State financial equalization

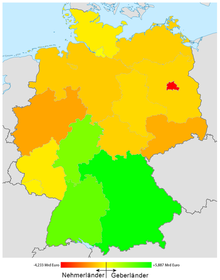

The federal state financial equalization (LFA) was a mechanism in Germany until 2019 to redistribute financial resources between the federal government and the federal states as well as between the federal states. It was replaced by new regulations in 2020. In 2017, 11.2 billion euros were reallocated, 5.3 percent more than in 2016. Berlin received 4.2 billion euros, 37.8 percent of the total. Bavaria paid the most (5.89 billion) - which, however, was still the recipient country until German reunification - as well as Baden-Württemberg (2.8 billion) and Hesse (2.5 billion)

overview

The state financial equalization is the best known financial equalization system in Germany and a financial instrument of regional development. The level of awareness is also due to the public disputes between the countries; Various federal states have sued the Federal Constitutional Court several times over the design of the LFA, for example in 1952, 1986, 1992, 1999 and 2006. The volume of the compensation amounts in 2015 was around € 9.6 billion, compared to the tax revenue of the federal states and Municipalities of € 306 billion. For many years, the share of state financial equalization in income has been between 2 and 3%.

Its aim is to “adequately balance the different financial strengths of the federal states” ( Art. 107 (2) sentence 1 of the Basic Law ). This is intended to put all Länder in a position to fulfill the tasks assigned to them, as it corresponds to the constitutional requirement of Article 106, Paragraph 3 of the Basic Law. The procedure is intended to ensure that the coverage needs of the federal government and the federal states are coordinated with one another with the aim of achieving cheap compensation, avoiding overloading taxpayers and ensuring the uniformity of living conditions in the federal territory.

In order to guarantee a parallel budget policy in this process and to exclude “stepping stones”, the budgets of the federal and state governments have been reviewed by a “ stability council ” since 2009 . It is a joint federal and state body to monitor budget management and compliance with European budget discipline. Its establishment goes back to the Federalism Reform II and is regulated in Art. 109a GG. The stability council includes the finance ministers from the federal and state levels as well as the federal economics minister.

In the financial equalization of the federal states, a gap between financially strong and financially weak countries has been widening for many years; this was exacerbated by the inclusion of the new federal states with their initially particularly weak economic and financial strength. In 2015, only four federal states paid into the compensation, the Free State of Bavaria 5.5 billion euros, Baden-Württemberg 2.3, Hesse 1.7 billion and Hamburg 112 million euros. The largest recipient country was Berlin with 3.6 billion. The eastern German states received a total of 3.2 billion euros in 2015, including Saxony alone 1 billion euros.

History of the state financial equalization

Empire

With the establishment of the North German Confederation in 1867, the need for financial equalization also arose in the newly created confederation of states. In the Bismarckian constitution (1871) it was stipulated that the federal states support the empire with “matricular contributions” if its own income from customs and consumption taxes is insufficient. This was regularly the case, and the federal government became the “boarder of the states”.

Weimar Republic

In the Weimar Imperial Constitution , the relationship was reversed: According to Article 8 of the Weimar Imperial Constitution, the Reich was given the legislative competence and the sovereignty over taxes and other income. The regionally fragmented financial management was in a Reichsfinanzverwaltung summarized. The countries became "boarders of the empire". They received essentially percentage allocations from the tax revenue, which were distributed to the federal states according to the principle of local revenue and residents. Remaining differences in financial strength between the countries were offset by a supplementary guarantee from the Reich in accordance with the State Tax Act (March 30, 1920), which ensured that no country received less than 80% of the average state tax revenue.

In contrast, National Socialist Germany was also run as a central state economically.

Federal Republic of Germany

In the deliberations of the Parliamentary Council on the future constitution of the Federal Republic of Germany, such a "boarding system" should be avoided. The federal and state governments should have equal rights and be financially independent of one another. With regard to a uniform economic area, there was agreement on uniformly standardized taxes under federal law, a tax separation system with exclusive and competing federal legislation, a financial administration shared between the federal government and the federal states, and financial equalization among the federal states. In fact, a small tax group was introduced. In 1955 this was written into the constitution.

1969 financial reform

In 1969, after many years of deliberations, a financial reform was passed, which is the basis of the current financial constitution of the Basic Law:

The distribution of tax revenues between the federal and state governments is regulated by Article 106 of the Basic Law. A large tax association consisting of income and corporation tax and sales tax was created: the federal and state governments share the most abundant tax sources, income and corporation tax as well as sales tax, which make up around three quarters of the state's total tax revenue, according to legally established keys (community taxes). There is an advance sales tax adjustment for particularly financially weak countries, the share of all countries in the community taxes is determined, followed by various federal supplementary allocations. At the same time, the entire area of mixed financing, which was constitutionally controversial, was placed on a new constitutional basis with the introduction of joint tasks and the regulations of the cash benefit laws and federal investment aid. In addition, planning elements were introduced into the Basic Law: Medium-term financial planning and the Budget Principles Act.

