Economic growth: Difference between revisions

m Reverted edits by 137.158.152.204 to last version by Radeksz (HG) |

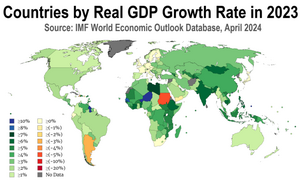

figure Real GDP Growth Rate in 2023 |

||

| Line 1: | Line 1: | ||

{{Short description|Measure of increase in market value of goods}} |

|||

'''Economic growth''' is the increase in the amount of the goods and services produced by an [[economics|economy]] over time. It is conventionally measured as the percent rate of increase in ''real [[gross domestic product]]'', or ''real GDP''. Growth is usually calculated in ''real'' terms, i.e. [[real vs. nominal in economics|inflation-adjusted]] terms, in order to net out the effect of [[inflation]] on the price of the goods and services produced. In [[economics]], "economic growth" or "economic growth theory" typically refers to growth of [[potential output]], i.e., production at "[[full employment]]," which is caused by growth in [[aggregate demand]] or observed output. |

|||

{{Use dmy dates|cs1-dates=ly|date=April 2022}} |

|||

{{Multiple image |

|||

| align = right |

|||

| direction = vertical |

|||

| width = 300 |

|||

| image1 = Gdp accumulated change.png |

|||

| caption1 = [[Gross domestic product]] real growth rates, 1990–1998 and 1990–2006, in selected countries |

|||

| image2 = WeltBIPWorldgroupOECDengl.PNG |

|||

| caption2 = Rate of change of gross domestic product, world and [[Organisation for Economic Co-operation and Development]], since 1961 |

|||

}} |

|||

{{Macroeconomics sidebar}} |

|||

'''Economic growth''' can be defined as the increase or improvement in the inflation-adjusted [[market value]] of the goods and services produced by an [[economics|economy]] in a financial year.<ref>{{cite web |last1=Roser |first1=Max |title=What is economic growth? And why is it so important? |url=https://ourworldindata.org/what-is-economic-growth#article-citation |website=[[Our World in Data]] |date=2021}}</ref> Statisticians conventionally measure such growth as the percent rate of increase in the [[Real versus nominal value (economics)|real]] and nominal [[gross domestic product]] (GDP).<ref>[http://www.statista.com/statistics/197039/growth-of-the-global-gross-domestic-product-gdp/ Statistics on the Growth of the Global Gross Domestic Product (GDP) from 2003 to 2013] {{Webarchive|url=https://web.archive.org/web/20130503165447/http://www.statista.com/statistics/197039/growth-of-the-global-gross-domestic-product-gdp/ |date=2013-05-03 }}, IMF, October 2012. - "Gross domestic product, also called GDP, is the market value of goods and services produced by a country in a certain time period."</ref> |

|||

As an area of study, ''economic growth'' is generally distinguished from ''[[development economics]]''. The former is primarily the study of how rich countries can advance their economies. The latter is the study of how poor countries can catch up with rich ones. |

|||

Growth is usually calculated in real terms – i.e., [[real vs. nominal in economics|inflation-adjusted]] terms – to eliminate the distorting effect of [[inflation]] on the prices of [[goods]] produced. [[Measures of national income and output|Measurement of economic growth]] uses [[National accounts|national income accounting]].{{sfn|Bjork|1999|p=251}} Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all the advantages and drawbacks of that measure. The economic growth-rates of countries are commonly compared using the ratio of the [[Gross domestic product|GDP]] to population ([[per-capita income]]).{{sfn|Bjork|1999|p=67}} |

|||

The "rate of economic growth" refers to the [[Exponential growth|geometric]] annual rate of growth in GDP between the first and the last year over a period of time. This growth rate represents the trend in the average level of GDP over the period, and ignores any fluctuations in the GDP around this trend. |

|||

==Short-term stabilization and long-term growth== |

|||

Economists draw a distinction between short-term economic stabilization and long-term economic growth. The topic of economic growth is primarily concerned with the long run. |

|||

Economists refer to economic growth caused by more efficient use of inputs (increased [[productivity]] of [[Labour productivity|labor]], of [[physical capital]], of [[Energy (disambiguation)|energy]] or of [[material]]s) as ''[[intensive growth]]''. In contrast, GDP growth caused only by increases in the amount of inputs available for use (increased population, for example, or new territory) counts as ''[[extensive growth]]''.{{sfn|Bjork|1999|pp=[https://archive.org/details/wayitworkedwhyit0000bjor/page/2 2], [https://archive.org/details/wayitworkedwhyit0000bjor/page/67 67]}} |

|||

The short-run variation of economic growth is termed the [[business cycle]], and almost all economies experience periodical [[recession]]s. The cycle can be a misnomer as the fluctuations are not always regular. Explaining these fluctuations is one of the main focuses of [[macroeconomics]]. There are different schools of thought as to the causes of recessions but some consensus- see [[Keynesianism]], [[Monetarism]], [[New classical economics]] and [[New Keynesian economics]]. Oil shocks, war and harvest failure are obvious causes of recession. Short-run variation in growth has generally dampened in higher income countries since the early 90s and this has been attributed, in part, to better macroeconomic management. |

|||

[[Innovation|Development of new goods and services]] also generates economic growth. As it so happens, in the U.S. about 60% of [[consumer spending]] in 2013 went on goods and services that did not exist in 1869.<ref>{{Cite book |last=Gordon |first=Robert J. |url=https://books.google.com/books?id=jXGYDwAAQBAJ&q=the+rise+and+fall+of+american+growth |title=The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War |date=2017-08-29 |publisher=Princeton University Press |isbn=978-0-691-17580-5 |pages=38–39 |language=en}}</ref> |

|||

The long-run path of economic growth is one of the central questions of [[economics]]; in spite of the problems of measurement, an increase in GDP of a country is generally taken as an increase in the standard of living of its inhabitants. Over long periods of time, even small rates of annual growth can have large effects through compounding (see [[exponential growth]]). A growth rate of 2.5% per annum will lead to a doubling of GDP within 28 years, whilst a growth rate of 8% per annum (experienced by some [[Four Asian Tigers]]) will lead to a doubling of GDP within 9 years. This exponential characteristic can exacerbate differences across nations. For example, the difference in the annual growth from country A to country B will multiply up over the years. A growth rate of 5% seems similar to 3%, but over two decades, the first economy would have grown by 165%, the second only by 80%. |

|||

==Measurement== |

|||

In the early 20th century, it became the policy of most nations to encourage growth of this kind. To do this required enacting policies, and being able to measure the results of those policies. This gave rise to the importance of [[econometrics]], or the field of creating measurements for underlying conditions. Terms such as "unemployment rate", "[[Gross Domestic Product]]" and "rate of inflation" are part of the measuring of the changes in an economy. |

|||

{{Main|Gross domestic product}} |

|||

[[File:Countries by Real GDP Growth Rate in 2023.png|thumb|upright=1.35|Real GDP Growth Rate 2023]] |

|||

The economic growth rate is calculated from data on GDP estimated by countries' [[List of national and international statistical services|statistical agencies]]. The rate of growth of GDP [[per capita]] is calculated from data on GDP and people for the initial and final periods included in the analysis of the analyst. |

|||

==Long-term growth== |

|||

In mainstream economics, the purpose of government policy is to encourage economic activity without encouraging the rise in the general level of prices (in other words, increase GDP without creating inflation). This combination is seen as, at the macro-scale (see [[macroeconomics]]) to be indicative of an increasing stock of capital. The argument runs that if more money is changing hands, but the prices of individual goods are relatively stable, then it is proof that there is more productive capacity, and therefore more capital, because it is capital that is allowing more to be made at a lower cost per unit. ''See [[Economies of scale]], [[Inflation]], [[Hyperinflation]], [[Price]], [[Supply and demand]]''. |

|||

Living standards vary widely from country to country, and furthermore, the change in living standards over time varies widely from country to country. Below is a table which shows GDP per person and annualized per person GDP growth for a selection of countries over a period of about 100 years. The GDP per person data are adjusted for inflation, hence they are "[[Real versus nominal value (economics)|real]]". GDP per person (more commonly called "per capita" GDP) is the GDP of the entire country divided by the number of people in the country; GDP per person is conceptually analogous to "[[average income]]". |

|||

{| class="wikitable" |

|||

than GDP. GDP still remains by far the most often-used measure, especially since, all else equal, a rise in real GDP is correlated with an increase in the availability of jobs, which are necessary to most individuals' survival. |

|||

|+ Economic growth by country<ref>{{cite book |last=Mankiw |first=Gregory |date=2011 |title=Principles of Macroeconomics |edition=6th |page=[https://archive.org/details/principlesofmacr00mank/page/236 236] |publisher=Cengage Learning |isbn=978-0538453066 |url=https://archive.org/details/principlesofmacr00mank/page/236 }}</ref> |

