monopoly

As a monopoly (from the Latin monopolium ; composition of ancient Greek μόνος monos “alone” and πωλεῖν pōlein “sell”) a market form is called in economics and business in which there is only one provider .

General

The same meaning is to be distinguished between pure monopoly and market forms in which, for example, monopoly structures only prevail in a smaller sub-area (as in the case of monopoly competition , see also the section on quasi-monopoly below ).

Sometimes, contrary to the etymological meaning ( pōlein "sell") and the definition on which this article is based, a market situation is referred to as a monopoly in which there is only one customer. This form is a demand monopoly in contrast to the supply monopoly outlined above . However, the name monopsony (which is also etymologically consistent) is common for the monopoly of demand .

The term monopoly is sometimes used socially and politically apart from the economy, for example for the state's monopoly of force or the monopoly of information .

Market participants in any market ( goods market , financial market ) are suppliers and buyers . The types of market can also be differentiated according to how many suppliers or buyers there are. Then there is:

| Enquirer | ||||

|---|---|---|---|---|

| lots | few | a | ||

| providers | lots | Polypol | Oligopsony | Monopsony |

| few | Oligopoly | bilateral oligopoly | limited monopsony | |

| a | monopoly | limited monopoly | bilateral monopoly | |

The only provider is called the “monopolist”.

Explanatory approaches for monopolies

Strictly speaking, the emergence of a monopoly begins where the idea of competition arises for the first time. One wants to be better than the other, that's the motto. As a result, an attempt is made to improve one's own position by setting differentiated parameters (price, quantity, advertising) in order to achieve a decisive competitive advantage up to the ideal of market power. To this end, various theoretical approaches can be set up that attempt to answer the key question of where exactly monopolies arise. A first guess can be found in the late Middle Ages (12th to 15th centuries), when goods were traded on the market and attempts were made to sell the products (fish, fruit, vegetables) faster than the competition. But it could also be due to the first factories that were established towards the end of the 17th century during the Baroque era . Or is it rather due to industrialization, in which the idea of efficiency, prosperity and progress in productivity played a decisive role.

Pierenkemper describes another possible approach . It describes the economic history and begins with the modern age (since 1500). Due to the ever advancing industrialization in the 19th century, shaped by Schumpeter and his creative process of destruction, he deals with the development of the industrialization process and its growth. He differentiates between five stages of development (see: economic style ).

In the 4th phase of the development stages, the maturity phase, it is possible to use the latest technology and thus use the resources optimally. Entirely new professions are emerging and companies are joining forces for the first time to form monopolies, trusts and cartels . By establishing a monopoly or a monopoly-like position, costs can be minimized ( subadditive cost structures of an individual company), other competitors can be pushed out of the market or it is difficult for you to establish yourself in the dominant market at all.

Definition of terms

Differentiation from structurally related market situations

- Bilateral monopoly

- In a bilateral monopoly , a supplier and a customer face each other.

- Oligopoly

- If there are only a few market participants on the supply side and many market participants on the demand side, one speaks of an oligopoly .

- Duopoly

- If two market participants appear, it is a duopoly .

- Polypol

- The counterpart to the monopoly is the polypole . A polypol is a market in which many buyers and many suppliers face each other.

Special forms of monopoly

- The state monopoly ; here the state acts as the sole supplier of a good.

- The partial monopoly ; there is a large supplier and many small suppliers facing many customers. Depending on the respective context, the term monopoly is often used for a market situation with incomplete competition , in which the large supplier has such a dominant position on the market due to clear competitive advantages or market shares that it is largely independent of the competition in terms of pricing. In the oligopoly, on the other hand, the providers are roughly equally weighted according to their market share.

- The quasi-monopoly, shaped by Erich Preiser , describes a market situation in which there are few providers and many buyers. This market situation is initially similar to the market form of the oligopoly. However, the few providers join forces to form cartels or trusts and the result is a quasi-monopoly . The providers still compete with each other, but still form a uniform price that they can set through their monopoly-like position. This phenomenon can be found in the labor market. The employers come together in an employers' association to jointly negotiate collective bargaining with the workers.

