Return to the Blue Lagoon and Henry Paulson: Difference between pages

No edit summary |

|||

| Line 1: | Line 1: | ||

{{Infobox US Cabinet official |

|||

{{refimprove|date=July 2008}} |

|||

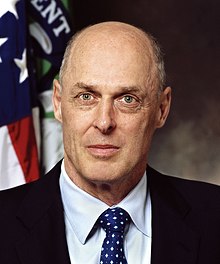

| name=Henry M. Paulson |

|||

{{Infobox_Film | |

|||

| image=Henry Paulson official Treasury photo, 2006.jpg |

|||

name = Return to the Blue Lagoon | |

|||

| order=74{{th}} |

|||

image = Return_To_The_Blue_Lagoon_DVD.jpg | <!-- FAIR USE of Return_To_The_Blue_Lagoon_DVD.jpg: see image description page at http://en.wikipedia.org/wiki/Image:Return_To_The_Blue_Lagoon_DVD.jpg for rationale --> |

|||

| title=[[United States Secretary of the Treasury]] |

|||

caption = DVD cover for ''Return to the Blue Lagoon'' | |

|||

| term_start=July 3, 2006 |

|||

director = [[William A. Graham (director)|William A. Graham]] | |

|||

| president=[[George W. Bush]] |

|||

writer = [[Leslie Stevens]] (screenplay)<br>Based on the novel ''[[The Garden of God]]'' by [[Henry De Vere Stacpoole]] | |

|||

| predecessor=[[John W. Snow]] |

|||

starring = [[Milla Jovovich]]<br>[[Brian Krause]]<br>[[Lisa Pelikan]]<br>[[Nana Coburn]]<br>[[Brian Blain]] | |

|||

| successor= |

|||

producer = [[Randal Kleiser]] (executive)<br>[[William A. Graham (director)|William A. Graham]] | |

|||

| birth_date={{birth date and age|mf=yes|1946|03|28}} |

|||

music = [[Basil Poledouris]] | |

|||

| birth_place=[[Palm Beach, Florida|Palm Beach]], [[Florida]] |

|||

cinematography = [[Robert Steadman (cinematographer)|Robert Steadman]] | |

|||

| alma_mater=[[Dartmouth College]], [[Harvard University]] |

|||

editing = [[Ronald J. Fagan]] | |

|||

| party=[[Republican (United States)]] |

|||

distributor = [[Columbia Pictures]] | |

|||

| profession=[[Investment banker]] |

|||

released = [[August 2]], [[1991]] | |

|||

| religion=[[Christian Science]] |

|||

runtime = 101 min. | |

|||

country = {{USA}} | |

|||

language = [[English language|English]] | |

|||

budget = $11,000,000 (estimated) | |

|||

gross = $2,808,000 (USA) | |

|||

amg_id = 1:41143 | |

|||

imdb_id = 0102782 | |

|||

preceded_by = ''[[The Blue Lagoon (1980 film)|The Blue Lagoon]]'' | |

|||

}} |

}} |

||

'''Henry Merritt "Hank" Paulson Jr.''' (born March 28, 1946) is the [[United States Treasury Secretary]] and member of the [[International Monetary Fund]] Board of Governors. He previously served as the [[Chairman]] and [[Chief Executive Officer]] of [[Goldman Sachs]]. |

|||

==Early life and family== |

|||

Born in [[Palm Beach, Florida|Palm Beach]], [[Florida]], to Marianna Gallaeur and Henry Merritt Paulson, a wholesale jeweler,<ref>[http://freepages.genealogy.rootsweb.com/~battle/celeb/paulson.htm 1<!-- Bot generated title -->]</ref> he was raised in [[Barrington Hills]], [[Illinois]]. He was raised as a [[Church of Christ, Scientist|Christian Scientist]].<ref>Patricia Sellers, [http://www.pbs.org/wsw/news/fortunearticle_20031229_01.html Hank Paulson's secret life, The CEO of Goldman Sachs is passionate about banking. But he's also obsessed with snakes, tarantulas, and coral reefs.], [[Public Broadcasting Service]], "Wall Street Week with Fortune" feature, December 29, 2003.</ref> Paulson attained the rank of [[Eagle Scout (Boy Scouts of America)|Eagle Scout]] in the [[Boy Scouts of America]].<ref name="honor">{{cite book | last = Townley | first = Alvin | authorlink = | coauthors = | origdate= [[2006-12-26]] |url= http://www.thomasdunnebooks.com/TD_TitleDetail.aspx?ISBN=0312366531| title = Legacy of Honor: The Values and Influence of America's Eagle Scouts | publisher = St. Martin's Press| location = New York| pages= pp. 178-188, 196| id = ISBN 0-312-36653-1 |accessdate= 2006-12-29}}</ref><ref name="honor2">{{cite web | last = Ray | first = Mark | authorlink = | coauthors = | year =2007 | url =http://www.scoutingmagazine.org/issues/0701/a-what.html | title =What It Means to Be an Eagle Scout | format = | work =Scouting Magazine| publisher =Boy Scouts of America | accessdate = 2007-01-05}}</ref> |

|||

A star athlete at [[Barrington_High_School_(Lake_County,_Illinois)|Barrington High School]], Paulson was a champion wrestler and stand out football player, graduating in 1964. Paulson received his [[Bachelor of Arts]] in English from [[St. Olaf College]] in 1968;<ref>{{cite news | last=Belser | first=Alex | title=Paulson '68 to lead Treasury | date=May 31, 2006 | publisher=The Dartmouth | url=http://www.thedartmouth.com/article.php?aid=2006053101010}}</ref> at Dartmouth he was a member of [[Phi Beta Kappa]] and [[Sigma Alpha Epsilon]] and he was an All Ivy, All East, and honorable mention [[All American]] as an offensive lineman. |

|||

'''''Return to the Blue Lagoon''''' is a [[1991 in film|1991]] English language [[romance film|romance]] and [[adventure film]] starring [[Milla Jovovich]] and [[Brian Krause]], produced and directed by [[William A. Graham (director)|William A. Graham]]. The screenplay by [[Leslie Stevens]] was based on the novel ''[[The Garden of God]]'' by [[Henry De Vere Stacpoole]]. The original music score was composed by [[Basil Poledouris]]. The film's closing theme song "A World of Our Own" is performed by [[Surface (band)|Surface featuring Bernard Jackson]]. The music was written by [[Barry Mann]], and the lyrics were written by [[Cynthia Weil]]. The film was marketed as "''Return to the Romance, Return to the Adventure...''"<ref>[http://www.imdb.com/title/tt0102782/ Return to the Blue Lagoon (1991)]</ref> |

