value added tax

A sales tax ( USt ) is

- a tax that taxes the payment for supplies and other services by entrepreneurs ;

- a community tax ;

- an indirect tax ;

- a traffic control or (also) excise ;

- a tax that is often harmonized between neighboring countries ( tax harmonization ); and

- a main source of income for the state ( tax revenue ).

The sales tax is calculated as a percentage of the fee and, together with this, forms the price to be paid by the recipient of the service. Sales tax is not part of the operating costs and does not reduce the entrepreneur's income .

There are essentially two variants of sales tax: the all-phase gross sales tax used in Germany until 1967 and in Austria until 1973 and the all-phase net sales tax with input tax deduction used since then . The legislature in Germany and Austria has left the name of the tax unchanged during the changeover; nevertheless, the expression value added tax (VAT) has established itself in everyday language for the new variant with input tax deduction. This designation is appropriate insofar as the new, in contrast to the old variant, basically only impacts the added value .

Systematic classification

- Sales tax is an indirect tax because the tax debtor (debtor) and the economically charged party are not identical. Deliveries and other services against payment that an entrepreneur carries out in the context of his company in Germany are taxed. Payment is everything that the recipient or a third party has to spend in order to receive the service, but without the sales tax included in the total price. Especially in trade between EU countries, however, there is a reversal of the tax liability according to § 13b UStG, so that the VAT in these cases loses its indirect character, since the recipient of the service has to calculate and pay the sales tax.

- The sales tax is a transaction tax because it is triggered by the exchange (traffic) of services.

- From an economic point of view, sales tax is also a consumption tax because it burdens the end customer who consumes the service purchased. But legally, according to § 21 Abs. 1 UStG in Germany only the import sales tax is a consumption tax in the sense of the tax code .

- After all, it is a community tax within the meaning of the German financial constitution, Article 106 (3) of the Basic Law.

History of sales tax

While customs duties (Latin teloneum ) and transfer taxes have been known since ancient times, consumption taxes (excises) were only introduced at the beginning of modern times. Its beginnings go back to the 16th century in the Netherlands, about which an observer writes, "that there is nothing for subsistence or need there that has not paid taxes five to six times."

- Following the Dutch model, Elector Friedrich Wilhelm, the Great Elector, of Brandenburg established the General Consumptionsaccise in 1685 as the first in Germany to permanently establish it.

- He was followed by the House of Saxony ( Friedrich August I ("August the Strong") - 1703).

- A few years later it was widespread throughout the empire. A “general sales tax” was also levied in Bremen from 1863 to 1884.

In Germany, the huge financial requirements in the First World War led to a uniform stamp duty on goods deliveries in 1916 and an all-phase gross sales tax in 1918, which was maintained in the Federal Republic until the end of 1967 and in the GDR until September 18, 1970.

The original tax rate of 0.5% rose in Germany and later in the Federal Republic after repeated changes to 2.0% in 1935, in 1946 to 3.0% and in 1951 to 4.0%.

In 1968 - as part of the harmonization of sales taxation within the European Community - the transition to the system of value added tax with input tax deduction was completed. This is a fundamental change to the net all-phase sales tax with input tax deduction. The designation sales tax is legally correct, but the economic content of sales tax is designed as value added tax .

Due to the input tax deduction within the European Union, the 6th guideline on the common VAT system of May 17, 1977 was the first important regulation to standardize the sales tax law. This directive also forms the basis for calculating the Community's own income from the sales tax revenue of the Member States. For this reason, it contains comprehensive regulations on the delimitation of sales and the assessment basis for sales tax and also defines the scope of the tax exemptions bindingly for all member states. The 6th directive was replaced by directive 2006/112 / EC of November 28, 2006 on the common VAT system (VAT system directive). In terms of content, the VAT system directive does not differ from the 6th directive. There have only been editorial adjustments. The change will not have any impact on sales tax law in Germany.

