Tax agreement between Germany and Switzerland

The agreement between the Swiss Confederation and the Federal Republic of Germany on cooperation in the areas of taxation and the financial market , or tax treaty between Germany and Switzerland , is a bilateral agreement between the Federal Republic of Germany and the Swiss Confederation on the taxation of cross-border capital movements between the two countries. It should come alongside the double taxation agreement between Germany and Switzerland . The agreement was signed on September 21, 2011 after a lengthy negotiation phase that was kept secret from the public. According to the additional protocol of September 21, 2011, the minimum tax rate for previously undeclared money was 21% and the planned maximum tax rate was 41%. A withholding tax on investment income was planned for the future, which Switzerland will pass on to Germany. The owners of the finances remain anonymous for the tax authorities. Rules were also drawn up in the agreement for inquiries from the German authorities and the subject of inheritance. The agreement was discussed controversially, government representatives supported it. a. with the fact that the agreement is difficult to circumvent. In the criticism, however, it was objected that the agreement made tax evasion easier. The agreement was ratified by the Swiss National Council and the Council of States. In Germany, on November 23, 2012, the Federal Council , in which the states ruled by the SPD , the Greens and the Left hold a majority, refused to approve the tax agreement. The federal cabinet called the mediation committee . The Federal Government rejected the mediation result worked out there on January 17, 2013, the Federal Council on February 1, 2013; so the law had failed.

This agreement between the two countries must be distinguished from agreements between non-governmental persons and the tax authorities of Switzerland ( tax ruling ).

history

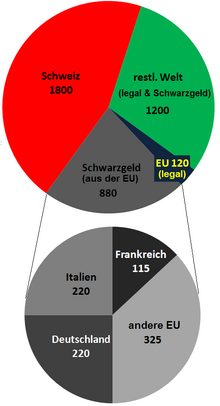

For a long time, Switzerland was considered a “safe haven” for untaxed funds and the like. a. from Germany . The amount of untaxed German assets in Switzerland, which were withdrawn from the access of the German tax authorities there, was estimated at the beginning of 2010 at around 131 billion euros, 150 billion euros or 180 billion euros (220 billion Swiss francs ).

Tax CD

At the beginning of 2010, tax investigators from North Rhine-Westphalia acquired stolen data on a so-called “ tax CD ” from Credit Suisse in order to be able to pursue tax evasion .

In November 2010, the Federal Constitutional Court permitted the use of data from such data carriers in criminal prosecution. In this way, the information acquired about alleged tax evaders can be used in investigative proceedings. The court stated that it did not matter whether the purchase of the data was originally lawful. The reasoning for the judgment also stated: “The 'data theft' was not attributable to the Federal Republic of Germany. Even if international conventions were circumvented, this would be harmless because the violation of an international treaty that did not grant personal rights would not result in a prohibition of exploitation. Incidentally, the possibly illegal event ('data theft' and purchase of the 'stolen' data) was concluded; by using the data in the investigation against the complainant, the convention would not be affected again. ”Furthermore,“ Evidence obtained from private individuals, even if this was done in a punishable manner, can in principle be used, so that crimes committed by the informant alone the assessment of a possible prohibition of exploitation need not be taken into account from the outset. "

As a result, further CDs were bought by North Rhine-Westphalia , including a CD with customer data from Bank Julius Baer .

International tax treaties

The agreement was signed on September 21, 2011 after a lengthy negotiation phase that was kept secret from the public. On September 21, 2011, an amendment agreement was signed by both sides of the government. Various parties, both from the right and left of the party spectrum, wanted to hold a referendum on the agreement and collected signatures for it. However, the 50,000 signatures required for a referendum were not collected. Thus, the tax agreement and the associated introductory law had successfully passed the legislative process in Switzerland. In Germany, on November 23, 2012, the Federal Council , in which the states governed by the SPD , the Greens and the Left hold a majority, refused to approve the tax agreement, which meant that it was not passed after a failed mediation.

After the agreement became known, Switzerland announced that it had signed a corresponding agreement with Great Britain on October 6, 2011 and with Austria on April 13, 2012. In addition, negotiations between Switzerland and Italy have started.

Content of the tax agreement

The tax treaty regulates the taxation of the past and the future of capital assets and income of natural persons with tax domicile in Germany who have a banking relationship with a bank in Switzerland. Domiciliary companies (e.g. trusts or foundations ) or foreign corporations (with the exception of Swiss corporations) whose beneficial owners are taxable in Germany are also covered by the tax treaty. With the tax agreement, both states want to achieve a solution for the tax regulation of the old assets of German taxpayers in Switzerland and ensure it will continue to do so in the future. The interests of the German federal government lie in the subsequent taxation of the assets located in Switzerland and the associated, presumably substantial, additional tax income and the securing of future taxation of capital income of German taxpayers in Switzerland. The interests of the Swiss government lie in solving a simmering conflict with a neighboring country and a solution that guarantees partial anonymity for customers in Switzerland . The possibility of self - disclosure in accordance with Section 371 of the Tax Code (AO) remains reserved for all persons and is not affected by the tax agreement.

The following statements are based on the published supplementary agreement to the tax agreement and the guidance to the tax agreement published by the Federal Tax Administration (FTA) in the draft stage. The guidelines are currently only partially coordinated with the German authorities. Final implementation provisions on the German and Swiss side still have to be awaited.

Regulating the past

This section deals with the subsequent taxation of assets held by German taxpayers in Switzerland. Held in Switzerland means that the assets are booked with a Swiss bank or with a Swiss securities dealer . These agencies are paying agents within the meaning of the agreement. If a person who is taxable in Germany is looked after by an asset manager in Switzerland, the asset manager's custodian takes on the role of paying agent. The asset manager cannot make any decision about the subsequent taxation of assets for his clients. Comprehensive subsequent taxation of assets held in Switzerland means that the customer's tax debts expire, insofar as these are listed in the tax agreement. The customer is decriminalized in this regard without having to reveal his identity. Offenses under professional law, such as those caused by tax evasion by civil servants or doctors , are not covered by the tax treaty and do not expire with the one-off payment. Administrative offenses (e.g. failure to report a gift or inheritance ) will not be prosecuted after proper subsequent taxation. With the tax treaty, persons subject to tax in Germany have three options for regulating the tax history of their assets. The person can:

- submit a voluntary disclosure exempt from punishment. This is defined outside of the tax agreement and must always be comprehensive. Possibly. Untaxed assets held in other countries must be included in the voluntary disclosure, as this would otherwise be ineffective.

