depreciation

Depreciation ( English depreciation / amortization ) is in accounting the detection and accounting of impairments , the at assets of the investment and working capital occur. The opposite is the ascription .

General

Section 253, Paragraph 1, Clause 1 of the German Commercial Code( HGB ) standardizes thedepreciation requirement under commercial law . In assets of assets whose useful life is limited in time, which are acquisition or manufacturing costs to reduce depreciation. The depreciation expense ispostedagainst the (residual) book value of the asset. Among the depreciable assets, in particular: buildings , equipment and machinery, fleet , office furniture and equipment such as office furniture or storage and workshop facilities and tools , including the accessories of this property as well as intangible resources including derivative goodwill are subject to wear or age impairment . This reduction in value must betaken into accountin the balance sheet and the income statement so that the annual financial statements give a true and fair view of the assets, financial and earnings position . Depreciation leads to a reduction in the book value of an asset in the balance sheet; In the income statement, they reduce the annual surplus as an expenseor increase the annual deficit.

Section 253 (4) sentence 1 of the German Commercial Code( HGB ) stipulates that the strict lower-of-cost-or-market principle is to be implemented through unscheduled depreciation. In the case of current assets , write-downs are to be made in order to apply them at a lower value resulting from a stock exchange or market price on the reporting date. In the case of fixed assets, there is a right to depreciate ; Unless these are permanently impaired, an unscheduled write-down to the lower stock exchange or market price can be omitted (moderate lower value principle). Unlike scheduled depreciation, unscheduled depreciation is reversible and subject to reversal. According to Section 253 (5) sentence 1 of the German Commercial Code (HGB), the book value reduced by the unscheduled depreciation may not be retained if the reasons for this no longer apply; A write-up affecting net incomemust be madeon the reduced book value(write-up requirement). There is an express prohibition of write-ups for impaired goodwill.

Depreciation in the balance sheet theories

When defining depreciation, the author's scientific location also plays an important role. For the static balance sheet theory , the main focus of the balance sheet is the determination of assets and debts . Accordingly, depreciation has the task of recording usage-related impairments. One of its founders, Heinrich Nicklisch , described depreciation in 1922 as “generally an amount by which the value of the assets is reduced by some method”. In the dynamic balance sheet approach of Eugen Schmalenbach , however, the profit and loss account is in the foreground, so that the acquisition or production costs of assets are distributed in the form of depreciation over the period of their expected operational use. Erich Gutenberg took this dynamic view; For him, depreciation represents "a method of determining and distributing the expenditure on assets, the use of which extends over several business periods".

Commercial law and tax law

While every decrease in value is referred to as depreciation under commercial law , tax law distinguishes between the following variants:

- the scheduled depreciation in accordance with commercial law is referred to in tax law as the depreciation for wear and tear ,

- the unscheduled commercial law depreciation on fixed assets corresponds to the tax deduction for extraordinary wear and tear (AfaA),

- the unscheduled commercial depreciation on current assets corresponds to the partial value depreciation for tax purposes ,

- collective depreciation in accordance with Section 6 (2a) EStG and

- Tax policy depreciation instruments ( increased depreciation , special depreciation ).

Causes of depreciation

The causes of the loss of value can be of a general or specific nature. Come into question

- General losses in value:

- economic causes: impairment due to technical progress or shifts in demand,

- Legal causes: Expiry of property rights or usage rights before the end of the technical useful life of the asset,

- Weather- related causes: Depreciation due to the weather ( rain , rust on vehicles).

- Special losses in value:

- Usage- related causes: wear and tear through use ,

- temporal causes: wear and tear and degradation .

The cause of unscheduled depreciation are stock exchange or market prices on the balance sheet date that are below the book value of the asset.

detection

The following arithmetic variables must be included in determining the depreciation:

- The acquisition and production costs are a value convention and are calculated according to the strict regulations of § 255 HGB. The lower value is formed by the individual costs , necessary and appropriate material and production overheads are capitalizable . For the upper value limit, the lower value limit is set by the administrative overheads , as well as voluntary social benefits and the company pension scheme, provided that they apply to the period of manufacture ( Section 255 (2) sentences 3 to 4 HGB). Acquisition and production costs serve as the starting point for calculating depreciation.

