Bank Schelhammer & Schattera

| Bank Schelhammer & Schattera AG | |

|---|---|

|

|

|

| Country |

|

| Seat | Vienna |

| legal form | Corporation |

| Bank code | 19190 |

| BIC | BSSWATWWXXX |

| founding | 1832 |

| Website | www.schelhammer.at |

| Business data 2012 | |

| Total assets | 701.3 million euros |

| insoles | 511.4 million euros |

| Customer credit | 206.2 million euros |

| Employee | 100 |

| management | |

| Board | Ernst Huber Peter Böhler Gerd Stöcklmair |

| Supervisory board | Christian Jauk (Chairman) |

The Bankhaus Schelhammer & Schattera AG is Vienna's oldest private bank . It is a public company . The core shareholders of the universal bank, founded in 1832, were institutions of the Roman Catholic Church in Austria for decades . Since December 2014, the majority of shares has been held by Grazer Wechselseiten Versicherung AG .

history

The beginnings

In 1832 the merchant CM Perisutti opened a private bank in the "Haus zur alten Mehlgrube " (today Kärntner Strasse 20 , Hotel Ambassador, with entrances at Neuer Markt 4 and Donnergasse 1 ). The first customer base includes business people and wealthy private individuals. In the absence of files and documents, little can be said about the activities of Perisutti and his main treasurer and successor Richard Ott . The securities business was already an important line of business in the first few decades and it did not go bankrupt compared to other medium-sized and small Viennese banks at the time. Bonds were issued to finance the major rail and industrial projects. In 1858 the bank moved to Vienna's Stephansplatz 11 . At the World Exhibition in 1873 , the bank was represented with an exchange office . The bank survived the Vienna stock market crash in the same year, in contrast to more than three quarters of the banks based in Vienna, which often only existed for a few years.

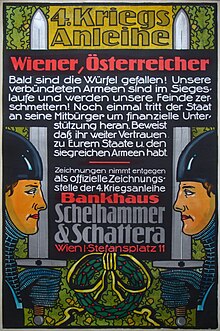

In 1876, Ott handed the bank over to long-time bank clerk Carl Schelhammer and his partner Eduard Schattern . The company was recorded as an open trading company of these two gentlemen on November 14, 1876 as a general partnership with the company name "Schelhammer & Co." at the Commercial Court of Vienna. On July 27, 1877, the company name was changed to "Schelhammer & Schattera" , which has largely remained until today. During this time, the company developed from a small exchange office to a universal bank. The lottery and securities business formed a dominant line of business. In 1902, Wilhelm Simon and Johann Thomas Wancura (1869–1939, by marriage to Schelhammer), authorized signatories of the bank, entered as general partners. Schelhamer remained a partner in the bank until his death in 1905. In 1909, Wancura took over the bank as sole owner. A year later, the bank was given a barrier on the Vienna Stock Exchange and trading in securities was expanded. In the same year it was the only bank that operated an exchange office at the First International Hunting Exhibition in Vienna in 1910 . Also in 1910 the respected Thomas Wancura received the title of " Imperial Councilor " and in 1918 he was appointed to the Commercial Council. The bank had taken over the general representation of the Lower Austrian State Insurance Company. As early as the turn of the century, the bank was offering combined savings and insurance plans with the assurance of a monthly pension. Another line of business was the administration of foundation capital, orphans, entails and deposits funds, whereby the company stayed away from speculative investments. The class lottery was introduced in January 1913, and the bank became its largest branch. In 1914, as a result of the great expansion of banking business, the bookkeeping was separated from the cash desk and relocated to the mezzanine of the house at Goldschmiedgasse 10 (formerly "Zum Eisgrübel"). Communication was maintained by cashiers. A direct telephone connection was later established, which made work much easier despite the cumbersome crank mechanisms at the time. A safe depot system was built on the ground floor of Goldschmiedgasse.

