Cavalier Telephone and Global financial crisis of 2008–2009: Difference between pages

m Reverted edits by 64.83.1.16 to last version by Soliloquial (HG) |

Fred Bauder (talk | contribs) →Week of October 5, 2008: Friday meeting, confirmation of equity stakes in banks |

||

| Line 1: | Line 1: | ||

{{Current|date=October 2008}} |

|||

{{Infobox_Company |

|||

The '''global financial crisis of September–October 2008''' is a developing [[financial crisis]] which emerged the week of September 14, 2008. Beginning with failures of large financial institutions in the United States, it rapidly evolved into a global crisis resulting in a number of European bank failures and sharp reductions in the value of [[equity|equities]] ([[stock]]) and [[commodity|commodities]] worldwide. The crisis has lead to a [[liquidity]] problem and the de-[[Leverage_(finance)|leveraging]] of world assets, which has further accelerated the problem. World political leaders have coordinated their efforts to reduce fears but the crisis is ongoing and continues to change. The crisis has roots in the [[subprime mortgage crisis]] and is an acute phase of the [[financial crisis of 2007–2008]]. |

|||

| company_name = Cavalier Telephone and TV |

|||

==Initial events== |

|||

| company_logo = [[Image:cavalier telephone logo.gif]] |

|||

An inability to secure loans led to the September 15, 2008 decision by [[Lehman Brothers|Lehman Brothers Holdings, Inc.]] to file for [[Bankruptcy of Lehman Brothers|bankruptcy]], the buyout of [[Merrill Lynch]] by [[Bank of America]], and concerns over the [[American International Group|American International Group (AIG)]] ending in that company's bailout by the [[Federal Reserve System]] on September 16. These events resulted in large stock market losses, prompting large infusions of cash by central banks around the world. |

|||

| company_type = [[private company|Private]]<br /> |

|||

| founded = 1998 |

|||

| foundation = 1998 |

|||

| founder = |

|||

| location_city = {{flagicon|U.S.}} [[Richmond, Virginia]] |

|||

| location_country = [[United States|US]] |

|||

| area_served = [[United States]] |

|||

| key_people = |

|||

| industry = [[Internet Service Provider]], [[Telecommunications]] |

|||

| products = Internet, Telephone, Digital Television |

|||

| market cap = |

|||

| revenue = |

|||

| net_income = |

|||

| assets= |

|||

| equity= |

|||

| num_employees = |

|||

| company_slogan = Let us turn you on |

|||

| homepage = [http://www.cavtel.com/ cavtel.com] |

|||

}} |

|||

'''Cavalier Telephone and TV''' is a telephone, internet, and digital television provider formed in 1998, with operations headquartered in [[Richmond, Virginia]]. It provides service to the [[District of Columbia]], [[Delaware]], [[Georgia (U.S. state)|Georgia]], [[Maryland]], [[Michigan]], [[New Jersey]], [[New York]], [[Ohio]], [[Pennsylvania]], [[Alabama]], [[Florida]], [[Kentucky]], [[Louisiana]], [[Mississippi]], [[North Carolina]], [[Tennessee]], and [[Virginia]]. |

|||

==Time line== |

|||

Founded in 1998, Cavalier Telephone and TV is a [[Competitive Local Exchange Carrier]] (CLEC) operating in 16 states and [[DC]] throughout the eastern US. Cavalier currently provides voice and data services to businesses, residential, and government customers on a private network. |

|||

On the first day, the [[Dow Jones Industrial Average]] plunged 504 points (4.4%) while the [[S&P 500]] fell 59 points (4.7%). [[Asia]]n and [[Europe]]an markets rendered similarly sharp drops. [[United Kingdom]] regulators announced a temporary ban on [[Short (finance)|short-selling]] of financial stocks on September 18<ref>{{cite news|url=http://www.iht.com/articles/ap/2008/09/19/business/EU-Britain-Short-Selling.php|title=Ban on short-selling won't fix markets on its own|publisher=[[International Herald Tribune]]|date=[[2008-09-19]]|accessdate=2008-09-21}}</ref> and were followed by the [[United States]] on September 19.<ref>{{cite news|url=http://www.npr.org/templates/story/story.php?storyId=94807831|title=SEC Bans Short Selling Financial Stocks|publisher=[[National Public Radio]]|date=[[2008-09-19]]|accessdate=2008-09-21}}</ref> |

|||

* On September 29, the Dow dropped 777 points (6.98%), the largest one-day point-drop in history (but only the 17th largest percentage drop).<ref>{{cite news| url = http://www.marketwatch.com/news/story/us-stocks-slide-dow-plunges/story.aspx?guid={7F45BE2A-0486-494E-B87C-76D9F2688338} | title = U.S. stocks slide, Dow plunges 777 points, as bailout fails|publisher=[[MarketWatch]]|date=[[2008-09-29]]|accessdate=2008-09-29}}</ref> For comparison, during the [[Great Depression]] the market fell only 340 points - but this amounted to a 90% fall overall. |

|||

== Services == |

|||

* On September 29, the [[OBX Index]] of [[Oslo Stock Exchange]] dropped 8.3%, its third largest drop ever in one day.<ref>{{cite news |first= Klever |last= Magnus |title= Verste dag på 17 år |url= http://www.na24.no/imarkedet/borskommentar/article2258169.ece |work= [[NA24]] |publisher= |location= Oslo, Norway |page= |date=2008-09-29 |accessdate=2008-09-30 |language= Norwegian}}</ref> |

|||

=== Telephone === |

|||

* On October 9, the one-year anniversary of the [[DJIA|Dow]]'s peak, the [[DJIA|Dow]] dropped below 8600, reaching a five year low. It was the first time since August 2003 that the Dow closed below 9000. |

|||

Cavalier offers a number of different business and residential telephone service plans for both local and long distance calling. Rates vary based upon the number of optional features added to supplement basic telephone service. |

|||

== Federal Reserve actions to lower interest rates and stimulate the economy == |

|||

=== Internet === |

|||

{| class="wikitable" border="1" align="center" |

|||

Cavalier offers high speed internet service through [[DSL|digital subscriber lines]]. |

|||

|- |

|||

| colspan=6 |'''Federal reserve rates changes ''' ( Just data after January 1, 2008 ) |

|||

|- |

|||

! [[Date]] !! [[Discount rate]] !! [[Discount rate]] !! [[Discount rate]] !! [[Fed funds]] !! [[Fed funds rate]] |

|||

|- |

|||

! !! !! Primary !! Secondary !! !! |

|||

|- |

|||

! !! rate change !! new interest rate !! new interest rate !! rate change !! new interest rate |

|||

|- |

|||

| Oct 8, 2008* || -.50% || 1.75% || 2.25% || -.50% || 1.50% |

|||

|- |

|||

| Apr 30, 2008 || -.25% || 2.25% || 2.75% || -.25% || 2.00% |

|||

|- |

|||

| Mar 18, 2008 || -.75% || 2.50% || 3.00% || -.75% || 2.25% |

|||

|- |

|||

| Mar 16, 2008 || -.25% || 3.25% || 3.75% || || |

|||

|- |

|||

| Jan 30, 2008 || -.50% || 3.50% || 4.00% || -.50% || 3.00% |

|||

|- |

|||

| Jan 22, 2008 || -.75% || 4.00% || 4.50% || -.75% || 3.50% |

|||

|} |

|||

- * Part of a coordinated global rate cut of 50 basis point by main central banks. [http://news.bbc.co.uk/2/hi/business/7658958.stm] |

|||

== Relationship with Verizon == |

|||

Cavalier has had a particularly rocky relationship with [[Verizon Wireless]]. In 2001, Cavalier brought a [[lawsuit]] against Verizon alleging [[antitrust]] violations and violations of the [[Telecom Act of 1996]]. The suit was dismissed by [[United States District Court]] [[Judge]], [[James R. Spencer]] in March 2002. The dismissal was upheld on appeal in May 2003. In 2007, Cavalier sued Verizon in federal court again, alleging misuse of Virginia's 911 [[database]]. |

|||

- See more detailed [[US federal discount rate]] chart: |

|||

==External links== |

|||

[http://www.newyorkfed.org/markets/statistics/dlyrates/fedrate.html] |

|||

<!-- data is not copyrightable, fair use allows coping data such as telephone numbers from phone book and |

|||

other sweat of the brow data --> |

|||

==Week of September 14, 2008== |

|||

[[Category:Telecommunications companies of the United States]] |

|||

===Major financial firm crises=== |

|||

[[Category:Companies based in Richmond, Virginia]] |

|||

On Sunday, September 14, it was announced that [[Lehman Brothers]] would file for bankruptcy after the Federal Reserve Bank declined to participate in creating a financial support facility for Lehman Brothers. The same day, the sale of [[Merrill Lynch]] to [[Bank of America]] was announced.<ref name="Lehman Merrill"> |

|||

[[Category:Companies established in 1998]] |

|||

[http://www.nytimes.com/2008/09/15/business/15lehman.html "Lehman Files for Bankruptcy; Merrill Is Sold"] article by Andrew Ross Sorkin in ''[[The New York Times]] September 14, 2008</ref> |

