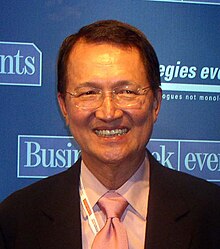

Rafael Buenaventura

Rafael Carlos "Paeng" Baltazar Buenaventura (born August 5, 1938 in San Fernando (La Union) ; † November 30, 2006 ) was a Filipino banker and from 1999 to 2005 governor of the Philippine Central Bank (Bangko Sentral ng Pilipinas).

biography

Studies and banker at Citibank and PCIB

Buenaventura, son of the treasurer of the Ilocos region , Antonio Buenaventura, and Consuelo Baltazar, co-founder of the Agricultural Bank (Rural Bank) of Aringay , graduated after attending the elite school Ateneo de Manila to study at the De La Salle University-Manila, which he graduated with a Bachelor of Commerce degree. During his studies he met the future President of the Philippines , Joseph Estrada . Later he continued his studies at the Stern School of Business of New York University continued where it the academic degree of Master of Business Administration acquired.

While still a student, he began his banking career as a credit specialist at Security Bank and continued after his exams as a management trainee at Citibank in Manila . In the following years he rose rapidly and was a few weeks before the imposition of martial law by Ferdinand Marcos in 1972 commercial bank director of Citibank Singapore . In 1974 he was appointed Chief Executive Officer (CEO) of Citibank Indonesia and, two years later, CEO of Ciibank Malaysia . He kept this position until his appointment as Senior Vice President of Citibank Hong Kong in 1979. As such, he was until 1982 responsible for the financial operations of Citibank in twelve Southeast Asian -born Filipino-states until the first ( Filipino ) CEO of Citibank Philippines was called. In this role he had his first serious relationship in macroeconomic financial planning until 1985 . During this period, the Philippines became increasingly caught up in a debt crisis and sought extensive restructuring of the heavy debt burden. During this time he was a key member of a committee of private and government experts negotiating the restructuring of the debt burden. He was then Senior Vice President and Head of Department for Southern Europe from 1985 to 1989 with responsibility for Greece , Italy , Portugal , Spain and Portugal.

He was then appointed President and CEO of the Philippine Commercial International Bank (PCIB), part of the Gokongwei Group, by the Chinese-born Filipino businessman John Gokongwei , whose business spans food and heavy industry to aviation and banking, and held this position between 1989 and 1989 1999 from. At the same time he was President of the Bankers Association of the Philippines from 1994 to 1997 and Chairman of the Bank Council of ASEAN from 1996 to 1907 .

Governor of Bangko Sentral (BSP)

Asian financial crisis

While he was still president of the PCIB, his old school friend Joseph Estrada was elected President of the Philippine Islands in 1998, who immediately asked him to take over the post of governor of the Philippine Central Bank (Bangko Sentral ng Pilipinas) after the previous governor's retirement Gabriel Singson was imminent and on the other hand the Asian financial crisis broke out in 1997 . However, Buenaventura initially turned down this offer as well as other government offices offered to him. Instead, after taking office, Estrada extended Singson's six-year term. When Estrada asked him again to take over the governor of the BSP after the extension of Singson's tenure, he turned down the offer again, saying that he and his siblings had promised their late father that none of them would ever hold office would assume. Ultimately, however, Estrada and his close advisor and finance minister José Trinidad Pardo , also a close friend of Buenaventura, managed to convince him to take over the post of central bank governor two months before Singson's term of office was over. After his contract as president of the PCIB expired, he finally became second governor of Bangko Sentral ng Pilipinas on July 6, 1999 after Singson.

Challenges of globalization

His appointment as central bank governor met with widespread approval in the banking industry as the banking industry was in great trouble due to the Asian financial crisis, which put the entire financial system at risk. At the same time, the Philippine financial world was faced with the challenges of globalization , which required radical measures to survive international standards. The Enron scandal over falsification of accounts also called for further measures to regulate market forces. At the time of Buenaventura's inauguration, over 15 percent of the total banking sector's loans were unsecured loans and that percentage rose to 17 percent within the first year of office. This required the passage of the so-called Special Purpose Vehicles Act, a law that allowed these "bad" loans to be sold at a reduced price to specialized firms for the purpose of reselling to avoid a collapse of the financial sector. Buenaventura himself presented these mechanisms to the members of Congress and pointed out that the government did not itself have the resources necessary to save the financial world. However, the legislative process came to a standstill when Estrada was overthrown by the EDSA II revolution in 2001 and replaced by its previous Vice President, Gloria Macapagal Arroyo . This also led to the idea of resigning at Buenaventura in order to be replaced by a confidante of the new president. In order to avoid weakening the office of central bank governor, however, he remained in office and soon resumed the legislative process to save the financial world. Finally, in 2003, the Purpose Vehicles Act was passed.

In addition, Buenaventura faced other challenges. The markets accepted less and less confidentiality obligations, investors increasingly asked for transparency in financial transactions, but on the other hand they wanted the greatest possible security and predictability of investments. This required the advancement of transparency, good governance and the assumption of responsibility in both banking and business in general. Against this background, Buenaventura campaigned massively for regulations that allowed the highest level of market transparency and protection for banks and their customers. To do this, he introduced key elements that resulted in greater influence for the central bank.