With the completion of the European internal market , with effect from January 1, 1993, customs duties and import sales taxes in the movement of goods within the Union have ceased to exist. The goods are subject to taxation in the country of their final destination. This country of destination principle, however, is a transitional arrangement that was originally limited in time. In the meantime, the country of destination principle applies indefinitely. The aim, however, is uniform taxation in the European internal market based on the so-called country of origin principle. Thereafter, taxation is carried out in the country from which the goods come. At the moment it is not foreseeable when the country of origin principle will be introduced.

In 2009, the finance ministers of the European Union agreed that member states could apply the reduced VAT in some local service sectors. The Netherlands use this option for overnight stays in the hotel industry, which are calculated using a tax rate of 6.0% and which in Germany was 19% until the end of 2009. Since January 2010, the reduced VAT of 7% has been in effect in Germany for accommodation services by innkeepers and hoteliers. The federal states of Bavaria, Lower Saxony and Saarland are calling for a rapid structural VAT reform in times of the financial crisis . a. a tax relief for the hospitality industry (in force since 2010) and for certain craftsman services.

Essence of sales tax

Most assets go through a multitude of phases up to the end user. A commodity is usually made from a wide variety of materials, sold to a wholesaler who then sells them to a retailer until they are finally passed on to the end consumer. In this value chain, sales taxation can be all-phase (application to each stage), multi-phase (application to some, but not all stages) and single-phase (application to only one sales process). From the place of sales it depends on whether the sales tax incurred at all.

All-phase gross sales tax

This form of sales tax was in use in Germany from 1918 to 1967. The tax rate rose from 0.5 percent (when it was introduced) in the following years to 4 percent (1967).

At the present time, this variant only exists in a few exceptional cases (e.g. in the case of local authorities that do not have the administration required to collect the tax, or in the case of small businesses that do not meet the accounting requirements for all-phase net sales tax with input tax deduction ).

The assessment basis for the all-phase gross sales tax is the gross sales of each stage of production and trade. As a result, the amount of tax on the end product depends on how many production or trading steps a product goes through.

Advantages and disadvantages

The all-phase gross sales tax has two main advantages: on the one hand, it is easy to calculate and, on the other hand, it is low in administrative costs.

The disadvantages are:

- The all-phase gross sales tax creates a cumulation / cascade effect (see the example ).

- Since the sales tax is passed on through all stages without correction, in contrast to the all-phase net sales tax with input tax deduction, there is a distortion of competition. Sales tax is included in the assessment basis of the subsequent production or trade level through the sales price, whereby sales tax is levied from sales tax.

- In addition, there is a limited value transparency, which is caused by the fact that the cascade effect makes it no longer possible to identify the added value that is created at each stage of production and trade.

example

All-phase net sales tax with input tax deduction

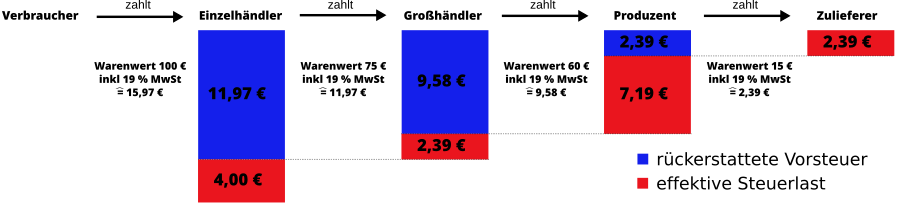

In this variant, in contrast to the all-phase gross sales tax, the input tax deduction ensures that the product remains completely sales tax-free during manufacture and the sales tax is only paid by the end customer. Until then, the sales tax will be set to zero again at every further processing stage, i.e. it will be reimbursed to the company by the tax office or offset against a sales tax liability. Only when an end consumer or a company not entitled to deduct input tax purchases the product does the amount of sales tax remain in the treasury.

example

Supplier Z sells raw materials to producer P for € 15. P uses it to produce goods that he delivers to wholesaler G for € 60. He sells the goods to retailer E for € 75. Finally, retailer E sells these goods to the end consumer for € 100.