|||

The beginning of the week was marked by [[Global stock market crash of September 2008|extreme instability in global stock markets]], with dramatic drops in market values on Monday, September 15, and Wednesday, September 17. On September 16, the large insurer [[American International Group]] (AIG), a significant participant in the [[credit default swap]]s markets suffered a liquidity crisis following the downgrade of its credit rating. The [[Federal Reserve]], at AIG's request, and after AIG has shown that it could not find lenders willing to save it from insolvency, created a credit facility for up to US$85 billion in exchange for an 79.9% equity interest, and the right to suspend dividends to previously issued common and preferred stock.<ref> See [[American International Group]] for details and citations. |

|||

</ref> |

|||

===Money market funds insurance and short sales prohibitions=== |

|||

{{US-telecom-company-stub}} |

|||

On September 16, the [[Reserve Primary Fund]], a large [[money fund|money market mutual fund]], lowered its share price below $1 because of exposure to Lehman debt securities. This resulted in demands from investors to return their funds as the financial crisis mounted.<ref name = 'NYT-Bernard-2008-09-17 '> |

|||

[http://www.nytimes.com/2008/09/18/business/yourmoney/18money.html "Money Market Funds Enter a World of Risk"] article by Tara Siegel Bernard in ''[[The New York Times]] September 17, 2008 |

|||

</ref> |

|||

By the morning of September 18, money market sell orders from institutional investors totalled $0.5 trillion, out of a total market capitalization of $4 trillion, but a $105 billion liquidity injection from the Federal Reserve averted an immediate collapse.<ref = 'NYPost-Gray-2008-09-18' > Gray, Michael. [http://www.nypost.com/seven/09212008/business/almost_armageddon_130110.htm "Almost Armageddon: Markets Were 500 Trades from a Meltdown] (September 21, 2008 ) [[New York Post]] |

|||

</ref> |

|||

On September 19 the U.S. Treasury [[Money fund#September 2008|offered temporary insurance]] (akin to [[FDIC]] insurance of bank accounts) to money market funds.<ref name = 'Treasury-Money Market Insurance-2008-09-18 '> |

|||

[http://www.treasury.gov/press/releases/hp1147.htm "Treasury Announces Guaranty Program for Money Market Funds"] ( September 19, 2008) Press Release. United States Department of the Treasury. |

|||

</ref> |

|||

Toward the end of the week, [[Short (finance)|short selling]] of financial stocks was suspended by the [[Financial Services Authority]] in the United Kingdom and by the [[Securities and Exchange Commission]] in the United States.<ref name = 'NYT-Bajaj-2008-09-20'> |

|||

[http://www.nytimes.com/2008/09/20/business/20sec.html "S.E.C. Issues Temporary Ban on Short-Selling"] article by Vikas Bajaj and Jonathan D. Glater in ''[[The New York Times]]'' September 19, 2008 |

|||

</ref> |

|||

Similar measures were taken by authorities in other countries.<ref name="aus-09-22"> |

|||

{{cite news | title = Australian short selling ban goes further than other bourses | publisher = ''NBR'' | date = [[2008-09-22]] | url = http://www.nbr.co.nz/article/australian-short-selling-ban-goes-further-other-bourses-35494 | accessdate = 2008-09-22 }} |

|||

</ref> |

|||

Some restoration of market confidence occurred with the publicity surrounding efforts of the Treasury and the [[Securities Exchange Commission]]<ref> |

|||

[http://www.nytimes.com/2008/09/20/business/economy/20cndleadall.html "Stocks Surge as U.S. Acts to Shore Up Money Funds and Limits Short Selling"] article by Graham Bowley in ''[[The New York Times]]'' September 19, 2008 |

|||

</ref><ref> |

|||

[http://www.nytimes.com/2008/09/20/washington/19cnd-cong.html "Congressional Leaders Were Stunned by Warnings"] article by David M. Herszenhorn in ''[[The New York Times]]'' September 19, 2008 |

|||

</ref> |

|||

===Troubled Asset Relief Program=== |

|||

{{main|Emergency Economic Stabilization Act of 2008}} |

|||

On September 19, 2008, a plan intended to ameliorate the difficulties caused by the [[subprime mortgage crisis]] was proposed by the Secreatry of the Treasury, [[Henry Paulson]]. He proposed a [[Troubled Asset Relief Program]] (later incorporated into the [[Emergency Economic Stabilization Act of 2008]]) which would permit for the United States government to purchase [[Market liquidity|illiquid assets]] (also termed ''toxic assets'') from financial institutions.<ref> |

|||

[http://www.nytimes.com/2008/09/19/business/19fed.html "Vast Bailout by U.S. Proposed in Bid to Stem Financial Crisis"] article by Edmund L. Andrews in ''[[The New York Times]]'' September 18, 2008 |

|||

</ref><ref> |

|||

[http://www.nytimes.com/2008/09/20/business/economy/20paulson.html "Paulson Argues for Need to Buy Mortgages"] article by David Stout in ''[[The New York Times]]'' September 19, 2008 |

|||

</ref> |

|||

The value of the securities is extremely difficult to determine.<ref name= 'NYT=Bjaj-2008-09-24'> |

|||

[http://www.nytimes.com/2008/09/25/business/25value.html "Plan’s Mystery: What’s All This Stuff Worth?"] article by Vikas Bajaj in ''[[The New York Times]]'' September 24, 2008 |

|||

</ref> |

|||

Consultations of between the [[Secretary of the Treasury]], the [[Chairman of the Federal Reserve]], and the Chairman of the [[U.S. Securities and Exchange Commission]], Congressional leaders and the [[President of the United States]] moved forward plans to advance a comprehensive solution to the problems created by illiquid mortgage-backed securities. At the close of the week the Secretary of the Treasury and President Bush announced a proposal for the federal government to buy up to US$700 billion of illiquid [[mortgage backed securities]] with the intent to increase the liquidity of the [[secondary mortgage market]]s and reduce potential losses encountered by financial institutions owning the securities. The draft proposal of the plan was received favorably by investors in the stock market. Details of the bailout remained to be acted upon by Congress.<ref> |

|||

[http://www.nytimes.com/2008/09/20/business/20fed.html "Bush Officials Urge Swift Action on Rescue Powers}"] article by Edmund L. Andrews in ''[[The New York Times]]'' September 19, 2008 |

|||

</ref><ref> |

|||

[http://www.nytimes.com/2008/09/21/business/21draftcnd.html Draft Proposal for Bailout Plan] (September 21, 2008). ''New York Times'' |

|||

</ref><ref> |

|||

[http://www.nytimes.com/aponline/business/AP-Financial-Meltdown.html "Rescue Plan Seeks $700 Billion to Buy Bad Mortgages"] article by [[The Associated Press]] in ''[[The New York Times]]'' September 20, 2008 |

|||

</ref><ref> |

|||

[http://www.nytimes.com/2008/09/21/business/21cong.html "$700 Billion Is Sought for Wall Street in Vast Bailout"] article by David M. Herszenhorn in ''[[The New York Times]]'' September 20, 2008 |

|||

</ref> |

|||

==Week of September 21, 2008== |

|||

On Sunday, September 21, the two remaining investment banks, [[Goldman Sachs]] and [[Morgan Stanley]], with the approval of the Federal Reserve, converted to [[bank holding company|bank holding companies]], a status subject to more regulation, but with readier access to capital.<ref>[http://www.nytimes.com/2008/09/22/business/22bank.html "Shift for Goldman and Morgan Marks the End of an Era"] article by Andrew Ross Sorkin and Vikas Bajaj in ''[[The New York Times]]'' September 21, 2008</ref> On September 21, Treasury Secretary [[Henry Paulson]] announced that the original proposal, which would have excluded foreign banks, had been widened to include foreign financial institutions with a presence in the US. The US administration was pressuring other countries to set up similar bailout plans.<ref>{{Cite news |

