German inflation 1914 to 1923

The German inflation from 1914 to November 1923 was one of the most radical devaluations in major industrial nations . The history of this hyperinflation can be found in the financing of the First World War . By the end of the war in 1918, the mark had officially lost more than half of its value, or more precisely: its internal and external purchasing power . The inflation index was much higher on the black market. The real cause of the hyperinflation, which began in 1919, was the massive expansion of the money supply by the state in the early years of the Weimar Republic in order to eliminate the national debt .

prehistory

The national government lifted shortly after the beginning of World War I on August 4, 1914, the legal note convertibility of the Reichsbank in gold (see Mark ) on. In addition, the state's options for borrowing and increasing the amount of money in the case of coins and banknotes were expanded through the removal of the gold anchor (= statutory one-third coverage of Reichsbanknotes with gold). The plan had been secretly drawn up before the war began; it was carried by the so-called "national enthusiasm" . This increase in money should be financed by war bonds instead of taxes . Because the deployment and supply of the German armed forces, whose strength grew to several million after the mobilization , brought unprecedented costs.

At the same time, the purchasing power of the population for military needs should be siphoned off or shut down in order to be able to counteract the foreseeable war-related shortage of goods domestically against the formation of the black market through the shortage of money among the citizens. In order to get additional money and gold, several war bonds were issued and I gave the action gold for iron . Unlike in Great Britain and France , where the war was financed by property taxes, these war bonds were to be redeemed again after the “victory peace” with the “spoils of war” in the form of reparations . The high reparations France paid after the lost war in 1870/71 were still remembered by many.

In August 1915, at a session of the Reichstag, the Conservative Minister of State Karl Helfferich admitted that the war opponents would finance the war in the form of reparations:

“Gentlemen, as things are, the only way that remains for the time being is to postpone the final settlement of the costs of war through the means of credit until the future, until the conclusion of peace and until the time of peace. And I would like to emphasize again today: If God gives us victory and with it the possibility of shaping peace according to our needs and the necessities of life, then we do not want to and must not forget the question of costs as well as everything else; [ Lively approval ] which we are the future of our people guilty. [ 'Very true!' Shouts ]

The whole future way of life of our people must, as far as it is at all possible, be relieved of the immense burden that war increases. [ more 'Very true!' shouts ]

The instigators of this war deserved the lead weight of billions; [ 'Very right!' Shouts ] they may drag it through the decades, not us. [ 'Very good!' Shouts ] "

From a financial point of view, the increase in money via the printing press took place during the war in the form of so-called treasury notes , which had to be financed by the population afterwards by subscribing war bonds , if they were not purely an increase in money tokens. The following table shows the ever decreasing coverage:

| War Loan | Nominal amount of the subscription |

Treasury bills outstanding |

balance | |

|---|---|---|---|---|

| 1. | September 1914 | 4,460 | 2,632 | +1,832 |

| 2. | March 1915 | 9,060 | 7.209 | +1,851 |

| 3. | September 1915 | 12.101 | 9,691 | +2,410 |

| 4th | March 1916 | 10,712 | 10,388 | +324 |

| 5. | September 1916 | 10,652 | 12,766 | −2,114 |

| 6th | March 1917 | 13,122 | 14,855 | −1,733 |

| 7th | September 1917 | 12,626 | 27.204 | −14,578 |

| 8th. | March 1918 | 15.001 | 38,971 | −23,970 |

| 9. | September 1918 | 10,443 | 49,414 | −38,971 |

At the same time, the amount of consumer goods (food, clothing, heating fuel, etc.) for domestic consumption decreased for the citizen with the duration of the war. There were various goods bottlenecks that forced substitutes and substitutes, for example coffee substitutes instead of coffee beans or nettle fibers instead of cotton. In addition, considerable amounts of higher value goods were used for the maintenance of the military. The funds available for consumption did not decrease to the same extent in certain sections of the population, despite the subscription of war bonds. The prices rose. During the war there were repeated requests to subscribe to war bonds and numerous local requests to citizens, for example to hand in copper objects or tin plates at collection points (see metal donation ). At the same time as appeals to the population to voluntarily surrender raw materials, particularly from 1916 onwards, there were rigorous checks in rural areas and small businesses to ensure that food and raw material stocks had been correctly displayed. Violations of these obligations resulted in charges and confiscations by state customs and tax officials.

In order to avoid unrest, the wages of small workers and white-collar workers were adjusted in line with price developments, albeit with a significant delay. And in order not to raise the wealthy, taxes were not raised appropriately. Nevertheless, only a small group of the particularly rich escaped the general impoverishment caused by the shortage of goods and the rise in prices.

