Foreign exchange market

The foreign exchange market ( foreign currency market , FX market , also forex ; English Foreign exchange market ) is a sub-market of the financial market where the supply of foreign currency and the demand for foreign currency meet and are exchanged at the negotiated exchange rate .

General

In addition to the foreign exchange market, the financial markets also include the money and capital markets . The foreign exchange market cannot be localized because the majority of foreign exchange trading takes place directly between market participants and foreign exchange exchanges have largely been abolished or have become meaningless. Market participants in the foreign exchange market are credit institutions , central banks (also within the framework of foreign exchange market intervention ), the state and large companies in the non-bank sector . Small and medium-sized businesses as well as households must turn to credit institutions for their foreign exchange transactions. Trading objects on the foreign exchange market are foreign exchange, i.e. book money in foreign currency .

The foreign exchange market is the largest financial market in the world with a worldwide daily turnover of approximately 6.6 trillion US dollars in 2019.

history

Foreign exchange trading had its primitive beginnings in ancient Greece. When Hellenism was in its heyday, traders from the Middle East and the surrounding Europe met in Greece , which is why a wide variety of currencies collided. In the port city of Piraeus , so-called “ money changers ” changed coins from different cities and countries by measuring their gold ratio and weight. Furthermore, raw materials such as gold and silver could be exchanged for a corresponding amount of money and vice versa. In the 16th century it was the powerful Florentine Medici family who wrote a book in the form of a nostro account (called nostro ), which contained a detailed list of domestic and foreign currencies and their respective exchange values. International foreign exchange trading began in 1880 with the option of having foreign payments credited to your own bank account abroad. With the establishment of the IMF and the World Bank, and in particular the Bretton Woods Agreement of July 22, 1944, fixed exchange rates were created around the world , the fluctuation ranges of which were set internationally. Central banks were obliged to intervene in the market if the so-called intervention points were exceeded or not reached, and thus to restore the intervention points. These fixed exchange rates were loosened for the first time on September 30, 1969, on March 19, 1973 the EC began joint block-floating against the US dollar, which replaced the previously applicable fixed exchange rates in favor of freely fluctuating exchange rates. By floating exchange rates, the risks for market participants increased; Stock, interest and foreign exchange markets were henceforth exposed to greater price fluctuations (volatilities).

This was particularly true in times of crisis such as the first so-called oil crisis , which was triggered by the Yom Kippur War after October 26, 1973. The closure of the Herstatt Bank on June 26, 1974 raised questions about counterparty risks in interbank trading for the first time , with the risk that one bank could default and no longer meet its contractual obligations when the other bank relied on the consideration has already done (so-called Herstatt risk ). As a result, new banking supervisory regulations became necessary and the need for effective instruments for effective and efficient risk management increased.

On August 13, 1982 Mexico closed its foreign exchange market, triggering the so-called debt crisis, particularly in Latin America and other developing countries. Other state crises such as the tiger crisis (1997) or the Argentina crisis (1998) followed and had an enormous impact on the foreign exchange markets. This showed that the foreign exchange markets, unlike securities or money markets, are very much shaped by state and state-political influences: if a certain currency gets into a crisis, the central bank or even the state itself intervenes.

Market participants, trade media, trade object

The foreign exchange market enables domestic money to be exchanged for foreign currency and vice versa, thereby converting purchasing power from domestic currency to foreign currency. The global foreign exchange markets are characterized in particular by foreign exchange trading. In addition to credit institutions , major players in the foreign exchange market are also larger industrial companies, private foreign exchange dealers, foreign exchange brokers and trading houses. Central banks are an important group of actors in the foreign exchange market. These can intervene in the market for (economic) political reasons through foreign exchange market interventions in order to e.g. B. restore the currency market equilibrium.

Most of the foreign exchange trading takes place over the counter in interbank trading . Foreign exchange exchanges - unlike the stock exchanges - were rarely involved in foreign exchange trading and were therefore largely abolished (in Germany on December 31, 1998). Its most important function, the determination of the official exchange rates , has been performed by reference values such as the EuroFX in Europe ever since . The main trading medium is online trading via trading platforms such as the electronic broker EBS and telephone trading . Trading objects are foreign currencies that have a currency denomination representing their country of origin. Of the world's most important trading currencies , the pound sterling was introduced as the first currency in 1750, followed by the Swiss franc in 1850 , the yen in 1871 , and the US dollar in 1875 . One of the youngest currencies is the euro, introduced in January 2002 .