Financial equalization between the countries

Art. 107 GG regulates the horizontal financial equalization between the federal states . In principle, the principle of “local income” no longer applies to the tax income accruing to the federal states, but is distributed in proportion to the number of inhabitants: the income tax income is due to the country in which the taxpayer lives; the tax income from corporation tax is due to the country in which the taxable economic service was provided. The country's share of sales tax is an exception: up to a quarter of the country's revenue can be allocated in advance to the particularly financially weak countries. The state financial equalization has been intensified: The tax power of countries entitled to equalization should be increased to 95% instead of the previous 91% of the national average.

In retrospect, the breakdown by place of residence disadvantages the city-states with their high rates of commuting because the wage tax share rose above average due to the cold progression, especially in the first half of the 1970s. While in 1950 it accounted for a fifth of the tax revenue and a quarter of the sales tax, in 1973 it was two fifths and the sales tax share was 16%. Today the ratio has leveled off at more than a third or almost a quarter of the tax revenue. They experience a certain compensation through the population rating. The clause on advance sales tax adjustment, which was introduced into the Basic Law in 1969, gained importance after German reunification with the introduction of a state-wide financial equalization scheme in 1995: As part of the first solidarity pact, the federal government allocated seven sales tax percentage points to the states, which through this provision went to the particularly financially weak East German states rivers.

Due to the lawsuits, the financial constitution was adjusted several times in individual points, but after this reform it lasted for over 40 years and also allowed the fiscal integration of the new federal states . In 2013, Bavaria and Hesse filed a lawsuit with the Federal Constitutional Court. After the new regulation passed in 2017, they withdrew their lawsuit.

Compensation mechanisms

The state financial equalization in the broader sense consisted of three levels: advance VAT adjustment, state financial equalization in the narrower sense (ie p.) And general federal supplementary allocations . The compensation levels were to be applied in the order prescribed by law. In particular, the equalization between the federal states (horizontal financial equalization) is to be strictly separated from federal payments to the federal states (vertical financial equalization). The state financial equalization in the narrower sense is the best-known component of this overall system:

- Horizontal financial equalization

- Advance VAT settlement

- State financial equalization in the narrower sense

- Vertical financial equalization

- Federal supplementary grants

The current financial equalization is based on the Measures Act (MaßstG) and the Financial Equalization Act (FAG), both passed in 2001 and in force since January 1, 2005. The Standard Act is intended to serve as a long-term basis that specifies the constitutional requirements, while the FAG specifies the currently applicable calculation steps for the compensation mechanism. With this unusual construction, the legislature complied with the requirements of the Federal Constitutional Court in its ruling of November 11, 1999. Since the Measure Act and the FAG will expire on December 31, 2019, the current redistribution system will expire in 2019; just like the Solidar Pact II for the construction of the East . The federal and state governments have started negotiations on a continuation.

Before the financial equalization begins, first of all the taxes that federal and state governments are jointly entitled ( income tax , corporate income tax and sales tax ) between the two planes divide . The starting point for the actual compensation mechanisms is then the local supply of the federal states. According to Art. 107, Paragraph 1 of the Basic Law, this means the taxes collected in the tax offices of the federal states, corrected by the decomposition .

Advance VAT settlement

A maximum of 25% of the sales tax share of the countries was used to approximate the financial strength of the weak countries to the average financial strength of all countries. If there was a large difference to the average financial strength, 95% of the difference was initially compensated; with increasing approach to the average, the compensation intensity decreased degressively to 60%. The rest of the revenue was distributed to the federal states according to the number of residents.

State financial equalization

State financial equalization in the narrower sense consisted of compensatory payments from richer federal states (donor states ) to poorer federal states (recipient states). The obligation to compensate resulted from a comparison of the so-called compensatory index with the financial strength index .

Compensation index

It shows the income a country would have achieved if its income had corresponded to the average income of the countries per inhabitant. However, various weighting factors were included in the calculation (see below). The financial strength indicator, on the other hand, represented the actual income according to the country's cameralistics .

Specifically, which was compensation base rate calculated by dividing the sum of the first tax revenues of all states and collected on the production of crude oil and natural gas royalties all the states are divided by the (weighted) population. Then, for each country, this average income per inhabitant was multiplied by the number of inhabitants in that country. It should be noted, however, that the city-states were granted so-called "refined residents", i. H. for them, the number of inhabitants must be multiplied by 1.35 ( city-state privilege ). Then the tax revenues of the municipalities of all federal states had to be divided by the (weighted) population of all federal states and multiplied by 0.64 and the number of inhabitants of the federal state for which the compensation index is to be calculated. In terms of the number of inhabitants, however, it was again to be noted that the number of inhabitants of the city-states had to be multiplied by 1.35, and the following federal states had refined inhabitants: Mecklenburg-Western Pomerania: 1.05; Brandenburg: 1.03; Saxony-Anhalt: 1.02. If the results from the two partial calculations were added up, the compensation index was obtained .

Financial strength metric

It was calculated as the sum of the actual revenues of the country from taxes and charges in drilling for oil and gas mining royalties and currently 64% of the taxes levied by the municipalities of the country.

