AS-AD model

The AS-AD model , also AD-AS model or total supply total demand model is a model of macroeconomics and describes the overall economic equilibrium in the closed economy over a medium-term period . The AS-AD model is intended to describe the macroeconomic effects of government and financial policy measures on wages, price levels and production. The model consists of the aggregate supply or total supply ( English Aggregate Supply , short: AS ) according to the neoclassical approach and the aggregate demand or total demand ( English Aggregate Demand , short: AD ) according to John Maynard Keynes . The synthesis was largely developed through contributions from Hicks in 1937 and Modigliani in 1944.

history

In 1936 John Maynard Keynes published the "General Theory of Employment, Interest and Money". In this work he criticized the prevailing opinion of full employment on the labor market . So he questioned whether there would be an equilibrium in the labor market. Keynes also assumed wage rigidities, which means that wages will not adjust to the labor market equilibrium, at least in the short term. With this Keynes attacked the assumption that wage flexibility prevails.

Keynes' theories were opposed to the neoclassical view, which emerged from the classical approaches of Adam Smith , David Ricardo and other authors. Important representatives of the neoclassical were among others William Stanley Jevons , Carl Menger and Léon Walras . According to the neoclassical model of Walras, flexible prices and perfect foresight prevail in the markets, which means that each market participant can determine exactly what is the best economic solution for the entire market in terms of wealth distribution. In addition, according to Walras, no adjustment processes take place, as an exchange process only takes place once the equilibrium prices have been set.

By combining the Keynesian view of the money and goods market as well as the neoclassical assumptions on the labor market, authors such as Franco Modigliani in 1944 developed the first descriptions of an aggregated supply and an aggregated demand.

AS-AD model as a continuation of the IS-LM model

While in the IS-LM model only the goods market and money market are in equilibrium, the AS-AD model includes an equilibrium in the labor market. The model assumes that there is a natural unemployment rate that will arise in the medium term. Only if the actual unemployment corresponds to the natural unemployment (including structural unemployment) is the labor market in equilibrium.

In addition, unlike in the IS-LM model, changes in the price level are also included in the model analysis. In the IS-LM model, prices are treated as given quantities, which means that a change in demand for goods always leads to a corresponding change in the quantity of goods produced. The AS-AD model shows how various measures, such as an expansionary monetary policy , could affect an economy . The AS-AD model also shows that an economy is not constantly growing , but that there are periods with different growth rates . The relationship between the AS-AD and IS-LM models is, on the one hand, that the AD curve is derived from the IS-LM model and, on the other hand, that the effects of price changes on the money and goods market can be described .

Composition of aggregated supply and aggregated demand

The aggregated supply and thus the aggregated supply curve shows the quantity that the companies want to offer at any given price level .

In the medium term, i.e. the point in time at which the AS-AD model starts, the supply curve is in the transition from the short term to the long term. In the short term, the supply curve runs horizontally according to the classical theory , since in the short term it can be assumed that prices are not changeable. In the long run it runs vertically, which means that prices are flexible. As a result, the supply curve has a positive slope in the medium term .

The aggregated demand curve shows the combination of the price level and the quantity at which the goods and money markets are in equilibrium. This is the intersection of the IS and LM functions in the IS-LM model.

The IS function describes that there is an equilibrium on the goods market when the quantity produced corresponds to demand. The LM function shows that an equilibrium is established in the money and financial markets when the money supply matches the money demand . Here, the real money supply, i.e. the money supply expressed in goods, must match the real income.

Adjustment mechanism for the transition from the short to the medium term

In the short term, production can deviate from its natural level, as a change in a variable from the AS or AD function leads to a change in the price and production level. In the medium term, however, production will always return to its natural level. The adjustment takes place via changes in price expectations and the resulting consequences for the actual price level and production.

