John Maynard Keynes: Difference between revisions

+ka |

No edit summary |

||

| Line 195: | Line 195: | ||

[[Category:Liberal Party politicians (UK)]] |

[[Category:Liberal Party politicians (UK)]] |

||

[[Category:Bretton Woods conference delegates]] |

[[Category:Bretton Woods conference delegates]] |

||

[[Category:Debating alumni]] |

|||

[[ar:جون مينارد كينز]] |

[[ar:جون مينارد كينز]] |

||

Revision as of 21:11, 2 January 2008

John Maynard Keynes | |

|---|---|

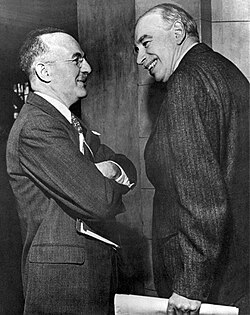

John Maynard Keynes (right) and Harry Dexter White at the Bretton Woods Conference | |

| Born | June 5, 1883 |

| Died | April 21, 1946 (aged 62) |

| Education | King's College, Cambridge |

| Occupation | Economist |

| Spouse | Lydia Lopokova |

| Parent(s) | John Neville Keynes, Florence Ada Brown |

John Maynard Keynes, 1st Baron Keynes, CB (Template:PronEng "cains") (5 June 1883 – 21 April 1946) was a British economist whose ideas, called Keynesian economics, had a major impact on modern economic and political theory as well as on many governments' fiscal policies. He advocated interventionist government policy, by which the government would use fiscal and monetary measures to mitigate the adverse effects of economic recessions, depressions and booms. He is one of the fathers of modern theoretical macroeconomics.

Biography

Personal and marital life

Born at 6 Melville Road, Cambridge, John Maynard Keynes was the son of John Neville Keynes, an economics lecturer at Cambridge University, and Florence Ada Brown, a successful author and a social reformer. His younger brother Geoffrey Keynes (1887–1982) was a surgeon and bibliophile and his younger sister Margaret (1890–1974) married the Nobel-prize-winning physiologist Archibald Hill.

Keynes' early relationships were almost all with men. One of his great loves was the artist Duncan Grant , whom he met in 1908. They remained together for several years, and remained friends for life.[1] In 1918, Keynes met Lydia Lopokova, a well-known Russian ballerina, and they married in 1925. By most accounts, the marriage was a happy one.

Keynes was ultimately a successful investor, building up a substantial private fortune. He was nearly wiped out following the Stock Market Crash of 1929, but he soon recouped his fortune. He enjoyed collecting books: for example, he collected and protected many of Isaac Newton's papers. He was interested in literature in general and drama in particular and supported the Cambridge Arts Theatre financially, which allowed the institution to become, at least for a while, a major British stage outside of London.

Bertrand Russell named Keynes as the most intelligent person he had ever known, commenting, "Every time I argued with Keynes, I felt that I took my life in my hands, and I seldom emerged without feeling something of a fool." Keynes also famously commented to his wife that he had "met God on the 5:15 train" when he received Russell's protege Ludwig Wittgenstein on behalf of Cambridge.

Education

Keynes enjoyed an elite early education at Eton, where he displayed talent in a wide range of subjects; particularly mathematics, classics and history. His abilities were remarkable for their sheer diversity. He entered King’s College, Cambridge, in 1902, to study mathematics, but his interest in politics led him towards the field of economics, which he studied at Cambridge under A.C. Pigou and Alfred Marshall. Marshall is believed to have prompted Keynes's shift in interest from mathematics and classics to economics. Keynes received his B.A. in 1905 and his M.A. in 1908

Career

Keynes accepted a lectureship at Cambridge in economics funded personally by Alfred Marshall, from which position he began to build his reputation. Soon he was appointed to the Royal Commission on Indian Currency and Finance, where he showed his considerable talent at applying economic theory to practical problems.

His expertise was in demand during the First World War. He worked for the Adviser to the Chancellor of the Exchequer and to the Treasury on Financial and Economic Questions. Among his responsibilities were the design of terms of credit between Britain and its continental allies during the war, and the acquisition of scarce currencies.

