List of recessions in the United States: Difference between revisions

→Recessions: cleanup |

→Recessions: cleanup |

||

| Line 5: | Line 5: | ||

==Recessions== |

==Recessions== |

||

[[Image:Gdp20-40.jpg|thumb|[[Great Depression]]: [[United States]] [[GDP]] annual pattern and long-term trend, 1920-40, in billions of constant dollars<ref> based on data in Susan Carter, ed. ''Historical Statistics of the US: Millennial Edition'' (2006) series Ca9 </ref>]] |

[[Image:Gdp20-40.jpg|thumb|[[Great Depression]]: [[United States]] [[GDP]] annual pattern and long-term trend, 1920-40, in billions of constant dollars<ref> based on data in Susan Carter, ed. ''Historical Statistics of the US: Millennial Edition'' (2006) series Ca9 </ref>]] |

||

[[Image:Oil Prices 1861 2006.jpg|thumb |

[[Image:Oil Prices 1861 2006.jpg|thumb|[[1973 oil crisis]]: Long-Term Oil Prices, 1861-2006 (orange line adjusted for inflation, black not adjusted).]] |

||

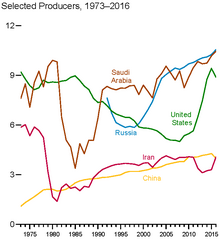

[[Image:Top Oil Producing Counties.png|thumb|[[1979 energy crisis]]: Graph of Top Oil Producing Counties, showing drop in Iran's Production <ref> http://www.eia.doe.gov/emeu/aer/pdf/pages/sec11_10.pdf</ref>]] |

[[Image:Top Oil Producing Counties.png|thumb|[[1979 energy crisis]]: Graph of Top Oil Producing Counties, showing drop in Iran's Production <ref> http://www.eia.doe.gov/emeu/aer/pdf/pages/sec11_10.pdf</ref>]] |

||

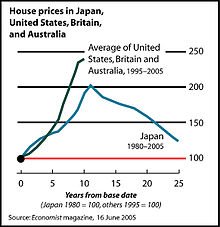

[[Image:EconomistHomePrices20050615.jpg|thumb|right|[[Japanese asset price bubble]]: Inflation-adjusted house prices in [[Japan]] (1980–2005) compared to house price appreciation the [[United States]], [[Great Britain|Britain]], and [[Australia]] (1995–2005).]] |

[[Image:EconomistHomePrices20050615.jpg|thumb|right|[[Japanese asset price bubble]]: Inflation-adjusted house prices in [[Japan]] (1980–2005) compared to house price appreciation the [[United States]], [[Great Britain|Britain]], and [[Australia]] (1995–2005).]] |

||

Revision as of 23:17, 29 February 2008

This is a list of recessions, financial crises, and depressions. A recession is defined as a decline in a country's gross domestic product (GDP), or negative real economic growth, for two or more successive quarters for a year. Recessions that have a Wikipedia article are considered notable and are therefore listed here. Many of the recessions listed here have affected economies on a worldwide scale, including the Great Depression, the late 1980s recession, and the early 2000s recession.

The list is sorted chronologically by the year when each recession first began, and from the earliest recession to the latest. Since recessions can affect several different countries beginning in different years, the recessions are considered to have begun during the year in which the recession was first recognized, while the recessions are considered to have ended the last year in which the recession was recognized. Also note that before detailed economic statistics began to be gathered in the nineteenth century, it was very difficult to tell when recessions occurred. In spite of this, prior to industrialization, economic recessions were typically caused by external actions on the economic system such as wars and variations in the weather.

Recessions

| Name | Duration | Comments | References |

|---|---|---|---|

| Panic of 1797 | 1797– 1800 | Bank of England's deflation crosses the Atlantic and disrupts commercial and real estate markets in the colonies and Caribbean. | |

| Panic of 1819 | 1819– 1824 | The first major financial crisis in the United States. | |

| Panic of 1837 | 1837– 1843 | A sharp downturn in the American economy caused by bank failures and lack of confidence in the paper currency | |

| Panic of 1857 | 1857– 1860 | Failure of the Ohio Life Insurance and Trust Company bursts a European speculative bubble in U.S. railroads and loss of confidence in U.S. banks | |

| Panic of 1873 | 1873– 1879 | Economic problems in Europe prompt the failure of Jay Cooke & Company, the largest bank in the U.S., bursting the post-Civil War speculative bubble | |

| Long Depression | 1873– 1896 | Begins with the collapse of the Vienna Stock Exchange and spreads throughout the world. Some historians do not believe it is actually one large recession. It is important to note that during this period the global industrial production greatly increased. In the US for example, industrial output increased 4 times. | |

| Panic of 1893 | 1893– 1896 | Failure of the U.S. Reading Railroad and withdrawal of European investment leads to a stock market and banking collapse. Duration: 17 months | |

| Panic of 1907 | 1907– 1908 | Begins with a run on Knickerbocker Trust Company stock October 22nd 1907 sets events in motion that will lead to a depression in the United States. Duration: 13 months | |

| Post-WWI recession | Marked by severe hyperinflation in Europe over production in North America. Very sharp, but also brief. | ||

| Great Depression | 1929– 1939 | Stock market crash, banking collapse in the United States sparks a global downturn, including a second but not heavy downturn in the U.S., the Recession of 1937. Durations: 43 and 13 months respectiviely. | |

| Post-Korean War Recession | 1953– 1954 | The Recession of 1953 was a demand-driven recession due to poor government policies and high interest rates. Duration: 10 months | |

| 1973 oil crisis | 1973– 1975 | A quadrupling of oil prices by OPEC coupled with high government spending due to the Vietnam War leads to stagflation in the United States. Duration: 16 months | |

| 1979 energy crisis | 1979– 1980 | The Iranian Revolution sharply increases the price of oil | |

| Great Commodities Depression | 1980– 2000 | General recession in commodity prices | |

| Early 1980s recession | 1982– 1983 | Caused by tight monetary policy in the U.S. to control inflation and sharp correction to overproduction of the previous decade which had been masked by inflation | |

| Late 1980s recession | 1987– 1995 | On Black Monday of October 1987 a stock collapse of unprecedented size lopped 22.6 percent off the Dow Jones Industrial Average. The collapse, larger than that of 1929, was handled well by the economy and the stock market began to quickly recover. However the lumbering savings and loans were beginning to collapse, putting the savings of millions of Americans in jeopardy. | |

| Early 1990s recession | 1990– 1992 | Collapse of junk bonds and a credit crunch in the United States leads to one quarter of US GDP decline, and therefore not an official recession. | |

| Japanese recession | 1990– 2003 | Collapse of a real estate bubble and more fundamental problems halts Japan's once astronomical growth | |

| Asian financial crisis | 1997 | A collapse of the Thai currency inflicts damage on many of the economies of Asia | |

| Early 2000s recession | 2001– 2003 | The collapse of the Dot Com Bubble, September 11th attacks and accounting scandals contribute to a relatively mild contraction in the North American economy. Since the US GDP never actually declined in this period it is not considered an official recession. |

See also

References

- ^ based on data in Susan Carter, ed. Historical Statistics of the US: Millennial Edition (2006) series Ca9

- ^ http://www.eia.doe.gov/emeu/aer/pdf/pages/sec11_10.pdf