Forex trading and foreign exchange transactions

The foreign exchange market is institutionalized through foreign exchange trading. In the narrower sense, this is understood to mean the interbank market in the context of customer business and proprietary trading . Here, internationally active credit institutions trade in the form of standardized foreign exchange transactions on the basis of recognized trading practices with the trading object foreign exchange. Foreign exchange transactions, in turn, consist of the basic forms of foreign exchange spot or forward exchange transactions and the derived ( derivatives ) currency swaps and currency options transactions.

Spot foreign exchange transactions

Foreign exchange spot transactions (also spot transactions ) are used if there is a maximum of two banking days between the day the transaction is concluded and the day the mutual claims are met . On the day of fulfillment, the seller delivers the sold foreign currency to the agreed account, while the buyer of the foreign currency has to pay the agreed value. It is therefore a pure currency exchange.

Forward foreign exchange transactions

In the case of forward exchange transactions (also known as forward , solo or outright transactions ) there is a period of at least 3 working days or 1, 2, 3, 6, 12 or more months between the day the transaction is concluded and the fulfillment date, whereby both parties to the contract apply the conditions agreed on the day of the transaction (especially the exchange rate) regardless of whether the current exchange rate situation has changed. For this reason, the forward exchange business belongs to the rate hedging or hedging business .

Foreign exchange swaps

In a foreign exchange swap (also briefly swap , from narrow. To swap , swap ') is, to the combination of a spot transaction with a forward transaction, namely spot exchange purchase are exchanged with foreign currency forward sales, or vice versa. The exchange of two currencies on the day the transaction is concluded and the exchange back at a later point in time are agreed at the same time. Because of the combination with a forward transaction, the swap transaction is also a rate hedging transaction.

Currency option transactions

A currency option is an agreement that gives the option buyer the right to purchase or deliver a currency at a specific rate and at a specific time or within a period of time. For this right, the buyer pays the seller a price (option premium). The seller of the option assumes the obligation to deliver or receive the currency.

Pricing in Macroeconomic Theory

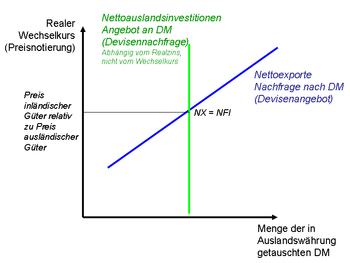

The supply represents the net foreign investment, i.e. the supply of foreign exchange demand. They are independent of the real exchange rate (only dependent on the real interest rate on the credit market ). The demand comes about through net exports , i.e. the demand for foreign exchange supply. The market equilibrium gives net exports = net foreign investment . The foreign exchange market and the credit market are related, among other things, to foreign investments.

trade

Trading venues

Trading does not take place centrally via an exchange, but mostly directly between financial institutions via appropriate dealer networks. Increasingly, there are also corporations , brokers and private speculators among the participants . Trading takes place around the world and usually exclusively on weekdays (the dollar is not traded on US public holidays; the euro not on May 1st) around the clock (Sun 11pm - Fri 11pm CEST), so that the investors involved are always on relevant Events can react.

terminology

As with any legal transaction , foreign exchange trading consists of performance and consideration , e.g. B. Euros are exchanged for dollars or dollars for yen.

Exchange rates are usually given in so-called currency pairs - this notation is also called price quotation . The base currency is then Base currency (of English base currency ) and the target currency is quote currency (of English quote currency called). In addition to the pure exchange ratio, the ISO 4217 codes of the two currencies are also mentioned, either without a separator symbol or separated by a slash or a point. The exchange rate is usually given with five significant digits :

If the exchange rate rises (e.g. EUR / USD), you get

- with the same amount of base currency, more of the target currency, the target currency "weakens" or

- for the same amount of the target currency, less has to be paid in the base currency, the base currency becomes “stronger” or “quoted more firmly”.

The opposite applies to a falling exchange rate.

Price changes are given in pips and the unit of trade is the lot .

Example: 1.5933 EUR / USD

The base currency here is the euro and the quote currency is the US dollar, i. H. for € 1 you would get $ 1.5933.

Institutional market participants

In practice, foreign exchange trading between banks now takes place almost exclusively electronically. Large amounts are often traded between banks within seconds. In this form of forex trading, there is usually no delivery of cash, almost exclusively book money is transferred.