To calculate the sales tax, the price must first be reduced by the sales tax:

| from → to | Remuneration (net) | VAT (19%) | Gross price) | Input tax | effectively |

|---|---|---|---|---|---|

| from Z to P | € 12.61 | € 2.39 | 15.00 € | € 0.00 | Z pays € 2.39 |

| from P to G | € 50.42 | € 9.58 | € 60.00 | € 2.39 | P pays € 7.19 |

| from G to E | € 63.03 | € 11.97 | € 75.00 | € 9.58 | G pays € 2.39 |

| from E to V | € 84.03 | € 15.97 | € 100.00 | € 11.97 | E pays € 4.00 |

Consideration of the retailer (E):

- The consumer (V) pays € 100.00 for the goods to the retailer (E).

- E has to pay the VAT of 15.97 € contained therein to the tax office.

- For his part, E has received an invoice for € 75.00 gross for these goods from the wholesaler (G), which includes € 11.97 VAT.

- E paid this sales tax to G with the gross amount of € 75.00 and so E can deduct the € 11.97 as input tax from the € 15.97 VAT to be paid to the tax office.

- E pays € 4.00 to the tax office, of the € 25.00 gross surcharge that he has made.

As a result, the consumer pays:

- € 75.00 gross that the retailer had to pay to wholesalers,

- € 21.00 net, which the retailer has calculated as a surcharge for various costs and profit,

- € 4.00 VAT for the € 21.00 net.

This makes it clear that the end consumer bears the entire tax burden economically. The individual amounts are paid by different parts of the value chain (from Z 2.39 € + from P 7.19 € + from G 2.39 € + from E 4.00 € = 15.97 €). Since the end consumer cannot deduct any input tax, he bears the entire sales tax on the added value (value added) in the chain. The total added value is € 12.61 (supplier) + € 37.81 (producer) + € 12.61 (wholesaler) + € 21 (retailer) = € 84.03. 19% of this is sales tax of € 15.97. The added value of a chain member results from its gross sales price minus the sales tax demanded by the next chain member minus the added value amounts of all upstream chain members.

Business consideration

From a business point of view, the tax is initially cost-neutral. Because the sales tax received can be offset against the input tax previously paid to the tax authorities, the latter is treated as a transitory item . However, according to Section 10.4 (3) sentence 1 UStAE does not represent a transitory item (“Taxes, public fees and charges owed by the entrepreneur are not transitory items ...”).

In the example above, the following tax amounts have flowed to the tax office:

- from Z € 2.39 (charged to P € 2.39 minus input tax of € 0.00)

- from P € 7.19 (the G invoiced € 9.58 minus input tax of € 2.39)

- of G € 2.39 (charged to E € 11.97 minus input tax of P € 9.58)

- of E 4.00 € (invoiced to V 15.97 € minus input tax of G 11.97 €)

However, capital tie-up effects and costs as well as negative demand effects due to the fact that due to sales tax the final price of a product or service is higher for the consumer than without sales tax and thus the demand for the product falls ( price-sales function ) should not be neglected . Smaller companies and the self-employed, in particular, who are primarily active in the private customer business and have a relatively low share of operating costs, experience sales tax increases as real decreases in profits if they cannot compensate for the sales tax increases through price increases.

Example: A craftsman sells a service for € 115 gross with a sales tax rate of 15% and own costs of € 85. His net sales price is € 100, so his profit is € 15. If the sales tax rate is increased to 19%, but the gross sales price for the service is cemented in the minds of the customers at € 115 and is maintained by the competitors, then its net sales price is now € 115: 1.19 = 96. 64 €, which corresponds to a new profit of 11.64 € with unchanged costs of 85, - €. So he suffers a profit drop of 22.4%.

Sales tax pre-registration and sales tax return

Sales tax incurred must be calculated by the entrepreneur by way of self- assessment, reported to the tax office several times a year by means of a sales tax notification and paid. At the end of the year, the payments already made will be credited in the VAT return.

Effect of sales tax

- Temporal perspective

- Not least because of the simple collection procedure, VAT is one of the fastest ways for the state to collect taxes. It is also advantageous to establish a periodic congruence between market and fiscal financing that can be measured and felt.

