Michaelhouse and Subprime mortgage crisis: Difference between pages

m Reverted edits by 41.242.89.36 (talk) to last version by Coffee joe |

|||

| Line 1: | Line 1: | ||

[[Image:Subprime Crisis Diagram - X1.png|thumb|A diagram of the elements of the subprime crisis]] |

|||

{{for|the former college of the [[University of Cambridge]]|Michaelhouse, Cambridge}} |

|||

{{Infobox School2 |

|||

| name = Michaelhouse |

|||

| image = [[Image:mhs badge.gif|School badge]] |

|||

| motto = ''Quis ut Deus'' |

|||

| established = 1896 |

|||

| type = [[Private school|Private]], [[Boarding school|Boarding]] |

|||

| locale = Rural |

|||

| grades = Blocks E - A |

|||

| head_name = Rector |

|||

| head = Guy Pearson |

|||

| head_name2 = Exam board |

|||

| head2 = [[Independent Examinations Board|IEB]] |

|||

| city = [[Balgowan, KwaZulu-Natal|Balgowan]] |

|||

| state = [[KwaZulu-Natal]] |

|||

| country = [[South Africa]] |

|||

| students = 540 boys |

|||

| school_colors = Red and white |

|||

| free_label = Fees |

|||

| free = R 117 660 p.a. |

|||

| website = [http://www.michaelhouse.org/ www.michaelhouse.org] |

|||

}} |

|||

'''Michaelhouse''' is a [[private school|private]] [[boarding school|full boarding]] [[senior school]] for boys founded in 1896. It is located in the [[Balgowan, KwaZulu-Natal|Balgowan]] valley in the [[KwaZulu-Natal Midlands|Midlands]] of [[KwaZulu-Natal]], [[South Africa]]. It is widely regarded as one of the top schools in [[South Africa]] and is part of the [[Elite Seven]]. |

|||

The '''subprime mortgage crisis''' is an ongoing [[finance|financial]] [[financial crisis|crisis]] characterized by contracted [[liquidity]] in global [[credit (finance)|credit]] markets and [[banking]] systems. A downturn in the [[real estate|housing]] market of the [[United States]], risky practices in lending and borrowing, and excessive individual and corporate [[debt]] levels have caused multiple adverse effects on the [[world economy]]. The crisis, which has roots in the closing years of the 20th century but has become more apparent throughout 2007 and 2008, has passed through various stages exposing pervasive weaknesses in the global financial system and regulatory framework. |

|||

== History == |

|||

''St. Michael's Diocesan College'' was founded in [[Pietermaritzburg]] in 1896 by James Cameron Todd, an [[Anglican]] [[Canon (priest)|canon]]. The school was established as a private venture with fifteen boys in two small houses in Loopy Street. |

|||

The crisis began with the bursting of the [[United States housing bubble]]<ref name="Moyers Morgenson">{{cite episode | title = Episode 06292007 | series = [[Bill Moyers Journal]] | network = [[PBS]] | transcripturl = http://www.pbs.org/moyers/journal/06292007/transcript5.html | airdate = 2007-06-29}}</ref><ref name="WSJ Housing Bubble Burst">{{cite news | author = Justin Lahart | title=Egg Cracks Differ In Housing, Finance Shells | work = [[WSJ.com]] | publisher=''[[Wall Street Journal]]'' | url=http://online.wsj.com/article/SB119845906460548071.html?mod=googlenews_wsj | date = 2007-12-24 | accessdate = 2008-07-13 | quote=It's now conventional wisdom that a housing bubble has burst. In fact, there were two bubbles, a housing bubble and a financing bubble. Each fueled the other, but they didn't follow the same course. }}</ref> and high default rates on "[[subprime lending|subprime]]" and [[adjustable rate mortgage]]s (ARM), beginning in approximately 2005–2006. For a number of years prior to that, declining lending standards, an increase in loan incentives such as easy initial terms, and a long-term trend of rising housing prices had encouraged borrowers to assume difficult mortgages in the belief they would be able to quickly refinance at more favorable terms. However, once interest rates began to rise and housing prices started to drop moderately in 2006–2007 in many parts of the U.S., refinancing became more difficult. [[default (finance)|Defaults]] and [[foreclosure]] activity increased dramatically as easy initial terms expired, home prices failed to go up as anticipated, and ARM [[interest]] rates reset higher. [[Foreclosure]]s accelerated in the United States in late 2006 and triggered a [[Financial crisis of 2007–2008|global financial crisis through 2007 and 2008]]. During 2007, nearly 1.3 million U.S. housing properties were subject to foreclosure activity, up 79% from 2006.<ref>{{cite news | title = U.S. FORECLOSURE ACTIVITY INCREASES 75 PERCENT IN 2007 | url=http://www.realtytrac.com/ContentManagement/pressrelease.aspx?ChannelID=9&ItemID=3988&accnt=64847 |work= realtytrac.com |publisher= RealtyTrac Inc |accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

James Cameron Todd had a clear idea of what he wanted the school to be. He wrote: "A man's tone, moral and spiritual, as well as intellectual, is largely determined for life by his school." |

|||

Major banks and other financial institutions around the world have reported losses of approximately US$435 billion as of 17 July 2008.<ref>{{cite web|url=http://www.bloomberg.com/apps/news?pid=20601087&sid=atGti_UmcPnM&refer=home|title=Bloomberg.com: Worldwide<!-- Bot generated title -->}}</ref><ref name = "sgsntp">{{cite news | author = Yalman Onaran | title = Subprime Losses Top $379 Billion on Balance-Sheet Marks: Table | url = http://www.bloomberg.com/apps/news?pid=20601087&sid=aK4Z6C2kXs3A&refer=home | work = [[Bloomberg.com]] | publisher = [[Bloomberg L.P.]] | date = 2008-05-19 | accessdate = 2008-06-04}}</ref> The [[liquidity]] concerns drove central banks around the world to take action to provide funds to member banks to encourage lending to worthy borrowers and to restore faith in the commercial paper markets. The U.S. government also bailed out key financial institutions, assuming significant additional financial commitments. |

|||

Within a few years, Michaelhouse became the Diocesan College of Natal, governed by a permanent trust deed and administered by a [[board of governors]]. |

|||

The risks to the broader economy created by the financial market crisis and housing market downturn were primary factors in several decisions by the U.S. Federal Reserve to cut interest rates and the [[Economic Stimulus Act of 2008|economic stimulus package]] passed by Congress and signed by President [[George W. Bush]] on February 13, 2008.<ref>{{cite press release | title = FRB: Press Release—FOMC statement—22 January 2008 | publisher = [[Federal Reserve]] | date = 2008-01-22 | url=http://www.federalreserve.gov/newsevents/press/monetary/20080122b.htm | accessdate=2008-06-05 | year = 2008 }}</ref><ref>{{cite news | title = Full speed ahead | url=http://www.economist.com/world/na/displaystory.cfm?story_id=10589983 | work economist.com | publisher = [[The Economist]] | date = 2008-01-24 | accessdate=2008-06-05 }}</ref><ref name="Yahoo-mail">{{cite news | author = Jeannine Aversa | title = Rebate Checks in the Mail by Spring | url=http://www.huffingtonpost.com/2008/02/13/rebate-checks-in-the-mail_n_86525.html | work = [[The Huffington Post]] | publisher = [[Arianna Huffington]] | date = 2008-02-13 | accessdate=2008-05-19 }}</ref> During the week of September 14, 2008 the crisis accelerated, developing into a [[Global financial crisis of September–October 2008|global financial crisis]]. Following a series of ad-hoc market interventions to bail out particular firms, a [[Proposed bailout of U.S. financial system (2008)|$700 billion proposal]] was presented to the U.S. Congress in September, 2008. These actions are designed to stimulate economic growth and inspire confidence in the financial markets. On 3 October 2008, President George W. Bush signed the amended version of the bill into law. The following week the U.S. stock market declined 22%, the worst week in its 118 year history. Since Jan. 1, 2008, owners of stocks in U.S. corporations have suffered about $8 trillion in losses, as their holdings declined in value to $12 trillion from $20 trillion. Losses in other countries have averaged about 40%.<ref> ''Wall Street Journal'' Oct. 11, 2008, p.1</ref> |

|||

In 1901 the school relocated to [[Balgowan, South Africa|Balgowan]], when some 77 boys took up residence in the buildings which remain the core to the school to this day. Its name was later changed to ''Michaelhouse''. The school adopted the 9th century [[chorale]] [http://upload.wikimedia.org/wikipedia/en/5/59/StarsOfTheMorning.ogg Stars of the Morning] as its official school [[hymn]]. |

|||

== |

==Economic background== |

||

[[Image:Foreclosure Trend - 2007.png|thumb|Number of U.S. household properties subject to foreclosure actions by quarter.]] |

|||

The [[Latin]] school [[motto]], ''Quis ut Deus'' literally translates to 'Who like God?', or, less literally, 'Who is like God?'. This motto is derived from the name of the school whose origin stems from the [[Hebrew]] ''Mikha'el'' which translates to the same<ref>http://dictionary.reference.com/browse/Michael</ref>. The school hymn, ''Stars of the Morning'', reflects this with the line ''"Who like the Lord?" thunders [[Archangel Michael|Michael, the Chief]].'' |

|||

[[Image:Financial Leverage Profit Engine.png|thumb|Understanding financial leverage.]] |

