Debit card

A debit card (from latin debere , debt ', English debit , set', 'account debit') is a credit card, savings bank card or ATM card (trademark, Austria) used for cashless payment or cash at the ATM may be used. Debit cards are one of the forms of payment cards .

General

The chip card is usually a card made of plastic (usually PVC ) in the ISO-7810 format. In contrast to credit cards , after a purchase has been made with the card, the cardholder's current account is debited immediately or within a few days .

For historical reasons, the term check card is also incorrectly used, as this card was used for redemption authorization (signature verification, etc.) at the time of euro checks . It is also often referred to colloquially in Germany as the Eurocheque card .

history

Today's debit card has European and US origins. In Europe, the Eurocheque card was developed and issued from 1968. As a guarantee card for a Eurocheque, it first enabled cash withdrawals in financial institutions and later also cashless payments.

In the USA, ATM cards (Automated Teller Machine) could be used to withdraw cash from ATMs using a PIN . Later they made cashless payments possible at POS terminals (POS = point of sale ) in shops.

European origin - eurocheque card

The Eurocheque and the EC card guaranteeing it were the first cross-institute and cross-border payment system with a card. Initially, it was not a debit card; it was not possible to make cashless payments. It only identified the holder as an authorized representative of the bank when a guarantee agreement was concluded between the bank and the check recipient. Outside of Europe (especially in the USA) several check guarantee systems were implemented that remained local, national or regional and did not lead to a global solution.

The name of the payment service based on a check and a plastic card became one of the first brands in the banking sector. At the same time, the Eurocheque was the first cross-border service of its kind in Europe. The popularity of the EC card meant that its successor, the Maestro card , often still bears the EC logo in Germany . It was reinterpreted as "Electronic Cash" and the cards continued to be called "EC Card" in everyday language.

With the advent of cash machines (ATM) since the late 1970s / early 1980s, the EC card was used as a service medium in several countries - in addition to its traditional function as a guarantee card for Eurocheques. Thus a first debit function, the direct debiting of ATM withdrawals, was added. From June 1, 1984 it was possible to carry out cross-border ATM transactions using the national ATM networks on the basis of a common interchange standard. Under the EC logo, this service quickly became a standard feature of eurocheque cards and European ATMs.

The next steps to further develop the eurocheque card into a comprehensive debit card have taken place since the end of the 1980s / beginning of the 1990s under the edc brand as a European POS function in addition to the EC symbol as a European ATM function. Due to the advancing globalization of the economy with special consideration of cross-border payment transactions, the two functions have been merged since 1993 as global debit functions for ATM and POS use under the Maestro logo . The Eurocheque card thus became an electronic debit card that can be used worldwide. The Eurocheque guarantee was discontinued at the end of 2001 due to the decreasing importance of the paper-based Eurocheque.

American Origin - ATM Card

With the advent of ATMs in the US Automated Teller Machines called (ATM), the first ATM cards were issued in the 1970s. They were used to withdraw banknotes from ATMs with a card and PIN. They were originally issued exclusively by financial institutions for their own customers to use at their own ATMs. The debit was made on the customer's checking account . These ATM cards were therefore typical debit cards.

Due to the fragmentation of the US banking system, the increasing mobility of customers and the high costs of setting up and operating such ATM systems, joint ventures soon formed that technically processed ATM transactions via their electronic funds transfer networks ( EFT networks ) ( switches ) . The ATMs and ATM cards of the financial institutions involved were provided with the logo of the respective EFT network, so that the cardholders were able to use their ATM cards beyond the ATMs of their own financial institution.

After cash withdrawals at ATMs with cards and PINs had prevailed, cashless payments had become possible using the same procedure at POS terminals and the bank-related and local POS systems had failed due to the lack of frequency, the regional, bank-neutral and interoperable ATMs took over Switches also performed this function and thus created comprehensive EFTPOS networks with single messaging (authorization and clearing in one transaction). Instead of being debited from the checking account for an ATM cash withdrawal, the debit is made for a POS payment.

The cards used for the POS transactions within the EFTPOS network remained the same and are today - although there are now more POS than ATM transactions - colloquially called ATM cards. In addition, there are Mastercard or Visa cards with these functions so that the cardholder can decide at the POS whether to pay with signature (clearing and settlement via MasterCard or Visa) or with PIN (clearing and settlement via switch ), if that is the case Card payment accepting companies provide both payment options. If only one of the two payment options is offered, the POS transaction is processed using this method. In the case of ATM transactions, routing and thus clearing and settlement take place via this switch , as long as the transaction takes place at an ATM that is connected to the switch listed on the card . Outside of this range, the transaction is a MasterCard or Visa cash withdrawal.

