Oil price

The oil price describes an exchange ratio determined on a market for a certain amount of a type of oil . The large number of different types of oil results in a large number of oil prices. The price of oil depends on the different chemical composition, in particular the sulfur content and the energy density . Lower quality oil for industrial use is consistently traded at lower prices than higher quality oil.

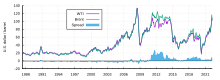

A large part of the real international oil trade takes place directly between supplier and buyer without participation in the stock exchange. The prices are based on the prices of the international oil exchanges New York Mercantile Exchange (NYMEX), ICE Futures in London (formerly "International Petroleum Exchange"), Rotterdam (ARA), Chicago ( CBoT ), Shanghai (SHFE) and the Singapore Exchange (SGX). The most important types of crude oil in this context are Brent for Europe and WTI for North America.

The market price for crude oil determined on the oil exchanges results from the supply and demand for crude oil. The demand and supply side are determined by different factors such as the economic growth of the industrialized countries, the limited oil reserves as well as geologically determined production maxima , the output quantities of the refineries and the production quantities and investments of the oil producers. A large number of financial market factors such as exchange rates , futures contracts and interest rates as well as various events such as political conflicts, wars or natural disasters also influence the oil price.

Determinants of the price of oil

In the following, the determinants of the oil price in international markets are explained in more detail.

Demand factors

The demand for oil depends primarily on the growth of the gross national product , on structural changes in the economy and on technical progress and the development of the oil price. The demand for exhaustible goods can disappear under certain conditions, for example through technological progress or the introduction of a substitute. The case of the expropriation of the resource is also modeled as the disappearance of demand. In various macroeconomic publications it has been shown that depending on the assessment of the probability of occurrence of one of the above-mentioned scenarios, the producer or promoter tries to accelerate production or exploration .

Economic growth

The economic development and thus the demand for oil in the industrialized countries and large emerging countries such as B. China , India and Brazil influenced the development of the oil price.

Storage

The volatility of the oil price affects inventory in two ways. The incentive to stockpiling by consumers, refiners and governments is usually greater in a volatile market, which in turn leads to short-term price increases if conditions remain unchanged. Second, the volatility itself increases the value of the call option . Furthermore, the oil price is subject to a certain seasonality. The low point is usually in the middle of winter between December and January, despite the high consumption of heating oil. In contrast, the oil price reaches its highs in spring, when the “driving season” begins in the USA, and in autumn because of the general supply of heating oil.

Price elasticity of demand

The price elasticity of demand measures the relative change that occurs on the demand side when a relative price change occurs. The demand for oil turns out to be very price inelastic, which means that there is only a weak reaction of the demand to price changes. This is often the case with goods that cannot be quickly and easily substituted .

The International Energy Agency mainly blames the low price elasticity for the strong fluctuations in the oil price in the years 2007–2009. In the period from January to July 2008, the price jump was 55% with a simultaneous growth in demand of only 1%.

Income elasticity of demand

When disposable income increases, the demand for oil increases faster. As income increases, higher prices are accepted. If real income remains constant, then higher prices would reduce demand.

In particular, the statements on the market situation with constant real incomes must be questioned. With constant or falling real income and rising oil prices, there is also a prioritization of consumption. Other goods are then consumed or demanded less or not at all in order to be able to compensate for the price increase with a defined budget and given demand. Since oil is one of the basic goods for people in industrial societies, such mechanisms are of considerable importance in the (political) assessment of social and economic realities.

Supply factors

The supply side is mainly determined by availability, future availability and the assessment of this, as well as the market structure.

Oil reserves

The uncertainty about the actual reserves available and the different valuation approaches of the oil companies are important factors in determining the oil price. Due to physical limits, only a small part of the global oil reserves can be extracted. As the oil price rises, the economically sensible proportion of recoverable reserves increases.

Market structure and scarcity rent

In contrast to perfect competition , the price for exhaustible resources is not the intersection of demand with marginal costs . The Hotelling Rule states that for a non-renewable resource that is available in limited quantities, neglecting storage costs, the profit from the sale of the resource is maximized if the scarcity rent (i.e. the periodic discounted payments of this scarcity rent) is the same for each period. The scarcity pension indicates the opportunity costs of selling an additional resource unit. In other words, in a perfect market, the difference between market price and marginal cost grows from period to period with the interest rate, and therefore the price of the exhaustible resource must increase over time, assuming marginal cost is constant.