Differentiation from market dynamics / dynamic competition

In this chapter the monopoly is seen as static. A market in which there is no incentive to compete and the associated innovations are absent cannot, by definition, be a dynamic market. A dynamic market, on the other hand, is shaped by Schumpeter's theory of innovations. According to this, pioneering profits enable a temporary monopoly position and thus trigger incentives for competition and the associated innovations.

Delimitation of perfect and imperfect monopoly

The perfect market is a model in economics . In the perfect market, many suppliers and many buyers face each other. It is assumed that the goods are homogeneous and that there is complete market transparency . There are no temporal, spatial or personal preferences on the customer side . In the perfect market, all companies that correspond to the same market segment have the same product quality. The following applies: buyers are price takers and providers are volume adjusters.

In the imperfect market, goods are not alike. There is no complete transparency among the market participants and customers have personal, spatial or temporal preferences. The providers can enter or exit the market without restriction. In terms of monopoly competition, it is primarily the diversity of goods that applies. Therefore there is a small monopolistic price margin for the providers .

In the perfect market, the monopolist's profit would be highest because he has no restrictions or obstacles. When marginal costs equals marginal revenues, the monopolist maximizes his profit. The theory of the perfect market does not exist in reality. While there are a few markets that are very close to the perfect market (such as financial markets ), there are only imperfect markets. From this point of view it is obvious that in reality the monopolist cannot maximize his profit as the theory describes it. The monopoly is restricted by the state, by substitutes from other companies or by a lack of market transparency. Compared to the polypol on the perfect market, the supplier in the polypol on the imperfect market can set its price higher than its marginal cost and produces a smaller amount. The market result is inefficient from an economic point of view due to the overcapacity and the higher prices.

Types of monopolies according to their establishment

Natural monopolies

Purely natural monopolies

The monopoly ideally exists without any market-regulating influence, for example because a supplier alone has access to certain raw materials or only has significant technologies (e.g. through a market advantage). The natural monopoly often arises from natural barriers to market entry , especially when a complex, comprehensive infrastructure is required, such as in the case of rail networks or the supply of electricity, water or gas. A natural monopoly in the narrower sense is a form of market in which a company can satisfy demand with falling average costs and increasing production volumes; in this case, a single company produces more cost-effectively in the long term and can force competitors out of the market.

Quasi-monopoly

If there is more than one supplier in a market, one of whom has a dominant position due to a very strong natural competitive advantage, it is a quasi-monopoly. It is not a real monopoly, but it comes close in its effects.

Quasi-monopolies are particularly common in information technology : The design of software and data is often based on certain quasi-standards to which only one provider has the rights or where it would be too costly for competitors to convert compatible products to competitive ones Develop price. (The latter in particular, since the inexpensive digital reproduction makes it easy for the market leader to undercut a competitor in terms of price and thus make it more difficult for him to enter the market.) Products from this provider. The best-known example is Microsoft , which has a quasi-monopoly with Microsoft Windows for PC operating systems and with Microsoft Office a quasi-monopoly for office suites . Quasi-monopolies in the field of information technology can possibly be prevented through the consistent use of open standards .

Artificial monopolies

Collective monopoly

Collective monopoly (also contractual monopoly ): The monopoly exists because all suppliers or buyers commit themselves to common services and prices (for example through a cartel ) and thus competition is eliminated. In most countries, such agreements are usually illegal (in Germany: Law against Restraints of Competition ).

Legal monopoly

A legal monopoly is a monopoly that exists on the basis of a legal provision. This form is found today with the state (for example in the foreign trade monopoly in Art. 14h of the Soviet Constitution of 1936 ) and with (also former) state-owned companies (such as the postal monopoly ); the few exceptions such as the ignition goods monopoly , liquor monopoly or the salt shelf have largely been abolished in modern economic systems. In the past, there was a regional monopoly in fire insurance due to the compulsory insurance with public insurers in individual federal states . There was also a sweeping monopoly for the chimney sweeps . Monopolies based on patents and other intangible monopoly rights such as copyright are included in this category.