|||

He met his wife Wendy during his senior year. The couple have two adult children, [[Merritt Paulson|Henry Merritt III]] and Amanda Clark, and became grandparents in June 2007. They maintain homes in [[Washington, DC]] and [[Barrington Hills, Illinois]]. |

|||

The film tells the story of two young children marooned on a [[desert island|tropical island paradise]] in the [[Oceania|South Pacific]]. Their life together is blissful, but not without physical and emotional changes, as they grow to [[sexual maturity|maturity]] and fall in love. The film has major thematic similarities to the [[Bible|Biblical]] story of [[Adam and Eve]]. |

|||

In 1970 Paulson received a [[Master of Business Administration]] degree from [[Harvard Business School]].<ref>www.02138mag.com/people/385.htmlM</ref> |

|||

== Plot summary == |

|||

In the [[Victorian era|Victorian period]], Mrs. Sarah Hargrave, a beautiful widow, and two young children are cast off from the ship they are travelling on. After days afloat, a sailor who has been sent with them tries to kill the children. But Sarah kills him, using an oar, and dumps his body overboard, as she feels suitable to preserve the children. The mother and children later arrive at and are stranded on a beautiful tropical island in the [[Oceania|South Pacific]]. Sarah tries to raise them to be civilized, but soon gives up, as the orphaned boy Richard was born and raised by young lovers on this same island, and he influences the widow's daughter Lilli. They grow up, and Sarah educates them from the [[Bible]], as well as from her own knowledge, including the facts of life. She cautiously demands the children never to go to the forbidden side of the island. |

|||

==Career highlights== |

|||

When Richard and Lilli are about eight, she dies from pneumonia, leaving them to finish raising themselves. Sarah is buried on a scenic promontory overlooking the tidal reef area. Together, they survive solely on their resourcefulness, and the bounty of their remote paradise. Years later, both Richard Lestrange and Lilli Hargrave grow into tall, strong and beautiful young adults. They live in a house on the beach and spend their days together fishing, swimming, and exploring the island. Both their bodies mature and develop, and they are physically attracted to each other. Richard loses the child's game [[egg hunt|Easter egg hunt]] and dives to find Lilli an adult's [[pearl]] as her reward. His penchant for racing a lagoon [[shark]] sparks a domestic quarrel; Lilli thinks he is foolhardy, but the liveliness makes Richard feel virile. |

|||

Paulson was Staff Assistant to the [[Assistant Secretary of Defense]] at [[The Pentagon]] from 1970 to 1972.<ref name="nature">The Nature Conservancy (2006). [http://www.nature.org/pressroom/leadership/art11950.html Henry M. Paulson, Jr.].</ref> He then worked for the administration of [[President of the United States|U.S. President]] [[Richard Nixon]], serving as assistant to [[John Ehrlichman]] from 1972 to 1973. |

|||

He joined [[Goldman Sachs]] in 1974, working in the firm's [[Chicago]] office for Manmeet Taneja. He became a partner in 1982. From 1983 until 1988, Paulson led the Investment Banking group for the Midwest Region, and became managing partner of the Chicago office in 1988. From 1990 to November 1994, he was co-head of Investment Banking, then, Chief Operating Officer from December 1994 to June 1998;<ref>Goldman Sachs (2006). [http://www.gs.com/our_firm/investor_relations/financial_reports/docs/prospectus_usa_multipage/USA/Management.html Goldman Sachs Group, Inc - Management].</ref> eventually succeeding [[Jon Corzine]] (now [[Governor of New Jersey]]) as its chief executive. His compensation package, according to reports, was [[US$]]37 million in 2005, and US$16.4 million projected for 2006.<ref name="Forbes">Forbes (2006). [http://www.forbes.com/lists/2006/12/VY36.html Henry M. Paulson, Jr.].</ref> His net worth has been estimated at over US$700 million.<ref name="Forbes"/> |

|||

Lilli awakens in the morning with her first menstrual period, just as Sarah described the threshold of womanhood. Richard awakens in the morning with an erection. One night, he goes off to the forbidden side of the island, and discovers its origins there. A group of natives from another island use the shrine of an impressive, [[Viracocha|Kon-Tiki]]-like idol to sacrifice conquered enemies every full moon. Richard camouflages himself with mud and hides in the muck. Meanwhile, Lilli worries about his disappearance. Richard escapes unscathed, though not unseen, by a lone native who may think he is a god. Ultimately, after making up after a fight, Richard and Lilli discover [[romance (love)|natural love]] and [[intimate relationship|passion]], which deepens their emotional bond. They fall in love, and exchange formal wedding vows and rings in the middle of the jungle. From then on, they consummate their newfound feelings for each other for the next several months. |

|||

Paulson has personally built close relations with [[China]] during his career. In July 2008 it was reported by ''[[The Daily Telegraph]]'' that: "Treasury Secretary Hank Paulson has intimate relations with the Chinese elite, dating from his days at Goldman Sachs when he visited the country more than 70 times."<ref>[http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2008/07/16/ccusdebt116.xml US faces global funding crisis, warns Merrill Lynch - Telegraph<!-- Bot generated title -->]</ref> |

|||

===Tenure at and later relationship with Goldman Sachs=== |

|||

Soon after, a ship arrives at the island, carrying unruly sailors, a stuffy captain, and his beautiful but wicked daughter, Sylvia Hilliard. The party is welcomed by the young couple, and they ask to be taken back to [[civilization]], after many years in isolation. Sylvia tries to steal Richard from Lilli and seduce him, but as tempted as he is by her strange ways, he realizes that Lilli is his heart and soul, upsetting Sylvia. Richard leaves Sylvia behind in the middle of the fish pond, in plain view of the landing party. Meanwhile, a sailor ogles Lilli in her bath, drags her back to the house, and tries to rape her and steal her pearl, before Richard comes to her rescue. Richard flees his shots, chased by the sailor, and then lures him to his death in the jaws of the shark in the tidal reef area. Upon returning, he apologizes to Lilli for hurting her, and she reveals that she is pregnant. They decide to stay and raise their child on the island, as they feel their blissful life would not compare to civilization. The ship departs and the two young lovers stay on the island, and have their baby girl they named Sarah. |

|||

In 2004, at the request of the major Wall Street investment houses, including [[Goldman Sachs]], then headed by Paulson, the [[U.S. Securities and Exchange Commission]] agreed unanimously to release the major investment houses from the [[net capital rule]], the requirement that their brokerages hold reserve capital that limited their [[leverage]] and risk exposure. The complaint that was put forth by the investment banks was of increasingly onerous regulatory requirements -- in this case, not U.S. regulator oversight, but [[European Union]] [[regulation]] of the foreign operations of US investment groups. In the immediate lead-up to the decision, EU regulators also acceded to US pressure, and agreed not to scrutinize foreign firms' reserve holdings if the SEC agreed to do so instead. The 1999 [[Gramm-Leach-Bliley Act]], however, put the parent [[holding company]] of each of the big American brokerages beyond SEC oversight. In order for the agreement to go ahead, the investment banks lobbied for a decision that would allow "voluntary" inspection of their parent and [[subsidiary]] holdings by the SEC. |

