Renminbi

| Rénmínbì | |

|---|---|

| Country: |

|

| Subdivision: | 1 yuan = 10 jiǎo = 100 fēn |

| ISO 4217 code : | CNY |

| Abbreviation: | RMB ¥ , (CN ¥) |

|

Exchange rate : (August 24, 2020) |

1 EUR = 8.19 CNY 1 CHF = 7,611 CNY |

Renminbi ( Chinese 人民幣 / 人民币 , Pinyin - “people's currency”, casually “people's money”) is the currency of the People's Republic of China and is issued by the Chinese People's Bank . As “people's money” it was differentiated from the waibi ( 外幣 / 外币 , wàibì ), which existed in parallel in the same denomination, casually the “ foreign money”, correctly the foreign currency or foreign exchange that was reserved for foreigners.

The international abbreviation according to ISO 4217 is CNY , also referred to as CNH in off-shore trading centers for foreign exchange, e.g. Hong Kong , in order to distinguish it from other trading centers. In China, however, RMB is often used. The units of the currency are Yuan ( 元 , , alternative symbols are 圓 traditional or 圆 simplified), Jiao ( 角 , ) and Fen ( 分 , ). One yuan “ 元 ”, abbreviated with the symbol “ ¥ ” (“CN ¥”), corresponds to 10 Jiǎo “ 角 ” or 100 Fēn “ 分 ”.

In Chinese colloquial language, instead of Yuán ( 元 ), Kuài ( 塊 / 块 to hear ( standard - "piece") and instead of Jiǎo ( 角 - "horn, corner"), mostly to Máo ( 毛 to hear ( standard - "hair") is used. In the west, the currency itself is often referred to as yuan or renminbi yuan .

Denomination

There are 100, 50, 20, 10, 5, 2 and 1 yuan, 5, 2 and 1 jiao and 5, 2 and 1 fen notes. There are coins of 1 yuan, 5 and 1 jiao, 5, 2 and 1 fen. Fen-denominated banknotes have almost disappeared from circulation.

| unit | coll. name | Value in ¥ |

|---|---|---|

| 1 yuan ( 元 , yuán ) | 1 kuai ( 塊 / 块 , kuài ) | 1.00 yen |

| 1 Jiao ( 角 , jiǎo ) | 1 Mao ( 毛 , máo ) | ¥ 0.10 |

| 1 Fen ( 分 , fēn ) | ¥ 0.01 | |

The prices in most shops are in full jiao, with the exception of some supermarket prices with an ending in 5 fen, i.e. half jiao. However, these prices are usually rounded down to full Jiao amounts at the checkout.

When changing from foreign currency to yuan, you also get coins in Fen values, as there is no rounding.

There are regional differences when it comes to the use of small values in coins or bills: While in Shanghai predominantly 1-yuan coins are in circulation, in Qingdao mainly 1-yuan bills are in circulation, also with Jiao-denominations.

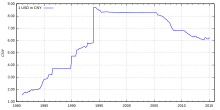

Exchange rate system

The Chinese currency has been pegged to the US dollar only unofficially and later officially with a bandwidth of 0.5% since 1995 . As of July 21, 2005, the median rate of the bond was 8.11 yuan per dollar (as of February 2014). Before that, the median exchange rate was 8.277 yuan to the dollar. In the 1980s, the exchange rate was 2 yuan to the US dollar. The Chinese central bank ensures compliance with the specified exchange rate through targeted foreign exchange market interventions .

The fixed exchange rate system , China has initially both the inflation -fighting as well as in access to international capital gives great advantages, as the exchange rate policy of China as applies very credible. The high inflows of foreign capital in recent years were not least due to the low currency risk. The renminbi even survived the Asian crisis without devaluing . In recent years, however, there has been increasing international pressure on China to unpeg the dollar and let its currency float freely (and thus presumably appreciate). Above all, the USA , the EU and China's Southeast Asian neighbors are calling on the country to release the renminbi yuan, which in their opinion is now severely undervalued. However, since Chinese monetary policy indirectly supports the US national debt through dollar purchases , an appreciation of the renminbi would have ambivalent consequences for the US.

Most studies (for example, the Big Mac Index of the Economist ) show a significant undervaluation of the Chinese currency, which the country over its economic competitors are a significant cost advantage. However, the Chinese central bank has announced several times that it will not allow itself to be put under pressure to reform the exchange rate system and that any restructuring of the system depends on the economic situation in China and the situation of its financial market . The government and the central bank do not regard the exchange rate peg in isolation, but rather as part of several economic policy measures, which also include substantial capital controls.

