Distribution of income in Belgium

The income distribution in Belgium considers the distribution of income in Belgium . When analyzing the distribution of income, a distinction is generally made between the functional and the personal income distribution discussed here. Personal income distribution looks at how the income of an economy is distributed among individuals or groups (e.g. private households ), regardless of the source of income from which it originates.

Belgium is one of the few countries where income inequality has remained stable or has decreased slightly in recent years. The Gini coefficient of equivalised disposable income for Belgium was 26% in 2017 and was thus below the EU27 average of 30.7%. This year the median disposable income was € 22,777 and was thus above the EU27 average of € 17,032. The average disposable income in 2017 was € 24,408.

Income distribution in general

When interpreting statistical data, one must always pay attention to which terms are used. The term income can refer, for example, to market income, i.e. income from employment, business activity, rental or capital before taxes and duties or to disposable income. This is calculated by subtracting direct taxes and social security contributions from market income and adding public (e.g. social assistance , unemployment benefits ) or private (e.g. maintenance ) transfers. The calculations below are always based on the equivalised disposable income . The data shown come from the OECD and Eurostat . The personal income distribution can be summarized using various measures of inequality and then analyzed. The most frequently used indicators are the Gini coefficient and quantile ratios ; a consideration of the median and mean income is usually the starting point for the analysis of income distribution.

Mean and median of household disposable income

If you put the incomes of different people next to one another, the median income or the mean income is the income that lies exactly in the middle of this series. Compared to mean income, median income is a more stable measure for determining income inequality because it is more robust against statistical outliers. The average income or the mean value of the income reflects the arithmetic mean of the income in relation to the number of income earners. A large difference between middle and average income indicates a highly unequal distribution of income.

In most cases, it is not only the income of the population at a certain point in time that is of interest, but also the development of income over time. Since income increases in the presence of inflation do not necessarily mean increases in prosperity , the real income is calculated in addition to the nominal income .

Average income

The average income , i.e. the average equivalised disposable income, reflects the arithmetic mean of the income in relation to the number of income earners. The average net income in Belgium in 2017 was € 24,408. However, this measure is susceptible to statistical outliers; H. high incomes distort the average income upwards.

From 1996 to 2017, the inflation-adjusted average income rose by around 5 percentage points.

Median income

If you put the incomes of different people next to one another, the median income or the mean income is the income that lies exactly in the middle of this series. Compared to mean income, median income is a more stable measure for determining income inequality because it is more robust against statistical outliers.

According to Eurostat calculations, the median income was € 22,777 in 2017. In 2016, the median income was € 22,293 - an increase of 2.17% in one year.

| year | Average | Median | HICP (2015 = 100) | Mean (adjusted) | Median (adjusted) |

|---|---|---|---|---|---|

| 2017 | 24408 | 22777 | 104.03 | 23462 | 21895 |

| 2016 | 24240 | 22293 | 101.77 | 23818 | 21905 |

| 2015 | 23674 | 21690 | 100 | 23674 | 21690 |

| 2014 | 23434 | 21698 | 99.38 | 23580 | 21833 |

| 2013 | 23268 | 21501 | 98.9 | 23527 | 21740 |

| 2012 | 21900 | 20280 | 97.68 | 22420 | 20762 |

| 2011 | 21612 | 19950 | 95.18 | 22706 | 20960 |

| 2010 | 21376 | 19458 | 92.09 | 23212 | 21129 |

| 2009 | 21002 | 19309 | 89.99 | 23338 | 21457 |

| 2008 | 19997 | 17993 | 90 | 22219 | 19992 |

| 2007 | 19144 | 17566 | 86.13 | 22227 | 20395 |

| 2006 | 19018 | 17216 | 84.6 | 22480 | 20350 |

| 2005 | 18524 | 16567 | 82.67 | 22407 | 20040 |

| 2004 | 16935 | 15667 | 80.63 | 21003 | 19431 |

| 2003 | 17168 | 15533 | 79.16 | 21688 | 19622 |

| 2001 | 17803 | 15492 | 76.78 | 23187 | 20177 |

| 2000 | 17282 | 14768 | 74.96 | 23055 | 19701 |

| 1999 | 16415 | 14200 | 73 | 22486 | 19452 |

| 1998 | 15644 | 14013 | 72.18 | 21674 | 19414 |

| 1997 | 15649 | 14086 | 71.54 | 21874 | 19690 |

| 1996 | 15719 | 14111 | 70.48 | 22303 | 20021 |

- ↑ a b To adjust income for inflation, the following calculation is used: Nominal income / HICP * 100