|||

== Cast == |

|||

[[Image:ReturnBlueLagoon1991.jpg|right|200px|thumb|Milla Jovovich and Brian Krause starring in ''Return to the Blue Lagoon'' (1991).]] |

|||

{| class="wikitable" |

|||

|- bgcolor="CCCCCC" |

|||

! Actor !! Role |

|||

|- |

|||

| [[Milla Jovovich]] || Lilli Hargrave |

|||

|- |

|||

| [[Brian Krause]] || Richard Lestrange |

|||

|- |

|||

| [[Lisa Pelikan]] || Mrs. Sarah Hargrave |

|||

|- |

|||

| [[Courtney Barilla]] || Young Lilli |

|||

|- |

|||

| [[Garette Ratliff Henson]] || Young Richard |

|||

|- |

|||

| [[Emma James]] || Infant Lilli |

|||

|- |

|||

| [[Jackson Barton]] || Infant Richard |

|||

|- |

|||

| [[Nana Coburn]] || Sylvia Hilliard |

|||

|- |

|||

| [[Brian Blain]] || Captain Jacob Hilliard |

|||

|- |

|||

| [[Peter Hehir]] || Quinlan |

|||

|- |

|||

| [[Alexander Peterson]] || Giddens |

|||

|- |

|||

| [[John Mann (actor)|John Mann]] || First Captain |

|||

|- |

|||

| [[Wayne Pygram]] || Kearney |

|||

|- |

|||

| [[John Dicks]] || Penfield |

|||

|- |

|||

| [[Gus Mercurio]] || First Mate |

|||

|- |

|||

| [[John Turnbill]] || Dawes |

|||

|- |

|||

| [[Todd Rippon]] || Gullion |

|||

|- |

|||

| [[John Keightley]] || Lestrange |

|||

|- |

|||

| [[Pita Degei]] || Chief |

|||

|- |

|||

| [[Mikaele Nasau]] || Lone Cannibal |

|||

|- |

|||

| [[Annabel E. Graham]] || Infant Sarah |

|||

|} |

|||

During this repeal of the net capital rule, SEC Chairman [[William H. Donaldson]] agreed to the establishment of a risk management office that would monitor signs of future problems. This office was eventually dismantled by Chairman [[Christopher Cox]], after discussions with Paulson. According to the [[New York Times]], "While other financial regulatory agencies criticized a blueprint by Mr. Paulson, the [new] Treasury secretary, that proposed to reduce their stature — and that of the S.E.C. — Mr. Cox did not challenge the plan, leaving it to three former Democratic and Republican commission chairmen to complain that the blueprint would neuter the agency."<ref>[http://www.nytimes.com/2008/10/03/business/03sec.html "Stephen Labaton, "Agency’s ’04 Rule Let Banks Pile Up New Debt"] [[New York Times]], October 2, 2008</ref> |

|||

== Background and production == |

|||

The film was shot on location in [[Australia]] and [[Taveuni]], [[Fiji]] and is a sequel to the [[1980 in film|1980]] remake ''[[The Blue Lagoon (1980 film)|The Blue Lagoon]]'', starring [[Brooke Shields]] and [[Christopher Atkins]]. ''Return to the Blue Lagoon'' bears a strong similarity to the original film, which was produced and directed by [[Randal Kleiser]], but picks up from where the original film left off. It is almost nothing like ''The Garden of God'', Henry De Vere Stacpoole's sequel to his novel ''The Blue Lagoon''. However, in the second sequel novel, ''[[The Gates of Morning]]'', a pair of sailors attack the people of a nearby island because they know its waters are rich with pearls, and it is possible the filmmakers used this. Richard is the child of Richard and Emmeline Lestrange of the original film, who both are revealed to be dead at the beginning and are [[burial at sea|buried at sea]]. The new [[shipwreck]] occurred mere days after they were found where the crew is struck with cholera. |

|||

In late September 2008, Chairman Cox and the other Commissioners agreed to end the 2004 program of voluntary regulation. |

|||

Although many of the film's elements were derived from the 1980 ''Blue Lagoon'' film, and there was some nudity, the film was much more sanitized in content than its predecessor, and was able to garner a [[MPAA film rating system|PG-13]] rating in the United States. Despite the adult content of this film, including partial nudity (controversially, from a fifteen-year-old Milla Jovovich) and sexual themes, when ''Return to the Blue Lagoon'' was released to [[home video]], it was promoted in North America as a family film suitable for all ages. The [[DVD]] version of this film is reframed to cut out Milla Jovovich's breasts in the scene where she's looking at herself in the mirror. The older [[VHS]] version showed her nipples at the very bottom of the screen.<ref>''Return to the Blue Lagoon (DVD)'' Released 11/5/02</ref><ref>''Return to the Blue Lagoon (VHS)'' Released 12/7/92</ref> |

|||

==Treasury Secretary nomination== |

|||

== Nominations == |

|||

[[Image:President Bush Nominates Henry Paulson as Treasury Secretary 2.jpg|thumb|righ|Paulson (''right'') with President George W. Bush as his nomination to become Treasury Secretary is announced.]] |

|||

'''[[1991 Golden Raspberry Awards]]''' |

|||

:'''Nominee:''' Worst Director - William A. Graham |

|||

:'''Nominee:''' Worst New Star - Milla Jovovich |

|||

:'''Nominee:''' Worst New Star - Brian Krause |

|||

:'''Nominee:''' Worst Picture - William A. Graham |

|||

:'''Nominee:''' Worst Screenplay - Leslie Stevens |

|||

'''[[Young Artist Award]]s'''<ref>[http://www.youngartistawards.org/pastnoms13.htm ''1990-1991 Young Artist Awards'']</ref> |

|||

:'''Nominee:''' Best Young Actress Starring in a Motion Picture - Milla Jovovich |

|||

Paulson was nominated by [[President of the United States|U.S. President]] [[George W. Bush]] to succeed [[John W. Snow|John Snow]] as the Treasury Secretary on May 30, 2006.<ref>White House (2006). [http://www.whitehouse.gov/news/releases/2006/05/20060530.html President Bush Nominates Henry Paulson as Treasury Secretary]. Retrieved June 29, 2006.</ref> On June 28, 2006, he was confirmed by the [[United States Senate]] to serve in the position.<ref name="NYTAP/">Associated Press (2006). [http://www.nytimes.com/aponline/washington/AP-Treasury-Paulson.html?hp&ex=1151553600&en=852ed97a977c03e0&ei=5094&partner=homepage Senate Approves Paulson as Treasury Secretary].</ref> Paulson was officially sworn in at a ceremony held at the Treasury Department on the morning of July 10, 2006. |