Since the PIN-based POS transactions are cheaper to process with these debit cards and the risks are lower than those of the signature-based credit card transactions in retail and service companies, the merchant is charged lower fees for them than for accepting credit cards. Nevertheless, this form of card transactions got off to a tough start in the USA - the payment habits of Americans first had to change, and not only there they are slowly changing. Today these "regionals" are the dominant network operators there.

In terms of acceptance points, food retail outlets and petrol stations were dominant for many years. It wasn't until the mid-1990s that POS terminals with PIN pads began to spread across all industries. Overall, PIN transactions are now accepted by a wide range of companies. The reason for this growth was that the POS terminals with PIN pads became increasingly cheaper, which made the purchase commercially sensible due to the differences in the lower debit card fees compared to the higher credit card fees. It can be assumed that in the future all terminals in the USA will allow signature-based transactions (predominantly with credit cards) and PIN-based transactions (predominantly with debit cards).

Up until the mid-1990s there was an abundance of EFTPOS networks that processed PIN transactions with the cards of their shareholders - almost exclusively banks. In the years that followed, however, there was a wave of consolidation that brought with it a concentration that had hitherto been considered impossible. The aim of these mergers was the pursuit of more transactions in order to come to lower settlement costs. At the same time, most of the shareholder banks gave up their holdings in EFTPOS networks . This gave non-banks the dominant position in cashless payments via debit cards.

From Eurocheque and ATM cards to global debit cards

Based on the two origins and the creation of various credit card clones with prompt debiting from the current account / check account , a wide range of debit cards was created.

After the eurocheque service was discontinued at the end of 2001, only the ATM and POS functions remained with the former Eurocheque cards. More or less all 72 million Eurocheque cards already bore the Maestro logo - the logo for the online PIN debit product of the MasterCard organization - and enable their cardholders to make worldwide payments and withdraw cash with cards and PINs. Some of these cards have the Maestro function for cross-border transactions in addition to a national debit function for transactions in the respective country, while others also use the Maestro logo as a domestic brand, so that the cardholder only has to look out for one logo.

As in the USA, there were also pure ATM and later ATM and POS cards in Europe - somewhat delayed - usually for national / institute-specific ATM networks and POS payment systems. In order to achieve broader use, these have been provided with the debit logos of international card organizations. Both Maestro and the Visa organization gained additional cards from this pool. Of the Visa debit brands, Visa Electron - an online debit product based on signature for POS payments and PIN for cash withdrawals at ATMs - is the most popular.

In the USA, with the increasing concentration of switches, a boom began in ATM and POS cards, which are now issued by almost all financial institutions. These cards are often provided with several Switch logos, if a financial institution does not only conduct private customer business in one region.

Today, Concord EFS is the dominant switch with the big Switch Star, where the former Honor, Mac and Cash Station switches have now been integrated, and with NYCE , a large switch in the eastern United States that is soon to be incorporated into Star. The market share of this group in POS transactions is now over two thirds (2002). Concord EFS has now been acquired by FDC , one of the largest providers of credit card contract corporate services in the United States.

With the upward trend in the credit card business, US banks soon realized that, on the basis of card processing at the POS according to the rules of MasterCard and Visa, there would also be a direct debit to the check account for those customers who were not eligible for a credit card or who were receiving are not interested in a revolving credit , often makes sense. These cards - MasterCard MasterMoney or Visa CheckCard - can be accepted by all MasterCard or Visa contractual partners with POS terminals for cashless payment. Every transaction is authorized online by the card-issuing bank. As with credit cards, the data transfer for clearing and settlement takes place afterwards. The cardholder verification takes place at the POS as with credit cards by signature.

Most of these debit cards with the MasterCard or Visa logo also have the logo of one of the large US switches, so that the transaction is a MasterCard or Visa transaction with signature or a switch transaction with PIN, depending on the decision of the cardholder at the POS if the company accepting the card payment offers both payment options. If the retail or service company only offers one of the two payment options, the POS transaction is carried out using this method. For ATM transactions, routing (and thus clearing and settlement) to the respective switch is primary and secondary to MasterCard or Visa.

The two largest debit card systems in the world, Maestro and Visa Electron, are currently trying to participate in the rapidly growing debit card market

- in those countries where there are already existing local / regional / national debit card systems to integrate them into their systems and

- to create a debit card base by issuing cards via member banks in those countries where debit cards are not (yet) widespread.

