Parental Allowance (Germany)

The parental allowance is a transfer payment that is dependent on the net income as compensation for specific disadvantages in the early phase of starting a family and thus a parent-related, time-limited compensation payment . The parental allowance takes the place of the previous childcare allowance . Parents who are not or not fully employed because of caring for a child or who interrupt their employment to care for their child are entitled to parental allowance . It is intended to support the parents in securing their livelihood and is therefore designed as a compensation payment.

In 2013, 4.9 billion euros were paid out as parental allowance (this was 83% of all expenses by the Federal Ministry of Family Affairs ). Almost 80 percent of the men receiving parental allowance took two months of parental leave ; 92 percent of the receiving women took 10 to 12 months.

General

The law on parental allowance and parental leave (BEEG), which applies to children born on or after January 1, 2007, replaced the previous parental allowance. Parental allowance is generally limited to twelve months immediately after the child is born. The entitlement can be extended to a maximum of 14 months over (at least two) partner months. Single parents who have sole custody or at least sole right to determine residence are entitled to fourteen months of parental allowance (Section 4 (3) BEEG). The amount of the parental allowance is based on the net income of the parent who applies for parental allowance and serves as compensation. Parents who were unemployed or without income before the child was born receive the minimum amount of 300 euros for 14 months. Parents who were not working received more financial support before the introduction of parental allowance; see the section “Historical Development” .

From the Scandinavian model, the rule was adopted to reserve a fixed portion of the duration of the parental allowance for both the mother and the father. A right to parental leave is a child while under the age of three have, but no more than fourteen months is long granted parental benefits. This is intended to provide an incentive to return to work earlier.

The parental allowance plus , which came into force on July 1, 2015 , extended part-time use of the 14 parental allowance months to up to twice the duration.

Political goal setting

With the parental allowance, the legislature wants to achieve various goals that it developed in the context of sustainable family policy. It is a paradigm shift in family policy . The parental allowance is primarily intended to enable a person to leave their profession temporarily without having to accept excessive restrictions on living standards. According to the justification of the law, it should give people more courage to have more children so that they can make a contribution to securing their future. Chancellor Angela Merkel emphasized that the linking of the parental allowance to the amount of the previous salary should encourage academics in particular to opt for more children. In doing so, however, she assumed the presumably false assumption that 40 percent of female academics are childless.

According to its conception, the parental allowance tries to compensate for the so-called roller coaster effect : This effect consists in the fact that within the framework of modern partnership models in which both partners are gainfully employed, the birth of the child usually leads to one partner (mostly the woman) doing his job gives up and becomes dependent on the other partner (mostly the man). The family income drops significantly with the birth of each child, until it is old enough that both partners can be (fully) gainfully employed again. Since the European family model is culturally based on economic independence from the family of origin, the re-entry of economic dependencies (on the partner who has left working life) and the significant drop in income levels are experienced as unpleasant. The roller coaster effect is therefore considered to be the central reason for the low birth rate of 'highly qualified' people, for whom this effect is particularly evident.

One of the main incentive mechanisms of parental allowance is a partial compensation of the opportunity costs of childcare, which should also encourage fathers to share work in partnership.

Legal bases

The Federal Parental Allowance and Parental Leave Act came into force on January 1, 2007 and has been amended several times since then.

Authorized

- According to Section 1 (1) BEEG, anyone who

- has a place of residence or habitual abode in Germany,

- lives in a household with his child,

- this child looks after and brings up and

- has no or no full gainful employment.

- Under certain conditions ( Section 1 (2) to (7) BEEG), other people can also be entitled to parental allowance.

- The requirement that the child must be looked after by the recipient of the parental allowance does not preclude other people or institutions from being involved in the care and upbringing of the child.

Foreigners can essentially only claim parental allowance if they are also entitled to child allowance , i.e. either have a settlement permit or a residence permit for humanitarian reasons , if they have been legally resident in Germany for three years and have been employed. The Federal Constitutional Court, however, declared the requirement of gainful employment to receive parental allowance to be unconstitutional and null and void.

Reference period and duration

Parental allowance is paid for months of the child's life and not for calendar months. For example, if a child is born on July 27th, the first month of entitlement runs from July 27th to August 26th, the second from August 27th to September 26th, and the third from September 27th to October 26th, up to the fourteenth and a maximum of the last month of entitlement from August 27 to September 26 of the following year. Income accruing during one month of life for which parental allowance is paid is offset against the parental allowance and either reduce it by the full amount of the income (wage replacement benefits such as maternity allowance) or proportionally in the case of income from gainful employment (see the following list).

- Parental allowance can be received from the day of birth up to the child's 14th month. Parental Allowance Plus (from July 1, 2015) allows you to extend this period if you use part-time.

- The application for parental allowance must indicate the months for which parental allowance is being applied for. Parental allowance can be paid retrospectively for up to three months. The decision made in the application can be changed once up to the end of the reference period without giving reasons.

- Parental allowance is paid for up to twelve months (freely distributable among the partners) and extended by two so-called "partner months" if the second parent takes parental leave for at least these two months and if one parent reduces their income during the reference period. That already applies if the child 's mother receives the maternity allowance . The months of parental allowance can also be claimed at the same time (e.g. seven months for both parents).

- Single parents with sole custody or right to determine residence can also claim the two “partner months” for themselves if the child's mother was gainfully employed before the child was born.

- The reference period for parental allowance can be extended to double if it is only used half a month.

- Anyone who had more than € 250,000 in the last completed assessment period, or more than € 500,000 in taxable income in the case of two entitled persons, is not entitled to parental allowance (Section 1 (8) BEEG).

Flexibility and partner bonus through Elterngeld Plus

Parents of children born on or after July 1, 2015 are entitled to parental benefit plus , a flexible parental benefit payment. The parental allowance Plus can be "twice as long and half as high as the full parental allowance" while part-time work are related. However, partners who share childcare in half at the same time continue to be disadvantaged by parental allowance compared to couples in whom one of the two only looks after and the other works full-time, as it may support them significantly less:

- Example: Earn e.g. As both parents before birth above the compulsory insurance limit insured voluntarily by law and are then available to the parent who only cares for the child, the maximum rate of 1,800 € parental allowance per month, while the other z. B. works 40 hours a week.

- If the two parents split the 40 hours into 20 hours per week with a gross income of € 2,401 per month, then the total funding with Parental Allowance Plus for both parents together is only € 1,364 per month (€ 682 + € 682). From € 3,771 gross per parent, there is only the minimum rate of € 300 (€ 150 + € 150). In the latter case, the funding for shared care is € 1,500 lower per month than for care by one parent.

- If, on the other hand, one partner stays 100% at home and the other works 100% in the meantime and the couple changes roles after a few months, the couple receives full parental allowance of 1,800 € parental allowance per month or, with parental allowance plus , twice as long € 900 parental allowance per month Month.

In addition, a partnership bonus "eg in the amount of 10% of the parental allowance" is paid if the parents both work 25 to 30 hours a week while receiving parental allowance. These are four consecutive additional months of parental allowance for parents who are simultaneously gainfully employed for 25 to 30 hours per week. Criticism is that the partner bonus is completely eliminated if only one parent works an hour more or less and these limits are difficult for self-employed people to strictly adhere to, for example if a child becomes ill.