Microeconomic theory of monopoly

Price-setting behavior of the monopolist

If it is assumed, as is traditionally the case, that the monopoly situation is exogenously specified (for example by state and technological barriers to market entry), a monopoly does not need to take (any) competitors into account when setting prices . The monopolist knows the given market demand function or its inverse ( price-sales function ) . Its cost function is . Based on this, he maximizes his revenue function . It can either be imagined that he chooses the quantity on offer or that he chooses the price. The only thing to note is that the other variable results directly from his decision: If he chooses a price , it follows from the demand function that he can sell a maximum of exactly units; if he chooses the quantity , it follows from the (inverse) demand function that the price results on the market . The following maximization problems accordingly yield the same price-quantity pair

For practical reasons, the latter problem is usually considered. Solving using the product rule and rearranging provides the first-order condition for the optimum profit

- ,

where is the price elasticity of demand to quantity of goods . If it is now assumed that according to the ( law of demand ) is negative, the following equations result:

- .

In the optimum of the monopoly, the Lerner index corresponds to the reciprocal value of the demand elasticity in terms of amount. With this condition , the elasticity of demand applies because and according to the assumption.

This condition shows that the monopoly price is above the marginal costs. This clearly shows the difference to the case of perfect competition , where in the optimum the price corresponds to the marginal costs. It can also be seen that the possible price can be higher in relation to the marginal costs, the more inelastic the demand for goods.

Inefficiency of the monopoly case

Allocative inefficiency

The graph on the right (Fig. 1) shows the allocative inefficiency in a monopoly case. The abscissa is the quantity and the ordinate is the price. The LDG (long-term average costs) and the LGK (long-term marginal costs) coincide for reasons of simplification. In addition, a demand curve is shown that intersects the LDK / LGK at point E. The maximum welfare would be the triangle ADF. The reduction in welfare "CEF" can be seen in the triangle marked in black. How does a welfare decrease come about. The monopolist sets his Cournot price at point C. There, as already mentioned above, the profit margins are highest for him. But the consumers, who would buy a good from the monopolist from point C to point E of the demand curve, cannot be satisfied by the monopolist's too high a price. The optimal allocation point would be the intersection between LGK and the demand curve. Since this does not come about through the Cournot price, there is no optimal distribution effect between demand and supply. The distribution is therefore sub-optimal and raises the question of regulation, as can be seen in the next two cases.

Technical inefficiency

The second diagram on the right (Fig. 2) shows the technical inefficiency. The abscissa is the quantity and the ordinate is the price. Technical inefficiency means that the actual costs do not correspond to the economically lowest costs for the real given output quantity. Since the monopolist has decreasing incentives for cost discipline (monopolist is no longer disciplined due to a lack of competition), the optimal LGK / LDK straight line (long-term marginal costs / long-term average costs) changes up to the GK / DK straight line. The area marked in black is still the allocative loss of welfare. This technical inefficiency shifts point C to C 'upwards. As a result, the welfare loss increases by the area marked in red (i.e. red and black represent the current welfare loss below the demand curve - points: CC'DF). The green area BB'D'F represents the technical inefficiency for the monopolist. In the amount of the green area, the monopolist now has to bear more costs because he does not produce at the lowest possible cost. The monopolist's profit diminishes.

Harvey Leibenstein differentiates between X-inefficiencies of type I and type II when it comes to technical inefficiency .

Type I: insider pensions

Type II: Technologies with irreversibility

Qualitative inefficiency

The third diagram on the right (Fig. 3) shows the last of the inefficiencies in the monopoly, "The qualitative inefficiency". In order to better understand the diagram, the initial situation N1 and GK, DK (marginal costs / average costs) with the intersection point D (optimal welfare A1, A, D) is considered first. Now N1 is shifting to N2 (customers are becoming fewer) due to qualitative defects in products that, given the given cost conditions, do not correspond to the preferences of customers. The marginal revenue cost curve now intersects the GK, DK no longer in point B1, but in B2 and therefore leads to the new Cournot point C2. The area marked in black is, as in the previous graphs, the loss of welfare due to the allocative inefficiency. Now the red area is added due to the decrease in quality. The green area shows the qualitative inefficiency due to the left shift in the demand curve. Consumers now pay less for the monopolist's goods than before because they are no longer satisfied with the quality. Ultimately, the monopolist's welfare and profits decrease.