|||

{{further|[[Subprime crisis background information]]}} |

|||

[[Subprime lending]] is the practice of making [[loans]] to borrowers who do not qualify for [[Interest rate#Market interest rates|market interest rates]] owing to various risk factors, such as income level, size of the down payment made, [[credit history]], and employment status. The value of U.S. subprime mortgages was estimated at $1.3 trillion as of March 2007,<ref>{{cite news | title = How severe is subprime mess? | url=http://www.msnbc.msn.com/id/17584725 | accessdate=2008-07-13 | work = [[msnbc.com]] | publisher = [[Associated Press]] | date = 2007-03-13 | accessdate = 2008-07-13 }}</ref> with over 7.5 million first-[[lien]] <!-- lien is not a misspelling - read the article -->subprime mortgages outstanding.<ref>{{cite speech | title = The Subprime Mortgage Market | author = [[Ben S. Bernanke]] | date = 2007-05-17 | location = [[Chicago, Illinois]] | url=http://www.federalreserve.gov/newsevents/speech/bernanke20070517a.htm | accessdate=2008-07-13 }}</ref> Approximately 16% of subprime loans with adjustable rate mortgages (ARM) were 90-days delinquent or in foreclosure proceedings as of October 2007, roughly triple the rate of 2005.<ref>{{cite speech | title = The Recent Financial Turmoil and its Economic and Policy Consequences | author = [[Ben S. Bernanke]] | date = 2007-10-17 |location = [[New York, New York]] | url=http://www.federalreserve.gov/newsevents/speech/bernanke20071015a.htm | accessdate=2008-07-13 }}</ref> By January 2008, the delinquency rate had risen to 21%<ref name = "Bernanke20080110a">{{cite speech | title = Financial Markets, the Economic Outlook, and Monetary Policy | author = [[Ben S. Bernanke]] | date = 2008-01-10 | location = [[Washington, D.C.]] | url=http://www.federalreserve.gov/newsevents/speech/bernanke20080110a.htm | accessdate=2008-06-05 }}</ref> and by May 2008 it was 25%.<ref>{{cite speech |

|||

=== Rectors === |

|||

| title = Mortgage Delinquencies and Foreclosures |

|||

[[Image:michaelhouse east.jpg|thumb|400px|East House]] |

|||

| author = Bernanke, Ben S |

|||

*Canon James Cameron Todd (1896 - 1903) |

|||

| date = 2008-05-05 |

|||

*Canon Edward Bertram Hugh Jones (1903 - 1910) |

|||

| location = Columbia Business School's 32nd Annual Dinner, New York, New York |

|||

*Antony William Scudamore Brown (1910 - 1916) |

|||

| url = http://www.federalreserve.gov/newsevents/speech/Bernanke20080505a.htm |

|||

*Eldred Pascoe (1917 - 1926) |

|||

| accessdate=2008-05-19 |

|||

*[[Warin Foster Bushell]] (1927 - 1930) |

|||

}}</ref> |

|||

*Ronald Fairbridge Currey (1930 - 1938) |

|||

*Frederick Rowlandson Snell (1939 - 1952) |

|||

*Clem Morgan (1953 - 1960) |

|||

*Robert Thomas Stanley Norwood (1960 - 1968) |

|||

*Rex Frampton Pennington (1969 - 1977) |

|||

*Neil Jardine (1978 - 1986) |

|||

*John Hay Pluke (1987 - 1996) |

|||

*Reginald Dudley Forde (1997 - 2001) |

|||

*Guy Ronald Pearson (2002 - [[Today|present]]) |

|||

The U.S. mortgage market is estimated at $12 trillion<ref name="nytimes1">{{cite web|url=http://www.nytimes.com/2008/07/11/business/11ripple.html?ex=1373515200&en=8ad220403fcfdf6e&ei=5124&partner=permalink&exprod=permalink|title=NY Times}}</ref> with approximately 9.2% of loans either delinquent or in foreclosure through August 2008.<ref name="mbaa1">{{cite web|url=http://www.mbaa.org/NewsandMedia/PressCenter/64769.htm|title=MBA Survey}}</ref> Subprime ARMs only represent 6.8% of the loans outstanding in the US, yet they represent 43.0% of the foreclosures started during the third quarter of 2007.<ref>{{cite press release | title = Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey | publisher = [[Mortgage Bankers Association]] | date = 2007-06-12 | url=http://www.mbaa.org/NewsandMedia/PressCenter/58758.htm | accessdate=2008-07-13 }}</ref> During 2007, nearly 1.3 million properties were subject to foreclosure filings, up 79% versus 2006.<ref>{{cite news | title=U.S. FORECLOSURE ACTIVITY INCREASES 75 PERCENT IN 2007 | date=2008-01-29 | publisher= RealtyTrac | url=http://www.realtytrac.com/ContentManagement/pressrelease.aspx?ChannelID=9&ItemID=3988&accnt=64847 | accessdate= 2008-06-06}}</ref> |

|||

=== Relationship with Hilton College === |

|||

Besides being the two most expensive schools of their kind in South Africa, [[Hilton College]] and Michaelhouse have much in common in that they are the only two full boarding schools left in South Africa and are both located near one another in the somewhat remote [[KwaZulu-Natal Midlands]]. |

|||

== Understanding the risks of default== |

|||

A friendly rivalry on the sports field has developed since 1896, the high point being the biannual Michaelhouse/Hilton Day. This event, held alternately between the two schools, sees them play one another in various sports, primarily rugby and hockey. The culmination of the day is the main rugby match between the two schools' 1st XVs. |

|||

Traditionally, banks lent money to homeowners for their mortgage and retained the risk of default, called [[credit risk]]. However, due to financial innovations, banks can now sell rights to the mortgage payments and related credit risk to investors, through a process called [[securitization]]. The securities the investors purchase are called [[mortgage backed securities]] (MBS) and [[collateralized debt obligations]] (CDO). This new "originate to distribute" banking model means credit risk has been distributed broadly to investors, with a series of consequential impacts. There are four primary categories of risk involved: [[credit risk]], asset price risk, [[liquidity risk]], and counterparty risk. Each of these risk types is described separately in the [[Subprime crisis background information|background information]]. |

|||

====Understanding the market mechanisms affecting corporations and investors==== |

|||

== Academics == |

|||

There is a greater interdependence now than in the past between the U.S. housing market and global financial markets due to MBS. When homeowners default, the amount of cash flowing into MBS declines and becomes uncertain. Investors and businesses holding MBS have been significantly affected. The effect is magnified by the high debt levels maintained by individuals and corporations, sometimes called [[financial leverage]]. The mechanisms through which a decline in housing prices affects market participants is described separately in the [[Subprime crisis background information|background information]]. |

|||

As at [[Eton College]], the years of study are referred to as blocks E to A. "A block" is the equivalent of grade 12 or year 12 and has boys aged 17 or 18 and "E block" is the equivalent of grade 8 or year 8 and has boys aged 13 or 14. |

|||

==Causes of the crisis== |

|||

Michaelhouse educates boys and has an academic staff of about sixty with a male teaching quotient of approximately 70%; the master/pupil ratio is 1:10 .<ref>{{cite web|url=http://www.isasa.org/component/option,com_hotproperty/task,view/id,77/Itemid,147/<|title=ISASA School Directory}}</ref> |

|||

The reasons for this crisis are varied and complex.<ref name="FT-interactive">{{cite web | title = FT.com / Video & Audio / Interactive graphics - Credit squeeze explained | url=http://www.ft.com/cms/s/2/c2c12708-6d10-11dc-ab19-0000779fd2ac.html | accessdate=2008-05-19 | year = 2008 }}</ref> The crisis can be attributed to a number of factors pervasive in both the housing and credit markets, which developed over an extended period of time. Some of these include: the inability of homeowners to make their [[mortgage]] payments, poor judgment by the borrower and/or the lender, speculation and overbuilding during the boom period, risky mortgage products, high personal and corporate debt levels, financial innovation that distributed and perhaps concealed default risks, central bank policies, and regulation (or lack thereof).<ref>http://www.cnn.com/2008/POLITICS/09/17/stiglitz.crisis/index.html Time-Stiglitz]</ref> Another source of the crisis is arguably the evidence of insider trading in [http://papers.ssrn.com/sol3/papers.cfm?abstract_id=767864 credit derivatives]/ |

|||

===Boom and bust in the housing market=== |

|||

Michaelhouse school-leavers write the [[Independent Examinations Board]] exams and consistently achieve top results. |

|||

{{further|[[United States housing bubble]], [[United States housing market correction]]}} |

|||

[[Image:Existing Home Sales Chart - v 1.0.png|thumb|Existing homes sales, inventory, and months supply, by quarter.]] |

|||

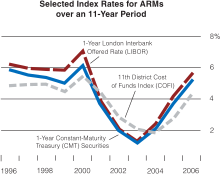

[[Image:ARMs Indexes 1996-2006.svg|thumb|Common indexes used for adjustable rate mortgages (1996–2006).]] |

|||

A combination of low interest rates and large inflows of foreign funds helped to create easy credit conditions for many years leading up to the crisis.<ref>{{cite web|url=http://www.whitehouse.gov/news/releases/2008/09/20080924-10.html|title=President Bush's Address to Nation}}</ref> Subprime borrowing was a major contributor to an increase in home ownership rates and the demand for housing. The overall U.S. home ownership rate increased from 64% in 1994 (about where it was since 1980) to a peak in 2004 with an all-time high of 69.2%.<ref>{{cite news | title=CENSUS BUREAU REPORTS ON RESIDENTIAL VACANCIES AND HOMEOWNERSHIP | date=26 October 2007| publisher= U.S. Census Bureau | url=http://www.census.gov/hhes/www/housing/hvs/qtr307/q307press.pdf }}</ref> |