- Administrative efficiency

- From the point of view of the state, the VAT is a relatively low-bureaucratic and therefore collection-efficient tax. It does not require any essential survey administration, but the survey effort can mainly be limited to supervision. This means that a relatively high proportion of the VAT paid is actually available to the state budget. Because almost all economic transactions are affected by VAT, the payment of this tax - especially for smaller companies - was associated with considerable effort until the 1980s. In Germany this was the reason for the foundation of DATEV in 1966.

- Self-regulation by the taxable person

- The VAT enables the end user to control their own debts, which is not possible with direct taxes. If he purchases more goods on the market, he is burdened more, if he uses less, he is burdened less. In practice, this only means a time delay in the burden, since you will at some point spend the money you put aside (= saved) on purchasing goods.

- Non-income tax rate

- The tax rate is based on the goods consumed. Thus, with VAT, it is more difficult to burden larger incomes disproportionately, as is done, for example, with income tax . This disproportionate burden on higher incomes is achieved through split tax rates: Goods that are only purchased by high-income consumers are subject to a higher tax rate. Nevertheless, critics complain that low-income recipients and families with children would have to spend a higher proportion of their income on consumption and would therefore be disproportionately burdened by the VAT.

- Others, on the other hand, consider social compensation to be given because of the lower taxation of basic needs and different reimbursements through the social systems. Some even see this aspect as a guarantee for more social justice, since it hardly enables tax evasion and greatly restricts tax loopholes.

- However, not only basic food, but also luxury consumer goods such as frogs' legs, quail eggs or the delivery of racehorses are tax-deductible. As a result, this privilege was referred to as subsidizing luxury items.

- Effect on import and export

- If the country of destination principle applies, VAT is not levied on export products. The entire export volume thus does not contribute to public financing via the VAT. Imported products, on the other hand, are subject to (import) sales tax. The export therefore does not contribute to the tax income of the exporting country.

- Consumption tax compared to factor taxation

- VAT taxes the end product of the production process. Factor taxation, on the other hand, taxes the production factors, i.e. the product creation. The two types of taxation have different effects on the productive forces of an economy. Since factor taxation opposes product creation and thus inhibits productive forces, it only makes sense if the objective is to avoid factors. With our current system of non-wage labor costs and wage tax, e.g. B. has a very strong impact on labor costs and creates unemployment. Here a consumption tax has clear advantages over taxing labor. In principle, factor taxation influences the use of factors in the company and causes a factor reduction by the company. In general, taxation focused on one factor must be viewed as problematic, as this leads to a reduction of this factor and thus to a reduction in government revenue. Companies are encouraged by factor taxation to work against the state because they can increase their prosperity by reducing costs, but at the same time prevent state revenues. The consumption tax avoids this crucial disadvantage. This only applies to a limited extent to companies and their products that are exempt from tax under Section 4 of the UStG. Since they cannot claim their input tax, they pass it on in a supposedly tax-free transaction. In addition to private customers (who must pay VAT in any case), companies are also excessively charged, which in turn pass these higher costs on to consumers.

- Susceptibility to abuse

- The current sales tax system is very susceptible to abuse. The tax authorities lose billions of euros every year through so-called carousel deals. According to the Ifo Institute for Economic Research, there should have been sales tax losses totaling 14 billion euros for 2007. The default rate is said to have decreased slightly for the first time in 2005; this trend is said to have continued in 2006 as well. The default rate for 2006 was 9.5%, in 2007 it was 7.5%.

- Abuse Compensation

- Regardless of this, the VAT has the advantage that it also applies to income from undeclared work and undeclared money (both of which avoid direct taxation) if it is also due to a tax-reducing no-account agreement v. a. is often circumvented in connection with illicit business.

- Shift from income taxes to the transfer taxes

- In some countries (e.g. Italy ) there is a strong tendency to lower direct taxes and increase indirect taxes ; this increases net income, enables easier implementation of the wage gap rule , increases the incentive to earn money and reduces the propensity to consume. As long as the income tax is not a poll tax or a flat tax , this can avoid tax overloads (keyword cold progression, bleeding of the middle class) of individual population groups.

