Redlining

As redline ( English red = red, to redline = correcting drawings and documents) is the practice designated areas due to racial delineate or ethnic characteristics and to discriminate. This can lead to the fact that services are not offered to the residents of this area, only at higher prices or in a lower quality. Just like the word discrimination, the term now has a negative connotation . He initially referred to the practice of enclosing areas of a map with a red line where there is an increased risk to insurance and investments.

Black and ethnic minority neighborhoods in the United States were primarily affected by the redlining . The term was first coined by civil rights activists in Chicago in the late 1960s and goes back primarily to the sociologist John McKnight. In the meantime, the understanding of the term has expanded and in the English-speaking area includes any discrimination against population groups, regardless of place of residence or any other geographical classification. Black lists are a similar practice .

history

Origins

The practice can be traced back to 1934. As a result of the National Housing Act passed this year, the US government wanted to relax the conditions for mortgages in order to create adequate housing for larger population groups as part of the New Deal policy after the global economic crisis . One reason was the falling number of homeowners. Until 1934, the typical term of mortgages was set at ten years and 50 percent repayment. The government also pursued the goal of making it easier to grant mortgages in order to stimulate the construction industry.

In 1935 the Home Owners' Loan Corporation was hired to assess mortgage security in 239 cities. For this purpose, the residential areas within the cities were divided into five categories based on the data available at the time. The areas with the highest security for mortgages have been marked as Type A and delimited with a green line; these were mostly new development areas. A blue line was used for type B to mark areas with sufficient security. A yellow line was used for areas of deterioration and was designated Type C. Type D was given a red border and should show the highest risk; this mainly affected the oldest parts of the city. Type D often included areas that were inhabited by blacks or colored people. In this context, the government also planned to redevelop slums and issued minimum standards for the construction of housing.

Some of these maps were also produced by other private institutions, as early as 1934 by JM Brewer for the city of Philadelphia. According to some authors, however, this type of discrimination arose much earlier, for example in the statistical surveys and the definitions of Race (United States Census) since 1790, the data of which are also shown on maps.

The Chinese and Chinese minority groups in American cities such as San Francisco and New York City have been affected by a similar practice. After the Chinese Exclusion Act 1882 came into force, local laws required them to settle exclusively in certain areas. These districts, which always comprised only a few street blocks, had to accommodate tens of thousands of residents in some cities. This type of forced settlement did not end until the 1940s.

Reforms

The behavior of the Federal Housing Administration (FHA) as a regulatory authority, which discriminated against minorities with its procedural principles and operated redlining, was criticized . The principles of the FHA from 1938 contained, among other things, provisions that amounted to a racial segregation of residential areas - similar to apartheid . Between 1945 and 1959, only 2 percent of the black population in the United States received a mortgage that was secured by the state. In contrast, according to the United States Census Bureau , the proportion of the Afro-American population was around 10 percent.

The Civil Rights Act of 1968 was a first step to officially ban the practice of redlining. However, there were still contractual terms to circumvent the ban. Discussions about this arose in connection with a conference in Chicago in 1973. The rules established in 1968 were only reluctantly implemented by the individual states. It was not until 1974 that the US state of Illinois outlawed redlining. With the Community Reinvestment Act , passed in 1977 under President Jimmy Carter , these and similar forms of discrimination were to be pushed back further.

The Wells Fargo case in Baltimore

In a public lawsuit against Wells Fargo Bank in January 2008, the financial firm alleged that the loan terms used by the bank drove hundreds of homeowners into foreclosure in Baltimore and cost the city millions of dollars in taxes and city services. The May 2009 data showed that more than half of the homes that were foreclosed on a Wells Fargo loan in 2005-2008 were vacant. 71 percent of these houses were in predominantly black neighborhoods. The central allegation against the bank was reverse redlining , the marketing of the most expensive loans to black customers. The New York Times , in an analysis of mortgage lending for New York City, found that black households with incomes above $ 68,000 a year were nearly five times more likely than whites to have high-interest subprime mortgages . The difference was even greater for borrowers at Wells Fargo, Baltimore, because only 2 percent of whites and 16.1 percent of blacks were in the subprime loan bracket. As a rule, the interest on subprime loans was 3 percentage points higher. This practice has been used for many years and has been confirmed by employees of the bank. In addition to Baltimore, southeastern boroughs of Washington and Prince George's Counties have also been selected as target areas. There was a marketing strategy in Silver Spring that targeted black customers through the African-American churches. The acquisition of customers for such loans was rewarded with generous bonus payments. An employee of the bank earned up to US $ 700,000 a year. In defense, a bank spokesman said only 1 percent of the 33,000 foreclosures in Baltimore were due to Wells Fargo mortgages. He justified the effort to enable people with black skin to own homes.

In January 2010 the court found that the damage estimated by the city of Baltimore in the millions was "implausible". City lawyers insisted that it was reverse redlining . The judge recommended that city officials include a detailed description of the damage on their appeal. The further process took place in the district court. A first statement was published in April 2011 in which the term redlining no longer appears. However, the presiding judge found that Wells Fargo had deliberately sold sub-prime contracts to Afro-American borrowers with a higher financial burden, putting them at greater risk of losing their homes.

Discussions after the financial crisis from 2007

More recently, the term redlining has been used in connection with research into the causes of the 2007 financial crisis . The term was also used in a 2010 discussion between the US economist James K. Galbraith and the German manager Hans-Olaf Henkel . Henkel had identified the home ownership promotion programs under Bill Clinton and George W. Bush and the Community Reinvestment Act of 1977 as one of the causes of the financial crisis in the USA. A similar view has been taken by some authors in the United States. William K. Black, Professor of Economics and Law at the University of Missouri – Kansas City , then referred to Hans-Olaf Henkel in an open letter as a “racist banking advisor” because he had brought up old discussions about redlining again.