- carry out the tax regulation of the assets through a one-off payment. The tax debts on the defined tax types expire and the taxable person is decriminalized. This regulation only applies to assets that are held with a bank in Switzerland.

- bring about tax regulation by submitting a voluntary report. The Swiss bank will disclose defined customer and asset data to the German authorities via the Swiss authorities. This voluntary report counts as an effective voluntary disclosure . In Germany, the assets are, if necessary, back-taxed in the normal process.

The following sections highlight the requirements for a one-off payment or voluntary notification.

Relevant deadlines and deadlines for data subjects

The tax regulation covers the period from 2002 to 2012. This is the same period that is usually used for voluntary disclosures . Periods before 2002 are not considered. At the same time, the person subject to tax in Germany must also be a customer of the Swiss bank (paying agent) on January 1, 2013. If this is not the case (for example due to the withdrawal of the funds or the death of the taxable person), the tax treaty does not apply. This means that the customer cannot regulate his tax past and is therefore not decriminalized. Another important point in time is December 31, 2010, the so-called cut-off date 2. When the tax agreement was signed and published, cut-off date 2 was already in the past. This makes it difficult to circumvent the tax treaty. Only by closing the relationship before December 31, 2012 can an affected person evade the tax treaty. On key date 2, u. a. determines whether the taxable person is covered by the agreement and what the relevant assets are. All withdrawals by the taxable customer after December 31, 2010 have no effect on the amount of the one-off payment. A partial “copying” of the customer is therefore not possible for the subsequent taxation of the assets. The paying agent must inform all persons concerned by February 28, 2013 at the latest about the tax agreement, the procedure and the expected amount of the one-off payment. The person concerned must notify the paying agent in writing of all necessary decisions by May 31, 2013 (reference date 3). Many paying agents in Switzerland will use standardized forms for this. In particular, the person concerned must decide by reference date 3 whether they prefer voluntary reporting or a one-off payment. The tax treaty stipulates that the one-off payment will be used if the person concerned does not react. Key date 4 is June 30, 2013. On this date at the latest, a customer who opened their relationship after December 31, 2010 must inform their current paying agent which form of regulation is desired and at which Swiss paying agent the assets are to be purchased before December 31, 2010.

The one-time payment will be credited to the settlement account of the paying agent on May 31, 2013 and from there forwarded to the Swiss authorities. These then forward the money to the responsible German authority. With the credit on the settlement account of the paying agent, the tax claims on the assets defined for subsequent taxation against the taxable person expire. It is therefore considered decriminalized. On May 31, 2013 (reference date 3), the paying agent will issue the person concerned with a certificate showing the subsequent taxation. The person concerned can lodge a written objection against this certificate to the paying agent within 30 days.

Affected persons and affected assets

The tax treaty uses a very broad definition of a data subject and property. A data subject is always a natural person . However, this natural person does not necessarily have to be the bank's contractual partner (account holder). The “look-through principle” is used. This means that structures, domiciliary companies and companies always fall under the tax agreement if the assets are attributable to a natural person behind them. This was identified when the relationship was opened with the paying agent in accordance with the applicable money laundering guidelines. In the case of a foundation , the founder is the person concerned and the foundation is the bank's contractual partner:

- Mr. Meier, a taxable person in Germany, set up a foundation in Liechtenstein in 2006 , which still exists in 2013. The foundation serves to provide for his children. The foundation itself is a customer (contractual partner) at the bank in Switzerland. The bank communicates with the board of trustees . Nevertheless, Mr. Meier is a data subject within the meaning of the tax agreement. When the relationship with the foundation was opened , the bank identified Mr. Meier as the beneficial owner of the assets. Mr. Meier falls under the tax agreement and must either authorize the paying agent (via the Board of Trustees) to report voluntarily or choose the one-off payment.

This foundation is classified as a transparent structure. In the case of transparent structures, the beneficial owner is looked through directly and an assessment is made as to whether this person is an affected person. The guidance to the tax agreement defines a very long list of structures that are to be regarded as transparent in the sense of the tax agreement. These are, for example, the Liechtenstein Anstalt, Liechtenstein Stiftung , Cayman Islands company, US Virgin Island International Business Company, Guernsey zero tax company, US Limited Liability Companies ( Delaware , Wyoming etc.), Bahamas International Business Company, Panama company, Lebanon company. This very extensive list prevents the restructuring of the assets with the aim of evading the tax treaty. Exceptions, i.e. non-transparent structures, are Swiss corporations and irrevocable, discretionary trusts . The Swiss corporations are considered to be effectively taxed and in the case of the aforementioned trust form, the assets are not attributable to the beneficial owner. The settlor has no influence on the assets and cannot issue any instructions. Therefore this structure is treated as opaque for the tax treaty.

The natural person must have been resident in Germany on December 31, 2010 (reference date 2) . The tax treaty deliberately chose this date retrospectively so that it is more difficult to escape from the treaty. In addition, the person must have been authorized to use the assets booked with the paying agent on December 31, 2010 and January 1, 2013 and be a customer of the paying agent on January 1, 2013. With these four characteristics (1) natural person, (2) residence in Germany on December 31, 2010, (3) customer of the paying agent on January 1, 2013 and (4) entitled to use the assets on December 31, 2010 and January 1, 2013 a very comprehensive definition was made in the tax treaty. The following two examples show this:

- Mr. Müller has been a customer of paying agent X since 2002 and on December 31, 2010. After the tax agreement has been published, Mr. Müller will move to Switzerland and inform his paying agent that he will be taxable in Switzerland as of January 1, 2012. Mr. Müller's account with the Swiss paying agent exists on January 1, 2013. Although Mr. Müller has been taxable in Switzerland since 2012, he is an affected person within the meaning of the tax treaty. Because only December 31, 2010 is relevant for determining the domicile. Since Mr. Müller is still entitled to use the assets at the same paying agent, he is covered by the tax agreement.