As mentioned at the beginning, geopolitical uncertainties, capacity bottlenecks, low inventories and price volatility also influence the market price. The dynamics of the oil market are mostly hesitant and a (partial) equilibrium price finding tends to be long-term. The above-mentioned circumstances can lead to spot prices and prices for short-term futures rising dramatically above the equilibrium price in the short term.

OPEC - pricing and supply shortages

The crude oil market is often referred to as a cartel . This designation is a very strong simplification. Nevertheless, most macroeconomic studies regarding the structure of the oil market come to the conclusion that the OPEC member states and some non-members at least cooperate strongly in determining the oil production rates. This strong cooperation is sometimes referred to as horizontal collusion , which leads to a price distortion. The strong cooperation behavior impairs the equilibrium pricing by the free market forces of supply and demand. Under extreme conditions, supply restrictions on the part of the producing countries and the ensuing price increases can threaten global financial stability.

Financial market factors

In the following section, various factors are shown that have an influence on the formation of oil prices, but which are not directly related to the fundamental supply and demand situation for physical oil.

speculation

The US Commodities and Futures Trade Commission (CFTC) describes market participants as “speculators” who do not primarily want to hedge their own operational risk, but rather are generally looking for an external trading risk.

The oil futures contract , which usually does not lead to physical delivery, can e.g. B. to protect the petroleum-refining industry against unexpected drop in prices of oil finished product (through a put option , the trader is "short") or the transport industry against unexpected price increases (by a purchase option , the trader is "long") are used. In these cases it will not have a significant influence on the spot price because the volume of the contracts falls short of the physical core business. The spot price or spot price is the price for short-term sale or purchase if delivery is made within two weeks.

The volume of crude oil traded on the futures exchanges via futures contracts is now many times the amount of oil actually delivered. Only about 5% of all futures contracts are physically settled as oil delivery at the end of the term, the majority being settled through equalization payments.

Investments in commodity indices have multiplied in the period from 2003 with 13 billion US dollars to 2008 with 260 billion US dollars. Investors in commodity index funds are not buyers of physical quantities of oil, but rather invest in futures contracts through the fund manager . The only investment interest of investors is rising oil prices. Speculation on falling prices is the exception here.

The decisive link between futures contracts or the commodity indices issued with them and the physical market is arbitrage trading , a physical intermediate sale in a contango . One speaks of a contango when the current market price is lower than the forward price. The arbitrage trading, which is basically desired to adjust market disparities, leads in this case to an adjustment to the price for the forward option . Role effects sometimes play a role here.

Herding

Herding effects in the oil market, especially in the futures segment, are the subject of several scientific studies. More recent studies show that herding behavior, especially among hedge funds , brokers and traders for futures contracts, takes place at levels that are higher than previously assumed in studies and that are significantly higher than, for example, in the stock market . Macroeconomic and behavioral studies show that herding behavior is more likely to occur in markets with great information uncertainty than in markets with high information security.

Exchange rate factor

The relationship between exchange rates and the price of oil is complex. Exchange rates can affect the price of oil and vice versa. For example, oil exporting countries are trying to maintain their purchasing power . Since the US dollar has been the standard currency in the commodities market, its exchange rate to other currencies has played an important role. A change in the dollar exchange rate means a change in the terms of trade between two countries. The extent of this change depends on the ratio of “dollar goods” to “non-dollar goods” in the respective country's trade balance . Since the difference between the export and import of "dollar goods" is greatest for the oil-exporting countries, their earnings situation is most affected by fluctuations in the dollar exchange rate. Accordingly, these countries have an interest in raising export prices for crude oil, for example through a supply shortage, if the US dollar falls in value.

Interest rates

The relationship between interest rates and the price of oil can vary widely and depends on a variety of economic variables. In principle, the oil price and interest rates can correlate negatively or positively . A negative correlation is assumed when interest rate cuts lead to an increase in the oil price. Positive correlation is assumed when the rate cuts are made as a result of a decline in economic activity or a recession. With these rate cuts, the oil price can also fall due to weaker demand.

manipulation

In principle, one cannot assume that the oil market functions as a market per se just because it is a market. Structural inefficiencies can certainly arise. This includes not only manipulation, but also a lack of transparency, structural advantages of traders with large supply and / or demand positions and the market power exercised by them. Insider trading and self-dealing and trading practices that accelerate market development.