A country was entitled to compensation if the compensation index was greater than the financial strength index. In this case, the recipient country received allocations from the donor countries, which were technically processed by the federal government as the paying agent. To measure the compensation payments, a three-part, partially linear-progressive rate profile was used. If a recipient country achieved more than 93% of the average financial strength, the compensation intensity dropped significantly. This did not guarantee a minimum level of funding for financially weak countries.

The countries subject to compensation had to surrender a progressively growing share of their surplus. This part was also calculated using the three-part tariff that applies to the recipient countries. The maximum deduction of 75% is achieved for the parts of the tax revenue that are above 121% of the average. A maximum of 72.6% of the total surplus of a country is siphoned off.

A bonus model was provided to improve the incentive to increase one's own tax income. After that, significantly above-average increases in tax revenue were removed from the equalization mechanism, i.e. they remained entirely with the respective country.

Further clauses ensure that contributions and benefits are identical.

Federal Supplementary Allocations (BEZ)

Federal states whose financial strength is still below 100% of the state average even after the state financial equalization in the narrower sense, also received federal supplementary allocations from the federal budget. General federal supplementary grants were granted when the financial strength of a country according to the LFA in the sense of the word remained below 99.5% of the national average. The deficit was then made up to 77.5%.

In 2013, the federal government paid the following amounts for supplementary federal grants:

| country | Amount in € million |

|---|---|

|

|

0 |

|

|

0 |

|

|

2,344 |

|

|

1,351 |

|

|

250 |

|

|

42 |

|

|

0 |

|

|

1,025 |

|

|

0 |

|

|

341 |

|

|

178 |

|

|

130 |

|

|

2,369 |

|

|

1,446 |

|

|

145 |

|

|

1,340 |

| total | 10,959 |

provisional result, rounding errors due to addition included

Special needs federal supplementary grants (SoBEZ) were granted for three reasons:

- due to the division-related special burdens of the new federal states,

- Special burdens from structural unemployment and

- above-average costs of political leadership.

The division-related SoBEZ were designed to be degressive. They fell from initially € 10.5 billion annually from 2007 to € 2.096 billion in 2019. These SoBEZ were an important part of Solidarity Pact II. Until the end of 2004, the federal government also granted Bremen and Saarland SoBEZ to remedy their budgetary emergency . After this aid expired, both countries sued the Federal Constitutional Court for continuation. However, this lawsuit is currently suspended. The Berlin Senate has also filed a lawsuit - without success.

Financial volume

The volume of state financial equalization (as well as that of the additional sales tax equalization) has also expanded over time with the increased volume of state budgets. The volume jumped in 1995 when the new federal states and Berlin were included in the system for the first time.

Broken down according to the individual federal states, the equalization payments of the federal state financial equalization developed as follows: Negative numbers denote payments by the "donor country", positive numbers denote credits from the "recipient country" (all figures in € million, partially converted).

| year | BE Berlin |

BW Baden- Württemberg |

BY Bavaria |

BB Brandenburg |

HB Bremen |

HH Hamburg |

HE Hessen |

MV Mecklenburg- Western Pomerania |

NI Lower Saxony |

NW North Rhine- Westphalia |

RP Rhineland- Palatinate |

SL Saarland |

SN Saxony |

ST Saxony- Anhalt |

SH Schleswig- Holstein |

TH Thuringia |

volume |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1950 1 | ./. | −33 | 18th | ./. | 0 | −17 | −14 | ./. | 41 | −65 | 18th | ./. | ./. | ./. | 53 | ./. | ± 130 |

| 1951 | ./. | −16 | 7th | ./. | 0 | −19 | −10 | ./. | 13 | −43 | 15th | ./. | ./. | ./. | 52 | ./. | ± 88 |

| 1952 | ./. | −23 | 8th | ./. | 0 | −21 | 0 | ./. | 29 | −69 | 17th | ./. | ./. | ./. | 59 | ./. | ± 113 |

| 1953 | ./. | −40 | 14th | ./. | 0 | −11 | 0 | ./. | 31 | −74 | 10 | ./. | ./. | ./. | 71 | ./. | ± 126 |

| 1954 | ./. | −41 | 20th | ./. | 0 | −17 | 0 | ./. | 37 | −77 | 9 | ./. | ./. | ./. | 69 | ./. | ± 135 |

| 1955 | ./. | −59 | 52 | ./. | −6 | −67 | −5 | ./. | 65 | −139 | 47 | ./. | ./. | ./. | 113 | ./. | ± 277 |

| 1956 | ./. | −72 | 56 | ./. | −18 | −82 | 0 | ./. | 92 | −169 | 61 | ./. | ./. | ./. | 131 | ./. | ± 341 |

| 1957 | ./. | −89 | 71 | ./. | −8 | −102 | −24 | ./. | 107 | −182 | 89 | ./. | ./. | ./. | 140 | ./. | ± 406 |

| 1958 | ./. | −61 | 113 | ./. | −6 | −136 | −37 | ./. | 136 | −249 | 115 | ./. | ./. | ./. | 124 | ./. | ± 489 |

| 1959 | ./. | −76 | 119 | ./. | −1 | −163 | −29 | ./. | 132 | −256 | 143 | ./. | ./. | ./. | 130 | ./. | ± 525 |