- Mr Schulze has been a customer of paying agent X since 2002 and on December 31, 2010. After the tax agreement has been published, he will bring the assets to an asset management Swiss corporation which is to be regarded as non-transparent in the sense of the tax agreement. On January 1, 2013, the latter held the assets with the same Swiss paying agent. Mr. Schulze is an affected person within the meaning of the agreement, because on January 1, 2013 only the right to use the property is decisive. Since Mr. Schulze is the beneficial owner of the assets of the Swiss corporation, he is covered by the tax agreement.

A pivotal point for the tax agreement is December 31, 2010 (reference date 2). The existing documentation of the paying agent on this reference date defines the status of the customer. The tax agreement makes very high demands on the retrospective change in this status, which the paying agent must meet. A retroactive change of the country of domicile is only possible if a certificate of residence is provided from the new country of domicile, which explicitly states December 31, 2010 as the date of residence or, alternatively, a de-registration certificate from Germany and a registration certificate from the new country of domicile, which contains the reference date 2. Simply specifying a vacation home will not lead to success. The rules of the tax treaty regarding the country of domicile are very extensive, as the following example shows:

- Ms. Müller has been a customer of Paying Agent X since 2002. Her domicile country is Germany. Due to her job as a manager in a large corporation, however, she worked in South Africa from 2004 to 2008 and was also subject to tax there. Since 2009 Ms. Müller has been subject to tax in Germany again. Your relationship also exists on January 1, 2013 with the same paying agent X. Ms. Müller is treated by paying agent X as the person concerned, because paying agent X is based on the dates December 31, 2010 and January 1, 2013. The fact that Ms. Müller was not subject to tax in Germany between 2004 and 2008 is irrelevant to the tax agreement. If Ms. Miller should opt for a one-off payment, this will be calculated based on the assets in 2002, 2010 and 2012. For Ms. Müller, a voluntary self-disclosure that exempts her from punishment is probably an option , since only the taxes actually owed (including penalty surcharge) are subsequently charged. The years 2004 to 2008 are therefore not taken into account.

The tax treaty defines a “data subject” very comprehensively. Almost all structures are classified as transparent and the person only has to actually be domiciled in Germany on December 31, 2010. On January 1, 2013, it is sufficient to determine the usage authorization. Furthermore, there are very high requirements for a retrospective change in the country of domicile as of December 31, 2010. Only people who completely balance their relationship with paying agent X before December 31, 2012 can evade the tax treaty.

Now that it has been defined which clients are affected, the question arises as to which types of assets are considered under the tax treaty. The assets concerned include all assets that can be kept in an account or custody account . These are, for example, cash accounts, precious metal accounts, fiduciary investments , funds , collective investment schemes , stocks , bonds , physical precious metal stocks (held in a custody account), structured products . The gross assets of the customers apply. Securities loans are not deducted. Valuables that are not kept in the custody account, such as land, real estate , occupational pension assets and the contents of lockers , are not included in the assets concerned. In the press, the fact that the contents of lockers are not part of the property concerned has been criticized again and again. The alternative to this would be to open all lockers , evaluate the items (which would raise a number of questions, such as: How should the watch collection and family jewelry be treated?) And assign them to the locker owner , whereby the locker owner does not necessarily have to be the owner of the items must and the content does not necessarily have to have been evaded tax. However, the tax treaty has a built-in security mechanism. Any deductions made by the affected person after December 31, 2010 will not reduce the one-time payment. Thus, lockers cannot be actively used to lower the assets for the one-off payment.

Life insurance policies to which affected persons are entitled are subject to a special regulation. So-called life insurance coats are considered transparent. The beneficial owner of this life insurance is considered the person concerned. This is different with insurance policies recognized for tax purposes in Germany. These do not count towards the affected assets and the customer is therefore not an affected person. However, the person with these assets is also not subject to tax in Germany. The differentiation between the types of insurance is made by the insurance companies , who have to rely on an expert report by an auditor . The paying agent has no influence on this. The insurance company is the contractual partner for the paying agent .

The one-time payment as a means of regulating the tax past

The one-time payment is an option for tax regulation of the past of data subjects. The one-time payment is the rule. If a person concerned does not react to contacting the paying agent, they will automatically apply the one-off payment. If there is insufficient liquidity in the account of the person concerned , this will lead to a compulsory disclosure of the relationship via the Swiss authorities to the German authorities after an additional period of eight weeks. This compulsory report has the character of an effective self - disclosure of the person concerned in Germany, which exempts them from punishment .

The one-time payment will be charged to the person concerned on May 31, 2013. If there is insufficient liquidity in the account, the paying agent will set a further period of eight weeks. The paying agent then makes a compulsory report. The paying agent will not sell any securities of the customer of its own accord in order to provide liquidity. The person concerned receives a certificate from the paying agent. The amount of the one-time payment, the calculation of the one-time payment and the date on which the one-time payment was credited to the settlement account of the paying agent are noted there. On this date, the tax liabilities on the defined tax types with regard to the relevant capital expire. The customer is decriminalized. This certificate serves as the customer's proof that the tax past has been settled. The German authorities can have the authenticity of this certificate checked by the Swiss authorities and still initiate proceedings against the taxable person within the framework of the applicable rules in Germany. The German authorities can investigate the taxpayer despite presenting the certificate.