There is a trend that more and more debit cards are becoming globally applicable debit cards. At the same time, Maestro and Visa Electron are making massive efforts to ensure card acceptance worldwide through the acquisition of contract companies with appropriate POS terminals.

The successive replacement of the globally applicable Maestro card with the V-Pay card, which is currently limited to Europe, represents an at least temporary change in the internationalization of debit cards.

With the Monnet project since 2009, German and French banks have planned to establish a European debit card. In addition, two competing systems are being planned with PayFair and EAPS .

Debit systems

Differentiation according to provider

Girocard

The debit card Girocard comes from the Deutsche Kreditwirtschaft (DK) . For use abroad, these cards usually have an international co-branding of Maestro or V Pay . As a rule, the Girocard is given priority when paying and the co-branding is only used if Girocard is not supported at the point of sale. Girocard replaced the EC card in 2007 ; the outdated term EC card is a brand of Mastercard .

maestro

The Maestro card is a debit card from Mastercard that has existed since 1992 . In Germany, the Maestro can often be found as co-branding on the Girocard so that cardholders outside Germany can also make cashless payments. In many other countries such as B. Austria it is the standard payment system of the banks. In Germany, the Maestro card is often confused with the earlier Eurocheque card or the current Mastercard EC card, the Debit Mastercard, because the EC cards of that time usually had the Maestro logo very prominently on the front of the card. and many dealers do not know the differences between the systems.

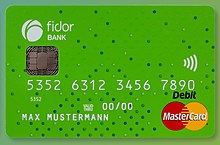

Debit Mastercard

Debit Mastercard is a debit system that is mainly used in the USA, but also worldwide. Mastercard also operates the Maestro card infrastructure . Cirrus is MasterCard's ATM brand. A card with the Cirrus logo can be used worldwide at ATMs that also have the Cirrus logo, and is often compatible with Maestro. In Germany, the name Mastercard is more likely to be associated with the credit card issued under the same name. Mastercard debit cards can usually be recognized by the “Debit” printed above the Mastercard logo. Due to the slightly lower fees for using the card, payments with debit cards are sometimes a little cheaper than with the credit cards of the providers. Both Maestro and Mastercard cards (debit and credit) are available for contactless payments under the additional designation Paypass with NFC .

VISA

VISA Debit is a large debit system from the USA and also represented worldwide. In France z. B. VISA cards are optionally debit or credit cards. In addition to the VISA credit card or debit card, the company also operates the V Pay debit card and the VISA Electron card, which can be issued as debit, credit and prepaid cards. PLUS is also Visa’s ATM brand.

Differentiation by country

Often national and international systems are also combined on one card.

- EFTPOS in Australia and New Zealand

- Bancontact in Belgium

- Mister Cash in Belgium

- Dankort in Denmark

- Point of sale without payment guarantee (POZ) in Germany

- Electronic direct debit (ELV) in Germany

- Girocard in Germany

- Cartes Bancaires (CB) in France

- Solo and Switch in Great Britain, now replaced by Maestro

- Laser in Ireland, now replaced by international payment systems

- Pago Bancomat in Italy

- Interac in Canada

- PIN in the Netherlands, now replaced by "pure" Maestro or V Pay

- BankAxept in Norway

- ATM (trademark) in Austria

- Multibanco in Portugal

- Postcard in Switzerland

- Telebanco in Spain

- Servired in Spain

- NYCE in the USA

- Pulse in the USA

- Star in the USA

- Interlink in the USA

Since in Europe debit cards are mostly issued by banks in connection with a current account and the fees for payment transactions with debit cards are significantly lower, they are more popular than credit cards. The back of the debit card has a magnetic strip that contains important information for processing transactions. Since the mid-1990s, many of the bank cards (Sparkasse cards) issued in Germany have also been equipped with an EMV chip . This is a prerequisite for using the electronic wallet function . In Germany, the banks and savings banks issued around 92 million debit cards (as of 2007) and in Austria over 8 million (as of 2005).

safety

In order to prevent abuse , you have to authenticate yourself when using it . This is usually done by entering a secret number ( PIN ) or a signature .

Debit cards in Germany contain a dielectrically embossed identification code that is read capacitively. In contrast to the magnetic stripe, the so-called MM feature (modulated feature) is difficult to copy. Fraudulent cash withdrawals with duplicates are mainly made abroad, where the MM feature is not read.