Quantification of the welfare loss

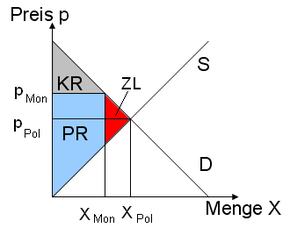

If the welfare loss is to be quantified, the graph of the supply and demand curve can be used (see Fig. 4). In full competition (Polypol) supply and demand correspond; the traded quantity is X Pol , the associated price p Pol . As shown above, the price in a monopoly is higher (here: p Mon ) and the quantity is correspondingly lower (here: X Mon ). This results in considerable shifts in the analysis of consumer and producer surplus. In Fig. 1, the consumer surplus only corresponds to the triangle highlighted in gray. Because consumers who have a willingness to pay less than the monopoly price do not even acquire the good; the producer surplus corresponds to the entire light blue area. Compared to the Polypol, the rectangular part of the blue area is also attributable to the producer surplus - in the Polypol it was still part of the consumer surplus. The reason for this is again the higher price or the fact that it is now further above the marginal costs expressed in the supply function.

Since the amount is only X Mon , it follows that the total of consumer and producer surplus in the case of the monopoly is lower than in the case of the Polypol: The red-colored areas are no longer included, they are to a certain extent due to the inefficiently low provision of the goods " lost ”, it is referred to in English as deadweight loss . The entire red area forms the so-called Harberger triangle .

Increase in welfare through price discrimination

The monopoly result can be influenced by various forms of price discrimination . For example, if a monopolist can discriminate perfectly (1st degree price discrimination), he can demand his reservation price (i.e. the highest price he is willing to pay) from each consumer and sell the goods to those who are most valued. There is then no loss of welfare because he sells the same amount as would result in a competitive case: The perfectly price-discriminating monopoly sells his goods to anyone who has a marginal willingness to pay that at least corresponds to the marginal costs of production, and he demands an amount for it that corresponds exactly to the individual willingness to pay.

This result is accordingly Pareto-efficient, because any change in the resulting allocation would result in the monopolist (who receives the full pension) being in a worse position.

Multi-product monopoly

The monopolies considered so far are all one-product monopolies, i.e. a supplier is a monopoly with regard to a good. The situation changes if the supplier is a monopoly for several goods, because there may be interdependencies between the two goods ( substitution or complementary relationship ) - this changes the price-setting behavior of the monopoly supplier.

Let ( ) be the demand for good as a function of the prices of all goods; be the additively separable cost function depending on the quantity of all goods offered. The maximization problem (formulated here for reasons of simplicity and the usability of the result with regard to the price) is

and leads to the conditions of the first order

in which

- .

That means: In the profit optimum of the multi-product monopolist (also: multi-product monopolist), for every good offered, the learner index for this good (left side of the condition) corresponds to the so-called Ramsey index for the good (right side) . It should be noted that this implies that if there are substitutes ( ), the learner index is greater than the reciprocal of the (own price) elasticity, i.e. a higher price is set than in the case of the single-product monopoly (see above). The opposite applies to the case of complementary goods ( ) - here the set price is even below the price that the monopolist would strive for if he did not hold a monopoly position on both goods markets.

Deniability of the monopoly

Monopoly resistance

The term "monopoly resistance " means that a monopoly is protected against attacking market participants or newcomers . This is mostly the case with natural monopolies. A natural monopoly always arises when the production of a good by a single company is more cost-effective than it could be provided by several companies on the market. Natural monopolies arise due to indivisibility. Indivisibilities let the production volume grow at great intervals. This property is in contrast to the perfect market theory. Due to these sub-additive cost structures , a company with a monopoly position produces efficiently and leaves no gaps that potential newcomers could use to enter the market (this relationship is based on the premise that the markets are homogeneous). If the newcomer enters the market despite the efficiency of the monopoly, he will have to reckon with an immediate loss, since the total costs per unit produced are above the market price. Hence an immediate exit will take place. The monopoly has made the market undeniable.