Gini coefficient

The Gini coefficient (or Gini index) is a statistical measure used to represent inequality in a society. This coefficient can be between 0 and 1 (or between 0 and 100 by multiplying the Gini coefficient by 100). A Gini coefficient for income of 1 describes that one individual in the economy has all income. A value of 0, on the other hand, shows total income equality. With a Gini coefficient of 0, everyone in an economy therefore has the same income. The closer the value is to 0, the more equal is the distribution of income. In general, countries with a Gini index between 20% and 35% are said to be relatively equal.

The development of the Gini coefficient in Belgium over the period from 1996 to 2017 shows that income inequality has decreased. While the Gini of equivalised disposable income was 29% in 1996, this figure fell to 26% in 2017.

Compared with other EU member states, Belgium is one of the countries with the lowest income inequality in terms of the Gini coefficient. The Gini coefficient was 30.7% on average in the EU in 2017.

S80 / S20

The quintile ratio S80 / S20 (income quintile ratio) is also a measure to describe the unequal distribution of income. It describes how often the household income of the poorest 20% fits into the household income of the richest 20%. The more unequal this value of 1, the more unequal the social distribution of income. The comparison of the top and bottom quintiles, however, only provides an assessment of the inequality on the two outer areas of the income distribution. For a detailed study of income inequality, additional or more complex measures of distribution (such as the Gini coefficient mentioned above) should be used and compared .

This distribution measure has also remained stable and low in Belgium in recent years.

At-risk-of-poverty rate

There are different indicators to show poverty. A distinction is made, for example, between material deprivation and monetary poverty. According to EU standards, people are generally at risk of poverty if they have to live on less than 60% of the median income of the total population. In Belgium, 15.9% of the population was at risk of poverty in 2017.

5.1% of the Belgian population are severely materially deprived . These people cannot afford various expenses that the majority of people in Belgium consider desirable or even necessary for a decent lifestyle. This includes, for example, regular meals containing meat or protein, a washing machine, a telephone or adequate heating of the apartment. According to the Belgian statistical office, unemployed people, single parents and people with low educational attainments are the most vulnerable to poverty.

| year | Gini | Share of the top 10% | S80 / 20 | At-risk-of-poverty rate |

|---|---|---|---|---|

| 2017 | 26th | 20.7 | 3.8 | 15.9 |

| 2016 | 26.3 | 20.7 | 3.8 | 15.5 |

| 2015 | 26.2 | 20.8 | 3.8 | 14.9 |

| 2014 | 25.9 | 20.4 | 3.8 | 15.5 |

| 2013 | 25.9 | 20.7 | 3.8 | 15.1 |

| 2012 | 26.5 | 21st | 4th | 15.3 |

| 2011 | 26.3 | 21.1 | 3.9 | 15.3 |

| 2010 | 26.6 | 21.4 | 3.9 | 14.6 |

| 2009 | 26.4 | 21.1 | 3.9 | 14.6 |

| 2008 | 27.5 | 22.3 | 4.1 | 14.7 |

| 2007 | 26.3 | 21.1 | 3.9 | 15.2 |

| 2006 | 27.8 | 22.4 | 4.2 | 14.7 |

| 2005 | 28 | 23.2 | 4th | 14.8 |

| 2004 | 26.1 | 20.6 | 3.9 | 14.3 |

| 2003 | 28.3 | 22.2 | 4.3 | 15.4 |

| 2001 | 28 | 24 | 4th | 13 |

| 2000 | 30th | 25th | 4.3 | 13 |

| 1999 | 29 | 25th | 4.2 | 13 |

| 1998 | 27 | 22nd | 4th | 14th |

| 1997 | 27 | 23 | 4th | 14th |

| 1996 | 28 | 23 | 4.2 | 15th |

| 1995 | 29 | 23 | 4.5 | 16 |

Top 10 percent of income

As can be seen in the figure, the top 10% (again, this is the equivalised disposable income) related to 20.7% of total income in Belgium in 2017. The share of the top decile in total national equivalised income decreased between 1995 and 2017. There was a decline in the share of income, especially after 2000. Since the data was collected at EU level in 2005, the share in Belgium has always remained below the EU average and has continued to fall compared to the EU average. The observed values are significantly higher in various other EU countries and in many cases have risen sharply.

