the price is above the fundamental value.

Trend reinforcement

According to critics, speculation can help market trends intensify and create bubbles. Speculators are blamed for currency crises and economic crises such as the Argentina crisis or the Asian crisis . Some economists (e.g. globalization critics , see also free economy ) therefore take the view that speculation should be made more difficult or even prohibited. The introduction of financial transaction taxes , especially a Tobin tax , is justified by the proponents with the hoped-for containment of speculation. According to the prevailing view in economics, the associated higher transaction costs reduce arbitrage and thus the efficiency of the markets, which would even make speculation easier. The empirical research results show a clear positive relationship between transaction costs and the volatility (instability) of the market price.

Financial crisis

While the speculative bubble is invariably a result of previous speculation, financial crises can have other causes as well. Speculation can, however, cause or exacerbate financial crises. In the case of price-destabilizing speculation with an macroeconomically negative net welfare effect, there is a risk of a financial crisis. This requires that speculation - which is concentrated on one market - spreads to the economy as a whole or the conditions on the speculative market infect the rest of the economy . High lending rates as a result of a speculative bubble affect inflation and cause asset prices to fall. The result is losses that can lead companies into a corporate crisis - the most important indicator of a financial crisis.

Ethical criticism

Economic speculation is an activity that is viewed negatively by some ethicists . However, this view is controversial.

Making a profit

The aim of every speculation is the speculative profit. This is collected by the speculator when he closes his speculative business. Then there is a positive difference between the lower acquisition cost and the higher sales price. According to Section 23 of the Income Tax Act (EStG), this speculative profit is taxable in Germany and often also internationally if certain speculative objects are acquired and sold within a certain speculation period. However, since there is an inherent uncertainty in every speculation, there can also be a loss of speculation.

Demarcation

For investment , the speculation borders on the fact that the investor is not interested in profits from the purchase and sale of an investment, but only the income of the investment ( interest or dividends will collect). An investor is also interested in the capital investment and is characterized by long holding periods (“buy and hold”). The extreme speculator, on the other hand, holds financial products in the context of high-frequency trading or automated trading for a very short time (seconds or minutes) and achieves high sales. Arbitrage deals entered into at a certain point in time and closed out at the same time (elsewhere) are risk-free, as all information about rates, interest rates or prices is already available at the time of the conclusion of the deal and therefore decisions are made with certainty .

Others

“Hot money” is the term used to describe money that is temporarily shifted from one country to another for reasons of speculation on the money or currency markets . These funds achieve economic significance above all if they are withdrawn just as quickly and have a crisis-intensifying effect.

When rating agencies are available for rating the rating category "speculative"; the creditworthiness is classified as not worth investing. The speculative objects classified in this way ( states , companies , issues such as stocks or bonds ) are subject to a particularly high risk and are highly at risk of default .

See also

literature

- Hans-Heinrich Bass : The relevance of speculation (PDF; 1.1 MB) , in: Rural 21. The International Journal for Rural Development, 05/2011, pp. 17-21.

- Nasser Saber: Speculative Capital. Financial Times, Prentice Hall 1999

- Volume 1: The Invisible Hand of Global Finance. ISBN 0-273-64155-7

- Volume 2: The Nature of Risk in Capital Markets. ISBN 0-273-64422-X

- Urs Stäheli: Spectacular speculation. The popular of the economy. Suhrkamp Verlag, Frankfurt am Main 2007, ISBN 3-518-29410-5

- Plump, Werner: economic crises. History and present. Beck, Munich 2010. (Beck Wissen, 2701) ISBN 978-3-406-60681-6 (esp. Pp. 11–16: The crises and speculation. )

Web links

- Keyword speculation in the Lexicon of the Social Market Economy of the Konrad-Adenauer-Stiftung

- The big speculators , series of the Süddeutsche Zeitung

- Arne Storn: Few gentlemen with many billions. How big speculators bet huge sums of money against banks, real estate buyers and whole currencies. In: Die Zeit 20/2010 from May 12, 2010

- Are Speculators Bad? In: Die Zeit 36/2010 from September 2, 2010

Individual evidence

- ↑ Ulrich Stephan, Information Efficiency of Equity Index Options , 1998, p. 39.

- ↑ Fernando De Filippis: Currency Risk Management in Small and Medium-Sized Enterprises , 2010, p. 50 f.

- ↑ Friedrich Schlimbach: Short Selling: The Regulation of Covered and Uncovered Short Selling in the European Union , 2015, p. 17.

- ↑ Markus Enders: Seuse's mature spirituality in his time in Ulm , 2010, p. 74

- ^ Adam Smith, An Inquiry into the Nature and the Causes of the Wealth of Nations , Volume 1, p. 18

- ↑ John Stuart Mill: Principles of Political Economy , Vol. II, 1848, p. 279.

- ^ Alfred Marshall: Industry and Trade , 1919, p. 264.

- ↑ John Stuart Mill: Principles of Political Economy , Vol. II, 1848, p. 257.

- ↑ John Stuart Mill: Principles of Political Economy , Vol. II, 1848, p. 717.

- ^ Alfred Marshall: Industry and Trade , 1919, p. 252.