The following shows the theoretical conditions under which markets can be made contestable (or the opposite of non-contestable markets):

1. Newcomers have the same rights and conditions as the existing company, namely low-cost production technologies, access to input markets and there are no subsidies

2. No company has a demand advantage

3. There are no entry barriers (entry and exit are free) and therefore no irreversible costs

4. All entrepreneurs strive to maximize profits

5. Entry into the market is only made under the condition of profitability

6. Profitability is defined for the newcomer as the undercutting of the given market prices with a profit discount

Monopoly protection

A monopoly always strives to maintain its sole market leadership. For this it is necessary to equip your products with the highest quality standards. However, many products are substitutable (that is, they can be substituted for) by others . It may be necessary to forego individual properties. However, this often plays a subordinate role if it results in a lower price and a larger selection of providers is available. This limits the practical effect of supply monopolies.

To at least mitigate this situation, there are various strategies:

- The monopolist can diversify his product . The product is provided with properties that other, similar products lack (exclusivity). Or several products with different properties are made from one product (product range). The main risk lies in the question of whether the new property is what interests the customers at all.

- The monopolist can try to give his product an " image ". The product should be anchored in the awareness of the buyer through its reputation, so that it becomes irreplaceable for him. However, this is difficult. On the one hand, it often requires elaborate advertising campaigns, on the other hand, a positive image (such as youthfulness) is often copied by competitors after a while.

- Potential competitors are forced out of the market or bought up. However, that doesn't always work. On the one hand, this requires appropriate economic power. For example, a small company would only have bad cards against a global corporation, no matter how innovative it was. The merger can also fail due to government regulations ( antitrust law ).

- Legal regulations can also help to keep pesky competition at bay. The monopoly can try to influence state legislation in order to secure a particular monopoly. Such monopolies often follow state interests (secure source of income). Private companies use lobbying for this , but criminal methods such as corruption and extortion can also be used. The transitions between state self-interest, legal lobbying and criminal methods can be fluid. Conversely, however, state-owned companies have been privatized on a large scale in the last few decades (Post, Rail). Lobbying had to be carried out here in order to maintain the existing monopoly for as long as possible.

Since a monopoly position promises the highest possible profit, a monopolist will aim to continue to shield the market from possible competitors. In order to achieve this, unfair or market-distorting means are used again and again. An example of such a practice is dumping : products are offered for a certain period of time at prices that do not cover their costs until the competitor has been forced out of the market, and prices are then increased again. This situation can arise from a cartel or an oligopoly . Here, too, there are some legal restrictions (see prohibition of sales on loss in France).

If monopolies are not broken up for natural reasons, the state occasionally intervenes for reasons of competition law. In most cases, there is a violation of the respective national legislation (in Germany these are the law against unfair competition and the law against restraints of competition ).

For example, Microsoft , a quasi-monopoly, was convicted of abusing its market power .

According to the theory of contestable markets, the contestability of the monopoly is often sufficient: For this purpose, the threat must be credible that the monopoly position can be lost if certain requirements are not adhered to. Credibility increases especially when the market exit costs are low.

Vulnerability of monopolies

If the monopolist does not produce efficiently (see allocative, technical or qualitative inefficiency) and consequently sets too high a price for the goods, there is an opportunity for potential newcomers to enter the market.

Following William J. Baumol's theory of contestable markets , the view is that the existence of a monopoly would not require action by competition authorities, because competition is not visible in the form of several suppliers , but it works in a latent manner. Depending on the framework conditions that justify its monopoly, a monopoly may be subject to certain restrictions in its decisions regarding price setting or its range of services (quantity, quality) . This would reduce his monopoly rent .

A contestable market could discipline a monopolist. If the offer price is higher than the market entry costs , there is a risk that offer competitors will enter the market. If the offer price is higher than the prices for substitute goods , buyers can switch to comparable products. In the extreme case , the offer price then falls to the lower price limit , which, as in the oligopoly or the polypol, is determined either by the average costs or the marginal costs . A monopoly that can be attacked at any time is called a morphological monopoly . It is often considered desirable, at least for a short time, in order to ensure technical progress .