German debit cards can be blocked via the emergency number 01805 021021 (costs up to 42ct / min). Since July 2005, the emergency number 116 116 has been used in Germany for all blocking processes . However, not all banks currently support the blocking of the card via the central emergency number, and the identity of the caller is not verified. In the event of theft or loss, in addition to the obligatory report to the police, the debit card should also be blocked for direct debit use via the hotline 0800 1044403 (free of charge from the German landline and mobile network) or via the Internet.

Austrian Maestro cards can be blocked via the emergency number 0800 2048800 (in Austria and free of charge) or via the emergency number +43 1 2048800 (from outside Austria). According to a court ruling in November 2015, banks are no longer allowed to charge their customers for blocking their debit or credit card since the Payment Services Act (ZaDiG) came into force at the beginning of November 2009.

Situation in individual countries

Due to the distinction between national and international systems, the distribution and acceptance situation in the individual countries is extremely different. While some countries mainly rely on one or more national systems. This can lead to considerable problems with the acceptance of foreign cards, others rely exclusively on international solutions or real parallel operation.

Germany

In Germany, a debit card is legally a payment card (according to Section 152a Paragraph 1 No. 1 StGB in conjunction with Paragraph 4 StGB).

There is a national debit card system under the name girocard , which is by far the most frequently used. However, this system only works with German debit cards that have the girocard logo. While the savings banks have a well-developed network of vending machines, the other banks have formed associations ( Cash Group and Cashpool ) that enable their customers to withdraw cash free of charge within the same association.

The international functionality of the girocard is ensured by so-called co-branding with Maestro or V Pay . Almost every German debit card is a girocard and Maestro card or V-Pay card at the same time and can therefore be used at all Maestro or V-Pay acceptance points. The V-Pay system was introduced by Visa as a competitor to Maestro, but only works in Europe and there only on chip-compatible terminals. Use outside of Europe is no longer possible. Since June 2016, customers have been able to choose whether to pay with girocard, Maestro or V-Pay when paying.

Maestro or V-Pay cards are not accepted at pure girocard terminals, nor are Mastercard or VISA. Each acceptance point must enable the use of the respective acceptance brand through a corresponding agreement with their respective payment service provider, which is usually associated with additional costs. Particularly in local retail and mostly in smaller shops, the acceptance of debit cards other than the girocard cannot be expected. Some payment service providers operating in Germany without a fixed basic fee for the merchants do not accept girocard, but use Maestro and V-Pay co-branding of the cards. Examples of these are iZettle and SumUp .

There is also the possibility of co-branding girocard + JCB ; such a product has also been offered in Germany since around 2018. Co-branding with Visa Debit or Debit MasterCard is not yet available.

Pure Maestro cards without a girocard function are only very rarely issued in Germany.

MasterCard debit credit cards are also increasingly being offered in Germany, while Visa debit credit cards are still very rare.

It is now possible at an increasing number of retail tills to withdraw cash while shopping.

Austria

The debit card system used across the board is Maestro, all domestic and foreign Maestro cards are accepted.

Maestro cards were also often used as Quick cards. However, this functionality was discontinued on July 31, 2017.

Since 2013, only NFC-enabled cards have been issued for contactless payments. This allows amounts of up to 25 euros to be paid at suitable terminals without having to insert the card. It is also possible to pay with NFC-enabled smartphones at these terminals. The “digital ATM card” was tested in a field trial from June 2015 and has been offered by all major banks and the three major mobile phone providers since the beginning of 2016, but only for Android devices. It is necessary to exchange the SIM with an NFC SIM at the mobile phone provider ; new customers have not yet been automatically equipped with it. The digital ATM card can then be ordered from the house bank in addition to a real ATM card.

Since April 8, 2019, Erste Bank und Sparkasse has been issuing the Debit Mastercard as a debit card instead of the Maestro card to its customers and would like to replace existing cards by the end of 2020. This step was justified with the better acceptance worldwide and on the Internet.

Switzerland

One of the two debit card systems used across the board is Maestro; all domestic and foreign Maestro cards are accepted. The former national EC system, which was not identical to the German electronic cash and only worked with Swiss cards, has now been completely integrated into Maestro.

In addition, there with the PostFinance Card to the system PostFinance another national debit card network, which is also widely available is (usually Maestro and PostFinance Card are accepted from all points of acceptance alike). The PostFinance Card can be used for cashless payments within the framework of EUFISERV not only in Switzerland, it is also possible to withdraw cash at ATMs from all banks affiliated with EUFISERV.

Cards with V Pay, Visa Debit and Mastercard Debit are now also available in Switzerland. Unlike with Maestro, banks and card companies can benefit from kickbacks here .

