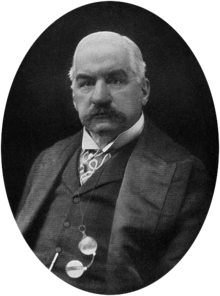

JP Morgan

John Pierpont Morgan , better known as JP Morgan (born April 17, 1837 in Hartford , Connecticut , † March 31, 1913 in Rome , Italy ), was an American entrepreneur and the most influential private banker of his time.

Life

Morgan was the son of the banker and financier Junius Spencer Morgan (1813-1890) and his wife Juliet Pierpont (1816-1884), daughter of a lawyer and teacher. He studied in Bellerive in the French-speaking canton of Vaud and in 1856/57 at the Georg-August University in Göttingen .

He lived in New York in a mansion at 219 Madison Avenue in the Murray Hill neighborhood . The house's black mahogany-lined Black Library was where some of the most important decisions of the early 20th century for New York as the United States were made.

John Pierpont Morgan was the nephew of James Lord Pierpont , the composer of the Christmas carol Jingle Bells . His son John Pierpont Morgan junior continued the company empire.

job

From 1857 he worked in the banking branch of his father's company in London . In 1858 he went to New York City . For the Civil War (1861-1865) he was not drafted after paying a $ 300 fee. In 1871, together with Anthony Joseph Drexel, he founded the Drexel, Morgan & Company banking house , which from 1895 operated as JP Morgan & Company . He used the railway crisis of 1893 to secure funding for the subsequent reorganizations of various railway companies. In 1901, Morgan helped create the United States Steel Corp. , the largest stock corporation in the world at the time, took the lead through several mergers. In addition to the income from the sale of securities, Morgan also grew his fortune by claiming $ 150 million as a negotiation fee for the mergers. To support the trust, a shipping trust also acquired English lines, the International Mercantile Marine Company ( IMMC ) , was founded in 1902 with the participation of German shipping companies. The IMMC also included the White Star Line , for which z. B. the ships of the Olympic class , including the Titanic , drove. Morgan was originally scheduled to take part in the Titanic's maiden voyage in April 1912 and was assigned the luxury suite B-52-54-56, but canceled his ticket due to illness. The suite was instead taken over by Bruce Ismay .

In 1903 he invested in the fledgling automotive industry when he contributed two-thirds of the share capital of the Maxwell-Briscoe Motor Company . The company became the third largest manufacturer in the USA and later the basis for the Chrysler Corporation . According to its own statements and statements by contemporary witnesses, Morgan attached great importance to the stability and predictability of conditions in its dealings. Several times he also intervened in state finances. In 1895 and 1907 (stock market crisis) he bought large amounts of government bonds as the leader of groups of investors, thereby saving the USA from national bankruptcy. At the same time he was able to sell the government bonds at a profit. In 1912 he was tried for questionable financial transactions. Although he was acquitted, the entire scope of his now gigantic corporate empire came to the public in the course of the negotiations. Until his death, Morgan expanded his business activities beyond the railroad, banking, shipping and also to the telecommunications and electrical industries. In 1901, for example, Morgan controlled B. Half of the railroad network and two-thirds of steel production in the US.

JP Morgan & Company was also active in investment banking and financed various mergers of companies, including General Electric , and participated in various railroad lines in the USA. In 1899 the first European bonds were introduced on the US market. When the Glass-Steagall Act in 1933 stipulated the separation between investment banking on the one hand and deposit and lending business on the other, JP Morgan & Co. opted for the latter; the investment banking business was outsourced to a separate start-up company called Morgan Stanley . JP Morgan & Co. continued to exist in parallel and in 2000 merged with Chase Manhattan Bank to form JPMorgan Chase & Co.

family

In 1861 he married Amelia Sturges (1835–1862), who died a short time later of tuberculosis. On May 3, 1863, he married Frances Louisa Tracy (1842–1924), with whom he had four children:

- Louisa Pierpont Morgan (1866-1946); married Herbert Livingston Satterlee

- JP Morgan, Jr. (1867-1943); married Jane Norton Grew

- Juliet Pierpont Morgan (1870-1952); married William Pierson Hamilton

- Anne Tracy Morgan (1873-1952); unmarried

criticism

The author F. William Engdahl writes that Morgan started his career at the age of 24 organizing the repurchase of decommissioned rifles from the US Army for the American Civil War. At his behest, straw men secretly bought 5,000 rifles at a price of $ 3.50 each from the weapons arsenal in New York City and then sold the defective rifles, which had been declared new and in perfect condition, to Army Headquarters for $ 22 a piece in St. Louis. This is how Morgan's spectacular career of fraud, deception and corruption began.