The partnership bonus is partly similar to the equal opportunities bonus ( jämställdhetsbonus ) of the Swedish parental allowance .

Relevant income (assessment period)

In principle, the average net income of the applicant from gainful employment in the twelve calendar months prior to the calendar month of the birth is decisive for the calculation of the parental allowance (monthly net). Only calendar months are taken into account for which no maternity allowance or parental allowance was received for another child. Months in which there was a loss of income due to a pregnancy-related illness or due to military and community service are not taken into account, although according to case law it is irrelevant which pregnancy is involved. Due to these factors, the assessment period can extend to well over twelve months. In the case of employees , the monthly net results from the monthly gross minus taxes , minus statutory social contributions , minus 1/12 of the flat -rate amount for income-related expenses . For the self-employed , the monthly net results from 1/12 of the annual profit. For employees, the monthly net depends on the choice of tax class . A change to a more favorable tax class to increase the net income is possible before submitting the application. The starting point is income without bonus payments, Christmas bonuses, vacation pay, surcharges for Sunday, holiday and night work. For the self-employed, a longer period can also be decisive. For self-employed persons who were gainfully employed in their last financial year , these twelve months apply (Section 2 (9) BEEG). The monthly net also includes wages in the case of certain employment bans ( Section 18 MuSchG ), but not : unemployment benefit , unemployment benefit II, short-time work allowance, seasonal short-time work allowance, foreign compensation benefits, housing allowance, social assistance, domestic help from the health insurance company, pensions, scholarships, BAföG, sick pay a statutory or private health insurance.

Changes from January 1, 2013

As of January 1, 2013, the law to simplify the enforcement of parental allowance changed how the relevant net income is calculated. In the case of employment, the current gross income subject to wage tax is taken from every wage or salary slip , from which a fictitious net income is calculated using computer control . Exemptions on the income tax card are not taken into account. In the case of profit income , the net income is also calculated using flat tax rates. Here, the income tax is calculated by the on average monthly earnings Lohnsteuertabelle is applied. The changes apply to children born on or after January 1, 2013 ( Section 27 (1) BEEG).

The law has made it difficult for married couples to optimize the amount of parental allowance after the birth by changing the tax class during pregnancy. A change in tax class after the pregnancy becomes known is now only taken into account if it was submitted to the tax office seven calendar months before the start of maternity leave.

Amount of parental allowance

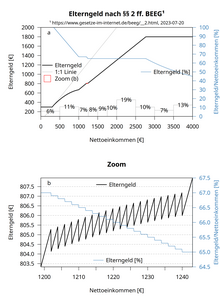

- The parental allowance is income-related and amounts to between 65 and 100 percent of the previous net monthly income, a maximum of 1,800 euros, at least 300 euros per month (§ § 2 ff. BEEG). The amount of the parental allowance is based on the average relevant (see postponement balance ) monthly net income of the requesting parent in the 12 months before the birth of the child.

| Monthly net income | Share of the resulting parental allowance in the lost income |

|---|---|

| between 0 and 1000 euros | 67 percent increases by 0.1 percentage points for every two euros by which the monthly net falls below 1,000 euros, up to a maximum of 100 percent. If the earned income falls to zero during parental leave and the monthly net of the applicant is between 300 and 340 euros, the parental allowance is 100% of the monthly net. Mothers or fathers who did not receive any income during the assessment period receive a minimum parental allowance of 300 euros, which is offset against the social benefits listed in the following section. |

| between 1,000 and 1,200 euros | 67 percent |

| higher than 1,200 euros | 67 percent drops by 0.1 percentage points for every two euros by which the monthly net exceeds 1,200 euros to up to 65 percent, which is reached from a monthly net of 1,240 euros. |

| higher than 2,769.23 euros | The parental allowance is generally 1,800 euros (= 65% of 2,769.23 euros; maximum value) |

- A flat-rate advertising fee of 83.33 euros per month is deducted from the previous net monthly income calculated by the parental allowance office. Only then does the parental allowance arise. The lump sum for advertising costs is set as an earmarked earlier salary, which was mainly spent on commuting (distance lump sum) or the like, therefore was virtually never available (and therefore not taxed during working hours) and is therefore omitted during parental leave, that is is deducted from the salary as if the salary was previously 83.33 euros lower per month.

- Unemployment has different effects on maternity protection and parental benefit entitlement: While the entitlement to maternity benefit depends on the existence of an employment relationship, the amount of parental benefit is only linked to the average income during the assessment period, but is otherwise not dependent on the existence of an employment relationship.

- If a father or mother reduces the workload by the hour after the birth , this part-time employment relationship may not exceed 30 hours per week, otherwise there is no entitlement to parental allowance.

- For part-time employees, the income from part-time work is also taken into account. "The caring parent receives the parental allowance as a replacement for the lost part of the income. This is the difference between the average income before the birth and the expected average income from part-time work while receiving the parental allowance. The replacement rate is used to calculate the parental allowance The following applies to the income before the birth: This is at least 65 or 67 percent, for income of less than 1,000 euros before the birth up to 100 percent. However, a maximum of 2,770 euros is taken into account as income before the birth. "

- Since the parental allowance is paid for months of the child's life, not for calendar months, the income is also credited to the months of life. For example, if the child was born on the 4th of a calendar month, one month of life lasts from the 4th of the month to the 3rd of the following month. It may be cheaper to take up part-time employment while receiving parental allowance at the same time as the beginning of a month of life or to end it at the same time as the end of a month. If part-time employment is started at the beginning of a calendar month, income would already be credited for the month that has started and lasts until the third of the calendar month.

- Example: Monthly net before the birth EUR 1,200. Birth of the child on April 4th. The mother earns € 400 in the calendar month of June, and her monthly net income for the months of 4 May to 3 June and 4 June to 3 July is 200 euros. She receives EUR 670 parental allowance in each of the two months in which she has earned income (67% of the difference between 1,200 and 200). If the mother achieved the EUR 400 in the period from June 4 to July 3, she would receive EUR 536 parental allowance for that month (67% of the difference between 1,200 and 400), but in the previous month she would still have the full parental allowance of 804 EUR. In the first case, the total of the parental allowance for the two months is € 1,340 (€ 670 + € 670), in the second case it is also € 1,340 (€ 536 + € 804).

- Anyone who has a child younger than three or at least two children younger than six (not counting the newborn) receives a sibling bonus as an addition to the parental allowance. This is ten percent, but at least 75 euros per month.

- In the case of multiple births, there is a bonus of 300 euros per month for the second and each subsequent child. This regulation was reviewed by the Federal Social Court, which ruled on June 27, 2013 that parents who have twin or multiple births not only have one parental allowance per birth, but also a separate parental allowance for each newborn child. Parents can apply for the additional parental allowance amounts at their local parental allowance office - not only for periods from June 27, 2013, but also retrospectively for earlier parental allowance periods from January 1, 2009 if the application is received by the end of 2013 or from January 1, 2010 if the application is received until the end of 2014. The BMFSFJ explained: “If a parent uses the parental allowance per month for only one of the children, he receives the income-related parental allowance for this child plus the multiple surcharges of 300 euros each for the other children. For the other child or the other children, the other parent can receive the parental allowance at the same time. ”However, the legal regulations are to be changed on January 1, 2015 so that for multiple births there is only an entitlement to parental allowance with multiple surcharges.