Ireland

The largest debit card system in Ireland was called "Laser" and was only introduced in 1996, before only credit cards were available. Laser cards have been issued by seven banks and can be used in stores, as well as when ordering by mail / phone and on the internet. For use abroad, they are usually branded with Maestro or Cirrus .

In contrast to most Irish banks, the British bank Halifax does not issue a laser card in Ireland, but a “Visa Debit” card as in Great Britain. The Irish Postbank, on the other hand, issues Maestro cards (without laser).

The laser system was completely abandoned in February 2014 after several banks dropped out and instead issued Visa Debit or Debit MasterCard.

As in Great Britain, all cards have a “Chip and PIN” feature.

Italy

There is a widespread national debit card system under the name PagoBancomat. This system only works with Italian cards. Most Italian banks issue PagoBancomat cards co-branded with international systems such as Maestro or - if the customer has the appropriate creditworthiness - also with credit cards. Unlike in Germany, the functionality of the respective international system can also be used at all corresponding acceptance points in Germany.

In addition to PagoBancomat, international debit card systems such as Maestro are also widespread in Italy, which largely ensures the usability of foreign cards, at least in areas relevant to tourism. Smaller shops in particular (local supermarkets), however, often continue to use a pure PagoBancomat solution if they allow cashless payments at all, and thus exclude foreign customers from paying by card.

The Italian Postbank does not issue PagoBancomat cards to its customers, but so-called Postamat cards. Initially, these were mainly used for cash withdrawals, but they are still only very rarely accepted for cashless payments (Postamat payments are possible , for example, at motorway tollbooths ). However, this poor acceptance situation was largely defused through co-branding with Maestro that can also be used domestically.

Netherlands

Before 2012 there was a national payment system called PIN. PIN debit cards were issued with an EMV chip and, thanks to co-branding with maestro, could also be used abroad. PIN was extremely popular in the Netherlands and accepted in almost every store, as were international Maestro and V-Pay cards. The PIN no longer exists in 2012 and banks only issue cards with Maestro or V PAY. Like the PIN co-brand cards, they are equipped with an EMV chip. Paying with the bank card is still popular. However, the acceptance of Visa Debit and Debit MasterCard is low. In common parlance, cashless payments are called “pinning”.

Poland

Banks in Poland mainly issue the international Visa Debit or Debit MasterCard.

Portugal

With the Multibanco system, a uniform debit card and ATM system for all banks in the country was created in Portugal in 1985. Their widespread machines accept most of the international debit cards, but limit the payouts to 400 euros per day.

United Kingdom of Great Britain and Northern Ireland

The UK mainly uses international debit card systems. British banks issue either “Visa Debit” cards (formerly: Visa Delta), Debit MasterCard or Maestro cards (formerly: Switch ). "Visa Electron" (instead of Visa) and " Solo " (instead of Maestro) play a secondary role . These cards are mainly given to minors or account holders with low credit ratings, as they only work with online authorization and cannot be overdrawn.

All cards also have the "link" function for cash withdrawals at ATMs, Solo cards have a Maestro logo on the back for making payments abroad. All cards (Visa Debit, Maestro, Electron, Solo) can be used to pay in shops as well as for orders by post / telephone and on the Internet, as the British Maestro cards (unlike the German ones) have a 16-digit Card number are provided. British debit cards are always equipped with an EMV chip and can only be used in terminals by entering the PIN. This system is called “Chip and PIN”.

Historical debit cards

EC card

Debit cards from many German credit institutions are combined EC / Maestro cards, whereby "EC" no longer stands for "eurocheque", but for the German electronic cash debit card system . Many shops in Germany only accept Electronic Cash (or ELV / POZ ), but not V Pay or Maestro. This is not noticeable for the majority of German customers, as their cards are compatible with electronic cash anyway. The former EC card has been called girocard since 2007 . However, customers with Maestro or V-Pay cards often find that their cards are not accepted.

GDR money card

From 1983 the development of an electronic check card system began in the GDR . Every holder of a current account could receive a so-called "money card" and thus withdraw money free of charge from all ATMs in the country within the scope of their account balance - there were no overdrafts as in the current form. In contrast to today's debit card, the application was not signed on the card, but on the application. The signature could not be smudged and was forgery-proof. A passport photo was also stuck on the application. The application itself thus also represented the actual “blank” for the card. You could also choose your PIN when applying. This was entered using a numeric keypad and encoded (with a floppy disk) with the application. In addition to the name and account number, the card also contained the personal identification number. However, until the end of the GDR, the network of ATMs was not very dense, so that this system could only prevail in larger cities.