At this latter endeavor Keynes’ “nerve and mastery became legendary,” in the words of Robert Lekachman, as in the case where he managed to put together — with difficulty — a small supply of Spanish pesetas and sold them all to break the market: it worked, and pesetas became much less scarce and expensive. These accomplishments led eventually to the appointment that would have a huge effect on Keynes’ life and career: financial representative for the Treasury to the 1919 Paris Peace Conference.

Keynes' career lifted off as an adviser to the British finance department from 1915 – 1919 during World War I, and their representative at the Versailles peace conference in 1919. His observations appeared in the highly influential book The Economic Consequences of the Peace in 1919, followed by A Revision of the Treaty in 1922. Using statistics provided to him by the German delegation, he argued that the reparations which Germany was forced to pay to the victors in the war were too large, would lead to the ruin of the German economy and result in further conflict in Europe. These predictions were borne out when the German economy suffered in the hyperinflation of 1923. Only a fraction of reparations were ever paid.

Keynes published his Treatise on Probability in 1921, a notable contribution to the philosophical and mathematical underpinnings of probability theory, championing the important view that probabilities were no more or less than truth values intermediate between simple truth and falsity. He attacked the deflation policies of the 1920s with A Tract on Monetary Reform in 1923, a trenchant argument that countries should target stability of domestic prices and proposing flexible exchange rates. The Treatise on Money (1930) (2 volumes) effectively set out his Wicksellian theory of the credit cycle.

As Keynes recognizes in his magnum opus which was published in 1936, the General Theory of Employment, Interest and Money, his efforts challenged the economic paradigm. In the foreword to the German edition of the General Theory , [2] Keynes states that "the theory of aggregated production, which is the point of the following book, nevertheless can be much easier adapted to the conditions of a totalitarian state [eines totalen Staates] than the theory of production and distribution of a given production put forth under conditions of free competition and a large degree of laissez-faire."

In this book Keynes put forward a theory based upon the notion of aggregate demand to explain variations in the overall level of economic activity, such as were observed in the Great Depression. The total income in a society is defined by the sum of consumption and investment; and in a state of unemployment and unused production capacity, one can only enhance employment and total income by first increasing expenditures for either consumption or investment. The book was indexed by Keynes's student, later the economist David Bensusan-Butt.

The total amount of saving in a society is determined by the total income and thus, the economy could achieve an increase of total saving, even if the interest rates were lowered to increase the expenditures for investment. The book advocated activist economic policy by government to stimulate demand in times of high unemployment, for example by spending on public works. The book is often viewed as the foundation of modern macroeconomics. Historians agree that Keynes influenced U.S. president Roosevelt's New Deal, but disagree as to what extent. Deficit spending of the sort the New Deal began in 1938 had previously been called "pump priming" and had been endorsed by President Herbert Hoover. Few senior economists in the U.S. agreed with Keynes in the 1930s. With time, however, his ideas became more widely accepted.[3]

In 1942, Keynes was a highly recognized economist and was raised to the House of Lords as Baron Keynes, of Tilton in the County of Sussex, where he sat on the Liberal benches. During World War II, Keynes argued in How to Pay for the War that the war effort should be largely financed by higher taxation, rather than deficit spending, in order to avoid inflation. As Allied victory began to look certain, Keynes was heavily involved, as leader of the British delegation and chairman of the World Bank commission, in the negotiations that established the Bretton Woods system. The Keynes-plan, concerning an international clearing-union argued for a radical system for the management of currencies, involving a world central bank, the International Clearing Union, responsible for a common world unit of currency, the Bancor. The USA's greater negotiating strength, however, meant that the final outcomes accorded more closely to the less radical plans of Harry Dexter White.

Keynes wrote Essays in Biography and Essays in Persuasion, the former giving portraits of economists and notables, whilst the latter presents some of Keynes' attempts to influence decision-makers during the Great Depression. Keynes was editor in chief for the Economic journal from 1912. He was also a member of the Liberal Party.