Manipulating the oil price generally means five different variants.

- Market participants with greater market power can manipulate the price of oil through the intentional and unintentional spreading of false news about their intentions or behavior.

- Market participants with inside information about fundamentals may intentionally or unintentionally make false announcements about factors likely to affect fundamentals.

- Market participants buy oil stocks in a market with an inelastic supply function in order to be able to sell them for a monopoly profit.

- Market participants accumulate a higher number of forward contracts than the delivery volume available at the due dates. At the due dates, an excess demand arises , which causes the base value, here the oil price, to rise. Usually the contracts are then settled in cash.

- Market participants with greater market power (read: OPEC and the eight OPEC Plus countries, such as Russia and Mexico) make agreements about the maximum oil production in order to influence the supply and thus the prices on the world market. These have been held since 2017, most recently on July 1, 2019.

Production costs by country of origin

Different countries have very different costs of producing oil due to their geological conditions. The countries of the Arabian Peninsula (e.g. Kuwait and Saudi Arabia for around $ 9 per barrel) produced the cheapest in 2015, with Russia ($ 17), Venezuela ($ 23), Mexico and China ( 29–30 $), in the upper cost range Norway (36 $), USA and Canada (36–41 $), and especially Great Britain (52 $). If the world market price falls, these countries can often no longer produce at a cost-covering level and make losses.

Historical price history

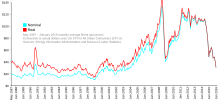

The historical oil price trend is characterized by strong fluctuations with the exception of the so-called “golden age of cheap oil” between the First World War and the first oil crisis in 1973.

From the Pennsylvania Oil Boom to the Oil Crisis (1859–1973)

Between 1859 and the golden age of cheap oil, the historical inflation-adjusted oil price showed significant price fluctuations, but the price peaks of that time were not reached again until the end of the 20th century. Even the (real) price increases and jumps in demand at the beginning of modern oil production in the 19th century were comparable to the modern oil crises. As early as the 1860s, oil could be produced profitably. The first commercially successful oil wells worldwide took place at the end of July 1858 under the direction of Georg Christian Konrad Hunäus in Wietze , Lower Saxony . Lignite was suspected and actually searched for in the earth, the oil was extracted and used in the following years.

Edwin L. Drake's first successful, commercial petroleum well was drilled on August 27, 1859 at Oil Creek in Titusville , Pennsylvania. Drake drilled on behalf of the American industrialist George H. Bissell and came across the first major oil deposit at a depth of just 21 meters. In the same year in the United States 34 companies Petroleum produced a turnover of five million US dollars . The first oil refineries came into being. By 1864 the price of oil rose to a high of $ 8.06 per barrel (159 liters ). Adjusted for inflation, an annual average of 135.06 US dollars had to be paid.

With the start of Russian oil exports and due to the success of the electric light bulb , which made oil no longer necessary for lighting in private households (see kerosene lamp ), the oil price fell to 2.56 US dollars per barrel in 1876 (inflation-adjusted US 62.88 -Dollar).

Soon after the development of the automobile , the Rockefeller family, as co-founders of the Standard Oil Company, pushed through the use of the petroleum product gasoline as gasoline instead of the ethanol initially intended by Henry Ford . With the launch of the Ford Model T in 1908, the automobile became a commercial mass product in the USA. American demand for gasoline increased rapidly. In the mid-1920s, the US auto industry became the largest consumer of oil. In 1929 there were around 23 million motor vehicles here, more than six times as many as in 1916. In 1929, consumption in the USA was 2.58 million barrels of crude oil per day, 85% of which for gasoline and heating oil. The number of drive-in filling stations was 143,000 in the same year. It was the beginning of the motorized society and the dawn of the petrol age.