|||

! Country |

|||

! Period |

|||

! Real GDP per person at beginning of period |

|||

! Real GDP per person at end of period |

|||

! Annualized growth rate |

|||

|- |

|||

! Japan |

|||

| 1890–2008 || $1,504 || $35,220 || 2.71% |

|||

|- |

|||

! Brazil |

|||

| 1900–2008 || $779 || $10,070 || 2.40% |

|||

|- |

|||

! Mexico |

|||

| 1900–2008 || $1,159 || $14,270 || 2.35% |

|||

|- |

|||

! Germany |

|||

| 1870–2008 || $2,184 || $35,940 || 2.05% |

|||

|- |

|||

! Canada |

|||

| 1870–2008 || $2,375 || $36,220 || 1.99% |

|||

|- |

|||

! China |

|||

| 1900–2008 || $716 || $6,020 || 1.99% |

|||

|- |

|||

! United States |

|||

| 1870–2008 || $4,007 || $46,970 || 1.80% |

|||

|- |

|||

! Argentina |

|||

| 1900–2008 || $2,293 || $14,020 || 1.69% |

|||

|- |

|||

! United Kingdom |

|||

| 1870–2008 || $4,808 || $36,130 || 1.47% |

|||

|- |

|||

! India |

|||

| 1900–2008 || $675 || $2,960 || 1.38% |

|||

|- |

|||

! Indonesia |

|||

| 1900–2008 || $891 || $3,830 || 1.36% |

|||

|- |

|||

! Bangladesh |

|||

| 1900–2008 || $623 || $1,440 || 0.78% |

|||

|} |

|||

Seemingly small differences in yearly GDP growth lead to large changes in GDP when [[Compound interest|compounded]] over time. For instance, in the above table, GDP per person in the United Kingdom in the year 1870 was $4,808. At the same time in the United States, GDP per person was $4,007, lower than the UK by about 20%. However, in 2008 the positions were reversed: GDP per person was $36,130 in the [[United Kingdom]] and $46,970 in the United States, i.e. GDP per person in the US was 30% more than it was in the UK. As the above table shows, this means that GDP per person grew, on average, by 1.80% per year in the US and by 1.47% in the UK. Thus, a difference in GDP growth by only a few tenths of a percent per year results in large differences in outcomes when the growth is persistent over a generation. This and other observations have led some economists to view GDP growth as the most important part of the field of [[macroeconomics]]: |

|||

==The history of economic growth theory== |

|||

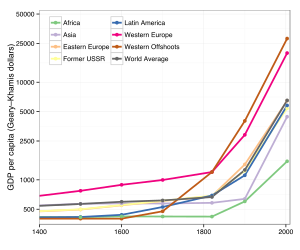

[[Image:World GDP Capita 1-2003 A.D.png|right|thumb|250px|World [[GDP]]/capita changed very little for most of human history before the [[industrial revolution]]. (Note the empty areas mean no data, not very low levels. There are data for the years 1, 1000, 1500, 1600, 1700, 1820, 1900, and 2003.)]] |

|||

===Origins of the concept and theories of economic growth=== |

|||

In 1377, the [[Islamic economics in the world|Arabian economic]] thinker [[Ibn Khaldun]] provided one of the earliest descriptions of economic growth in his famous ''[[Muqaddimah]]'' (known as ''Prolegomena'' in the [[Western world]]): |

|||

{{Blockquote |

|||

{{quote|"When civilization [population] increases, the available labor again increases. In turn, luxury again increases in correspondence with the increasing profit, and the customs and needs of luxury increase. Crafts are created to obtain luxury products. The value realized from them increases, and, as a result, profits are again multiplied in the town. Production there is thriving even more than before. And so it goes with the second and third increase. All the additional labor serves luxury and wealth, in contrast to the original labor that served the necessity of life."<ref>[[Ibn Khaldun]], ''[[Muqaddimah]]'', 2:272-73, quoted in Dieter Weiss (1995), "Ibn Khaldun on Economic Transformation", ''International Journal of Middle East Studies'' '''27''' (1), p. 29-37 [30].</ref>}} |

|||

|text=...if we can learn about government policy options that have even small effects on long-term growth rates, we can contribute much more to improvements in standards of living than has been provided by the entire history of macroeconomic analysis of [[Procyclical and countercyclical variables|countercyclical policy]] and fine-tuning. Economic growth [is] the part of macroeconomics that really matters.<ref>{{cite book |last1=Barro |first1=Robert |first2=Xavier |last2=Sala-i-Martin |date=2004 |title=Economic Growth |edition=2nd |page=6 |asin=B003Q7WARA}}</ref> |

|||

}} |

|||

===Growth and innovation=== |

|||

In the [[early modern period]], some people in [[Western Europe]]an nations developed the idea that economies could "grow", that is, produce a greater economic surplus which could be expended on something other than mere subsistence. This surplus could then be used for consumption, warfare, or civic and religious projects. The previous view was that only increasing either population or tax rates could generate more surplus money for the Crown or country. |

|||

[[File:Creative Economics The system of economic growth in developed regions.PNG|thumb|The system of economic growth in developed regions]] |

|||

It has been observed that GDP growth is influenced by the size of the economy. The relation between GDP growth and GDP across the countries at a particular point of time is convex. Growth increases as GDP reaches its maximum and then begins to decline. There exists some extremum value. This is not exactly middle-income trap. It is observed for both developed and developing economies. Actually, countries having this property belong to ''conventional growth domain''. However, the extremum could be extended by technological and policy innovations and some countries move into ''innovative growth domain'' with higher limiting values.<ref>{{cite journal |last1=Das |first1=Tuhin K. |title=Cross-Sectional Views of GDP Growth in the Light of Innovations |journal=Economic Growth eJournal |date=2019 |doi=10.2139/ssrn.3503386 |ssrn=3503386 |s2cid=219383124}}</ref> |

|||

Now it is generally recognized that economic growth also corresponds to a process of continual rapid replacement and reorganization of human activities facilitated by investment motivated to maximize returns. This [[exponential growth|exponential]] evolution of our self-organized life-support and cultural systems is remarkably creative and flexible, but highly unpredictable in many ways. Since science still has no good way of modeling complex self-organizing systems, various efforts to model the long term evolution of economies have produced few useful results. |

|||

==Determinants of per capita GDP growth== |

|||

During much of the [[Mercantilism|"Mercantilist"]] period, growth was seen as involving an increase in the total amount of specie, that is circulating medium such as silver and gold, under the control of the state. This [[Bullionism|"Bullionist"]] theory led to policies to force trade through a particular state, the acquisition of colonies to supply cheaper raw materials which could then be manufactured and sold. |

|||

[[File:Historic world GDP per capita.svg|thumb|upright=1.35|Historic world GDP per capita]] |

|||

In national income accounting, per capita output can be calculated using the following factors: output per unit of labor input (labor productivity), hours worked (intensity), the percentage of the working-age population actually working (participation rate) and the proportion of the working-age population to the total population (demographics). "The rate of change of GDP/population is the sum of the rates of change of these four variables plus their cross products."{{sfn|Bjork|1999|p=68}} |

|||

Later, such trade policies were justified instead simply in terms of promoting domestic trade and industry. The post-Bullionist insight that it was the increasing capability of manufacturing which led to policies in the 1700s to encourage manufacturing in itself, and the formula of importing raw materials and exporting finished goods. Under this system high tariffs were erected to allow manufacturers to establish "[[factory|factories]]". Local markets would then pay the fixed costs of capital growth, and then allow them to export abroad, undercutting the prices of manufactured goods elsewhere. Once competition from abroad was removed, prices could then be increased to recoup the costs of establishing the business. |

|||

Economists distinguish between long-run economic growth and short-run economic changes in [[production (economics)|production]]. Short-run variation in economic growth is termed the ''[[business cycle]]''. Generally, according to economists, the ups and downs in the business cycle can be attributed to fluctuations in [[aggregate demand]]. In contrast, economic growth is concerned with the long-run trend in production due to structural causes such as technological growth and factor accumulation. |

|||

Under this theory of growth, the road to increased national wealth was to grant monopolies, which would give an incentive for an individual to exploit a market or resource, confident that he would make all of the profits when all other extra-national competitors were driven out of business. The "[[Dutch East India Company|Dutch East India company]]" and the "[[British East India Company|British East India company]]" were examples of such state-granted trade [[monopoly|monopolies]]. |

|||

===Productivity=== |

|||

In this period the view was that growth was gained through "advantageous" trade in which specie would flow in to the country, but to trade with other nations on equal terms was disadvantageous. It should be stressed that Mercantilism was not simply a matter of restricting trade. ''Within'' a country, it often meant breaking down trade barriers, building new roads, and abolishing local toll booths, all of which expanded markets. This corresponded to the centralization of power in the hands of the Crown (or "[[Political absolutism|Absolutism]]"). This process helped produce the modern [[nation-state]] in Western Europe. |

|||

{{main|Productivity-improving technologies}} |

|||

Increases in labor [[productivity]] (the ratio of the value of output to labor input) have historically been the most important source of real per capita economic growth.{{sfn|Bjork|1999|p={{pn|date=July 2022}}}}<ref>{{Cite web |last1=Roubini |first1=Nouriel| last2=Backus |first2=David |work=Lectures in Macroeconomics |year=1998 |title=Productivity and Growth |url=http://pages.stern.nyu.edu/~nroubini/NOTES/CHAP4.HTM#topic2}}</ref><ref>{{Cite web |