| 1960 2 | ./. | −55 | 95 | ./. | 0 | −113 | −35 | ./. | 133 | −265 | 131 | ./. | ./. | ./. | 109 | ./. | ± 468 |

| 1961 | ./. | −98 | 112 | ./. | 0 | −170 | −79 | ./. | 228 | −385 | 170 | 65 | ./. | ./. | 156 | ./. | ± 732 |

| 1962 | ./. | −141 | 117 | ./. | 0 | −193 | −98 | ./. | 251 | −370 | 178 | 74 | ./. | ./. | 182 | ./. | ± 802 |

| 1963 | ./. | −154 | 99 | ./. | 0 | −199 | −117 | ./. | 204 | −269 | 182 | 83 | ./. | ./. | 172 | ./. | ± 740 |

| 1964 | ./. | −183 | 119 | ./. | 0 | −184 | −159 | ./. | 220 | −252 | 166 | 90 | ./. | ./. | 182 | ./. | ± 778 |

| 1965 | ./. | −188 | 97 | ./. | 6th | −165 | −185 | ./. | 260 | −276 | 165 | 107 | ./. | ./. | 179 | ./. | ± 814 |

| 1966 | ./. | −222 | 72 | ./. | 5 | −181 | −210 | ./. | 256 | −208 | 180 | 113 | ./. | ./. | 195 | ./. | ± 821 |

| 1967 | ./. | −239 | 62 | ./. | −2 | −216 | −215 | ./. | 347 | −216 | 172 | 119 | ./. | ./. | 190 | ./. | ± 889 |

| 1968 | ./. | −220 | 51 | ./. | −1 | −246 | −224 | ./. | 313 | −190 | 185 | 131 | ./. | ./. | 201 | ./. | ± 881 |

| 1969 | ./. | −317 | 119 | ./. | −7 | −353 | −319 | ./. | 454 | −249 | 250 | 155 | ./. | ./. | 266 | ./. | ± 1,245 |

| 1970 | ./. | −161 | 76 | ./. | 46 | −150 | −148 | ./. | 208 | −162 | 117 | 73 | ./. | ./. | 102 | ./. | ± 621 |

| 1971 | ./. | −194 | 102 | ./. | 26th | −176 | −100 | ./. | 230 | −188 | 122 | 73 | ./. | ./. | 106 | ./. | ± 659 |

| 1972 | ./. | −303 | 91 | ./. | 37 | −158 | −158 | ./. | 312 | −176 | 149 | 80 | ./. | ./. | 126 | ./. | ± 795 |

| 1973 | ./. | −302 | 85 | ./. | 36 | −169 | −186 | ./. | 347 | −174 | 127 | 94 | ./. | ./. | 141 | ./. | ± 831 |

| 1974 | ./. | −260 | 177 | ./. | 28 | −260 | −164 | ./. | 380 | −293 | 153 | 100 | ./. | ./. | 139 | ./. | ± 977 |

| 1975 | ./. | −338 | 188 | ./. | 23 | −278 | −105 | ./. | 367 | −222 | 150 | 91 | ./. | ./. | 122 | ./. | ± 943 |

| 1976 | ./. | −368 | 170 | ./. | 26th | −277 | −98 | ./. | 393 | −258 | 174 | 100 | ./. | ./. | 138 | ./. | ± 1,001 |

| 1977 | ./. | −541 | 204 | ./. | 74 | −316 | −132 | ./. | 475 | −183 | 147 | 108 | ./. | ./. | 165 | ./. | ± 1,172 |

| 1978 | ./. | −556 | 153 | ./. | 79 | −299 | −241 | ./. | 453 | −62 | 182 | 110 | ./. | ./. | 181 | ./. | ± 1,158 |

| 1979 | ./. | −581 | 168 | ./. | 120 | −426 | −265 | ./. | 512 | 0 | 149 | 117 | ./. | ./. | 205 | ./. | ± 1,271 |

| 1980 | ./. | −769 | 206 | ./. | 91 | −160 | −152 | ./. | 385 | −39 | 126 | 147 | ./. | ./. | 165 | ./. | ± 1,120 |

| 1981 | ./. | −838 | 137 | ./. | 82 | −218 | −183 | ./. | 515 | 0 | 155 | 133 | ./. | ./. | 216 | ./. | ± 1,239 |

| 1982 | ./. | −915 | 83 | ./. | 122 | −220 | −143 | ./. | 577 | 0 | 142 | 134 | ./. | ./. | 219 | ./. | ± 1,278 |

| 1983 | ./. | −730 | 69 | ./. | 134 | −197 | −170 | ./. | 360 | 0 | 131 | 156 | ./. | ./. | 249 | ./. | ± 1,097 |

| 1984 | ./. | −747 | 21st | ./. | 159 | −151 | −294 | ./. | 427 | 0 | 145 | 170 | ./. | ./. | 268 | ./. | ± 1,191 |

| 1985 | ./. | −738 | 14th | ./. | 170 | −208 | −370 | ./. | 423 | 46 | 191 | 184 | ./. | ./. | 288 | ./. | ± 1.317 |