Extension to exchange offices

In the young Republic of Austria, a branch was opened in the wealthy residential district of Hietzing in 1921 , and it still exists today. The bank did not survive the circumstances accompanying the currency reforms of 1924/25 and the Great Depression of the 1930s, but the counters remained open and no employee had to be fired. On February 10, 1933, the name in the commercial register was changed to "Bank- und Wechselhaus Schelhammer & Schattera" and in 1934 the bank was granted the license to operate exchange offices throughout Austria. Exchange offices were set up at Semmering, in Baden, Salzburg, Kitzbühel and Badgastein and recorded as branches in the commercial register. Wancura also represented his company's interests on the board of directors of the newly founded Österreichische Casino AG (today Casinos Austria ). Johann Thomas Wancura died on June 23, 1939 and his closest colleague Oskar Kühn took over the management. The bank became a general partnership again. At the end of World War II burned on 11/12. April 1945 the building at Stephansplatz 11 , shortly before St. Stephen's Cathedral . Only the fireproof iron armored coffers could be shoveled free from the rubble heaps. With no money, no securities and only part of the business books , Oskar Kühn , Karl Philip , Ernst Pieracher and a few employees began to rebuild the bank. One of the first activities was the effort to mobilize funds for the reconstruction of St. Stephen's Cathedral. The first reconstruction lots were issued in 1945. In the following year, a provisional shop was opened at Goldschmiedgasse 10 . About three years after the fire, the accounting was reconstructed and savings accounts could be opened anonymously again. In 1954, new rooms were acquired in House 3 at Goldschmiedgasse . This address has been preserved to this day. The former house on Stephansplatz could no longer be occupied due to a year-long construction ban. In September 1956, the first church loan was issued for subscription. In 1957 the Association of Catholic Workers 'and Employees' Savings Associations was founded. Since young people in particular found it difficult to find their own living space, the bank developed what was known as “youth housing savings ” in collaboration with the Catholic youth towards the end of the 1950s, comparable to later premium savings .

Origins of the "Bank of the Church"

Maintenance work on almost all church buildings had not been carried out for many years. There was great damage during and after the war through confiscation and fighting. In addition, church institutions were to be set up in settlement areas newly emerging in the course of industrialization. The funds for the necessary work could only rarely be released from the current income. As early as 1950, considerations about the creation of a generous financing concept were made. The idea of an Austrian bond to be issued on the capital market was developed. The abbots 'conference immediately supported the project, the bishops' conference had to be persuaded in individual discussions. After receiving the Roman approval, the stock corporation for the promotion of economic enterprises and building projects (Förderungs-AG) was founded as a legal entity on December 12, 1955 . At the beginning, the dioceses and foundations created the necessary collateral and trust base by assuming guarantees without any consideration and enabled low-cost borrowing independent of conditions, mortgages, etc. In September 1956, the first church loan was issued under the motto “The church builds, the church guarantees”. Further bonds were issued in 1957, 1958, 1966, 1969, 1972, 1976 and 1988. The first bond was fully repaid in 1981 and by 1996 all bonds were repaid. The Catholic Church financed more than 400 investment projects. 391 million schillings were used for kindergartens, schools and boarding schools, 55 million for educational academies, 279 million for various pastoral care institutions, 207 million for hospitals, 232 million for economic ventures, 212 million for charitable institutions and 200 million for housing.

Josef Melchart (1926–1996) worked as a freelance tax and business consultant and has been working for Förderungs-AG since 1956, first for the technical process, then as an authorized signatory and later on the board. The Förder-AG took a stake in Schelhammer & Schattera in 1959, with Melchart also becoming the sole general partner. The bank acted as a clearing house for the bonds. Melchart was thus a fully liable partner and managing director, which he remained in Australia until his accidental death. With him a new era began. The bank was adapted to the requirements of the time and reorganized. And the necessary shareholder resolutions have been passed unanimously since then. The checkout area was redesigned in 1964 and the branch in Hietzing was comprehensively redesigned in 1967. Cashless payment transactions multiplied the number of account movements to be posted and in 1970/71 the accounting was switched to magnetic account computers . In 1979 the bank was granted a license to issue its own medium-term securities. From 1981 Robert Norden joined the management as a general partner.

Bank development progress

Bankhaus Schelhammer & Schattera Kapitalanlage GmbH was founded in 1988 in response to the desire of the male religious communities for suitable investment funds to secure the retirement provision of members of the religious order . The limited partnership was converted into a stock corporation in 1990 . The first board of directors is made up of Josef Melchart and Josef Löw. Robert Norden moved to the supervisory board. In 1995 the Förder-AG was merged with the Bank-AG and the members of the company's board of trustees formed the bank's advisory board. After Melchart's death, the house at Goldschmiedgasse 5 was acquired under the new management . In the 1990s, so-called ethically sustainable financial products were propagated.

