Accounting

Bookkeeping refers to the complete, chronologically and factually ordered recording of all business transactions in a company based on receipts . It is the numerical reflection of a company and an important source of information for the entrepreneur and also serves to comply with the legally fixed information requirements of authorities.

Records of economic processes are among the oldest documents of all. The system of double-entry bookkeeping that dominates today was developed in Italy in the Middle Ages and has remained largely unchanged since then.

Nature and definition of the term

The bookkeeping is to be understood as reporting required by the legislator. The accounting regulation on which this article is based follows the HGB . In Germany, however, other accounting regulations are also met with bookkeeping (for example IFRS and US GAAP ). This then requires parallel bookkeeping from which several financial statements (in accordance with the various accounting regulations) can be created.

It is useful to subdivide the generic term “bookkeeping” into

- Financial accounting from which an annual financial statement ( balance sheet , profit and loss account ) is developed and

- the management accounts , which the internal cost accounting and the cost account ( pricing is used).

The bookkeeping is part of the company accounting . In addition to the financial and operating bookkeeping, this contains business statistics and comparative calculations as well as the planning calculation (estimates for future income and expenditure).

As a synonym for "Bookkeeping" also is often accounting used. That doesn't seem appropriate since

- the term "accounting" is mostly used in laws,

- In practice, “bookkeeping” is often only understood to mean the organizational unit of a company in which the bookkeeping is carried out.

This article explains the financial accounting and in particular the double entry methodology. This is the method generally used in the private sector and required by law for merchants to keep books properly. Small business owners and freelancers can use the simpler income statement to settle their businesses .

In public administration since the end of the 20th century complement the place Kameralistik to elements in this area Doppik place called method of double-entry bookkeeping. In Germany there were first pilot attempts to use double accounting systems at the municipal level in the 1990s. Since January 1, 2010 (entry into force), there has been a general legal basis for the application of double budget management (Doppik) in federal and state administrations ( § 49a HGrG) in the form of the amended Budgetary Principles Act ( § 1a , § 7a HGrG). The local authorities were given the opportunity to use their own legislation to independently design the process of introducing further accounting systems in addition to cameralistics. The partially applied "state double policy" was subsequently supplemented with a "municipal double policy". In this way, the basic rules of commercial bookkeeping and accounting found their way into public budgeting and accounting. In the municipal area, the double taxation led to a major change in the structure of the budget statute .

Goals and areas of responsibility of financial accounting

- overview of the company's financial position and debt at any time . At least once a year, the asset situation and debt level must be documented in the balance sheet and evidenced by an inventory .

- Identification and systematically organized recording of all processes that change assets and liabilities.

- Determination of success by comparing income and expenditure. This is done at least once a year in the profit and loss account.

- Provision of the information required by law, on the basis of which the tax authorities carry out the taxation of the company, as well as further information for authorities, courts, banks or other external addressees in the prescribed form.

Addressees of results from the financial accounting

internal addressees:

- the entrepreneur himself: he cannot keep all transactions in his head. He needs a constant overview for his commercial decisions.

- Investors involved in the company : Many companies are organized in the form of a company . Participating shareholders demand - constantly or at least periodically - meaningful, verifiable information about the company's situation.

- Employees and their representatives

external addressees:

- external investors, especially banks

- creditor

- Tax office

- Publicity

If different addressees require different standards for reporting from the financial accounting ( balance sheet , profit and loss account , cash flow statement, among others), this may require U. parallel bookkeeping .

Accounting obligation

In addition to the self-interest of the entrepreneur, there are legal regulations in which the obligation to keep accounts is laid down. The accounting regulations of the Commercial Code (HGB) apply to merchants and voluntary accounting staff :

According to commercial law

" Every merchant [i. S. d. § 1 –7 HGB] is obliged to keep books and to show in these his commercial transactions and the situation of his assets according to the principles of proper accounting. "

Tradespeople whose companies, in terms of their type and scope, require a commercially set up business or who are entered in the commercial register are traders and are therefore obliged to keep accounts.

§ 241a HGB (inserted by the Accounting Law Modernization Act (BilMoG)) lays down the exemption of small sole traders from the accounting obligation.

According to the EU regulations for stock exchange financed corporations

According to the regulation of the European Parliament and the Council of July 19, 2002, listed companies in the European Union must prepare their consolidated financial statements from 2005 (comparative figures 2004) according to the International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS). In doing so, the EU reacted to the requirements of international stock exchanges which, as a prerequisite for admission to trading, require a trade in accordance with the legal provisions of their country. The original regulation has since been replaced by Regulation No. 1126/2008. The application of the IAS / IFRS of the EU is seen today on the stock exchanges of almost all countries as being on a par with national reporting requirements. In its catalog of measures published on February 25, 2003, the German government reacted to the demands of the EU Commission. In addition, unlisted companies were given the option to apply IAS / IFRS in their consolidated financial statements. With the Accounting Law Reform Act, the obligation to apply IFRS was also extended to companies whose securities are not yet traded, but which are in the approval process (cf. § 264d HGB).