- The useful life ( Section 253 (3) sentence 2 HGB) or normal operational useful life ( Section 7 (1) sentence 2 EStG) results from an "depreciation table" from the Federal Ministry of Finance , which lists assets with their respective useful lives in great detail. This means that, for example, for passenger cars (reference 4.2.1), a useful life of 6 years is provided.

- Depreciation methods are procedures that can be used in the case of scheduled depreciation to determine the annual depreciation amounts. The HGB does not contain any precise regulations on this, but merely requires the acquisition and production costs to be reduced by the scheduled depreciation (Section 253 (3) sentence 1 HGB). Tax law, on the other hand, specifies exactly which depreciation methods are permitted.

Depreciation period

Start of depreciation

The depreciation is first made at the time of operational readiness (and not at the beginning of actual use). In the case of a purchase, this is usually the day of purchase or delivery. This is calculated to the exact month ( pro rata temporis ). For example, if the acquisition is made on a date between May 1 and May 31, eight months - provided that the fiscal year corresponds to the calendar year - must be written off.

- Calculation path

- .

End of depreciation

Depreciation must be carried out until the asset leaves the company through sale, loss or scrapping. Scheduled depreciation usually means that the asset is reduced to a book value of 0 monetary units (MU) in the last year of use . If the asset continues to be used in the company after it has been fully written off, a reminder value of 1.00 GE can be continued in the books.

For the purposes of internal accounting, it can also make sense to calculate a possible sale proceeds that can be achieved after the sale has expired. This realization proceeds would reduce the imputed depreciation and thus the depreciation volume. The application of a presumed realization proceeds is usually not permitted under commercial law.

species

In commercial law, a distinction is generally made between direct and indirect, paid and imputed, and between scheduled and unscheduled depreciation .

- With direct depreciation , the value of the asset item is reduced on the asset side . Alternatively, with indirect depreciation, all depreciations are collected as value adjustment items and as such are shown separately with a positive sign on the liabilities side under the balance sheet item “Value adjustment”. Both methods reduce equity and profit in the same way.

- While paid-off depreciation according to commercial and tax law must be based on payments actually made ( paid- off depreciation are fictitious payments), in the company's internal accounting system, on the other hand, imputed depreciation can also be made without a paid basis. For example, instead of historical acquisition and manufacturing costs, depreciation can be made on replacement values that may be higher than the original acquisition or manufacturing costs.

- While scheduled depreciation is a consumption of value that a business / professionally used asset suffers through normal use (wear and tear) over a certain period of time, unscheduled depreciation is a consumption of value that a business / professionally used asset suffers from an extraordinary one Process (drop in prices, destruction). These are impairments that are not caused by normal use in the company. This could be for example:

- Damage caused by accidents or force majeure,

- External value fluctuations, d. H. falling market values of assets,

- technical obsolescence.

In contrast to the scheduled depreciation, the unscheduled depreciation can be carried out not only for depreciable assets, but also for all assets, including current assets. Unscheduled depreciation is called partial value depreciation in German tax law .

Depreciation methods

The depreciation amount per year does not always have to be the same. Various types of depreciation can arise due to various reasons for the loss of value:

- Time-proportional depreciation : time alone determines the loss in value (depreciation in age),

- Performance-proportional depreciation : Depending on the performance (according to operating hours),

- Asset value depreciation : the asset is reduced through use ( e.g. gravel mining , quarry )

The following types derived from this are generally permitted under commercial law, but they must comply with the GoB and must not contradict the actual wear and tear and depreciation of the asset.

| Depreciation method | trade balance | Tax balance |

|---|---|---|

| Linear depreciation | Yes | yes, for all depreciable assets (Section 7 (1) sentence 1 EStG) |

| Geometric-degressive depreciation | Yes | yes, for all movable fixed assets (Section 7 (2) EStG) |

| Arithmetic declining balance depreciation | Yes | only in falling graduated rates for buildings (Section 7 (5) and 5a of the Income Tax Act) |

| Broken Depreciation | Yes | yes, for all movable fixed assets (§ 7 Abs. 2, 3 EStG) |

| Progressive depreciation | Yes | No |

| Depreciation | Yes | yes, for movable fixed assets (Section 7 (1) sentence 6 EStG) |

It can be seen from this that all depreciation methods are permitted under commercial law (optional method).