|||

| last = Schwartz |

|||

| first = Nelson D. |

|||

| coauthors = Carter Dougherty |

|||

| title = Foreign Banks Hope Bailout Will Be Global |

|||

| work = The New York Times |

|||

| date = 2008-09-22 |

|||

| url = http://www.nytimes.com/2008/09/22/business/22global.html?hp |

|||

}}</ref> On Monday and Tuesday during the week of September 22, appearances were made by the Secretary of the Treasury and the Chairman of the Board of Governors of the Federal Reserve before Congressional committees and on Wednesday a prime time presidential address was delivered by the President of the United States on television. Behind the scenes, negotiations were held refining the proposal which had grown to 42 pages from its original 3 and was reported to include both an oversight structure and limitations on executive salaries, with other provisions under consideration. On September 25, agreement was reported by congressional leaders on the basics of the package;<ref>[http://www.nytimes.com/2008/09/26/business/26bush.html "Lawmakers Agree on Outline of Bailout"] article by David M. Herszenhorn in ''[[The New York Times]]'' September 25, 2008</ref> however, general and vocal opposition to the proposal was voiced by the public.<ref>[http://www.nytimes.com/2008/09/25/business/25voices.html "Lawmakers’ Constituents Make Their Bailout Views Loud and Clear"] article by Sheryl Gay Stolberg in ''[[The New York Times]]'' September 24, 2008</ref> On Thursday afternoon at a White House meeting attended by congressional leaders and the presidential candidates, John McCain and Barack Obama, it became clear that there was no congressional consensus, with Republican representatives and the ranking member of the Senate Banking Committee, [[Richard C. Shelby]], strongly opposing the proposal.<ref>[http://www.nytimes.com/2008/09/26/business/26bailout.html "Talks Implode During Day of Chaos; Fate of Bailout Plan Remains Unresolved"] article by David M. Herszenhorn, Carl Hulse, and Sheryl Gay Stolberg in ''[[The New York Times]]'' September 25, 2008</ref> The alternative advanced by conservative House Republicans was to create a system of mortgage insurance funded by fees on those holding mortgages; as the working week ended, negotiations continued on the plan, which had grown to 102 pages and included mortgage insurance as an option.<ref>[http://www.nytimes.com/2008/09/27/business/27repubs.html "Conservatives Viewed Bailout Plan as Last Straw"] article by Carl Hulse in ''[[The New York Times]]'' September 26, 2008</ref><ref>[http://www.nytimes.com/2008/09/27/business/27cong.html "Politics Take Hold of Bailout Proposal"] article by David M. Herszenhorn in ''[[The New York Times]] September 26, 2008</ref><ref>[http://www.nytimes.com/2008/09/27/business/27plan.html "House Republicans Support a Plan That Would Insure Troubled Mortgages"] article by Edmund L. Andrews in ''[[The New York Times]]'' September 26, 2008</ref> On Thursday evening [[Washington Mutual]], the nation's largest savings and loan, was seized by the [[Federal Deposit Insurance Corporation]] and most of its assets transferred to [[JPMorgan Chase]].<ref>[http://www.nytimes.com/2008/09/26/business/26wamu.html "Government Seizes WaMu and Sells Some Assets"] article by Eric Dash and Andrew Ross Sorkin in ''[[The New York Times]]''</ref> [[Wachovia]], one of the largest US banks, was reported to be in negotiations with [[Citigroup]] and other financial institutions.<ref>[http://www.nytimes.com/2008/09/27/business/27bank.html "Wachovia, Looking for Help, Turns to Citigroup"] article by Ben White and Eric Dash in ''[[The New York Times]] September 26, 2008</ref> |

|||

==Week of September 28, 2008== |

|||

Early into Sunday morning an announcement was made by the United States Secretary of the Treasury and congressional leaders that agreement had been reached on all major issues: the total amount of $700 billion remained with provision for the option of creating a scheme of mortgage insurance.<ref>[http://www.nytimes.com/2008/09/28/business/28bailout.html "Breakthrough Reached in Negotiations on Bailout"] article by David M. Herszenhorn and Carl Hulse in ''[[The New York Times]]'' September 27, 2008</ref> |

|||

It was reported on Sunday, September 28, that a rescue plan had been crafted for the British mortgage lender [[Bradford & Bingley]].<ref>[http://www.nytimes.com/2008/09/29/business/worldbusiness/29britbank.html "Britain Close to Takeover of Another Lender"] article by Landon Thomas, Jr. in ''[[The New York Times]]'' September 28, 2008</ref> |

|||

[[Grupo Santander]], the largest bank in Spain, is slated to take over the offices and savings accounts while the mortgage and loans business will be nationalized.<ref>[[The Times]]. [http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4842950.ece "Taxpayers must risk billions for Bradford & Bingley"] article by Philip Webster, Patrick Hosking and Tim Reid in ''[[The Times of London]]'' September 29, 2008</ref> |

|||

[[Fortis (finance)|Fortis]], a huge [[Benelux]] banking and finance company was partially nationalized on September 28, 2008, with [[Belgium]], the [[Netherlands]] and [[Luxembourg]] investing a total of 11.2 billion euros (16.3 billion U.S. dollars) in the bank. Belgium will purchase 49% of Fortis's Belgian division, with the Netherlands doing the same for the Dutch division. Luxembourg has agreed to a loan convertible into a 49% share of Fortis's Luxembourg division.<ref>{{cite news |

|||

|url=http://www.bloomberg.com/apps/news?pid=20601087&sid=ahlKDjeO0Lik&refer=home |

|||

|title=Fortis Gets EU11.2 Billion Rescue From Governments |

|||

|publisher=Bloomberg |

|||

|date=2008-09-29 |

|||

|accessdate=2008-09-29 |

|||

|first=Martijn |

|||

|last=van der Starre |

|||

|coauthors=Meera Louis |

|||

}}</ref> |

|||

It was reported on Monday morning, September 29, that [[Wachovia]], the 4th largest bank in the United States, would be acquired by [[Citigroup]].<ref>{{cite news |

|||

|url=http://dealbook.blogs.nytimes.com/2008/09/29/citigroup-nears-a-deal-for-wachovia/index.html |

|||

|title=Citigroup to Buy Wachovia Banking Operations |

|||

|publisher=The New York Times blog Dealbook |

|||

|date=2008-09-30 |

|||

|accessdate=2008-09-29 |

|||

|first=Andrew Ross |

|||

|last=Sorkin |

|||

|coauthors= |

|||

}}</ref><ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/09/29/business/29bank.html |

|||

|title=Citigroup and Wells Fargo Said to Be Bidding for Wachovia |

|||

|publisher=The New York Times |

|||

|date=2008-09-28 |

|||

|accessdate=2008-09-29 |

|||

|first=Andrew Ross |

|||

|last=Sorkin |

|||

|coauthors=Eric Dash |

|||

}}</ref> |

|||

On Monday the German finance minister announced a rescue of [[Hypo Real Estate]], a [[Munich]]-based holding company comprised of a number of real estate financing banks, but the deal collapsed on Saturday, 4 October. |

|||

The same day the government of Iceland nationalized [[Glitnir (bank)|Glitnir]], [[Iceland|Iceland’s]] third largest lender.<ref>[http://www.glitnir.is/english/about-glitnir/news/detail/item14983/The_government_of_Iceland_acquires_75_percent_share_in_Glitnir_Bank/ Glitnir, ''About Glitnir, News: 29.09.2008, The government of Iceland acquires 75 percent share in Glitnir Bank'']</ref><ref>[http://eng.forsaetisraduneyti.is/news-and-articles/nr/3016 Prime Minister's Office, ''News and Articles: The Government of Iceland provides Glitnir with new equity (9/29/08)'']</ref> |

|||

Stocks fell dramatically Monday in Europe and the US despite infusion of funds into the market for short term credit.<ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/d925b966-8dec-11dd-8089-0000779fd18c.html |

|||

|title=Heavy stock losses after Fed action |

|||

|publisher=The Financial Times |

|||

|date=2008-09-29 |

|||

|accessdate=2008-09-29 |

|||

|first=Michael |

|||

|last=Hunter |

|||

|coauthors=Neil Dennis |

|||

}}</ref><ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/f9525dd4-8d24-11dd-83d5-0000779fd18c.html |

|||

|title=Central banks pump cash into system |

|||

|publisher=The Financial Times |

|||

|date=2008-09-29 |

|||

|accessdate=2008-09-29 |

|||

|first=James |

|||

|last=Politi |

|||

|coauthors=Krishna Guha, Daniel Dombey and Harvey Morris |

|||

}}</ref> |

|||

The U.S. bailout plan, now named the [[Emergency Economic Stabilization Act of 2008]] and expanded to 110 pages was slated for consideration in the House of Representatives on Monday, September 29 as HR 3997 and in the Senate later in the week.<ref>Information from C-Span September 29, 2008</ref><ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/09/29/business/29bailout.html |

|||

|title=Bailout Plan in Hand, House Braces for Tough Vote |

|||

|publisher=The New York Times |

|||

|date=2008-09-28 |

|||

|accessdate=2008-09-29 |

|||

|first=Carl |

|||

|last=Hulse |

|||

|coauthors=David M. Herszenhorn |

|||

}}</ref> The plan failed after the vote being held open for 40 minutes in the House of Representatives, 205 for the plan, 228 against.<ref>C-Span 2 PM 9/30/08</ref><ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/09/30/business/30bailout.html |

|||

|title=House Rejects Bailout Package, 228-205, But New Vote Is Planned; Stocks Plunge |

|||

|publisher=The New York Times |

|||

|date=2008-09-29 |

|||

|accessdate=2008-09-29 |

|||

|first=Carl |

|||

|last=Hulse |

|||

|coauthors=David M. Herszenhorn |

|||

}}</ref> Meanwhile US stock markets suffered steep declines, the Dow losing 300 points in a matter of minutes, ending down 777.68, the Nasdaq losing 199.61, falling below the 2000 point mark, and the S.&P. 500 off 8.77% for the day.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/09/30/business/30markets.html |

|||

|title=For Stocks, Worst Single-Day Drop in Two Decades |

|||

|publisher=The New York Times |

|||

|date=2008-09-29 |

|||

|accessdate=2008-09-29 |

|||

|first=Michael M. |

|||

|last=Grynbaum |

|||

|coauthors= |

|||

}}</ref> By the end of the day, the Dow suffered the largest drop in the history of the index.<ref>{{cite news|url=http://money.cnn.com/2008/09/29/markets/markets_newyork/index.htm?postversion=2008092916|publisher=[[CNN Money]]|title=Stocks crushed|first=Alexandra|last=Twin|date=2008-09-29|accessdate=2008-09-29}}</ref> The S&P 500 Banking Index fell 14% on September 29 with drops in the stock value of a number of US banks generally considered sound, including [[Bank of New York Mellon Corporation|Bank of New York Mellon]], [[State Street Corporation|State Street]] and [[Northern Trust]]; three Ohio banks, [[National City Corp.|National City]], [[Fifth Third Bank|Fifth Third]], and [[KeyBank]] were down dramatically.<ref>{{cite news |