Main contributions to economic thought

In his magnum opus, The General Theory of Employment, Interest, and Money (1936), Keynes laid the foundation for the branch of economics termed "Macroeconomics" today. Based on the methods devised by Alfred Marshall, he argued that macroeconomic relationships differ from their microeconomic counterparts because the ceteris paribus clauses applicable to different levels of aggregation differ. The view of given prices and wages income determines demand (see IS-LM), pre-dates Keynes. His innovation is to take, in his core argument, prices and wages as perfectly flexible and establish that the interaction of "aggregate demand" (in his sense) and "aggregate supply" (in his sense) may lead to stable unemployment equilibria. His work on employment went against the idea that the market ultimately settles at a state of full employment - a central tenet of Classical economists. Instead he argued that there exists a continuum of equilibria, the full employment equilibrium position being just one of them.(This idea underlies the choice of the title "General Theory": the classical theory being just a special case.)

His main contribution can be seen in establishing an approach to macroeconomics that maintains its relationship to the underlying microeconomic behaviors, but assumes a form qualitatively different from microeconomic models. (This contrasts with the assumption made in New Classical Economics where macro relationships are modelled analogously to micro-relationships, →Robert Lucas, Jr.). He maintained, however, many factually doubtful assumptions of standard theory. He assumed for instance that (marginal) labour productivity decreases with expanding employment. This is incompatible with the empirical findings summarized in Okun's Law. He combined this position with the marginal productivity theory of wages, implying that real wages decrease with increasing employment. This is empirically incorrect, as has been pointed out by the economist Dunlop, and the criticism has readily been accepted by Keynes. Further, Keynes suggested in the General Theory that inflation would occur only near "full employment" (in his sense), but it has been observed in many cases that inflation creeps up in states of severe underemployment (Stagflation). The assumption entertained by Keynes that inflation can only occur near full employment is still maintained in modern macroeconomics (→NAIRU). Keynes held that the cause of unemployment is a too high rate of savings, or insufficient investment expenditure. He conjectured that the amount of labour supplied is different when the decrease in real wages is due to a decrease in the money wage, than when it is due to an increase in the price level, assuming money wages stay constant. This conjecture relates to the "actual attitudes of workers" and is "not theoretically fundamental," although the New Keynesian economics emphasizes this point.

In his Theory of Money, Keynes said that savings and investment were independently determined. The amount saved had little to do with variations in interest rates which in turn had little to do with how much was invested. Keynes thought that changes in saving depended on the changes in the predisposition to consume which resulted from marginal, incremental changes to income. Therefore, investment was determined by the relationship between expected rates of return on investment and the rate of interest.

In 1944, Mount Washington Hotel hosted the United Nations Monetary and Financial Conference also known as the Bretton Woods International Monetary Conference. Delegates from 44 nations convened, establishing the World Bank and International Monetary Fund, setting the gold exchange standard at $35.00 an ounce and designating the United States dollar as the backbone of international exchange. Keynes was leader of the British delegation. The signing of the formal documents took place in the Gold Room, located off the Hotel Lobby and now preserved as an historic site, creating the Bretton Woods system. This system partly ended with the Nixon Shock.

Keynes vs. Hayek

Keynes had a fearsome reputation as a talented debater and Friedrich von Hayek refused to discuss economics matters in person with him on several occasions. (However, this repeated refusal came after Hayek had extensively critiqued Keynes's 1930 Treatise on Money,[4] only to have Keynes assert that the Treatise no longer reflected his thinking.) However, after reading Hayek's The Road to Serfdom Keynes said, "In my opinion it is a grand book ... Morally and philosophically I find myself in agreement with virtually the whole of it: and not only in agreement with it, but in deeply moved agreement." Keynes was known, however, to open his letters with such complimentary language. He concluded the same letter with the prophecy, "What we need therefore, in my opinion, is not a change in our economic programmes, which would only lead in practice to disillusion with the results of your philosophy; but perhaps even the contrary, namely, an enlargement of them. Your greatest danger is the probable practical failure of the application of your philosophy in the United States." [5] Hayek explained the first section of the letter saying that this is "because Keynes believed that he was fundamentally still a classical English liberal and wasn't quite aware of how far he had moved away from it. His basic ideas were still those of individual freedom. He did not think systematically enough to see the conflicts."[6]

Arts Council of Great Britain

Keynes' personal interest in Classical Opera and Dance focused on his support of the Royal Opera House, Covent Garden and the Ballet Company at Sadlers Wells. During the War as a member of CEMA Keynes helped secure government funds to maintain both companies while their venues were shut. Following the War Keynes was instrumental in establishing the Arts Council of Great Britain and was the founding Chairman in 1946. Unsurprisingly from the start the two organisations that received the largest grant from the new body were the Royal Opera House and Sadlers Wells.