- Broader tax base

- As a rule, all consumers are equally subject to VAT. In contrast, there are differences in the taxation of income depending on the type of income, income level and income earner (e.g. married versus non-married). Income from capital, from the sale of real estate, from the pension, from employment, from work for an employer of a European institution, etc. is taxed differently. The consequence of a broad tax base is that z. For example, instead of raising a tax with only a small base of around ten percentage points, only an increase of, for example, one percentage point is necessary to achieve the same fiscal effect.

- Lower net transfer rate

- The VAT lowers the net transfer amount to transfer income recipients ; In particular, retirees, pensioners, unemployed and children (child benefit) should be mentioned here. This enables the nominal amount of the transfer to be maintained while at the same time keeping the costs for society at a manageable level. The Nordic countries in particular (e.g. Sweden) use this effect and have a correspondingly high sales tax rate.

Sales tax fraud

In certain industries and especially in international business, sales tax is particularly vulnerable to tax evasion . Sales tax evasion is usually committed through sales tax carousels. Goods are delivered via different stations. The customer asserts the input tax deduction at one station without the respective supplier paying the sales tax to the tax authorities. Tax evasion in the area of sales tax takes an ever larger share of the additional taxes due to uncovered tax crimes.

Sales tax identification number (USt-IdNr., UID)

When exporting to another EU country, no sales tax is calculated (tax-free intra - community delivery ) if the commercial customer in the recipient country applies sales tax at the tax rate of the destination country. The existence of this requirement is assumed if the recipient provides his sales tax identification number. This country of destination principle means that taxation is shifted to the recipient country by way of intra-Community acquisition . In addition, since January 1, 2010, as part of the “VAT Package 2010”, a new requirement is that the VAT ID no. of the recipient of the service must be specified so that the place of performance is occupied abroad and the entrepreneur can issue an invoice without showing sales tax. Furthermore, the VAT ID no. in the summary report to the tax authorities since July 1, 2010 monthly (previously quarterly) and the VAT ID no. to disclose related sales.

Sales tax uniformly regulated in the EU

Within the European Union , sales tax is uniformly regulated on the basis of the Value Added Tax System Directive (UStSystRL), which replaced the previously applicable 6th EC Directive on January 1, 2007. Every country has structured sales tax as value added tax. Member States must have a standard tax rate of at least 15%. There is no upper limit for the tax rates. They are also permitted to provide lower tax rates for certain service and product groups. The minimum tax rate for the reduced tax rate is 5%. According to the guideline, service groups can be exempt from VAT or a zero rate can be introduced for them. Services to which a zero rate regulation is applicable are still subject to VAT regulations and in particular also entitle them to input tax deduction . In Germany, the zero rate rule is only applied in relation to intra-community and international air, sea and, in some cases, inland waterway traffic. A consolidated version, i. H. The version of the 6th EC directive can be found in EUR-Lex .

For most countries, sales tax is a main source of financing. It is at least as important as directly levied taxes and is the most widely practiced modern financing instrument.

In December 2007, EU finance ministers agreed to change the system for taxing services. From 2015 onwards, cross-border services within the EU should no longer be subject to VAT in the country of origin but in the country of destination to avoid distortions of competition.

In international usage one speaks of VAT (Value added tax) or in some countries also of GST, see Goods and Services Tax .

Abbreviations for sales tax in European countries

- Germany : USt (sales tax)

- Austria : USt (sales tax)

- Switzerland : VAT (Value Added Tax)

- Belgium : btw (laden over de Toegevoegde Waarde), TVA (taxe sur la valeur ajoutée), VAT (Value Added Tax)

- Bulgaria : ДДС (DDS) (Данък Добавена Стойност)

- Denmark : MOMS (mereomsætningsafgift)

- Estonia : Km (Käibemaks)

- Finland : ALV (Arvonlisävero)

- France : TVA (Taxe sur la Valeur Ajoutée)

- Greece : ΦΠΑ (FPA) (foros prostithemenis axias)

- Italy : IVA (imposta sul valore aggiunto)

- Croatia : PDV (porez na dodanu vrijednost)

- Latvia : PVN (Pievienotās vērtības nodoklis)

- Lithuania : PVM (Pridėtinės vertės mokestis)

- Luxembourg : TVA (Taxe sur la Valeur Ajoutée)

