National debt ratio in Malta

The national debt ratio of Malta shows the relationship between the Maltese national debt on the one hand and the Maltese nominal gross domestic product on the other.

Development in recent years

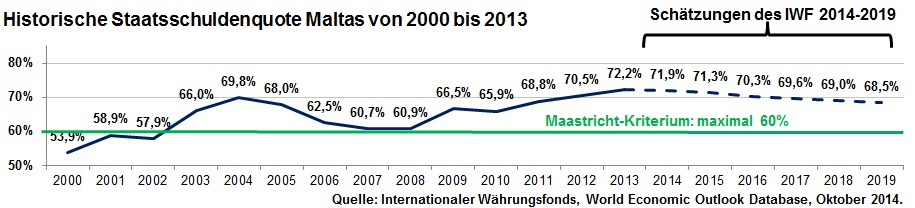

Malta's national debt ratio increased between 2008 and 2013 due to the financial crisis . While the national debt of 3.6 billion euros at the end of 2008 corresponded to a government debt ratio of 60.9%, the national debt ratio at the end of 2013, given a debt level of then 5.2 billion euros, reached 72.2%.

Forecast development

The International Monetary Fund assumes that Malta's national debt ratio will decrease to 68.5% by the end of 2019, with a debt level of 6.2 billion euros. This would mean that Malta would still fail to meet the Maastricht criterion by a maximum of 60%.

Graphical representation

See also

- List of countries by national debt ratio

- List of European countries by national debt ratio

- Government debt ratio

Individual evidence

- ↑ International Monetary Fund: World Economic Outlook Database, October 2014, General government gross debt (National currency, Percent of GDP)