|||

== DVD details == |

|||

*Release date: [[November 5]], [[2002]] |

|||

*Digitally mastered audio and video |

|||

*Region 1 |

|||

*Full screen presentation |

|||

*Aspect Ratio: 1.33:1 |

|||

*Available audio tracks: English, Portuguese |

|||

*Available subtitles: |

|||

:English, French, Spanish, Portuguese, Chinese, Japanese |

|||

*Theatrical trailers: |

|||

:''Return to the Blue Lagoon'', ''[[Mr. Deeds]]'' |

|||

*Running time: 101 minutes |

|||

Paulson's three immediate predecessors as CEO of [[Goldman Sachs]] — [[Jon Corzine]], [[Stephen Friedman (PFIAB)|Stephen Friedman]], and [[Robert Rubin]] — each left the company to serve in government: Corzine as a U.S. Senator (later [[Governor of New Jersey]]), Friedman as chairman of the [[National Economic Council]] (later chairman of the [[President's Foreign Intelligence Advisory Board]]) under President George W. Bush, and Rubin as both chairman of the NEC and later Treasury Secretary under President [[Bill Clinton]].<ref>White House (2006).[http://www.whitehouse.gov/news/releases/2006/06/20060628-4.html President Commends Senate for Confirming Henry Paulson as Treasury Secretary]. Retrieved June 29, 2006.</ref> |

|||

== References == |

|||

{{reflist}} |

|||

== |

== Acts as Treasury Secretary == |

||

Paulson has quickly distinguished himself from his two predecessors in the Bush administration by formally identifying the wide gap between the richest and poorest Americans as an issue on his list of the country's four major long-term economic issues to be addressed, highlighting the issue in one of his first public appearances as Secretary of Treasury.<ref>[[The Christian Science Monitor]] August 3, 2006 [http://www.csmonitor.com/2006/0803/p03s03-usec.html New Treasury head eyes rising inequality]. Retrieved August 3, 2006.</ref> |

|||

*''[[The Blue Lagoon (film)|The Blue Lagoon]]'', 1949 version |

|||

*''[[The Blue Lagoon (1980 film)|The Blue Lagoon]]'', 1980 version |

|||

*''[[Paradise (1982 film)|Paradise]]'' |

|||

Paulson has conceded that chances were slim for agreeing on a method to reform [[Social Security (United States)|Social Security]] financing, but said he would keep trying to find [[bipartisan]] support for it. <ref name="NewsMax">"[http://newsmax.com/archives/articles/2007/2/2/212410.shtml Paulson: Social Security Reform Hopes Slim]". [[Reuters]], February 3, 2007.</ref> |

|||

== External links == |

|||

{{wikiquote}} |

|||

*{{imdb title|id=0102782|title=Return to the Blue Lagoon}} |

|||

*{{tcmdb title|id=18505|title=Return to the Blue Lagoon}} |

|||

*{{amg title|id=1:41143|title=Return to the Blue Lagoon}} |

|||

*{{rotten-tomatoes|id=return_to_the_blue_lagoon|title=Return to the Blue Lagoon}} |

|||

*[http://film.virtual-history.com/film.php?filmid=8494 Movie stills] |

|||

He also helped to create the [[Hope Now Alliance]] to help struggling homeowners during the [[subprime mortgage crisis]].<ref>{{cite press release |title= HOPE NOW Alliance Created to Help Distressed Homeowners |url= http://www.fsround.org/media/pdfs/AllianceRelease.pdf |publisher= [[Hope Now Alliance]] |date= 2007-10-10 |accessdate=2008-09-24}}</ref> |

|||

[[Category:1991 films]] |

|||

[[Category:Adventure films]] |

|||

[[Category:American films]] |

|||

[[Category:Columbia Pictures films]] |

|||

[[Category:Coming-of-age films]] |

|||

[[Category:English-language films]] |

|||

[[Category:Films based on novels]] |

|||

[[Category:Films based on romance novels]] |

|||

[[Category:Romantic drama films]] |

|||

[[Category:Romantic period films]] |

|||

[[Category:Sequel films]] |

|||

[[Category:Teen romance films]] |

|||

[[Category:Victorian era films]] |

|||

===Views Expressed by Paulson as Secretary of the Treasury=== |

|||

[[de:Rückkehr zur blauen Lagune]] |

|||

In Spring 2007, Secretary Paulson told an audience at the [[Shanghai Futures Exchange]] that "An open, competitive, and liberalized financial market can effectively allocate scarce resources in a manner that promotes stability and prosperity far better than governmental intervention." <ref> {{cite news |title = China Shuns Paulson's Free Market Push as Meltdown Burns U.S.| url = http://www.bloomberg.com/apps/news?pid=20601087&sid=aCl7bFUJzWRk| publisher = Bloomberg.com| date = 2008-09-24 | accessdate = 2008-09-25}}</ref> |

|||

[[it:Ritorno alla laguna blu]] |

|||

[[nl:Return to the Blue Lagoon]] |

|||

In August 2007, Secretary Paulson explained that U.S. subprime mortgage fallout remained largely contained due to the strongest global economy in decades. <ref>{{Citation| last =Lawder | first = David | title = Paulson sees subprime woes contained | newspaper = The Boston Globe| date =August 1, 2007 | url =http://www.boston.com/business/articles/2007/08/01/paulson_sees_subprime_woes_contained/}}</ref> |

|||

[[pt:Return to the Blue Lagoon]] |

|||

[[ru:Возвращение в Голубую лагуну (фильм)]] |

|||

On July 20, 2008, after the failure of [[Indymac Bank]], Paulson reassured the public by saying, “it's a safe banking system, a sound banking system. Our regulators are on top of it. This is a very manageable situation.” <ref> {{cite news |title = Treasury Secretary Insists Banks Are Safe| url = http://cbs5.com/national/henry.paulson.economy.2.775329.html| publisher = CBS News| date = 2008-07-20 | accessdate = 2008-09-23}}</ref> |