On October 24, 1929, an initially only slight decline in the growth of the world's leading US economy caused the speculatively overvalued US stock market to collapse on Black Thursday . This led to a reversal of financial flows. Funds that had been invested in other economies in previous years were hastily withdrawn. Worldwide, this credit withdrawal triggered the worst economic crisis phenomena in many industrialized countries . In the chain of events there were, among other things, corporate failures, mass unemployment, deflation and a massive decline in world trade due to protectionist measures. During the Great Depression, the demand for oil decreased and the oil price sank to its all-time low. In 1931 the price was $ 0.65 per barrel (adjusted for inflation: $ 10.89).

After the Second World War , the oil price remained at a relatively low level. In 1948, during the reconstruction period in Europe, the price was US $ 2.57 (US $ 27.24 adjusted for inflation) for a barrel of crude oil. Since then, trading in oil has been mainly settled in US dollars. The money used for this is also known as petrodollars . At the beginning of the 1950s, crises such as the putsch in Iran and the Suez crisis did not lead to an oil price shock in the Federal Republic of Germany, as at that time it still covered 35% of its oil needs from domestic sources.

The GDR intensified the prospecting of oil. Crude oil increasingly became the starting product of the chemical industry and production volumes rose by leaps and bounds in the 1960s. In the general competition for market share, the oil price fell to lows. In 1964, a barrel of crude oil cost $ 2.92 (adjusted for inflation: $ 24.01).

Political Oil Crises (1970s and 1980s)

The first oil crisis began in the autumn of 1973 when the Organization of the Petroleum Exporting Countries (OPEC) cut production volumes (by around five percent) after the Yom Kippur War, thereby making political demands. On October 17, 1973, the price of oil rose from around three US dollars per barrel to over five dollars. This corresponds to an increase of around 70%. During 1974 the world oil price rose to $ 11.16 a barrel (adjusted for inflation: $ 57.73). This event also went down in history under the name of the oil embargo. The oil crisis in 1973 demonstrated the dependence of industrialized nations of fossil fuels , in particular of fossil fuels. Among other things, this led to the North Sea becoming an important oil production region through high investments.

In 1979/1980, during the second oil crisis, there were again brief price increases after a decline in oil prices. They were mainly triggered by funding failures and uncertainty after the Islamic Revolution . In December 1979, a barrel of crude oil was $ 32.50 ($ 114.28 when adjusted for inflation). The price increase peaked in April 1980 at $ 39.50 a barrel (adjusted for inflation: $ 122.35).

In 1981 oil sales decreased. The industrialized countries were in recession and due to the first oil crisis and high oil prices, many countries invested in alternative energy sources, which in the years 1978-1983 reduced world oil consumption by 11%. Due to global overproduction of crude oil and the attempt by some OPEC countries to improve their global market position by lowering prices, the price fell by 75%. On April 1, 1986, the price was $ 9.75 per barrel ($ 22.70 adjusted for inflation).

Low oil prices (1990s to 2001)

The 1990s were - apart from price increases in 1990/1991 caused by the Second Gulf War - a phase of very low oil prices. On October 10, 1990, a barrel of crude oil cost $ 41.15 ($ 80.33 when adjusted for inflation).

During the Asian crisis , the demand for oil fell. On December 11, 1998, the price was $ 10.65 per barrel ($ 16.67 when adjusted for inflation). After overcoming the crisis, the global economy and with it the demand for oil grew rapidly. After a cyclical rise in the oil price on September 18, 2000 to $ 37.15 (adjusted for inflation: $ 55.05), the bursting of the speculative bubble in the technology sector and the events surrounding the terrorist attacks on September 11, 2001 led to a decline at the beginning of 2001 Demand for kerosene . In the short term, this lowered the demand for oil and thus the oil price.

The overall impact was less than in the 1970s. Increases in oil production prevented a serious oil crisis. Transportation and technical advancement played a bigger role than an actual shortage in oil production.

In line with the long-term price increase for other raw materials , the nominally high prices for crude oil at the end of the 20th century were still below the inflation-adjusted and thus real values at the beginning of the 20th century and also below the values around 1860 (at the beginning of industrialization ). The oil intensity , ie the amount of crude oil used per national product unit, was, according to the International Monetary Fund for the period 1977 to 1980 the OECD , the Organization for Economic Cooperation and Development, 1.07, in the 2004 to 2006 0.57.