Examples

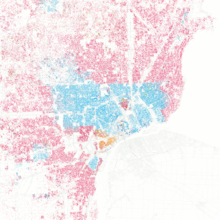

The city of Detroit is very much shaped by different population groups. The booming automotive industry also attracted African-Americans from the southern states in the 20th century . These newcomers to the city have been separated from the resident white population by various types of discrimination, including redlining.

In the southwestern United States, Mexican Americans lived in separate residential areas due to the law and the policies of real estate companies. These practices were in line with official racial segregation and continued into the 1950s.

In the 1970s there was signs of decay in Jamaica Plain , a district of Boston in the northeastern United States. The redlining of banks, in conjunction with government planning, led to the formation of slums and high vacancy rates, especially in the center of the district. Similar developments occurred in other parts of Boston, such as Mattapan (Boston) .

The city of Baltimore still shows clearly separated residential areas for whites and blacks. In the Northwest Baltimore district, for example, the white part of the population lives in the northern, sparsely populated area with single-family houses, while the Afro-Americans in the south mainly live in rented apartments - a large part of them according to the Census 2000 below the poverty line. The two areas are separated by the Northern Parkway, which was built in the 1950s.

A representation of skin colors according to maps can still be found today in the results of the United States Census 2010 , but is not based on objective criteria, but on people's self-assessment.

Trivia

In one scene from the film The Big Short , some fund managers visit a residential area to check the local situation. They find that many houses are empty and that the tenants have no idea of the owners' financial risk. The brokers of the loans for these houses boast high commissions and are completely indifferent to the financial risk. This shows an example of reverse redlining , in which the poor creditworthiness of the borrower is compensated for by high interest rates.

See also

swell

- Elizabeth Eisenhauer, In poor health: Supermarket redlining and urban nutrition , GeoJournal Volume 53, Number 2 / February, 2001

- Kenneth T. Jackson, Crabgrass Frontier: The Suburbanization of the United States. New York, 1985. Oxford University Press. ISBN 0-19-504983-7

- Michael and Ann Vick. Westgate, Gale Force, The Battles For Disclosure and Community Reinvestment , Harvard Book Store, 2nd edition, 2011. ISBN 978-0-615-44901-2

Individual evidence

- ↑ Sagawa, Shirley; Segal, Eli. Common Interest, Common Good: Creating Value Through Business and Social Sector Partnerships. Harvard Business Press, 1999. page 30. ISBN 0-87584-848-6

- ^ John Buescher: Home Sales During the Dreat Depression

- ↑ Kenneth T. Jackson, Crabgrass Frontier: The Suburbanization of the United States

- ↑ http://www.census.gov/history/www/through_the_decades/index_of_questions

- ^ The Chinese American Experience 1857-1882

- ^ "Racial" Provisions of FHA Underwriting Manual, 1938

- ↑ Thomas W. Hanchett, The Other 'Subsidized Housing': Federal Aid to Suburbanization 1940s-1960s. in John F. Bauman, Roger Biles and Kristin M. Szylvian, From Tenements to the Taylor Homes: In Search of an Urban Housing Policy in Twentieth Century America, University Park, Pennsylvania State University Press, 2000, pp 163-179

- ↑ http://civilrights.findlaw.com/discrimination/understanding-your-rights-housing-discrimination.html

- ↑ a b Kirk Hallahan: THE MORTGAGE REDLINING CONTROVERSY, 1972-1975 . Qualitative Studies Division, Association in Journalism and Mass Communication, Montreal, August 1992. Archived from the original on August 9, 2013. Information: The archive link has been inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved November 12, 2012.

- ↑ 'Bank Accused of Pushing Mortgage Deals on Blacks' , New York Times , June 6, 2009

- ↑ City's Wells Fargo lawsuit dismissed notification dated January 7, 2010

- ↑ Baltimore can proceed with suit against Wells Fargo, reported April 25, 2011

- ^ "There is No Return to Self-Sustaining Growth": An Interview with James K. Galbraith. newdeal20.org , February 2, 2010

- ↑ Russ Roberts, "How Government Stoked the Mania" , Wall Street Journal , October 3rd of 2008.

- ^ William K. Black: Mr. Henkel´s Hall of Shame. The Huffington Post , February 5, 2010

- ↑ Thomas J. Sugrue: A Dream Deferred Still . In: New York Times , March 26, 2011. Retrieved July 27, 2012.

- ^ Elizabeth Anne Martin: City of Opportunity . In: Detroit and the Great Migration 1916–1929 . University of Michigan, 1992. Archived from the original on December 12, 2009 Info: The archive link was automatically inserted and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (Retrieved March 25, 2016): "The thousands of African-Americans who flocked to Detroit were part of the 'Great Migration' of the twentieth century."

- ^ Reynolds Farley, Sheldon Danziger, Harry J. Holzer: The Evolution of Racial Segregation . In: Detroit divided . Russell Sage Foundation, New York 2002, ISBN 978-0-87154-281-6 .

- ↑ Michael L. Feloney: Neighborhood Stabilization in Jamaica Plain . Patterns, Responses and Prospects. Boston 1994 ( online version ( memento of July 27, 2013 in the Internet Archive ) [PDF; accessed on January 18, 2012] Master's thesis in PDF format).

- ^ Peter O'Brien: 257 Lamartine Street. (No longer available online.) In: Jamaica Plain Historical Society. Archived from the original on December 3, 2011 ; Retrieved January 18, 2012 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ^ Hillel Levine, Lawrence Harmon: The death of an American Jewish community . A tragedy of good intentions. Maxwell Macmillan International, New York 1992, ISBN 0-02-913865-5 .

- ^ How Racism Doomed Baltimore The New York Times. May 9, 2015