|||

|url=http://money.cnn.com/2008/09/29/news/companies/bank_failures/index.htm |

|||

|title=Wondering which bank is next: Analysts brace for more bank failures after Wachovia sells out banking assets to Citi; bank stocks plunge after House rejects bailout bill. |

|||

|publisher=CNN Money |

|||

|date=2008-09-29 |

|||

|accessdate=2008-09-29 |

|||

|first=Aaron |

|||

|last=Smith |

|||

|coauthors= |

|||

}}</ref><ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/09/30/business/30citi.html |

|||

|title=With Wachovia Sale, the Banking Crisis Trickles Up |

|||

|publisher=The New York Times |

|||

|date=2008-09-29 |

|||

|accessdate=2008-09-29 |

|||

|first=Eric |

|||

|last=Dash |

|||

|coauthors= |

|||

}}</ref> |

|||

On Tuesday, September 30, stocks rebounded but credit markets remained tight with the [[London Interbank Offered Rate]] (overnight dollar Libor) rising 4.7% to 6.88%.<ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/17ce4468-8f22-11dd-946c-0000779fd18c.html |

|||

|title=Banking’s crisis of confidence deepens |

|||

|publisher=The Financial Times |

|||

|date=2008-09-30 |

|||

|accessdate=2008-09-30 |

|||

|first=Krishna |

|||

|last=Guha |

|||

|coauthors=Harvey Morris and James Politi in Washington and Paul J Davies |

|||

}}</ref> |

|||

On Tuesday, September 30, 9 billion was made available by the French, Belgian and Luxembourg governments to the French-Belgian bank [[Dexia]].<ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/116457fe-8ebc-11dd-946c-0000779fd18c.html |

|||

|title=Dexia receives €6.4bn capital injection |

|||

|publisher=The Financial Times |

|||

|date=2008-09-30 |

|||

|accessdate=2008-09-30 |

|||

|first=Scheherazade |

|||

|last=Daneshkhu |

|||

|coauthors=Ben Hall |

|||

}}</ref> |

|||

After Irish banks came under pressure on Monday, September 29, the Irish government undertook a two year "guarantee arrangement to safeguard all deposits (retail, commercial, institutional and inter-bank), covered bonds, senior debt and dated subordinated debt (lower tier II)" of 6 Irish banks: [[Allied Irish Banks]], [[Bank of Ireland]], [[Anglo Irish Bank]], [[Irish Life and Permanent]], [[Irish Nationwide]] and the [[EBS Building Society]]; the potential liability involved is about 400 billion dollars.<ref>{{cite news |

|||

|url=http://www.irishtimes.com/newspaper/ireland/2008/1001/1222724598521.html |

|||

|title=Government statement (of the Government of Ireland) |

|||

|publisher=The Irish Times |

|||

|date=2008-10-01 |

|||

|accessdate=2008-10-01 |

|||

|first= |

|||

|last= |

|||

|coauthors= |

|||

}}</ref> |

|||

The United States Senate's version of the $700 billion bailout plan, [[HR1424]], modified to expand bank deposit guarantees to $250,000 and to include $100 billion in tax breaks for businesses and [[alternative energy]], passed with bi-partisan support 74-25 on October 1st.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/02/business/02bailout.html |

|||

|title=Adding Sweeteners, Senate Passes Bailout Plan |

|||

|publisher=The New York Times |

|||

|date=2008-10-01 |

|||

|accessdate=2008-10-01 |

|||

|first=Carl |

|||

|last=Hulse |

|||

|coauthors=David M. Herszenhorn |

|||

}}</ref> Reaction in the House was mixed,<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/02/business/02bailout.html |

|||

|title=Senate to Vote Today on the Bailout Plan |

|||

|publisher=The New York Times |

|||

|date=2008-10-01 |

|||

|accessdate=2008-10-01 |

|||

|first=Carl |

|||

|last=Hulse |

|||

|coauthors=Robert Pear |

|||

}}</ref><ref>{{cite news |

|||

|url=http://www.bloomberg.com/apps/news?pid=20601087&sid=aQzP3B9VG90E |

|||

|title=Senate Sets Financial-Rescue Vote, House Decision Likely Friday |

|||

|publisher=Bloomberg |

|||

|date=2008-10-01 |

|||

|accessdate=2008-10-01 |

|||

|first=James |

|||

|last=Rowley |

|||

|coauthors=Brian Faler |

|||

}}</ref> but in a vote on Friday the House of Representatives passed the Emergency Economic Stabilization Act of 2008, as refashioned by the Senate, 263-171 in a bipartisan vote.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/04/business/economy/04bailout.html |

|||

|title=House Approves Bailout on Second Try |

|||

|publisher=The New York Times |

|||

|date=2008-10-03 |

|||

|accessdate=2008-10-03 |

|||

|first=David M. |

|||

|last=Herszenhorn |

|||

|coauthors= |

|||

}}</ref> |

|||

Discussions were ongoing in Europe regarding possible remedies for financial instability in Europe leading up to a conference Saturday afternoon in Paris hosted by [[Nicolas Sarkozy]], president of France. [[UniCredit]] of Italy was reported to be the latest bank to come under pressure.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/02/business/worldbusiness/02regulate.html |

|||

|title=European Officials Debate Need for a Bailout Package |

|||

|publisher=The New York Times |

|||

|date=2008-10-01 |

|||

|accessdate=2008-10-01 |

|||

|first=Stephen |

|||

|last=Castel |

|||

|coauthors=Katrin Bennhold |

|||

}}</ref> During the night of October 2 Greece followed Ireland's lead and guaranteed all bank deposits.<ref>{{cite news |

|||

|url=http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4870873.ece |

|||

|title=European bank rescue plan in tatters amid savings stampede |

|||

|publisher=The Times |

|||

|date=2008-10-03 |

|||

|accessdate=2008-10-03 |

|||

|first=Patrick |

|||

|last=Hosking |

|||

|coauthors=http://www.nytimes.com/2008/10/06/business/06bank.html?ref=todayspaper |

|||

}}</ref> |

|||

On October 3 it was reported that Wachovia had rejected the previous offer from Citigroup in favor of acquisition by [[Wells Fargo]],<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/04/business/04bank.html |

|||

|title=Wells Fargo Swoops In |

|||

|publisher=The New York Times |

|||

|date=2008-10-03 |

|||

|accessdate=2008-10-04 |

|||

|first=Eric |

|||

|last=Dash |

|||

|coauthors=Ben White |

|||

}}</ref> resulting in a legal dispute with Citigroup.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/06/business/06bank.html |

|||

|title=Weekend Legal Frenzy Between Citigroup and Wells Fargo for Wachovia |

|||

|publisher=The New York Times |

|||

|date=2008-10-05 |

|||

|accessdate=2008-10-06 |

|||

|first=Eric |

|||

|last=Dash |

|||

|coauthors= |

|||

}}</ref> |

|||

In Britain, the Financial Services Authority announced on October 3 that effective Tuesday, October 7, the amount of the guarantee of bank deposits would be raised to £50,000 from £35,000.<ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/25915358-9137-11dd-b5cd-0000779fd18c.html |

|||

|title=Savings guarantee to rise to £50,000 |

|||

|publisher=The Financial Times |

|||

|date=2008-10-03 |

|||

|accessdate=2008-10-03 |

|||

|first=Peter Thal |

|||

|last=Larsen |

|||

|coauthors=George Parker |

|||

}}</ref> On Friday, October 3, the government of the Netherlands took over the Dutch operations of [[Fortis (finance)|Fortis]], replacing the bailout plan of September 28.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/04/business/worldbusiness/04fortis.html |

|||

|title=Netherlands Takes Over Some Fortis Operations |

|||

|publisher=The New York Times |

|||

|date=2008-10-03 |

|||

|accessdate=2008-10-03 |

|||

|first=Neson D. |

|||

|last=Schwartz |

|||

|coauthors= |

|||

}}</ref> |

|||

==Week of October 5, 2008== |

|||

Over the weekend and on Monday a major banking and financial crisis emerged in [[Iceland]] with its currency the [[Icelandic krona|krona]], dropping 30% against the euro.<ref>{{cite news |

|||

|url=http://www.guardian.co.uk/world/2008/oct/07/iceland.globaleconomy |

|||

|title= |

|||

Reykjavik battles to save economy |

|||

|publisher=The Guardian |

|||

|date=2008-10-07 |

|||

|accessdate=2008-10-06 |

|||

|first=David |

|||

|last=Teather |

|||

|coauthors= |

|||

}}</ref> At a meeting on Monday night emergency legislation was passed granting broad powers to the government to seize and regulate banks. The [[Landsbanki]] and [[Glitnir]] were seized, while [[Kaupthing]] was subjected to a rescue plan.<ref>{{cite news |