Ordoliberals like Walter Eucken reject this argument, however, since every monopoly fundamentally contradicts the economic policy objective of an optimal allocation balance.

Regulation of monopolies

A monopoly is in need of regulation if it shows inefficiencies or if fair and efficient competition cannot take place.

In general, there are two general forms of company regulation. The first form of regulation (often practiced in America) stipulates that private companies must be controlled by state institutions. The state only has an indirect influence on companies. In the second form of regulation, however, the state can exert direct influence on the company. This is done by the state acquiring shares in companies or taking over the entire company. Thus, the state acts as the owner and can help / shape the regulatory measures according to its wishes (the second form often occurs in Germany / Europe).

Specific examples are Deutsche Bahn or Deutsche Post AG .

The goals of regulation are therefore to maximize welfare, to bring the price close to the company's marginal costs, and to create the framework for fair competition. Various regulatory methods can be used for this.

1. Price regulation based on historical costs

- The actual costs of the last few years are taken from the balance sheet / bookkeeping and thus a price is determined that is close to the costs of the company. For this purpose, the LGK or LDK (long-term marginal cost curve or long-term average cost curve) are determined and used.

2. Price regulation based on efficient costs

- The efficient costs are the costs that a company incurs in the efficient provision of services. The costs that the company would have if it were to operate optimally (allocatively, technically and efficiently) are evaluated. If a company does not operate optimally, it has to charge higher prices. Due to the regulation, the company has to adjust its prices to the efficient costs and thus there is an incentive for efficiency.

3. Price cap regulation

= Share of the bundle of goods in total sales in the previous period

= Price of the bundle of goods in period t

RPI = Retail Price Index (macroeconomic inflation rate for period t)

X = discount (productivity factor to be applied)

The formula specifies the “change in the regulated price within the framework of the change in the general price level minus a company-specific correction factor for productivity progress”.

advantages

- If a company is making high profits, it cannot be forced to change prices during the current period

- Flexibility in pricing (but not higher than the cap)

Problems

Possible problems in practice are that the regulatory authorities (mostly Monopolies Commission) do not know what the long-term marginal costs of the company to be produced are. In addition, if the company has less income from regulation, the quality of the respective products may suffer as a result.

Examples of monopolies

Supply monopolies

Examples of supply monopolies are:

- the postal monopoly (the monopoly of Deutsche Post AG was abolished on January 1, 2008, the monopoly of Österreichische Post AG on January 1, 2011);

- the German Telekom , still dominant position, particularly in the local networks and in the analog domain away from the metropolitan areas ; However, this is not a monopoly in the true sense of the word, since Telekom is the largest, but no longer the only provider in the telecommunications market;

- the state lottery monopoly ;

- the spirits monopoly (until the end of 2017);

- the ignition goods monopoly (abolished in 1983);

- the sweeping monopoly (statutory special rights for chimney sweeps until the end of 2012);

- the gaming monopoly (state power of disposal over publicly accessible games for assets), the specific design of which in Germany was judged to be illegal by the European Court of Justice in September 2010 and was therefore repealed.

- the Austrian tobacco monopoly, which only allows tobacco products to be sold through tobacconists .

Demand monopolies

A demand monopoly (also called monopsony ) is understood to mean a market situation with several suppliers but only one customer. One example is the arms market in a closed economy. In reality, a monopsony only occurs to a very limited extent. A limited monopsony is used in the case of a few suppliers and one customer . This type of market is often found in tendering procedures in local rail passenger transport ; There, a national transport company act as the customer and the railway companies that apply for the offered transport contract act as providers.

Examples of demand monopolies (mostly limited demand monopolies) are:

- often with military products

- Products for holders of supply monopolies

- Products and services for federal agencies

- Niche products in the space industry (such as the European space program)

Bilateral monopolies

If there are only a few buyers / suppliers facing a monopolist, it is a limited monopoly. If there is only one supplier and one customer on both sides, it is a bilateral monopoly. This is to be distinguished from a situation with two providers, the so-called duopoly . If there is more than one supplier or buyer in a market, but only very few, this is an oligopoly .