|||

{| border="1" cellpadding="2" cellspacing="0" style="margin: 1em 1em 1em 0; background: #f9f9f9; border: 1px #aaa solid; border-collapse: collapse; font-size: 95%; text-align: right" |

|||

!style="background-color:#E9E9E9" align=left|IEB Results |

|||

!style="background-color:#E9E9E9" align=right|2004 |

|||

!style="background-color:#E9E9E9" align=right|2005 |

|||

!style="background-color:#E9E9E9" align=right|2006 |

|||

!style="background-color:#E9E9E9" align=right|2007 |

|||

|- |

|||

|align=left|Number of candidates ||106 ||109 ||90 ||108 |

|||

|- |

|||

|align=left|Number of failures ||0 ||0 ||0 ||0 |

|||

|- |

|||

|align=left|University endorsement (%) || ||87.2 ||95.5 ||94.4 |

|||

|- |

|||

|align=left|A aggregates (%) ||20 ||22 ||27 ||21 |

|||

|- |

|||

|align=left|A-B-C aggregates (%) ||94 ||83 ||91 || |

|||

|- |

|||

|align=left|Subject distinctions ||125 ||126 ||137 ||139 |

|||

|- |

|||

|align=left|Number in top 50 ||0 ||0 ||1 ||0 |

|||

|} |

|||

This demand helped fuel housing price increases and consumer spending.<ref>{{cite web|url=http://www.realestatejournal.com/buysell/markettrends/20051223-simon.html|title=www.realestatejournal.com/buysell/markettrends/20051223-simon.html<!--INSERT TITLE-->}}</ref> Between 1997 and 2006, American home prices increased by 124%.<ref>{{cite web | title = CSI: credit crunch | Economist.com | url=http://www.economist.com/specialreports/displaystory.cfm?story_id=9972489 | accessdate=2008-05-19 | year = 2008 }}</ref> Some homeowners used the increased property value experienced in the [[housing bubble]] to refinance their homes with lower interest rates and take out [[second mortgage]]s against the added value to use the funds for consumer spending. U.S. household debt as a percentage of income rose to 130% during 2007, versus 100% earlier in the decade.<ref name="economist-downtown">{{cite web | title = America's economy | Getting worried downtown | Economist.com | url=http://www.economist.com/world/na/displaystory.cfm?story_id=10134077 | accessdate=2008-05-19 | year = 2008 }}</ref> A culture of consumerism is a factor "in an economy based on immediate gratification".<ref>{{cite web | quote=in an economy based on immediate gratification | author=Lasch, Christopher | title=The Culture of Consumerism | publisher=Smithsonian Center for Education and Museum Studies | work=Consumerism | url=http://smithsonianeducation.org/idealabs/ap/essays/consume.htm | pages=1 | accessdate=2008-09-15 }}</ref>Americans spent $800 billion per year more than they earned. Household debt grew from $680 billion in 1974 to $14 trillion in 2008, with the total doubling since 2001. During 2008, the average U.S. household owned 13 credit cards, and 40 percent of them carried a balance, up from 6 percent in 1970.<ref>[http://www.newsweek.com/id/163449 Zakaria - There is a Silver Lining]</ref> |

|||

Most leavers go on to attend top South African universities such as the [[University of Cape Town]], [[Stellenbosch University]], [[University of the Witwatersrand|Wits University]], [[University of KwaZulu-Natal]] and [[Rhodes University]]. |

|||

Overbuilding during the boom period eventually led to a surplus inventory of homes, causing home prices to decline, beginning in the summer of 2006. Easy credit, combined with the assumption that housing prices would continue to appreciate, had encouraged many subprime borrowers to obtain [[adjustable-rate mortgage]]s ([[ARM]]s) they could not afford after the initial incentive period. Once housing prices started depreciating moderately in many parts of the U.S., refinancing became more difficult. Some homeowners were unable to re-finance and began to default on loans as their loans reset to higher interest rates and payment amounts. |

|||

The school has produced over 30 [[Rhodes scholar]]s to study at the [[University of Oxford]] and 10 Elsie Ballot scholars to study at the [[University of Cambridge]].<ref>{{cite web|url=http://www.genealogyworld.net/michaelhouse/rhodes.html<|title=Genealogy World}}</ref> |

|||

An estimated 8.8 million homeowners — nearly 10.8% of total homeowners — had zero or negative equity as of March 2008, meaning their homes are worth less than their mortgage. This provided an incentive to "walk away" from the home, despite the credit rating impact.<ref>{{cite web|url=http://www.nytimes.com/2008/02/22/business/22homes.html|title=Negative Equity}}</ref> |

|||

In recent years, one Michaelhouse graduate was accepted directly to the [[University of Oxford]] and four to the [[University of Pennsylvania]], of which three were accepted to [[Wharton School of the University of Pennsylvania|Wharton Business School]]. |

|||

Increasing foreclosure rates and unwillingness of many homeowners to sell their homes at reduced market prices had significantly increased the supply of housing inventory available. Sales volume (units) of new homes dropped by 26.4% in 2007 versus the prior year. By January 2008, the inventory of unsold new homes stood at 9.8 months based on December 2007 sales volume, the highest level since 1981.<ref name = "MSNBC-newhome">{{cite web | title = New home sales fell by record amount in 2007 - Real estate - MSNBC.com | url=http://www.msnbc.msn.com/id/22880294/ | accessdate=2008-05-19 | year = 2008 }}</ref> Further, a record of nearly four million unsold existing homes were for sale,<ref>{{cite web | title = Housing Meltdown | url=http://www.businessweek.com/magazine/content/08_06/b4070040767516.htm?chan=rss_topStories_ssi_5 | accessdate=2008-05-19 | year = 2008 }}</ref> including nearly 2.9 million that were vacant.<ref>{{cite web|url=http://biz.yahoo.com/cnnm/080513/051208_q12008_home_prices.html|title=Vacant homes 2.9 MM}}</ref> |

|||

The school hosted the [[World Individual Debating and Public Speaking Championships]] in 2002. |

|||

This excess supply of home inventory placed significant downward pressure on prices. As prices declined, more homeowners were at risk of default and foreclosure. According to the [[S&P]]/[[Case-Shiller]] price index, by November 2007, average U.S. housing prices had fallen approximately 8% from their Q2 2006 peak<ref name="economist-downtown" /> and by May 2008 they had fallen 18.4%.<ref>{{cite web|url=http://www2.standardandpoors.com/portal/site/sp/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,0,1,1,0,0,0,0,0.html|title=Case Shiller Data File}}</ref> The price decline in December 2007 versus the year-ago period was 10.4% and for May 2008 it was 15.8%.<ref>{{cite web|url=http://www2.standardandpoors.com/spf/pdf/index/CSHomePrice_Release_072943.pdf|title=Case Shiller Index May 2008|format=PDF}}</ref> Housing prices are expected to continue declining until this inventory of surplus homes (excess supply) is reduced to more typical levels. |

|||

== The estate and facilities == |

|||

[[Image:Michaelhouse Rose Window.jpg|right|thumb|200px|The chapel [[rose window]] depicts the head of Christ surrounded by the birds of [[Kwa-Zulu Natal|Natal Province]].]] |

|||

===Speculation=== |

|||

=== Pietermaritzburg Foundation (1896 to 1902) === |

|||

The school was founded in a building in Loop Street, [[Pietermaritzburg]]. It had capacity for about 30 boys in total, but it was not long before that became inadequate. |

|||

Speculation in real estate was a contributing factor. During 2006, 22% of homes purchased (1.65 million units) were for investment purposes, with an additional 14% (1.07 million units) purchased as vacation homes. During 2005, these figures were 28% and 12%, respectively. In other words, nearly 40% of home purchases (record levels) were not primary residences. NAR's chief economist at the time, David Lereah, stated that the fall in investment buying was expected in 2006. "Speculators left the market in 2006, which caused investment sales to fall much faster than the primary market."<ref>{{cite web|url=http://money.cnn.com/2007/04/30/real_estate/speculators_fleeing_housing_markets/index.htm|title=Speculation statistics}}</ref> |

|||

=== Balgowan Estate (from 1902) === |

|||

Around the turn of the century, Rector James Cameron Todd was donated approximately {{convert|600|acre|km2}} of land in the picturesque Balgowan valley, approximately 45 minutes north of Pietermaritzburg. The buildings were started in 1901 and the school took occupation in 1902. |

|||

While homes had not traditionally been treated as investments like stocks, this behavior changed during the housing boom. For example, one company estimated that as many as 85% of condominium properties purchased in Miami were for investment purposes. Media widely reported the behavior of purchasing condominiums prior to completion, then "flipping" (selling) them for a profit without ever living in the home.<ref>{{cite web|url=http://www.local10.com/news/4277615/detail.html|title=Speculative flipping}}</ref> Some mortgage companies identified risks inherent in this activity as early as 2005, after identifying investors assuming highly leveraged positions in multiple properties.<ref>{{cite web|url=http://realtytimes.com/rtpages/20050321_tighterrules.htm|title=Speculation Risks}}</ref> |

|||

The first buildings to be completed were the existing administration block, vestry and gallery of the now extended chapel, and Founders House. |

|||

Keynesian economist [[Hyman Minsky]] described three types of speculative borrowing that can contribute to the accumulation of debt that eventually leads to a collapse of asset values:<ref>{{cite web|url=http://www.dailyreckoning.co.uk/economic-forecasts/hyman-minsky-why-is-the-economist-suddenly-popular.html|title=www.dailyreckoning.co.uk/economic-forecasts/hyman-minsky-why-is-the-economist-suddenly-popular.html<!--INSERT TITLE-->}}</ref><ref>{{cite web|url=http://mises.org/story/2787|title=mises.org/story/2787<!--INSERT TITLE-->}}</ref> the "hedge borrower" who borrows with the intent of making debt payments from cash flows from other investments; the "speculative borrower" who borrows based on the belief that they can service interest on the loan but who must continually roll over the principal into new investments; and the "Ponzi borrower" (named for [[Charles Ponzi]]), who relies on the appreciation of the value of their assets (e.g. real estate) to refinance or pay-off their debt but cannot repay the original loan. |