|||

|url=http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4894904.ece |

|||

|title=Terror as Iceland faces economic collapse |

|||

|publisher=The Times |

|||

|date=2008-10-07 |

|||

|accessdate=2008-10-07 |

|||

|first=Hildur |

|||

|last=Sigurðardóttir |

|||

|coauthors=Helen Power and Peter Stiff |

|||

}}</ref> |

|||

On October 6, the [[Icelandic Financial Supervisory Authority]] decided temporarily to suspend from trading on regulated markets all financial instruments issued by [[Glitnir (bank)|Glitnir banki hf.]], [[Kaupthing Bank|Kaupþing banki hf.]], [[Landsbanki|Landsbanki Íslands hf.]], [[Straumur Investment Bank|Straumur-Burðarás fjárfestingarbanki hf.]], [[Spron hf.]], and [[Exista hf.]]<ref>[http://www.fme.is/?PageID=581&NewsID=328 The Financial Supervisory Authority - Iceland, ''News: Temporary suspension from trading'' (06.10.2008)] {{en icon}}</ref> |

|||

Before the opening of the business day, October 6. [[BNP Paribas]], the French bank, assumed control of the remaining assets of Fortis following Dutch nationalization of the operations of the bank in The Netherlands.<ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/1523014a-9323-11dd-98b5-0000779fd18c.html |

|||

|title=BNP to take control of Fortis |

|||

|publisher=The Financial Times |

|||

|date=2008-10-06 |

|||

|accessdate=2008-10-06 |

|||

|first=Micheal |

|||

|last=Steen |

|||

|coauthors=Joshua Chaffin and Peter Thal Larsen |

|||

}}</ref> [[Denmark]], [[Austria]], and possibly [[Germany]]{{clarify}}, joined [[Ireland]] and [[Greece]]<ref>{{cite news |

|||

|url=http://en.wikinews.org/wiki/Greece_guarantees_bank_deposits |

|||

|title=Greece guarantees bank deposits |

|||

|publisher=Wikinews |

|||

|date=2008-10-09 |

|||

|accessdate=2008-10-09 |

|||

}}</ref> in guaranteeing bank deposits on Monday, October 6.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/06/business/06markets.html |

|||

|title=Financial Crises Spread in Europe |

|||

|publisher=The New York Times |

|||

|date=2008-10-05 |

|||

|accessdate=2008-10-06 |

|||

|first=Carter |

|||

|last=Dougherty |

|||

|coauthors=Nelson Schwartz and Floyd Norris |

|||

}}</ref><ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/d895ef54-92ef-11dd-98b5-0000779fd18c.html |

|||

|title=Germany guarantees savings |

|||

|publisher=The Financial Times |

|||

|date=2008-10-05 |

|||

|accessdate=2008-10-06 |

|||

|first=Bertrand |

|||

|last=Benoit |

|||

|coauthors=James Wilson |

|||

}}</ref> Following this, the FTSE100 index of leading British shares took its worst one-day hit in history <ref>BBC. [http://news.bbc.co.uk/1/hi/business/7655288.stm Stocks slide despite reassurances]. retrieved 2008-10-06</ref>. A banking Bill easing rescues is slated for introduction in the British Parliament on Tuesday, October 7.<ref>{{cite news |

|||

|url=http://business.timesonline.co.uk/tol/business/economics/article4888248.ece |

|||

|title=German savings pledge raises stakes for Gordon Brown |

|||

|publisher=The Times |

|||

|date=2008-10-06 |

|||

|accessdate=2008-10-06 |

|||

|first=Francis |

|||

|last=Elliott |

|||

|coauthors=Christine Seib |

|||

}}</ref> On 6 October German chancellor [[Angela Merkel]] pledged that the government would guarantee all German private bank savings. The government also announced a revised bailout plan for German mortgage lender [[Hypo Real Estate]] (HRE).<ref>[[Deutsche Welle]]. http://www.dw-world.de/dw/article/0,2144,3694172,00.html German Government Under Pressure to Deliver on Crisis Promise] (English) Retrieved 2008-10-06</ref><ref>[[Deutsche Welle]]. [http://www.dw-world.de/popups/popup_single_mediaplayer/0,,3692883_type_video_struct_1432,00.html?mytitle=Berlin%2Bhas%2BGiven%2Ba%2BBlanket%2BGuarantee%2Bfor%2Ball%2BPrivate%2BBank%2BSavings Berlin has Given a Blanket Guarantee for all Private Bank Savings]. (English) Retrieved 2008-10-06. (video, English) Merkel: "we also pledge that those who have conducted business irresponsibly will be held to account. The government will ensure that that happens."</ref><ref>{{cite news |

|||

|url=http://www.ft.com/cms/s/0/389588ae-93ce-11dd-9a63-0000779fd18c.html |

|||

|title=Berlin shrugs off attacks on savings pledge |

|||

|publisher=The Financial Times |

|||

|date=2008-10-06 |

|||

|accessdate=2008-10-06 |

|||

|first=Bertrand |

|||

|last=Benoitt |

|||

|coauthors=George Parker |

|||

}}</ref> On Monday, October 6, the Dow Jones Industrial Average closed below 10,000, a drop of 30% from its high above 14,000 a year earlier on October 9, 2007.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/07/business/07markets.html |

|||

|title=Chaotic Day Ends With Stocks Off 3.8% |

|||

|publisher=The New York Times |

|||

|date=2008-10-06 |

|||

|accessdate=2008-10-06 |

|||

|first=Micheal M. |

|||

|last=Grynbaum |

|||

|coauthors= |

|||

}}</ref> In Brazil and Russia trading was suspended on Monday following dramatic drops in their markets.<ref>{{cite news |

|||

|url=http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article4895024.ece |

|||

|title=Banking crisis: the world takes fright |

|||

|publisher=The Times |

|||

|date=2008-10-07 |

|||

|accessdate=2008-10-07 |

|||

|first=Patrick |

|||

|last=Hosking |

|||

|coauthors= |

|||

}}</ref> |

|||

On October 7, the [[Icelandic Financial Supervisory Authority]] took control of [[Landsbanki]].<ref>[http://www.fme.is/?PageID=581&NewsID=331 The Financial Supervisory Authority - Iceland, ''News: Based on New Legislation, the Icelandic Financial Supervisory Authority (IFSA) Proceeds to take Control of Landsbanki to ensure Continued Commercial Bank Operations in Iceland'' (07.10.2008)]</ref> <ref>[http://www.landsbanki.is/english/aboutlandsbanki/pressreleases/?GroupID=720&NewsID=13284&y=0&p=1 Landsbanki Íslands, ''Press release: Landsbanki's Operations Continued Under Unchanged Management'' (October 07, 2008)]</ref> On the same day, the [[Central Bank of Iceland]] announced that [[Russia]] had agreed to provide a four-billion-[[euro]] loan,<ref>[http://www.sedlabanki.is/?PageID=287&NewsID=1869 Central Bank of Iceland, ''The Foreign Exchange Reserves of the Central Bank of Iceland bolstered'' (07.10.2008; No. 31/2008)]</ref><ref>[http://www.sedlabanki.is/?PageID=287&NewsID=1874 Central Bank of Iceland, ''Foreign exchange reserves'' (07.10.2008; No. 33/2008)]</ref> however this was soon denied by Russian authorities, and the Icelandic Finance Minister had to correct the earlier announcement and now stated that discussions had been initiated with Russia on providing a loan to Iceland. This was also denied by Russian Deputy Finance Minister [[Dmitry Pankin]]. Late in the evening, however, Russia's Finance Minister [[Alexei Kudrin]] did concede that a request had been received, to which Russia was positive, and that discussions on financial matters would be conducted later in the week when an Icelandic delegation was expected to arrive in Moscow.<ref name="RD">{{cite news |first= Polya |last= lesova |authorlink= |title= Iceland takes dramatic steps to stabilize economy |url= http://www.marketwatch.com/news/story/icelands-economic-stabilization-efforts-melt-down/story.aspx?guid={B4AA0766-A3A9-41F6-92CF-BBF0406F8147}&dist=msr_11 |work= [[Russia Today]] |location= Moscow |date=2008-10-07 |accessdate=2008-10-07}}</ref> [[Standard & Poor's]] also cut Iceland's foreign-currency sovereign [[credit rating]] from A-/A-2 to BBB/A-3 and local-currency sovereign credit rating from A+/A-1 to BBB+/A-2. S&P also lowered Iceland's banking industry country risk assessment from group 5 to group 8, worrying that "In a severe recession scenario, the cumulative amount of nonperforming and restructured loans could reach 35% to 50% of total outstanding loans in Iceland.<ref name="RD"/><!-- suggest moving above Iceland paragraphs to subsection or its own article and leave short one sentence summary here. --><!--Yes, this article should eventually contain only a summary of events. It does little harm during the current event, but blow by blow should eventually be moved to articles where detail is appropriate --> |

|||

The same day, the Russian president pledged a credit line of [[USD]] 36 billion to the country's banks.<ref name="BBCOct7"/> Several countries announced new or increased deposit guarantees: Taiwan outlined plans to double the guarantee to NT$3 million ($92,000)<ref>International Herald Tribune. [http://www.iht.com/articles/ap/2008/10/07/business/AS-Taiwan-Banks.php Taiwan doubles bank deposit insurance]. Retrieved 2008-10-07</ref> and the European Union agreed to increase guarantees across the EU to at least €50,000 per saver. Several EU states then announced increases on top of this minimum: [[Netherlands]], [[Spain]], and [[Belgium]] each announced they would guarantee up to €100,000.<ref name="BBCOct7">{{cite news |authorlink=[[BBC news]] |title=Financial crisis at-a-glance: 7 Oct |url=http://news.bbc.co.uk/2/hi/business/7656212.stm |