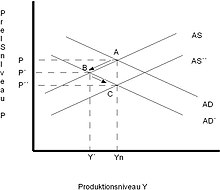

The following process takes place if, for example, the transition from the short to the medium term is considered, assuming that the actual production level is above the natural production level (see figure "Starting point of the adjustment in the AS-AD model") The natural production level is that Level at which production takes place when employment corresponds to the natural level of employment. The natural level of employment is the level that results from subtracting the natural unemployment rate from the number of the labor force.

- In the starting point, the actual production ( denoted by) is above the natural production ( ). In this case, the expected price level ( ) does not correspond to the actual price level ( ) either . The expected price level is lower.

- In the first step (see figure “First step of the adjustment in the AS-AD model”), those involved in wage setting will then increase their price expectations to the actual price level, since assuming that the production level is above the natural production level, the previous one Price expectation was below the actual price level. This will cause the AS curve to move upwards, because an increase in output will increase employment, thereby lowering the unemployment rate and thus improving the bargaining position of workers . This then leads to an increase in nominal wages , which is reflected in more expensive production and thus reflected in a higher price level. This shift results in a reduction in the money supply , since an increase in the price level causes this effect on the money market. This reduction in the money supply leads to higher interest rates because an adjustment process is now taking place on the money market, which leads to a shift in the LM curve (in an open economy, this process is also intensified by an increase in the real exchange rate and therefore a worsening of net exports ). But this also means that a new equilibrium is established on the money and goods market, which then describes lower production.

- However, due to the postponement in the first step, the natural level of production has not yet been reached. This process will repeat itself until production has returned to its natural level. As a result, the expected price level again corresponds to the actual price level (see figure "Second step of the adjustment in the AS-AD model").

Effects on the AS-AD model by changing variables

In the following, the effects of changes in variables from the IS-LM model and from the labor market model and the consequences of external influences, so-called shocks, are considered.

Monetary policy

If the money supply increases, this lowers the interest rate on the money market in the IS-LM model for a short time , assuming that production was at its natural level before the increase (see figure "Adjustment process in the AS-AD model with expansionary monetary policy") . This increases production and the price level. The increase in production is initially higher than the increase in the price level. This effect is reversed, however, so that the increase in the money supply leads in the medium term to an equally large increase in the price level and no change in production. In this case it is a question of the neutrality of money .

This result is achieved through the following adjustment process. If the nominal money supply increases in the IS-LM model, the real money supply also increases with the price level initially given. This increases production according to the properties of the IS-LM model. This causes the aggregate demand curve to shift to the right. As a result of this shift, production is in equilibrium, but above its natural level and thus the actual price level is also above the price level that those involved in wage-setting expected. These will now adjust their price expectations upwards, so that the aggregated supply curve will shift upwards and there will be a movement along the AD curve. This process will continue until production has returned to its natural level, with the result that production has not changed in the medium term, but the price level has risen in line with the increase in the amount of money.

Fiscal policy

If the state reduces its expenditure, this initially leads to falling production. In the further course of time, however, production increases again and there is a lower price level (see figure: "Adjustment process in the AS-AD model with restrictive fiscal policy").

The following steps lead to this result, assuming that production was at its natural level before the fiscal intervention. As a result of the reduction in government spending , the AD curve shifts to the left, since the aggregated demand curve represents an equilibrium on the goods and money markets. This balance changes when production decreases. In this case, production no longer corresponds to its natural level. In the further course of time, according to the adjustment process explained above, production will adjust to its natural level again, since in this case the actual price level will also be below the expected price level and those involved in wage setting will adjust their expectations accordingly. In this case, there is a movement along the aggregated demand curve until it intersects again with the adjusted aggregated supply curve. Production has thus returned to its natural level.

Shocks

Negative shocks, such as a drastic rise in the oil price , can lead to an increase in the price level and a decrease in production (see figure: “Possible adjustment process in the AS-AD model in the event of a shock”).