In the tax treaty, the types of tax are defined that expire as a result of the one-off payment on the relevant capital. This includes wealth tax , inheritance tax , gift tax , trade tax , income tax and sales tax . Corporate income tax is excluded . The person concerned is therefore only decriminalized in relation to these types of taxes.

The amount of the one-off payment depends on the initial balance of capital, the final balance of capital and the duration of the customer relationship with the same paying agent. The tax rate is between 21% and 41% of the relevant capital. The following formula is used to calculate the one-time payment:

in which:

If

- ,

this expression is set equal to zero to prevent negative taxes. In this case, the 1st summand in the calculation of SB in the square brackets becomes zero.

To a large extent, the formula takes into account the asset growth since the beginning of the customer relationship (or since December 31, 2002), a fictitious interest rate and the final capital (the so-called relevant capital ).

- SB = tax amount

- SB '= increased tax amount

- s = tax rate (34%)

- sl = tax burden

- sl '= increased tax burden

- Kr = relevant capital

- n = number of years in the banking relationship before December 31, 2010, 0 ≤ n ≤ 8

- Kb = capital stock at the end of the year in which the banking relationship was opened. For banking relationships that were opened before January 1, 2003, the capital stock on December 31, 2002 is decisive.

- i = year i, 1 ≤ i ≤ 10, with year 1 beginning on January 1, 2003

- Ki = capital stock at the end of the year i

- K8 = capital stock at the end of the eighth year (December 31, 2010)

- K10 = capital stock at the end of the tenth year (December 31, 2012)

- K9 ', K10' = fictitious capital at the end of the ninth (December 31, 2011), resp. of the tenth year (December 31, 2012)

- r = return (3% for each year)

- smin = minimum tax rate (21%)

- Return flows = inflows in years 9 and 10 which compensate for outflows in years 1–8

The formula is based on a few simple principles. An increase in assets between the opening of the relationship and the relevant capital increases the one-off payment. This is intended to put a greater burden on those affected who have constantly added capital. Affected persons who have not added or even consumed new capital pay a lower one-off payment with the length of the relationship. The increase in wealth increases the one-off payment, the length of the relationship decreases the one-off payment. However, these two effects can overlap. A simple preparation of the formula, which allows the tax amount to be read from a table, is possible after mathematical simplifications. The customer pays a minimum of 21% on the relevant capital. Unlike the tax collection in Germany, this is a percentage of total wealth. A one-time payment of 41% is possible at the peak. To achieve such a value, the person concerned must achieve a tax burden of 34%. From a million euros assets, this value increases by one percent for every million additional assets. With assets of seven million euros, the top figure of 41% is achieved. However, a tax burden of 34% as the triggering hurdle will only be reached in rare exceptional cases. To do this, considerable new assets would have to have accrued by 2012 after the person concerned opened the relationship. Loads of 21% to 25% on the customer's assets are realistic.

Important factors are the identification of the initial capital stock and the relevant capital. The initial capital stock is the assets of the person concerned at the end of the year in which the relationship was opened. No later than December 31, 2002. The determination of the relevant capital is more complex. The relevant capital is determined using one of the following three methods:

- the assets of the person concerned at the end of 2010, if this value is higher than the assets at the end of 2012

- the assets of the person concerned at the end of 2012. However, a maximum of 120% of the assets at the end of 2010

- The sum of the assets at the end of 2010 plus the outflows from the years up to 2010, reduced by the inflows in 2011 and 2012 and increased by the increases in the value of the assets in 2011 and 2012. This rule only applies if the person concerned explicitly apply for this calculation to the paying agent by May 31, 2013 and the paying agent will provide the relevant documentation.

Affected persons who withdraw their assets after 2010 cannot reduce the one-off payment. Since this key date was only defined after the signature in the past, this rule represents a safeguard for the one-off payment. The definition of the 120 percent limit prevents a person concerned from consolidating additional, untaxed assets from other countries in Switzerland to the To take advantage of decriminalization through the tax treaty. The third variant offers affected persons who have distributed assets among several banks in Switzerland the possibility of returning them to a bank if necessary. This is necessary because switching banks in Switzerland (for example from one bank to two other banks) would lead to absurdly high one-off payments after December 31, 2010 (at least 42%).

As a modification of the formula, negative increases in value in 2010 and 2012 do not lead to a reduction in the relevant capital. This value is then set to zero in the calculation. Returns are the gross outflows in the years 2002 up to and including 2010, less the gross inflows in 2011 and 2012.

Comparisons between the top tax rate in Germany on income and the amount of the one-off payment under the tax treaty cannot be drawn. As shown, the one-off payment relates to the customer's assets at the end of 2010 or the end of 2012, regardless of which taxes were actually reduced by the person concerned. A constant addition of assets is reflected in a higher percentage, so that - despite a simplified calculation process - different customer behavior is taken into account.

Voluntary reporting as an alternative to a one-off payment

As a further option for tax regulation in the past, the data subject has the option of authorizing the paying agent to disclose personal data. The person concerned or the contractual partner must inform the paying agent in writing of their choice of this option by May 31, 2013. Most paying agents will use standardized forms for this. If the data subject chooses to report voluntarily, no one-off payment will be made by the paying agent. From the date on which the authorization to voluntarily report is issued, this is deemed to be the submission of a self-disclosure in Germany that exempts the penalty.

With the disclosure, the identity of the data subject, the account relationship and the asset status between the opening of the relationship (back to a maximum of December 31, 2003) and the end of 2012 are reported for each year. If the property is untaxed, the German authorities will approach the taxpayer and make a subsequent assessment. However, the voluntary report is considered an effective self-disclosure, so that the data subject is protected from the legal consequences from the date of submitting the voluntary report to the paying agent. However, the interest run for the penalty interest does not stop because no payment has been made. This is only possible with an effective voluntary disclosure. The person concerned receives a certificate from the paying agent. All transmitted data can be seen on it.