|||

=== The Buildings === |

|||

The school buildings are made of historical [[Pietermaritzburg]] red brick. |

|||

The role of speculative borrowing has been cited as a contributing factor to the subprime mortgage crisis.<ref>{{cite news | title = H. P. Minsky, 77, Economist Who Decoded Lending Trends | url=http://query.nytimes.com/gst/fullpage.html?res=990CEEDB1F30F935A15753C1A960958260 | author = LOUIS UCHITELLE | accessdate=2008-09-26 | publisher = [[New York Times]] | date = October 26, 1996 | accessdate = 2008-07-13}}</ref> |

|||

==== The Boarding Houses ==== |

|||

There are eight boarding houses at Michaelhouse. These are, in order of age: |

|||

*Founders (founded in 1902, formerly called "Foundation House") |

|||

*East (founded in 1902) |

|||

*West (founded in 1902) |

|||

*Farfield |

|||

*Tatham (founded 1923) |

|||

*Pascoe (founded 1940) |

|||

*Baines (founded 1956) |

|||

*Mackenzie (founded 1995) |

|||

===High-risk loans=== |

|||

Each boarding house has the facilities to house about 60 boys in dormitories of 4 to 6 for the younger boys and in double and single rooms for the senior boys. |

|||

A variety of factors have caused lenders to offer an increasing array of higher-risk loans to higher-risk borrowers. The share of subprime mortgages to total originations was 5% ($35 billion) in 1994,<ref name = "bankrate-20040515a2">{{cite web | title = Warning signs of a bad home loan (Page 2 of 2) | url=http://www.bankrate.com/brm/news/mortgages/20040615a2.asp | accessdate=2008-05-19 | year = 2008 }}</ref> 9% in 1996,<ref name = "NPR-Brace">{{cite web | title = NPR: Economists Brace for Worsening Subprime Crisis | url=http://www.npr.org/templates/story/story.php?storyId=12561184 | accessdate=2008-05-19 | year = 2008 }}</ref> 13% ($160 billion) in 1999,<ref name = "bankrate-20040515a2"/> and 20% ($600 billion) in 2006.<ref name = "NPR-Brace"/><ref>{{cite web|url=http://www.federalreserve.gov/newsevents/speech/bernanke20080314a.htm|title=FRB: Speech-Bernanke, Fostering Sustainable Homeownership-14 March 2008<!-- Bot generated title -->}}</ref><ref>{{cite web|url=http://query.nytimes.com/gst/fullpage.html?res=9C0DE7DB153EF933A0575AC0A96F958260&sec=&spon=&pagewanted=all|title= Fannie Mae Eases Credit To Aid Mortgage Lending|publisher=New York Times|date=1999-09-30}}</ref> A study by the Federal Reserve indicated that the average difference in mortgage interest rates between subprime and prime mortgages (the "subprime markup" or "risk premium") declined from 2.8 percentage points (280 basis points) in 2001, to 1.3 percentage points in 2007. In other words, the risk premium required by lenders to offer a subprime loan declined. This occurred even though subprime borrower credit ratings and loan characteristics declined overall during the 2001–2006 period, which should have had the opposite effect. The combination is common to classic boom and bust credit cycles.<ref name = "ssrn.com-1020396"> |

|||

{{cite web |

|||

| url = http://ssrn.com/abstract=1020396 |

|||

| title = Understanding the Subprime Mortgage Crisis |

|||

| last = Demyanyk |

|||

| first = Yuliya |

|||

| coauthors = Van Hemert, Otto |

|||

| date = 2008-08-19 |

|||

| publisher = [[SSRN|Social Science Electronic Publishing]] |

|||

| work = Working Paper Series |

|||

| accessdate = 2008-09-18 |

|||

}}</ref> |

|||

In addition to considering higher-risk borrowers, lenders have offered increasingly high-risk loan options and incentives. These high risk loans included the "No Income, No Job and no Assets" loans, sometimes referred to as [[Ninja loans]]. |

|||

The boys share two dining halls (one for senior boys and one for juniors) for their meals and are supplied by a fully equipped kitchen, with an on-site bakery and butchery. |

|||

Another example is the interest-only adjustable-rate mortgage (ARM), which allows the homeowner to pay just the interest (not principal) during an initial period. Still another is a "payment option" loan, in which the homeowner can pay a variable amount, but any interest not paid is added to the principal. Further, an estimated one-third of ARM originated between 2004 and 2006 had "teaser" rates below 4%, which then increased significantly after some initial period, as much as doubling the monthly payment.<ref>{{cite web | title = NPR: Economists Brace for Worsening Subprime Crisis | url=http://www.npr.org/templates/story/story.php?storyId=12561184 NPR Article | accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

==== The Chapel ==== |

|||

The chapel is an important a focal point in the school's architecture and ethos. The original chapel was built running from North to South with the apse at the North end. |

|||

The Center for Responsible Lending, in its report on IndyMac, related testimony that the bank actually made efforts to '''avoid''' having income information about some borrowers.<ref>{{cite web|url=http://www.responsiblelending.org/pdfs/indymac_what_went_wrong.pdf|title=IndyMac: What Went Wrong|format=PDF}}</ref> The Associated Press has reported that a federal grand jury is investigating subprime lenders Countrywide Financial Corp., New Century Financial Corp. and IndyMac Bancorp Inc. and reports also that the FBI is investigating IndyMac for possible fraud.<ref>{{cite web|url=http://www.cbsnews.com/stories/2008/07/25/national/main4292140.shtml|title=Grand Jury Investigating SubPrime Lenders}}</ref> The question, then, is whether banks and other private mortgage originators of subprime and other "nonprime" loans might deliberately have profited or attempted to profit - in moneys, economic benefit or even fraudulent gain - through reducing the amount of information they collected from borrowers. |

|||

In the 1940s, however, it became apparent that the chapel was no longer big enough to fit the entire school in for a service. Thus a large architectural work was undertaken to extend the chapel from its existing site towards the East. Because of [[World War II]], the chapel was only finished in the 1950s. A memorial to those who died in World War II is outside the entrance to the chapel. |

|||

Judge Leslie Tchaikovsky of the U.S. Bankruptcy Court for the Northern District of California, found on 25 May 2008 that even though a pair of borrowers had, indeed, misrepresented their incomes on a "stated income" home equity loan, National City Bank's "reliance" on these statements of income "was not reasonable based on an objective standard".<ref>{{cite web|url=http://calculatedrisk.blogspot.com/2008/05/bk-judge-rules-stated-income-heloc-debt.html|title=Judge Rules Stated Income HELOC Debt Dischargeable}}</ref> |

|||

The original chapel now forms the gallery and vestry. The apse of the old chapel is used as a baptism font. The extended chapel has seated nearly 600 people at its fullest, but is built for a more moderate 530. Beneath the new chapel is a crypt which is used for smaller prayer meetings and services. The crypt can seat 30 people. |

|||

The banking industry provided home loans to [[Illegal immigration to the United States|undocumented immigrants]], viewing it as an untapped resource for growing their own revenue stream.<ref>[http://money.cnn.com/2005/08/08/news/economy/illegal_immigrants/ Banks help illegal immigrants own their own home], CNN/Money, August 8, 2005</ref><ref>[http://www.toprealtynews.com/realestatenews/residental_property/id_30896/ Mortgages for Illegal Immigrants Becoming More Common], November 21, 2006</ref> Pro-immigrant expert Tim Ready at the [[University of Notre Dame]] argued that "It's really important to the economy as a whole and to the real estate market in particular that Latinos be able to purchase a home."<ref>[http://www.businessweek.com/the_thread/hotproperty/archives/2007/07/mortgages_for_i.html Mortgages for illegal immigrants], BusinessWeek, July 30, 2007</ref> Banks, including some major institutions, offered home-mortgage loans to people who don't have [[Social Security number]]s.<ref>[http://www.sfgate.com/cgi-bin/article.cgi?file=/c/a/2006/06/15/MNGRMJEGM81.DTL Selling illegal immigrants the American dream], San Francisco Chronicle, June 15, 2006</ref> |

|||

The [[Stained Glass|stained glass windows]] featured in the [[Sir Herbert Baker]] designed chapel include the Michaelhouse [[rose window]], depicting the head of Christ surrounded by the birds of [[Kwa-Zulu Natal|Natal Province]] at the rear of the chapel, and windows depicting [[Christ]], [[St Michael]] and other angels in the sanctuary. The windows were created by [[Ervin Bossanyi]]. The pews are made of solid teak. |

|||

===Securitization practices === |

|||

The chapel has a bell-tower, installed in the 1950s with a [[carillon]] of 8 bells. It has been a tradition (with unknown origins) that only boys from Tatham House may ring the bells. The bells are rung before each chapel service (there are five services a week, although not all are compulsory). |

|||

[[Image:Borrowing Under a Securitization Structure.gif|thumb|Borrowing under a securitization structure.]] |

|||

[[Securitization]] is a [[structured finance]] process in which assets, receivables or financial instruments are acquired, classified into pools, and offered as [[collateral]] for third-party investment.<ref name="black">Black's Law Dictionary (7th ed)</ref> There are many parties involved. Due to securitization, investor appetite for mortgage-backed securities (MBS), and the tendency of rating agencies to assign investment-grade ratings to MBS, loans with a high risk of default could be originated, packaged and the risk readily transferred to others. Asset securitization began with the structured financing of mortgage pools in the 1970s.<ref>{{cite web |title= Asset Securitization Comptroller’s Handbook |url=http://www.dallasfed.org/news/ca/2005/05wallstreet_assets.pdf |date= November 1997 |publisher= US Comptroller of the Currency |

|||

Administrator of National Banks}}</ref> |

|||

The traditional mortgage model involved a bank originating a loan to the borrower/homeowner and retaining credit (default) risk. With the advent of securitization, the traditional model has given way to the "originate to distribute" model, in which the credit risk is transferred (distributed) to investors. The securitized share of subprime mortgages (i.e., those passed to third-party investors) increased from 54% in 2001, to 75% in 2006.<ref name = "ssrn.com-1020396"/> [[Alan Greenspan]] stated that the securitization of home loans for people with poor credit — not the loans themselves — was to blame for the current global credit crisis.<ref>{{cite web | title = Greenspan sees signs of credit crisis easing - Stocks & economy - MSNBC.com | url=http://www.msnbc.msn.com/id/21097872/ | accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