In November 1918 the Reich's debts of around 150 billion marks exceeded the national income of 1919 of an estimated 142 billion marks. Because it had lost the war, the German Reich could not pass the burden of war on to other states. On the contrary, the empire had to pay reparations itself , which exacerbated inflation. Because the reparations were also paid for by printing additional paper money. Although the reparations had to be paid in foreign currencies or in gold marks, the state obtained the necessary funds through the (uncontrolled) increase in its own paper money. With the thus provoked ruin of its own currency, the German Reich also wanted to demonstrate that the reparation payment obligations under the Versailles Treaty were excessive or not affordable.

Reparations and inflation 1918 to 1922

After the November Revolution of 1918, the Treaty of Versailles in 1919 obliged Germany to pay reparations to the victorious powers (particularly to France ). German reparations payments had to be made in gold marks, foreign currency and material goods and were therefore not affected by inflation. In January 1920 the mark had only a tenth of the exchange rate of August 1914 against the US dollar .

The other states involved in the war also suffered from the consequences of the world war. In 1921 and 1922 there was a global economic slump . The German economy was able to recover during this time. The devalued wages and incomes acted like wage dumping . German economic growth was stronger than the winners' economies.

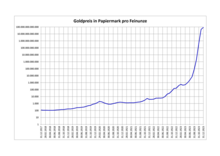

In October 1921 the mark was still a hundredth of its value in August 1914, and in October 1922 only one thousandth.

The hyperinflation of 1923

Because the Reich government was no longer able to pay the reparations in a reasonable amount or to provide substitute services in the form of economic goods, the Ruhr was occupied by French and Belgian troops. The German government under Chancellor Wilhelm Cuno called for the "Ruhrkampf", for passive resistance against the military occupation. In order to keep the strikers happy, they were given appropriate financial aid - in a mark that was devaluing more and more quickly due to the increase in money run by the government. This marked the beginning of the months of hyperinflation , which generations of Germans would follow as an example of the horrors of inflation. The depreciation against the US dollar multiplied faster and faster, until finally in November 1923 the rate for one US dollar was 4.2 trillion marks.

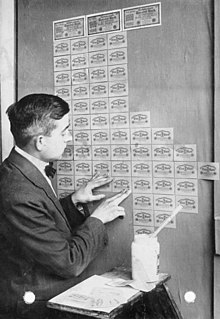

The hyperinflation led to a partial collapse of the German economy and the banking system. Two complete editions of 1000 Mark and 5000 Mark banknotes could no longer be put into circulation at the beginning of 1923; at the end of 1923 they had to be used with “1 billion” and “500 billion” imprints. The stock index of the Reich Statistical Office rose in December 1923 to a monthly average of 26.89 trillion points and the gold price to 86.81 trillion marks per troy ounce . Unemployment rose, real wages plummeted and the KPD gained more and more support. The state unions were so drained that they had to be financed by the government. When Gustav Stresemann became Chancellor, he broke off the war on the Ruhr on September 26th. The decisive factor was the fear of a subversion. The assertion by the former Chancellor Cuno that the German Reich could no longer pay the reparations was tacitly cashed in.

The conditions were now in place for the currency to stabilize. The victorious powers also demanded this stabilization as a prerequisite for negotiations on the reparation payments that led to the Dawes Plan . The economic situation was able to stabilize in the course of 1924 - as a result, the political situation as well.

Concepts to stabilize the currency

After the consequences of hyperinflation had triggered not only economic but also serious political upheavals, proposals for currency stabilization were made from various sides. Unlike Austria, which achieved the introduction of the schilling through an international loan (see Geneva Protocols ) in 1922 , the German Reich was unable to raise foreign capital because of the tense foreign policy situation. The currency stabilization therefore had to take place on a purely domestic basis. Three essential concepts were discussed in specialist circles:

- The Reich government proposed to stabilize the existing currency with instruments of tax and credit policy. Higher taxes and extensive credit freezes should reduce the growth of the money supply. In addition, foreign exchange policy measures and indexation (“stable value calculation”) should be introduced for tax assessments. The paper mark should be preserved, but gradually made scarce again and thus valuable.

- The concept of stabilization through the return to the gold currency was propagated by industrial circles who hoped for better export opportunities through a fixed exchange rate within the framework of the international gold standard . These plans were supported by economists such as the then liberal Hjalmar Schacht and the social democrat Rudolf Hilferding .

- The German national finance expert Karl Helfferich proposed a new currency, which should be covered by the encumbrance of property in the country .