According to tax law

Derivative (derived) accounting obligation

“ Anyone who has to keep books and records according to laws other than tax laws that are important for taxation has to fulfill the obligations that are incumbent on him under the other laws for taxation as well. "

Original accounting obligation

“ Commercial entrepreneurs as well as farmers and foresters who, according to the findings of the tax authorities, for the individual company

- Sales, including tax-exempt sales, with the exception of sales in accordance with Section 4 No. 8 to 10 of the Sales Tax Act , of more than 600,000 euros (until the end of 2015: 500,000 euros) in the calendar year or

- (dropped out)

- self-managed agricultural and forestry areas with an economic value (...) of more than 25,000 euros or

- a profit from commercial operations of more than 60,000 euros (until the end of 2015: 50,000 euros) in the financial year or

- a profit from agriculture and forestry of more than 60,000 euros (until the end of 2015: 50,000 euros) in the calendar year

have had, are also obliged to keep books for this operation and on the basis of annual stocktaking statements to make when a legal obligation to not § 140 [s. o.] results. "

However, this does not apply to the so-called liberal professions , such as B. lawyer, tax advisor or doctor, for whom there is basically no accounting obligation. The only exception to this is if the company in question is operated in the legal form of a corporation or trading company, for example a tax advisory firm run as a GmbH - here Section 6 (1) HGB ( form merchants ) would apply and require bookkeeping.

The original accounting obligation, however, only applies from the financial year following the notification from the tax office about the exceeding of the limits. It does not end until the end of the fiscal year following the determination of the shortfall.

Nature of the accounting

The § 238 HGB states:

“The bookkeeping must be such that it can give an expert third party an overview of the business transactions and the situation of the company within a reasonable period of time. The business transactions must be traceable in their development and processing. "

An “expert third party” can be a tax officer who controls the bookkeeping as part of an external audit. However, a third party expert can also be a family member or a financier who wants to use the business books to convince himself that his money is well invested.

In the tax code , these provisions are also supplemented from a tax point of view. If the bookkeeping does not meet the requirements, for example because documents are missing, the tax authorities can estimate the tax bases according to § 162 AO.

Principles of proper accounting (GOB)

These principles are contained in various legal regulations, but result overall from proven commercial practice. They can be summarized in the two basic principles “truth” and “clarity”.

- Truth in the bookkeeping means that everything must be booked as it really happened. Fake bookings for transactions that have not actually taken place are prohibited forgeries.

- Clarity means that everything must be clear, unambiguous, legible, traceable and protected against forgery.

Documentation requirement

A rule that is derived from the requirement for truth and clarity is that no booking may be made without a receipt . If the receipt does not arise directly from the business transaction (e.g. incoming invoice, receipt), a personal receipt must be prepared (copy of the outgoing invoice, wage receipt , material withdrawal receipt , depreciation receipt , ...). When preparing your own receipts, it should be borne in mind from the outset that they have to withstand every revision , especially before the tax office. There are retention requirements for accounting documents (usually 6 years for commercial letters or 10 years for receipts).

Organizational principles

- Each business transaction must be recorded in a document.

- The documents are to be recorded continuously, completely and promptly.

- The business transactions are to be systematized.

Booking principles

- Principle of verifiability

- Principle of clarity and clarity

- Books are to be kept in a living language

- Abbreviations must be easy to understand

- Annual financial statements in German

- Principle of completeness

- complete recording of all business cases

- Principle of correctness and truth

- do not make it illegible

- Devalue the space

- no posting without receipt

- no posting without offsetting entry (contra account)

Electronic documents can be handled and archived according to the principles of proper IT-supported accounting systems. The GOB are of particular importance in accounting . The Commercial Code contains a number of special provisions that must be taken into account.

Compliance is measured by the degree of compliance with the principles for the proper management and storage of books, records and documents in electronic form and for data access (GoBD). The GoBD contain requirements that, according to the tax authorities, are relevant for all IT systems that record or process tax-relevant data directly or indirectly. When implementing these requirements, the tax authorities assume compliance with the principles of proper bookkeeping and compliance with the taxpayer's obligation to cooperate for a smooth tax audit.

Double-entry bookkeeping - the basics

Double-entry bookkeeping or double-entry bookkeeping - also known as commercial bookkeeping - is the type of financial accounting that predominates in the private sector . In the meantime, more and more municipalities in Germany are switching from cameralistics to double-entry bookkeeping ( see New Municipal Financial Management ).