- Netherlands : BTW (laden over de Toegevoegde Waarde, Omzet approximately)

- Poland : PTU (Podatek od towarów i usług)

- Portugal : IVA (Imposto sobre o valor acrescentado)

- Romania : TVA (Taxa pe valoarea adaugata)

- Slovakia : DPH (Daň z pridanej hodnoty)

- Spain : IVA (Impuesto sobre el valor añadido)

- Czech Republic : DPH (Daň z přidané hodnoty), see also: Sales tax system in the Czech Republic

- Hungary : áfa (Általános forgalmi adó)

- United Kingdom and other countries with English as the official language: VAT (Value Added Tax)

Sales tax in EU countries

| country | normal | Between | Reduced | Greatly reduced | service performance |

Zero rate? | Valid since |

|---|---|---|---|---|---|---|---|

|

|

21st | 12 | 6th | - | - | Yes | 01.2000 |

|

|

20th | - | 9 | - | - | Yes | 04.2011 |

|

|

25th | - | - | - | - | Yes | 01.1992 |

|

|

16 | - | 5 | - | - | Yes | 07.2020 |

|

|

20th | - | 9 | - | - | Yes | 07.2009 |

|

|

24 | - | 14th | - | 10 | Yes | 01.2013 |

|

|

20th | 10 | 5.5 | 2.1 | - | No | 01.2014 |

|

|

24 | - | 13 | - | 6th | Yes | 06.2016 |

|

|

23 | - | 13.5 | 4.8 | 12 | Yes | 01.2012 |

|

|

22nd | 10 | 5 | 4th | - | No | 01.2016 |

|

|

25th | - | 13 | 5 | - | No | 01.2014 |

|

|

21st | - | 12 | 5 | - | Yes | 01.2018 |

|

|

21st | - | 9 | 5 | - | No | 09.2009 |

|

|

17th | 14th | 8th | 3 | - | No | 01.2015 |

|

|

18th | - | 7th | 6th | - | Yes | 01.2011 |

|

|

21st | - | 9 | - | - | Yes | 01.2019 |

|

|

20th | 13 | 10 | - | - | Yes | 01.2016 |

|

|

23 | - | 8th | - | 5 | Yes | 01.2011 |

|

|

23 | - | 13 | 6th | - | No | 01.2011 |

|

|

19th | - | 9 | 5 | - | No | 01.2017 |

|

|

25th | - | 12 | - | 6th | Yes | 01.1996 |

|

|

20th | - | 10 | - | - | No | 01.2011 |

|

|

22nd | - | 9.5 | 5 | - | No | 01.2020 |

|

|

21st | - | 10 | 4th | - | No | 09.2012 |

|

|

21st | 15th | 10 | - | - | No | 01.2015 |

|

|

27 | - | 18th | 5 | - | Yes | 01.2012 |

|

|

19th | - | - | 5 | 9 | Yes | 01.2014 |

|

|

16 | 10 | 5 | 2.1 | 5 | ||

|

|

27 | 15th | 18th | 6th | 12 |

Special regulations

- ↑ Greece: still on a few Greek islands: 17%, 9%, 4%

- ↑ Portugal: 22% / 12% / 5% in Madeira and 16% / 9% / 4% in the Azores

- ↑ Spain: only 5% island tax instead of the normal tax rate in the Canaries

Tax rate changes

- ↑ France: Change in tax rates from 2014 (IHK) ( Memento of the original from February 2, 2014 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ What will change in Luxembourg in 2015? ( Page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice.

- ↑ Btw-tarief Autovermietung.nl, Tax Authorities, accessed September 5, 2019.

- ↑ A heavily reduced tax rate of 5% is applied to social housing.