FATF crisis

Alongside this crisis, Buenaventura's tenure was grappling with another problem due to the FATF crisis . In June 2000, the Financial Action Task Force on Money Laundering (FATF) , a group of experts made up of the heads of state of the G7 countries and the President of the EC Commission , was tasked with analyzing the methods of money laundering and developing measures to combat it Philippines referred to as an "uncooperative state". The blacklist of the FATF suggested serious measures to use black money in international money and currency transactions. In order to avoid formal sanctions and to be removed from the FATF's black list, the central bank endeavored to initiate a legislative procedure that made money laundering criminal offenses and the establishment of an anti-money laundering authority called for by the FATF. This legislative process turned out to be difficult in Congress, however, as some MPs accused the BSP of abuse of office to spy on private bank accounts. It was also feared that this would uncover money laundering of illegally acquired assets by banks. This debate lasted for almost a year, and Buenaventura had to repeatedly explain to Congress members the need for action against international standards. Finally, in September 2001, the Anti-Money Laundering Act was passed, including the establishment of an Anti-Money Laundering Council under the direction of the BSP and the Securities and Exchange Commission (SEC). In the following two years these laws were expanded until the Philippines was finally removed from the FATF blacklist in early 2005.

During his tenure as Governor of Bangko Sentral he also banned the controversial and easily abused so-called "Common Trust Funds" and replaced them with more transparent and easier-to-understand so-called "Unit Investment Trust Funds". At the same time, with the support of the Vice-Governor of the Central Bank, Alberto Reyes , a cautious restructuring of the banking system took place , which led to a level of transparency unprecedented in the Philippine banking system and to greater protection of the forces of the market.

At the same time, he was known to the general public in particular for his monetary policy , which was intended to enable the peso to be protected , which he did not always succeed in, as the exchange rate developments during his tenure showed. At the same time, he was also seen as a moral authority in exercising the power and influence of the central bank, who called bank managers to himself when he saw the peso endangered due to large speculative transactions.

When the government of President Arroyo got into a new budget crisis in 2002 , which led to a rise in the budget deficit to 220 trillion pesos, there was intermittent political pressure on the government for a debt relief, which Buenaventura wanted to avoid. This demonstrated independence as central bank governor led more than once to the fact that his dismissal by the president was expected. However, because of its popularity in the national and international economy and the financial markets, this did not happen.

Despite his notoriety and success as central bank governor, he made it clear that after his term in office he would not take on an extension of his tenure or other offices in government. After a six-year term in office, on July 6, 2005, he therefore handed over the official business to the then Vice-Governor of the BSP, Amando Tetangco junior , one of the co-architects of the reforms he initiated.

In 2001 he was named the first Central Bank Governor of the year for the Asia region by The Banker magazine, a sister publication of the Financial Times .

For his services in the international financial world, he was named one of the world's best (Grade A) central bank governors by the New York magazine "Global Finance" in 2002 and 2003 alongside the Australian and Polish central bank governors, Ian Macfarlane and Leszek Balcerowicz . At the same time, in 2003 he was voted one of the five outstanding financial managers in Asia by Business Week magazine. In 2004 he was named "Management Man of the Year" in the Philippines.

Quotes about his work as central bank governor

- "He's the one who holds everything together" (Cezar P. Consing, Co-Director Investment Banking Asia JPMorgan Chase & Co. ),

swell

Individual evidence

- ^ "Some Economic Lessons as an Asian Star Burns Out" , William Pesek, BLOOMBERG December 4, 2006

- ^ "Tens of thousands of supporters of the ex-president on the street. Estrada is taken to another prison for mass protests" , Handelsblatt April 27, 2001

- ^ "Keeping Up the Tempo of Progress in the Year of the Rooster" , speech by Buenaventura on February 14, 2005

- ↑ "PESO CONTINUES TO SLIDE; BUENAVENTURA DUE BACK TODAY FROM US TRIP" , Newsflash August 27, 2003

- ^ "Philippines Tries to Help Its Currency" , New York Times August 29, 2003

- ↑ "Central Banker Of The Year" , TheBanker January 2, 2002 ( Memento of the original from September 18, 2006 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ "WORLD'S TOP BANKERS: RP'S BUENAVENTURA NAMED GRADE 'A' CENTRAL BANKER" , Newsflash August 29, 2003

- ↑ "The Stars of Asia.25 leaders at the forefront of change" Business Week June 9, 2003

- ↑ "BSP GOVERNOR BUENAVENTURA BAGS 'MANAGEMENT MAN OF THE YEAR' AWARD" , Newsflash November 24, 2004

- ↑ "The Stars of Asia.25 leaders at the forefront of change" Business Week June 9, 2003

| personal data | |

|---|---|

| SURNAME | Buenaventura, Rafael |

| ALTERNATIVE NAMES | Buenaventura, Rafael Carlos Baltazar (full name); Buenaventura, Paeng (nickname) |

| BRIEF DESCRIPTION | Philippine Central Bank Governor |

| DATE OF BIRTH | August 5, 1938 |

| PLACE OF BIRTH | San Fernando (La Union) |

| DATE OF DEATH | November 30, 2006 |