Double-entry bookkeeping became known in Europe at the latest through its compilation in the book Summa de arithmetica, geometria, proportioni et proportionalità by the Italian Franciscan Father Luca Pacioli , printed in Venice in 1494 . One speaks of "double" bookkeeping because every business transaction is recorded in two ways. Each business transaction is reflected in one of four possible double postings: asset exchange, liability exchange, balance sheet extension or balance sheet shortening. The continuity of the double bookings is achieved through Pacioli's introduction of the adjustment item "Equity" (assets minus debts), which makes both sides of the balance sheet the same length. In a posting record, debit to credit is always posted, meaning that each business transaction is recorded twice, but in different accounts. Exactly the same value is posted in debit and credit at the same time .

Another interpretation of the term "double entry bookkeeping" sees the duplicity in the fact that the success of a company can be proven in two ways:

- by comparing the equity of the current year with that of the previous year in the respective balance sheet ,

- by comparing the expenses and income of the current year in the income statement .

According to a third interpretation, the term is derived from the two books in which every business transaction is recorded. The land register (journal, social insurances: time book) records the postings in chronological order, in the general ledger (account sheets, social insurances: non-fiction book) an objective allocation is made by posting in accounts.

Balance sheet

The term balance comes from the Italian "bilancia" and translated means scales. The balance sheet is the presentation of the assets - the assets - on the one hand and the presentation of the financing - the liabilities - on the other hand. Assets are those types of assets that a company can "actively" use, regardless of whether they are self-financed or not. To put it simply: the assets side expresses what assets are available. The liabilities side shows how this asset was financed, i.e. the origin of the capital; either through one's own assets (equity) or through debts ( liabilities ).

| assets | liabilities |

|---|---|

| Forms of wealth | Origin, sources of funding |

| Invested in | How was it financed? |

| How were the funds used? | Where do the funds come from? |

In the past, the level of detail in the balance sheet was left to the merchant - a kind of general, social agreement had developed. In Germany, the exact procedure is now regulated by law in Section 266, Paragraphs 2 and 3 of the German Commercial Code. The balance sheet structure contained there is only required for large and medium-sized corporations and certain partnerships ( Section 264a HGB). In practice, however, this structure has become established for all partnerships and sole proprietorships, with the items often being further compressed.

The balance sheet structure can be found under the keyword balance sheet. Both sides of the balance sheet are sorted, namely:

- the assets side ascending according to "liquidity" (liquidity): Assets that are most difficult to convert into cash (for example land) are at the top, those closest to money (cash in hand, bank balances) are at the bottom.

- The liabilities side in ascending order according to "maturity": Above are the sources of finance that are available to the company over the long term, and below are the short-term liabilities.

Relationship between balance sheet and inventory

A balance sheet will only provide the entrepreneur, possible financiers and the tax authorities with the necessary information if the values contained therein correspond to the truth. These values are determined as part of the inventory , during which the existing operational inventory is also determined and assessed.

During the inventory, too, the entrepreneur's information requirements coincide with those of outside interested parties. The protection of creditors requires the businessman working with borrowed funds to put a precise figure on his assets and debts. He may not simply enter any estimated values in the balance sheet items. Each value must be appropriately verifiable. Therefore, he is required to draw up a balance sheet:

"At the beginning of his trade, every businessman has to precisely record his property, his claims and debts, the amount of his cash as well as his other assets and indicate the value of the individual assets and debts."

Relationship between balance sheet and accounts

The account in the financial accounting is used to develop a dynamic representation of the business cases from the balance sheet as a snapshot. This function results from the fact that each business case changes at least two balance sheet items. So it makes sense to only change the items that are affected by the business transactions, instead of creating the entire balance sheet after each business transaction. This led to the realization that the balance sheet should be broken down into accounts and only the changes entered into the accounts. Without the resolution of the balance sheet into asset and liability accounts in order to process the posting of business cases in it, compliance with the principles of proper bookkeeping would not be possible.

The principle of "no posting without counter-posting", according to which two accounts are always touched in a posting, is already taken into account when the opening balance sheet is closed. Since there is actually no contra account for the transfer of the opening balances into the accounts, the opening balance account (SFBC) was introduced as an auxiliary construction . This thus contains all opening balances, but - logically - mirrored, and also serves to check the correctness and completeness of the amounts to be transferred. In this way, the values that are on the left-hand side of the balance sheet (the assets side) also appear on the left-hand side of the account (referred to as debit). In contrast, the values from the right-hand side (the liabilities side) of the balance sheet also end up on the right-hand side of the account (credit).