Sales tax in non-EU countries

In the following comparison, it is important to note that in some countries VAT is not calculated on the basis of the net amount, but on the basis of the gross amount. Example: In Brazil, the sales tax rate for an invoice within the state is i. d. Usually 18% (18% of the gross price must be paid as tax). According to the calculation method based on the net amount - as is common in the EU - this corresponds to a VAT of 21.951%.

| country | General | Reduced | |

|---|---|---|---|

|

|

20th | 0 | |

|

|

4th | 0 | |

|

|

21st | 10.5 | 0 |

|

|

10 | ||

|

|

13 | 3 | |

|

|

17th | ||

|

|

17th | ||

|

|

19th | ||

|

|

17th | 6th | 3 (13) |

|

|

25th | 0 | |

|

|

12.5 | 4th | 1, 0 |

|

|

24 | 11 | |

|

|

18th | ||

|

|

10 | ||

|

|

5 | 0 | |

|

|

16 | 0 | |

|

|

7.7 | 3.7 / 2.5 | 0 |

|

|

20th | ||

|

|

18th | 5 | |

|

|

16 | 0 | |

|

|

17th | 8th | |

|

|

15th | ||

|

|

25th | 11 | 7th |

|

|

20th | 10 | 0 |

|

|

5 | 0 | |

|

|

7.7 | 3.7 / 2.5 | 0 |

|

|

20th | 8th | 0 |

|

|

7th | ||

|

|

15th | ||

|

|

15th | 7th | 4th |

|

|

10 | ||

|

|

5 | ||

|

|

7th | ||

|

|

18th | 8th | 1 |

|

|

20th | 0 | |

|

|

5 | 0 | |

|

|

0-10 | ||

|

|

20th | 5 | 0 |

|

|

12 | 0 | |

- ↑ Israel - Increase in the regular VAT rate in June 2013. ( Memento of the original from April 29, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. In: accordancevat.de , accessed on April 29, 2014

- ↑ Increase to 10% planned for October 2015

- ↑ Canada: Base plus 0% ( Alberta ) to 10% ( Nova Scotia ) depending on the province

- ↑ a b from 2011 to 2017: 8%, 3.8% and 2.5% from 2011

- ↑ ird.govt.nz

- ↑ Russia to increase standard VAT rate from 18% to 20% as of 1 January 2019

- ↑ Thailand: Actual tax rate of 10% lowered after the Asian crisis, extended again in 2010

- ↑ USA: various tax formulas depending on the country

Comparison 1976, 1987 and 2007

| country | 1976 | luxury | 1987 | 2007 |

|---|---|---|---|---|

|

|

11 | 14th | 19th | |

|

|

18th | 25th | 19th | 21st |

|

|

15th | 22nd | 25th | |

|

|

20th | 33.33 | 18.6 | 19.6 |

|

|

8th | 25th | 15th | 17.5 |

|

|

19.5 | 36.75 | 25th | 21st |

|

|

12 | 18th | 20th | |

|

|

16 | 17.5 | 19th | |

|

|

20th | 20th | 25th | |

|

|

18th | 30th | 18 (32) | 20th |

|

|

17.65 | 23.46 | 25th |

See also

- VAT account

- Sales tax verification

- Sales tax identification number

- List of no longer levied tax types

- Small business regulation

- Stock exchange sales tax

- Real estate transfer tax

- Financial transaction tax

- reversal of tax liability

- VAT harmonization

Web links

- Text of the Value Added Tax Act (Germany)

- EU VAT System Directive 2006/112 of November 28, 2006

- Administrative regulation for the application of the Value Added Tax Act (UStAE)

- Sales tax rates in the EU - as of January 1, 2016 (PDF; 350 kB)

- Research report "Economic psychological analysis of a VAT increase on consumption" (PDF; 13.8 MB)

- USA sales tax. In: taxadmin.org

- Subsequent input tax deduction under the Swiss VAT Act and the 6th EU VAT Directive ( PDF )

- Europe-wide sales tax calculator

Individual evidence

- ^ Johann Heinrich Ludwig Bergius: New policey and cameral magazine in alphabetical order ... MG Weidmann, 1775 ( google.de [accessed on August 4, 2020]).

- ↑ Sr. Königl. Majest. And Elector. Highness. zu Sachsen General-Consumtions-Accis -ordnung, In those cities and Marck-Flecken of the Electorate of Saxony and all countries (1707)

- ^ Sandra Duda: Tax law in the state budget system of the GDR . Publishing house Peter Lang, Frankfurt a. M. 2011, ISBN 978-3-631-61305-4 , pp. 181ff.