|||

|date=2008-10-07 |accessdate=2008-10-07}}</ref> |

|||

The government of Britain announced on Wednesday morning, October 8 that it would make £25 billion available as "[[Tier 1 capital]]" ([[Preferred stock|preference share capital]] or "PIBS") to the following financial institutions: [[Abbey (bank)|Abbey]], [[Barclays plc|Barclays]], [[HBOS]], [[HSBC Bank (Europe)|HSBC Bank plc]], [[Lloyds TSB]], [[Nationwide Building Society]], [[Royal Bank of Scotland Group|Royal Bank of Scotland]], and [[Standard Chartered Bank|Standard Chartered]]. An additional £25 billion will be made available to other financial institutions, including British subsidiaries of foreign banks. "In reviewing these applications the Government will give due regard to an institution's role in the UK banking system and the overall economy". The plan included increased ability to borrow from the government, offered assistance in raising equity, and a statement of support for international efforts.<ref>{{cite news |

|||

|url= |

|||

http://www.guardian.co.uk/business/2008/oct/08/creditcrunch.banking1/article4895024.ece |

|||

|title=Treasury's official announcement on the banks |

|||

|publisher=The Guardian |

|||

|date=2008-10-08 |

|||

|accessdate=2008-10-08 |

|||

|first=[[HM Treasury]] |

|||

|last= |

|||

|coauthors= |

|||

}}</ref> The plan has been characterized as partial [[nationalization]].<ref>{{cite news |

|||

|url=http://www.guardian.co.uk/business/2008/oct/08/creditcrunch.banking |

|||

|title=Government to spend £50bn to part-nationalise UK's banks |

|||

|publisher=The Guardian |

|||

|date=2008-10-08 |

|||

|accessdate=2008-10-08 |

|||

|first=Graeme |

|||

|last=Wearden |

|||

|coauthors= |

|||

}}</ref> |

|||

On Wednesday, October 8, the [[European Central Bank]], [[Bank of England]], [[Federal Reserve]], [[Bank of Canada]], [[Sveriges Riksbank|Swedish Riksbank]] and [[Swiss National Bank]] all announced simultaneous cuts of 0.5% to their base rates at 11:00 UTC. <ref>{{cite web|url=http://www.federalreserve.gov/newsevents/press/monetary/20081008a.htm|title=Federal Reserve and other central banks announce reductions in policy interest rates|accessdate=2008-10-08}}</ref><ref>{{cite web|url=http://www.bankofcanada.ca/en/press/2008/pr08-21.html|title=Central banks announce reductions in policy interest rates|accessdate=2008-10-08|date=2008-10-08}}</ref><ref>{{cite web|url=http://www.ecb.int/home/html/index.en.html|title=ECB homepage|date=2008-10-08|accessdate=2008-10-08}}</ref><ref>{{cite web|url=http://news.bbc.co.uk/2/hi/business/7658958.stm|title=BBC News - Central banks cut interest rates|accessdate=2008-10-08}}</ref> Shortly afterwards, the [[People's Bank of China|Central Bank of the People's Republic of China]] also cut interest rates.<ref> [http://english.people.com.cn/90001/90776/90884/6511768.html China's central bank cuts reserve requirement ratio, interest rate to stimulate economy], People's Daily Online, Retrieved 2008-10-08 </ref> On October 8 there were sharp losses on stock markets worldwide with a loss of over 9% in Japan. Trading was suspended in Russia and Indonesia after steep morning losses. In the United States, following the funds cut by the Federal Reserve, stocks were volatile, finishing down.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/09/business/09markets.html |

|||

|title=For Dow, Final Swing Was Down |

|||

|publisher=The New York Times |

|||

|date=2008-10-08 |

|||

|accessdate=2008-10-08 |

|||

|first=David |

|||

|last=Jolly |

|||

|coauthors=Bettina Wassener and Keith Bradsher |

|||

}}</ref> On October 8 the Federal Reserve loaned [[AIG]] $37.8 billion, in addition to the previous loan of $85 billion.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/09/business/economy/09insure.html?hp |

|||

|title=Fed Gives A.I.G. $37.8 Billion Loan |

|||

|publisher=The New York Times |

|||

|date=2008-10-08 |

|||

|accessdate=2008-10-08 |

|||

|first=Associated Press |

|||

|last= |

|||

|coauthors= |

|||

}}</ref> |

|||

On Wednesday night, October 8, the [[Central Bank of Iceland]] abandoned its attempt to peg the [[Icelandic króna]] at 131 króna to the euro after trying to set this peg on Monday, October 6.<ref>{{cite web|url=http://www.forbes.com/home/2008/10/08/iceland-sovereign-currency-markets-currency-cx_po_1008markets28.html|title=Iceland Teeters On Bankruptcy|publisher=Forbes|date=2008-10-09|accessdate=2008-10-08}}</ref>By Thursday October 9, the [[Icelandic króna]] was trading at 340 to the euro when the government suspended all trade in the currency.<ref>{{cite web|url=http://www.investmentmarkets.co.uk/20081009-2520.html|title=Trade halted on Icelandic krona|publisher=Investment markets|last=Frei|first=Elaine|date=2008-10-09|accessdate=2008-10-08}}</ref> |

|||

On Thursday, October 9, the [[Icelandic Financial Supervisory Authority]] took control of the country's biggest bank [[Kaupthing Bank|Kaupþing banki hf.]].<ref>[http://www.fme.is/?PageID=581&NewsID=340 The Financial Supervisory Authority - Iceland, ''News: Based on New Legislation, the Icelandic Financial Supervisory Authority (FME) Proceeds to take Control of Kaupþing to ensure Continued Commercial Bank Operations in Iceland'' (09.10.2008)]</ref> <ref>[http://www.kaupthing.com/pages/164?path=K/133944/PR/200810/1258139.xml Kaupthing Bank, ''Press release: Kaupthing Bank turns to the Icelandic FSA'' (2008.10.09)]</ref><ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/09/business/worldbusiness/09icebank.html |

|||

|title=In Flailing Iceland, Disbelief and Regret |

|||

|publisher=The New York Times |

|||

|date=2008-10-09 |

|||

|accessdate=2008-10-09 |

|||

|first=Eric |

|||

|last=Pfanner |

|||

|coauthors= |

|||

}}</ref> This occurred when the [[Kaupthing]] Board resigned and asked the national authorities to take control. This came about when "Britain transferred control of the business of [[Kaupthing Edge]], its Internet bank, to [[ING Direct]] and put Kaupthing's UK operations into administration" placing [[Kaupthing]] in technical default according to loan agreements.<ref>{{cite web|url=http://www.reuters.com/article/innovationNews/idUSTRE4981SV20081009?sp=true|title=Shellshocked [[Iceland]] takes control of biggest bank|publisher=Reuters|date=2008-10-09|accessdate=2008-10-08}}</ref> This marked an escalating row between [[Iceland]] and the [[United Kingdom]] over the growing crisis. All trade was also suspended on the [[Iceland Stock Exchange]] until Monday October 13.<ref>{{cite web|url=http://uk.reuters.com/article/businessNews/idUKTRE4986YE20081009|title=Iceland takes over biggest bank|publisher=Reuters|date=2008-10-09|accessdate=2008-10-08}}</ref> |

|||

On Thursday, October 9, the cost of short term credit rose while there were heavy losses in the United States stock market; losses were moderate in Europe.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/10/business/10markets.html |

|||

|title=Stocks Plunge Again; Dow Under 8,600 |

|||

|publisher=The New York Times |

|||

|date=2008-10-09 |

|||

|accessdate=2008-10-09 |

|||

|first=David |

|||

|last=Jolly |

|||

|coauthors=Bettina Wassener |

|||

}}</ref> The following day, Friday, October 10, there were large losses in Asian and European markets <ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/11/business/11markets.html |

|||

|title=Global Markets Dive in Relentless Selloff |

|||

|publisher=The New York Times |

|||

|date=2008-10-10 |

|||

|accessdate=2008-10-10 |

|||

|first=David |

|||

|last=Jolly |

|||

|coauthors=Bettina Wassener |

|||

}}</ref> [[Yamato Life]] filed for bankruptcy. Beset by falling commodities prices, Russia's stock markets remained closed on October 10. The Russian Parliament passed a plan authorizing lending of $36 billion gained from global oil sales to banks which met creditworthiness requirements.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/11/business/worldbusiness/11moscow.html |

|||

|title=Russia Approves Loan Plan to Ease Credit Crunch |

|||

|publisher=The New York Times |

|||

|date=2008-10-10 |

|||

|accessdate=2008-10-10 |

|||

|first=Andrew E. |

|||

|last=Kramer |

|||

|coauthors= |

|||

}}</ref> The government of the United States, as authorized by [[Emergency_Economic_Stabilization_Act_of_2008#Government_equity_interests_in_participating_firms|the Emergency Economic Stabilization Act]], announced plans to infuse funds into banks by purchasing equity interests in them, in effect, partial nationalization, as done in Britain. The Treasury secretary Henry M. Paulson Jr. met Friday in Washington with world financial leaders.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/11/business/11markets.html |