Profit and Loss Account

Events that affect a company's business performance could be posted directly to the company's equity account. This corresponds to the booking logic and is completely correct in terms of content. In this case, clarity would also be preserved for a few business cases. In practice, however, there are countless business cases, even in small companies, that represent income or expenses and thus influence equity. If entries were always made directly to the equity account, the result would be chaotic and confusing. In order to maintain clarity, income and expenses are not posted directly, but only netted on the equity account. A special profit and loss account is set up for this purpose and connected to the equity account . The structure (structure) of this invoice results from § 275 HGB. The most common is the income statement based on the total cost method .

Accounts and bookings

Account system

Before values flow into the balance sheet or profit and loss account, a company's finances are recorded in accounts in the course of ongoing business transactions . An account is a table with two columns: a debit (S) and a credit (H) side.

In the past, when the accounts were still kept in bound books, the so-called T account was used to display the accounts. The presentation graphically resembles the letter T . Today the account has a different look, but still the debit and credit display. The words “debit” and “have” have no meaning in terms of content and have historical reasons. So it's not about “having something” or “something that should be”. The term “having” in particular is often misunderstood: it does not mean “owning”; it is to be explained from the function of the supplier account. The corresponding amount was entered on the right-hand side of this account according to the principle “We HAVE to pay!”. “The customer SHOULD pay!” Was entered on the left side of the customer account - therefore “Debit” as the left side of an account.

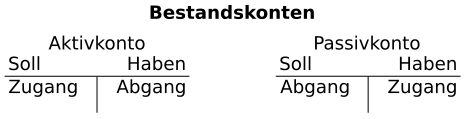

In accounting, a distinction must be made between inventory accounts and profit accounts:

-

Inventory accounts take inventory of goods and money, i.e. status neutral to profit .

- Active inventory accounts hold assets . The use of capital is recorded on asset accounts. All financial resources that are available to a company are available in a certain form: for example, as land, machines, stocks and cash, but also as receivables or intangible assets such as licenses . The payment of a customer reduces a claim which previously had an impact on the related income account. Receipts are posted as debits, issues as credit.

- Passive inventory accounts recorda company's liabilities or "debts". Liability accounts record the origin of equity and debt . The payment of an invoice is posted as a retirement of a liability. The assets of a company are formed from the funds of the owners and creditors: for example, the partners, shareholders, banks or suppliers. Receipts are posted on credit, issues on debit.

-

Success accounts include transactions that affect income . Success is a neutral term in accounting and describes both profit and loss.

- Expense accounts are used to record a decrease in equity. Expenditure means "consumption of value", for example the consumption of material, personnel costs, interest or depreciation . An expense is posted in the debit.

- Income accounts are posted with “value inflows” that increase equity. The most important type of income in a company is usually sales . Income is posted in credit.

The accounts are arranged in a systematic order ( chart of accounts ). Modern systems that are based on one of the recommended charts of accounts correspond to the structure of the balance sheet. The accounts have numbers that immediately show how they are classified in the balance sheet system.

Posting record

A simple posting concerns two accounts, one posting in debit and a second posting on credit. How it is posted is noted on each receipt. This takes place in the form of a booking record . First, the account on which the debit entry is made is named. This is followed by the word "to" and then the account that records the credit posting (or in short: always "debit to credit"). An example of this: Purchasing raw materials on target receives the booking record

- Commodities to liabilities

Compound booking records can address a large number of accounts. However, the sums of all debit and credit postings must match. If the sums are different, the booking record is incomplete (it “does not work”) and a booking is not possible in most IT-based accounting systems.

Booking system

Each posting changes at least two accounts and thus has an effect on the values of the balance sheet and the profit and loss account. A distinction is made between postings not affecting income, which only affect the balance sheet, and postings affecting income, which are reflected in both the balance sheet and the profit and loss account. Based on this, there are six basic situations:

not affecting earnings :

-

Active exchange : An active account is increased by an amount, another reduced by the same amount.

- Example: A customer pays an invoice by bank transfer.

- Booking record: "Bank account" to "Receivables".

-

Liability exchange : A liability account is increased by an amount, another reduced by the same amount.

- Example: A supplier debt is converted into a long-term loan.

- Posting record: "Trade payables" (liabilities a. L. L.) to " loans ".

-

Asset / liability increase ( balance sheet extension ): the assets and liabilities side are increased by the same amount.

- Example: Raw materials are bought “ on target ”, i. H. the bill is not paid immediately.

- Posting rate: "raw materials" and "input tax" to "liabilities a. L. L. ".

-

Asset / liability reduction ( balance sheet shortening ): the assets and liabilities side are reduced by the same amount.

- Example: A supplier invoice is paid by bank transfer.

- Posting record: "Liabilities a. L. L. "to" Bank account ".

affecting net income :

- Positive effectiveness : 1 inventory and 1 income account addressed → profit

-

Negative effectiveness : 1 inventory and 1 expense account addressed → loss

- Example: A tradesman's invoice is paid in cash.

- Booking record: "Maintenance costs" to "Cash desk".