See also

Web links

literature

- Friedrich Breyer: Microeconomics. An introduction. 5th edition. Springer, Heidelberg a. a. 2011, ISBN 978-3-642-22150-7 .

- Edwin G. West: Monopoly. In: Steven N. Durlauf, Lawrence E. Blume (Eds.): The New Palgrave Dictionary of Economics. 2nd Edition. Palgrave Macmillan 2008, doi: 10.1057 / 9780230226203.1134 .

- Hal Varian : Intermediate Microeconomics. A modern approach. 8th edition. WW Norton, New York / London 2010, ISBN 978-0-393-93424-3 .

Individual evidence

- ^ Johann Heinrich Zedler : "Sales Freyheit", in: Large complete universal lexicon of all sciences and arts , 1754, p. 515 .

- ↑ This definition can be traced back to Aristotle , Politik , I, 11; Joseph A. Schumpeter , (Elizabeth B. Schumpeter, ed.): History of economic analysis . First volume, Vandenhoeck Ruprecht, Göttingen 1965, p. 101.

- ↑ See for example Federal Ministry of Finance : Glossary. Monopoly. ( Memento of April 29, 2013 in the web archive archive.today ) accessed on April 10, 2013.

- ^ Heinrich von Stackelberg , Market Form and Equilibrium , 1934, p. 195

- ↑ Uta Neumann, Das Marktphasenschema , 1997, p. 38

- ↑ Wolfgang Münchenhagen: Timeline: Orientation data from antiquity to modern times. (PDF) 2003, accessed on May 15, 2017 .

- ↑ www.mccanndigital.cz: The origins of the manufactories. Retrieved June 7, 2017 .

- ^ A b Toni Pierenkemper: Economic history . R. Oldenbourg Verlag, Munich / Vienna 2005, ISBN 3-486-57794-8 , p. 152-160 .

- ^ Definition of "quasi-monopoly" . In: Gabler Wirtschaftslexikon . ( gabler.de [accessed June 18, 2017]).

- ^ Definition of "competition theory" . In: Gabler Wirtschaftslexikon . ( gabler.de [accessed on May 17, 2017]).

- ^ Ingo Schmidt: Competition Policy and Antitrust Law . 9th edition. Oldenbourg Wissenschaftsverlag, Munich 2012, ISBN 978-3-486-71522-4 , p. 4-6 .

- ↑ Gregory Mankiw, Mark P. Taylor,: Grundzüge der Volkswirtschaftslehre . 5th edition. Schäffer-Poeschel, Stuttgart 2011, ISBN 978-3-7910-3098-2 , pp. 384-386 .

- ↑ Gregory Mankiw, Mark P. Taylor,: Grundzüge der Volkswirtschaftslehre . 5th edition. Schäffer-Poeschel, Stuttgart 2011, ISBN 978-3-7910-3098-2 , pp. 415-416 .

- ↑ Federal Agency for Civic Education: imperfect monopoly | bpb. Retrieved June 7, 2017 .

- ↑ Robert S. Pindyck, Daniel L. Rubinfeld: Microeconomics . 8th edition. Pearson Studium, 2013, ISBN 978-3-86894-167-8 , pp. 612-613 .

- ^ A b Paul A. Samuelson, William D. Nordhaus: Economics. 3. Edition. 2007.

- ↑ Werner Lachmann, AK Mitschke, S. Vogel: Volkswirtschaftslehre 2. Springer, 2004, ISBN 3-540-20219-6 , p. 198.

- ↑ To rule out mathematical problems, let us also assume that the price-sales function and the cost function are continuous and twice differentiable , that and that a strictly positive output level exists, so that . Andreu Mas-Colell, Michael Whinston, Jerry Green: Microeconomic Theory. Oxford University Press, Oxford 1995, ISBN 0-19-507340-1 , p. 385.

- ↑ a b c d e Jörn Kruse: Economics of monopoly regulation (= economic policy studies . Issue 70). Vandenhoeck & Ruprecht, 1985, ISBN 3-525-12271-3 , pp. 89-120 .