Linear depreciation

The acquisition or production costs of the asset to be depreciated (WG) are divided equally over the years of the useful life . The same amount is written off every year and the flat share is completely written off at the end of its useful life. The depreciation value is calculated using the following formula:

- , in which

Acquisition costs: useful life = annual (depreciation) rate

Meaning of the symbols: = depreciation amount of the period , = depreciation starting amount (acquisition value-residual value), = useful life, depreciation = deduction for wear and tear

In general, the value of an asset with acquisition cost c and useful life n after x years is:

example

A machine is purchased for 21,000.00 euros (net, without VAT ). With a normal useful life of seven years and the use of straight-line depreciation, 1/7 of the acquisition costs per year, i.e. 3,000.00 euros, must be calculated as an expense for seven years.

| year | depreciation | Residual book value |

|---|---|---|

| 0 | 0.00 euros | 21,000.00 euros |

| 1 | 3,000.00 euros | 18,000.00 euros |

| 2 | 3,000.00 euros | 15,000.00 euros |

| 3 | 3,000.00 euros | 12,000.00 euros |

| 4th | 3,000.00 euros | 9,000.00 euros |

| 5 | 3,000.00 euros | 6,000.00 euros |

| 6th | 3,000.00 euros | 3,000.00 euros |

| 7th | 3,000.00 euros | 0.00 euros |

| cumulative | 21,000.00 euros |

Geometric-degressive depreciation

The deduction for wear and tear is measured in decreasing annual amounts with a constant multiplication factor.

example

A machine is purchased for 21,000.00 monetary units (MU) (net, without VAT ). Using declining balance depreciation, 20% of the reported value per year can be deducted as an expense for about seven years.

| year | depreciation | Residual book value |

|---|---|---|

| 0 | 0.00 GE | 21,000.00 GE |

| 1 | 4,200.00 GE | 16,800.00 GE |

| 2 | 3,360.00 GE | 13,440.00 GE |

| 3 | 2,688.00 GE | 10,752.00 GE |

| 4th | 2,150.40 GE | 8,601.60 GE |

| 5 | 1,720.32 GE | 6,881.28 GE |

| 6th | 1,376.26 GE | 5,505.02 GE |

| 7th | 1,101.00 GE | 4,404.02 GE |

| cumulative | 16,595.98 GE |

To ensure that the asset is fully depreciated at the end of its useful life, it is permitted in some countries to switch from geometric-degressive depreciation to straight-line depreciation. In the year of the change, the residual book value is divided by the number of remaining years of depreciation, so that from the change there are constant, i.e. linear, depreciation amounts that are all greater than those that would have resulted from continued declining balance depreciation. Under the condition

it follows that the optimal time for menopause is out

results, wherein = menopausal, = useful life = degressive depreciation rate .

In the year of the change, the residual book value is divided by the number of remaining years of depreciation, so that from the change there are constant, i.e. linear, depreciation amounts that are all greater than those that would have resulted from continued declining balance depreciation. In the example of the geometric degressive depreciation , a change in the 4th year would be advisable. The remaining book value of 10,752.00 MU at the end of the 3rd year (= after the 3rd straight-line depreciation) would result in a depreciation of 2,688.00 MU per year over the remaining useful life of 4 years. With the degressive method, on the other hand, only 2,150.40 MU would be written off in the 4th year.