Tax treatment

Parental allowance is exempt from social security contributions and tax, but is subject to the progression proviso ( Section 32b (1) EStG).

Crediting of other social benefits

Other compensation payments “which, according to their intended purpose, completely or partially replace this income from gainful employment” are offset against the parental allowance ( Section 3 (2) BEEG). According to the guideline to § 3 BEEG, the following creditable services are involved:

- Old-age pension ( Sections 34-37, 40, 42, 236-238 SGB VI) and comparable benefits from private insurance companies

- Unemployment benefit ( § 86a SVG)

- Unemployment benefits ( §§ 136 ff SGB III), partial unemployment benefit ( § 162 SGB III)

- Vocational training allowance ( Sections 56 ff. SGB III)

- Parental allowance for an older child

- Disability pension ( Sections 43, 67, 93, 94, 96a, 240, 241 SGB VI) and comparable benefits from private insurance companies

- Start-up grant ( §§ 93 f SGB III)

- Insolvency money ( Sections 165–175 SGB III)

- Sickness benefit ( Sections 44-51 SGB V, Sections 12, 13 KVLG 1989)

- Short -time work allowance and seasonal short-time work allowance ( Sections 95 to 111 SGB III)

- Maternity allowance according to § 19 MuSchG, insofar as it is paid for the period of the eight-week ban on employment after the birth.

- Transitional grant ( §§ 12, 13 SVG)

- Transitional allowance §§ 119 to 121 SGB III for participation in benefits for participation in working life ( § 112 ff SGB III in conjunction with § 49 and §§ 64 ff. SGB IX)

- Transitional allowance ( §§ 20 ff SGB VI, §§ 49, 50 SGB VII)

- Transitional allowance TVöD

- Compensation for loss of earnings according to §§ 13, 13c USG from the funds of the European Social Fund

- comparable foreign compensation payments

- Injury benefit ( Sections 45-48, 52, 55 SGB VII)

- Injury pension ( Sections 56-60 SGB VII) and comparable benefits from private insurance companies

- Supply sickpay ( §§ 16-16h, 18a BVG and §§ 82, 83 SVG, §§ 48.49 ZDG, § 1 OEG i. V. m. § 16ff BVG, § 60 m IfSG i. V. §§ 16ff BVG)

These benefits are not taken into account if the entitlement to parental allowance is limited to the minimum parental allowance and, if applicable, the multiple birth bonus.

Parental benefit when receiving unemployment benefit I

The following options can be considered when drawing unemployment benefit I and parental benefit:

- Parental allowance is only drawn if the entitlement to unemployment benefit I is suspended. This means that the income from the time as an employee is used as a basis for assessment.

- Both funds are withdrawn at the same time. ALG I is offset against the amount of parental allowance, only 300 euros remain free. This means that ALG I and reduced parental allowance are paid.

Parental benefit when receiving unemployment benefit II

Since January 1, 2011, parental allowance has been offset against benefits according to Hartz IV as well as social assistance and child allowance according to § 6a BKGG. This also applies to parents who have made use of the extension option according to § 6 sentence 2 BEEG before the introduction of the crediting and have not revoked this before January 1, 2011. However, 300 euros remain exempt from a parental allowance entitlement resulting from employment (Section 10 (5) BEEG).

Parental allowance for employees of European institutions

The parental allowance offices of the federal states of Hesse (seat of the European Central Bank ) and Bavaria ( European Patent Office ) have in the past denied the employees of these authorities the payment of parental allowance. This was justified by the fact that these European institutions have their own social system. It was also argued that the parental allowance is tax financed and that the employees of European institutions do not pay any German taxes. The European Court has regard to the European Central Bank in a preliminary ruling judged the Hessian State Social Court that the Federal Republic must grant the persons working parents money. This means that employees of the central bank and the patent office should in principle be entitled to parental allowance (possibly taking into account comparable benefits).

Health insurance coverage while receiving parental allowance

- Parental allowance recipients who were statutory health insurance as compulsory members before they received the parental allowance (exception according to § 5 Abs. 1 Nr. 13 SGB V) are insured free of charge for the duration of the parental allowance receipt, provided they have no other income besides the parental allowance ( § 192 Paragraph 1 No. 2 and Section 224 Paragraph 1 SGB V). For students who are subject to compulsory insurance, however, the obligation to contribute continues if they remain enrolled.

- Those previously voluntarily insured in statutory health insurance must (continue to) pay the contribution for voluntarily insured persons. If you have no other income besides parental allowance, you pay the minimum contribution. It should be noted that in addition to a possible income from non-self-employed work, many other types of income are also taken into account during this time (see list under "Weblinks").

- However, if they are married, they may switch to the non-contributory family insurance if they meet the other requirements.

- Married people and those living in a registered partnership cannot take out family insurance through their privately insured partner. If you are voluntarily insured by law, half of the partner's income will be taken into account when calculating the contribution. The monthly contributions are then up to approx. 300 € and are to be paid during parental leave and afterwards if no employment is taken up or sought.

- Privately insured persons still have to pay their contributions.

Statistics on recipients of parental allowance

Of the children born in 2008, 96% of mothers and 21% of fathers applied for parental leave. Parental allowance was claimed by 27 percent of fathers in Bavaria, but only by 12 percent in Saarland. In 2012 fathers received an average of 1,140 euros nationwide, mothers 701 euros. The reasons for the differences were, among other things, differences in the labor force participation of men and women, 9 out of 10 men but only 7 out of 10 women were employed before the birth of their child.

| receiver | 2009 | 2010 | 2011 | 2012 | 2013 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|

| Mothers | 630.906 | 642,572 | 623.454 | 640.084 | 657.033 | 1,350,000 | 1,400,000 |

| Fathers | 153.141 | 167,659 | 176.719 | 194.275 | 217,545 | 410,000 | 433,000 |

| total | 784.047 | 810.231 | 800.173 | 834.359 | 874.578 | 1,760,000 | 1,833,000 |

According to a study, the parental allowance has led to an increase in the income of parents of young children. Academic families, older parents and parents of only children benefited the most, very young parents and single parents, on the other hand, are worse off than before thanks to the parental allowance. 28% of fathers took parental leave. The average length of parental leave for fathers was 3.3 months. According to another study, the number of first-time women with university degrees rose by 30% after the introduction of parental allowance. Among the women with the highest income, the number of births increased by 70%.

In 2017, 1.35 million mothers and 410,000 fathers received parental allowance, in 2018 the figure was 1.4 million mothers and 433,000 fathers.

criticism

Crediting of unemployment benefit II

The crediting of unemployment benefit II was often criticized as a de facto deletion of parental benefit for Hartz IV recipients. In the parental allowance report of the federal government, however, it was emphasized that the parental allowance is not a benefit that is intended to raise the economic basis of the family above the level existing before the birth. It was designed to compensate for specific disadvantages in the early phase of starting a family as a wage replacement benefit. For this reason, the payments are limited in time. Social counseling centers and social associations criticized that the de facto cancellation of parental allowance for Hartz IV recipients made it more difficult to decide to have a child in pregnancy conflict counseling .