Death

Keynes died of myocardial infarction (heart attack) at his vacation home in Tilton, East Sussex., his heart problems being aggravated by the strain of working on post-war international financial problems. He died soon after he arranged a guarantee of an Anglo-American loan to Great Britain. Keynes' father, John Neville Keynes (1852 – 1949) outlived his son by three years. Keynes' brother Sir Geoffrey Keynes (1887 – 1982) was a distinguished surgeon, scholar and bibliophile. His nephews include Richard Keynes (born 1919) a physiologist; and Quentin Keynes (1921 – 2003) an adventurer and bibliophile.

Bibliography

- Essays in Persuasion

- A Treatise On Probability

- Tract on Monetary Reform

- The General Theory of Employment, Interest, and Money

- The Economic Consequences of the Peace

Influences on Keynes' works

- Knut Wicksell

- Arthur C. Pigou

- Alfred Marshall

- Adam Smith

- David Ricardo

- Dennis Robertson

- Karl Marx

- Thomas Malthus

- Michal Kalecki

Keynes' influence

Keynes' theories were so influential, even when disputed, that a subfield of Macroeconomics called Keynesian economics is further developing and discussing his theories and their applications. John Maynard Keynes had several cultural interests and was a central figure in the so-called Bloomsbury group, consisting of prominent artists and authors in Britain. His autobiographical essays Two Memoirs appeared in 1949.

Critique

- While Milton Friedman describes The General Theory as 'a great book', he argues that its implicit separation of nominal from real magnitudes is neither possible nor desirable; macroeconomic policy, Friedman argues, can reliably influence only the nominal.[7]. He and other monetarists have consequently argued that Keynesian economics can result in stagflation, the combination of low growth and high inflation that developed economies suffered in the early 1970s. More to Friedman's taste was the 1923 Tract on Monetary Reform, which he regarded as Keynes's best work because of its focus on maintaining domestic price stability.[7]

- Friedrich von Hayek reviewed the Treatise on Money so harshly that Keynes decided to set Piero Sraffa to review (and condemn no less harshly) Hayek's own competing work. [reference needed] The Keynes-Hayek conflict was but one battle in the Cambridge-LSE war. Hayek also felt that application of Keynes policies gives too much power to the state and leads to socialism.[8]

- Murray Rothbard's essay Keynes, the Man[2], a scathing attack on both Keynes' economic theories and personage. Rothbard criticized Keynesian Economics as being "old discredited Mercantilism fallacies dressed up by Keynes in a wilderness of unclear writing and pretentious jargon."

- Henry Hazlitt has written a book entitled The Failure of the New Economics, a detailed chapter-by-chapter critique of Keynes' "General Theory" [3]

- German economist and banker L. Albert Hahn wrote The Economics of Illusion in the 1940's, which criticized many of Keynes' theories.

- Roger W. Garrison author of Time and Money: The Macroeconomics of Capital Structure and other

- The Crisis of Keynesian Economics A Marxist View by Geoffrey Pilling

- Winston Churchill was quoted as saying: "If you put two economists in a room, you get two opinions, unless one of them is Lord Keynes, in which case you get three opinions."

See also

- Keynesian economics or Keynesianism

- Michał Kalecki

- Simon Kuznets

- Paul Samuelson

- John Hicks

- John Kenneth Galbraith

- G.L.S. Shackle

- Silvio Gesell

External links

- Bio, bibliography, and links

- Works by John Maynard Keynes at Project Gutenberg

- The Keynesian Revolution

- Bio at Time 100 - the most important people of the century

- John Maynard Keynes, The Economic Consequences of the Peace (1919)

- John Maynard Keynes, The end of laissez-faire (1926)

- John Maynard Keynes, An Open Letter to President Roosevelt (1933)

- John Maynard Keynes, The General Theory of Employment, Interest and Money (1936)

- Eton College Keynes (Economics) Society

- Short bio with birth location

- Escoffier, Jeffrey. "Keynes, John Maynard." In Glbtq: An Encyclopedia of Gay, Lesbian, Bisexual, Transgender, and Queer Culture. glbtq, Inc.: Chicago, 2004.