==== The Schlesinger Theatre ==== |

|||

A 550-seat theatre was built and completed in 1976. The theatre hosts a wide variety of performances, mainly aimed at the resident population of pupils. However, the theatre is open to the local community. There are a wide variety of high-calibre shows and many performers give a one night performance on their way between runs in [[Johannesburg]] and [[Durban]]. |

|||

Some believe that mortgage standards became lax because of a [[moral hazard]], where each link in the mortgage chain collected profits while believing it was passing on risk.<ref>{{cite news | title='Moral hazard' helps shape mortgage mess |

|||

The Schlesinger theatre is one of a number of facilities at the school that was funded by an old boy. |

|||

| first=Holden | last=Lewis | publisher= Bankrate.com | |url=http://www.bankrate.com/brm/news/mortgages/20070418_subprime_mortgage_morality_a1.asp?caret=3c | date=18 April 2007}} |

|||

</ref><ref>Originate-to-distribute model and the subprime mortgage crisis | |

|||

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1167786</ref> |

|||

=== Inaccurate credit ratings === |

|||

{{further|[[Role of credit rating agencies in the subprime crisis]]}} |

|||

The construction of the Inglis Indoor Centre was completed in August 2006. It is named after James Inglis, a past chairman of the Board of Governors. The centre can house many spectators and in summer it is used for basketball, and has three courts that can be used simultaneously, whilst during winter it is used for indoor hockey. |

|||

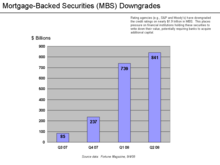

[[Image:MBS Downgrades Chart.png|thumb|MBS credit rating downgrades, by quarter.]] |

|||

[[Credit rating agencies]] are now under scrutiny for giving investment-grade ratings to [[securitization]] transactions (CDOs and MBSs) based on subprime mortgage loans. Higher ratings were believed justified by various credit enhancements including over-collateralization (pledging collateral in excess of debt issued), credit default insurance, and equity investors willing to bear the first losses.{{Fact|date=October 2008}} These high ratings encouraged the flow of investor funds into these securities, helping finance the housing boom. The reliance on ratings by these agencies and the intertwined nature of how ratings justified investment led many investors to treat securitized products — some based on subprime mortgages — as equivalent to higher quality securities and furthered by SEC removal of regulatory barriers and reduced disclosure requirements in the wake of the [[Enron scandal]].<ref>{{cite web|link=http://www.law.berkeley.edu/files/RAShortWhitePaperJH090908KTrev-1.pdf|title=Credit Rating Agencies and the ‘Worldwide Credit Crisis’: The Limits of Reputation, the Insufficiency of Reform, and a Proposal for Improvement (Summary; PDF) by John P. Hunt, September 5, 2008}}</ref> Critics claim that conflicts of interest were involved, as rating agencies are paid by the firms that organize and sell the debt to investors, such as investment banks.<ref>{{cite web|url=http://www.economist.com/finance/displaystory.cfm?story_id=9769471|title=Buttonwood | Credit and blame | Economist.com<!-- Bot generated title -->}}</ref> On 11 June 2008 the [[U.S. Securities and Exchange Commission]] proposed far-reaching rules designed to address perceived conflicts of interest between rating agencies and issuers of structured securities.<ref>{{cite web | title = SEC Proposes Comprehensive Reforms to Bring Increased Transparency to Credit Rating Process | U.S. Securities and Exchange Commission | url=http://www.sec.gov/news/press/2008/2008-110.htm | accessdate=2008-07-2008 | year = 2008}}</ref> |

|||

Rating agencies lowered the credit ratings on $1.9 trillion in mortgage backed securities from Q3 2007 to Q2 2008. This places additional pressure on financial institutions to lower the value of their MBS. In turn, this may require these institutions to acquire additional capital, to maintain capital ratios. If this involves the sale of new shares of stock, the value of existing shares is reduced. In other words, ratings downgrades pressured MBS and stock prices lower.<ref>{{cite web|url=http://money.cnn.com/2008/08/04/magazines/fortune/whitney_feature.fortune/index.htm|title=Fortune Article}}</ref> |

|||

The centre also features a cafeteria/restaurant which is available to the pupils as well as the public, and accommodation for visiting teams to stay overnight. |

|||

=== |

===Mortgage fraud=== |

||

[[Image:Mortgage loan fraud.png|thumb|[[Mortgage fraud]] by borrowers from US Department of the Treasury.<ref name="Fincen-MortgageLoanFraud">{{cite web|url=http://www.fincen.gov/MortgageLoanFraud.pdf|title=Reported Suspicious Activities<!-- Bot generated title -->|format=PDF}}</ref>]] |

|||

The library is stocked with over 16,000 books and has an adjoining 50 seat lecture theatre. There are four Science laboratories and three Biology laboratories and three computer centres. The school also has a dedicated sanatorium and laundry services. The staff reside on the estate. |

|||

Misrepresentation of loan application data and mortgage fraud are other contributing factors.<ref>{{cite web|url=http://www.nytimes.com/2008/01/13/business/13view.html?_r=2&scp=1&sq=Tyler+Cowen&oref=login&oref=slogin|title=So We Thought. But Then Again . . . - New York Times<!-- Bot generated title -->}}</ref> US Department of the Treasury [[suspicious activity report]] of [[mortgage fraud]] increased by 1,411% between 1997 and 2005.<ref name="Fincen-MortgageLoanFraud"/> |

|||

=== Sporting Facilities === |

|||

There are 12 playing fields, including 6 turf [[cricket]] pitches, an artificial field [[hockey]] surface, a heated [[swimming]] pool, 8 [[tennis]] courts, 5 [[foozeball]] tables, 3 fully equipped [[tabletennis]] arenas, a fully equipped weight training facility, a 6 [[court]] [[Squash (sport)|squash]] complex, a golf driving range, an indoor sports centre (mentioned above) and a [[dam]] for [[canoeing]]. |

|||

===Flawed oversight by mortgage brokers=== |

|||

== Notable Old Boys (year of matriculation) == |

|||

According to a study by Wholesale Access Mortgage Research & Consulting Inc., in 2004 Mortgage brokers originated 68% of all residential loans in the U.S., with subprime and [[Alt-A]] loans accounting for 42.7% of brokerages' total production volume.<ref>{{cite web |title=New Research About Mortgage Brokers Published |url=http://www.wholesaleaccess.com/7_28_mbkr.shtml |accessdate=2008-05-19 |year=2008 }}</ref> |

|||

*Sir George Albu, 3rd Bt. (1962) |

|||

*[[Dale Benkenstein]] (1992), [[Dolphins cricket team|Dolphins]] [[cricket]]er |

|||

*[[Sir Rupert Bromley|Sir Rupert Bromley, 10th Bt.]] ([[Oxon]]) (1952), [[Rhodes scholar]] and businessman |

|||

*Professor [[David H.M.Brooks]], philosopher and author of "''The Unity of the Mind''" |

|||

*[[Peter Brown (South African politician)|Peter Brown]] ([[Cantab]]) (1941), activist and founding member of the [[South African Liberal Party|Liberal Party]] |

|||

*Michael Cassidy ([[Cantab]]), evangelist |

|||

*[[Sir John Craven]], director of [[Reuters]] and [[Deutsche Bank]] |

|||

*Robbie Diack,(2003) [[Western Province (rugby team)|Western Province]] [[rugby union]] footballer<ref>[http://www.iol.co.za/index.php?set_id=6&click_id=18&art_id=vn20060914133717511C269379 Cape Argus - 14 September 2006]</ref> |

|||

*[[George Ellis]] ([[Cantab]]) (1955), scientist and author (co-written book with [[Stephen Hawking]]) |

|||

*[[James Goodman]], television horseracing presenter and former polo player |

|||

*[[Chick Henderson]] (1947), [[rugby union]] footballer and commentator |

|||

*[[Giles Henderson]], [[Order of the British Empire|CBE]], Master of [[Pembroke College, Oxford]] |

|||

*Craig Higginson (1989), author of ''The Hill'' |

|||

*[[Robert Holmes à Court]], entrepreneur and Australia's first [[billionaire]] |

|||

*[[William H.C. Lloyd, Archdeacon of Durban|Anson Lloyd]], Director of Huletts and Chairman of the Board of Governors |

|||

*[[Ian Lloyd (UK politician)|Sir Ian Lloyd]] ([[Cantab]]), [[United Kingdom|British]] politician and [[Conservative Party (UK)|Tory]] [[British House of Commons|MP]] |