Disadvantageous parents with no income

Unemployed and low-earning parents received a total transfer benefit of € 7,200 per child up to 2006 with the social compensatory child-raising allowance paid for two years, from 2007 with the one-year parental allowance paid € 3,600 per child. The monthly amount is 300 euros each.

Research on household income from 2008 indicates that household income in the year after the birth of the child is not necessarily lower than before: “A comparison of household income in the year before and after the birth of the youngest child shows that 80 percent of families with less than EUR 1,000 net household income in the year after the birth have as much or more money at their disposal than before. "" 67% of families with an income of over EUR 3,000 net have less money than before the birth ". Other calculations show that 57-62% of those receiving parental allowance were worse off.

Different amount of parental allowance

The different amount of the parental allowance, which results from the assessment of the previous income, is criticized by the party Die Linke , the Ecological Democratic Party , the family party and parts of the CDU, such as the former Prime Minister of Baden-Württemberg Erwin Teufel . Double-earning couples and previously working single parents would be promoted to a considerable extent, while single-earning families and low-earning and unemployed parents, young parents still in education and parents with multiple children would be worse off.

From a scientific and legal point of view, the unequal amount of parental allowance was criticized by Christian Seiler even before the law came into force . The earning family is discriminated against. In the light of the value decision of Article 6 of the Basic Law, every child must be equally welcome to the state, so that the only distinguishing feature is parental education, but not prenatal income, especially since parental allowance, unlike other compensation benefits, is not the equivalent of a larger previous one Contribution is.

In a legal opinion on the constitutionality of § 2 BEEG commissioned by the ÖDP , Thorsten Kingreen comes to the conclusion that the parental allowance transports the one-sided model of an upbringing oriented towards gainful employment, thus an ethical model of the “right” and “good” marriage and family life. There is no justification for this. As a tax-financed social benefit, the parental allowance is not justified by the welfare state principle, since it is a compensation benefit which, without any advance payment on the part of the entitled persons, improves people with a higher income before the birth of the child than those with a low income or no income at all, even though this group of people is precisely that tends to be needier. Parental allowance is the only, non-causal, tax-financed compensation payment that is foreign to German social law. The relationship to prenatal income leads to a disadvantage of families with more than one child, which increases with the number of children. The expert assesses § 2 BEEG as incompatible with Art 3 Paragraph 1 and Art 6 Paragraph 1 of the Basic Law.

In the opinion of the Federal Social Court, linking the parental allowance to the income from employment received in the twelve-month period prior to the birth of the child is constitutional. In the context of a non-acceptance decision, the Federal Constitutional Court has § 2 (7) sentence 5 BEEG (in the version valid until September 18, 2012), according to which parents who take parental leave beyond the parental allowance period may receive lower parental allowance for another child are considered constitutional as parents who have earned an income for the previous child after the parental allowance period. The legislature does not exceed its discretion if it gives the parental allowance an income-replacing function. With the parental allowance designed in this way, the state does not violate its duty to recognize any decisions made by parents in the service of the child's best interests, such as how they shaped their family life, and to not attach any disadvantageous legal consequences to them. With the establishment of parental allowance and parental leave, the state is already promoting the possibility of looking after children to a considerable extent. According to a decision by the Federal Constitutional Court, the income-related nature of the parental allowance according to Section 2 (1) BEEG is also compatible with the Basic Law. The unequal treatment associated with the income-related differentiation of the amount of parental allowance is constitutionally justified. The main focus of the parental allowance is to support parents with low and medium incomes, as they are usually earned at the beginning of their working life. In view of this legal objective, it is acceptable that there would be differences in support between families depending on the parents' prenatal income, especially since parents without prenatal income did not remain entirely without support.

The Chamber justifies its decision by stating that Article 3, Paragraph 2 of the Basic Law obliges the legislature to “enforce gender equality in social reality and overcome traditional roles” (Rn 18) and the “partnership-based participation” of both parents in upbringing - and strengthening care tasks (margin no. 19). Johannes Resch is of the opinion that the Chamber redefined the terms "gender equality" and "partnership participation" to a politically prescribed "equality in working life", which in many cases precisely prevents a partnership, ie amicable, solution according to the wishes of the parents . The mandate of the Basic Law is thus inadmissibly reinterpreted as a state right to paternalize parents.

In the opinion of the ÖDP politician Johannes Resch, this chamber decision contradicts fundamental judgments of the Federal Constitutional Court.

Qualitative population policy

According to Christoph Butterwegge, the parental allowance should "primarily motivate high-earning, highly qualified women [...] to have more children and then return to work as quickly as possible". For recipients of Unemployment Benefit II, students and low-income people, the conversion of the childcare allowance into parental allowance resulted in significant financial disadvantages, even if the basic amount of 300 € was retained.

Both the discussion before the legal anchoring of the parental allowance and the justification both in the draft bill and in the joint coalition declaration speak for the fact that a "qualitative population policy " should be made with the parental allowance . He criticizes this because in Germany there is no poverty, but rather among children. According to the draft bill: “It is particularly striking that a total of 39 percent of 35 to 39-year-old female academics in Germany live without children in the household.” In contrast, DIW Berlin found in a study: “About a quarter of men like that Women in the upper income bracket remain permanently childless. ”[Herv. not in the original].

Combined compensation and social benefits

The social judge Jürgen Borchert considers the parental allowance to be insufficient and, at 12 months, too short compared to how much German society provides for those over 55 years of age. The regulation with two thirds of the last income for the parental benefit is modeled on the unemployment benefit. In comparison with the early retirement scheme and partial retirement scheme for over 55-year-olds, who are set to half their working hours at 70 to 80 percent of their last net wage, it is clear which different standards are used in Germany, depending on whether they are older people or children goes.

The special construction of the parental allowance was criticized, which is not a pure compensation payment , but is paid around a third as a social benefit (minimum parental allowance , top-up for low-wage earners, sibling bonus). The mixing of social benefits and family policy goals leads to systematic breaks. This is also reflected in the different ways in which parental allowance is calculated. For example, children of recipients of unemployment benefit II would already be taken into account within the framework of the community of needs with 60% of the standard rate up to the age of 14 and 80% of the standard rate up to the age of majority. Targeted support for low-income families with children is already provided through the unlimited child allowance . Wage replacement function or social aspects could not justify the granting of minimum parental allowance. From another side the minimum parental allowance was described as too low.

Before it came into force, the Federal Audit Office also criticized the unequal treatment that would result from the mixing of social benefits and earnings replacement benefits, in particular that recipients of unemployment benefit I receive an additional € 300 minimum parental benefit .

Criticism also met with the failure to take into account short - time working allowance received before parental leave when calculating the amount of parental allowance and details of grandparent leave .

Partner months, crediting of income and flexibility

The attempt to influence the family-internal distribution of tasks by the state through the two partner months was, in the opinion of some critics, considered constitutionally problematic, but no constitutional complaint was filed in this regard. Critics saw a violation of Article 6, Paragraph 2 of the Basic Law , which guaranteed the care and upbringing of children as the “natural right of parents”. In addition, Article 6.1 of the Basic Law protects the decision of spouses about the division of labor during marriage , free from state influence. Both arguments were countered by the fact that Article 3 (2) of the Basic Law obliges the state to take measures to actually achieve equality between women and men; this view is in line with the European Parental Leave Directive 96/34 / EC , which assumes non-transferability.