|||

On August 10, 2008, Secretary Paulson told NBC’s Meet the Press that he had no plans to inject any capital into [[Fannie Mae]] or [[Freddie Mac]].<ref>{{cite news| first =John | last = Brinsley | title = Paulson Says No Plans to Add Cash to Fannie, Freddie |url =http://www.bloomberg.com/apps/news?pid=20601087&sid=aULVZ2mAF9es&refer=home| publisher = Bloomsberg Worldwide| date =August 10, 2008 | accessdate = 2008-09-23}}</ref> On September 7, 2008, both Fannie Mae and Freddie Mac went into conservatorship.<ref> {{cite news | first = James B., III | last = Lockhart | title = Statement of FHFA Director James B. Lockhart | url = http://www.ofheo.gov/newsroom.aspx?ID=456&q1=0&q2=0 | publisher = Federal Housing Finance Agency | date = 2008-09-07 | accessdate = 2008-09-23}}</ref> |

|||

===Leader of U.S. government economic bailout efforts of 2008=== |

|||

Paulson was the designated leader of the Bush administration's efforts in 2008 to nationalize the cost of bad loans made by financial institutions. |

|||

Through unprecedented intervention by the U.S. Treasury, Paulson led government efforts to avoid a severe economic slowdown. He pushed through the [[conservatorship]] of government agency mortgage giants [[Fannie Mae]] and [[Freddie Mac]]. Working with Federal Reserve Chairman [[Ben Bernanke]], he influenced the decision to create a credit facility (bridge loan & [[Warrant (finance)|warrants]]) of US$85 billion to [[American International Group|American International Group]] so it would avoid filing bankruptcy. |

|||

In late September of 2008, Paulson, along with Ben Bernanke and [[Christopher Cox]], led the effort to help financial firms by agreeing to use US$700 billion dollars to purchase bad debt they had incurred.<ref>Joelle Tessler, [http://news.yahoo.com/s/ap/20080919/ap_on_bi_ge/financial_meltdown_paulson;_ylt=AhIiQHKdYKHlbVj1pF.kj99v24cA Paulson oversees historic government intervention], [[Associated Press]], [[2008-09-19]]</ref> Discussing his decision to take action, Paulson said: “It just happened dramatically. There was only one way that we could reassure the markets and deal with a very significant and broad-based freezing of the credit market. There was no political calculus. It was overwhelmingly obvious.”<ref>{{cite news |first=Peter |last=Baker |authorlink= |coauthors= |title=A Professor and a Banker Bury Old Dogma on Markets |url=http://www.nytimes.com/2008/09/21/business/21paulson.html |work=New York Times |publisher= |date=2008-09-20 |accessdate= }}</ref> |

|||

On September 19, 2008, Paulson called for the U.S. government to use hundreds of billions of Treasury dollars to help financial firms cleanup nonperforming mortgages that threaten the liquidity of those firms.<ref>{{cite news |first=Jeanne |last=Sahadi |authorlink= |coauthors= |title=Rescue cost: Hundreds of billions |url=http://money.cnn.com/2008/09/19/news/economy/paulson_plan_cost/index.htm |work=CNNMoney.com |publisher= |date=2008-09-19 |accessdate= }}</ref> Due to his leadership and public appearances on this issue, the press labeled these measures the "[[Proposed bailout of U.S. financial system (2008)|Paulson financial rescue plan]]" or simply the Paulson Plan.<ref>{{ cite news |title = "Paulson plan"| work = [[Google News]] search |url=http://news.google.com/news?hl=en&as_epq=&as_oq=&as_eq=&num=100&lr=&as_filetype=&ft=i&as_sitesearch=&as_qdr=all&as_rights=&as_occt=any&cr=&as_nlo=&as_nhi=&safe=off&q=paulson-plan&um=1&ie=UTF-8&sa=N&tab=wn }}</ref> |

|||

With the passage of [[H.R. 1424]], he became the manager of the [[United States Emergency Economic Stabilization fund]]. |

|||

====Conflict of interest claims==== |

|||

Some have suggested Paulson's plan may potentially have some conflicts of interest, since Paulson is the former CEO of [[Goldman Sachs]], a firm that may benefit from the plan.<ref>{{cite web |

|||

| last = Herbert |

|||

| first = Bob |

|||

| authorlink = Bob Herbert |

|||

| title = A Second Opinion? |

|||

| publisher = ''[[The New York Times]]'' |

|||

| date = [[2008-09-22]] |

|||

| url = http://www.nytimes.com/2008/09/23/opinion/23herbert.html?hp |

|||

| accessdate = 2008-10-10}}</ref> Paulson has no direct financial interest in Goldman, however, since he sold his entire stake in the firm prior to becoming Treasury Secretary, pursuant to ethics law.<ref>{{cite web |

|||

| last = White |

|||

| first = Ben |

|||

| authorlink = |

|||

| title = Details of a Rescue Plan Are Unclear, but Some Already Benefit |

|||

| publisher = ''[[The New York Times]]'' |

|||

| date = [[2008-09-19]] |

|||

| url = http://www.nytimes.com/2008/09/20/business/20winners.html?fta=y |

|||

| accessdate = 2008-10-10}}</ref> |

|||

The proposed bill would give the United States Treasury Secretary unprecedented powers over the economic and financial life of the U.S.. Section 8 of Paulson’s plan states: “Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.”<ref>{{cite news |first=Rachel |last=Beck |authorlink= |coauthors= |title=Transparency key to bailout success |url=http://ap.google.com/article/ALeqM5gca54s0LCP-1CIz0sSK5QWjOCzbgD93CKMNG0 |work=Associated Press |publisher= |date=2008-09-23 |accessdate=2008-09-23}}</ref> |

|||

== Civic activities == |

|||

Paulson has been described as an avid nature lover.<ref>{{cite news | last=Somerville | first=Glenn | title=Paulson brings Wall Street luster to Treasury | date=May 30, 2006 | publisher=Yahoo! News | url=http://news.yahoo.com/s/nm/20060530/bs_nm/economy_paulson_dc_3}}</ref> He has been a member of [[The Nature Conservancy]] for decades and was the organization's board chairman and co-chair of its [[Asia]]-[[Pacific Ocean|Pacific]] Council.<ref name="nature"/> In that capacity, Paulson worked with former [[President of the People's Republic of China]] [[Jiang Zemin]] to preserve the [[Tiger Leaping Gorge]] in [[Yunnan]] province. |

|||

Paulson is also on the Board of Directors of the [[Peregrine Fund]]; was the founding Chairman of the Advisory Board of the School of Economics and Management of [[Tsinghua University]] in [[Beijing]]; and, previously served as chairman of the influential trade group, the [[Financial Services Forum]]. |

|||

Notable among the members of Bush's cabinet, Paulson has said he is a strong believer in the effect of human activity on [[global warming]] and advocates immediate action to decrease this effect.<ref>{{cite news | last=Heilprin | first=John | title=A global warming believer in Bush Cabinet | date=June 2, 2006 | publisher=Associated Press | url=http://www.libertypost.org/cgi-bin/readart.cgi?ArtNum=144182}}</ref> |