Arithmetic declining balance depreciation

The arithmetic-degressive depreciation is a method permitted by commercial law, in which the depreciation amount is reduced by a fixed amount (degression amount) every year. The degression amount is the quotient of acquisition costs and the sum of the planned years of use (for example, with three years of use: 1 + 2 + 3 = 6). This means that the asset is completely written off at the end of its useful life. The most common form of arithmetic-degressive depreciation is digital depreciation, in which the depreciation in the last year of use is exactly as high as the annual difference (see example below).

According to the digital depreciation, the value of an asset, with the acquisition costs and the useful life , after years:

example

A machine is purchased for 21,000.00 GE (net, without VAT ). With a normal useful life of seven years, the depreciation amount must be reduced by MU 750.00 each year. (1 + 2 + 3 +… + 7 = 28; 21,000.00 MU / 28 = 750.00 MU)

| year | depreciation | Residual book value |

|---|---|---|

| 0 | 0.0 GE | 21,000.00 GE |

| 1 | 5,250.00 GE | 15,750.00 GE |

| 2 | 4,500.00 GE | 11,250.00 GE |

| 3 | 3,750.00 GE | 7,500.00 GE |

| 4th | 3,000.00 GE | 4,500.00 GE |

| 5 | 2,250.00 GE | 2,250.00 GE |

| 6th | 1,500.00 GE | 750.00 GE |

| 7th | 750.00 GE | 0.00 GE |

| 21,000.00 GE |

Broken Depreciation

The fractional depreciation differentiates between the time wear and the wear and tear. While the time wear is taken into account by fixed (constant) depreciation, the wear and tear corresponds to a proportional depreciation share. The wear and tear is adjusted to the actual employment in the company. In the case of the vehicle fleet, for example, the depreciation could be divided into an operating time-dependent (time wear) and kilometer-dependent (usage wear) part. Fractional depreciation proves to be problematic because of the close interdependencies between time and usage components.

Progressive depreciation

In contrast to declining balance depreciation, progressive depreciation makes increasing annual depreciation as the useful life increases. The economic justification for this type of depreciation is a higher loss of value at the end of the useful life. Coal mines or similar plants are an example, because the longer they are used, the mining of the material becomes more and more complicated, technically demanding and therefore more expensive. It is also appropriate for fixed assets that only slowly reach their full use over time ( orchards , wineries ). The progression amount is the quotient of acquisition costs and the sum of the planned years of use (for example, with three years of use: 1 + 2 + 3 = 6). This means that the asset is completely written off at the end of its useful life.

In general, the value of an asset, with acquisition costs and useful life , after years:

example

A vineyard is purchased for 21,000 GE (net, without VAT ). The normal useful life is seven years, with the loss in value increasing linearly and being greatest in the last year of use. This means that the depreciation amount has to be increased by MU 750.00 each year. (1 + 2 + 3 +… + 7 = 28; 21,000.00 MU / 28 = 750.00 MU)

| year | depreciation | Residual book value |

|---|---|---|

| 0 | 0.0 GE | 21,000.00 GE |

| 1 | 750.00 GE | 20,250.00 GE |

| 2 | 1,500.00 GE | 18,750.00 GE |

| 3 | 2,250.00 GE | 16,500.00 GE |

| 4th | 3,000.00 GE | 13,500.00 GE |

| 5 | 3,750.00 GE | 9,750.00 GE |

| 6th | 4,500.00 GE | 5,250.00 GE |

| 7th | 5,249.00 GE | 1.00 GE |

| 20,999.00 GE |

Performance-related depreciation

The amount to be written off annually is determined by the specific use of the asset in the respective year. In order for it to be fully written off in a specified time, an anticipated total performance must be assumed.

example

A machine is purchased for 21,000.00 GE (net, without VAT ). The expected operating hours are a total of 19,320 hours. The operating hours actually performed are determined at the end of each year and recognized as a loss in value in the corresponding ratio (expected operating hours to acquisition costs, here around 0.92).

| year | Operating hours | depreciation | Residual book value |

|---|---|---|---|

| 0 | 0h | 0.0 GE | 21,000.00 GE |

| 1 | 4636 h | 5,039.00 GE | 15,961.00 GE |

| 2 | 2724 h | 2,961.00 GE | 13,000.00 GE |

| 3 | 927 h | 1,008.00 GE | 11,992.00 GE |

| 4th | 2357 h | 2,562.00 GE | 9,430.00 GE |

| 5 | 4173 h | 4,536.00 GE | 4,894.00 GE |

| 6th | 2179 h | 2,368.00 GE | 2,526.00 GE |

| 7th | 2322 h | 2,524.00 GE | 2.00 GE |

| 19,320 h | 20,998.00 GE |

Which method is the best?