- ↑ Michael Fritsch, Thomas Wein, Hans-Jürgen Ewers: Market failure and economic policy . Munich 2007, p. 182-183 .

- ↑ Jörn Kruse: Economics of Monopoly Regulation (= Economic Policy Studies . Issue 70). Vandenhoeck & Ruprecht, Göttingen 1985, ISBN 3-525-12271-3 , pp. 298-300 .

- ↑ Jörn Kruse: Economics of Monopoly Regulation (= Economic Policy Studies . Issue 70). Vandenhoeck & Ruprecht, Göttingen 1985, ISBN 3-525-12271-3 , pp. 297-298 .

- ↑ WJ Baumol, Panzar JC, RD Willig: Conte Table Markets and the Theory of Industry Structure. 1982.

- ↑ An example of this are lighters as a substitute for matches during the times of the ignition goods monopoly .

- ↑ “Economically, however, it is important to overcome the scarcity of all goods in the right proportions. Due to its monopoly position, the company succeeds in drawing in more capital and making this additional investment profitable. Without a monopoly it would have invested less, the machinery would be renewed less quickly, but other branches of production had more means of production and the - ultimately decisive - consumer goods supply would be better on the whole. The admiration of the technical apparatus of monopolists is therefore economically meaningless. [...] Because the construction of the production apparatus in the case of a monopoly lacks reliable control, the costs that the monopoly expects in ongoing production do not need to correctly express the scarcity of the means of production. ”(Walter Eucken: Principles of Economic Policy. 6. Edition. Tübingen 1990, p. 39)

- ^ Ingo Schmidt: Competition Policy and Antitrust Law . 9th edition. Oldenbourg Wissenschaftsverlag, Munich 2012, ISBN 978-3-486-71216-2 , p. 61-63 .

- ↑ Jörn Kruse: Economics of monopoly regulation . Ed .: Harald Jürgensen, Erhard Kantzenbach (= Economic Policy Studies . Issue 70). Vandenhoeck & Ruprecht, Göttingen 1985, ISBN 3-525-12271-3 , pp. 222 .

- ↑ Model for K + S ?: In which corporations the German state is involved . In: manager magazin . ( manager-magazin.de [accessed June 12, 2017]).

- ↑ Jörn Kruse: Economics of Monopoly Regulation (= Economic Policy Studies . Issue 70). Vandenhoeck & Ruprecht, Göttingen 1985, ISBN 3-525-12271-3 , pp. 246-249 .

- ^ A b Prof. Andreas Haufler: Selected areas of economic policy. (PDF) 2009, accessed June 1, 2017 .

- ↑ EU judges overturn gambling monopoly. on: stern.de , September 8, 2010.

![\ max _ {{p}} p \ cdot q (p) -c \ left [q (p) \ right]](https://wikimedia.org/api/rest_v1/media/math/render/svg/ff1f82bba5b59c3a372f729dc3fbd21e335f552a)

![\ forall i \ colon {\ frac {p _ {{i}} - C _ {{i}} '({\ mathbf {p}})} {p _ {{i}}}} = {\ frac {1} { \ left | \ epsilon _ {{ii}} \ right |}} + \ sum _ {{j \ neq i}} {\ frac {\ left [p _ {{j}} - C _ {{j}} '( {\ mathbf {p}}) \ right] \ cdot D _ {{j}} ({\ mathbf {p}}) \ cdot \ epsilon _ {{ij}}} {p _ {{i}} \ cdot D_ { {i}} ({\ mathbf {p}}) \ cdot \ left | \ epsilon _ {{ii}} \ right |}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/4826caf5108975a37a423eed89f2910cb39f05d3)

![{\ displaystyle \ sum _ {i = 1} ^ {n} w_ {t-1} ^ {i} \ left [{\ frac {p_ {t} ^ {i} -p_ {t-1} ^ {i }} {p_ {t-1} ^ {i}}} \ right] \ leq RPI-X}](https://wikimedia.org/api/rest_v1/media/math/render/svg/a31c35cf43b41fecdd8c69ba55268699b898863c)