|||

|last1 = Wang |

|||

|first1 = Ping |

|||

|title = Growth Accounting |

|||

|year = 2014 |

|||

|page = 2 |

|||

|url = http://pingwang.wustl.edu/Econ472/Growth%20Development-V.pdf |

|||

|url-status = dead |

|||

|archive-url = https://web.archive.org/web/20140715173535/http://pingwang.wustl.edu/Econ472/Growth%20Development-V.pdf |

|||

|archive-date = 2014-07-15 |

|||

}}</ref><ref>{{ Cite web |

|||

| last1 = Corry |

|||

| first1 =Dan |

|||

| last2 = Valero |

|||

| first2=Anna |

|||

| last3 = Van Reenen |

|||

| first3 =John |

|||

| title = UK Economic Performance Since 1997 |

|||

| date = Nov 2011 |

|||

| url = http://cep.lse.ac.uk/conference_papers/15b_11_2011/CEP_Report_UK_Business_15112011.pdf |

|||

| quote = The UK‟s high GDP per capita growth was driven by strong growth in productivity (GDP per hour), which was second only to the US. |

|||

}}</ref><ref name="Kendrick_1961"/> In a famous estimate, MIT Professor [[Robert Solow]] concluded that technological progress has accounted for 80 percent of the long-term rise in U.S. per capita income, with increased investment in capital explaining only the remaining 20 percent.<ref>{{ Cite journal |

|||

| last = Krugman |

|||

| first =Paul |

|||

| title = The Myth of Asia's Miracle |

|||

| year = 1994 |

|||

|journal=Foreign Affairs |

|||

|volume=73 |

|||

|issue=6 |

|||

|pages=62–78 |

|||

| url = https://www.foreignaffairs.com/articles/asia/1994-11-01/myth-asias-miracle |

|||

| doi=10.2307/20046929 |

|||

| jstor =20046929 |

|||

}}</ref> |

|||

Increases in productivity lower the real cost of goods. Over the 20th century, the real price of many goods fell by over 90%.<ref>{{cite book |title=Inside the Black Box: Technology and Economics |last=Rosenberg |first=Nathan |year=1982 |publisher=Cambridge University Press |location=Cambridge, New York |isbn=978-0-521-27367-1 |page=[https://archive.org/details/insideblackboxte00rose/page/258 258] |url=https://archive.org/details/insideblackboxte00rose/page/258 }}</ref> |

|||

Internationally, Mercantilism led to a contradiction: growth was gained through trade, but to trade with other nations on equal terms was disadvantageous. This – along with the rise of nation-states – encouraged several major wars. |

|||

Economic growth has traditionally been attributed to the accumulation of human and physical capital and the increase in productivity and creation of new goods arising from technological innovation.<ref name="Lucas1988">{{cite journal |last=Lucas |first=R. E. |year=1988 |title=On the Mechanics of Economic Development |journal=[[Journal of Monetary Economics]] |volume=22 |issue=1 |pages=3–42 |doi=10.1016/0304-3932(88)90168-7 |s2cid=154875771 }}</ref> Further [[division of labour]] (specialization) is also fundamental to rising productivity.<ref>{{cite book|title= Capitalism: A complete understanding of the nature and value of human economic life|last=Reisman|first= George|year= 1998|isbn= 0-915463-73-3|publisher =Jameson Books }}</ref> |

|||

Before [[industrialization]] technological progress resulted in an increase in the population, which was kept in check by food supply and other resources, which acted to limit per capita income, a condition known as the [[Malthusian trap]].<ref name="Galor (2005)">{{cite book |last=Galor |first=Oded |year=2005 |chapter=From Stagnation to Growth: Unified Growth Theory |title=Handbook of Economic Growth |volume=1 |pages=171–293 |publisher=Elsevier |chapter-url=https://ideas.repec.org/h/eee/grochp/1-04.html}}</ref>{{sfn|Clark|2007|loc=Part I: The Malthusian Trap|p={{pn|date=July 2022}}}} The rapid economic growth that occurred during the [[Industrial Revolution]] was remarkable because it was in excess of population growth, providing an escape from the Malthusian trap.{{sfn|Clark|2007|loc=Part 2: The Industrial Revolution|p={{pn|date=July 2022}}}} Countries that industrialized eventually saw their population growth slow down, a phenomenon known as the [[demographic transition]]. |

|||

Increases in productivity are the major factor responsible for per capita economic growth—this has been especially evident since the mid-19th century. Most of the economic growth in the 20th century was due to increased output per unit of labor, materials, energy, and land (less input per widget). The balance of the growth in output has come from using more inputs. Both of these changes increase output. The increased output included more of the same goods produced previously and new goods and services.<ref name="nber.org">Kendrick, J. W. 1961 "[https://www.nber.org/books/kend61-1 Productivity trends in the United States] {{Webarchive|url=https://web.archive.org/web/20190304154526/https://www.nber.org/books/kend61-1 |date=2019-03-04 }}", Princeton University Press</ref> |

|||

During the [[Industrial Revolution]], [[mechanization]] began to replace hand methods in manufacturing, and new processes streamlined production of chemicals, iron, steel, and other products.<ref name="Landes1969"> |

|||

{{cite book |

|||

|title=The Unbound Prometheus: Technological Change and Industrial Development in Western Europe from 1750 to the Present |

|||

|last=Landes |

|||

|first= David. S. |

|||

|author-link=David Landes |

|||

|year= 1969|publisher =Press Syndicate of the University of Cambridge |

|||

|location= Cambridge, New York |

|||

|isbn= 978-0-521-09418-4 |

|||

}} |

|||

</ref> [[Machine tool]]s made the economical production of metal parts possible, so that parts could be interchangeable.<ref name="Houndshell_1984">{{Hounshell1984}}</ref> (See: [[Interchangeable parts]].) |

|||

During the [[Second Industrial Revolution]], a major factor of [[productivity]] growth was the substitution of inanimate power for human and animal labor. Also there was a great increase in power as steam-powered [[electricity generation]] and internal combustion supplanted limited wind and [[water power]].<ref name="Landes1969"/> Since that replacement, the great expansion of total power was driven by continuous improvements in [[energy conversion efficiency]].<ref name="Ayres-Warr2004">{{Cite journal |

|||

|last1 = Ayres |

|||

|last2 = Warr |

|||

|first1 = Robert U. |

|||

|first2 = Benjamin |

|||

|title = Accounting for Growth: The Role of Physical Work |

|||

|date = June 2005 |

|||

|url = https://www.academia.edu/5771930 |

|||

|access-date = 2022-08-09 |

|||

|journal=Structural Change and Economic Dynamics |volume=16 |issue=2 |pages=181–209 |doi=10.1016/j.strueco.2003.10.003 |citeseerx=10.1.1.1085.9040 |

|||

}}</ref> Other major [[Productivity improving technologies (historical)|historical sources of productivity]] were [[automation]], transportation infrastructures (canals, railroads, and highways),<ref>{{Cite book |

|||

| last1 = Grubler |

|||

| first1 = Arnulf |

|||

| title = The Rise and Fall of Infrastructures |

|||

| year = 1990 |

|||

| url = http://www.iiasa.ac.at/Admin/PUB/Documents/XB-90-704.pdf |

|||

| access-date = 2011-02-01 |

|||

| archive-date = 2012-03-01 |

|||

| archive-url = https://web.archive.org/web/20120301221205/http://www.iiasa.ac.at/Admin/PUB/Documents/XB-90-704.pdf |

|||

| url-status = dead |

|||

}}</ref><ref> |

|||

{{cite book |

|||

|title=The Transportation Revolution, 1815–1860 |

|||

|last=Taylor |

|||

|first= George Rogers |

|||

|isbn= 978-0873321013|year=1951 |

|||

}} |

|||

</ref> new materials (steel) and power, which includes steam and internal combustion engines and [[electrification|electricity]]. Other [[productivity]] improvements included [[mechanized agriculture]] and scientific agriculture including chemical [[fertilizer]]s and livestock and poultry management, and the [[Green Revolution]]. [[Interchangeable parts]] made with [[machine tool]]s powered by [[electric motor]]s evolved into [[mass production]], which is universally used today.<ref name="Houndshell_1984" /> |

|||

[[File:Cost of chicken in time worked.jpg|thumb|upright=1.35|right|Productivity lowered the cost of most items in terms of work time required to purchase. Real [[food prices]] fell due to improvements in transportation and trade, [[mechanized agriculture]], [[fertilizer]]s, scientific farming and the [[Green Revolution]].]] |

|||

Great sources of productivity improvement in the late 19th century were railroads, steam ships, horse-pulled [[reaper]]s and [[combine harvester]]s, and [[steam engine|steam]]-powered factories.<ref name="Wells_1890">{{cite book |

|||

|title=Recent Economic Changes and Their Effect on Production and Distribution of Wealth and Well-Being of Society |