Affected customers who have declared their assets held in Switzerland in Germany and have taxed them regularly must also authorize the paying agent to voluntarily report them. They are also affected persons. If this is not done, the one-time payment will be made by the paying agent. In contrast to customers in Germany, the local tax office receives one-off knowledge of the customer's assets.

Start of a new customer relationship with a Swiss bank

The commencement of a customer relationship with a Swiss paying agent after December 31, 2010 is subject to special processes. Instead of until May 31, 2013, the persons concerned have to decide by June 30, 2013 for an option to regulate the tax past.

If the person concerned has transferred the assets from another Swiss paying agent and continues to have a relationship with this paying agent, the previous paying agent must carry out the settlement. The assets at the new paying agent are not taken into account. Since the values flowed out after December 31, 2010, the relevant capital will be the assets at the end of 2010 at the previous paying agent. Accordingly, the assets at the new paying agent are also recorded in this way. However, the person concerned must provide sufficient liquidity at the previous paying agent by May 31, 2013.

If the person concerned has brought assets from another Swiss paying agent, but has ended this relationship, the new paying agent must carry out the settlement. To do this, they must access the data from the previous paying agent. Therefore, the data subject must authorize both paying agents to exchange information. If this authorization is not given, or if the previous paying agent refuses to cooperate, the person concerned will be compulsorily notified by the current paying agent. This is considered an effective voluntary disclosure in Germany.

If the assets were not booked with any Swiss paying agent on December 31, 2010, the paying agent will not take any further action. In this case, the customer is not a data subject within the meaning of the tax agreement. It can be assumed that the Swiss banks will require proof from these customers that the assets are taxed or that they will terminate the relationship of their own accord.

Accompanying measures to ensure the implementation of the tax agreement

The tax treaty was controversial in both countries. Various actors in the two countries are interested in circumventing the tax treaty. For this reason, measures have been created in the tax treaty but also outside the tax treaty that make circumvention much more difficult or even impossible. The following levels should be mentioned:

- Ensuring the purpose of the agreement through measures anchored directly in the agreement

- Ensuring the purpose of the agreement through measures initiated by the paying agents

- Definition of a legal framework in Switzerland

- Binational agreements or supranational regulations that Switzerland and Germany have entered into

The strongest mechanism within the tax treaty is the retrospective definition of reference date 2 (December 31, 2010). On this key date, the person concerned and the assets concerned are identified. Important instruments are the comprehensive definition of the person concerned (including the majority of the known structures) and the fact that on January 1, 2013 only the right to use the assets is checked, but not their tax domicile. This means that the agreement cannot be circumvented through cash withdrawals, transfers, relocation of residence or the interposition of foundations or trusts.

- Mr. Schlau would like to evade the tax agreement through the intermediary of a foundation in Liechtenstein . Therefore, immediately after the publication of the agreement in 2011, he set up a foundation in Liechtenstein and dissolves his existing relationship with the Swiss paying agent. The foundation opens a new account in Switzerland. The assets are transferred from paying agent X to paying agent Y in Switzerland. This means that Mr. Schlau cannot escape the agreement. He is no longer a customer of paying agent X on January 1, 2013. Is no longer available for this paying agent. At the new paying agent Y, however, he is recorded as the beneficial owner of the foundation. Paying agent Y will contact the foundation by February 28, 2013 at the latest and point out that Mr. Schlau is an affected person and should notify paying agent Y by June 30, 2013 at the latest, which Swiss paying agent he was previously with and authorization to exchange data should sign. If Mr. Schlau refuses to sign this authorization, Mr. Schlau will be disclosed by the new paying agent Y. Mr. Schlau can also grant the authorization. In this case, the data from the previous paying agent X is used to calculate the one-off payment. Since Mr. Schlau was the sole beneficial owner of both relationships, both relationships can be linked. Due to the design, Mr. Schlau cannot escape the agreement, he also incurs transaction costs and the risk of discovery increases because Germany and Liechtenstein have had an information exchange agreement since the beginning of 2010.

However, the customer can end his relationship with a Swiss paying agent before December 31, 2012 and withdraw his assets from Switzerland. He is then no longer an affected person. To prohibit this would be tantamount to expropriating the people concerned. However, the tax treaty stipulates that the ten most important target countries, including shifted assets and the number of people, are reported to the German authorities. The German authorities can then put pressure on the target countries. Singapore is critical of the inflow of European funds. Figures on this were published for the first time during the expert hearing in the Bundestag Finance Committee on September 24, 2012. These support the assumption that hardly any funds flow into non-European countries. Another measure defined in the tax agreement is the review of the paying agent’s measures by the Swiss authority ( Federal Tax Administration , FTA). The report goes to the German authorities and can be made public. In addition, the tax treaty provides for up to 1,300 inquiries in the first two years. These can be used to check compliance with the tax agreement without naming a specific paying agent. The tax treaty also provides banks with a monetary incentive to implement the treaty. An advance payment of two billion francs is made by the Swiss banks, which, according to a distribution key, is only deemed to have been made when at least four billion francs have been transferred to Germany. This is a strong incentive for the banks to collect the one-off payment, especially since a considerable amount of assets have been declared through voluntary disclosures since the tax agreement was signed . These assets are no longer available as a basis for the voluntary disclosure.

Many paying agents have derived their own additional rules from the tax agreement. This is to prevent bypasses. The banks want to avoid making headlines after the introduction of the tax treaty. These rules include very severe restrictions on the customer to withdraw cash . The acceptance of new cash from Germany is only possible at all major banks if there is evidence that this money is taxed. This regulation was recently challenged by a German newspaper's mystery shopping and was complied with by all banks tested. However, the attempt to invest untaxed Swiss funds in Germany was "successful". Further rules concern the setting up of structures that are potentially suitable for evading the agreement. One possibility would be to bring the untaxed funds into a life insurance policy recognized for tax purposes in Germany . This would work like closing an account: the contractual partner is no longer the customer, but the life insurance company. Insurance that is recognized for tax purposes in Germany is not included in the assets concerned. For this reason, many banks require proof of the proper taxation of the assets to be brought in before entering into a relationship with the life insurance company.