| 1986 | ./. | −891 | 25th | ./. | 228 | −101 | −400 | ./. | 437 | 0 | 194 | 195 | ./. | ./. | 314 | ./. | ± 1,393 |

| 1987 | ./. | −978 | 0 | ./. | 258 | −30 | −628 | ./. | 570 | 85 | 244 | 172 | ./. | ./. | 306 | ./. | ± 1.636 |

| 1988 | ./. | −982 | 0 | ./. | 262 | 0 | −736 | ./. | 807 | 15th | 159 | 170 | ./. | ./. | 305 | ./. | ± 1,718 |

| 1989 | ./. | −722 | −33 | ./. | 322 | −6 | −985 | ./. | 856 | −51 | 155 | 168 | ./. | ./. | 296 | ./. | ± 1,797 |

| 1990 | ./. | −1.264 | −18 | ./. | 327 | −4 | −739 | ./. | 985 | −32 | 250 | 187 | ./. | ./. | 308 | ./. | ± 2,057 |

| 1991 | ./. | −1,282 | −2 | ./. | 301 | −34 | −682 | ./. | 898 | −4 | 301 | 195 | ./. | ./. | 308 | ./. | ± 2,003 |

| 1992 | ./. | −770 | 28 | ./. | 262 | 0 | −942 | ./. | 661 | −2 | 338 | 219 | ./. | ./. | 206 | ./. | ± 1,714 |

| 1993 | ./. | −518 | −6 | ./. | 325 | 58 | −1.094 | ./. | 510 | 16 | 398 | 215 | ./. | ./. | 95 | ./. | ± 1.618 |

| 1994 | ./. | −210 | −342 | ./. | 291 | 31 | −935 | ./. | 490 | 80 | 336 | 222 | ./. | ./. | 37 | ./. | ± 1,487 |

| 1995 | 2.159 | −1,433 | −1,295 | 442 | 287 | −60 | −1,101 | 394 | 231 | −1,763 | 117 | 92 | 907 | 574 | −72 | 521 | ± 5,724 |

| 1996 | 2,217 | −1.289 | −1,463 | 529 | 325 | −246 | −1,657 | 438 | 283 | −1,598 | 118 | 120 | 1.005 | 635 | 8th | 576 | ± 6,253 |

| 1997 | 2,266 | −1,232 | −1,586 | 504 | 179 | −140 | −1,610 | 431 | 344 | −1,564 | 151 | 104 | 981 | 601 | −3 | 574 | ± 6,134 |

| 1998 | 2,501 | −1,778 | −1,486 | 534 | 466 | −314 | −1,758 | 448 | 403 | −1,583 | 219 | 117 | 1,020 | 617 | 0 | 595 | ± 6,920 |

| 1999 | 2,725 | −1,760 | −1,635 | 587 | 340 | −345 | −2,433 | 464 | 532 | −1,318 | 195 | 153 | 1,122 | 672 | 89 | 612 | ± 7,490 |

| 2000 | 2,812 | −1,957 | −1,884 | 644 | 442 | −556 | −2,734 | 500 | 568 | −1,141 | 392 | 167 | 1,182 | 711 | 185 | 670 | ± 8,273 |

| 2001 | 2,653 | −2,115 | −2,277 | 498 | 402 | −268 | −2,629 | 434 | 952 | −278 | 229 | 146 | 1,031 | 591 | 60 | 573 | ± 7,568 |

| 2002 | 2,677 | −1,663 | −2.047 | 541 | 407 | −197 | −1,910 | 439 | 487 | −1,628 | 419 | 139 | 1,047 | 607 | 112 | 571 | ± 7,445 |

| 2003 | 2,639 | −2,169 | −1,859 | 502 | 346 | −656 | −1,876 | 392 | 393 | −50 | 259 | 107 | 936 | 520 | 16 | 500 | ± 6,610 |

| 2004 | 2,703 | −2,170 | −2,315 | 534 | 331 | −578 | −1,529 | 403 | 446 | −213 | 190 | 116 | 930 | 532 | 102 | 517 | ± 6,804 |

| 2005 | 2,456 | −2,235 | −2.234 | 588 | 366 | −383 | −1,606 | 434 | 363 | −490 | 294 | 113 | 1,020 | 587 | 146 | 581 | ± 6,948 |

| 2006 | 2,709 | −2.057 | −2.093 | 611 | 417 | −623 | −2,418 | 475 | 240 | −132 | 346 | 115 | 1,078 | 590 | 124 | 617 | ± 7,322 |

| 2007 | 2,900 | −2,316 | −2,311 | 675 | 471 | −368 | −2,885 | 513 | 318 | −38 | 343 | 125 | 1,165 | 627 | 136 | 644 | ± 7,917 |

| 2008 | 3.139 | −2,499 | −2,923 | 621 | 505 | −371 | −2,470 | 538 | 317 | 54 | 374 | 116 | 1,158 | 627 | 177 | 637 | ± 8,264 |

| 2009 | 2,877 | −1,488 | −3,354 | 501 | 433 | −45 | −1.902 | 450 | 110 | −59 | 293 | 93 | 910 | 514 | 169 | 497 | ± 6,848 |