Note: in principle, several accounts can also be addressed.

using the example of an asset swap: One asset account is reduced by an amount, two others increased by the same amount.

- Example: A customer pays an invoice for € 1,000, half in cash and half by bank transfer.

- Posting record: “Bank account 500.00”, “Cash 500.00” to “Receivables 1,000.00”.

Pulling balances

The balance on the individual accounts is determined by drawing balances . This is done by determining the sums of the debit and credit side. The value of the smaller side is deducted from the value of the larger side. If the debit side makes up the greater value, a debit balance is created. If the credit side predominates, it is a credit balance.

| Should | To have |

|---|---|

| 100 | 50 |

| 30th | |

| Total target: 100 | Total credits: 80 |

| Balance: 20 | |

Accounting traditionally works with absolute values, as can be seen in the table above. However, there are computer programs that show debit items as positive and credit items as negative numbers. In this case, the balance is the sum of the line items in an account.

In business life, a balance list is drawn up at least once a month during the year, as it shows the entrepreneur the status of his accounts, practically an interim balance. After the addition, the equality of the sum of all debit and credit balances shows that debits and credits were not confused and that there were no inverted numbers.

It is often argued that the difference in the income and expense accounts should not be referred to as the “balance”, but only as the “result”. Strictly speaking, this term is more precise. It is usually justified with the prohibition of balancing , which states that expenses and income may not be offset for the sake of clarity until they are posted to the profit and loss account.

Books

Every booking is recorded in at least two books. The term “book” comes from traditional accounting, which was done by manually entering the values in bound books. However, it is still used today for the electronic logs of accounting data. The two most important books are the journal and the ledger. They are always managed separately from one another. Only the simplest form of double entry bookkeeping, the American Journal , summarizes both books in a table.

In Switzerland, the Business Books Ordinance (GeBüV) regulates the books to be kept, their storage and materials.

Journal (land register)

In the journal (translated as diary ) all business transactions are recorded chronologically (chronologically) with serial number, date, amount, reference to the receipt, explanation and account assignment ( debit account , credit account ). The function of the journal is based on the following principle: All business cases must be able to be tracked chronologically and assigned to the individual balance sheet items. The chronological order is guaranteed by the fact that all posting records are recorded according to the date in the journal. It is the land register of the bookkeeping. At the same time, the journal is the booking instruction for transferring the bookings from the land register to the general ledger.

Ledger

The general ledger is the set of accounts with its factual reduction and movement through business cases of the individual balance sheet items. In the general ledger (also: account sheets), all postings in the land register are entered in the accounts specified in the posting records. The stock accounts are opened at the beginning of each financial year with the closing balances of the previous year (for example bank balances), at the end of the financial year they are closed via the closing balance account (SBK) (profit accounts are closed via the income statement account, direct sub-accounts beforehand via their actual " Parent accounts ", for example input tax deduction via VAT , private via equity, etc.). The factual order of the individual business transactions is therefore made through the records in the general ledger.

The basic rule applies to the posting itself: First entry in the land register (journal), then posting to the accounts (in the general ledger).

Sub-ledgers

There are also various subsidiary ledgers that explain certain general ledger accounts. These include, for example

- the current account or business friend book (contains liabilities and receivables from suppliers ( creditors ) and customers ( debtors ))

- the stock ledger (contains incoming and outgoing goods from the warehouse )

- the wages and salaries book (contains the statements of wages )

- the banking book (contains the fixed assets )

- the bank book and the cash book (contain the cash balance )

- the outgoing invoice ledger (contains the invoicing )

The end of the year

Basic regulations for the annual financial statements are contained in § 242 HGB:

- (1) At the beginning of his trade and for the end of each financial year, the merchant must draw up a statement of accounts (opening balance sheet, balance sheet) showing the relationship between his assets and his debts. The provisions applicable to the annual financial statements are to be applied accordingly to the opening balance sheet, insofar as they relate to the balance sheet.

- (2) At the end of each financial year, it has to compile a comparison of the expenses and income of the financial year (profit and loss account).

- (3) The balance sheet and the profit and loss account form the annual financial statements.

Steps in the annual financial statements

- The inventory is to be determined through an inventory (recording of all stocks) and recorded in writing. This determines the amount of all assets and liabilities. Any differences to the balances on the accounts are to be clarified and corrected by postings (with your own receipts).

- The sub-accounts of the profit and loss accounts are then closed via their "parent accounts", for example "VAT to VSt", "Private to equity" etc.

- Then the success accounts are to be closed via the profit and loss account. For the expense accounts, the posting rate is “profit and loss account to expense account”. The booking rate for the conclusion of income accounts is "income account to profit and loss account".

- The profit and loss account must be closed using the equity account. If the income was greater than the expense (i.e. there was a profit), the posting record is "Profit and loss account of equity".