In addition to these voluntary bank rules, the Swiss government has passed an introductory law for tax agreements. The federal law on international withholding taxation defines u. a. Penal provisions (Section 10). Even negligent endangerment of the one-off payment or the report is fined 20,000 francs per case. The provision of incorrect information is already included under negligence . A Swiss authority checks the implementation of the agreement directly at the Swiss banks and imposes severe penalties on violations. Some of these penalties have a direct impact on the consultant involved (in addition to the penalty for the bank).

The binational and supranational regulations are to be seen as the last stage of the accompanying measures . The possibility of making group inquiries in accordance with the OECD standard comes into consideration here . The double taxation agreement between Switzerland and Germany already contains the so-called large information clause. Germany has the option of querying typical behavioral patterns for tax evasion without specifying customer names. If a group request is permitted, the customer names will be reported via the Swiss authorities. The law enforcement authorities and tax investigators in Germany should be familiar with the samples because of the CD purchases and voluntary disclosures . In Switzerland it is currently still controversial whether these inquiries should apply from January 1, 2013 or from mid-July 2012 (OECD publication). A retroactive effect is currently mostly excluded. Germany also has congruent agreements with Mauritius , Bahamas and the Cayman Islands . This shows that Germany can take effective measures to detect tax evaders.

Self-disclosure exempt from punishment versus one-off payment

Affected persons with assets that are not subject to taxation generally have the options of one-off payment, voluntary reporting or voluntary disclosure . The problem of weighing up the one-off payment and the voluntary disclosure quickly arises. The question cannot be answered in general, but there are a few clues.

For customers with assets in Switzerland of less than 300 to 400 thousand Swiss francs , the voluntary disclosure will not be worthwhile. The fees for tax and legal advice eat up the economic advantage of self-disclosure.

Typical portfolios in Switzerland (buy-and-hold share strategy, low personal tax rate , observance of speculation deadlines ) often only result in a burden of 10 to 14% on total assets in the case of post-assessment. Customers for whom anonymity is not so important (for example, because they want to make a gift) prefer the way of self-disclosure, as do customers who may have other untaxed assets in other jurisdictions. The voluntary disclosure can be submitted immediately and is independent of the tax treaty.

Customers who care about anonymity or who have received one or more inheritances / gifts over the years may fare better with the one-off payment. No tax and / or legal expert is required for this. However, the decriminalization will not occur until mid-2013 and until then there is still a risk of discovery for the customer.

For customers with untaxed assets, the voluntary report is not recommended. In effect, this corresponds to a voluntary disclosure, but the interest run for subsequent taxation and penalty interest does not stop. The customer becomes dependent on the tax authorities, which will at some point carry out a subsequent assessment or request further documents. In this way, the customer hands over the reins of action.

Withholding tax for the future

In the future, Swiss banks will be able to withhold the German withholding tax directly like German paying agents. In principle, the same income as in Germany (interest, dividends, other income, capital gains) with the same tax rate of 26.375%, i.e. H. 25% capital gains tax plus 5.5% solidarity surcharge levied. A customer can also opt to withhold church tax, but only the higher church tax rate of 9% can be withheld. Alternatively, the customer can opt for disclosure. The Swiss banks do not have to offer both options. The customer must choose the option to tax in the future by December 31, 2012 at the latest. This choice is independent of the past option chosen. At a paying agent that offers both options, the customer can choose between the withholding tax and disclosure each year.

Reactions and criticism

The German Federal Ministry of Finance and the Federal Tax Administration welcomed the agreement in a joint declaration as a “good negotiation result for both states” and emphasized the aspects of tax justice and the mutual exchange of interests. They also made it clear that the agreement should enter into force in 2013 after approval by national parliaments. The Swiss Bankers Association welcomed the agreement as a "bridge to tax compliance while at the same time preserving their [customers] financial privacy" and hoped to negotiate with other countries.

Immediately after the agreement became known, there was clear public criticism of the agreement, as according to the criticism of the agreement, among other things, black money with very low taxation (low tax rate lump sum) can be whitewashed and there is no exchange of information to combat tax evasion. The SPD expressed sharp criticism of the agreement, which, in their opinion, guaranteed tax evaders too cheap impunity and announced that it might let the law fail in the Federal Council. Transparency International also expressed criticism of the long secrecy of the agreement and the non-transparent procedure.

The Tax Justice Network had prepared a detailed statement for the Bundestag Finance Committee. and previously criticized the following points in the agreement:

- The Swiss Bankers Association had already incorporated various circumvention options into the agreement. For example B. by interposing a trust from a third country or a Swiss company, taxation is excluded.

- Safe deposit boxes would be excluded. These could be used for the interim storage of funds beyond the deadline.

- Only paying agents over CHF 1 million in interest / dividend payments would be taken into account.

- Only a very small number of inquiries about German taxpayers are allowed. B. could be dragged on by planned delays by Switzerland and the filing of legal remedies.

- Active acquisition of information about German tax evaders is no longer possible.

According to the Swiss Bankers Association, the effective tax burden for most customers would have been around 20% - 25% of their assets. The Swiss banks criticized the high implementation costs amounting to what they say will probably be in the three-digit million range. Various German politicians said that the agreement did not mean that the possibility of buying more tax CDs would be taken away as a means of exerting pressure against tax refugees.

Renegotiations of the agreement also took place because of the concerns expressed by the European Union . However, a spokesman for the lead finance ministry in Rhineland-Palatinate stated at the end of March 2012 that the red-green led German states will not agree to the improved agreement either.

See also

- Double taxation

- Tax evasion , black money , money laundering

- Tax amnesty , voluntary disclosure , tax evasion , tax code

- Tax investigation , tax crime

literature

- Agreement between the Federal Republic of Germany and the Swiss Confederation on cooperation in the areas of taxes and the financial market of September 21, 2011. Website of the Federal Ministry of Finance . Retrieved October 7, 2017.