This result is reached through the following considerations, which only deal with the effects on the AS curve, since it is assumed, for the sake of simplicity, that the AD curve does not change. An increase in the oil price can be taken into account when considering the AS-AD model by increasing the profit mark-up factor μ accordingly when considering the labor market. This increase shifts the price-setting straight line on the labor market, that is, the real wage of the employed is lower than before. In order for this reduction in real wages to be accepted by employees, a higher natural unemployment rate or a lower natural level of employment is required. If it is assumed that exactly one worker is necessary for the production of a production unit, then the natural level of production also falls due to the decline in the natural level of employment.

Based on the above-mentioned adjustment process on the labor market and the corresponding consequences for the AS-AD model, the current level of production is accordingly higher than the natural level of production in the event of such a negative shock. As a result, an adjustment process in the AS-AD model will take place again until production has returned to its natural level.

Mathematical derivation

The derivation of the AS-AD model is based on the IS-LM model (equilibrium on the money and goods market) and the labor market equilibrium, as it can be derived from these two equilibrium conditions.

AD curve

The AS-AD model continues the assumptions from the IS-LM model in the AD curve , i.e. the aggregated demand, and also reacts to changes in variables from this model. Accordingly, the AS-AD model presupposes an equilibrium on the goods and money market in order to derive the AD curve. An equilibrium in the goods and money markets corresponds to one point each on the AD curve. The AD curve is thus made up of the variables of the goods market, such as consumer spending , capital expenditure and government spending, and the variables of the money market, such as the price level and interest rate.

First, the IS curve is solved for the interest rate .

Here describes the demand for goods, the consumption expenditure of households, the investments of companies and government spending. The investments are dependent on the demand for goods and the interest rate .

- (1)

The LM curve is then resolved according to the price level, with the nominal money supply, the price level and the interest rate being reflected.

- (2)

The AD curve is created by inserting the IS curve (1) into the LM curve (2).

AS curve

The AS curve has its origin in the labor market. The components of the labor market are the WS curve (wage setting) and the PS curve (price setting). The PS curve, which describes the prices, is considered in the following to be independent of income. So it runs horizontally. The prerequisite for this are constant marginal costs .

One possible version of the pricing equation is:

- (1)

It stands for the price level, for a profit mark-up by the company on the costs incurred and for the aggregated nominal wage, i.e. the amount that an average employee receives at the end of the month.

One possible version of the wage setting equation is:

- (2)

Here stands for the expected price level, u for the unemployment rate and for a collective variable in which all other variables are summarized that can influence wage setting.

The AS curve is created by equating WS curve (2) and PS curve (1).

Since wages rarely react immediately to a change in the price level, collective bargaining partners calculate with an estimated inflation rate . The labor market is only in equilibrium if the expected inflation corresponds to the actual one. The level of production corresponds to the natural level of production. Economic theory assumes that this equilibrium will be established in the medium term, provided all other conditions remain unchanged.

The AS curve was first derived from the British economist Alban William Phillips . He derived his model, the Phillips curve , from empirical observations. The AS-AD model, on the other hand, was formulated later.

criticism

The critical reception of the basic concept began as early as 1938 by Dunlop and 1939 by Tarshis. Both authors emphasized the inadequate empirical foundation.

The AS and AD curves have a different course depending on the approach used. In the classic approach, the AS curve runs vertically. On the other hand, in the extreme Keynesian case, that is, when wages are rigid, it runs horizontally. These different views result in a variety of interpretations, since, for example, the consequences of government intervention can be different.

The AD curve can also be derived in different ways. Some authors assume that this is derived from the aggregation of the microeconomic equilibria on individual markets. Mostly, however, one finds the interpretation of the AD curve as a derivation from the money and goods market equilibrium, i.e. the intersection of the IS and LM curves in the IS-LM model.

It should also be noted that the AS-AD model presented here does not take into account external trade relations. Important external elements, such as changes in exchange rates , could change the course of the curves and this could make it necessary to introduce other measures to stabilize the economy.

The AS-AD model also shows that the use of just one measure, i.e. a state or monetary policy intervention, rarely contributes to achieving the macroeconomic goals. A combined use of supply-side and demand-side instruments is usually required. If, for example, only an expansionary monetary policy takes place, this leads to an increase in the level of production, but also to an increased price level.