In July 2005, the central bank reacted to the pressure from the markets and let the renminbi appreciate slightly by 2.1%. For the future, the bank announced a transition to a currency basket system. According to initial statements by the governor of the central bank, Zhou Xiaochuan, in August 2015, the currency basket should contain more than ten currencies, primarily the US dollar, the euro , the Japanese yen and the South Korean won . However, there was still a very strong focus on the US dollar. Since the completely fixed peg was broken, the renminbi had appreciated by around nine percent by July 2007. In 2007 the renminbi appreciated by a further six percent against the dollar, and at the same time also depreciated by six percent against the euro, as the euro was able to gain twelve percent against the dollar. The 2007 Chinese exchange rate regime roughly corresponded to a basket of currencies with the same weighting of the dollar and the euro.

In June 2010, the Chinese central bank announced on its website that it would press ahead with the reform of the exchange rate policy and increase the flexibility of the exchange rate . The announcement was well received internationally. On June 22, 2010, the Chinese central bank raised the daily rate against the dollar by 0.42%. According to Paul Krugman , this has in no way changed the principle of Chinese currency policy; at worst, he only sees trade sanctions as a possible answer.

At the annual meeting of the International Monetary Fund in October 2010, the differences over Chinese monetary policy could not be resolved either. The United States in particular renewed their criticism of the undervaluation of the renminbi, and experts warned of a “ currency war ”. On October 13, 2010, the Chinese central bank set the exchange rate at 6.6693 yuan, the highest level of the renminbi yuan since the introduction of the dollar peg.

From August 2010 to August 2011, the yuan appreciated five percent against the dollar. The exchange rate was 6.434 yuan / dollar (0.1554 dollar / yuan). Experts continue to regard the currency as severely undervalued, but believe that the Chinese central bank will gradually abandon its interventions, and liberalization of Chinese foreign trade would make the renminbi a freely convertible currency.

From 2015

On August 11, 2015, the Chinese central bank surprisingly devalued the renminbi yuan by 1.9 percent, followed by a further devaluation of 1.6 percent the following day. The aim is to get closer to market economy mechanisms and adapt to the expectations of currency traders. This is another "building block of the fiscal reform program". Observers feared that a new currency war would ignite , which the Chinese have described as "completely exaggerated".

In order to make its currency one of the leading international currencies, the Chinese central bank decoupled it from the US dollar in 2015 . Since then, the value of a renminbi yuan has been determined using a new currency basket in which the US dollar is still the largest single currency. The US dollar, euro and yen make up about half of the currency basket. The currency basket was named after the “China Foreign Exchange Trade System” and is referred to as the “CFETS RMB Index”. The share of the individual currencies corresponds to the trade volume of the respective country with China.

On November 30, 2015, the International Monetary Fund (IMF) declared the renminbi to be the global reserve currency alongside the US dollar, euro, British pound and yen. With this status, it can be used more widely in the global trade and financial system. On October 1, 2016, the renminbi was added to the IMF's world currency basket as the fifth currency .

Renminbi Trading Center

As a trading center for China's yuan currency in the euro zone has been the financial center Frankfurt contractual.

Since November 2014, companies from all over the euro zone have been able to use the RMB Clearing Bank ( Bank of China , Frankfurt branch) to process their payment transactions in Renminbi on the same day. Previously, renminbi payments were only possible through selected financial centers in Asia, particularly Hong Kong.

Appearance

In 1999, a new series of banknotes was released that was used in parallel with the previous notes before the latter disappeared from circulation. Since then, the image of Mao Zedong can be seen on all Renminbi notes (with the exception of the not newly issued notes in Jiao denominations) .

The Chinese central bank introduced new banknotes at the end of 2005, which are supposed to offer better protection against forgery. The new banknotes with a value of 5, 10, 20, 50 and 100 yuan hardly differ from the series introduced in 1999, but now also contain new serial numbers, watermarks, the EURion constellation and other features.

In 2015, a new version of the 100 RMB banknote was introduced. Among other things, it contains security features such as additional watermarks and special light-reflecting zones, but remains largely the same visually.

Waibi - "foreign exchange"

The special banknotes for foreigners in the same yuan denomination, the Foreign Exchange Certificates (FEC), known in China as waibi , to distinguish the renminbi , were introduced in 1979 in addition to the renminbi , but were abolished in 1994 after A lively black market around Waibi , ie “black market for foreign exchange trading”, had developed, since import and numerous export products were only available against convertible Waibi .