In principle, there is no “best” depreciation method, as the choice of the appropriate depreciation method depends on the balance sheet policy . Although the balance sheet should reflect as realistic a picture of the company's financial situation as possible, the value of the depreciable assets is not least dependent on the choice of depreciation method. Depreciation that goes beyond the actual loss in value leads to hidden reserves and serves to finance companies internally .

Abolition of the reversal rule

Until the German Accounting Law Modernization Act (BilMoG) came into force in 2009, depreciation was also permitted in the commercial balance sheet if increased depreciation and special depreciation were carried out under German tax law so that the asset could also be accounted for with the same value under commercial law (uniform balance sheet). This principle of reversal relevance was abolished with the BilMoG, i. H. Tax valuations are no longer allowed in the commercial balance sheet.

Business aspects and key figures

Depreciation is not a paid cost, such as personnel or material costs , because it does not result in a payout . Depreciation represents expenses in external accounting . In internal accounting they are costs . Depreciation flows back to the company as sales revenue via the price calculation ; they become liquidity that can be used for reinvestment (see Lohmann-Ruchti effect ). Depreciation is incurred regardless of employment and is therefore a fixed cost . For tax purposes, depreciation is a business expense .

If depreciation dominates over other types of costs in the cost structure , we speak of depreciation-intensive operations . However, these companies do not necessarily have to belong to the category of investment-intensive operations, because a certain asset intensity does not automatically indicate a high cost intensity of the corresponding cost type. Whether asset-intensive companies are also depreciation-intensive depends on the propensity to invest, the useful life of the equipment, the depreciation method and the nature of the circulation process ( throughput time of the material or production process in multi-shift operation ). Depreciation-intensive operations include transport , infrastructure or telecommunications companies , power generation , transport companies and hotels .

You are subject to the risk of being exposed to underutilized capacities with fluctuations in the level of employment, resulting in idle costs . In particular, fixed costs such as depreciation and interest expenses are wholly or partially no longer generated by the sales process in the event of underemployment and can lead to losses (so-called operating leverage ). These fixed costs constantly force the company to fully utilize its capacity so that the fixed costs of fixed assets are distributed over the largest possible number of products and therefore kept as low as possible for each product ( unit costs ) ( fixed cost degression ).

The economic key figure of the depreciation intensity measures the amount of depreciation in relation to the total costs or sales revenues and indicates to what extent the sales revenues of the company can contribute to its asset maintenance:

The intensity of depreciation increases when particularly valuable equipment with a long useful life is required and a lengthy production process ensures a slow throughput of the material and vice versa. High depreciation intensity and at the same time low personnel intensity can indicate a high degree of rationalization .

Residential property depreciation

The tax depreciation for residential property ("residential purposes") is regulated in Section 7, Paragraphs 4 and 5 of the Income Tax Act. The amount of the depreciation rates is made dependent on the completion , submission of the building application or the conclusion of a property purchase agreement.

-

Straight-line depreciation in accordance with Section 7 (4) No. 2 EStG:

- 2.5% for 40 years (completion up to 1924)

- 2% for 50 years (completion from year of construction 1925)

-

Declining balance depreciation for building applications or purchases between March 1989 and December 1996 (Section 7 (5) No. 3a EStG):

- 7% for 3 years, thereafter

- 5% for 6 years, thereafter

- 2% for 6 years, thereafter

- 1.25% for 24 years.

- Further variants in Section 7 (5) No. 3b and c EStG relate to later periods in which a building application or purchase was made.