Part of the GRAWE banking group

The takeover of the majority stake in Bankhaus Schelhammer & Schattera by the GRAWE banking group agreed in January 2015 was completed on June 9, 2015 with the so-called "Closing". The shares previously held by the Superior Conference of the male religious orders in Austria as well as by some orders and church institutions have been transferred to the GRAWE banking group, which currently holds more than 86% of the shares in the Schelhammer & Schattera bank.

Bankhaus Schelhammer & Schattera AG is a fully consolidated member of the banking group of Bank Burgenland . DADAT, a direct banking brand of Bankhaus Schelhammer & Schattera AG, has been active in the Austrian direct banking market since March 2017 .

Board members (chronological)

| Surname | from | to | Chairman |

|---|---|---|---|

| Josef Melchart | 1990 | 1996 | since 1990 |

| Josef Loew | 1990 | 2000 | |

| Heinz Burgmann | 1993 | 2004 | from 1996 |

| Helmut Jonas | 1993 | 2011 | from 2005 |

| Gerold Milabersky | 1996 | 2004 | |

| Fritz Rosenbusch | 1996 | 2005 | |

| Günter Bergauer | 2005 | 2012 | |

| Peter Boehler | 2005 | ||

| Michael Martinek | 2011 | 2015 | from 2011 |

| Gerd Stöcklmair | 2015 | ||

| Ernst Huber | 2016 |

General

Today, Schelhammer & Schattera offers two offices in Vienna in the investment and credit business as well as in payment transactions services of a universal bank - with a focus on the investment business, it specializes primarily in asset management and securities advice. The bank, which employs around 100 people, had total assets of EUR 750 million as of December 31, 2009.

The range of services in the lending business includes common financing products for private customers, church institutions and companies. The financing of real estate is also an important pillar. As of December 31, 2009, loans to customers of the bank amounted to EUR 212 million.

The bank is officially based on the values of the Roman Catholic Church and Catholic social teaching is a model.

The total primary funds of the bank (including medium-term notes) amounted to EUR 629 million as of December 31, 2009.

The bank still holds shares in Casinos Austria and operates several exchange offices in the Austrian casinos.

In 2014, 54% belonged to Catholic male orders through the Communitas Holding , a holding that was owned by the Austrian Superior Conference. This block of shares was taken over by the Grawe Group in December 2014. Another 31% hold other church institutions in Austria, with the Göttweig Abbey and the Archdiocese of Vienna among the larger shareholders .

Web links

- Web presence of the bank Schelhammer & Schattera

- Kirchenbank-Schelhammer - Schattera-profited-in-the-crisis - according to the standard according to APA broadcast

Individual evidence

- ↑ a b query for bank code 19190. In: SEPA payment transactions directory of the Oesterreichische Nationalbank (OeNB) . (Requires browser reloading.)

- ↑ Annual & Sustainability Report 2012 (PDF; 2.2 MB)

- ^ Majority of Kirchenbank Schelhammer & Schattera sold to Grawe Die Presse , December 29, 2014.

- ↑ a b c d e f g h i j k 175 years of Bankhaus Schelhammer & Schattera. (PDF) Festschrift 1832–2007. (No longer available online.) Bankhaus Schelhammer & Schattera, April 19, 2007, archived from the original on December 31, 2014 ; accessed on December 30, 2014 .

- ↑ a b c d e f g Our story. About us - history. (No longer available online.) In: schelhammer.at. Bankhaus Schelhammer & Schattera, archived from the original on December 31, 2014 ; accessed on December 31, 2014 .

- ↑ a b c We spoke to ... Kommerzialrat Dipl.-Ing. Josef Melchart . In: The industrial engineer . tape 27 , no. 3 , 1994 ( ubtug.net [accessed December 31, 2014]). ubtug.net ( Memento of the original dated December 31, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ DADAT: New Austrian online broker. In: direktbanken-vergleich.at. March 31, 2017, accessed March 25, 2019 .

Coordinates: 48 ° 12 ′ 30.6 ″ N , 16 ° 22 ′ 16.9 ″ E