|||

*[[Tufty Mann]], former [[South African cricket team|South African]] [[cricket]]er |

|||

*[[Don MacLeod]] ([[Oxon]]), managing director of Illovo Sugar |

|||

*Hal Miller, newspaper baron and former chairman of the [[Cape Argus|Argus Group]]<ref>[http://www.iol.co.za/index.php?set_id=1&click_id=13&art_id=vn20060519021355879C360461 Cape Times - 19 May 2006]</ref> |

|||

*Brian O’Shaughnessy, radio and television personality |

|||

*[[Gary Ralfe]] ([[Cantab]]), Managing Director of [[De Beers]] |

|||

*[[Richard Scott, Baron Scott of Foscote]] ([[Cantab]]) (1951), [[United Kingdom|British]] barrister and judge |

|||

*[[Barry Streek]], political journalist and anti-apartheid activist |

|||

*William Thomson ([[Oxon]]), author |

|||

*Rex Tremlett, gold prospector |

|||

*[[Timothy Woods]], schoolmaster |

|||

*[[Wilbur Smith]] (1950), bestselling novelist |

|||

*[[Paul Hepker]] (1984), film composer ([[Tsotsi]]) |

|||

*[[John van de Ruit]] (1993), playwright and author of ''[[Spud (novel)|Spud]]'' |

|||

*Nolly Zaloumis, environmentalist |

|||

*Patrick Cilliers, Sharks rugby player |

|||

*Julian Pearce, Duzi Canoe Marathon Top 30, 2006 |

|||

*Stephen Bird, South African Canoeist, 2006 |

|||

The chairman of the Mortgage Bankers Association claimed brokers profited from a home loan boom but did not do enough to examine whether borrowers could repay.<ref>{{cite web | title = Brokers, bankers play subprime blame game - Real estate - MSNBC.com | url=http://www.msnbc.msn.com/id/18804054/ | accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

== Michaelhouse today == |

|||

The relatively high fees of [[South African Rand|R]]117,660 p.a. in 2008, makes Michaelhouse the second most expensive boarding school in [[South Africa]], after [[Hilton College]]. |

|||

===Excessive underwriting of high-risk mortgages=== |

|||

Michaelhouse is a member of the [[Independent Schools Association of Southern Africa]] and the [[Headmasters' and Headmistresses' Conference]]. |

|||

Underwriters (working for the actual banks who lend the money, not mortgage brokers) determine if the risk of lending to a particular borrower under certain parameters is acceptable. Most of the risks and terms that underwriters consider fall under the three C’s of underwriting: credit, capacity and collateral. See [[mortgage underwriting]]. |

|||

In 2007, 40% of all subprime loans were generated by automated underwriting.<ref>{{cite news |author=Lynnley Browning |title=The Subprime Loan Machine |url=http://www.nytimes.com/2007/03/23/business/23speed.html?_r=1&partner=rssnyt&emc=rss&oref=slogin |work=nytimes.com |publisher= Arthur Ochs Sulzberger, Jr.|location=New York City |date=2007-03-27 |accessdate=2008-07-13 }}</ref> |

|||

The [[Deputy President of South Africa]], [[Phumzile Mlambo-Ngcuka]] was the guest speaker at the speech and prizegiving day in 2006. |

|||

An Executive vice president of Countrywide Home Loans Inc. stated in 2004 "Prior to automating the process, getting an answer from an underwriter took up to a week. We are able to produce a decision inside of 30 seconds today. ... And previously, every mortgage required a standard set of full documentation."<ref>{{cite web | title = Bank Systems & Technology | url=http://www.banktech.com/story/featured/showArticle.jhtml?articleID=21401117 | accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

Some think that users whose lax controls and willingness to rely on shortcuts led them to approve borrowers that under a less-automated system would never have made the cut are at fault for the subprime meltdown.<ref>{{cite web | title = REALTOR Magazine-Daily News-Are Computers to Blame for Bad Lending? | url=http://www.realtor.org/rmodaily.nsf/f3c66d0c6457c1e1862570af000cb13b/b187c47b7d488dd8862572a7004ec179?OpenDocument | accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

===Government policies=== |

|||

== Development == |

|||

Several critics have commented that the current regulatory framework is outdated. President [[George W. Bush]] stated in September 2008: "Once this crisis is resolved, there will be time to update our financial regulatory structures. Our 21st century global economy remains regulated largely by outdated 20th century laws. Recently, we've seen how one company can grow so large that its failure jeopardizes the entire financial system."<ref>{{cite web|url=http://www.whitehouse.gov/news/releases/2008/09/20080924-10.html|title=President's Address to the Nation September 2008}}</ref> The [[Securities and Exchange Commission]] (SEC) has conceded that self-regulation of investment banks contributed to the crisis.<ref>{{cite web|url=http://www.nytimes.com/2008/09/27/business/27sec.html?em|title=SEC Concedes Oversight Flaws}}</ref><ref>{{cite web|url=http://www.nytimes.com/2008/10/03/business/03sec.html?em|title=The Reckoning}}</ref> |

|||

The school has an endowment of approximately [[South African Rand|R]]21.7 million. |

|||

Economist [[Robert Kuttner]] has criticized the repeal of the [[Glass-Steagall Act]] by the [[Gramm-Leach-Bliley Act]] of 1999 as possibly contributing to the subprime meltdown, although other economists disagree.<ref>{{cite web | title = The Bubble Economy | The American Prospect | url=http://www.prospect.org/cs/articles?article=the_bubble_economy | accessdate=2008-05-19 | year = 2008 }}</ref><ref>{{cite web | title = Did the Gramm-Leach-Bliley Act cause the housing bubble? | url=http://www.marginalrevolution.com/marginalrevolution/2008/09/did-the-gramm-l.html | accessdate=2008-09-28 }}</ref> A taxpayer-funded government bailout related to mortgages during the [[savings and loan crisis]] may have created a [[moral hazard]] and acted as encouragement to lenders to make similar higher risk loans.<ref>{{cite news|url=http://www.npr.org/templates/story/story.php?storyId=16734629| title=Subprime Bailout: Good Idea or 'Moral Hazard|first=Eric |last=Weiner|date=29 November 2007|publisher=NPR.org}}</ref> Additionally, there is debate among economists regarding the effect of the [[Community Reinvestment Act]], with detractors claiming it encourages lending to uncreditworthy consumers<ref>{{cite web |

|||

== Feeder schools == |

|||

|first=Robert |last=England |

|||

*[[Clifton Preparatory School, Nottingham Road]], [[KwaZulu-Natal]] |

|||

|title=Assault on the Mortgage Lenders |

|||

*[[Highbury Preparatory School]], [[KwaZulu-Natal]] |

|||

|url=http://findarticles.com/p/articles/mi_m1282/is_/ai_14779796 |

|||

*[[Cordwalles Preparatory School]], [[KwaZulu-Natal]] |

|||

|publisher=''[[National Review]]'' |

|||

*[[Clifton School]], [[KwaZulu-Natal]] |

|||

|date=December 27, 1993 }}</ref><ref>{{cite web |

|||

*[[The Ridge School]], [[Gauteng]] |

|||

|first=Howard |last=Husock |

|||

*[[Pridwin Preparatory School]], [[Gauteng]] |

|||

|title=The Trillion-Dollar Bank Shakedown That Bodes Ill for Cities |

|||

|url=http://www.city-journal.org/html/10_1_the_trillion_dollar.html |

|||

|publisher=''[[City Journal]]'' |

|||

|date=January 01, 2000 }}</ref><ref name=DiLorenzo>[[Thomas J. DiLorenzo]], [http://www.lewrockwell.com/dilorenzo/dilorenzo125.html The Government-Created Subprime Mortgage Meltdown], [[LewRockwell.com]], September 6, 2007 ''accessdate=2007-12-07''</ref><ref>{{cite web |

|||

| title=The Real Scandal - How feds invited the mortgage mess |

|||

| url=http://www.nypost.com/seven/02052008/postopinion/opedcolumnists/the_real_scandal_243911.htm?page=0 |

|||

| first=Stan |last=Liebowitz |

|||

| publisher=''[[New York Post]]''}}</ref> and defenders claiming a thirty year history of lending without increased risk.<ref>{{cite web |title=Did Liberals Cause the Sub-Prime Crisis? |

|||

|url=http://www.prospect.org/cs/articles?article=did_liberals_cause_the_subprime_crisis |

|||

|first=Robert |last=Gordon |

|||

|publisher=''[[The American Prospect]]''}}</ref><ref>{{cite web |title=No, Larry, CRA Didn’t Cause the Sub-Prime Mess |

|||

|url=http://www.newamerica.net/blog/asset-building/2008/no-larry-cra-didn-t-cause-sub-prime-mess-3210 |

|||

|first=Ellen |last=Seidman |

|||

|publisher=''[[New American Foundation]]''}}</ref><ref>{{cite web |title=Prepared Testimony of Michael S. Barr |

|||

|url=http://www.house.gov/apps/list/hearing/financialsvcs_dem/barr021308.pdf |

|||

|first=Michael |last=Barr |

|||

|publisher=''[[U.S. House of Representatives]]''}}</ref><ref name="Ellis">{{cite journal|last=Ellis |first=Luci |title=The housing meltdown: Why did it happen in the United States? |journal=BIS Working Papers|issue=259|pages=5|url=http://www.bis.org/publ/work259.pdf?noframes=1}}</ref> Detractors also claim that amendments to the CRA in the mid-1990s, raised the amount of home loans to otherwise unqualified low-income borrowers and also allowed for the first time the securitization of CRA-regulated loans containing subprime mortgages.<ref>{{cite web |title=Congress Tries To Fix What It Broke |