|||

As an environmental leader and philanthropist, Paulson while at Goldman Sachs, oversaw the corporate donation of 680,000 forested acres on the Chilean side of Tierra del Fuego, which led to criticisms from Goldman shareholder groups <ref>[http://www.humanevents.com/article.php?id=15481 Treasury Nominee Hank Paulson Needs to Answer Some Questions], [[Human Events]], [[2006-06-13]]</ref>. He further donated US$100 million of assets from his wealth to conservancy causes. He pledged his entire fortune for the same purpose at death. <ref>[http://www.independent.co.uk/news/business/news/paulson-plans-to-donate-163410m-fortune-to-environmental-causes-432346.html Paulson plans to donate £410m fortune to environmental causes], [[The Independent]], [[2004-01-16]]</ref> He has also been considered someone who can influence world and business leaders to think beyond the bottom line. <ref>Mark Brandon. [http://sustainablelog.blogspot.com/2006/06/environmental-cred-for-bush-treasury.html Environmental Cred for Bush Treasury Nominee], Sustainable Log ([[Blogspot]])</ref> |

|||

==References== |

|||

{{reflist|2}} |

|||

==Further reading== |

|||

*[http://www.pbs.org/wsw/news/fortunearticle_20031229_01.html Fortune Magazine: Hank Paulson's secret life] |

|||

*[http://www.theglobeandmail.com/servlet/story/RTGAM.20060530.wpaulsonside0530/BNStory/Business AP story: Paulson picks bird watching over golf] |

|||

==External links== |

|||

{{commons}} |

|||

*[http://www.ustreas.gov/organization/bios/paulson-e.html Paulson's biography from the Treasury Department] |

|||

* Paulson on China: [http://china.usc.edu/ShowArticle.aspx?articleID=827 October 2007], [http://china.usc.edu/ShowArticle.aspx?articleID=844 November 2007] |

|||

*[http://www.vote-smart.org/bio.php?can_id=68484 Project Vote Smart - Secretary Henry M. Paulson Jr.] |

|||

*[http://www.newsmeat.com/ceo_political_donations/Henry_Paulson.php Henry Paulson's federal campaign contributions] |

|||

{{start box}} |

|||

{{s-bus}} |

|||

{{succession box | before= [[Jon Corzine]] | title= [[Chair (official)|Chairman]] and [[CEO]], [[Goldman Sachs]]|years= June 1998 – July 3, 2006| after= [[Lloyd Blankfein]]}} |

|||

{{s-off}} |

|||

{{U.S. Secretary box |

|||

| before= [[John W. Snow]] |

|||

| after= Incumbent |

|||

| start= July 10, 2006 |

|||

| president= George W. Bush |

|||

| department= Secretary of the Treasury}} |

|||

{{s-prec}} |

|||

{{succession box | title=[[United States Presidential Line of Succession]] | before=[[Condoleezza Rice]]<br>Secretary of State | after=[[Robert Gates]]<br>Secretary of Defense | years= 5th in line}} |

|||

{{s-prec|usa}} |

|||

{{s-bef|before=[[Sandra Day O'Connor]]'''<br>''Retired Associate Justice of the Supreme Court of the United States''}} |

|||

{{s-ttl|title=[[United States order of precedence]]'''<br>''United States Secretary of the Treasury''|years=}} |

|||

{{s-aft|after=[[Robert Gates]]'''<br>''United States Secretary of Defense''}} |

|||

{{end}} |

|||

{{USSecTreas}} |

|||

{{U.S. Cabinet}} |

|||

{{G8-Finance}} |

|||

{{GW Bush cabinet}} |

|||

<!-- Metadata: see [[Wikipedia:Persondata]] --> |

|||

{{Persondata |

|||

|NAME=Paulson, Henry Merritt "Hank" |

|||

|ALTERNATIVE NAMES= |

|||

|SHORT DESCRIPTION=74th [[United States Secretary of the Treasury]] |

|||

|DATE OF BIRTH=March 28, 1946 |

|||

|PLACE OF BIRTH=[[Palm Beach, Florida]], [[United States]] |

|||

|DATE OF DEATH= |

|||

|PLACE OF DEATH= |

|||

}} |

|||

{{DEFAULTSORT:Paulson, Henry}} |

|||

[[Category:American businesspeople]] |

|||

[[Category:Dartmouth College alumni]] |

|||

[[Category:Harvard Business School alumni]] |

|||

[[Category:American Christian Scientists]] |

|||

[[Category:American environmentalists]] |

|||

[[Category:American philanthropists]] |

|||

[[Category:1946 births]] |

|||

[[Category:Living people]] |

|||

[[Category:United States Secretaries of the Treasury]] |

|||

[[Category:People from Barrington, Illinois]] |

|||

[[Category:George W. Bush Administration cabinet members]] |

|||

[[Category:Goldman Sachs people]] |

|||

[[Category:Eagle Scouts]] |

|||

[[Category:Illinois Republicans]] |

|||

[[da:Henry Paulson]] |

|||

[[de:Henry Paulson]] |

|||

[[es:Henry Merritt Paulson Jr.]] |

|||

[[fr:Henry Paulson]] |

|||

[[hr:Henry M. Paulson]] |

|||

[[he:הנרי פולסון]] |

|||

[[la:Henricus Paulson]] |

|||

[[ja:ヘンリー・ポールソン]] |

|||

[[no:Henry Paulson]] |

|||

[[pl:Henry Paulson]] |

|||

[[ru:Полсон, Xенри]] |

|||

[[sv:Henry Paulson]] |

|||

[[zh:亨利·保尔森]] |

|||

Revision as of 01:51, 11 October 2008

Henry M. Paulson | |||

|---|---|---|---|

| |||

74

| |||

| Assumed office July 3, 2006 | |||

| President | George W. Bush | ||

| Preceded by | John W. Snow | ||

| Personal details | |||

| Born | March 28, 1946 Palm Beach, Florida | ||

| Political party | Republican (United States) | ||

| Alma mater | Dartmouth College, Harvard University | ||

| Profession | Investment banker | ||

Henry Merritt "Hank" Paulson Jr. (born March 28, 1946) is the United States Treasury Secretary and member of the International Monetary Fund Board of Governors. He previously served as the Chairman and Chief Executive Officer of Goldman Sachs.

Early life and family

Born in Palm Beach, Florida, to Marianna Gallaeur and Henry Merritt Paulson, a wholesale jeweler,[1] he was raised in Barrington Hills, Illinois. He was raised as a Christian Scientist.[2] Paulson attained the rank of Eagle Scout in the Boy Scouts of America.[3][4]

A star athlete at Barrington High School, Paulson was a champion wrestler and stand out football player, graduating in 1964. Paulson received his Bachelor of Arts in English from St. Olaf College in 1968;[5] at Dartmouth he was a member of Phi Beta Kappa and Sigma Alpha Epsilon and he was an All Ivy, All East, and honorable mention All American as an offensive lineman.