When the monetary, economic and social union with the Federal Republic of Germany came into effect , the GDR's ATMs were switched to the issue of DM , but the proportion of ATMs that worked with DM was rather small. This was partly due to the generally quite difficult cash procurement at that time, as checks , which were a common and safe means of payment in the GDR, could not be redeemed either before or after the monetary, economic and social union came into force in the Federal Republic of Germany was also not usable there and the issuing of EC cards and the installation of the corresponding ATMs in the GDR could only take place gradually.

further reading

- Ewald Judt, P. Zimmerl: 35 years of debit cards - 5 years of Maestro cards in Austria. In: Bank Archives. 9, 2003, ISSN 1015-1516 , pp. 665-671.

Individual evidence

- ↑ Austrian dictionary . 41st edition. ÖBV , Vienna 2009, ISBN 978-3-209-06875-0 , p. 88.

- ^ New competition for Visa & Co. Handelsblatt, accessed on December 29, 2010 .

- ↑ cardworldonline.com: PayFair European payments scheme appoints new CEO , January 18, 2011, accessed June 4, 2011.

- ↑ Mastercard is pushing into German business. In: n-tv.de. July 10, 2015, accessed July 24, 2016 .

- ↑ MM feature ( Memento of the original from April 1, 2015 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. on Kartensicherheit.de

- ↑ kuno-sperrdienst.de

- ↑ Card blocking must not cost anything. on: orf.at , November 10, 2015, accessed November 10, 2015.

- ^ The German banking industry: girocard. Retrieved June 10, 2019 .

- ↑ Girocard, Maestro, V Pay: Card payments are getting more complicated. In: verbrauchzentrale.de. August 31, 2016, accessed January 20, 2017 .

- ↑ kartensicherheit.de, Interview with JCB on the subject of girocard co-badging, December 19, 2013 ( Memento of the original from November 11, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Cardduo from PayCenter. Retrieved September 18, 2018 .

- ↑ Commerz Finanz - CashCard and N26 is one of the few offers.

- ↑ MasterCard Debit Credit Card. Retrieved September 18, 2018 .

- ^ Supermarket Inside editorial team: Withdraw money from Edeka, Lidl & Co .: Who actually benefits from it. Retrieved June 10, 2019 .

- ↑ Martin Hock: Withdraw cash: the supermarket checkout beats the ATM . ISSN 0174-4909 ( faz.net [accessed June 10, 2019]).

- ↑ CHIP reporter Konstantinos Mitsis: Norma expands service at the checkout: Discounter makes fun of banks. Retrieved June 10, 2019 .

- ↑ Kai Wiedermann: How customers can avoid a fee when withdrawing money. May 15, 2019, accessed on June 10, 2019 (German).

- ↑ Information on Quick. Retrieved on February 2, 2019 (discontinuation Quick - SIX Payment Services).

- ↑ Contactless payment - frequently asked questions about NFC. Chamber of Labor and Employees , accessed February 2, 2019 .

- ↑ Martin Stepanek: Delayed start of the ATM card on the cell phone. In: Futurezone . December 9, 2015, accessed February 2, 2019 .

- ↑ ERSTE Bank and Mastercard launch new debit cards. falstaff, April 8, 2019, accessed on August 2, 2019 .

- ↑ New study: Austrians on the way to innovative means of payment. Erste Group , accessed February 1, 2019 (press release).

- ↑ Michael Heim: Banks: Thanks to new cards, more profit. In: handelszeitung.ch. May 9, 2019, accessed February 22, 2020 .

- ↑ lasercard.ie: Cardholder - What is Laser? ( Memento of the original from December 9, 2008 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , Accessed December 29, 2010.

- ↑ lasercard.ie: Cardholder - Who owns laser? ( Memento of the original from December 9, 2008 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Accessed December 29, 2010.

- ↑ Einde PIN as of January 1, 2012. (No longer available online.) September 5, 2010, archived from the original on September 5, 2010 ; Retrieved April 12, 2017 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ^ Hans-Georg Günter: DDR-Geschichte.de. The following text is taken from the Guter Rat magazine of March 1989. Retrieved on September 13, 2015 ( Guter Rat , Verlag für die Frau , Leipzig / Berlin, Issue 3/89, p. 33): “ATMs offer their services in the capital and in some large cities. Over 200 ATMs are currently in use. 350 will be there by the end of the year. "