This plan, with adaptations by the Reich Finance Minister Hans Luther , was finally implemented. However, the reintroduction of the gold standard was still pursued as a long-term goal.

Introduction of the Rentenmark and end of inflation

In terms of currency, the inflation and the speculation related to it were ended on November 15, 1923 by the replacement of the paper mark with the introduction of the Rentenmark (equal in value to the later Reichsmark ). Physically, the paper mark notes valid on November 15, 1923, had to be used as emergency money of stable value until the beginning of 1925 (rate: 1 trillion marks = 1 Rentenmark), because the new Rentenmark could only be put into circulation slowly. For example, until the beginning of 1925, the employees of the Hoechst paintworks received only some of their wages in new Rentenmark notes and the rest in emergency money notes. In addition to Rentenmark, the Reichsbank had official paper mark stocks until October 1924, which it put into circulation in February 1924 in the form of a series of 5, 10, 20, 50 and 100 billion mark notes.

The emergency coin with the highest face value of all time, the 1 trillion mark piece from the Province of Westphalia from 1923, which had already been devalued by hyperinflation on the planned issue date, was only sold as a souvenir after the end of inflation and stabilization of the currency in 1924 offered.

Due to the inflationary devaluation of money , the economic and social burdens of the lost war were borne by the mass of dependent employees and the pure owners of financial assets. Only in 1928 did real wages on average return to the level of 1913 (according to official statistics). A substantial part of the middle classes - used to living their lives without the help of the state - found themselves in poverty. Their financial reserves melted almost completely due to inflation.

Overview of currency devaluation

The following table outlines the decline in the internal and external value of the German currency:

| 1 gold mark = paper mark (nominal) | date | Postage in marks | Dollar rate in marks | Period |

|---|---|---|---|---|

| 1 | July 1, 1914 | 4.20 | k. W. | |

| 2 | January 31, 1918 | 0.15 | ||

| 4th | January 31, 1919 | 0.15 | ||

| 10 | January 31, 1920 | 0.20 | 42.00 | 2040 days |

| 30th | January 31, 1921 | 0.40 | 60.43 | - |

| 100 | October 3, 1921 | 0.60 | 127.37 | 611 days |

| 200 | January 31, 1922 | 2.00 | 199.40 | - |

| 1,000 | October 21, 1922 | 6, - | 4,439.00 | 383 days |

| 10,000 | January 31, 1923 | 50.00 | 49,000.00 | 102 days |

| 100,000 | June 26, 1923 | 100.00 | 760,000.00 | 115 days |

| 1,000,000 | August 8, 1923 | 1,000.00 | 4,860,000.00 | 74 days |

| 10,000,000 | September 7, 1923 | 75,000.00 | 53,000,000.00 | 30 days |

| 100,000,000 | October 3, 1923 | 2,000,000.00 | 440,000,000.00 | 26 days |

| 1,000,000,000 | October 11, 1923 | 5,000,000.00 | 5,060,000,000.00 | 8 days |

| 10,000,000,000 | October 22, 1923 | 10,000,000.00 | 32,150,000,000.00 | 11 days |

| 100,000,000,000 | November 3, 1923 | 100,000,000.00 | 418,950,000,000.00 | 12 days |

| November 9, 1923 | 1,000,000,000.00 | 628,500,000,000.00 | - | |

| 600,000,000,000 currency reform 1,000,000,000,000 |

November 15, 1923 | 1 RPf = 10,000,000,000.00 | 4.20 RM = 4,200,000,000,000.00 | 12 days |

| (values in italics were math. interpolated) | Postage from December 1st 10 RPf |

- Some stamps from the 1923 stamp year of the Deutsche Reichspost

Envelope of a domestic letter from Wilhelmshaven to the north with so-called roof tile franking , canceled on November 4, 1923

- Hyperinflation paper mark banknotes

- Rentenmark banknotes from November 1923

In addition to the new Rentenmark notes, the old “trillion” paper mark notes remained a valid means of payment as emergency money until the beginning of 1925. After the latter had been withdrawn from monetary transactions, additional Rentenmark notes were put into circulation.

Effects

Inflation as an important part of a social process in the early years of the Weimar Republic discredited the first German republic in the eyes of many. Sections of the middle class, the small and middle class, felt betrayed by the Weimar Republic. Growing sections of the working class were unable to see anything worth defending in this state (unlike in 1920, when they reacted to the Kapp Putsch with a general strike), especially since with the global economic crisis from 1929 their social situation became catastrophic again as in 1923. There were also inflation winners. Indeed, the landowners were completely discharged from inflation, while the real estate retained its value. The legislature tried to skim off these inflationary gains through the house interest tax .