|||

|title=U.S. Proceeds With Plan for Equity Stakes in Banks |

|||

|publisher=The New York Times |

|||

|date=2008-10-10 |

|||

|accessdate=2008-10-10 |

|||

|first=Graham |

|||

|last=Bowley |

|||

|coauthors=David Jolly |

|||

}}</ref> A meeting of international financial leaders hosted by President Bush at the White House in Washington is planned on Saturday to attempt to coordinate global response to the financial crisis. The annual meetings of both the International Monetary Fund and World Bank will be held in Washington over the weekend.<ref>{{cite news |

|||

|url=http://www.nytimes.com/2008/10/10/business/worldbusiness/10global.html |

|||

|title=As Credit Crisis Spreads, Global Approach Weighed |

|||

|publisher=The New York Times |

|||

|date=2008-10-09 |

|||

|accessdate=2008-10-10 |

|||

|first=Mark |

|||

|last=Landler |

|||

|coauthors=Edmund L. Andrews |

|||

}}</ref> |

|||

On Friday, October 10th, stock markets crashed across Europe and Asia. London, Paris and Frankfurt dropped 10% within an hour of trading and again when Wall Street opened for trading. Global markets have experienced their worst weeks since 1987 and some indexes, S&P 500, since the [[Wall Street Crash of 1929]].{{Citation Needed}} |

|||

On October 10th, within the first five minutes of the trading session on [[Wall Street]], the [[Dow Jones Industrial Average]] plunged 697 points, falling below 7900 to its lowest level since [[March 17]], [[2003]]. Later in the afternoon, the Dow made violent swings back and forth across the [[breakeven]] line, toppling as much as 600 points and rising 322 points. The Dow ended the day losing only 128 points, or 1.49%. In S&P100 one financial corporate +43%, showing signals upwards also. President [[George W. Bush]] reassured investors that the government will solve the financial crisis gripping world economies.<ref>{{cite web|url=http://money.cnn.com/2008/10/10/markets/markets_newyork/index.htm?postversion=2008101011|title=Vertigo on Wall Street|date=October 10, 2008|publisher=CNNMoney|accessdate=2008-10-10}}</ref> |

|||

==Key risk indicators in September 2008== |

|||

[[Image:TED Spread Chart - Data to 9 26 08.png|thumb|The [[TED spread]] – an indicator of credit risk – increased dramatically during September 2008.]] |

|||

Key risk indicators became highly volatile during September 2008, a factor leading the U.S. government to pass the [[Emergency Economic Stabilization Act of 2008]]. The “[[TED Spread]]” is a measure of credit risk for inter-bank lending. It is the difference between: 1) the risk-free three-month U.S. treasury bill rate; and 2) the three-month London InterBank Offered Rate ([[LIBOR]]), which represents the rate at which banks typically lend to each other. A higher spread indicates banks perceive each other as riskier counterparties. The t-bill is considered "risk-free" because the full faith and credit of the U.S. government is behind it; theoretically, the government could just print money so that the principal is fully repaid at maturity. |

|||

The [[TED Spread]] reached record levels in late September 2008. The diagram indicates that the Treasury yield movement was a more significant driver than the changes in LIBOR. A three month t-bill yield so close to zero means that people are willing to forgo interest just to keep their money (principal) safe for three months--a very high level of risk aversion and indicative of tight lending conditions. Driving this change were investors shifting funds from money market funds (generally considered nearly risk free but paying a slightly higher rate of return than t-bills) and other investment types to t-bills.<ref>[http://wsj.com/article/SB122186683086958875.html?mod=article-outset-box WSJ Article]</ref> These issues are consistent with the September 2008 aspects of the [[subprime mortgage crisis]] which prompted the [[Emergency Economic Stabilization Act of 2008]] signed into law by the U.S. President on October 2, 2008. |

|||

In addition, an increase in LIBOR means that financial instruments with variable interest terms are increasingly expensive. For example, car loans and credit card interest rates are often tied to LIBOR; some estimate as much as $150 trillion in loans and [[Derivative (finance)|derivatives]] are tied to LIBOR.<ref>[http://www.marketwatch.com/news/story/libor-jump-ted-spread-show/story.aspx?guid={3632A7B4-4B54-4AF5-86C2-78EFA350E927} Markewatch Article - LIBOR Jumps to Record]</ref> Higher interest rates place additional downward pressure on consumption, increasing the risk of recession. |

|||

==Global responses== |

|||

On September 15, 2008 China cut its interest rate for the first time since 2002.{{Fact|date=September 2008}} Indonesia reduced its overnight repo rate, at which commercial banks can borrow overnight funds from the central bank, by two percentage points to 10.25 percent. The [[Reserve Bank of Australia]] injected nearly $1.5 billion into the banking system, nearly three times as much as the market's estimated requirement. The Reserve Bank of India added almost $1.32 billion, through a refinance operation, its biggest in at least a month.<ref>{{cite news|url=http://www.iht.com/articles/2008/09/16/business/cbanks.php|title=Asian central banks spend billions to prevent crash|publisher=[[International Herald Tribune]]|date=[[2008-09-16]]|accessdate=2008-09-21}} |

|||

</ref> |

|||

In Taiwan, the central bank on September 16, 2008 said it would cut its required reserve ratios for the first time in eight years. The central bank added $3.59 billion into the foreign-currency interbank market the same day. Bank of Japan pumped $29.3 billion into the financial system on September 17, 2008 and the Reserve Bank of Australia added $3.45 billion the same day. The [[European Central Bank]] injected $99.8 billion in a one-day money-market auction. The Bank of England pumped in $36 billion. Altogether, central banks throughout the world added more than $200 billion from the beginning of the week to September 17.<ref> |

|||

{{cite news|url=http://www.bloomberg.com/apps/news?pid=20601101&sid=aTD8INGLUe2Q&refer=japan|title=Japan, Australia Inject $33 Billion to Soothe Markets|publisher=[[Bloomberg]]|date=[[2008-09-17]]|accessdate=2008-09-21}} |

|||

</ref> |

|||

On September 29, 2008 the Belgian, Luxembourg and Dutch authorities partially nationalized [[Fortis (finance)|Fortis]]. The German government bailed out [[Hypo Real Estate]].<ref>{{cite news |first= |last= |authorlink= |coauthors= |title=Germany Rescues Hypo Real Estate |url=http://www.dw-world.de/dw/article/0,2144,3692522,00.html |work=[[Deutsche Welle]] |publisher= |date=2008-10-06 |accessdate= }}</ref> |

|||

=== US responses === |

|||

The Federal Reserve, Treasury, and Securities and Exchange Commission took several steps on September 19 to intervene in the crisis. To stop the potential run on money market mutual funds, the Treasury also announced on September 19 a new $50 billion program to insure the investments, similar to the [[Federal Deposit Insurance Corporation]] (FDIC) program.<ref name="Gullapalli"/> Part of the announcements included temporary exceptions to section 23A and 23B (Regulation W), allowing financial groups to more easily share funds within their group. The exceptions would expire on January 30, 2009, unless extended by the [[Federal Reserve Board]].<ref>[http://www.federalreserve.gov/newsevents/press/monetary/20080919c.htm (Press Release) FRB: Board Approves Two Interim Final Rules], [[Federal Reserve Bank]], September 19, 2008.</ref> The Securities and Exchange Commission announced termination of short-selling of 799 financial stocks, as well as action against [[naked short selling]], as part of its reaction to the mortgage crisis.<ref>Boak, Joshua ([[Chicago Tribune). [http://www.mercurynews.com/markets/ci_10513612 "SEC temporarily suspends short selling"], [[San Jose Mercury News]], September 19, 2008.</ref> |

|||

====Loans to banks for asset-backed commercial paper==== |

|||

[[Image:Money market fund.png|500px|right|How money markets fund corporations]] |

|||

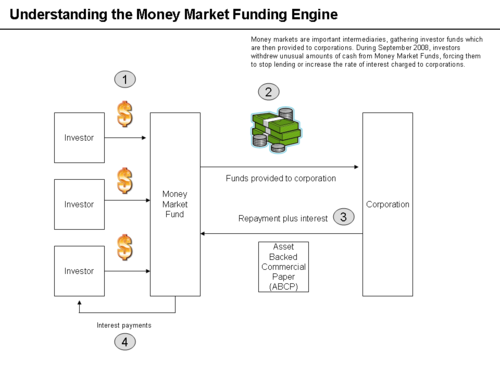

During the week ending September 19, 2008, [[money market]] mutual funds had begun to experience significant withdrawals of funds by investors. This created a significant risk because money market funds are integral to the ongoing financing of corporations of all types. Individual investors lend money to money market funds, which then provide the funds to corporations in exchange for corporate short-term securities called [[asset-backed commercial paper]] (ABCP). However, a potential [[bank run]] had begun on certain money market funds. If this situation had worsened, the ability of major corporations to secure needed short-term financing through ABCP issuance would have been significantly affected. To assist with liquidity throughout the system, the Treasury and Federal Reserve Bank announced that banks could obtain funds via the Federal Reserve's Discount Window using ABCP as collateral.<ref>Bull, Alister. [http://www.reuters.com/article/ousiv/idUSN1926607920080919 "Fed says to make loans to aid money market funds"], [[Reuters]], September 19, 2008.</ref><ref name="Gullapalli">Gullapalli, Diya and Anand, Shefali. [http://wsj.com/article/SB122186683086958875.html?mod=article-outset-box "Bailout of Money Funds Seems to Stanch Outflow"], [[The Wall Street Journal]], September 20, 2008.</ref> |

