National debt ratio in Italy

The national debt ratio of Italy indicates the relationship between the Italian national debt on the one hand and the Italian nominal gross domestic product on the other.

Development in recent years

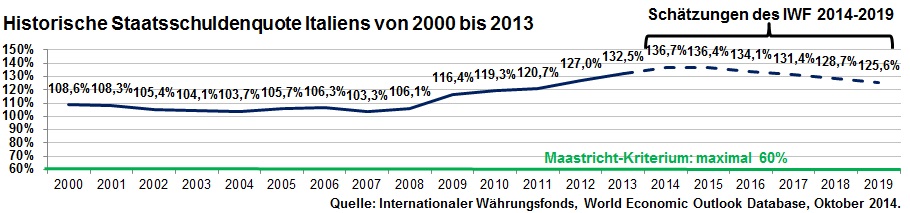

Italy's national debt ratio rose between 2008 and 2013 due to the financial crisis . Whereas the national debt of 1,671 billion euros at the end of 2008 corresponded to a government debt ratio of 106.1%, the national debt ratio at the end of 2013, given the debt level of then 2,067.5 billion euros, reached a value of 132.5%.

At the end of the 2nd quarter of 2015, the Italian government debt ratio was already 136.0% according to Eurostat, with the debt level rising to EUR 2,204.6 billion. This means it is still well above the average rates for the euro zone (92.2%) and for the European Union (87.8%, both as of June 30, 2015).

Forecast development

The International Monetary Fund assumes that Italy's national debt ratio will decline to 125.6% by the end of 2019, with a debt level of EUR 2,235.9 billion. This would mean that Italy would still fail to meet the Maastricht criterion by a maximum of 60%.

Graphical representation

See also

- List of countries by national debt ratio

- List of European countries by national debt ratio

- Government debt ratio

Individual evidence

- ↑ International Monetary Fund: World Economic Outlook Database, October 2014, General government gross debt (National currency, Percent of GDP)

- ↑ a b Eurostat: Public debt in the euro area fell to 92.2% of GDP, press release of 23 October 2015, accessed on 26 October 2015.