Gender

Belgium ranks very well on 31st place in the Global Gender Gap Index 2017 . Country-specific gender equality aspects or in the areas of economy, education, politics and health are summarized in the index. It measures the relative disadvantage of women in the respective areas and overall. The maximum achievable value is 0.995 - Belgium achieved a value of 0.739 in 2017.

S80 / S20 Income distribution by gender

The income quintile ratio (S80 / S20) is the ratio of the total income of the 20% of the population with the highest income (top quintile) to the total income of the 20% of the population with the lowest income (bottom quintile). So it tells how many times you have to multiply the income of the bottom 20% to get the income of the top 20%. If the factor = 1, the share of total income of the lower quintile is equal to the share of the upper quintile. In order to consider gender-specific characteristics, the income quintile ratio is considered by gender.

The S80 / S20 quintile ratio by sex shows no clear differences between men and women.

At the start of 1996 the income quintile ratio of women (men) in Belgium was still 4.5 (4.4) and fluctuated until the Great Recession . From 2009 the ratio was relatively constant and lower than before. Since then, the income quintile ratio for men has been 3.9 and that for women since 2013 has been slightly below.

Gender Pay Gap

At EU level, the gender pay gap (gender-specific wage gap ) is defined without adjustment as the difference between the average gross hourly wages of men and women as a percentage of the average gross hourly wages of male employees. NACE is the statistical classification of the economic activities in the European Community. NACE is derived from the International Standard Classification of Economic Activities of the United Nations (ISIC) in the sense that it is more finely divided than this. The positions of ISIC and NACE are exactly the same at the highest levels, while NACE is more detailed at the lower levels. The code B-S_X_O stands for industry, construction and services (excluding public administration, defense and social security).

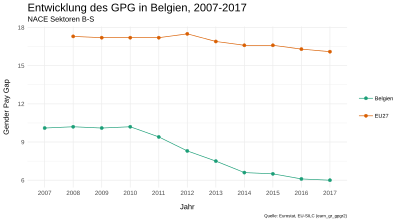

The development of the GPG in Belgium was constant between 2007 and 2010 by 10% - much lower than the European average (by 17%). From 2010 to 2014 the Belgian GPG fell sharply to below 7% and then further to 6% in 2017. In comparison, the European GPG only decreased slightly to around 16.5%.

In general, the disadvantages for women are lower hourly wages, fewer incentives to work more hours and lower employment rates or interrupted jobs. Women generally take on more unpaid upbringing and care services. According to Eurostat (2014), the 'gender overall earnings gap' (indicator of average hourly wages, monthly working hours and the employment rate) was 31.1% and thus below the European average of 39.6%. The early introduced women's rights policies around 1900 ( broader access to education and expanded civil rights ) certainly contributed to this positive development ( Wahlrecht 1948 ). Nowadays, Belgium is considered to be one of the model countries in this regard. A gender quota has been politically implemented in Belgium since 1994 (first EU country and second country worldwide). Belgium is also a country with a very high proportion of women in parliament, but these are not shown in the graphic because the Eurostat code B-S_X_O shown does not include public administration.

Regional differences

Available household income by region

A comparison of disposable household incomes by region in Belgium shows an income gap from north to south. The Walloon regions in the south of the country have a lower average income than the Flemish regions in the north. These differences are based on the industrial history of the Walloon North, which in the past was heavily dependent on the coal and steel industries. After the decline of these industries in Belgium, unemployment in the north of Wallonia increased significantly and the region has not yet been able to fully recover despite a solidarity contribution. This inequality continues to lead to social and political tensions, the so-called Flemish-Walloon conflict .