International

Depreciation according to international accounting standards International Financial Reporting Standards (IFRS, IAS) and the United States Generally Accepted Accounting Principles recognized (US GAAP). The admissibility of the depreciation results from IAS 16.62 and IAS 38.98. A change in the depreciation method is only permitted if this reflects the consumption of the economic benefit more accurately. In the case of intangible assets, IAS 38.97 requires straight-line depreciation if the expected consumption cannot be reliably determined. The IFRS use different terms for depreciation. “Depreciation” is the scheduled depreciation of property, plant and equipment, “Amortization” is the scheduled depreciation of intangible assets, “Impairments” are unscheduled depreciation of property, plant and equipment and intangible assets, “Write-Offs” are individual value adjustments of inventories and receivables , “Allowances” are general value adjustments to Inventories and Receivables.

National accounts

In the national accounts , depreciation is defined as a measure of the depreciation of fixed assets during a period (year) due to normal wear and tear, economic behavior (see moral wear and tear ) and including the risk of losses due to insurable claims.

In the national accounts, depreciation is calculated at replacement prices. The prices of the fixed assets for the respective year are used as replacement prices.

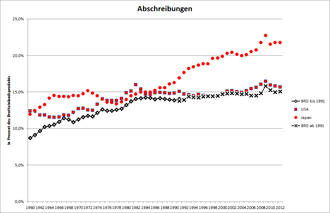

In the figure on the right , gross national income (GNI) has been set at 100% since 1960. The economic depreciation is the top (purple) size. The trend towards an increasing share of depreciation in GNI is remarkable, which makes distribution conflicts more difficult.

The figure on the left shows the depreciation rates for the USA, Japan and Germany. Japan is traditionally a capital-intensive economy, which is reflected in a high depreciation rate, while the US economy traditionally produces little capital-intensive. The German economy lies in between.

literature

- Manfred Frank, Günter Link: Valuation and depreciation . Richard Boorberg Verlag, Stuttgart, 7th, completely revised edition 2015, ISBN 978-3-415-05637-4 .

Individual evidence

- ^ Adolf G. Coenenberg: Annual accounts and analysis of the annual accounts , 23rd edition, Stuttgart 2014, p. 162 f.

- ^ Heinrich Nicklisch, Wirtschaftliche Betriebslehre , 1922, p. 202.

- ↑ Erich Gutenberg, Depreciations , in: Handwortbuch der Sozialwissenschaften, Volume 1, 1956, p. 20.

- ↑ Uwe Bestmann (Ed.), Kompendium der Betriebswirtschaftslehre , 2009, p. 760.

- ↑ § 255 HGB - single standard. Retrieved February 2, 2020 .

- ↑ Federal Ministry of Finance December 15, 2000, depreciation table for generally applicable assets (depreciation table "AV") , file number IV D 2-S 1551-188 / 00, B / 2-2-337 / 2000-S 1551 A, S 1551-88 / 00.

- ^ Adolf G. Coenenberg : Annual accounts and analysis of the annual accounts , 23rd edition, Stuttgart 2014, p. 162.

- ↑ Benjamin R. Auer / Luise Hölscher, Basic Accounting Course , 2008, p. 262 f.

- ↑ Thorsten Hadeler / Eggert Winter (eds.), Gabler Wirtschaftslexikon: The whole world of the economy , 2000, p. 1189.

- ↑ Erich Schäfer, The Enterprise: Introduction to Business Management , 1991, p. 167 fn. 109.

- ↑ Jörg Wöltje, Reading, Understanding and Designing Balance Sheets , 2016, p. 434.

- ↑ Gerald Preißler / German Figlin, IFRS-Lexikon , 2009, p. 3.

- ↑ Federal Statistical Office “Net fixed assets at replacement prices” ( Memento of March 24, 2014 in the Internet Archive ); Oda Schmalwasser and Michael Schidlowski (2006): “Capital stock calculation in Germany”, Wirtschaft und Statistik 11/2006, p. 1110 ff.