|||

|url=http://www.investors.com/editorial/editorialcontent.asp?secid=1501&status=article&id=306544845091102 |

|||

|date=9/17/2008 |

|||

|publisher=''[[Investor's Business Daily]]''}}</ref><ref>{{cite web |title=Ride out Wall Street's hurricane - The real reasons we're in this mess – and how to clean it up |

|||

|url=http://www.csmonitor.com/2008/0917/p09s01-coop.html |

|||

|first=Mark |last=Skousen |

|||

|date=9/17/2008|publisher=''[[Christian Science Monitor]]'' |

|||

}}</ref> A study by a legal firm which counsels financial services entities on Community Reinvestment Act compliance found that CRA-covered institutions were less likely to make subprime loans, and when they did the interest rates were lower. The banks were half as likely to resell the loans to other parties.<ref>{{cite web |

|||

|url=http://www.traigerlaw.com/publications/traiger_hinckley_llp_cra_foreclosure_study_1-7-08.pdf |

|||

|title=The Community Reinvestment Act: A Welcome Anomaly in the Foreclosure Crisis |

|||

|Publisher=Traiger & Hinkley LLP |

|||

|date=1/7/2008 |

|||

}}</ref> |

|||

Some have argued that, despite attempts by various U.S. states to prevent the growth of a secondary market in repackaged [[predatory loan]]s, the [[Treasury Department]]'s [[Office of the Comptroller of the Currency]], at the insistence of national banks, struck down such attempts as violations of Federal banking laws.<ref>{{cite web |

|||

| url=http://www.slate.com/id/2182709/pagenum/all |

|||

| title=Crashing the Subprime Party: How the feds stopped the states from averting the lending mess. |

|||

| first=Nicholas |

|||

| last=Bagley |

|||

| publisher=Slate |

|||

| date=2008-01-24}}</ref> |

|||

The [[U.S. Department of Housing and Urban Development]]'s mortgage policies fueled the trend towards issuing risky loans.<ref>{{cite news|url=http://www.washingtonpost.com/wp-dyn/content/article/2008/06/09/AR2008060902626.html| title=How HUD Mortgage Policy Fed The Crisis|first=Carol D. |last=Leonnig|date= June 10, 2008|publisher=[[Washington Post]]}}</ref><ref>{{cite web|url=http://biz.yahoo.com/ibd/080915/issues01.html?.v=1|title=The Real Culprits In This Meltdown}}</ref> In 1995, Fannie Mae and Freddie Mac began receiving affordable housing credit for purchasing mortgage backed securities which included loans to low income borrowers. This resulted in the agencies purchasing subprime securities.<ref>{{cite web|url=http://www.washingtonpost.com/wp-dyn/content/graphic/2008/06/10/GR2008061000059.html|title=www.washingtonpost.com/wp-dyn/content/graphic/2008/06/10/GR2008061000059.html<!--INSERT TITLE-->}}</ref> Subprime mortgage loan originations surged by 25% per year between 1994 and 2003, resulting in a nearly ten-fold increase in the volume of these loans in just nine years.<ref>{{cite news| url=http://www.fdic.gov/bank/analytical/fyi/2005/021005fyi.html| title= |

|||

U.S. Home Prices: Does Bust Always Follow Boom?||date= February 10, 2005 (revised April 8, 2005)|publisher=[[Federal Deposit Insurance Corporation]]}}</ref> As of November 2007 Fannie Mae held a total of $55.9 billion of subprime securities and $324.7 billion of Alt-A securities in their portfolios.<ref>{{cite web|url=http://www.fanniemae.com/ir/pdf/earnings/2007/credit_supplement.pdf|title=www.fanniemae.com/ir/pdf/earnings/2007/credit_supplement.pdf<!--INSERT TITLE-->|format=PDF}}</ref> As of the 2008Q2 Freddie Mac had $190 billion in Alt-A mortgages. Together they have more than half of the $1 trillion of Alt-A mortgages.<ref>{{cite web|url=http://www.bloomberg.com/apps/news?pid=20601109&refer=news&sid=arb3xM3SHBVk|title=www.bloomberg.com/apps/news?pid=20601109&refer=news&sid=arb3xM3SHBVk<!--INSERT TITLE-->}}</ref> The growth in the subprime mortgage market, which included B, C and D paper bought by private investors such as hedge funds, fed a housing bubble that later burst. |

|||

A September 30, 1999 [[New York Times]] article stated, "... the Fannie Mae Corporation is easing the credit requirements on loans... The action... will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough... Fannie Mae... has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people... borrowers whose incomes, credit ratings and savings are not good enough... Fannie Mae is taking on significantly more risk... the government-subsidized corporation may run into trouble... prompting a government rescue... the move is intended in part to increase the number of... home owners who tend to have worse credit ratings..." <ref>[http://query.nytimes.com/gst/fullpage.html?res=9C0DE7DB153EF933A0575AC0A96F958260&sec=&spon=&pagewanted=all Fannie Mae Eases Credit To Aid Mortgage Lending], The New York Times, September 30, 1999</ref> |

|||

On September 10, 2003, U.S. Congressman [[Ron Paul]] gave a speech to Congress where he said that the then current government policies encouraged lending to people who couldn't afford to pay the money back, and he predicted that this would lead to a bailout, and he introduced a bill to abolish these policies. <ref>[http://www.lewrockwell.com/paul/paul128.html Ron Paul in the House Financial Services Committee, September 10, 2003]</ref> |

|||

===Conflict of interest=== |

|||

Gerald P. O'Driscoll, former vice president at the [[Federal Reserve Bank of Dallas]], stated that [[Fannie Mae]] and [[Freddie Mac]] had become classic examples of [[crony capitalism]]. Government backing let Fannie and Freddie dominate the mortgage-underwriting. "The politicians created the mortgage giants, which then returned some of the profits to the pols - sometimes directly, as campaign funds; sometimes as "contributions" to favored constituents."<ref>Gerald P. O'Driscoll, Jr., [http://www.nypost.com/seven/09092008/postopinion/opedcolumnists/fannie_freddie_bailout_baloney_128135.htm Fannie/Freddie Bailout Baloney], [[New York Post]], September 9, 2008.</ref> |

|||

On April 18, 2006, home loan giant Freddie Mac was fined $3.8 million, by far the largest amount ever assessed by the Federal Election Commission, as a result of illegal campaign contributions. Much of the illegal fund raising benefited members of the [[United States House Committee on Financial Services]], a panel whose decisions can affect Freddie Mac,<ref>{{cite web|url=http://www.msnbc.msn.com/id/12373488/from/RSS/|title=Freddie Mac pays record $3.8 million fine (AP) updated 12:01 p.m. HT, Tues., April. 18, 2006<!--INSERT TITLE-->}}</ref> and congressional representatives in general.<ref>{{cite web|url=http://www.fec.gov/press/press2006/20060418mur.html|title=FEDERAL HOME LOAN MORTGAGE CORPORATION ("FREDDIE MAC") PAYS LARGEST FINE IN FEC HISTORY (FEC press release, April 18, 2006)}}</ref> |

|||

Some lawmakers received favorable treatment from financial institutions involved in the subprime industry. (See [[Countrywide financial political loan scandal]]). In June 2008 [[Conde Nast Portfolio]] reported that numerous Washington, DC politicians over recent years had received mortgage financing at noncompetitive rates at [[Countrywide Financial]] because the corporation considered the officeholders under a program called "FOA's"--"Friends of Angelo". Angelo being Countrywide's Chief Executive [[Angelo Mozilo]].<ref>{{cite web|url=http://banking.senate.gov/public/_files/HousingandEconomicRecoveryActSummary.pdf|title=banking.senate.gov/public/_files/HousingandEconomicRecoveryActSummary.pdf<!--INSERT TITLE-->|format=PDF}}</ref> |

|||

On 18 June 2008, a Congressional ethics panel started examining allegations that chairman of the [[Senate Banking Committee]], [[Christopher Dodd]] (D-CT), and the chairman of the [[Senate Budget Committee]], [[Kent Conrad]] (D-ND) received preferential loans by troubled mortgage lender [[Countrywide Financial Corp]].<ref name="reuters1">{{cite web|url=http://www.reuters.com/article/politicsNews/idUSWAT00970120080619|title=Ethics panel examines lawmakers' Countrywide loans | Politics | Reuters<!-- Bot generated title -->}}</ref> Two former CEOs of [[Fannie Mae]] [[Franklin Raines]] and [[James A. Johnson (businessman)|James A. Johnson]] also received preferential loans from the troubled mortgage lender. Fannie Mae was the biggest buyer of Countrywide's mortgages.<ref>{{cite web|url=http://online.wsj.com/article/SB121279970984353933.html?loc=interstitialskip|title=Countrywide Friends Got Good Loans - WSJ.com}}</ref> |

|||

=== Policies of central banks === |

|||

[[Central bank]]s are primarily concerned with managing monetary policy, they are less concerned with avoiding asset bubbles, such as the [[housing bubble]] and [[dot-com bubble]]. Central banks have generally chosen to react after such bubbles burst to minimize collateral impact on the economy, rather than trying to avoid the bubble itself. This is because identifying an asset bubble and determining the proper monetary policy to properly deflate it are a matter of debate among economists.<ref name="WallStreetJournal">{{cite web | title = The Wall Street Journal Online - Featured Article | url=http://opinionjournal.com/editorial/feature.html?id=110010981 | accessdate=2008-05-19 | year = 2008 }}</ref><ref>{{cite web | title = Assets and their liabilities | Economist.com | url=http://www.economist.com/specialreports/displaystory.cfm?story_id=9972549 | accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