| 2010 | 2,900 | −1,709 | −3,511 | 401 | 445 | −66 | −1,752 | 399 | 259 | 354 | 267 | 89 | 854 | 497 | 101 | 472 | ± 7,038 |

| 2011 | 3,043 | −1,779 | −3,663 | 440 | 516 | −62 | −1,804 | 429 | 204 | 224 | 234 | 120 | 918 | 540 | 115 | 527 | ± 7,308 |

| 2012 | 3.224 | −2,765 | −3,797 | 543 | 521 | −25 | −1,304 | 453 | 178 | 435 | 256 | 94 | 961 | 550 | 134 | 542 | ± 7,892 |

| 2013 | 3,328 | −2,415 | −4.307 | 518 | 588 | 88 | −1,702 | 461 | 107 | 691 | 242 | 137 | 995 | 559 | 168 | 543 | ± 8,424 |

| 2014 | 3,491 | −2,356 | −4,852 | 510 | 604 | −55 | −1,755 | 463 | 276 | 897 | 288 | 144 | 1,034 | 585 | 172 | 554 | ± 9,018 |

| 2015 | 3,613 | −2,313 | −5,449 | 494 | 626 | −111 | −1,720 | 472 | 418 | 1,021 | 349 | 151 | 1,022 | 596 | 247 | 580 | ± 9,594 |

| 2016 | 3,919 | −2,538 | −5,821 | 543 | 694 | 64 | −2,261 | 493 | 681 | 1.107 | 388 | 174 | 1,089 | 645 | 226 | 598 | ± 10,620 |

| 2017 | 4,232 | −2,773 | −5.905 | 607 | 692 | −49 | −2,471 | 524 | 684 | 1,232 | 389 | 200 | 1,180 | 549 | 244 | 644 | ± 11,198 |

| 2018 | 4,404 | −3.079 | −6,672 | 550 | 740 | −83 | −1,613 | 538 | 831 | 1,015 | 418 | 194 | 1,180 | 676 | 235 | 667 | ± 11,448 |

| 2019 | 4,330 | −2,436 | −6,701 | 555 | 771 | −120 | −1,905 | 517 | 778 | 1,041 | 308 | 179 | 1,176 | 652 | 230 | 626 | ± 11,161 |

| 71,685 | −67,836 | −72,518 | 12,865 | 15,013 | −11,924 | −58.144 | 10,978 | 25,646 | −10,623 | 13,727 | 7,655 | 24,721 | 14.305 | 10,656 | 13,794 | ||

| Adjusted for inflation ( note: only figures updated until 2013 ) | |||||||||||||||||

| 53,419 | −76.369 | −41,892 | 11,821 | 15,220 | −25.111 | −60.363 | 9,814 | 44,727 | −33,897 | 23,693 | 12,821 | 20,058 | 12,956 | 22,786 | 12,487 | ||

| year |

Berlin BE |

Baden- Württemberg BW |

Bavaria BY |

Brandenburg castle BB |

Bremen HB |

Hamburg HH |

Hessen HE |

Mecklenburg- Western Pomerania MV |

Lower Saxony NI |

North Rhine- Westphalia NW |

Rhineland- Palatinate RP |

Saarland SL |

Saxony SN |

Saxony- Anhalt ST |

Schleswig- Holstein SH |

Thuringia TH |

volume |

Source: Scientific Service of the Bundestag, Federal Ministry of Finance: 1950–1994:

from 1995:

| year | BE Berlin |

BW Baden- Württemberg |

BY Bavaria |

BB Brandenburg |

HB Bremen |

HH Hamburg |

HE Hessen |

MV Mecklenburg- Western Pomerania |

NI Lower Saxony |

NW North Rhine- Westphalia |

RP Rhineland- Palatinate |

SL Saarland |

SN Saxony |

ST Saxony- Anhalt |

SH Schleswig- Holstein |

TH Thuringia |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Average performance per year from 1999 to 2008 (in € million, adjusted for inflation) | ||||||||||||||||

| - | 2,952 | −2,250 | −2,315 | 625 | 433 | −468 | −2,426 | 495 | 504 | −583 | 327 | 141 | 1,150 | 655 | 123 | 638 |

| Share of donor and recipient countries in 2008 * | ||||||||||||||||

| giver | - | 30.3% | 35.3% | - | - | 4.5% | 29.9% | - | - | - | - | - | - | - | - | - |

| Taker | 37.9% | - | - | 7.5% | 6.1% | - | - | 6.5% | 3.9% | 0.6% | 4.5% | 1.4% | 14.1% | 7.6% | 2.1% | 7.7% |

| Per capita transfer performance (in €) | ||||||||||||||||

| 2006 | 796.88 | −191.50 | −167.74 | 239.41 | 627.55 | −356.41 | −397.88 | 279.39 | 29.99 | −7.29 | 85.37 | 110.16 | 252.93 | 240.23 | 43.69 | 265.40 |

| 2007 | 851.63 | −215.49 | −184.83 | 265.43 | 710.59 | −208.77 | −475.20 | 303.97 | 39.80 | −2.09 | 84.62 | 120.18 | 275.12 | 258.23 | 48.00 | 280.10 |

| 2008 * | 921.07 | −234.37 | −234.68 | 247.73 | 765.57 | −212.18 | −410.03 | 325.66 | 40.50 | 2.78 | 93.23 | 112.89 | 278.18 | 263.72 | 62.91 | 282.39 |

Calculations are based on the unrounded population and LFA performance figures of the Federal Ministry of Finance, as well as the price change rates of the Federal Statistical Office. Deviations in the sums due to rounding.