Regional economics generally deals with the economic relationships in regions and thus represents the economic counterpart to foreign trade. A comparison of regional data as detailed as possible is often more meaningful than a comparison of entire states and also makes the differences or similarities within individual states clear. These data play an important role, for example, in the European Union's cohesion policy. At the heart of the European Commission's regional statistics is the NUTS classification (the classification of territorial units for statistics). This is a regional system of the member states of the EU, in which the regions are represented in a harmonized hierarchical structure. In the context of the NUTS classification, each Member State is divided into three different levels of regions, namely the NUTS levels 1) large socio-economic regions, 2) base regions for regional policy measures and 3) small regions for specific diagnoses. Regional inequality can lead to agglomeration, thinning and displacement effects and thus distort the analysis if regional characteristics are not included. In addition, these influence social coexistence, public investment and the labor market, in connection with the interaction of regional income inequality with basic, house and apartment prices. The regionally different development of communities, districts and regions can be analyzed in terms of growth, income or productivity, for example. In the Belgian case, the graph of the disposable income (2016) shows that the country has the north-south divide mentioned above. The capital Brussels is considered separately.

Inequality in metropolitan areas

The degree of urbanization is over 50% worldwide. The wave of urbanization of the 21st century could have very positive effects for city dwellers themselves, the states concerned and the planet as a whole. The prerequisite for this, however, is that a number of important challenges (climate, affordable housing, transport planning, etc.) are met.

A comparison of the disparities in the metropolitan regions of Belgium paints a similar picture as the comparison by region. Liège , the only metropolitan region in the Walloon part, has a significantly lower average income than the Flemish cities of Antwerp and Ghent . Although the Brussels region also has a lower average income than the rest of the Flemish regions, the Brussels metropolitan region does not show any notable differences compared to Antwerp or Ghent. With regard to the Gini coefficient and the poverty rate, there are no differences in the three cities with corresponding available data.

| city | Population share | Household Disposable Income (2016 in USD) | GINI coefficient (2015) | Poverty rate (2015) |

|---|---|---|---|---|

| Brussels | 23.3 | 28,647 | n / A | n / A |

| Antwerp | 9.7 | 28,389 | 0.3 | 0.1 |

| Ghent | 5.3 | 29,363 | 0.3 | 0.1 |

| Charleroi | 4.3 | n / A | n / A | n / A |

| Liege | 6.6 | 24,802 | 0.3 | 0.1 |

According to a study by the German online statistics portal Statista , Belgium ranks 7th in the world with around 97.9% urbanization (proportion of city dwellers in relation to the total population) and is the most urbanized country in the EU.

Special features of the Belgian welfare state and effects on income distribution

The fact that Belgium shows falling income inequality over time compared to other EU countries is mainly due to the Belgian welfare and welfare state. As in many other European countries, in Belgium part of the income is deducted for social security benefits and other social transfers. These contributions subsequently finance the social security system, which provides health services, pension payments, family allowances, etc.

High incomes are heavily taxed in Belgium: 50% tax has to be paid on annual salary from employment over € 38,080. These relatively high income tax contributions for high incomes also contribute to income redistribution and are another reason why income inequality is lower in Belgium than in other EU member states. Belgium has the third highest tax rates in the EU, only Denmark and Sweden tax income even more heavily.

Belgium also has a well-functioning social partnership model in which the social dialogue between the various social partners is deeply embedded in the institutional framework. Paul Krugman , a well-known economist and winner of the Alfred Nobel Memorial Prize for Economics , writes about Belgium that the Belgian economy has performed better than its neighboring countries since the Great Recession , which began in 2007. He attributes this result to the fact that Belgium had no government for a long time and accordingly no cuts in the welfare state could be made (austerity measures ).

Belgium has a statutory minimum wage. This minimum wage was € 1,310 per month in 2008 and € 1,502 in 2015 - that's an increase of around 15%.

Together with the high level of collective bargaining coverage, the minimum wage offers effective protection against low wages and thus also contributes to a relatively even distribution of income.

The royal decree of November 18, 2015 aims to; Evaluate the application and effectiveness of anti-discrimination legislation every five years. An expert commission was set up, which consists of representatives from the judiciary, legal professions, trade unions and employers' organizations.

Web links

Individual evidence

- ↑ Definition: personal income distribution. Retrieved May 19, 2019 .

- ↑ a b Eurostat - Data Explorer. Eurostat, accessed on 18 January 2019 .

- ↑ a b c Mean and median income by household type - EU-SILC survey. Eurostat Database, accessed on 18 January 2019 .