Private customers

A common foreign exchange business in private customer business is the international transfer to a country with a foreign currency . Occasionally there is a need to hedge larger foreign currency liabilities, e.g. B. to maintain a holiday home in a country with a foreign currency or for cross-border commuters who live abroad. This can be done with the help of accounts at a local bank in the foreign currency country, through which the liabilities are then also paid.

Furthermore, the foreign exchange business also plays a role for private investors as part of the securities business. In the case of securities that are traded in foreign currencies, that generate income distributions in foreign currencies, or that are repaid in foreign currencies (e.g. foreign currency bonds), the bank automatically carries out the corresponding currency exchange. The same applies to foreign currency checks . Depending on their construction, certificates can be linked to the development of exchange rates.

Foreign exchange transactions are also an area of activity for speculative private investors. However, direct access to interbank trading and the currency futures market is not possible for small investors because the volumes traded are too large. For this reason, so-called "Forex brokers" appear on the market, giving speculators indirect access to the foreign exchange market via contracts for difference .

Risks

Foreign currency accounts at German banks are exempt from the statutory deposit guarantee insofar as they refer to currencies from non-EU countries.

According to the market efficiency hypothesis, speculation against the foreign exchange market is a pure risk business and, as a zero-sum game with fees, is also a losing business: Over half of the currency trading accounts generate losses. Exchange rates are subject to unpredictable fluctuations, which can also assume considerable proportions during the course of the day. This risk is multiplied when it is leveraged to exacerbate small fluctuations in exchange rates.

The US agency CFTC continues to warn against unfair methods that providers try to persuade retail investors to trade forex, including aggressive sales tactics, the promise of high profits or the trivialization of the risk of loss.

Fraud risks

The US consumer protection association NASAA warns that over-the-counter forex trading by private investors is extremely risky at best, and fraud at worst.

Some retail forex brokers are suspected of engaging in prohibited business practices that disadvantage customers, and the majority are exploiting legal gray areas. Regulatory authorities and the public prosecutor's office are also unable to distinguish the brokers concerned from the white sheep. The broker is subject to conflicts of interest because he can set the customer rate at a different rate from the rate of the refinancing transaction, so that there is no transparency in the quotation and execution of transactions.

The CFTC recorded a total of 114 foreign exchange-related interventions in the United States from December 2000 to September 2009, affecting over 26,000 customers. The average fraud victim loses about $ 15,000 in the process. In August 2008 she set up a special working group on forex fraud. The specific interventions by the CFTC made in part due to churning of customer accounts to generate commissions, false statements in advertising, particularly in relation to managed accounts and automatic trading software, pyramid schemes and direct fraud.

Frequently and rarely traded currencies

Most traded currencies

The international reserve currencies US dollar , euro , Japanese yen and British pound as well as the regional currency Australian dollar are the most widely traded currencies on the foreign exchange market. The following table shows the 20 most frequently traded currencies and their percentage share in the average daily turnover since 2001 (April each year). Since two currencies are always involved in every foreign exchange transaction, the proportions of the individual currencies add up to 200%.