The exception for single parents is also unsystematic . If you do not work or work only slightly, you will receive parental allowance for the full 14 months. The regulation to claim the “partner months” is more generous than is necessary to fulfill the purpose of the law. Single parents who work more than 30 hours for a living or who have to work due to their self-employment are excluded from parental allowance. Many self-employed people who have an irregular and relatively low income, who are in the start-up phase or who work in the business of their spouse, are only entitled to the minimum parental allowance. In a resolution by the FDP parliamentary group from November 2008, which refers to the Sixth Report of the Federal Republic of Germany on the CEDAW Convention, it was called for "the discrimination against the self-employed to be abolished" with regard to parental allowance . The FDP politician Ina Lenke criticized the fact that the parental allowance falls if payments are received during parental leave for invoices issued before parental leave, and because of the burden of proof when applying for freelancers , “many professionally successful mothers and fathers would accept it from the start dispense". In 2011, the State Social Court of North Rhine-Westphalia ruled that the work income paid back to the self-employed does not reduce the parental allowance; the Federal Social Court has meanwhile ruled that inflows during the reference period should be offset against parental allowance.

The Institute for Economic and Social Sciences criticized the fact that those parents would be severely disadvantaged who wanted to share family and gainful employment as partners in the months after the birth and at the same time reduced their working hours. If mother and father both work part-time at the same time, they would not be entitled to parental allowance for fourteen but only seven months. As a result, if, for example, everyone had the same income, they would receive only half as much parental allowance in total as a couple in which mother and father take turns on parental leave. The association Zukunftsforum Familie e. V. criticized the fact that parents would be massively disadvantaged in this case. The German Association of Women Lawyers (djb) proposed amendments to the draft law in 2006 and proposed a new formulation in 2008 that should enable both parents to take advantage of the benefits at the same time without financial disadvantage. Corresponding claims before the social courts based on this argument were, however, dismissed without exception. The Landessozialgericht Baden-Württemberg essentially stated: If the legislature creates an instrument with the parental allowance that provides financial incentives to temporarily give up work in favor of bringing up children, it would appear appropriate to reduce this incentive when the professional activity not being completely abandoned in favor of education. Due to the income dependency of the entitlement to parental allowance, the law is precisely not geared towards creating the same financial circumstances in every conceivable constellation. The legislature was not obliged to create such a situation. Therefore do not convince the arguments of the djb. The legislature is not required to provide the same financial benefits for any and every conceivable constellation of claiming parental allowance.

The lack of flexibility in terms of time for parental allowance also met with criticism, as there was no provision that would allow part of the entitlement to be transferred to a later date. To make it more flexible, the introduction of a flexibly manageable parental allowance account was required. In order to cushion unpredictable needs, it is obvious to provide a quota of days off as a precaution , which parents can use if children or frail parents have an unforeseen need for care, similar to the time quota of 60 days provided for this in Sweden. In the Federal Government's parental allowance report from October 2008, parental allowance was described as extremely flexible; a further flexibilization would appear "not appropriate". In April 2009, however, Family Minister Ursula von der Leyen announced a more flexible approach, according to which a parental allowance could be spread over more months than before in the case of reduced work.

In the coalition agreement between the CDU, CSU and FDP , the coalition stipulated in October 2009: “We want a further development, flexibility and less bureaucracy in parental allowance, especially with regard to determining income. The partner months are to be strengthened and partial parental allowance introduced for up to 28 months. We will ensure that simultaneous part-time work with simultaneous parental leave does not lead to double entitlement consumption. We want to take greater account of the living situation of the self-employed. "

The demands for greater flexibility were partially met from 2015 with the introduction of Elterngeld Plus , although it still applies that parents may receive significantly less support if they share care than if one of the two only looks after and the other works full-time , see section "Flexibility and partner bonus through Elterngeld Plus " .

Due date regulation

Another point of attack for criticism was provided by the date of birth-based regulation, with which the parental allowance has replaced the child-raising allowance. Childcare allowance was paid for births up to December 31, 2006, and parental allowance was paid for births from January 1, 2007. For low-wage earners, the legislation in force until 2006 means more money; for parents with better earnings, the legislation in force from 2007 means more money. A lawsuit before the Federal Social Court (BSG, Az. B 10 EG 3/07, 4/07 and 5/07) failed; the Federal Constitutional Court ruled in April 2011 that the cut-off date regulation for drawing parental allowance is not unconstitutional.

Due to this deadline regulation, which was already known at the time, parents with a due date at the turn of the year were faced with the question of whether they should postpone the birth with artificial labor suppressants.

Processing time

There are press releases and a few complaints from applicants in internet forums; the processing of proper and complete applications is delayed by months in some federal states. After overcoming the initial teething problems, the Federal Government is assuming an average processing time of four to six weeks (status: 12/2007).

effectiveness

The ineffectiveness of parental allowance is also discussed in the public debate. Critics point out that one of the stated goals, namely an increase in the birth rate, would be missed (at least so far). The funds expended of around 4.5 billion euros per year would be disproportionate to the benefits achieved by the parental allowance. There is a " deadweight effect " in which the parental allowance is claimed for behavior that would have taken place even without the additional incentive. According to information from the FAZ, the number of births has fallen since the introduction of parental allowance from around 685,000 in 2007 to around 665,000 in 2009.

Proponents of the parental allowance counter that a final assessment of the effectiveness of this measure is not possible at such an early stage. In 2006, a study by the German Institute for Economic Research predicted that the number of mothers in the labor force in the second year of their child's life will increase compared to the time before the introduction of parental allowance. Furthermore, the parental allowance will significantly improve the participation of fathers in childcare.

This public discussion is conducted against the background that in the draft of the Federal Parental Allowance and Parental Leave Act, one of the goals of parental allowance was formulated to encourage people to have more children and to make a contribution to securing their future. Modern family policy has to react to the fact that men and women decide later and less often to have children. It was emphasized that Germany has one of the lowest birth rates in the world and that it is particularly noticeable that a total of 39 percent of 35 to 39-year-old female academics in Germany lived without children in the household.

In 2010, the parental allowance had to be increased by 140 million euros due to the unexpectedly strong demand. This demand results from the birth rate which was higher than forecast, more fathers who used the parental allowance (2009 23%, 2008 21%) and the general increase in income. In 2009 around 665,000 babies were born, the Federal Statistical Office had expected a maximum of 660,000.

Parental leave vs. Parental allowance

While the connection to months of life for the Federal Education Allowance Act (BErzGG) is also possible without any problems with a retrospective application, the application for months of life with the BEEG can be a problem. Parental allowance can be applied for “from the day of birth” (§ 4 Paragraph 1 BEEG), parental leave must be applied for in writing to the employer “at least seven weeks before the start” (§ 16 Paragraph 1 BEEG) what periods of parental leave will be taken within two years. The addition “For urgent reasons, an appropriately shorter deadline is exceptionally possible.” Is intended to resolve this inconsistency, but the interpretation of the term “urgent” harbors potential for conflict for the relationship between parent and employer.

In fact, it is not possible to correctly apply for parental leave within the first seven weeks. In addition, aligning parental leave according to months of life is often not appropriate for the employment relationship. This arrangement is not compulsory for parental leave, but then leads to a loss in the amount of the parental allowance. The courts regularly interpret a “month of life principle” which, however, only existed in the BErzGG (see B 10 EG 20/11 R).