[[Federal Reserve]] actions raised concerns among some market observers that it could create a [[moral hazard]]. Some industry officials said that [[Federal Reserve Bank of New York]] involvement in the rescue of [[Long-Term Capital Management]] in 1998 would encourage large financial institutions to assume more risk, in the belief that the Federal Reserve would intervene on their behalf.<ref>{{cite web |

|||

| url= http://www.gao.gov/archive/2000/gg00067r.pdf |

|||

| title= Responses to Questions Concerning Long-Term Capital Management and Related Events |

|||

| accessdate=2008-07-13 |

|||

| author= Thomas J. McCool |

|||

| date= 2000-02-23 |

|||

| format= PDF |

|||

| work= General Government Division |

|||

| publisher= [[Government Accountability Office]] }}</ref> |

|||

A contributing factor to the rise in home prices was the lowering of interest rates earlier in the decade by the Federal Reserve, to diminish the blow of the collapse of the [[dot-com bubble]] and combat the risk of deflation.<ref name="WallStreetJournal" /> From 2000 to 2003, the Federal Reserve lowered the [[federal funds rate]] target from 6.5% to 1.0%.<ref>{{cite web | title = Federal Reserve Board: Monetary Policy and Open Market Operations | url=http://www.federalreserve.gov/fomc/fundsrate.htm | accessdate=2008-05-19}}</ref> The central bank believed that interest rates could be lowered safely primarily because the rate of [[inflation]] was low and disregarded other important factors. The Federal Reserve's inflation figures, however, were flawed{{fix|link=Wikipedia:Contents|text=citation needed}}. Richard W. Fisher, President and CEO of the [[Federal Reserve Bank of Dallas]], stated that the Federal Reserve's interest rate policy during this time period was misguided by this erroneously low inflation data, thus contributing to the housing bubble.<ref>{{cite web | author = Richard W. Fisher | title = Confessions of a Data Dependent: Remarks before the New York Association for Business Economics | date = 2006-11-02 | url = http://dallasfed.org/news/speeches/fisher/2006/fs061102.cfm | accessdate=2008-07-13}}</ref> |

|||

== Impacts and downturns in financial markets, 2007–2008== |

|||

{{Main|Financial crisis of 2007–2008|Global financial crisis of September–October 2008}} |

|||

=== Financial sector downturn === |

|||

{{see also|Subprime crisis background information|Subprime crisis impact timeline|List of writedowns due to subprime crisis|List of bankrupt or acquired banks during the subprime mortgage crisis}} |

|||

[[Image:FDIC Bank Profits - Q1 Profile.png|thumb|FDIC Graph - U.S. Bank & Thrift Profitability By Quarter]] |

|||

Many financial institutions had made enormous investments based on the expected continuation of housing price appreciation. As housing prices declined, the value of the [[mortgage-backed securities]] (MBS) representing these investments declined and became uncertain. Due to [[financial leverage]], what had magnified profits during the housing boom period now drove large losses after the bust. Financial institutions and investors holding MBS suffered significant losses as a result of widespread and increasing mortgage payment defaults or mortgage asset devaluation beginning in 2007 onward. [[Financial institutions]] from around the world have recognized subprime-related losses and [[write down| write-downs]] exceeding U.S. $501 billion as of August 2008.<ref>{{cite web|url=http://www.bloomberg.com/apps/news?pid=20601087&sid=a8sW0n1Cs1tY&refer=home|title=www.bloomberg.com/apps/news?pid=20601087&sid=a8sW0n1Cs1tY&refer=home<!--INSERT TITLE-->}}</ref> |

|||

A SEC regulatory ruling in 2004 greatly contributed to US Investment Banks' ability to leverage their balance sheets. In exchange for an exemption for their brokerage units from an old regulation that limited the amount of debt they could take on, the SEC would obtain greater oversight in the investment activities of the banks. The SEC decided to use the firms' own computer models for determining the riskiness of investments, but then did little to followup on the risky activities that their examiners uncovered.<ref>{{cite web|url=http://www.nytimes.com/2008/10/03/business/03sec.html|title=Agency’s ’04 Rule Let Banks Pile Up New Debt, and Risk}}</ref> |

|||

Profits at the 8,533 U.S. banks insured by the [[FDIC]] declined from $35.2 billion to $646 million (89%) during the fourth quarter of 2007 versus the prior year, due to soaring loan defaults and provisions for loan losses. It was the worst bank and thrift quarterly performance since 1990. For all of 2007, these banks earned approximately $100 billion, down 31% from a record profit of $145 billion in 2006. Profits declined from $35.6 billion to $19.3 billion during the first quarter of 2008 versus the prior year, a decline of 46%.<ref>{{cite web|url=http://www4.fdic.gov/qbp/2008mar/qbp.pdf|title=FDIC Quarterly Profile Q1 08|format=PDF}}</ref><ref>{{cite web|url=http://www4.fdic.gov/qbp/2007dec/qbp.pdf|title=FDIC Profile FY 2007 Pre-Adjustment|format=PDF}}</ref> |

|||

The financial sector began to feel the consequences of this crisis in February 2007 with the $10.5 billion writedown of [[HSBC]], which was the first major CDO or MBO related loss to be reported.<ref>{{cite web|url=http://news.bbc.co.uk/2/hi/business/7096845.stm|title=news.bbc.co.uk/2/hi/business/7096845.stm<!--INSERT TITLE-->}}</ref> During 2007, at least 100 [[mortgage]] companies either shut down, suspended operations or were sold.<ref name="bloomberg1">{{cite web|url=http://www.bloomberg.com/apps/news?pid=20601087&sid=aTARUhP3w5xE&refer=home|title=Bloomberg.com: Worldwide}}</ref> |

|||

Top management has not escaped unscathed, as the CEOs of Merrill Lynch and Citigroup were forced to resign within a week of each other.<ref>{{cite news | title = Prince out as Citigroup CEO; more writedowns disclosed - Nov. 4, 2007 | url=http://money.cnn.com/2007/11/04/news/companies/citigroup_prince/index.htm | accessdate=2008-05-19 | year = 2008 }}</ref> Various institutions followed up with merger deals.<ref> |

|||

{{cite web|url=http://www.reuters.com/article/ousiv/idUSN1128267820080111|title=Similar deals expected to follow Countrywide sale|date=2008-01-11|accessdate=2008-05-19|work=Mark McSherry|publisher=Reuters}}</ref> |

|||

===Market weaknesses, 2007=== |

|||

On July 19, 2007, the [[Dow Jones Industrial Average]] hit a record high, closing above 14,000 for the first time.<ref>{{cite news | title = Finally! Dow finishes above 14,000 - Jul. 19, 2007 | url=http://money.cnn.com/2007/07/19/markets/markets_530/index.htm | accessdate=2008-05-19 | year = 2008 }}</ref> |

|||

On August 15, 2007, the Dow dropped below 13,000 and the [[S&P 500]] crossed into negative territory for that year. Similar drops occurred in virtually every market in the world, with Brazil and Korea being hard-hit. Through 2008, large daily drops became common, with, for example, the [[KOSPI]] dropping about 7% in one day,<ref>{{cite web | title = National, World and Business News | Reuters.com | url=http://today.reuters.com/news/articlenews.aspx?type=businessNews&storyid=2007-08-16T052720Z_01_HKG37478_RTRUKOC_0_US-MARKETS-GLOBAL.xml | accessdate=2008-02-24 | year = 2008 }}</ref>{{Dead link|date=May 2008}} although 2007's largest daily drop by the S&P 500 in the U.S. was in February, a result of the subprime crisis. |

|||

Mortgage lenders<ref>{{cite web |title=Yahoo! - 404 Not Found |url=http://biz.yahoo.com/ap/070803/rait_financial_mover.html |accessdate=2008-02-24 |year=2008}}</ref>{{Dead link|date=May 2008}}<ref>{{cite web |title=Thornburg says no bankruptcy as shares sink |

|||

| Markets |

|||

| Markets News |

|||

| Reuters |

|||

| url=http://www.reuters.com/article/marketsNews/idUKN1444576220070814 | accessdate=2008-05-19 | year = 2008 }}</ref> and home builders<ref>{{cite news |title=Housing starts, building permits both at 10-year low - Aug. 16, 2007 |url=http://money.cnn.com/2007/08/16/news/economy/housing_starts/index.htm |accessdate=2008-05-19 |year=2008 }}</ref><ref>{{cite web |title=Yahoo! - 404 Not Found | url=http://biz.yahoo.com/ap/070813/sector_wrap_homebuilders.html | accessdate=2008-02-24 | year = 2008 }}</ref>{{Dead link|date=May 2008}} fared terribly, but losses cut across sectors, with some of |

|||

the worst-hit industries, such as metals & mining companies, having |

|||

only the vaguest connection with lending or mortgages.<ref>{{cite web |title=Mining, metals companies hammered on debt jitters, M&A; chill - MarketWatch |

|||

|url=http://www.marketwatch.com/news/story/mining-metals-companies-hammered-debt/story.aspx?guid=%7BD66D3B3A%2D1EC0%2D438C%2DA51D%2DE3176CFEA31A%7D |accessdate=2008-05-19 |year=2008}}</ref> |

|||

Stock indices worldwide trended downward for several months since the first panic in July–August 2007. |

|||

===Market downturns and impacts, 2008=== |

|||

[[Image:TED Spread Chart - Data to 9 26 08.png|thumb|The [[TED spread]] – an indicator of credit risk – increased dramatically during September 2008.]] |

|||