|||

====Legislation==== |

|||

{{main|Emergency Economic Stabilization Act of 2008}} |

|||

The Secretary of the United States Treasury, [[Henry Paulson]] and President [[George W. Bush]] proposed legislation for the government to purchase up to [[$700 billion dollar Treasury fund|US$700 billion of "troubled mortgage-related assets"]] from financial firms in hopes of improving confidence in the mortgage-backed securities markets and the financial firms participating in it.<ref> |

|||

{{cite news| url = http://www.nytimes.com/2008/09/21/business/21cong.html?bl&ex=1222228800&en=007cf9e8faaaf52a&ei=5087%0A | title = Administration Is Seeking $700 Billion for Wall Street|publisher=[[The New York Times]]|date=[[2008-09-20]]|accessdate=2008-09-25}} |

|||

</ref> Discussion, hearings and meetings among legislative leaders and the administration later made clear that the the proposal would undergo significant change before it could be approved by Congress.<ref> |

|||

[http://clerk.house.gov/evs/2008/roll674.xml House of Representatives Roll Call vote results]. [[Library of Congress]] [[THOMAS]] website. Retrieved on September 29, 2008. |

|||

</ref> |

|||

On October 1, a revised compromise version was approved by the Senate with a 74-25 vote, the sole Senator not to vote was cancer-stricken [[Ted Kennedy]] of [[Massachusetts]]. The bill, [[HR1424]] was passed by the House on October 3, 2008 and signed into law. |

|||

====Fed response==== |

|||

In an effort to increase available funds for [[commercial banks]] and lower the [[fed funds rate]], on September 29 the U.S. [[Federal Reserve]] announced plans to double its [[Term Auction Facility]] to $300 billion. Because there appeared to be a shortage of U.S. dollars in Europe at that time, the Federal Reserve also announced it would increase its swap facilities with foreign central banks from $290 billion to $620 billion.<ref>[http://www.thestreet.com/story/10439813/2/fed-pumps-huge-wads-of-cash-into-system.html]</ref> |

|||

== References == |

|||

{{Reflist|2}} |

|||

==External links and further reading== |

|||

* {{cite news | first = Joe | last= Nocera | coauthors= Andrew Ross Sorkin, Diana B. Henriques, Edmund L. Andrews | title= 36 Hours of Alarm and Action as Crisis Spiraled | date= 2008-10-01 | publisher= | url = http://www.nytimes.com/2008/10/02/business/02crisis.html?hp=&pagewanted=all |

|||

| work = New York Times| pages = | accessdate = 2008-10-02 }} (Background on development of the Treasury proposal to Congress) |

|||

{{2008 economic crisis}} |

|||

{{BankPanicUSA}} |

|||

[[Category:2008 in economics]] |

|||

[[Category:Financial crises]] |

|||

[[Category:United States housing bubble]] |

|||

[[es:Crisis de liquidez de septiembre de 2008]] |

|||

Revision as of 00:12, 11 October 2008

This article documents a current event. Information may change rapidly as the event progresses, and initial news reports may be unreliable. The latest updates to this article may not reflect the most current information. (October 2008) |

The global financial crisis of September–October 2008 is a developing financial crisis which emerged the week of September 14, 2008. Beginning with failures of large financial institutions in the United States, it rapidly evolved into a global crisis resulting in a number of European bank failures and sharp reductions in the value of equities (stock) and commodities worldwide. The crisis has lead to a liquidity problem and the de-leveraging of world assets, which has further accelerated the problem. World political leaders have coordinated their efforts to reduce fears but the crisis is ongoing and continues to change. The crisis has roots in the subprime mortgage crisis and is an acute phase of the financial crisis of 2007–2008.

Initial events

An inability to secure loans led to the September 15, 2008 decision by Lehman Brothers Holdings, Inc. to file for bankruptcy, the buyout of Merrill Lynch by Bank of America, and concerns over the American International Group (AIG) ending in that company's bailout by the Federal Reserve System on September 16. These events resulted in large stock market losses, prompting large infusions of cash by central banks around the world.

Time line

On the first day, the Dow Jones Industrial Average plunged 504 points (4.4%) while the S&P 500 fell 59 points (4.7%). Asian and European markets rendered similarly sharp drops. United Kingdom regulators announced a temporary ban on short-selling of financial stocks on September 18[1] and were followed by the United States on September 19.[2]

- On September 29, the Dow dropped 777 points (6.98%), the largest one-day point-drop in history (but only the 17th largest percentage drop).[3] For comparison, during the Great Depression the market fell only 340 points - but this amounted to a 90% fall overall.

- On September 29, the OBX Index of Oslo Stock Exchange dropped 8.3%, its third largest drop ever in one day.[4]

- On October 9, the one-year anniversary of the Dow's peak, the Dow dropped below 8600, reaching a five year low. It was the first time since August 2003 that the Dow closed below 9000.

Federal Reserve actions to lower interest rates and stimulate the economy

| Federal reserve rates changes ( Just data after January 1, 2008 ) | |||||

| Date | Discount rate | Discount rate | Discount rate | Fed funds | Fed funds rate |

|---|---|---|---|---|---|

| Primary | Secondary | ||||

| rate change | new interest rate | new interest rate | rate change | new interest rate | |

| Oct 8, 2008* | -.50% | 1.75% | 2.25% | -.50% | 1.50% |

| Apr 30, 2008 | -.25% | 2.25% | 2.75% | -.25% | 2.00% |

| Mar 18, 2008 | -.75% | 2.50% | 3.00% | -.75% | 2.25% |

| Mar 16, 2008 | -.25% | 3.25% | 3.75% | ||

| Jan 30, 2008 | -.50% | 3.50% | 4.00% | -.50% | 3.00% |

| Jan 22, 2008 | -.75% | 4.00% | 4.50% | -.75% | 3.50% |

- * Part of a coordinated global rate cut of 50 basis point by main central banks. [2]

- See more detailed US federal discount rate chart: [3]

Week of September 14, 2008

Major financial firm crises

On Sunday, September 14, it was announced that Lehman Brothers would file for bankruptcy after the Federal Reserve Bank declined to participate in creating a financial support facility for Lehman Brothers. The same day, the sale of Merrill Lynch to Bank of America was announced.[5] The beginning of the week was marked by extreme instability in global stock markets, with dramatic drops in market values on Monday, September 15, and Wednesday, September 17. On September 16, the large insurer American International Group (AIG), a significant participant in the credit default swaps markets suffered a liquidity crisis following the downgrade of its credit rating. The Federal Reserve, at AIG's request, and after AIG has shown that it could not find lenders willing to save it from insolvency, created a credit facility for up to US$85 billion in exchange for an 79.9% equity interest, and the right to suspend dividends to previously issued common and preferred stock.[6]

Money market funds insurance and short sales prohibitions

On September 16, the Reserve Primary Fund, a large money market mutual fund, lowered its share price below $1 because of exposure to Lehman debt securities. This resulted in demands from investors to return their funds as the financial crisis mounted.[7] By the morning of September 18, money market sell orders from institutional investors totalled $0.5 trillion, out of a total market capitalization of $4 trillion, but a $105 billion liquidity injection from the Federal Reserve averted an immediate collapse.[8] On September 19 the U.S. Treasury offered temporary insurance (akin to FDIC insurance of bank accounts) to money market funds.[9] Toward the end of the week, short selling of financial stocks was suspended by the Financial Services Authority in the United Kingdom and by the Securities and Exchange Commission in the United States.[10] Similar measures were taken by authorities in other countries.[11] Some restoration of market confidence occurred with the publicity surrounding efforts of the Treasury and the Securities Exchange Commission[12][13]

Troubled Asset Relief Program

On September 19, 2008, a plan intended to ameliorate the difficulties caused by the subprime mortgage crisis was proposed by the Secreatry of the Treasury, Henry Paulson. He proposed a Troubled Asset Relief Program (later incorporated into the Emergency Economic Stabilization Act of 2008) which would permit for the United States government to purchase illiquid assets (also termed toxic assets) from financial institutions.[14][15] The value of the securities is extremely difficult to determine.[16]

Consultations of between the Secretary of the Treasury, the Chairman of the Federal Reserve, and the Chairman of the U.S. Securities and Exchange Commission, Congressional leaders and the President of the United States moved forward plans to advance a comprehensive solution to the problems created by illiquid mortgage-backed securities. At the close of the week the Secretary of the Treasury and President Bush announced a proposal for the federal government to buy up to US$700 billion of illiquid mortgage backed securities with the intent to increase the liquidity of the secondary mortgage markets and reduce potential losses encountered by financial institutions owning the securities. The draft proposal of the plan was received favorably by investors in the stock market. Details of the bailout remained to be acted upon by Congress.[17][18][19][20]

Week of September 21, 2008