- ↑ See History of Value Added Tax. In: mehrwert-steuer.de. Retrieved January 12, 2015 .

- ↑ See: Peter Bohley: Public funding. Oldenbourg Verlag, 2003, ISBN 978-3-486-27374-8 , p. 336 ( limited preview in Google book search).

- ^ A b Cornelia Kraft, Gerhard Kraft: Basics of corporate taxation: The most important types of tax and their interaction . Springer-Verlag, 2014, ISBN 978-3-658-03256-2 , pp. 305 ( google.com ).

- ↑ See all-phase sales tax. In: rechtslexikon.net. Retrieved January 12, 2015 .

- ↑ Consumption and transport tax law (especially sales tax law) SS 2011

- ↑ Sales tax application decree - consolidated version (as of May 27, 2019) - Federal Ministry of Finance - Topics. Retrieved June 6, 2019 .

- ↑ Detlef Borchers: IT and taxes: 40 years of DATEV. In: heise.de , February 14, 2006, accessed April 8, 2017.

- ↑ Thomas Straubhaar : Crisis Way Out - Why a higher VAT can save us. In: spiegel.de , September 19, 2009, accessed April 8, 2017.

- ↑ Egbert Scheunemann : Are indirect taxes such as eco or value-added tax unsocial? In: memo.uni-bremen.de (PDF)

- ↑ Joachim Wieland: fair taxation instead of national debt | APuZ. Retrieved June 27, 2020 .

- ↑ Intra-Community VAT fraud ( "Intra-Community VAT Fraud"). ( Page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. In: bundesrechnungshof.de , March 12, 2009 (PDF; 291 kB).

- ↑ Results of the tax investigation in 2012 . Federal Ministry of Finance of October 21, 2013.

- ↑ The VAT rates in the member states of the European Community . ( Memento of the original from April 13, 2007 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. European Commission, pp. 10–19 (PDF; 365 kB)

- ↑ Directive 77/388 / EEC in the consolidated version of January 1, 2006 In: EUR-Lex .

- ↑ End of the Luxembourg VAT benefit. In: faz.net

- ↑ RIS.bka.gv.at .

- ↑ mwst-institut.ch ( Memento of the original dated November 6, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. .

- ↑ woordenlijst. Retrieved August 4, 2020 .

- ^ Belgian terminology database .

- ↑ List of sales tax rates of the Austrian Chamber of Commerce. Retrieved July 12, 2014.

- ↑ Käibemaksuseadus in the Riigi Teataja legal gazette , accessed on February 7, 2015 (Estonian, English).

- ↑ Value Added Tax Act. In: finlex.fi , accessed February 7, 2015 (Finnish, Swedish, English).

- ↑ Information on sales tax in France. In: die-mehrwertsteuer.de , accessed on April 18, 2016.

- ↑ Information on sales tax in Italy. In: die-mehrwertsteuer.de , accessed on April 18, 2016.

- ↑ Pievienotās vērtības nodoklis | Valsts ieņēmumu dienests. Retrieved December 10, 2017 (Latvian). .

- ↑ Information on sales tax in the Netherlands. In: die-mehrwertsteuer.de , accessed on April 18, 2016

- ↑ Information on sales tax in Poland. ( Page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. In: die-mehrwertsteuer.de , accessed on April 18, 2016.

- ↑ Information on sales tax in Portugal. In: die-mehrwertsteuer.de , accessed on May 14, 2017.

- ↑ Information on sales tax in Romania. In: die-mehrwertsteuer.de , accessed on April 18, 2016.

- ↑ Information on sales tax in Spain. In: die-mehrwertsteuer.de , accessed on April 18, 2016.

- ↑ Information on sales tax in Great Britain. In: die-mehrwertsteuer.de , accessed on April 18, 2016.

- ↑ Table of the European Union (PDF, English, as of January 2020)

- ↑ Sales tax Romania, Taxa pe valoarea adaugata, TVA, sales tax Romania. In: die-mehrwertsteuer.de. FRASUDIA UG (limited liability), accessed on January 23, 2017 .