- Then all inventory accounts (active and passive accounts) must be closed with the closing balance sheet.

- The closing balance account (SBK) contains the values for the annual balance sheet . The information must be given in the form required by law. The SBK is structured like the balance sheet, in contrast to the SFBC, which is a mirror image of the balance sheet and in which the opening balances of the asset items are in the credit, the opening balances of the liability items are in the debit: in the SBK the closing amounts of the asset items are in the debit, the closing amounts of the Liabilities in credit.

- The profit and loss account contains the values from the profit and loss account . Here, too, the legally required overview must be created on this basis.

History of accounting

Antiquity

The first approaches to recording economic processes can be found in Mesopotamia as early as the Obed period . Around 3500 BC BC the Sumerians made accounts for bread and beer on clay tablets in the evolving cuneiform script. Further developments around 3000 BC BC in Egypt and Babylonia led to the first depictions of debit and credit on papyrus rolls. The first loose-leaf bookkeeping on prepared palm leaves has been preserved in India from around AD 200. Records in Greece in the 5th century BC Chr. Speak of the Logis Thai, the final accounts of the cash accountant of the Delian League took over and the "tithe" to the goddess Athena determined.

middle Ages

From the year 795 there is an ordinance of Charlemagne on the crown estates and imperial courts, according to which a comprehensive annual report with a well-ordered statement of assets was required, for which the royal chancellery created ecclesiastically proven sample forms. The oldest merchant's document north of the Alps comes from the Hanseatic headquarters in Lübeck, where a cloth merchant recorded around 160 business transactions in the simplest form on a parchment roll around 1180. In Europe, bookkeeping in the Greek and Roman cultures was expanded by expanding current account accounting (recording the development of receivables and liabilities towards individual business partners). In Genoa in 1263 two urban "Oberkontierer" can be traced, who created individual accounts with the ancient Roman name ratio . At the beginning of the 13th century, the Arabic decimal system became known in Europe (see Leonardo Fibonacci ). The Roman number system, which was considered to be forgery-proof, lasted until the end of the 15th century.

A complete double-entry bookkeeping can be proven for 1340. From this period surviving ledgers from Genoa with the income and expenses of the government are available. These, broken down by debtors with taxes, bonds and penalties, clearly show double-entry bookkeeping. Also in 1340 in Lübeck - based on the model of Genoa, Venice and Florence - the double booking rate with the preparation of balance sheet-like overviews was introduced.

It has been documented since 1426 that goods accounts were kept both as inventory and as sales accounts. Among the handbooks on bookkeeping that emerged in the second half of the 15th century, the merchant Benedetto Cotrugli described the double entry method for the first time in his Libro dell'arte di mercatura . However, it was not fully represented until 1494 by the Venetian monk Luca Pacioli . His work Summa de Arithmetica, Geometria, Proportioni et Proportionalita was not yet a textbook on double entry bookkeeping, but under the term Venetian method it summarized principles that have remained essentially unchanged. The first German translation of Pacioli's work appeared in Nuremberg in 1537. In the 16th century, the Nuremberg Stock Exchange served as a link in trade between Italy and other European economic centers. Italian trade customs were therefore adopted early on in the city.

In Italian Benedictine monasteries, too, evidence of the use of double entry bookkeeping can be found even before the publication of Pacioli's book. The Prior of Durham Cathedral in England used a system of 13 accounts for recording income and expenses. The role and experience of the monasteries and orders (e.g. the Knights Templar ) in the development of accounting since the High Middle Ages - due to their ever increasing wealth and, above all, their diverse assets and types of income - cannot be overestimated and suggested settled in the works of the Franciscan Pacioli and in the highly systematic book Indirizzo degli economi by Benedictine Angelo Pietra , who rearranged the accounting of the Duchy of Mantua and adapted it to monastic bookkeeping.

Modern times

The Fuggers drew up a balance sheet for the first time as early as 1511 . In the 16th century, the chief accountant of the Augsburg Fugger House, Matthäus Schwarz , who was trained in Venice, contrasted the Italian with a “German” bookkeeping. The general ledger was divided into a person account or "debt book" and a general ledger account book or capus . In addition, there was a “booklet of expenses” for expenses, excise duties, etc., as well as a “secret book” for the principal, which, in addition to internal calculations of direct taxes, was primarily intended to include the income statement.

Advanced works on accounting appeared in Italy, Germany, Holland, France and England during the 16th century . These already contained descriptions of the concept for credit items (business assets), debt items (liabilities) and income. Among other things, the first bookkeeping textbook by the mathematician Wolfgang Sartorius from 1592 is worth mentioning.