He met his wife Wendy during his senior year. The couple have two adult children, Henry Merritt III and Amanda Clark, and became grandparents in June 2007. They maintain homes in Washington, DC and Barrington Hills, Illinois.

In 1970 Paulson received a Master of Business Administration degree from Harvard Business School.[6]

Career highlights

Paulson was Staff Assistant to the Assistant Secretary of Defense at The Pentagon from 1970 to 1972.[7] He then worked for the administration of U.S. President Richard Nixon, serving as assistant to John Ehrlichman from 1972 to 1973.

He joined Goldman Sachs in 1974, working in the firm's Chicago office for Manmeet Taneja. He became a partner in 1982. From 1983 until 1988, Paulson led the Investment Banking group for the Midwest Region, and became managing partner of the Chicago office in 1988. From 1990 to November 1994, he was co-head of Investment Banking, then, Chief Operating Officer from December 1994 to June 1998;[8] eventually succeeding Jon Corzine (now Governor of New Jersey) as its chief executive. His compensation package, according to reports, was US$37 million in 2005, and US$16.4 million projected for 2006.[9] His net worth has been estimated at over US$700 million.[9] Paulson has personally built close relations with China during his career. In July 2008 it was reported by The Daily Telegraph that: "Treasury Secretary Hank Paulson has intimate relations with the Chinese elite, dating from his days at Goldman Sachs when he visited the country more than 70 times."[10]

Tenure at and later relationship with Goldman Sachs

In 2004, at the request of the major Wall Street investment houses, including Goldman Sachs, then headed by Paulson, the U.S. Securities and Exchange Commission agreed unanimously to release the major investment houses from the net capital rule, the requirement that their brokerages hold reserve capital that limited their leverage and risk exposure. The complaint that was put forth by the investment banks was of increasingly onerous regulatory requirements -- in this case, not U.S. regulator oversight, but European Union regulation of the foreign operations of US investment groups. In the immediate lead-up to the decision, EU regulators also acceded to US pressure, and agreed not to scrutinize foreign firms' reserve holdings if the SEC agreed to do so instead. The 1999 Gramm-Leach-Bliley Act, however, put the parent holding company of each of the big American brokerages beyond SEC oversight. In order for the agreement to go ahead, the investment banks lobbied for a decision that would allow "voluntary" inspection of their parent and subsidiary holdings by the SEC.

During this repeal of the net capital rule, SEC Chairman William H. Donaldson agreed to the establishment of a risk management office that would monitor signs of future problems. This office was eventually dismantled by Chairman Christopher Cox, after discussions with Paulson. According to the New York Times, "While other financial regulatory agencies criticized a blueprint by Mr. Paulson, the [new] Treasury secretary, that proposed to reduce their stature — and that of the S.E.C. — Mr. Cox did not challenge the plan, leaving it to three former Democratic and Republican commission chairmen to complain that the blueprint would neuter the agency."[11]

In late September 2008, Chairman Cox and the other Commissioners agreed to end the 2004 program of voluntary regulation.

Treasury Secretary nomination

Paulson was nominated by U.S. President George W. Bush to succeed John Snow as the Treasury Secretary on May 30, 2006.[12] On June 28, 2006, he was confirmed by the United States Senate to serve in the position.[13] Paulson was officially sworn in at a ceremony held at the Treasury Department on the morning of July 10, 2006.

Paulson's three immediate predecessors as CEO of Goldman Sachs — Jon Corzine, Stephen Friedman, and Robert Rubin — each left the company to serve in government: Corzine as a U.S. Senator (later Governor of New Jersey), Friedman as chairman of the National Economic Council (later chairman of the President's Foreign Intelligence Advisory Board) under President George W. Bush, and Rubin as both chairman of the NEC and later Treasury Secretary under President Bill Clinton.[14]

Acts as Treasury Secretary

Paulson has quickly distinguished himself from his two predecessors in the Bush administration by formally identifying the wide gap between the richest and poorest Americans as an issue on his list of the country's four major long-term economic issues to be addressed, highlighting the issue in one of his first public appearances as Secretary of Treasury.[15]

Paulson has conceded that chances were slim for agreeing on a method to reform Social Security financing, but said he would keep trying to find bipartisan support for it. [16]

He also helped to create the Hope Now Alliance to help struggling homeowners during the subprime mortgage crisis.[17]

Views Expressed by Paulson as Secretary of the Treasury

In Spring 2007, Secretary Paulson told an audience at the Shanghai Futures Exchange that "An open, competitive, and liberalized financial market can effectively allocate scarce resources in a manner that promotes stability and prosperity far better than governmental intervention." [18]

In August 2007, Secretary Paulson explained that U.S. subprime mortgage fallout remained largely contained due to the strongest global economy in decades. [19]

On July 20, 2008, after the failure of Indymac Bank, Paulson reassured the public by saying, “it's a safe banking system, a sound banking system. Our regulators are on top of it. This is a very manageable situation.” [20]

On August 10, 2008, Secretary Paulson told NBC’s Meet the Press that he had no plans to inject any capital into Fannie Mae or Freddie Mac.[21] On September 7, 2008, both Fannie Mae and Freddie Mac went into conservatorship.[22]

Leader of U.S. government economic bailout efforts of 2008

Paulson was the designated leader of the Bush administration's efforts in 2008 to nationalize the cost of bad loans made by financial institutions.

Through unprecedented intervention by the U.S. Treasury, Paulson led government efforts to avoid a severe economic slowdown. He pushed through the conservatorship of government agency mortgage giants Fannie Mae and Freddie Mac. Working with Federal Reserve Chairman Ben Bernanke, he influenced the decision to create a credit facility (bridge loan & warrants) of US$85 billion to American International Group so it would avoid filing bankruptcy.

In late September of 2008, Paulson, along with Ben Bernanke and Christopher Cox, led the effort to help financial firms by agreeing to use US$700 billion dollars to purchase bad debt they had incurred.[23] Discussing his decision to take action, Paulson said: “It just happened dramatically. There was only one way that we could reassure the markets and deal with a very significant and broad-based freezing of the credit market. There was no political calculus. It was overwhelmingly obvious.”[24]

On September 19, 2008, Paulson called for the U.S. government to use hundreds of billions of Treasury dollars to help financial firms cleanup nonperforming mortgages that threaten the liquidity of those firms.[25] Due to his leadership and public appearances on this issue, the press labeled these measures the "Paulson financial rescue plan" or simply the Paulson Plan.[26]

With the passage of H.R. 1424, he became the manager of the United States Emergency Economic Stabilization fund.