- Protocol to amend the agreement signed in Berlin on September 21, 2011 between the Federal Republic of Germany and the Swiss Confederation on cooperation in the areas of taxes and the financial market of April 5, 2012. Website of the Federal Ministry of Finance . Retrieved April 20, 2012.

- Agreement between the Swiss Confederation and the Federal Republic of Germany on cooperation in the areas of taxes and the financial market (PDF; 358 kB) dated September 21, 2011. Website of the Swiss Bankers Association . Retrieved January 12, 2012.

- Obenhaus, The tax agreement with Switzerland on untaxed investment income in: Die Steuerberatung - Stbg - 2011, p. 508

- Bearer, Hendrik: The failure of the tax agreement with Switzerland. Why did the Federal Council fail to give its approval twice, and what should be considered in new negotiations? , in: Zeitschrift für Politik, Vol. 60 (2013), no. 2, pp. 162–181.

Web links

- Withholding tax agreement between Switzerland and Germany , press release by the federal authorities of the Swiss Confederation , March 30, 2012

- Tax agreement and guidance , documents and the latest press review on the tax agreement, September 24, 2012

- Matthias Benz: The cavalry will not be retired. Analysis of the failure of the tax treaty. In: Neue Zürcher Zeitung from December 14, 2012

Individual evidence

- ↑ The Broken Tax Agreement - Bad Business? , WSI announcement 04/2013

- ↑ Tax agreement with Switzerland remains controversial , German Bundestag hearing of experts on September 24, 2012

- ↑ Council of States waves through tax treaties , article from May 29, 2012 on the website of the Schweizer Handelszeitung, accessed on September 25, 2012.

- ↑ National Council says yes to the tax agreement. Surprising no to the framework law , article from May 30, 2012, Swiss television website, accessed on September 25, 2012.

- ↑ Bundestag printed paper 17/12282, Federal Council plenary protocol No. 906

- ^ German black money in Switzerland is taxed , article from August 10, 2011, website of the Hamburger Abendblatt , accessed on January 12, 2012.

- ↑ German-Swiss working group presents agreement on taxation of black money , article from July 31, 2011, Spiegel Online website , accessed on January 12, 2012.

- ^ The semi-arid oasis article dated August 11, 2011, Spiegel Online website , accessed on January 12, 2012.

- ↑ Swiss television : “880 billion black money in Switzerland” , article from February 8, 2010

- ↑ Tax CD should bring in 400 million euros , article from February 5, 2010, Spiegel Online website , accessed on January 12, 2012.

- ↑ Az. 2 BvR 2101/09

- ↑ Investigators target Julius Baer's customers , article from August 22, 2012, website on Spiegel-Online, accessed on September 25, 2012.

- ↑ Swiss Tax Agreement, more inquiries and higher penalty tax , article from April 5, 2012, Swiss television website, accessed on September 25, 2012.

- ↑ Junge SVP, AUNS, JUSO and Bund der Steuerpayers seize referendum , article from June 30, 2012, news.ch website , accessed on September 25, 2012.

- ↑ Referendum against tax treaties failed , article from October 2, 2012, Swiss television website, accessed on October 5, 2012.

- ↑ Bundestag printed paper 17/12282, Federal Council plenary protocol No. 906

- ↑ Switzerland and Austria sign withholding tax agreements ( memento of the original from July 23, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , Article dated April 13, 2012, website of the State Secretariat for International Finance, accessed September 25, 2012.

- ↑ Switzerland and Italy agree on a dialogue on financial and tax issues ( Memento of the original dated November 16, 2012 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. , Article dated May 9, 2012, website of the State Secretariat for International Finance, accessed September 25, 2012.

- ↑ Tax agreement, guidelines and position papers of the experts before the Finance Committee of the Bundestag ( Memento of the original from September 27, 2012 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , Article from September 24, 2012, website of askWiki.ch in Switzerland, accessed on September 25, 2012.

- ↑ Federal Act on Banks and Savings Banks of November 8, 1943 (PDF; 212 kB) of March 1, 2012, website of the Swiss Confederation, accessed on September 25, 2012.

- ↑ Affected person is used as a fixed term in this context.

- ↑ Voluntary disclosures: The late regret of tax evaders , article from August 28, 2012, website of the Frankfurter Allgemeine Zeitung , accessed on September 25, 2012.

- ↑ Bundestag printed paper 17/11093 of October 18, 2012, p. 9

- ↑ Federal Act on Combating Money Laundering and Terrorist Financing in the Financial Sector ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. (PDF; 62 kB) of June 27, 2012, website of the Federal Department of Justice and Police, accessed on September 25, 2012.

- ↑ Guidelines of the Federal Tax Administration on the Tax Agreement ( Memento of the original dated December 29, 2015 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 1.5 MB), article from July 31, 2012, website of askWiki in Switzerland, accessed on September 25, 2012.

- ^ German black money in Switzerland is taxed , article from April 20, 2012, independent blog, accessed on September 25, 2012.

- ↑ a b c d Overall positive assessment of the tax agreement between Switzerland and Germany - Agreement in the interests of customers - Basis laid for repositioning the Swiss financial center - Financial privacy is preserved for tax-compliant customers ( Memento of the original dated November 4, 2013 on the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , Press release of August 10, 2011, website of the Swiss Bankers Association , accessed on January 12, 2012.

- ↑ Hechtner, Frank: Statement on the draft law of the Federal Government: Draft law on the agreement of September 21, 2011 between the Federal Republic of Germany and the Swiss Confederation on cooperation in the areas of taxes and the financial market in the version of April 5, 2012 ( Memento des Originals from July 14, 2014 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 82 kB) from September 24, 2012.

- ↑ Archived copy ( memento of the original from March 1, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Agreement of September 2, 2009 between the Government of the Federal Republic of Germany and the Government of the Principality of Liechtenstein on cooperation and the exchange of information in tax matters of September 2, 2009, website of the Federal Ministry of Finance , accessed on September 25, 2012.