| Rank (2013) |

currency | ISO 4217 code | 2001 | 2004 | 2007 | 2010 | 2013 |

|---|---|---|---|---|---|---|---|

| 1 | U.S. dollar | USD | 89.9 | 88.0 | 85.6 | 84.9 | 87.0 |

| 2 | Euro | EUR | 37.9 | 37.4 | 37.0 | 39.1 | 33.4 |

| 3 | Japanese yen | JPY | 23.5 | 20.8 | 17.2 | 19.0 | 23.0 |

| 4th | British pound | GBP | 13.0 | 16.5 | 14.9 | 12.9 | 11.8 |

| 5 | Australian dollar | AUD | 4.3 | 6.0 | 6.6 | 7.6 | 8.6 |

| 6th | Swiss franc | CHF | 6.0 | 6.0 | 6.8 | 6.4 | 5.2 |

| 7th | Canadian dollar | CAD | 4.5 | 4.2 | 4.3 | 5.3 | 4.6 |

| 8th | Mexican peso | MXN | 0.8 | 1.1 | 1.3 | 1.3 | 2.5 |

| 9 | China yuan renminbi | CNY | 0.0 | 0.1 | 0.5 | 0.9 | 2.2 |

| 10 | New Zealand dollar | NZD | 0.6 | 1.1 | 1.9 | 1.6 | 2.0 |

| 11 | Swedish crown | SEK | 2.5 | 2.2 | 2.7 | 2.2 | 1.8 |

| 12 | Russian ruble | RUB | 0.3 | 0.6 | 0.7 | 0.9 | 1.6 |

| 13 | Hong Kong dollars | HKD | 2.2 | 1.8 | 2.7 | 2.4 | 1.4 |

| 14th | Norwegian krone | NOK | 1.5 | 1.4 | 2.1 | 1.3 | 1.4 |

| 15th | Singapore dollar | SGD | 1.1 | 0.9 | 1.2 | 1.4 | 1.4 |

| 16 | Turkish lira | TRY | 0.0 | 0.1 | 0.2 | 0.7 | 1.3 |

| 17th | South Korean won | KRW | 0.8 | 1.1 | 1.2 | 1.5 | 1.2 |

| 18th | South African rand | ZAR | 0.9 | 0.7 | 0.9 | 0.7 | 1.1 |

| 19th | Brazilian real | BRL | 0.5 | 0.3 | 0.4 | 0.7 | 1.1 |

| 20th | Indian Rupee | INR | 0.2 | 0.3 | 0.7 | 0.9 | 1.0 |

| Others | 8.9 | 9.0 | 10.8 | 8.8 | 6.4 | ||

| All currencies | 200.0 | 200.0 | 200.0 | 200.0 | 200.0 |

Most traded currency pairs

The currencies of the largest economic areas ( US dollar , euro , Japanese yen ), currencies from countries with strong financial centers ( British pound and Swiss franc ) and currencies of resource-rich countries ( Australian dollar and Canadian dollar ) are traded most frequently . The EUR / USD pair has the highest trading volume (28% of all sales), followed by USD / JPY (14%) and GBP / USD (9%).

In technical jargon , the most important currency pairs are referred to as "majors". Currency pairs that do not include the US dollar are called "crosses".

The following table shows the 20 most traded exchange rates since 2001 (April each).

| Rank (2010) |

Currency pair | Billion USD (2001) |

Share in% |

Billion USD (2004) |

Share in% |

Billion USD (2007) |

Share in% |

Billion USD (2010) |

Share in% |

|---|---|---|---|---|---|---|---|---|---|

| 1 | US dollars / euros | 372 | 30th | 541 | 28 | 892 | 27 | 1101 | 28 |

| 2 | US dollar / Japanese yen | 250 | 20th | 328 | 17th | 438 | 13 | 568 | 14th |

| 3 | US dollar / British pound | 129 | 10 | 259 | 13 | 384 | 12 | 360 | 9 |

| 4th | US dollar / Australian dollar | 51 | 4th | 107 | 6th | 185 | 6th | 249 | 6th |