Web links

literature

- Olivier Blanchard and Gerhard Illing: Macroeconomics . Pearson, July 2006, ISBN 3-8273-7209-7 .

- Rüdiger Dornbusch, Stanley Fischer, Richard Startz: Macroeconomics . 8th edition. Oldenbourg, Munich 2003, ISBN 3-486-25713-7 .

- Jürgen Kromphardt: Fundamentals of Macroeconomics . 2nd Edition. Vahlen, Munich 2006, ISBN 3-8006-3309-4 .

Individual evidence

- ↑ Peter Skott: Keynesian Theory and the Aggregate Supply / Aggregate Demand Framework: A Defense . March 1996, p. 4 , doi : 10.2139 / ssrn.75888 ( online ).

- ↑ Ute Arentzen: Gabler Wirtschafts-Lexikon . 14th edition. Gabler, Wiesbaden 1997, ISBN 3-409-30366-9 , pp. 2124-2130.

- ↑ Ute Arentzen: Gabler Wirtschafts-Lexikon. 14th edition. Gabler, Wiesbaden 1997, ISBN 3-409-30376-6 , pp. 2731-2732.

- ↑ Keynes Society: From Neoclassical Synthesis to AS / AD Analysis ( Memento April 7, 2013 in the Internet Archive ) . As of April 21, 2013.

- ↑ Jürgen Kromphardt: Fundamentals of Macroeconomics . 2nd Edition. Vahlen, Munich 2006, ISBN 3-8006-3309-4 , p. 169.

- ^ Rüdiger Dornbusch, Stanley Fischer, Richard Startz: Macroeconomics . 8th edition. Oldenbourg, Munich 2003, ISBN 3-486-25713-7 , p. 112.

- ^ Rüdiger Dornbusch, Stanley Fischer, Richard Startz: Macroeconomics . 8th edition. Oldenbourg, Munich 2003, ISBN 3-486-25713-7 , p. 115.

- ^ Rüdiger Dornbusch, Stanley Fischer, Richard Startz: Macroeconomics . 8th edition. Oldenbourg, Munich 2003, ISBN 3-486-25713-7 , pp. 117-119.

- ^ Rüdiger Dornbusch, Stanley Fischer, Richard Startz: Macroeconomics . 8th edition. Oldenbourg, Munich 2003, ISBN 3-486-25713-7 , p. 113.

- ↑ Olivier Blanchard and Gerhard Illing: Macroeconomics . Pearson, July 2006, ISBN 3-8273-7209-7 , p. 214.

- ↑ Olivier Blanchard and Gerhard Illing: Macroeconomics . Pearson, July 2006, ISBN 3-8273-7209-7 , pp. 217-222.

- ↑ Olivier Blanchard and Gerhard Illing: Macroeconomics . Pearson, July 2006, ISBN 3-8273-7209-7 , pp. 223-226.

- ↑ Olivier Blanchard and Gerhard Illing: Macroeconomics . Pearson, July 2006, ISBN 3-8273-7209-7 , pp. 227-231.

- ↑ Olivier Blanchard and Gerhard Illing: Macroeconomics . Pearson, July 2006, ISBN 3-8273-7209-7 , p. 189.

- ↑ Peter Skott, Keynesian Theory and the Aggregate Supply / Aggregate Demand Framework: A Defense , (March 1996). Available at: SSRN: http://ssrn.com/abstract=75888 or doi: 10.2139 / ssrn.75888 , p. 20

- ↑ Jeffrey D. Sachs and Felipe Larrain: Macroeconomics in a global view . 1st edition. Oldenbourg, Munich 1995, ISBN 3-486-22709-2 , p. 81.

- ↑ Klaus Rittenbruch: Macroeconomics . 1st edition. Oldenbourg, Munich 2000, ISBN 3-486-25486-3 , p. 339.

- ↑ Klaus Rittenbruch: Macroeconomics . 1st edition. Oldenbourg, Munich 2000, ISBN 3-486-25486-3 , p. 336.