National debt ratio in Finland

The national debt ratio of Finland indicates the relationship between the Finnish national debt on the one hand and the Finnish nominal gross domestic product on the other.

Development in recent years

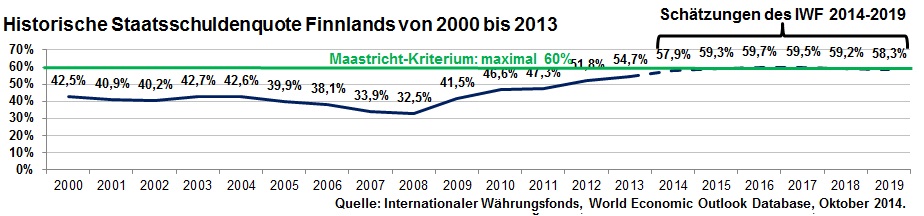

Finland's national debt ratio rose between 2008 and 2013 due to the financial crisis . Whereas the national debt of 63.0 billion euros at the end of 2008 corresponded to a national debt ratio of 32.5%, the national debt ratio at the end of 2013, given a debt level of 110.2 billion euros, reached a value of 54.7%. In 2014, the national debt ratio rose because, in addition to the economic problems at the large corporation Nokia , several export sectors such as the paper, metal and machine industries are also weak. In addition, the recession in Russia and the western sanctions against the important trading partner in the east had a negative impact.

Forecast development

The International Monetary Fund assumes that Finland's national debt ratio will increase to 58.3% by the end of 2019, with a debt level of EUR 140.8 billion. Finland would then meet the Maastricht criterion of 60% or less.

Graphical representation

See also

- List of countries by national debt ratio

- List of European countries by national debt ratio

- Government debt ratio

Individual evidence

- ↑ International Monetary Fund: World Economic Outlook Database, October 2014, General government gross debt (National currency, Percent of GDP)

- ^ Neue Zürcher Zeitung: Less growth, more debt March 2, 2015, accessed March 5, 2015.