| 5 | US dollar / Canadian dollar | 54 | 4th | 77 | 4th | 126 | 4th | 182 | 5 |

| 6th | US dollars / Swiss francs | 59 | 5 | 83 | 4th | 151 | 5 | 168 | 4th |

| 7th | Euro / Japanese yen | 36 | 3 | 61 | 3 | 86 | 3 | 111 | 3 |

| 8th | Euro / British pound | 27 | 2 | 47 | 2 | 69 | 2 | 109 | 3 |

| 9 | US dollars / Hong Kong dollars | 19th | 2 | 19th | 1 | 51 | 2 | 85 | 2 |

| 10 | Euro / Swiss franc | 13 | 1 | 30th | 2 | 62 | 2 | 72 | 2 |

| 11 | US dollar / South Korean won | 8th | 1 | 16 | 1 | 25th | 1 | 58 | 1 |

| 12 | US dollar / Swedish krona | 6th | 0 | 7th | 0 | 57 | 2 | 45 | 1 |

| 13 | US dollar / Indian rupee | 3 | 0 | 5 | 0 | 17th | 1 | 36 | 1 |

| 14th | Euro / Swedish krona | 3 | 0 | 3 | 0 | 24 | 1 | 35 | 1 |

| 15th | US dollar / Chinese renminbi | ... | ... | 1 | 0 | 9 | 0 | 31 | 1 |

| 16 | US dollar / Brazilian real | 5 | 0 | 3 | 0 | 5 | 0 | 26th | 1 |

| 17th | US dollar / South African rand | 7th | 1 | 6th | 0 | 7th | 0 | 24 | 1 |

| 18th | Japanese yen / Australian dollar | 1 | 0 | 3 | 0 | 6th | 0 | 24 | 1 |

| 19th | Euro / Canadian dollar | 1 | 0 | 2 | 0 | 7th | 0 | 14th | 0 |

| 20th | Euro / Australian dollar | 1 | 0 | 4th | 0 | 9 | 0 | 12 | 0 |

| US dollars / other | 152 | 12 | 251 | 13 | 498 | 15th | 445 | 11 | |

| Euro / other | 17th | 1 | 35 | 2 | 83 | 2 | 102 | 3 | |

| Japanese yen / other | 4th | 0 | 11 | 1 | 43 | 1 | 53 | 1 | |

| Other currency pairs | 23 | 2 | 36 | 2 | 90 | 3 | 72 | 2 | |

| All currency pairs | 1239 | 100 | 1934 | 100 | 3324 | 100 | 3981 | 100 |

Exotic currencies

As exotic currencies (including exotic currencies or short exotics ) are designated stock exchange jargon currencies that are traded little and their liquidity is low, that is, they are not available at all times sufficient for transactions. Exotic currencies can be convertible, such as the Mexican peso, or non-convertible, such as the Brazilian real. Exotic currency pairs are currency pairs with a low trading volume.

Exotic currencies come predominantly from politically and economically unstable developing countries. The most frequently traded exotic currencies include: the Mexican peso (MXN), the Chinese yuan (CNY), the Russian ruble (RUB), the Hong Kong dollar (HKD), the Singapore dollar (SGD) and the Turkish lira (TRY), the South Korean won (KRW), the South African rand (ZAR), the Brazilian real (BRL) and the Indian rupee (INR). The examples show that the term “exotic” does not characterize the countries. It only refers to the status of rarely to very rarely traded currency.

Trading exotic currencies is often associated with high fees and high risks.

Market surveillance

There is no global oversight of the foreign exchange markets. At most, a few market participants are supervised at the national level. To the extent that market participants are considered to be credit institutions , they are subject to banking supervision in their country. Contrary to popular belief, foreign exchange trading in Germany is a banking business requiring a license . According to Section 1 (1) No. 4 of the KWG , banking is “the acquisition and sale of financial instruments in one's own name for the account of a third party (financial commission business)”. In accordance with Section 1 (11) of the KWG, financial instruments are then defined as securities, money market instruments, foreign currencies or units of account and derivatives. The proprietary trading in foreign exchange is also a financial services requiring a license according to § 1. 1a, no. 4 KWG. However, this must be distinguished from proprietary business ( section 32 (1a) sentence 1 KWG), which does not necessarily require authorization.

The banking supervisory authority monitors compliance with statutory regulations, such as the minimum requirements for risk management in Germany , which specify the organizational structure for banks' foreign exchange trading (see proprietary trading ). In addition, credit institutions are subject to regulatory reporting requirements with regard to inventory risks in foreign currencies under the SolvV . According to Sections 294 et seq. SolvV, foreign exchange positions of credit institutions that have not been closed out are linked to the own funds of a credit institution. If the total open positions (according to one of the two alternatives) exceed 2% of own funds, these open positions must be weighted with 8% (Section 294 (3) SolvV). This automatically limits the volume of the risk-intensive open positions in foreign exchange trading.

Risk management

The risks in foreign exchange trading consist primarily of market price risks . Other significant risks are the risk of failure of business partners, especially with futures transactions ( counterparty risk ), liquidity risks and market liquidity risks , operational risks (such as the failure of data processing systems) and legal risks (such as unforeseeable changes in the legal situation relevant to the currency market).

The extent of the market price risk is typically measured using the value at risk . The value at risk is the upper loss limit which, with a given holding period, will not be exceeded with a high degree of probability (e.g. 99%).

Forex Market Efficiency

The theoretical assumptions valid for the market efficiency hypothesis also apply to the foreign exchange market, however, with the difference that through the internalization of the information, the corresponding supply and demand decisions flow into the exchange rate formation. In efficient foreign exchange markets, current information about events expected in the future is included in the current exchange rate formation and the exchange rate is influenced by this. However, it must be assumed as a prerequisite for currency market efficiency that market participants have an idea of the equilibrium exchange rate. If this is not assumed, it is not possible to say that prices have to fully reflect the relevant information. It follows that forex market efficiency requires two conditions to be met:

- The foreign exchange market participants must form their expectations rationally in the sense that they do not make systematic forecast errors.