|||

|last=Wells |

|||

|first=David A. |

|||

|year=1890 |publisher= D. Appleton and Co.|location= New York|isbn= 978-0543724748 |url= https://archive.org/details/recenteconomicc01wellgoog }}</ref><ref> |

|||

{{cite book |title = A New Economic View of American History |

|||

|last1 = Atack |

|||

|first1 = Jeremy |

|||

|last2 = Passell |

|||

|first2 = Peter |

|||

|year = 1994 |

|||

|publisher = W.W. Norton and Co. |

|||

|location = New York |

|||

|isbn = 978-0-393-96315-1 |

|||

|url = https://archive.org/details/neweconomicviewo00atac |

|||

}} |

|||

</ref> The invention of processes for making cheap [[steel]] were important for many forms of [[mechanization]] and transportation. By the late 19th century both prices and weekly work hours fell because less labor, materials, and energy were required to produce and transport goods. However, real wages rose, allowing workers to improve their diet, buy consumer goods and afford better housing.<ref name="Wells_1890"/> |

|||

[[Mass production]] of the 1920s created [[overproduction]], which was arguably one of several [[causes of the Great Depression]] of the 1930s.<ref>{{cite book |title=Mass Production, the Stock Market Crash and the Great Depression |last=Beaudreau |first=Bernard C. |year=1996 |publisher=Authors Choice Press|location=New York, Lincoln, Shanghi }}</ref> Following the [[Great Depression]], economic growth resumed, aided in part by increased demand for existing goods and services, such as automobiles, telephones, radios, electricity and household appliances. New goods and services included television, air conditioning and commercial aviation (after 1950), creating enough new demand to stabilize the work week.<ref>{{Cite journal| last1 = Moore |

|||

| first1 = Stephen |

|||

| last2 = Simon |

|||

| first2 = Julian |

|||

| title = The Greatest Century That Ever Was: 25 Miraculous Trends of the last 100 Years |publisher = The Cato Institute |journal =Policy Analysis |issue=364 |

|||

| date = December 15, 1999 |

|||

| url = http://www.cato.org/pubs/pas/pa364.pdf |

|||

}}[[Diffusion curve]]s for various innovations start at Fig. 14</ref> The building of highway infrastructures also contributed to post-World War II growth, as did capital investments in manufacturing and chemical industries.<ref> |

|||

{{cite book |

|||

|title=A Great Leap Forward: 1930s Depression and U.S. Economic Growth |

|||

|last1=Field |

|||

|first1= Alexander J. |

|||

|year= 2011 |publisher =Yale University Press |

|||

|location= New Haven, London |

|||

|isbn=978-0-300-15109-1 |

|||

}} |

|||

</ref> The post-World War II economy also benefited from the discovery of vast amounts of oil around the world, particularly in the [[Middle East]]. By [[John Whitefield Kendrick|John W. Kendrick's]] estimate, three-quarters of increase in U.S. per capita GDP from 1889 to 1957 was due to increased productivity.<ref name="Kendrick_1961">{{cite book |title=Productivity Trends in the United States |last=Kendrick |first=John W. |year=1961 |publisher= Princeton University Press for NBER |page=3 |url=https://www.nber.org/chapters/c2236.pdf}}</ref> |

|||

Economic growth in the [[United States]] slowed down after 1973.<ref>[https://research.stlouisfed.org/fred2/series/USARGDPC St. Louis Federal Reserve] {{Webarchive|url=https://web.archive.org/web/20150413023638/https://research.stlouisfed.org/fred2/series/USARGDPC |date=2015-04-13 }} Real GDP per capita in the U.S. rose from $17,747 in 1960 to $26,281 in 1973 for a growth rate of 3.07%/yr. Calculation: (26,281/17,747)^(1/13). From 1973 to 2007 the growth rate was 1.089%. Calculation: (49,571/26,281)^(1/34) From 2000 to 2011 average annual growth was 0.64%.</ref> In contrast, growth in [[Asia]] has been strong since then, starting with [[Japan]] and spreading to [[Four Asian Tigers]], [[China]], [[Southeast Asia]], the [[Indian subcontinent]] and [[Asia Pacific]].<ref name="MarketWatch 2019">{{cite web | title=Semiconductor Foundry Market: 2019 Global Industry Trends, Growth, Share, Size and 2021 Forecast Research Report | website=MarketWatch | date=2019-11-28 | url=https://www.marketwatch.com/press-release/semiconductor-foundry-market-2019-global-industry-trends-growth-share-size-and-2021-forecast-research-report-2019-11-28 | access-date=2019-12-20 | archive-date=2019-12-20 | archive-url=https://web.archive.org/web/20191220172649/https://www.marketwatch.com/press-release/semiconductor-foundry-market-2019-global-industry-trends-growth-share-size-and-2021-forecast-research-report-2019-11-28 | url-status=dead }}</ref> In 1957 [[South Korea]] had a lower per capita [[GDP]] than [[Ghana]],<ref>[https://www.independent.co.uk/news/education/education-news/leading-article-africa-has-to-spend-carefully-407666.html Leading article: Africa has to spend carefully] {{Webarchive|url=https://web.archive.org/web/20120124072325/https://www.independent.co.uk/news/education/education-news/leading-article-africa-has-to-spend-carefully-407666.html |date=2012-01-24 }}. The Independent. July 13, 2006.</ref> and by 2008 it was 17 times as high as Ghana's.<ref>Data refer to the year 2008. $26,341 GDP for Korea, $1513 for Ghana. ''World Economic Outlook Database – October 2008''. [[International Monetary Fund]].</ref> The Japanese economic growth has slackened considerably since the late 1980s. |

|||

Productivity in the United States grew at an increasing rate throughout the 19th century and was most rapid in the early to middle decades of the 20th century.<ref>{{Cite journal |

|||

| last1 = Kendrick |

|||

| first1 = John |

|||

| title = U.S. Productivity Performance in Perspective, Business Economics, October 1, 1991 |

|||

| journal = Business Economics |

|||

| volume = 26 |

|||

| issue = 4 |

|||

| pages = 7–11 |

|||

| year =1991 |

|||

| jstor = 23485828 |

|||

}}</ref><ref>{{Cite journal |

|||

| last = Field |

|||

| first = Alezander J. |

|||

| title = U.S. Economic Growth in the Gilded Age |

|||

| journal = Journal of Macroeconomics |

|||

| volume = 31 |

|||

| year = 2007 |

|||

| pages = 173–190 |

|||

| doi = 10.1016/j.jmacro.2007.08.008 |

|||

| s2cid = 154848228 |

|||

| url = http://www.scu.edu/business/economics/research/upload/field_macroecon_2009.pdf |

|||

| access-date = 2014-07-12 |

|||

| archive-date = 2016-01-08 |

|||

| archive-url = https://web.archive.org/web/20160108181103/http://www.scu.edu/business/economics/research/upload/field_macroecon_2009.pdf |

|||

| url-status = dead |

|||

}}</ref><ref>{{Cite journal|title=Technological Change and Economic Growth the Interwar Years and the 1990s|last=Field|first=Alexander|journal=The Journal of Economic History|year=2004|volume=66|issue=1 |url=https://www.cambridge.org/core/journals/journal-of-economic-history/article/technological-change-and-us-productivity-growth-in-the-interwar-years/99E3F7A9C33CA30278F06C1442A913E3|pages=203–236 |doi=10.1017/S0022050706000088 |ssrn=1105634 |s2cid=154757050}}</ref><ref name="Gordon2000">{{Cite journal |

|||

| last1 = Gordon |

|||

| first1 = Robert J. |

|||

| title = Interpreting the 'One Big Wave' in U.S. Long Term Productivity Growth |

|||

| journal = NBER Working Paper No. 7752 |

|||

| date = June 2000 |

|||

| doi = 10.3386/w7752 |

|||

| doi-access = free |

|||

}}</ref><ref>{{cite book |

|||

|title = Two Centuries of American Macroeconomic Growth From Exploitation of Resource Abundance to Knowledge-Driven Development |

|||

|last1 = Abramovitz |

|||

|first1 = Moses |

|||

|last2 = David |

|||

|first2 = Paul A. |

|||

|year = 2000 |

|||

|publisher = Stanford University |

|||

|pages = 24–5 (pdf pp. 28–9) |

|||

|url = http://www-siepr.stanford.edu/papers/pdf/01-05.pdf |

|||

|access-date = 2014-07-13 |

|||

|archive-date = 2020-07-31 |

|||

|archive-url = https://web.archive.org/web/20200731023437/http://www-siepr.stanford.edu/papers/pdf/01-05.pdf |