- ↑ http://asia.legalbusinessonline.com/news/singapore-banks-warned-against-european-tax-evaders/109073 Singapore: Banks warned against European Tax evaders , article of August 27, 2012. Website of the magazine Asian Legal Business , accessed September 25, 2012.

- ↑ Tax evasion: Singapore denies German black money , article from August 23, 2012, Handelsblatt website , accessed on September 25, 2012.

- ↑ Statement by UBS AG to the Finance Committee of the German Bundestag ( Memento of the original dated September 3, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 164 kB) from September 24, 2012, accessed on September 25, 2012.

- ↑ Tax evaders: wave of voluntary disclosures , article from February 8, 2012, website of Focus magazine , accessed on September 25, 2012.

- ↑ Tax havens: Paradigm shift in the Swiss banking world , article from September 19, 2012, Handelsblatt website , accessed on September 25, 2012.

- ↑ German banks vying for Swiss black money , article from May 23, 2012, website of the Schweizer Handelszeitung , accessed on September 25, 2012.

- ↑ Federal Law on International Withholding Taxation (IQG) ( Memento of the original from January 8, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 74 kB) from May 23, 2012, accessed on September 25, 2012.

- ↑ update to article 26 of the OECD model tax convention and its commentary ( Memento of the original from March 4, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 520 kB) from July 17, 2012, accessed on September 25, 2012.

- ↑ Tax dispute - National Council Commission against retroactive group inquiries. No details, no point in time , article from September 10, 2012, website of the Swiss Parliament, accessed on September 25, 2012.

- ↑ Information on bank customer data is made easier , article from July 18, 2012, website of the Neue Zürcher Zeitung , accessed on September 25, 2012.

- ↑ Tax dispute: National Council says yes to group inquiries Article dated September 12, 2012, moneycab website , accessed on September 25, 2012.

- ↑ Agreement of October 7, 2011 between the Federal Republic of Germany and the Republic of Mauritius to avoid double taxation and tax reduction in the field of taxes on income ( Memento of the original from February 9, 2013 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. of October 7, 2011. Website of the Federal Ministry of Finance. Retrieved September 25, 2012.

- ↑ Agreement between the Federal Republic of Germany and the Commonwealth of the Bahamas on Assistance in Tax and Criminal Tax Matters through the Exchange of Information from April 9, 2011 ( Memento of the original from August 21, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked . Please check the original and archive link according to the instructions and then remove this notice. of June 29, 2011. Website of the Federal Ministry of Finance. Retrieved September 25, 2012.

- ↑ Agreement of May 27, 2010 between the Government of the Federal Republic of Germany and the Government of the Cayman Islands on support in tax and criminal tax matters through the exchange of information ( Memento of the original of January 31, 2014 in the Internet Archive ) Info: The archive link was automatically inserted and still Not checked. Please check the original and archive link according to the instructions and then remove this notice. of June 29, 2011. Website of the Federal Ministry of Finance. Retrieved September 25, 2012.

- ↑ Page no longer available , search in web archives: Switzerland and Germany sign tax agreement , press release of September 21, 2011, website of the Federal Department of Finance , accessed on January 12, 2012.

- ↑ Switzerland and Germany sign tax agreement ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. , Press release of September 21, 2011, website of the Federal Ministry of Finance , accessed on January 12, 2012.

- ↑ z. B. Ulrich Thielemann called it a coup that allows black money to be washed cheaply in white WOZ: The coup of the banking republic, August 25, 2011 and according to Lorenz Jarass, would facilitate tax evasion through the agreement. The hearing in the Bundestag gives an overview of the controversy: Tax agreement with Switzerland remains controversial, German Bundestag hearing of the experts on September 24, 2012

- ↑ Steinbrück wants to "saddle the horses" in the tax dispute . Article from September 21, 2011, website of the Süddeutsche Zeitung , accessed on January 12, 2012.

- ↑ Bundestag disputes tax agreement with Switzerland , article from September 29, 2011, website of the Augsburger Allgemeine , accessed on January 12, 2012.

- ↑ Die Welt: Swiss tax deal brings in billions of dollars , September 21, 2011; Transparency criticizes the federal government's secret negotiations with Switzerland on tax agreements ( memento of the original from June 20, 2015 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. , Original press release from September 20, 2011 by Transparency International Germany

- ^ TJN statement on the tax agreement in the Bundestag Finance Committee , accessed on September 25, 2012.

- ↑ For a handful of euros and data - Germany surrenders to Swiss banking secrecy (PDF; 327 kB), accessed on August 22, 2012.

- ^ New vortex about Swiss tax data , article from November 17, 2011, website of the Neue Zürcher Zeitung , accessed on January 12, 2012.

- ↑ Switzerland wants to outsmart the EU. Article in the SonntagsZeitung on December 25, 2011

- ↑ Dance about “renegotiation” of the tax agreement , article from November 19, 2011, website of the Neue Zürcher Zeitung , accessed on January 12, 2012.

- ↑ Tax treaty under fire , article from November 6, 2011, website of the Neue Zürcher Zeitung , accessed on January 12, 2012.

- ^ Schäuble wants to save tax agreements , Neue Zürcher Zeitung, March 30, 2012

![SB = \ max \ left \ {s \ cdot \ left [{\ frac {2} {3}} \ cdot \ left (K_ {r} - {\ frac {n} {8}} \ cdot K_ {b} \ right) + {\ frac {1} {3}} \ left ({\ frac {n} {10}} \ cdot K_ {r} + {\ frac {2} {10}} \ cdot \ left ({ \ frac {K_ {9} ^ {\ prime} + K _ {{10}} ^ {\ prime}} {2}} \ right) \ right) \ right], \ s _ {\ min} \ cdot K_ {r } \ right \}](https://wikimedia.org/api/rest_v1/media/math/render/svg/02b6e7d77660d480b450c6748e16b964ba3378e3)