- Market participants need to know the equilibrium value.

When both conditions are considered to be met, the actual exchange rates describe random fluctuations around the equilibrium path. So when the efficiency property is now checked, both conditions are usually tested simultaneously in empirical checks. If the same conditions are rejected when checking the efficiency hypothesis, no statement can be made as to which of the two conditions was not met. This can be caused by the use of an incorrect model or that market participants' expectations are not rational.

See also

Individual evidence

- ↑ Bank for International Settlements : Turnover of OTC foreign exchange instruments, by currency , development of the average turnover per trading day on the global foreign exchange market from 1989 to 2019 (in billion US dollars), accessed: September 20, 2019

- ^ Mark Cartwright: Trade in Ancient Greece. In: ancient history. January 18, 2012, accessed December 16, 2014 .

- ↑ Heinz-Dieter Haustein: World Chronicle of Measurement . De Gruyter, 2001, ISBN 3-11-017173-2 , p. 46 .

- ^ Raymond de Rover: The Rise and Decline of the Medici Bank: 1397-1494 . Beard Books, 1999, ISBN 1-893122-32-8 , pp. 130-136 (English).

- ^ Raymond de Rover: The Medici Bank: its organization, management, operations and decline . Acls History, 2008, ISBN 1-59740-381-4 (English).

- ↑ Stephan Gehrmann, Strategic Implications of Credit Risk Management in Banks , 2004, p. 82 f.

- ^ Rolf Caspers: Balance of payments and exchange rates. 2002, p. 35 f.

- ↑ Jörn Altmann, Economic Policy - A Practice-Oriented Introduction , 2007, p. 410 f.

- ↑ Jörn Altmann, Economic Policy - A Practice-Oriented Introduction , 2007, p. 406.

- ↑ Stock exchanges and their trading hours ( Memento of the original from June 7, 2008 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Nick Douch: The Economics of Foreign Exchange . Greenwood Press, 1989, ISBN 978-0-89930-499-1 , pp. 87-90.

- ↑ http://www.financemagnates.com/forex/brokers/q4-2012-forex-traders-profitability-report-us-forex-market-keeps-losing-brokers-and-accounts/ (English)

- ^ Jack Egan: Check the Currency Risk. Then multiply by 100 . In: The New York Times , June 19, 2005. Retrieved October 30, 2007.

- ↑ http://www.cftc.gov/lawregulation/federalregister/ProposedRules/2010-456 January 20, 2010 (Volume 75, Number 12): FR Doc 2010-456 ( Memento of the original from August 28, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , Section E. The Commission's Proposed Rules

- ↑ CFTC / NASAA Investor Alert: Foreign Exchange Currency Fraud

- ^ Forex Fraud Investor Alert, " North American Securities Administrators Association , accessed May 27, 2015

- ↑ Archive link ( Memento of the original dated December 31, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Peter A. McKay: Scammers operating on Periphery Of CFTC's Domain Lure Little Guy With Fantastic Promises of Profits . In: The Wall Street Journal , Dow Jones and Company, July 26, 2005. Retrieved October 31, 2007.

- ^ CFTC establishes task force on currency fraud , Washington Post. August 11, 2007. Retrieved August 22, 2008.

- ↑ Fraud charges against multiple forex Firms ( Memento of the original from April 21, 2006 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Commodity Futures Trading Commission (CFTC) Release: 4946-0

- ↑ http://www.cftc.gov/opa/enf02/opa4711-02.htm

- ↑ SOFTWARE VENDOR CHARGED CFTC News Release 4789-03, May 21, 2003

- ↑ Foreign Currency Fraud Action ( Memento of the original from June 14, 2006 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. Commodity Futures Trading Commission (CFTC) vs. Donald O'Neill

- ^ Regulators Join Forces to Warn Public of Foreign Currency Trading Frauds . US Commodity Futures Trading Commission . May 7, 2007. Archived from the original on November 5, 2007. Retrieved March 18, 2008.

- ↑ a b Bank for International Settlements: Foreign exchange and derivatives market activity in April 2013 (PDF; 153 kB)

- ↑ a b c Exotic currencies glossary at kantox.com

- ↑ Exotic currency pairs ifcmarkets.de

- ↑ a b Börsenlexikon: Exotic currency kunnskap.de