|||

|url-status = dead |

|||

}}</ref> U.S. productivity growth spiked towards the end of the century in 1996–2004, due to an acceleration in the rate of technological innovation known as [[Moore's law]].<ref name="Gordon 2013">{{cite journal |title=U.S. Productivity Growth: The Slowdown Has Returned After a Temporary Revival |journal=International Productivity Monitor, Centre for the Study of Living Standards |date=Spring 2013 |last=Gordon |first=Robert J. |volume=25 |pages=13–9 |url=http://faculty-web.at.northwestern.edu/economics/Gordon/SAN-to-NBER%20Baily-Sharpe%20as%20published_130327.pdf |access-date=2014-07-19 |quote=The U.S. economy achieved a growth rate of labour productivity of 2.48 per cent per year for 81 years, followed by 24 years of 1.32 per cent, then a temporary recovery back to 2.48 per cent per cent, and a final slowdown to 1.35 per cent. The similarity of the growth rates in 1891–1972 with 1996–2004, and of 1972–96 with 1996–2011 is quite remarkable. |url-status=dead |archive-url=https://web.archive.org/web/20140809065612/http://faculty-web.at.northwestern.edu/economics/Gordon/SAN-to-NBER%20Baily-Sharpe%20as%20published_130327.pdf |archive-date=2014-08-09 }}</ref><ref name="Jorgenson&Ho_2014"><!-- Jorgenson, Ho, and Samuels (2014) Long-term Estimates of U.S. Productivity and Growth -->{{cite Q|Q111455533}}</ref><ref>{{cite journal|doi=10.1257/jep.22.1.3 |title=A Retrospective Look at the U.S. Productivity Growth Resurgence |journal=Journal of Economic Perspectives |volume=22 |issue=1 |pages=3–24 |author1=Dale W. Jorgenson |author2=Mun S. Ho |author3=Kevin J. Stiroh |year=2008 |doi-access=free }}</ref><ref>{{cite web|url=http://bea.gov/papers/pdf/ip-nipa.pdf |title=Information Processing Equipment and Software in the National Accounts |publisher=U.S. Department of Commerce Bureau of Economic Analysis |author1=Bruce T. Grimm |author2=Brent R. Moulton |author3=David B. Wasshausen |year=2002 |access-date=2014-05-15}}</ref> After 2004 U.S. productivity growth returned to the low levels of 1972–96.<ref name="Gordon 2013"/> |

|||

=== Factor accumulation === |

|||

Capital in economics ordinarily refers to physical capital, which consists of structures (largest component of physical capital) and equipment used in business (machinery, factory equipment, computers and office equipment, construction equipment, business vehicles, medical equipment, etc.).{{sfn|Bjork|1999|p=251}} Up to a point increases in the amount of capital per worker are an important cause of economic output growth. Capital is subject to [[diminishing returns]] because of the amount that can be effectively invested and because of the growing burden of depreciation. In the development of economic theory, the distribution of income was considered to be between labor and the owners of land and capital.<ref> |

|||

{{cite book|title=History of Economic Thought: A Critical Perspective|last1=Hunt|first1=E. K.|last2=Lautzenheiser|first2=Mark|publisher=PHI Learning|year=2014|isbn=978-0765625991}} |

|||

</ref> In recent decades there have been several Asian countries with high rates of economic growth driven by capital investment.<ref>{{Cite journal|last=Krugman|first=Paul|year=1994|title=The Myth of Asia's Miracle|url=https://www.foreignaffairs.com/articles/asia/1994-11-01/myth-asias-miracle|journal=Foreign Affairs|volume=73|issue=6|pages=62–78|doi=10.2307/20046929|jstor=20046929}}</ref> |

|||

The work week declined considerably over the 19th century.<ref>{{Cite web |

|||

|title = Hours of Work in U.S. History |

|||

|year = 2010 |

|||

|url = http://eh.net/encyclopedia/article/whaples.work.hours.us |

|||

|url-status = dead |

|||

|archive-url = https://web.archive.org/web/20111026075949/http://eh.net/encyclopedia/article/whaples.work.hours.us |

|||

|archive-date = 2011-10-26 |

|||

}}</ref><ref>{{Cite journal |

|||

| last1 = Whaples |

|||

| first1 = Robert |

|||

| title = The Shortening of the American Work Week: An Economic and Historical Analysis of Its Context, Causes, and Consequences |journal=The Journal of Economic History |volume=51 |issue= 2 |pages=454–7 |

|||

| date = June 1991 |

|||

| doi=10.1017/s0022050700039073 |

|||

| s2cid = 153813437 |

|||

}}</ref> By the 1920s the average work week in the U.S. was 49 hours, but the work week was reduced to 40 hours (after which overtime premium was applied) as part of the [[National Industrial Recovery Act]] of 1933. |

|||

Demographic factors may influence growth by changing the employment to population ratio and the labor force participation rate.{{sfn|Bjork|1999|p={{pn|date=July 2022}}}} [[Industrialization]] creates a [[demographic transition]] in which birth rates decline and the average age of the population increases. |

|||

Women with fewer children and better access to market employment tend to join the labor force in higher percentages. There is a reduced demand for child labor and children spend more years in school. The increase in the percentage of women in the labor force in the U.S. contributed to economic growth, as did the entrance of the [[baby boomer]]s into the workforce.{{sfn|Bjork|1999|p={{pn|date=July 2022}}}} |

|||

See: [[Spending wave]] |

|||

==Other factors affecting growth== |

|||

===Human capital=== |

|||

Many theoretical and empirical analyses of economic growth attribute a major role to a country's level of [[human capital]], defined as the skills of the population or the work force. Human capital has been included in both neoclassical and endogenous growth models.<ref>{{cite journal|last1=Mankiw|first1=N. Gregory|author-link=N. Gregory Mankiw|last2=Romer|first2=David|author-link2=David Romer|last3=Weil|first3=David|year=1992|title=A Contribution to the Empirics of Economic Growth|journal=[[Quarterly Journal of Economics]]|volume=107|issue=2|pages=407–37|doi=10.2307/2118477|jstor=2118477|citeseerx=10.1.1.335.6159|s2cid=1369978}}</ref><ref>{{cite journal|last1=Sala-i-Martin |first1=Xavier|last2=Doppelhofer|first2=Gernot|last3=Miller|first3=Ronald I.|year=2004|title=Determinants of Long-term Growth: A Bayesian Averaging of Classical Estimates (BACE) Approach|journal=[[American Economic Review]] |volume=94|issue=4|pages=813–35|doi=10.1257/0002828042002570|s2cid=55710066|url=http://www.nber.org/papers/w7750.pdf}}</ref><ref>{{cite journal|last=Romer|first=Paul|author-link=Paul Romer|year=1990|title=Human Capital and Growth: Theory and Evidence|journal=Carnegie-Rochester Conference Series on Public Policy|volume=32|pages=251–86|doi=10.1016/0167-2231(90)90028-J|s2cid=15491089|url=http://www.nber.org/papers/w3173.pdf}}</ref> |

|||

A country's level of human capital is difficult to measure since it is created at home, at school, and on the job. Economists have attempted to measure human capital using numerous proxies, including the population's level of literacy, its level of numeracy, its level of book production/capita, its average level of formal schooling, its average test score on international tests, and its cumulative depreciated investment in formal schooling. The most commonly-used measure of human capital is the level (average years) of school attainment in a country, building upon the data development of [[Robert Barro]] and Jong-Wha Lee.<ref>{{cite journal|last1=Barro|first1=Robert J. |last2=Lee|first2=Jong-Wha|year=2001|title=International Data on Educational Attainment: Updates and Implications|journal=Oxford Economic Papers|volume=53|issue=3|pages=541–63|doi=10.1093/oep/53.3.541|s2cid=30819754 |url=https://www.hks.harvard.edu/sites/default/files/centers/cid/files/publications/faculty-working-papers/042.pdf}}</ref> This measure is widely used because Barro and Lee provide data for numerous countries in five-year intervals for a long period of time. |

|||

One problem with the schooling attainment measure is that the amount of human capital acquired in a year of schooling is not the same at all levels of schooling and is not the same in all countries. This measure also presumes that human capital is only developed in formal schooling, contrary to the extensive evidence that families, neighborhoods, peers, and health also contribute to the development of human capital. Despite these potential limitations, Theodore Breton has shown that this measure can represent human capital in log-linear growth models because across countries GDP/adult has a log-linear relationship to average years of schooling, which is consistent with the log-linear relationship between workers' personal incomes and years of schooling in the [[Mincer earnings function|Mincer model]].<ref name="Theodore">{{cite journal|last=Breton|first=Theodore R.|year=2015|title=Higher Test Scores or More Schooling? Another Look at the Causes of Economic Growth|journal=[[Journal of Human Capital]]|volume=9|issue=2|pages=239–263 |url=http://repository.eafit.edu.co:80/bitstream/10784/2644/3/2013_34_Theodore_Breton.pdf |doi=10.1086/681911|hdl=10784/2644|s2cid=140069337|hdl-access=free}}</ref> |

|||

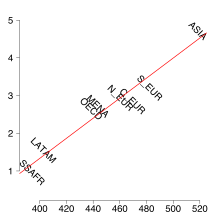

[[File:Knowledge capital and economic growth rates in different regions.svg|thumb|Economic growth rates (percent, vertical) v. standardized tests of student achievement in different regions, both adjusted for GDP per capita in 1960]] |