In 2014 (as of June) 96% of mothers and almost every third father took parental leave for their children born in 2012.

Historical development

The parental allowance replaced the former childcare allowance , which was regulated by the Federal Childcare Allowance Act that was in effect from 1986 to 2006 . The Parental Allowance Act was passed in 2006 by the grand coalition . The opposition parties FDP, Left Party and Greens voted against. The media cited the main point of criticism from these parties that there was a lack of childcare options after receiving parental allowance.

While the childcare allowance could be drawn for up to 24 months in the amount of 300 euros per month, regardless of the pre-natal income, parents who were unemployed or without income before the birth of the child receive the minimum amount of only for 14 months since the introduction of the parental allowance 300 euros as a social benefit. For this group, the parental allowance worsened.

The former childcare allowance cost 2.9 billion a year; For the parental allowance, four billion euros per year were temporarily budgeted. Around two thirds of the four billion approach were paid as compensation, around one third as social benefits to finance the EUR 300 minimum benefit.

The rule has been adopted from the Scandinavian model that a fixed portion of the duration of the parental allowance is reserved for both the mother and the father. A right to parental leave , formerly known as parental leave was called, consists of a child while under the age of three have, but no more than fourteen months is long granted parental benefits. This indirectly creates an incentive to return to work earlier. At the same time, the Day Care Expansion Act (TAG), which came into force in 2005, aims to develop childcare options for children under three years of age. The goal of guaranteeing the transition from parental allowance to childcare was confirmed in an agreement between the federal government and the federal states to accelerate the expansion of childcare for children under three and to introduce a legal right to a kindergarten place from the age of two from 2013.

In the first half of 2007 around 200,000 parental allowance applications were submitted; a further 187,000 were added in the third quarter. Averaged over the first half of the year, 8.5 percent of the applications were submitted by fathers, which is double the number of applications for parental leave in previous years. The proportion of fathers rose continuously in 2007: In the first quarter of 2007, 6.9 percent of the applications were submitted by fathers, and averaged over the first three quarters it was 9.6 percent. For mid-2008, more than 18 percent is reported. In 2001, 1.5 percent of fathers applied for childcare allowance, in 2006 it was 3 percent of fathers who took childcare leave.

In the coalition agreement of the 18th electoral term , the CDU / CSU and SPD stipulated in November 2013 to create a parental allowance plus . This should enable parents to “make the best possible use of the parental allowance in combination with a not insignificant part-time job” for a period of up to 28 months. On July 1, 2015, the ElterngeldPlus came into force, extending the part-time use of the 14 months of parental allowance up to twice the duration.

See also

- Demographics

- Federal Education Allowance Act regulations until December 31, 2006

- Parental leave

- Maternity Protection

- Maternity Protection Act

- Maternity allowance

- Work-life balance

- Compatibility of family and work in Germany

literature

- Svenja Pfahl, Stefan Reuyß, Dietmar Hobler, Sonja Weeber: Sustainable Effects of Parental Allowance Use by Fathers . SowiTra, Berlin 2014 ( sowitra.de [PDF]).

- Inge Böttcher: Federal Parental Allowance and Parental Leave Act. Basic comment . 3rd, revised edition. Bund-Verlag, Frankfurt am Main 2009, ISBN 978-3-7663-3951-5 .

- Jost Ebener: Rights for mothers and fathers. Advice on maternity leave, parental allowance, parental leave . 4th, revised edition. Bund-Verlag, Frankfurt am Main 2007, ISBN 978-3-7663-3796-2 .

- Christine Fuchsloch; Kirsten Scheiwe: Parental Allowance Guide , 1st edition 2007, ISBN 978-3-406-56201-3 .

- Ulla Niemann: Is Parental Allowance Unconstitutional? Kreuznach's mother sues in the social court against unequal treatment . Rhein Main Presse / Rhein-Nahe, p. 4, Bad Kreuznach / Mainz February 5, 2008.

- Anne Lenze: The cancellation of parental allowance for recipients of basic security - a disaster under equality law! , Information on unemployment law and social welfare law (info also) 01/2011, 3. ( Info-also.nomos.de (PDF))

Individual evidence

- ↑ Rheinische Post of May 29, 2014, p. A5 ( More parental allowance than ever )

- ↑ Federal Parental Allowance and Parental Leave Act - BEEG (PDF; 349 kB)

- ^ Draft by the CDU / CSU and SPD parliamentary groups for a law introducing parental allowance from June 20, 2006, Bundestag printed matter 16/1889, page 2

- ↑ Speech by Chancellor Angela Merkel at the 2006 Employers' Day Quote: “Ladies and gentlemen, with the parental allowance we have carried out a paradigm shift in social policy; but not so much because we now think that fathers can also look after small children. [...] The reason why the parental allowance is so interesting - and that's why I mention it again here - is that it is the first time that the decision to have a child and the option of not working for a year are linked to the previous salary. Until now, family support has always been a support for families in need. [...] I believe that it will start at least a little bit - you will never be able to count that - where we have the problem today that 40% of female academics, incidentally also academics, have no children . This is also a situation that a country that wants to call itself highly developed cannot afford. ” ( Online ( Memento from September 27, 2013 in the Internet Archive ))

- ↑ Childless academics? FAZ.net, accessed on February 27, 2009 .

- ^ Britta Hoem, Jan M. Hoem: Sveden's family policies and rollercoaster fertility. In: Journal of Population Problems. 52, 1996, pp. 1-22.

- ↑ Jörg Althammer (Ed.): Family policy and social security: Festschrift for Heinz Lampert , Springer Verlag, 2005, ISBN 3-540-24538-3 p. 414

- ↑ a b Changes to the BEEG

- ↑ Guidelines of the Federal Ministry for Family, Seniors, Women and Youth on the BEEG, Section 1.1.3.1 “Care and Upbringing of Children (No. 3)”, p. 31 (PDF).

- ↑ BVerfG, July 10, 2012, AZ 1 BvL 2/10

- ↑ What is the plus of ElterngeldPlus? tagesschau.de, November 18, 2013, archived from the original on November 21, 2013 ; accessed on January 10, 2014 .

- ↑ BMFSFJ - Parental Allowance Calculator. Federal Ministry for Family, Seniors, Women and Youth, 2017, accessed on 6 July 2018 .

- ↑ a b coalition agreement for the 18th electoral term of the Bundestag, available at www.cdu.de

- ↑ Schwesig's plans: Parental allowance should apply to part-time workers for 28 months. Spiegel online, March 21, 2014, accessed March 29, 2014 .

- ↑ On the way to family working hours ... (PDF; 1.62 kB) In: Overview of the BMFSFJ planned parental benefit plus. 2014, accessed May 4, 2014 . Linked to: Elterngeld - What's new? , elterngeld.net

- ↑ Verena Töpper: Court case for Elterngeld Plus: "We are punished for our honesty". In: spiegel.de. February 12, 2020, accessed February 15, 2020 .

- ^ Parental allowance office of the L-Bank , accessed on February 12, 2013

- ↑ Federal Social Court, Az .: B 10 EG9 / 15R. Quoted from: Elterngeld: Judges strengthen the rights of mothers. Spiegel online, March 16, 2017, accessed March 16, 2017 .