According to the population figures published in 2013 in the 2011 census , the relative proportions of the population have shifted. For example, the state of Bavaria will receive a total of 227 million euros in reimbursement for 2011 and 2012, Rhineland-Palatinate 203 million euros and North Rhine-Westphalia 130 million euros. Berlin has to repay 450 million euros, Baden-Württemberg 167 million and Hamburg 118 million euros. The other countries receive a reimbursement in the mostly lower double-digit million range. In the run-up to the census, the federal states had agreed to limit the additional payments for 2011 to one third and for 2012 to two thirds. From 2013, the changed proportions of the population should be fully taken into account.

criticism

The financial equalization scheme has been criticized by the academic community and by donor and recipient countries. The state financial equalization was designed as a so-called peak equalization; before reunification (1989) the volume was the equivalent of around 1.8 billion euros. It was not intended for a compensation to the extent practiced today. In the German federal state, the federal division of tasks is traditionally not carried out according to policy fields, but according to functions: The federal government defines the performance of public tasks very largely on the basis of its legislative powers ( Art. 72 ff . 83 ff. GG). The financial constitution is from a constitutional point of view, "Follow the Constitution" that carries this form of federal division of responsibilities into account.

The question of who pays what is of central importance for any financial system. In accordance with the principle of connectivity ( Article 104a, Paragraph 1 of the Basic Law), the Basic Law assigns the costs to the level that performs a task. According to Art. 83 GG, it is the task of the federal states to implement the federal laws as “their own affair”. It follows from the performance of this task that the federal states also have to bear the costs. The assumption of costs for the implementation of federal laws by the federal government is the exception according to the Basic Law. This leads again and again to conflicts and problems between the federal government and the federal states as well as between the federal states. These are made even more difficult because the system of the federal German state financial equalization in the broader sense, with its various interlocking levels, whose distributional effects also differ, is very complex and its consequences are only transparent for experts.

The financially weak countries criticize that their financial weakness is the result of a financial overload. The implementation of federal laws, in particular those that are socially politically motivated - from social assistance to Hartz IV to the costs of refugee policy - place a greater burden on the structurally and thus also tax-weak countries than the structurally strong countries. You would end up in a vicious circle of lower income and higher state-induced expenses. In addition, it is stated that the revenue from community taxes (especially corporation tax ) is distributed differently between the federal states, since large companies in particular pay these centrally at the company headquarters, even if they operate branches and branches nationwide. While Baden-Württemberg, for example, receives 22.5 percent of the nationwide corporate income tax revenue, the new federal states together only achieved around 9 percent.

The financially strong countries argue that the national financial equalization will further cement the financially problematic situation of recipient countries. Recipient countries have no economic incentives to stabilize their finances. Instead, they would get used to permanent subsidization. In this way, deficit countries would have neither an incentive to reduce their expenditure and costs, nor an incentive to increase their revenues (e.g. through taxes). The critics see the system as being hostile to competition (cf. competition federalism ). There is a risk that the federal government's stepping in in the event of an extreme budget emergency would be interpreted as a license to increase debt. In March 2013, Bavaria and Hesse filed a judicial review complaint with the Federal Constitutional Court. They applied to establish that the Measures Act and the Financial Equalization Act are incompatible with Article 107 (2) of the Basic Law. In September 2017, they withdrew the lawsuit.

Reforms of the financial equalization of the federal states have been called for or discussed for a long time. With the last major amendment to the Financial Equalization Act as part of the Solidarity Pact II in 2001, the validity of the law was limited to December 31, 2019. A reform of the LFA is to be embedded in a comprehensive modernization of the federal state, within the framework of which three basic law reforms have already been passed: 1994 the amendment of Art. 72 GG, 2006 the "first" federal state reform , which should serve the unbundling ( federalism reform I ), and in 2009 the “second” federal reform that enshrined a “debt brake” in the Basic Law ( Federalism Reform II ).

See also

literature

- Stephan Ebner: Constitutional design of the horizontal financial equalization. State financial equalization a federal cornerstone (?) . Publishing house Dr. Müller, 2009, ISBN 978-3-639-11665-6 .

- Adrian Jung: Fairness of scale in state financial equalization. The national finances between autonomy and leveling . Duncker & Humblot, Berlin 2008, ISBN 978-3-428-12673-6 .

- Martin Seybold: Financial equalization in the context of German federalism. Perspectives for a future state financial equalization . Nomos Verlag, 2005, ISBN 3-8329-1193-6 .