|||

[[Eric Hanushek]] and Dennis Kimko introduced measures of students' mathematics and science skills from international assessments into growth analysis.<ref>{{cite journal|last1=Hanushek|first1=Eric A.|last2=Kimko|first2=Dennis D.|year=2000|title=Schooling, Labor Force Quality, and the Growth of Nations|journal=American Economic Review|volume=90|issue=5|pages=1184–208|doi=10.1257/aer.90.5.1184|citeseerx=10.1.1.232.7942}}</ref> They found that this measure of human capital was very significantly related to economic growth. Eric Hanushek and [[Ludger Wößmann]] have extended this analysis.<ref>{{cite journal|last1=Hanushek|first1=Eric A.|last2=Woessmann|first2=Ludger|year=2008 |title=The Role of Cognitive Skills in Economic Development|journal=Journal of Economic Literature|volume=46|issue=3|pages=607–68|doi=10.1257/jel.46.3.607|citeseerx=10.1.1.507.5325}}</ref><ref>{{cite journal|last1=Hanushek |first1=Eric A.|last2=Woessmann|first2=Ludger|year=2011|title=How Much Do Educational Outcomes Matter in OECD Countries?|journal=Economic Policy|volume=26|issue=67|pages=427–91|doi=10.1111/j.1468-0327.2011.00265.x|s2cid=7733555 |url=https://www.cesifo-group.de/DocDL/cesifo1_wp3238.pdf}}</ref> Theodore Breton shows that the correlation between economic growth and students' average test scores in Hanushek and Wößmann's analyses is actually due to the relationship in countries with less than eight years of schooling. He shows that economic growth is not correlated with average scores in more educated countries.<ref name="Theodore" /> Hanushek and Wößmann further investigate whether the relationship of knowledge capital to economic growth is causal. They show that the level of students' cognitive skills can explain the slow growth in Latin America and the rapid growth in East Asia.<ref>{{cite book|url=https://books.google.com/books?id=rIhLCAAAQBAJ|title=The Knowledge Capital of Nations: Education and the Economics of Growth|last1=Hanushek|first1=Eric|last2=Woessmann|first2=Ludger|publisher=[[MIT Press]]|year=2015|isbn=978-0-262-02917-9}}</ref> |

|||

[[Jörg Baten|Joerg Baten]] and [[Jan Luiten van Zanden]] employ book production per capita as a proxy for sophisticated literacy capabilities and find that "Countries with high levels of human capital formation in the 18th century initiated or participated in the industrialization process of the 19th century, whereas countries with low levels of human capital formation were unable to do so, among them many of today's Less Developed Countries such as India, Indonesia, and China."<ref>{{Cite journal|last1=Baten|first1=Joerg|last2=van Zanden|first2=Jan Luiten|date=2008|title=Book Production and the Onset of Modern Economic Growth|journal=Journal of Economic Growth|volume=13 | issue = 3 |pages=217–235|doi=10.1007/s10887-008-9031-9|hdl=10230/757|s2cid=195314801|hdl-access=free}}</ref> |

|||

=== Health === |

|||

Here, health is approached as a functioning from [[Amartya Sen]] and [[Martha Nussbaum]]'s [[capability approach]] that an individual has to realise the achievements like economic success. Thus health in a broader sense is not the absence of illness, but the opportunity for people to biologically develop to their full potential their entire lives <ref name=Lustig>{{Cite journal|last=Lustig|first=Nora|year=2006 |title=Investing in health for economic development: The case of Mexico |journal=WIDER Research Paper |isbn=9291907987 |location=Helsinki |publisher=The United Nations University World Institute for Development Economics Research |url=https://www.econstor.eu/bitstream/10419/63484/1/510836623.pdf |issue=2006/30}}</ref> It is established that human capital is an important asset for economic growth, however, it can only be so if that population is healthy and well-nourished. One of the most important aspects of health is the mortality rate and how the rise or decline can affect the labour supply predominant in a developing economy.<ref name="Longevity and Life cycle Savings">{{Cite journal|last1=Bloom |first1=David|last2=Canning|first2=David|last3=Graham|first3=Bryan|year=2003|title=Longevity and Life cycle Savings |journal=The Scandinavian Journal of Economics|volume=105|issue=3|pages=319–338|s2cid=11960778 |doi=10.1111/1467-9442.t01-1-00001|url=https://onlinelibrary.wiley.com/doi/full/10.1111/1467-9442.t01-1-00001}}</ref> Mortality decline triggers greater investments in individual human capital and an increase in economic growth. [[Matteo Cervellati]] and [[Uwe Sunde]]<ref name="aeaweb.org">{{Cite journal |last1=Cervellati|first1=Matteo|last2=Sunde|first2=Uwe|year=2005|title=Human Capital Formation, Life Expectancy, and the Process of Development |journal=American Economic Review |volume=95 |issue=5 |pages=1653–1672 |pmid=29125727 |doi=10.1257/000282805775014380 |url=https://www.aeaweb.org/articles?id=10.1257/000282805775014380}}</ref> and [[Rodrigo.R Soares]]<ref name="Soares 2005">{{Cite journal|last=Soares|first=Rodrigo R.|year=2005|title=Mortality Reductions, Educational Attainment, and Fertility Choice|journal=American Economic Review |volume=95 |issue=3 |pages=580–601 |pmid=29125724 |doi=10.1257/0002828054201486 |url=https://www.aeaweb.org/articles?id=10.1257/0002828054201486}}</ref> consider frameworks in which mortality decline has an influence on parents to have fewer children and to provide quality education for those children, as a result instituting an economic-demographic transition. |

|||

The relationship between health and economic growth is further nuanced by distinguishing the influence of specific diseases on [[GDP]] per capita from that of aggregate measures of [[health]], such as [[life expectancy]]<ref name="Health and Economic Growth">{{Cite SSRN|last1=Bloom|first1=David|last2=Kuhn|first2=Michael|last3=Prettner|first3=Klaus|year=2018|title=Health and Economic Growth|ssrn=3301688}}</ref> Thus, investing in health is warranted both from the growth and equity perspectives, given the important role played by health in the economy. Protecting health assets from the impact of systemic transitional costs on economic reforms, pandemics, economic crises and natural disasters is also crucial. Protection from the shocks produced by illness and death, are usually taken care of within a country’s social insurance system. In areas such as Sub-Saharan Africa, where the prevalence of [[HIV and AIDS]], has a comparative negative impact on economical development. It will be interesting to see how research in the areas of health in near future uncover how the world will be performing living with the [[SARS-CoV-2]], especially looking at the economic impacts it already has in a space of two years. Ultimately, when people live longer on average, [[human capital]] expenditures are more likely to pay off, and all of these mechanisms center around the complementarity of longevity, [[health]], and [[education]], for which there is ample empirical evidence.<ref name="Health and Economic Growth"/><ref name=Lustig/><ref name="aeaweb.org"/><ref name="Soares 2005"/><ref name="Longevity and Life cycle Savings"/> |

|||

===Political institutions=== |

|||

{{see also|Great Divergence#Property rights|Great Divergence#Efficiency of markets and state intervention|Great Divergence#State prohibition of new technology}} |

|||

<blockquote>“As institutions influence behavior and incentives in real life, they forge the success or failure of nations.”<ref name="Acemoglu&Robinson">{{harvnb|Acemoglu|Robinson|2012|page= [https://archive.org/details/whynationsfailor0000acem/page/43 43]}}.</ref></blockquote> |

|||

In economics and economic history, the transition to [[capitalism]] from earlier economic systems was enabled by the adoption of government policies that facilitated commerce and gave individuals more personal and economic freedom. These included new laws favorable to the establishment of business, including [[contract law]], laws providing for the protection of [[private property]], and the abolishment of anti-usury laws.<ref> |

|||

{{cite book |

|||

|title=History of Economic Thought: A Critical Perspective |

|||

|last1=Hunt |

|||

|first1= E. K. |

|||

|last2=Lautzenheiser |

|||

|first2=Mark |

|||

|year= 2014 |publisher =PHI Learning |

|||

|isbn= 978-0765625991 |

|||

}} |

|||

</ref><ref> |

|||

{{cite book |

|||

|title=The Unbound Prometheus: Technological Change and Industrial Development in Western Europe from 1750 to the Present |