- ↑ See also Federal Social Court on 25 June 2009 - B 10 EC 8.3 R and B10 EC 4/08 R .

- ^ Barbara Blinzler: Parental Allowance. State-approved advice centers for pregnancy issues, archived from the original on March 1, 2009 ; Retrieved May 18, 2009 .

- ↑ Eligibility requirements and amount of parental allowance. BMSFSJ January 4, 2011, archived from the original on May 16, 2015 ; Retrieved June 9, 2015 .

- ↑ www.familien-wegweiser.de/wegweiser/stichwortverzeichnis,did=93576.html (Taken July 6, 2018 and last checked: October 31, 2014)

- ↑ Federal Social Court B10EG8 / 12R

- ↑ a b Changes to parental allowance for twins and multiple children. BMFSFJ, November 15, 2013, archived from the original on January 13, 2014 ; accessed on January 10, 2014 .

- ↑ bmfsfj.de (PDF).

- ↑ Guidelines for the BEEG. (PDF; 659 kB) In: BMFSFJ / 204. December 18, 2006, accessed November 7, 2009 . P. 75 ff (PDF).

- ↑ Parental allowance upon receipt of ALG I. Accessed on August 28, 2017 .

- ↑ § 10 para. 5 BEEG, added with effect from January 1, 2011 by Art. 14 No. 4 Budget Accompanying Act 2011 of December 9, 2010, Federal Law Gazette I, pp. 1885, 1896

- ↑ § 1 Paragraph 5 Unemployment Benefit II / Social Allowance Ordinance in the version of the Fourth Ordinance amending Unemployment Benefit II / Social Allowance Ordinance of December 21, 2010, Federal Law Gazette I, p. 2321

- ↑ Judgment of the Grand Chamber of the European Court of Justice of June 19, 2012, case C-62/11 (Feyerbacher)

- ↑ Determination by the National Association of Statutory Health Insurance Funds on January 1, 2009: Uniform principles for the assessment of contributions for voluntary members of the statutory health insurance and other member groups as well as for the payment and due dates of the contributions to be paid by members themselves (contribution procedure principles for self-payers) from October 27, 2008, last changed on October 17 December 2008 gkv-spitzenverband.de ( Memento from November 7, 2011 in the Internet Archive ) (PDF).

- ↑ destatis.de ( Memento from November 16, 2013 in the Internet Archive )

- ↑ destatis.de

- ↑ Bujard, Martin (Ed.) (2013): Parental Allowance and Parental Leave in Germany: Aims, Discourses and Effects. Special issue of the journal for family research, 25th year, volume 2, Leverkusen: Verlag Barbara Budrich

- ↑ Parental allowance: female academics have more children Focus from June 10, 2010

- ↑ Press Release No. 212 of June 14, 2018. In: destatis.de. June 14, 2018, accessed April 16, 2019 .

- ↑ Press release No. 145 of April 11, 2019. In: destatis.de. April 11, 2019, accessed April 16, 2019 .

- ↑ Parental Allowance Report. Report on the effects of the Federal Parental Allowance and Parental Leave Act as well as any further development that may be necessary. (PDF; 1.3 MB) BMFSFJ, October 2008, accessed on February 1, 2011 . Section 1.2. Parental allowance as a central measure of sustainable family policy (PDF).

- ↑ Austerity: Unwanted Babies. June 10, 2010, accessed June 12, 2010 .

- ^ Report (PDF; 779 kB) on the effects of the Federal Parental Allowance and Parental Leave Act, Federal Print 16/10770

- ↑ Parental Allowance - An Achievement of the New Family Policy? (2) by Stefan Fuchs

- ↑ Parental Allowance. Die Linke, 2009, accessed November 15, 2012 .

- ↑ ödp.de ( Memento from January 11, 2012 in the Internet Archive ) Opinion of the ÖDP on parental allowance

- ↑ Family party: Statement on parental allowance ( page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. (PDF).

- ↑ Erwin Teufel on parental allowance

- ↑ Statement from Prof. Dr. Christian Seiler on parental allowance before the Committee for Family, Seniors, Women and Youth, page 6 (PDF; 160 kB)

- ↑ Statement from Prof. Dr. Christian Seiler on parental allowance before the Committee for Family, Seniors, Women and Youth, page 4f (PDF; 160 kB)

- ↑ Prof. Dr. iur. Thorsten Kingreen, On the constitutionality of §§ 2 and 4 of the Federal Parental Allowance Act (BEEG), legal opinion on behalf of the Ecological Democratic Party (ÖDP) (PDF).

- ↑ Prof. Dr. iur. Thorsten Kingreen, On the constitutionality of §§ 2 and 4 of the Federal Parental Allowance Act (BEEG), legal opinion on behalf of the Ecological Democratic Party (ÖDP), p. 66 (PDF).

- ^ Federal Social Court, judgments of February 17, 2011, B 10 EG 17/09 R, B 10 EG 20/09 R and B 10 EG 21/09 R

- ↑ Federal Constitutional Court, 1 BvR 2712/09 Decision of June 6, 2011. Accessed on July 26, 2011 .

- ↑ See §2 in the difference between the versions that were valid before and after September 18, 2012 at buzer.de

- ↑ See §2 in the difference between the versions valid before and after September 18, 2012 at buzer.de, paragraph 8

- ↑ See §2 in the difference between the versions valid before and after September 18, 2012 at buzer.de, paragraph 9

- ^ Decision of November 9, 2011, 1 BvR 1853/11 ( Memento of March 4, 2016 in the Internet Archive )

- ↑ Johannes Resch, “Basic Law on the Siding”, Family Work Today, 1/2013, p. 1. (PDF; 26 kB) Retrieved on May 26, 2013 .

- ^ "Decision of non-acceptance" of the 2nd Chamber of the 1st Senate of the Federal Constitutional Court with a comment on the decisive paragraphs: by Dr. Johannes Resch. (PDF; 112 kB) Retrieved on August 24, 2012 .

- ↑ a b Christoph Butterwegge, Michael Klundt, Matthias Zeng: Child poverty in East and West Germany . 2nd, expanded and updated edition . VS Verlag für Sozialwissenschaften, 2008, ISBN 978-3-531-15915-7 , pp. 99-100

- ↑ Christoph Butterwegge: Crisis and Future of the Social State, p. 323

- ↑ Study by DIW Berlin. (PDF) (No longer available online.) DIW, formerly in the original ; Retrieved July 1, 2011 . ( Page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice.

- ↑ Families are the nation's piggy banks and milking cows

- ↑ FDP parliamentary group: Parental Allowance - “Well meant” is often the opposite of “good” ( Memento from June 9, 2008 in the Internet Archive )

- ↑ a b c motion for a resolution. (PDF; 73 kB) In: Drucksache 16/10830. November 10, 2008, accessed January 25, 2009 .

- ↑ Rosenberger: Parental allowance is the right instrument, but still needs to be corrected. NGG.net, October 30, 2008, accessed March 29, 2009 .

- ↑ a b Unnecessary overspending. Federal Audit Office criticizes parental allowance . In: RP Online . As of September 19, 2006. Accessed February 21, 2011.