Until the 17th century , in the course of the steadily increasing trade in goods, the accrual accounting (fiscal year or calendar year) with regular book closing developed gradually. At this time, incoming, outgoing and cash books, journals, etc. were kept. Asset accounts and operational accounting were only systematically expanded at the beginning of the industrial age . Since the end of the 19th century , the requirements for financial and operational accounting have increased both through the knowledge of commercial science and business administration as well as through legislation.

Legislation relating to bookkeeping was also gradually developed. In the Prussian general law of the year 1794, for the first time , one finds the statutory accounting obligation for Prussia: “A businessman who either does not keep proper books or who fails to balance his assets at least once a year, and thus becomes uncertain about the situation of his circumstances, will be punished as a negligent banker if the insolvency breaks out. "

After the dizzying early days of the stock corporation, new signals were also set in commercial law - in Germany with the stock amendment of 1884: The established principles of balance sheet preparation were imposed by law; her violation was made a criminal offense; the whole respectable business community knew that it was confirmed and committed to the principles of “proper” accounting. The Prussian Income Tax Act of 1891 then led to the coupling of the tax return with the commercial balance sheet.

Modern

The bookkeeping system constantly responded to advances in information recording and processing. For a long time the books were handwritten with great meticulousness. With the possibilities of carbon copy procedures, time and work could be saved by copying (tracing) the manual account entries to the journal. For this, however, the books had to be broken down into individual sheets. It was a kind of revolution for the traditional accountant. The copy process was further developed with typewriter technology and later with booking machines that could perform simple arithmetic tasks. The first booking machines were manual-mechanical, later an electromechanical drive was developed. From the 1960s onwards, it was possible for the first time to save the booking data electronically using so-called magnetic accounts . Special magnetic account computers served as an interface between classic bookkeeping and modern electronic data processing . Today the bookkeeping takes place almost exclusively electronically. There are a large number of more or less user -friendly accounting programs for personal computers . Despite these drastically different technical means, a company's bookkeeping has changed little with its accounting system. Today, the journal is often a table in a relational database ; it also stores the access time and the user who edited it, as there is no longer any handwriting, and is access-protected as required. The remaining master data as well as the chart of accounts , which serves as a template for the master account data, are linked to the journal in terms of data. Evaluations and reports such as B. Open items , advance VAT return, balance sheet are mostly based on preprogrammed queries. These can be called up at the push of a button after the receipts have been entered (the receipts are entered in the journal). In addition to the account master, the tax types and rates are also available.

Organization of bookkeeping

Standards and objectives of the accounting organization

The bookkeeping is to be designed in such a way that it becomes a source of information for the entrepreneur about his economic success and the decisions to be made. The requirements set by tax legislation for bookkeeping must also be met. At the same time, bookkeeping creates costs that reduce business success. Just like the whole company, the bookkeeping must be organized with the highest possible efficiency.

New possibilities for bookkeeping organization

Modern information and communication technology opens up new possibilities. They boil down to the complete electronic recording of all data and the programmed computer-aided processing of this data with accounting programs. The numbers are coded as fixed-point numbers (instead of floating-point numbers ).

In larger companies, the bookkeeping is carried out entirely in-house. The basic data are usually no longer recorded in the accounting department , but in the functional areas (purchasing, sales, human resources, production). The data is processed using accounting programs without having to be entered again (typing in).

In smaller companies, accounting tasks are mostly entrusted to an external service provider . Often, as in the past, all documents are handed over to the service provider who does all the work. The disadvantage of z. In some cases, the outdated procedure still practiced, that the entrepreneur receives the evaluations too late and does not have an overview of the commercial activities. Accounts receivable and payable can get out of hand. There is also the risk of double entry: For example, the information from the cash book, which is kept manually in the company, is entered again by the service provider with the computer and transferred to the accounting program.

The electronic data transfer between the client who is required to keep accounts and the service provider has the advantage that the double entry of data is avoided. The best way to proceed is to provide the tenant with all the data for accounting that is generated in the business process anyway or that can be easily processed:

- The basic data acquisition can take place at the client. For example, the cash book no longer needs to be kept by hand, but can be recorded on the computer with much less expenditure of time. According to § 146 AO , this technically requires proof that the data cannot be changed.

- The bank statements, which are transmitted to the client online, provide the necessary database for direct entry for the bookkeeping.

- The data required for bookkeeping can be output from the programs for creating outgoing invoices.

- Incoming invoices can be recorded in the company with the computer in simple lists that are transmitted to the service provider electronically.

The stated basic data for bookkeeping can be generated for the client with little effort. The service provider completes and checks the data and imports it into an electronic bookkeeping program.

The service provider provides the client with the following evaluations:

- Totals and balances list (evaluation of the balances of the accounts used)

- Economic evaluation

- Lists of open items for customers and vendors

- Advance VAT returns - electronically

- Balance sheets

- Tax returns

All data for the clients or the authorities can traditionally be provided on paper or directly used electronically.