|||

|last=Landes |

|||

|first= David. S. |

|||

|year= 1969|publisher =Press Syndicate of the University of Cambridge |

|||

|location= Cambridge, New York |

|||

|isbn= 978-0-521-09418-4|pages=8–18 |

|||

}} |

|||

</ref> |

|||

Much of the literature on economic growth refers to the success story of the British state after the [[Glorious Revolution]] of 1688, in which high fiscal capacity combined with constraints on the power of the king generated some respect for the rule of law.<ref>{{cite journal |last1=North |first1=Douglass C. |author-link=Douglass North |first2=Barry |last2=Weingast |s2cid=3198200 |title=Constitutions and Commitment: the Evolutions of Institutions Governing Public Choice in Seventeenth Century England |journal=Journal of Economic History |year=1989 |volume=49 |issue=4 |pages=803–32 |doi=10.1017/S0022050700009451 }}</ref><ref>{{cite book |last=Barker |first=J. H. |chapter=Personal Liberty under Common Law of England, 1200–1600 |editor-first=R. W. |editor-last=Davis |title=The Origins of Modern Freedom in the West |publisher=Stanford University Press |location=Stanford |year=1995 |pages=[https://archive.org/details/originsofmodernf0000unse/page/178 178–202] |isbn=978-0-8047-2474-6 |chapter-url=https://archive.org/details/originsofmodernf0000unse/page/178 }}</ref><ref>{{cite book |last1=Acemoglu |first1=Daron |first2=Simon |last2=Johnson |first3=James A. |last3=Robinson |chapter=Institutions as a Fundamental Cause of Long-Run Growth |editor-first=Philippe |editor-last=Aghion |editor2-first=Steven |editor2-last=Durlauf |title=Handbook of Economic Growth |series=Vol. 1, Part A |publisher=Elsevier |year=2005 |pages=385–472 |doi=10.1016/S1574-0684(05)01006-3 |isbn=9780444520418 }}</ref><ref name="Acemoglu&Robinson"/> However, others have questioned that this institutional formula is not so easily replicable elsewhere as a change in the Constitution—and the type of institutions created by that change—does not necessarily create a change in political power if the economic powers of that society are not aligned with the new set of rule of law institutions.<ref>{{cite book |last1=Rajan |first1=R. |first2=L. |last2=Zingales |title=Saving Capitalism from the Capitalists |publisher=Random House |location=New York |year=2003 |isbn=978-0-7126-2131-1 }}</ref> In England, a dramatic increase in the state's fiscal capacity followed the creation of constraints on the crown, but elsewhere in Europe increases in [[state capacity]] happened before major rule of law reforms.<ref name=":0">{{cite journal |last1=Johnson |first1=Noel D. |first2=Mark |last2=Koyama |title=States and Economic Growth: Capacity and Constraints |year=2017 |journal=Explorations in Economic History |volume=64 |pages=1–20 |doi=10.1016/j.eeh.2016.11.002 }}</ref> |

|||

There are many different ways through which states achieved state (fiscal) capacity and this different capacity accelerated or hindered their economic development. Thanks to the underlying homogeneity of its land and people, England was able to achieve a unified legal and fiscal system since the Middle Ages that enabled it to substantially increase the taxes it raised after 1689.<ref name=":0" /> On the other hand, the French experience of state building faced much stronger resistance from local feudal powers keeping it legally and fiscally fragmented until the French Revolution despite significant increases in state capacity during the seventeenth century.<ref>{{cite journal |last=Johnson |first=Noel D. |s2cid=73630821 |title=Banking on the King: The Evolution of the Royal Revenue Farms in Old Regime France |journal=Journal of Economic History |year=2006 |volume=66 |issue=4 |pages=963–991 |doi=10.1017/S0022050706000398 }}</ref><ref>{{cite journal |last1=Johnson |first1=Noel D. |first2=Mark |last2=Koyama |title=Tax Farming and the Origins of State Capacity in England and France |journal=Explorations in Economic History |year=2014 |volume=51 |issue=1 |pages=1–20 |doi=10.1016/j.eeh.2013.07.005 }}</ref> Furthermore, Prussia and the Habsburg empire—much more heterogeneous states than England—were able to increase state capacity during the eighteenth century without constraining the powers of the executive.<ref name=":0" /> Nevertheless, it is unlikely that a country will generate institutions that respect property rights and the rule of law without having had first intermediate fiscal and political institutions that create incentives for elites to support them. Many of these intermediate level institutions relied on informal private-order arrangements that combined with public-order institutions associated with states, to lay the foundations of modern rule of law states.<ref name=":0" /> |

|||

In many poor and developing countries much land and housing are held outside the formal or legal property ownership registration system. In many urban areas the poor "invade" private or government land to build their houses, so they do not hold title to these properties. Much unregistered property is held in informal form through various property associations and other arrangements. Reasons for extra-legal ownership include excessive bureaucratic red tape in buying property and building. In some countries, it can take over 200 steps and up to 14 years to build on government land. Other causes of extra-legal property are failures to notarize transaction documents or having documents notarized but failing to have them recorded with the official agency.<ref name="Desoto_2000">{{cite book |title = The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else |

|||

|last = De Soto |

|||

|first = Hernando |

|||

|year = 2000 |

|||

|publisher = Basic Books |

|||

|isbn = 978-0465016143 |

|||

|url = https://archive.org/details/mysteryofcapital00soto |

|||

}} |

|||

</ref> |

|||

Not having clear legal title to property limits its potential to be used as collateral to secure loans, depriving many poor countries of one of their most important potential sources of capital. Unregistered businesses and lack of accepted accounting methods are other factors that limit potential capital.<ref name="Desoto_2000"/> |

|||

Businesses and individuals participating in unreported business activity and owners of unregistered property face costs such as bribes and pay-offs that offset much of any taxes avoided.<ref name="Desoto_2000"/> |

|||

"Democracy Does Cause Growth", according to Acemoglu et al. Specifically, "democracy increases future GDP by encouraging investment, increasing schooling, inducing economic reforms, improving public goods provision, and reducing social unrest."<ref>{{cite journal |last1=Acemoglu |first1=Daron |last2=Naidu |first2=Suresh |last3=Restrepo |first3=Pascual |last4=Robinson |first4=James A. |title=Democracy Does Cause Growth |journal=NBER Working Paper No. 20004 |doi=10.3386/w20004 |date=March 2014 |doi-access=free}}</ref> [[UNESCO]] and the [[United Nations]] also consider that [[cultural property]] protection, high-quality education, cultural diversity and social cohesion in armed conflicts are particularly necessary for qualitative growth.<ref>Jyot Hosagrahar „Culture: at the heart of SDGs“, UNESCO-Kurier, April–June 2017.</ref> |

|||

According to [[Daron Acemoglu]], [[Simon Johnson (economist)|Simon Johnson]] and [[James A. Robinson (Harvard University)|James Robinson]], the positive correlation between high income and cold climate is a by-product of history. Europeans adopted very different colonization policies in different colonies, with different associated institutions. In places where these colonizers faced high mortality rates (e.g., due to the presence of tropical diseases), they could not settle permanently, and they were thus more likely to establish extractive institutions, which persisted after independence; in places where they could settle permanently (e.g. those with temperate climates), they established institutions with this objective in mind and modeled them after those in their European homelands. In these 'neo-Europes' better institutions in turn produced better development outcomes. Thus, although other economists focus on the identity or type of legal system of the colonizers to explain institutions, these authors look at the environmental conditions in the colonies to explain institutions. For instance, former colonies have inherited corrupt governments and geopolitical boundaries (set by the colonizers) that are not properly placed regarding the geographical locations of different ethnic groups, creating internal disputes and conflicts that hinder development. In another example, societies that emerged in colonies without solid native populations established better property rights and incentives for long-term investment than those where native populations were large.<ref>{{cite journal |last1=Acemoglu|first1=Daron|last2=Johnson|first2=Simon|last3=Robinson|first3=James A.|year=2001|title=The Colonial Origins of Comparative Development: An Empirical Investigation|journal=[[American Economic Review]]|volume=91 |issue=5|pages=1369–401|doi=10.1257/aer.91.5.1369|citeseerx=10.1.1.313.7172}}</ref> |

|||

In ''Why Nations Fail'', Acemoglu and Robinson said that the English in North America started by trying to repeat the success of the Spanish [[Conquistador]]s in extracting wealth (especially gold and silver) from the countries they had conquered. This system repeatedly failed for the English. Their successes rested on giving land and a voice in the government to every male settler to incentivize productive labor. In Virginia it took twelve years and many deaths from starvation before the governor decided to try democracy.{{sfn|Acemoglu|Robinson|2012|p=26}} |

|||

Economic growth, its sustainability and its distribution remain central aspects of government policy. For example, the [[UK Government]] recognises that "Government can play an important role in supporting economic growth by helping to level the playing field through the way it [[government procurement|buys public goods, works and services]]",<ref>Crown Commercial Service, [https://assets.publishing.service.gov.uk/media/5a7f8126e5274a2e8ab4c92f/Balanced_Scorecard_paper.pdf Procuring Growwth: Balanced Scorecard], published October 2016, accessed 17 April 2024</ref> and "Post-[[COVID-19 pandemic|Pandemic]] Economic Growth" has been featured in a series of inquiries undertaken by the parliamentary [[Business, Energy and Industrial Strategy Committee]], which argues that the UK Government "has a big job to do in helping businesses survive, stimulating economic growth and encouraging the creation of well-paid meaningful jobs".<ref>Business, Energy and Industrial Strategy Committee, [https://committees.parliament.uk/work/342/postpandemic-economic-growth/news/115838/postpandemic-economic-growth-superinquiry-launched-by-beis-committee/ Post-Pandemic Economic Growth super-inquiry launched by BEIS Committee], published 3 June 2020, accessed 17 April 2024</ref> |