- ↑ Short-time work: Effects on parental allowance. IG Metall, January 28, 2009, accessed May 18, 2009 . ; See also the linked PDF file Short-time work and effects on parental allowance (PDF; 75 kB) , January 21, 2009.

- ↑ Marianne Hürten: From child-raising allowance to parental allowance - progress in women's politics or redistribution from bottom to top? (PDF) April 2007, accessed January 25, 2009 . P. 29

- ^ Motion for a resolution. (PDF; 77 kB) In: Drucksache 16/8416. November 10, 2008, accessed January 25, 2009 . P. 3 (PDF).

- ↑ Section “Ina Lenke, Member of the Bundestag: Report on parental allowance only sober figures instead of honest analysis”. In: "Press" section. Liberal Women, Lower Saxony State Association, November 12, 2008, archived from the original on February 1, 2009 ; Retrieved January 25, 2009 .

- ↑ Lenke: Self-employed and freelancers at a disadvantage when it comes to parental allowance. FDP Federal Party, April 16, 2008, archived from the original on February 1, 2009 ; Retrieved January 25, 2009 .

- ↑ LSG North Rhine-Westphalia, Az .: L 13 EG 16/10, judgment of April 12, 2011, quoted from: LSG North Rhine-Westphalia: Work income paid back does not reduce the parental allowance of the self-employed. Gratis-urteile.de, accessed on May 12, 2012 .

- ↑ BSG, Az .: B 10 EG 10/11 R, judgment of April 5, 2012, quoted from BSG, April 5, 2012, B 10 EG 10/11 R - Entitlement to parental allowance - Determination of income for self-employed people - Application of the inflow principle under tax law . anwalt24.de, accessed on February 6, 2013 .

- ^ Parental allowance: draft with quirks. (PDF; 95 kB) In: Böckler Impuls 13/2006 . 2006, accessed June 10, 2008 .

- ↑ Grandparenthood for the diversity of families. January 18, 2008, archived from the original on April 15, 2008 ; accessed on September 24, 2015 .

- ^ Opinion on the draft law of the CDU / CSU and SPD on the introduction of a parental allowance in the Bundestag - printed matter 16/1889. June 20, 2006, archived from the original on September 25, 2015 ; Retrieved January 23, 2013 .

- ↑ Parental allowance is unattractive for parents who work part-time. Deutscher Juristinnenbund, November 14, 2008, archived from the original on September 25, 2015 ; Retrieved January 23, 2013 .

- ↑ Landessozialgericht Baden-Württemberg L 11 EG 5604/09 Judgment of December 14, 2010. Retrieved on February 3, 2011 .

- ↑ Landessozialgericht Baden-Württemberg L 11 EL 5603/09 Judgment of December 14, 2010. Accessed on February 3, 2011 .

- ↑ Landessozialgericht Baden-Württemberg L 11 EG 3952/10 Judgment of December 14, 2010. Retrieved on February 3, 2011 .

- ↑ Silke Bothfeld: Parental Allowance - A few comments on the discomfort with the new regulation. (PDF) (No longer available online.) In: femina politica 2/2006, pp. & 102–107. Archived from the original on February 5, 2009 ; Retrieved June 17, 2008 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF).

- ^ Günther Schmid : From unemployment insurance to employment insurance. Paths to a new balance between individual responsibility and solidarity through a life-course-oriented labor market policy. (PDF; 449 kB) Department of Economic and Social Policy of the Friedrich Ebert Foundation, April 2008, accessed on November 7, 2009 ( ISBN 978-3-89892-878-6 ).

- ↑ Parental Allowance Report. Report on the effects of the Federal Parental Allowance and Parental Leave Act as well as any further development that may be necessary. (PDF; 1.3 MB) BMFSFJ, October 2008, accessed on April 3, 2009 . Section 7.7 .: Flexibility of use, p. 52 (PDF).

- ↑ Family minister plans part-time parental allowance. Zeit-Online, April 24, 2009, accessed April 25, 2009 .

- ↑ Longer parental leave for part-time employees. Federal Government, April 24, 2009, archived from the original on September 27, 2013 ; Retrieved April 25, 2009 .

- ↑ "Growth. Education. Cohesion. "Coalition agreement between CDU, CSU and FDP, final version of October 26, 2009. (PDF; 643 kB) ( Memento of November 22, 2009 in the Internet Archive )

- ^ Resolutions of April 20, 2011, file number: 1 BvR 1811/08 and 1 BvR 1897/08

- ↑ Andrea Barthélémy: Social Policy: Postpone Birth for Parental Allowance? Mitteldeutsche Zeitung , December 28, 2006, accessed September 10, 2013 .

- ↑ Compare Bundestag printed paper 16/5858, answer to a small request from the FDP on June 29, 2007

- ↑ FAZ: Elterngeld does not father children, accessed on December 19, 2010

- ^ C. Katharina Spieß, Katharina Wrohlich, Elterngeld : Shorter employment breaks expected by mothers in the German Institute for Economic Research, weekly report of DIW Berlin 48/2006, pp. 689–693. On-line

- ↑ Draft by the CDU / CSU and SPD parliamentary groups on the law introducing parental allowance of June 20, 2006, Bundestag printed matter 16/1889 (PDF; 630 kB), page 2

- ↑ Bundestag printed matter 16/1889 (PDF; 630 kB), page 15

- ↑ taz, Too little parental allowance planned , December 21, 2010

- ↑ Federal Social Court B 10 EG 20/11 R judgment of August 29, 2012. Retrieved February 14, 2014 .

- ↑ destatis.de

- ↑ Parental allowance comes in 2007. Stern, September 29, 2006, accessed on April 23, 2017 .

- ↑ a b Parental allowance for 200,000 mothers and fathers in the first half of 2007 ( Memento of November 27, 2007 in the Internet Archive ), press release no. 321 of November 13, 2007, Federal Statistical Office Germany (accessed on December 8, 2007)

- ↑ a b Parental allowance for fathers mostly granted for 2 months ( memento from November 27, 2007 in the Internet Archive ), press release No. 453 from August 15, 2007, Federal Statistical Office Germany (accessed on December 8, 2007)

- ↑ a b Parental Allowance: More fathers are trying out new roles. In: Böckler Impulse 17/2009. Retrieved May 16, 2010 .

Web links

- Federal Parental Allowance and Parental Leave Act - BEEG

- Guidelines for the BEEG (PDF; 659 kB), BMFSFJ / 204, December 18, 2006

- Information on parental allowance on the family portal of the Federal Ministry for Family Affairs

- Parental allowance calculator of the Federal Ministry of Family Affairs

- Parental allowance digital from the Federal Ministry of Family Affairs : Apply for parental allowance in some federal states with electronic support

- Federal Ministry of Family Affairs on parental allowance

- Brochure from the Federal Ministry of Family Affairs on parental allowance (PDF; 5.6 MB)

- The unemployed are also entitled

- Uniform principles for the assessment of contributions for voluntary members of the statutory health insurance of the National Association of Statutory Health Insurance Funds (PDF; 191 kB)

- Parental allowance for the self-employed: who gets it, how is it calculated?

- Ulrike Unterhofer, Katharina Wrohlich ( DIW , 2017): Fathers, Parental Leave and Gender Norms . DIW Berlin Discussion Paper No. 1657.