It is further alleged that he spread rumors of the bankruptcy of a major New York bank, sparking the panic of 1907 that also affected other banks. Nelson W. Aldrich , who had close ties to the banking industry, headed a commission that was convened after this panic. In this commission he proposed the introduction of a central bank in order to avoid such panic in the future. According to G. Edward Griffin , the Federal Reserve System bill was drafted in 1910 on Jekyll Island , in the Morgan vacation home, by representatives of several banks in strict secrecy, and then passed to Nelson W. Aldrich, a Morgan business partner. Aldrich, the father-in-law of John D. Rockefeller Jr. , was the actual host.

Collections

From 1904 to 1913, Morgan was President of the Metropolitan Museum of Art in New York. The extensive art and book collection that was one of Morgan's hobbies was transferred to the Pierpont Morgan Library Foundation in New York City in 1924 . At the request of Coptologist Henri Hyvernat, he bought some manuscripts from the Coptic Library of St. Michael Monastery in Egypt. The facsimile Bybliothecae Pierpont Morgan Codice photographice expressi published by Hyvernat was named in his honor. Shortly after the establishment of the Chinese Republic in 1911, J. P. Morgan negotiated with the Chinese government about the acquisition of objects from the Imperial Palace, including a Ming- era palace carpet.

Morgan provided the necessary funds for an expedition from Princeton University to Patagonia to study the flora and fauna there.

The largest sapphire ever cut is the “Star of India” with a weight of 563.35 carats . The stone found in Sri Lanka was donated to the American Museum of Natural History by John Pierpont Morgan in 1901 and can be viewed there. In the “Morgan Memorial Hall of Gems” named after Morgan, a number of precious and semi-precious stones - raw and cut - are exhibited in addition to the “Star of India”. B. diamonds, emeralds and sapphires, as well as jewelry made of organic materials such as coral and amber.

As a patron , for example, he supported the photographer Edward Curtis and made it possible for him to publish his twenty illustrated books The North American Indian in an edition of 500 copies. He gave away the 25 numbered copies to which he was entitled to universities close to him, including to “his” University of Göttingen , to which he donated an endowment of US $ 50,000 in 1912 for the procurement of Anglo-Saxon literature. The Göttingen John Pierpont Morgan Foundation was dissolved in 1967 due to the devaluation of money in the 20th century. The SUB Göttingen commemorates this foundation with a plaque in the Paulinerkirche .

- Pictures in the collection of J. Pierpont Morgan at Princes Gate & Dover house, London. - Internet Archive (with an introduction by Thomas Humphry Ward and “Biographical and descriptive notes” by W. Roberts) 1907.

- Stephen W. Bushell, William M. Laffan Catalog of the Morgan Collection of Chinese porcelains. - Internet Archive - Metropolitan Museum of Art 1907.

- The Metropolitan Museum of Art: Guide to the loan exhibition of the J. Pierpont Morgan Collection - Internet Archive - The Gilliss Press, New York 1914.

- Catalog of the loan exhibition of drawings & etchings by Rembrandt from the J. Pierpont Morgan collections. - Internet Archive - The San Francisco Art Association, February – March 1920.

Quote

“The condition that has developed in Wall Street in the past fifteen years is to a considerable extent a personal one, and the authority which centers in the hands of Mr. Morgan, a man seventy-five years of age, is by no means something which can be passed down to his successors. Such men have no successors; and their work is either left undone after they are dead or the world devises other means and other works to take its place. "

"The constitution to which Wall Street has evolved over the past fifteen years is to a considerable extent personal, and the perfection concentrated in the hands of Mr. Morgan, a man of seventy-five, is something that can in no case be passed on to his successors. Such people have no successors; and their work will either be left unfinished after their death or the world will devise other ways and means to take their place. "

Interesting

Morgan had taken over the suite from Henry Clay Frick for the maiden voyage of the Titanic after he was unable to start the voyage due to a minor accident to his wife. But Morgan also had to cancel his trip because he had some business appointments.