|||

==== Democracy and economic growth ==== |

|||

{{excerpt|Democracy and economic growth}} |

|||

=== Entrepreneurs and new products === |

|||

Policymakers and scholars frequently emphasize the importance of entrepreneurship for economic growth. However, surprisingly few research empirically examine and quantify entrepreneurship's impact on growth. This is due to endogeneity—forces that drive economic growth also drive entrepreneurship. In other words, the empirical analysis of the impact of entrepreneurship on growth is difficult because of the joint determination of entrepreneurship and economic growth. A few papers use quasi-experimental designs, and have found that entrepreneurship and the density of small businesses indeed have a causal impact on regional growth.<ref>{{Cite journal | doi=10.1093/jeg/lbw021| title=Entrepreneurship, small businesses and economic growth in cities| journal=Journal of Economic Geography| pages=311–343 <!-- Bad Crossref data: lbw021 --> |volume=17 |issue=2 | date=2016-07-28| last1=Lee| first1=Yong Suk| url=https://academic.oup.com/joeg/article-pdf/17/2/311/11008876/lbw021.pdf}}</ref><ref>{{Cite journal | doi=10.1016/j.jbusvent.2017.11.001| title=Government guaranteed small business loans and regional growth| journal=Journal of Business Venturing| volume=33| pages=70–83| year=2018| last1=Lee| first1=Yong Suk| s2cid=168857205}}</ref> |

|||

Another major cause of economic growth is the introduction of new products and services and the improvement of existing products. New products create demand, which is necessary to offset the decline in employment that occurs through labor-saving technology (and to a lesser extent employment declines due to savings in energy and materials).<ref name="Jorgenson&Ho_2014"/><ref>{{Cite book |last1=Ayres |first1=Robert |author1-link=Robert Ayres (scientist) |title=Technological Transformations and Long Waves |year=1989 |page=9 |isbn=3-7045-0092-5 |publisher=Novographic |location=Vienna, Austria |url-status=dead |url=http://www.iiasa.ac.at/Admin/PUB/Documents/RR-89-001.pdf |archive-date=2011-07-16 |archive-url=https://web.archive.org/web/20110716175240/http://www.iiasa.ac.at/Admin/PUB/Documents/RR-89-001.pdf}} |

|||

Attributed to Mensch who described new products as "demand creating".</ref> In the U.S. by 2013 about 60% of consumer spending was for goods and services that did not exist in 1869. Also, the creation of new services has been more important than invention of new goods.<ref>{{cite book |title=The Rise and Fall of American Growth |last=Gordon |first=Robert J. |year=2016 |publisher=Princeton University Press |location=Princeton, NJ |isbn=978-0-691-14772-7 |pages=39}}</ref> |

|||

=== Structural change === |

|||

{{Main|Rostow's stages of growth}} |

|||

Economic growth in the U.S. and other developed countries went through phases that affected growth through changes in the labor force participation rate and the relative sizes of economic sectors. The transition from an agricultural economy to manufacturing increased the size of the sector with high output per hour (the high-productivity manufacturing sector), while reducing the size of the sector with lower output per hour (the lower productivity agricultural sector). Eventually high productivity growth in manufacturing reduced the sector size, as prices fell and employment shrank relative to other sectors.<ref>{{cite web |title=Manufacturing's declining share of GDP is a global phenomenon, and it's something to celebrate |url=http://www.uschamberfoundation.org/blog/2012/03/manufacturing%E2%80%99s-declining-share-gdp |work=U.S. Chamber of Commerce Foundation |access-date=2014-06-26 |archive-date=2021-04-20 |archive-url=https://web.archive.org/web/20210420114823/https://www.uschamberfoundation.org/blog/2012/03/manufacturing%E2%80%99s-declining-share-gdp |url-status=dead }}</ref><ref>{{cite web|title=All Employees: Manufacturing |date=January 1939 |url=http://research.stlouisfed.org/fred2/series/MANEMP}}</ref> The service and government sectors, where output per hour and productivity growth is low, saw increases in their shares of the economy and employment during the 1990s.{{sfn|Bjork|1999|p={{pn|date=July 2022}}}} The [[public sector]] has since contracted, while the service economy expanded in the 2000s. |

|||

The structural change could also be viewed from another angle. It is possible to divide real economic growth into two components: an indicator of extensive economic growth—the ‘quantitative’ GDP—and an indicator of the improvement of the quality of goods and services—the ‘qualitative’ GDP.<ref>{{Cite SSRN |last=Kuprianov|first=Alexey|date=2018-04-30|title=Decomposition of GDP. The Role of Quality of Goods and Services in Measuring Economic Growth |ssrn=3170839}}</ref> |

|||

== Growth theories {{anchor|theory}} == |

|||

=== Adam Smith === |

|||

Adam Smith pioneered modern economic growth and performance theory in his book [[The Wealth of Nations]]'','' first published in 1776. For Smith, the main factors of economic growth are division of labour and [[capital accumulation]]. However, these are conditioned by what he calls "the extent of the market". This is conditioned notably by geographic factors but also institutional ones such as the political-legal environment.<ref>Adam Smith, ''The Wealth of Nations'' (1776). ''Adam Smith's The Wealth of Nations: A Translation into Modern English'', ISR Publications, 2015.</ref> |

|||

=== Malthusian theory === |

|||

{{Main|Malthusianism}} |

|||

Malthusianism is the idea that population growth is potentially exponential while the growth of the food supply or other resources is linear, which eventually reduces living standards to the point of triggering a population die off. The Malthusian theory also proposes that over most of human history technological progress caused larger population growth but had no impact on income per capita in the long run. According to the theory, while technologically advanced economies over this epoch were characterized by higher population density, their level of income per capita was not different from those among technologically regressed society. |

|||

The conceptual foundations of the Malthusian theory were formed by Thomas Malthus,<ref>{{Cite book|title=An Essay on the Principle of Population|last=Malthus|first=Thomas R.|publisher=Oxford University Press|year=1798|editor-last=Gilbert|editor-first=Geoffrey|location=Oxford|publication-date=1999}}</ref> and a modern representation of these approach is provided by Ashraf and Galor.<ref name=":1">{{Cite journal|last1=Quamrul|first1=Ashraf|last2=Galor |first2=Oded|date=2011|title=Dynamics and Stagnation in the Malthusian Epoch|url=https://ideas.repec.org/a/aea/aecrev/v101y2011i5p2003-41.html|journal=American Economic Review|volume=101|issue=5|pages=2003–2041 |doi=10.1257/aer.101.5.2003|pmid=25506082|pmc=4262154}}</ref> In line with the predictions of the Malthusian theory, a cross-country analysis finds a significant positive effect of the technological level on population density and an insignificant effect on income per capita significantly over the years 1–1500.<ref name=":1" /> |

|||

===Classical growth theory=== |

===Classical growth theory=== |

||

In classical ([[David Ricardo|Ricardian]]) economics, the theory of production and the theory of growth are based on the theory of sustainability and law of variable proportions, whereby increasing either of the [[factors of production]] (labor or capital), while holding the other constant and assuming no technological change, will increase output, but at a diminishing rate that eventually will approach zero. These concepts have their origins in [[Thomas Malthus]]’s theorizing about agriculture. Malthus's examples included the number of seeds harvested relative to the number of seeds planted (capital) on a plot of land and the size of the harvest from a plot of land versus the number of workers employed.{{sfn|Bjork|1999|pp=297–298}} (See also [[Diminishing returns]]) |

|||

The modern conception of economic growth began with the critique of Mercantilism, especially by the [[physiocrats]] and with the [[Scottish Enlightenment]] thinkers such as [[David Hume]] and [[Adam Smith]], and the foundation of the discipline of modern [[political economy]]. The theory of the physiocrats was that productive capacity, itself, allowed for growth, and the improving and increasing capital to allow that capacity was "the wealth of nations". Whereas they stressed the importance of agriculture and saw urban industry as "sterile", Smith extended the notion that manufacturing was central to the entire economy. |

|||

Criticisms of classical growth theory are that technology, an important factor in economic growth, is held constant and that [[economies of scale]] are ignored.{{sfn|Bjork|1999|p=298}} |

|||

[[David Ricardo]] would then argue that trade was a benefit to a country, because if one could buy a good more cheaply from abroad, it meant that there was more profitable work to be done here. This theory of "[[comparative advantage]]" would be the central basis for arguments in favor of [[free trade]] as an essential component of growth. |

|||

One popular theory in the 1940s was the [[big push model]], which suggested that countries needed to jump from one stage of development to another through a [[virtuous cycle]], in which large investments in infrastructure and education coupled with private investments would move the economy to a more productive stage, breaking free from economic paradigms appropriate to a lower productivity stage.<ref>[[Paul Rosenstein-Rodan]] {{specify|date=November 2010}}</ref> The idea was revived and formulated rigorously, in the late 1980s by [[Kevin Murphy (economist)|Kevin Murphy]], [[Andrei Shleifer]] and [[Robert Vishny]].<ref>{{cite journal|last1=Murphy|first1=Kevin M.|last2=Shleifer |first2=Andrei|last3=Vishny|first3=Robert W.|year=1989|title=Industrialization and the Big Push|journal=[[Journal of Political Economy]] |volume=97|issue=5|pages=1003–1026|doi=10.1086/261641|citeseerx=10.1.1.538.3040 |s2cid=222424224}}</ref> |

|||