- ↑ HICP (2015 = 100) - annual data. Eurostat Database, accessed on 18 January 2019 .

- ↑ Economics basic knowledge for non-economists: Measuring socio-economic inequality. Free University of Berlin, accessed on January 18, 2019 .

- ↑ Distribution of income. Swiss Confederation - Federal Statistical Office, accessed on January 18, 2019 .

- ^ Federal Public Service - Social Security (Ed.): The Evolution of the Social Situation and Social Protection in Belgium: Increasing divergences. Monitoring the social situation in Belgium and the progress towards the social objectives and the priorities of the National Reform Program . Brussels 2016.

- ↑ Glossary: At-risk-of-poverty rate. Eurostat - Statistics Explained, accessed 19 January 2019 .

- ↑ Rate of people affected by poverty. Eurostat Database, accessed 19 January 2019 .

- ^ Poverty Indicators in Belgium 2017. Statbel, accessed January 19, 2019 .

- ↑ Glossary: Material Deprivation. Eurostat - Statistics Explained, accessed 19 January 2019 .

- ↑ Poverty indicators in Belgium in 2017 (EU-SILC). Statbel, accessed January 19, 2019 .

- ^ Gini coefficient of equivalised disposable income. Eurostat Database, accessed 19 January 2019 .

- ↑ Distribution of income by quantile - EU-SILC survey. Eurostat Database, accessed 19 January 2019 .

- ↑ S80 / S20 income quintile ratio by gender and by age group - EU-SILC survey. Eurostat Database, accessed 19 January 2019 .

- ↑ Rate of people at risk of poverty by risk of poverty line, age and gender - EU-SILC survey. Eurostat Database, accessed 19 January 2019 .

- ^ Income inequality: S80 / S20. Statistics Belgium, accessed May 8, 2019 .

- ↑ Gender pay gap in unadjusted form - NACE Rev. 2 activity (earn_grgpg2). Retrieved May 9, 2019 .

- ^ NACE Rev. 2 - Statistical classification of economic activities. Retrieved May 9, 2019 (UK English).

- ↑ European Commission (Ed.): Ec.europa.eu (PDF).

- ^ Petra Meier: Caught Between Strategic Positions and Principles of Equality: Female Suffrage in Belgium . In: Blanca Rodríguez-Ruiz, Ruth Rubio-Marín (eds.): The Struggle for Female Suffrage in Europe. Voting to Become Citizens . Brill Verlag, Leiden / Boston 2012, ISBN 978-90-04-22425-4 , pp. 407-420, p. 419 .

- ↑ Background - Eurostat. Eurostat, accessed 8 May 2019 .

- ^ The Metropolitan Century - Understanding Urbanization and its Consequences - en - OECD. Retrieved May 9, 2019 .

- ↑ Countries with the highest degree of urbanization in 2017 - statistics. Statista, accessed on May 8, 2019 .

- ↑ EU - Degree of Urbanization in the Member States 2017 - Statistics. Statista, accessed on May 8, 2019 .

- ^ Social Security in Belgium. Belgian Federal Government, accessed January 19, 2019 .

- ^ Income Taxes Abroad - Belgium. European Union, accessed January 19, 2019 .

- ^ The True Cost of Austerity and Inequality: Belgium Case Study. (PDF) OXFAM, accessed on January 19, 2019 .

- ^ I. Marx, L. Van Cant: Belgium: Is robust social concertation providing a buffer against growing inequality . In: Reduciing Inequalities in Europe: How Industrial Relations and Labor Policies Can Close the Gap . No. 116 , 2018.

- ^ Paul Krugman: The Secret of Belgium's Success. Retrieved January 18, 2019 .

- ↑ R. Plasman: The minimum wage system in Belgium and the mismatch in Brussels' region . Ed .: University of Brussels, Department of Applied Economics. Brussels 2015.

- ↑ Andrea Garnero, Stephan Kampelmann, François Rycx: Minimum wage systems and earnings inequalities: Does institutional diversity matter? In: European Journal of Industrial Relations . tape 21 , no. 2 , 2015, p. 115-130 .

- ^ Draft joint Commission and Council employment report. (PDF) European Union, accessed on May 7, 2019 .