- Klaus Detterbeck, Wolfgang Renzsch, Stefan Schieren (eds.): Federalism in Germany (textbooks and handbooks of political science). De Gruyter Oldenbourg, 2010, ISBN 978-3-486-59187-3 .

- Martin Junkernheinrich, Stefan Korioth, Thomas Lenk, Henrik Scheller , Matthias Woisin (eds.): Yearbook for Public Finances 1-2016, negotiations on financial equalization . Berlin 2016, ISBN 978-3-8305-3663-5

- Wolfgang Renzsch : Financial constitution and financial equalization. The disputes about their political formation in the Federal Republic of Germany between currency reform and German unification (1948 to 1990) . Bonn 1991, ISBN 3-8012-4029-0

Web links

- Federal Ministry of Finance: State financial equalization

- Federal Statistical Office on state financial equalization and federal supplementary allocations

- BVerfG, judgment of June 24, 1986, Az. 2 BvF 1, 5, 6/83, 1/84 and 1, 2/85; BVerfGE 72, 330 - Financial equalization I

- BVerfG, judgment of May 27, 1992, Az. 2 BvF 1, 2/88, 1/89 and 1/90; BVerfGE 86, 148 - Financial equalization II

- BVerfG, judgment of November 11, 1999, Az. 2 BvF 2, 3/98, 1, 2/99; BVerfGE 101, 158 - Financial equalization III

- haushaltssteuerung.de (portal for public budget and finance)

Individual evidence

- ↑ Bund.Länder Finances on tagesschau.de

- ↑ State financial equalization reaches new record level . Mirror online

- ↑ Chilla, Tobias, Kühne, Olaf & Markus Neufeld (2016): Regional Development . UTB .

- ^ Daniel Buscher: The federal state in times of the financial crisis. A contribution to the reform of the German financial and budget regulations . Duncker & Humblot, 2010, p. 147 ff.

- ↑ State financial equalization . Federal Ministry of Finance

- ↑ Hubert Schulte, Yearbook for Public Finances 2014 , Berlin 2015, p. 381 ff. ISBN 978-3-8305-3530-0

- ^ State financial equalization - Bavaria donor country . Zeit Online , March 2016

- ↑ Numbers Facts - Taxes, Finances . DESTATIS

- ↑ Bundestag resolves to reorganize federal-state relations. In: sueddeutsche.de. June 1, 2017, accessed March 20, 2018 .

- ↑ a b Hessen and Bavaria withdraw legal action against financial equalization . Welt Online , September 5, 2017

- ↑ Text of the Law of Measure

- ^ Text of the Financial Equalization Act

- ↑ BVerfG, judgment of November 11, 1999, Az. 2 BvF 2, 3/98, 1, 2/99; BVerfGE 101, 158 - Financial equalization III

- ↑ DESTATIS: State financial equalization

- ↑ BVerfG, judgment of October 19, 2006, Az. 2 BvF 3/03, BVerfGE 116, 327 - Berlin budget.

- ↑ § 2 of the Second Ordinance for the Implementation of the Financial Equalization Act in the 2005 equalization year

- ↑ § 2 of the Second Ordinance on the Implementation of the Financial Equalization Act in 2006

- ↑ § 2 of the Second Ordinance for the Implementation of the Financial Equalization Act in the 2007 equalization year

- ↑ § 2 of the Second Ordinance on the Implementation of the Financial Equalization Act in the 2008 equalization year

- ↑ § 2 of the Second Ordinance for the Implementation of the Financial Equalization Act in the 2009 equalization year

- ↑ § 2 of the Second Ordinance for the Implementation of the Financial Equalization Act in the equalization year 2010

- ↑ § 2 of the Second Ordinance on the Implementation of the Financial Equalization Act in the 2011 equalization year

- ↑ § 2 of the Second Ordinance for the Implementation of the Financial Equalization Act in the equalization year 2012

- ↑ § 2 of the Second Ordinance for the Implementation of the Financial Equalization Act in the equalization year 2013

- ↑ Preliminary settlement of the state financial equalization 2014 ( Memento of the original from April 18, 2015 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Preliminary settlement of the state financial equalization 2015. ( Memento of the original from March 25, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Federal Ministry of Finance

- ↑ bundesfinanzministerium.de (PDF) Federal Ministry of Finance

- ↑ The financial equalization between the federal states for the period from 01.01.2017 - 31.12.2017. (PDF) Federal Ministry of Finance, accessed on March 23, 2018 .

- ^ The financial equalization between the federal states for the period from 01.01.2018 - 31.12.2018. (PDF) Federal Ministry of Finance, accessed on January 21, 2019 .

- ↑ Results of the federal state financial equalization 2019 (PDF) Federal Ministry of Finance, accessed on April 25, 2020 .

- ↑ Compensation contributions and allocations until 1994 (PDF) Federal Ministry of Finance

- ↑ Axel Schrinner: Cash injection for the state of Bavaria . In: Handelsblatt . No. 120 , June 26, 2013, p. 9 .

- ↑ Axel Schrinner, Donata Riedel: Financial equalization angered Bavaria . In: Handelsblatt . No. 13 , January 18, 2013, p. 9 .