The mineral and coveted gemstone morganite was named after him.

literature

- Ron Chernow : The House of Morgan. An American Banking Dynasty and the Rise of Modern Finance. Simon & Schuster, London 1990, XVII, 812 pp., Ill., ISBN 0-671-71031-1 .

- Lewis Corey: The House of Morgan. A social biography of the masters of money. Watt, New York 1930, 479 pp., Ill.

- Henry Justin Smith: John Pierpont Morgan, the World Banker. The story of his house. About becoming America's greatest economic power. Reissner, Dresden 1928.

- John K. Winkler: Morgan, the magnificent. The life of J. Pierpont Morgan. Vanguard Press, New York 1930, ISBN 0-7661-4332-5 .

- Obituary. In: Neue Freie Presse , April 1, 1913.

- New masters live in the traditional Morgans house. In: FAZ . July 8, 2008 ( faz.net ).

- Jupiter on Wall Street . In: Die Zeit , No. 46/2003, p. 26.

- Kelly J. Peeler: The Rise and Fall of J.Pierpont Morgan: The Shift in John Pierpont Morgan's Public Image From the Bailout of the Moore & Schley Brokerage House in 1907 to the Pujo Hearings in 1913. fas.harvard.edu (PDF; 328 kB).

- Money Trust Hunt Turns to Insurance; Effort by Untermyer to Show Perpetual Control in the Interest of Leading Financiers. In: The New York Times . January 8, 1913 ( nytimes.com ).

Web links

- Literature by and about JP Morgan in the catalog of the German National Library

- Newspaper article about JP Morgan in the 20th century press kit of the ZBW - Leibniz Information Center for Economics .

- F. William Engdahl : American Exceptionalism - Serious Distortions of the New Economic Era. 2002

- Subcommittee of the Committee on Banking and Currency: interlocking directorates. (PDF; 1.8 MB) Washington United States Government Printing Office 1913.

- Money Trust Investigation: Investigation of Financial and Monetary Conditions in the United States Under House Resolutions Nos. 429 and 504

Individual evidence

- ^ A b c Howard Zinn: A People's History of the United States . Harper Perennial, New York 2005, ISBN 0-06-083865-5 , pp. 255-257.

- ^ John Pierpont Morgan and the American Corporation. In: Biography of America.

- ^ Ron Chernow: The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance . 2001, ISBN 0-8021-3829-2 , pp. Chapter 8 .

- ^ BR Kimes, HA Clark: Standard Catalog of American Cars, 1805-1942. (2nd ed., 1985). Krause Publications, Inc. ISBN 0-87341-111-0 , pp. 900-901.

- ^ Howard Zinn: A People's History of the United States. Harper Perennial, New York 2005, pp. 256, 323.

- ↑ JP Morgan , metmuseum.org, accessed March 13, 2013.

- ^ Henri Hyvernat: A check list of Coptic manuscripts in the Pierpont Morgan library. 1919 ( archive.org ).

- ↑ "Exhibition: Imperial Carpets from China from 1400 to 1750, Cologne"

- ^ William B. Scott (ed.): Reports of the Princeton University expeditions to Patagonia, 1896–1899: JB Hatcher in charge. Volume I. 1901 ( archive.org ).

- ^ "Star of India" in the American Museum of Natural History.

- ^ Morgan Memorial Hall of Gems .

- ↑ Göttingen patrons.

- ↑ Quoted in: F. William Engdahl : American Exceptionalism - Serious Distortions of the New Economic Era . 2002.

- ↑ Eaton, John P., Haas, Charles A., Müller, Torsten ,: Titanic, triumph and tragedy: a chronicle in texts and pictures . Heyne, Munich 1997, ISBN 3-453-12890-7 , pp. 71 .

- Jump up ↑ John P. Eaton, Charles A. Haas, Torsten Müller: Titanic, Triumph and Tragedy. A chronicle in texts and pictures . Heyne, Munich 1997, ISBN 3-453-12890-7 , pp. 71 .

| personal data | |

|---|---|

| SURNAME | Morgan, JP |

| ALTERNATIVE NAMES | Morgan, John Pierpont |

| BRIEF DESCRIPTION | American entrepreneur and banker |

| DATE OF BIRTH | April 17, 1837 |

| PLACE OF BIRTH | Hartford |

| DATE OF DEATH | March 31, 1913 |

| Place of death | Rome |