Counterfeit money

Counterfeit money is quite common. In order to prevent large amounts of money from being forged, the denomination already ends at 100 yuan.

As with euro banknotes, the feel-see-tilt verification concept also applies to yuan banknotes. The raised gravure print on the front, which is difficult to forge, can be felt in various places on the note, for example on the right edge, on the hatching on Mao's collar or on the large letters in the upper central area. The watermark that appears on the left does not offer sufficient reliability on its own, since good forgeries also contain this. However, a look under a UV lamp reveals features such as mottled fibers that do not appear on counterfeits. As a tilting element, the value of the banknote is applied in screen printing technology at the bottom left, but only with a glitter that is easy to imitate.

history

The renminbi was introduced by the communist government in 1949 after the founding of the People's Republic of China.

literature

- Ansgar Belke, Christian Dreger and Georg Erber: Reducing global trade imbalances: does China need to upgrade? In: weekly report. 77/2010, No. 40, 2010, ISSN 0012-1304 , pp. 2–8 ( PDF; DIW Online ).

Web links

- National Bank of the PR China, People's Bank of China (English)

- Background and effects of the peg to the dollar

- China's renminbi: on the way to the new world currency. FAZ.NET , February 16, 2012

- Current and historical banknotes of the PR China (including Foreign Exchange Certificate FEC) (private website)

Individual evidence

- ↑ Term “ Waibi ” - 外幣: (Chinese, English) [1] on www.zdic.net, accessed on January 12, 2018 - online

- ↑ Term “ Waibi ” - 外幣: (Chinese, German) [2] on dict.leo.org, accessed on January 12, 2018 - Online

- ↑ Term “ Waibi ” - 外幣: (Chinese) [3] on dict.revised.moe.edu.tw, accessed on January 12, 2018 - online

- ^ William R. Cline, John Williamson: New Estimates of Fundamental Equilibrium Exchange Rates. (PDF; 258 kB), Policy Brief, Peterson Institute for International Economics, Number PB08-7, July 2008

- ↑ Currency transition : China accepts weaker dollar , Spiegel Online from June 19, 2010.

- ↑ Bettina Wassener: China Pegs Renminbi's Value Higher. The New York Times , June 21, 2010.

- ^ Paul Krugman: The Renminbi Runaround. The New York Times, June 24, 2010.

- ↑ Spiegel Online: IMF cannot defuse currency dispute. October 9, 2010.

- ↑ Spiegel Online: China appreciates the yuan minimally. October 13, 2010.

- ↑ Appreciation against the dollar: China's currency on record course. Spiegel Online from August 3, 2011.

- ↑ a b c Marcel Grzanna: Yuan devaluation: Why China is making its currency cheaper. In: sz.de. Süddeutsche Zeitung , August 11, 2015, accessed on August 11, 2015 .

- ↑ a b Chinese central bank sends yuan further downhill. In: faz.net. Frankfurter Allgemeine Zeitung , August 12, 2015, accessed on August 12, 2015 .

- ↑ Christian Siedenbiedel: Devaluation Race: Is the “Currency War ” Coming Now? In: faz.net. Frankfurter Allgemeine Zeitung , August 12, 2015, accessed on August 12, 2015 .

- ↑ Dax loses almost 400 points because of concerns about China. Handelsblatt , August 12, 2015, accessed on August 12, 2015 .

- ↑ A RMB devaluation does not yet create a currency war. In: german.china.org.cn. China Internet Information Center, August 13, 2015, accessed August 13, 2015 .

- ↑ https://frontera.net/news/china-reconstituted-yuan-basket/attachment/the-new-composition-of-the-cfets-rmb-index/ The New Composition of the CFETS RMB Index

- ^ Keith Bradsher: IMF Adds China's Currency to Elite Global Financial Club. New York Times, Dec 1, 2015, p. 1

- ↑ International: Chinese currency added to the world currency basket. ( Memento of the original from October 2, 2016 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Stuttgarter Nachrichten, October 1, 2016

- ↑ Trading center for Chinese yuan in Frankfurt , FAZ from March 28, 2014.

- ↑ The Frankfurt financial center is growing internationally with the establishment of the European banking supervisory authority and the renminbi trading center. FAZ of December 11, 2014.

- ^ Deutsche Bundesbank: Renminbi clearing in Frankfurt

- ↑ China to issue new 100 yuan note to counter the counterfeits . In: South China Morning Post . ( scmp.com [accessed May 13, 2017]).

- ↑ Augsburger Allgemeine of June 21, 2010: Renminbi or Yuan?