The inflation also had its legal consequences, as it led to the appraisal of the Reichsgericht , which had far-reaching legal consequences in the field of civil law (anchoring the discontinuation of the business basis as a civil law institute, today Section 313 BGB ) and constitutional law (approaches to constitutional jurisdiction ).

literature

- Gerald D. Feldman : The Great Disorder. Politics, Economics, and Society in the German Inflation, 1914–1924 . Oxford University Press, New York / Oxford 1993, ISBN 0-19-503791-X . Another edition in 1996.

- Gerald D. Feldman (Ed.): The aftermath of inflation on German history 1924–1933 (= writings of the historical college . Colloquia . Vol. 6). Oldenbourg, Munich 1985, ISBN 978-3-486-52221-1 . ( Full text as PDF )

- Gerald D. Feldmann: Bavaria and Saxony in hyperinflation 1922/23 (= writings of the Historical College. Lectures . Vol. 6), Munich 1984 ( digitized version )

- Carl-Ludwig Holtfrerich : The German inflation 1914-1923. Causes and consequences from an international perspective . de Gruyter, Berlin / New York 1980, ISBN 3-11-008318-3 .

- Michael L. Hughes: Paying for the German Inflation. Univ. of North Carolina, Chapel Hill 1988, ISBN 0-8078-1777-5 .

- Helmut Kerstingjohänner: The German inflation 1919-1923 - politics and economy . Peter Lang, Frankfurt 2004, ISBN 3-631-51245-7 .

- Claus-Dieter Krohn : The great inflation in Germany 1918–1923 . Pahl-Rugenstein, Cologne 1977, ISBN 3-7609-0334-7 .

- Constantin Brescani-Turroni: The Economics of Inflation, A Study of Currency Depreciation in Post-War Germany, 1914–1923 . Augustus M. Kelly, Northampton 1938, 1953, 1968 (repr.), ISBN 0-04-332005-8 .

- Jens O. Parsson: Dying of Money. Lessons of the Great German and American Inflations. Wellspring Press, Boston 1974, OCLC 913840 .

- Hans Ostwald : Moral history of inflation. Neufeld & Henius, Berlin 1931, 1951, DNB 362285195 .

- Helmut Braun: Inflation (Weimar Republic). In: Historical Lexicon of Bavaria.

- Frederick Taylor : The Downfall of Money: Germany's Hyperinflation and the Destruction of the Middle Class - A Cautionary History. Bloomsbury Trade, London 2013 (German: Inflation: The Fall of Money in the Weimar Republic and the Birth of German Trauma. , Siedler Verlag, Munich 2013, ISBN 978-3-8275-0011-3 ).

Web links

- inflation

- Zeitgeschichten on Spiegel Online: Hyperinflation 1923: When the mark was destroyed and time is money

- Contemporary stories on Spiegel Online: Emergency money: The beautiful note.

- Inflation in Germany 1919-1923

Individual evidence

- ↑ Reichstag Protocols Volume 306, August 20, 1915, p. 224.

- ↑ Konrad Roessler: The financial policy of the German Reich in the First World War . Berlin 1967, p. 79, table 5.

- ^ Wolfgang Trapp / Torsten Fried: Handbook of coinage and money in Germany. Reclam-Verlag, Stuttgart 2006 ISBN 978-3-15-010617-4 p. 132 ff.

- ↑ Ernst Bäumler: The red factory. Verlag Piper 1988, ISBN 3-492-10669-2 , p. 262: In mid-1924, wages could only be paid with 25% new Rentenmarks, 25% emergency money from the Farbwerke and 50% old paper money. It was not until early 1925 that everything could be paid out in new Rentenmarks.

- ↑ Statistical Yearbook of the German Reich 1926, page 314

- ↑ Peter Menzel: German emergency coins and other money substitute stamps 1873-1932 , Berlin 1982

- ↑ Evidence of the inflation period. Infla-Berlin, Verein der Deutschlandsammler eV, accessed on January 29, 2013 .

- ^ Hermann Bente: The German monetary policy from 1914-1924 . In: World Economic Archive . Volume 25, 1926, No. 1, p. 134.

- ↑ Course November 15, 1923 final determination December 19, 1923

- ↑ After November 20, the Deutsche Reichspost increased the letter postage in increments of over 20 billion and 80 billion to last 100 billion marks. The postage from December 1st was set at 10 RPf. (online at: infla-berlin.de )