- Essays on John Maynard Keynes and Robert Lekachman by Reuben L. Norman Jr., Ph.D. ( 1998-2007 )

- Smith, Marx, Kondratieff and Keynes: Their Intellectual Life Spans, the Convergence of their Theories based upon the Long Wave Hypothesis and the Internet by Reuben L. Norman Jr., Ph.D. ( June 6, 1998 )

- Keynes's Career and Biographical Timeline

References

- The Economic Consequences of Mr. Keynes: How the Second Industrial Revolution Passed Great Britain By, Bernard C. Beaudreau, iUniverse, 2006, ISBN 0-595-41661-6

- Essays on John Maynard Keynes, Milo Keynes (Editor), Cambridge University Press, 1975, ISBN 0-521-20534-4

- The Life of John Maynard Keynes, R. F. Harrod, London, Macmillan, 1951, ISBN 1-12-539598-2

- "Keynes, John Maynard," Don Patinkin, The New Palgrave: A Dictionary of Economics, v. 2, 1987, pp. 19-41. Macmillan ISBN 0-333-37235-2 (US Edition: ISBN 0-935859-10-1)

- John Maynard Keynes: Hopes Betrayed 1883-1920, Robert Skidelsky, Papermac, 1992, ISBN 0-333-57379-X (US Edition: ISBN 0-14-023554-X)

- John Maynard Keynes: The Economist as Saviour 1920-1937, Robert Skidelsky, Papermac, 1994, ISBN 0-333-58499-6 (US Edition: ISBN 0-14-023806-9)

- The Commanding Heights: The Battle for the World Economy, Daniel Yergin with Joseph Stanislaw, New York: Simon & Schuster, 1998, ISBN 0-684-82975-4

- John Maynard Keynes: Fighting for Britain 1937-1946 (published in the United States as Fighting for Freedom), Robert Skidelsky, Papermac, 2001, ISBN 0-333-77971-1 (US Edition: ISBN 0-14-200167-8)

- Lytton Strachey, Michael Holroyd, 1995, ISBN 0-393-32719-1

Citations

- ^ Escoffier, Jeffrey (2004), "Keynes, John Maynard", glbtq.com

- ^ Keynes, John Maynard. Foreword to the General Theory. Foreword to the German Edition/Vorwort Zur Deutschen Ausgabe [[1]]

- ^ Martin, Kingsley (1940). "Mr Keynes Has A Plan". Picture Post.

{{cite journal}}: Unknown parameter|month=ignored (help); Unknown parameter|quotes=ignored (help) - ^ Hayek, Friedrick August von. “Reflections on the Pure Theory of Money of Mr. J.M. Keynes”, Economica #11 (August 1931) & #35 (February 1932)

- ^ [Hoover, Kenneth R. Economics as Ideology. Rowman and Littlefield Publishers(2008) p. 152 ISBN 0742531139]

- ^ Reason Magazine, The Road to Serfdom, Foreseeing the Fall. F.A. Hayek interviewed by Thomas W. Hazlett

- ^ a b Milton Friedman, John Maynard Keynes, Federal Reserve Bank of Richmond Economic Quarterly Volume 83/2, Spring 1997

- ^ Robert Dransfield, Don Dransfield, Key Ideas in Economics, Nelson Thornes (2003), ISBN 074877081X p.81

- 1883 births

- 1946 deaths

- Alumni of King's College, Cambridge

- Barons in the Peerage of the United Kingdom

- Bloomsbury Group

- British economists

- Economists

- Macroeconomists

- Keynesians

- Keynes family

- Keynesian economics

- LGBT people from England

- Macroeconomics

- People from Cambridgeshire

- Old Etonians

- Old Fidelians

- People from Cambridge

- Presidents of the Cambridge Union Society

- Liberal Party politicians (UK)

- Bretton Woods conference delegates

- Debating alumni