There are also inexpensive solutions for small companies to do their own accounting by IT. The data can then be made available to the tax advisor online for the annual financial statements.

Service providers now offer bookkeeping over the Internet. The client enters the data via a web browser, the entire bookkeeping including data backup is processed in the data center of the service provider. Tax advisors and tax authorities then receive the data via the network. This solution does not require a high initial investment in hardware, but only a monthly usage fee and saves costs for updates and their adaptation or support.

literature

- Franz-Josef Arlinghaus : Bookkeeping, Double-Entry Bookkeeping. In: Medieval Italy: An Encyclopedia. vol. 1, edited by Christoper Kleinhenz New York: Routledge 2004, pp. 147-150.

- Ulrich Döring ; Buchholz, Rainer: Bookkeeping and annual accounts. 14th edition. Erich Schmidt Verlag , 2015, ISBN 978-3-503-16327-4 .

- Gleeson-White, Jane: Debit and credit: double entry bookkeeping and the emergence of modern capitalism . Velcro-Cotta, 2015.

- Goldstein, Elmar: “A quick introduction to DATEV bookkeeping”, Haufe-Lexware, 9th edition 2011, ISBN 978-3-648-00291-9 .

- Hahn, Heiner; Wilkens, Klaus: bookkeeping and balance sheet. Part A: Fundamentals of Accounting. Introduction using the example of industrial accounting . 7th, updated and revised edition. R. Oldenbourg Verlag , Munich 2007, ISBN 978-3-486-58332-8 .

- Mindermann, Torsten; Gerrit Brösel : Bookkeeping and preparation of annual financial statements according to HGB. 5th edition. Erich Schmidt Verlag , 2014, ISBN 978-3-503-15603-0 .

- Balduin Penndorf : History of bookkeeping in Germany . Gloeckner, Leipzig 1913 (Reprint Saur, Auvermann, Frankfurt am Main 1966)

- Günter Wöhe ; Heinz Kussmaul : Fundamentals of bookkeeping and accounting technology. 7th edition. Vahlen 2010, ISBN 978-3-8006-3683-9 .

Web links

Individual evidence

- ↑ At www.dejure.org, the word “bookkeeping” within legal texts : 219 hits, the word “bookkeeping” : 3 hits. (As of October 2010)

- ↑ Federal Ministry of Finance (ed.): The development of budget law: The system of public budgets . Berlin 2015, PDF document pp. 20–21, online at www.bundesfinanzministerium.de

- ↑ Federal Ministry of Finance (ed.): Standards for state double bookkeeping (Standards state double entry) . Berlin 2016, PDF document p. 16 ff., Online at www.bundesfinanzministerium.de

- ↑ Federal Ministry of Finance (Ed.): The budget and accounting of the federal government and the states is becoming more modern . Communication dated December 17, 2008, at www.bundesfinanzministerium.de

- ↑ Volker Schultz: Basic knowledge of accounting. Bookkeeping, accounting, cost accounting, controlling. 2nd Edition. Deutscher Taschenbuch Verlag, Munich 2001, ISBN 3-423-50815-9 , pp. 12-13.

- ↑ Bitz, Michael: Creation will and striving for harmony of the Renaissance man : Luca Pacioli and the consequences - dogma-historical and linguistic reflections on the concept of equity. In: Winkeljohann, Norbert, Bareis, Peter / Volk, Gerrit (eds.): Accounting, Equity and Taxation - Development Trends, Festschrift for Dieter Schneeloch on his 65th birthday . Munich 2007, pp. 147–166. (on-line)

- ↑ Ordinance (PDF; 108 kB) on the keeping and storage of business books; SR221.431; Retrieved March 8, 2012

- ↑ Jane Gleeson-White: Debit and Credit: Double-entry bookkeeping and the emergence of modern capitalism. London: 2012, p. 140.

- ↑ A. Montrone, C. Chirieleison: I Prodromi della partita doppia in una Corporazione monastica: la contabilità dell'abbazia di San Pietro in Perugia dal 1461 al 1464. In: De Computis. Volume 10, 2009, pp. 239-263.

- ^ A. Dobie: The development of financial management and control in monastic houses and estates in England 1200-1540. In: Accounting Business and Financial History. Volume 18, 2008, p. 2, pp. 141-159.

- ↑ Lorenzo Maté Sadornil, M. Begoña Prieto Moreno, Alicia Santidrián Arroyo: El papel de la contabilidad monástica a lo largo de la historia en el orbe cristiano. Una revisión. In: Revista de Contabilidad. Volume 20, 2017, p. 2, pp. 143–156.

- ↑ Dt. for example: “Guidelines of the Treasurers”, Mantua 1586.

- ↑ Bookkeeping with two books.