Conflict of interest claims

Some have suggested Paulson's plan may potentially have some conflicts of interest, since Paulson is the former CEO of Goldman Sachs, a firm that may benefit from the plan.[27] Paulson has no direct financial interest in Goldman, however, since he sold his entire stake in the firm prior to becoming Treasury Secretary, pursuant to ethics law.[28] The proposed bill would give the United States Treasury Secretary unprecedented powers over the economic and financial life of the U.S.. Section 8 of Paulson’s plan states: “Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.”[29]

Civic activities

Paulson has been described as an avid nature lover.[30] He has been a member of The Nature Conservancy for decades and was the organization's board chairman and co-chair of its Asia-Pacific Council.[7] In that capacity, Paulson worked with former President of the People's Republic of China Jiang Zemin to preserve the Tiger Leaping Gorge in Yunnan province.

Paulson is also on the Board of Directors of the Peregrine Fund; was the founding Chairman of the Advisory Board of the School of Economics and Management of Tsinghua University in Beijing; and, previously served as chairman of the influential trade group, the Financial Services Forum.

Notable among the members of Bush's cabinet, Paulson has said he is a strong believer in the effect of human activity on global warming and advocates immediate action to decrease this effect.[31]

As an environmental leader and philanthropist, Paulson while at Goldman Sachs, oversaw the corporate donation of 680,000 forested acres on the Chilean side of Tierra del Fuego, which led to criticisms from Goldman shareholder groups [32]. He further donated US$100 million of assets from his wealth to conservancy causes. He pledged his entire fortune for the same purpose at death. [33] He has also been considered someone who can influence world and business leaders to think beyond the bottom line. [34]

References

- ^ 1

- ^ Patricia Sellers, Hank Paulson's secret life, The CEO of Goldman Sachs is passionate about banking. But he's also obsessed with snakes, tarantulas, and coral reefs., Public Broadcasting Service, "Wall Street Week with Fortune" feature, December 29, 2003.

- ^ Townley, Alvin. Legacy of Honor: The Values and Influence of America's Eagle Scouts. New York: St. Martin's Press. pp. pp. 178-188, 196. ISBN 0-312-36653-1. Retrieved 2006-12-29.

{{cite book}}:|pages=has extra text (help); Cite has empty unknown parameter:|coauthors=(help); Unknown parameter|origdate=ignored (|orig-date=suggested) (help) - ^ Ray, Mark (2007). "What It Means to Be an Eagle Scout". Scouting Magazine. Boy Scouts of America. Retrieved 2007-01-05.

{{cite web}}: Cite has empty unknown parameter:|coauthors=(help) - ^ Belser, Alex (May 31, 2006). "Paulson '68 to lead Treasury". The Dartmouth.

- ^ www.02138mag.com/people/385.htmlM

- ^ a b The Nature Conservancy (2006). Henry M. Paulson, Jr..

- ^ Goldman Sachs (2006). Goldman Sachs Group, Inc - Management.

- ^ a b Forbes (2006). Henry M. Paulson, Jr..

- ^ US faces global funding crisis, warns Merrill Lynch - Telegraph

- ^ "Stephen Labaton, "Agency’s ’04 Rule Let Banks Pile Up New Debt" New York Times, October 2, 2008

- ^ White House (2006). President Bush Nominates Henry Paulson as Treasury Secretary. Retrieved June 29, 2006.

- ^ Associated Press (2006). Senate Approves Paulson as Treasury Secretary.

- ^ White House (2006).President Commends Senate for Confirming Henry Paulson as Treasury Secretary. Retrieved June 29, 2006.

- ^ The Christian Science Monitor August 3, 2006 New Treasury head eyes rising inequality. Retrieved August 3, 2006.

- ^ "Paulson: Social Security Reform Hopes Slim". Reuters, February 3, 2007.

- ^ "HOPE NOW Alliance Created to Help Distressed Homeowners" (PDF) (Press release). Hope Now Alliance. 2007-10-10. Retrieved 2008-09-24.

- ^ "China Shuns Paulson's Free Market Push as Meltdown Burns U.S." Bloomberg.com. 2008-09-24. Retrieved 2008-09-25.

- ^ Lawder, David (August 1, 2007), "Paulson sees subprime woes contained", The Boston Globe

- ^ "Treasury Secretary Insists Banks Are Safe". CBS News. 2008-07-20. Retrieved 2008-09-23.

- ^ Brinsley, John (August 10, 2008). "Paulson Says No Plans to Add Cash to Fannie, Freddie". Bloomsberg Worldwide. Retrieved 2008-09-23.

- ^ Lockhart, James B., III (2008-09-07). "Statement of FHFA Director James B. Lockhart". Federal Housing Finance Agency. Retrieved 2008-09-23.

{{cite news}}: CS1 maint: multiple names: authors list (link) - ^ Joelle Tessler, Paulson oversees historic government intervention, Associated Press, 2008-09-19

- ^ Baker, Peter (2008-09-20). "A Professor and a Banker Bury Old Dogma on Markets". New York Times.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ Sahadi, Jeanne (2008-09-19). "Rescue cost: Hundreds of billions". CNNMoney.com.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ ""Paulson plan"". Google News search.

- ^ Herbert, Bob (2008-09-22). "A Second Opinion?". The New York Times. Retrieved 2008-10-10.

{{cite web}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ White, Ben (2008-09-19). "Details of a Rescue Plan Are Unclear, but Some Already Benefit". The New York Times. Retrieved 2008-10-10.

{{cite web}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ Beck, Rachel (2008-09-23). "Transparency key to bailout success". Associated Press. Retrieved 2008-09-23.

{{cite news}}: Cite has empty unknown parameter:|coauthors=(help) - ^ Somerville, Glenn (May 30, 2006). "Paulson brings Wall Street luster to Treasury". Yahoo! News.

- ^ Heilprin, John (June 2, 2006). "A global warming believer in Bush Cabinet". Associated Press.

- ^ Treasury Nominee Hank Paulson Needs to Answer Some Questions, Human Events, 2006-06-13

- ^ Paulson plans to donate £410m fortune to environmental causes, The Independent, 2004-01-16

- ^ Mark Brandon. Environmental Cred for Bush Treasury Nominee, Sustainable Log (Blogspot)

Further reading

External links

- American businesspeople

- Dartmouth College alumni

- Harvard Business School alumni

- American Christian Scientists

- American environmentalists

- American philanthropists

- 1946 births

- Living people

- United States Secretaries of the Treasury

- People from Barrington, Illinois

- George W. Bush Administration cabinet members

- Goldman Sachs people

- Eagle Scouts

- Illinois Republicans