- ^ John Maynard Keynes: The General Theory of Employment, Interest and Money , 1936, p. 156.

- ^ John Maynard Keynes: The General Theory of Employment, Interest and Money , 1936, p. 130.

- ^ Nicholas Kaldor: Speculation and Economic Stability , in: The Review of Economic Studies, Vol. 7, 1939, p. 1.

- ^ Milton Friedman, The Case for Flexible Exchange Rates , in: Friedman, Essays in Positive Economics, 1953, p. 23

- ↑ Michael J. Farrell, Profitable Speculation , in: Economica, Vol. 33, 1966, pp. 183-193

- ↑ Jörg Schimmler, Speculation, Profitability, and Price Stability - a Formal Approach , in: The Review of Economics and Statistics, Vol. LV, No. 1, 1973, pp. 110-114.

- ↑ Nicholas Kaldor: Speculation and Economic Stability , in: The Review of Economic Studies, Vol. 7, 1939, pp. 10 ff.

- ^ Nicholas Kaldor: Speculation and Economic Stability , in: The Review of Economic Studies, Vol. 7, 1939, p. 2.

- ^ William J. Baumol: Speculation, Profitability, and Stability , in: The Review of Economics and Statistics, Vol. 39, No. 3 (August 1957), p. 263 ff.

- ^ Oswald von Nell-Breuning: Grundzüge der Börsenmoral , 1928, p. 140.

- ↑ Celso Brunetti, Bahattin Buyuksahin: Is speculation destabilizing? ID 1393524. Social Science Research Network, Rochester, NY April 22, 2009, doi : 10.2139 / ssrn.1393524 ( ssrn.com [accessed July 19, 2020]).

- ↑ Christopher Knittel, Robert Pindyck: The Simple Economics of Commodity Price Speculation . w18951. National Bureau of Economic Research, Cambridge, MA April 2013, p. w18951 , doi : 10.3386 / w18951 ( nber.org [PDF; accessed July 19, 2020]).

- ↑ Holbrook Working: New Concepts Concerning Futures Markets and Prices , in: The American Economic Review, Vol. 52, 1963, pp. 445 ff.

- ↑ Martin Henssler: Risk as subject of the contract , 1994, p. 291.

- ↑ David Mengle: ISDA Research Notes , 2/2010, p. 6.

- ^ John Maynard Keynes, A Treatise on Money , 1930, pp. 143 f.

- ↑ Hans Otto Lenel / Helmut Gröner / Walter Hamm / Erich Heuß / Erich Hoppmann / Ernst-Joachim Mestmäcker: ORDO 51: Yearbook for the Order of Economy and Society , Volume 51, 2000, p. 83.

- ↑ Jürgen F. Baur / Klaus J. Hopt / K. Peter Mailänder: Festschrift for Ernst Steindorff on his 70th birthday , 1990, p. 479.

- ↑ Hans Otto Lenel et al. a. (Ed.): ORDO 62: Yearbook for the Order of Economy and Society , Volume 62, 2011, p. 121.

- ↑ Bernhard Emunds: Political Business Ethics of Global Financial Markets , 2014, p. 90.

- ↑ Marc JM Bohmann, David Michayluk, Vinay Patel: Price discovery in commodity derivatives: Speculation or hedging? In: Journal of Futures Markets . tape 39 , no. 9 , 2019, ISSN 1096-9934 , p. 1107–1121 , doi : 10.1002 / fut.22021 ( wiley.com [accessed July 19, 2020]).

- ↑ Rainer Völker / Eric Kasper: Internal Markets in Research and Development , 2004, p. 17.

- ^ Oswald von Nell-Breuning: Grundzüge der Börsenmoral , 1928, p. 143.

- ↑ Horst Siebert / Oliver Lorz: Introduction to Economics , 1969, p. 95 f.

- ↑ an investment behavior that shows itself through the purchase (sale) of speculative objects whose prices have risen (fallen)

- ^ Christian Köhler: The permissibility of derivative financial instruments in companies, banks and municipalities , 2012, p. 93.

- ^ Adam Smith / Dugald Stewart: The Works of Adam Smith , 1811, p. 160.

- ↑ Tavy Ronen / Daniel G Weaver: Teenies' Anyone? , in Journal of Financial Markets Vol. 4, 2001, pp. 231-260.

- ^ Harald Hau: The Role of Transaction Costs for Financial Volatility: Evidence from the Paris Bourse , in: Journal of the European Economic Association. June 2006, Vol. 4, No. 4, pp. 862–890 ( PDF; 2.01 MB )

- ↑ John A. Ryan: The Ethics of Speculation . In: International Journal of Ethics . tape 12 , no. 3 , 1902, ISSN 1526-422X , p. 335-347 , JSTOR : 2376347 .

- ↑ James J. Angel, Douglas M. McCabe: The Ethics of Speculation . In: Journal of Business Ethics . tape 90 , no. 3 , December 1, 2009, ISSN 1573-0697 , p. 277-286 , doi : 10.1007 / s10551-010-0421-5 .

- ↑ Michael F. Martin, Wayne M. Morrison: China's "Hot Money" Problems , in: CRS Report for Congress, July 21, 2008 , PDF