Price increases (2001 to 2014)

From an oil price of $ 17.10 on November 19, 2001 (adjusted for inflation: $ 24.64), there were significant price increases in the following years. At the beginning of the 21st century, the People's Republic of China became the second largest consumer of oil in the world. With the economic boom, the country's demand for oil also increased. On February 27, 2003, a barrel of crude oil was $ 39.99. On October 27, 2004, the price temporarily hit a level of $ 55.63 in an environment of political, economic, and speculative stress. On August 30, 2005, crude oil prices rose to $ 70.90 a barrel as a result of the devastating Hurricane Katrina , which affected oil production in the Gulf of Mexico and refining in the United States. On November 26, 2007, the oil price rose to an annual high of $ 99.04. On January 2, 2008, the oil price rose to the three-digit mark of 100 US dollars per barrel of West Texas Intermediate (WTI) for the first time.

The main reason for the increase was rising global consumption, which was not responded to to the same extent by increasing production. It is debatable why this did not happen in a few years, despite the price multiplying. Some studies such as the Energy Watch Group assume that production no longer be extended may , as the world peak oil was reached already of 2006. Other market observers such as the International Energy Agency see a narrow market, but do not take the view that a maximum subsidy has already been reached. Rather, the cause of the price increases is insufficient investment and insufficient capacity in the oil industry. Other major factors were the crisis surrounding the Iranian nuclear program , the unrest and attacks in oil-rich Iraq, and rebel attacks on oil production facilities in Nigeria . Speculation is also assumed to drive prices up. However, with the production of crude oil from oil sands in Canada, the production of biofuel and new large conventional production areas in, for example, Angola, new oil production areas have been added.

On July 11th, 2008, the price of oil in London, on ICE Futures , the largest exchange for options and futures on oil in Europe, rose to a new record high. For the North Sea grade Brent , the leading reference oil grade in Europe, the price in the course of trading was 147.40 US dollars per barrel. The price for US light oil (WTI), the most important reference oil grade for the production region North America, reached a new record price of 147.16 US dollars per barrel on July 11, 2008 in New York on NYMEX , the world's largest commodity futures exchange .

Concerns about weak demand due to the global financial crisis , bad economic news and the resulting drop in demand for oil products caused the oil price to fall sharply in the period that followed. The North Sea variety Brent hit a four-year low on December 24, 2008 at $ 37.45. The price of the US variety WTI fell to a five-year low on December 24, 2008. During the course of trading, US $ 35.18 per barrel was charged at times, 76.1% less than five months earlier.

On October 20, 2009, the price of oil on the New York Mercantile Exchange (NYMEX) rose above the $ 80 mark for the first time since October 2008. The main reason was hopes of an imminent economic recovery and the associated expectation of increasing oil consumption worldwide. In addition, the US dollar continued to weaken against most world currencies. Nevertheless, in the course of the global economic crisis since the beginning of 2008, oil demand has fallen faster than supply. For this reason, the warehouses around the world were very full. U.S. oil inventories on May 1, 2009 were 375.258 million barrels, their highest level since 1990.

On January 31, 2011, the oil price for the North Sea variety Brent rose for the first time since October 1, 2008 in the course of trading above the 100 dollar mark and on March 1, 2011 the price for the US variety WTI also exceeded for the first time since March 1, 2011 October 2008 the limit of 100 US dollars.

On April 11, 2011, the price of North Sea Brent oil rose to US $ 126.95. One reason for the increase is the events of the Arab Spring . Investors feared a long-term loss of oil production in the country and a spread of unrest to Saudi Arabia , one of the world's largest oil exporters, because of the civil war in Libya . The great gap between Brent and other types of oil is striking: a barrel of the US reference type WTI had to be paid for on the same day as 113.45 US dollars.

On March 1, 2012, the price of Brent oil was quoted at US $ 128.38 and for WTI oil at US $ 110.55. The main reason was the tensions surrounding the Iranian nuclear program. Against this background, the EU imposed an oil embargo on the country. Iran, in turn, has repeatedly threatened to block the Strait of Hormuz . Around 20% of the world's oil is transported through this strait in the Persian Gulf .

Price slump in 2014/2015

The indebtedness of the oil companies, no longer increasing consumption rates and the announcement by OPEC in November 2014 that it would not cut production quotas led to a sharp drop in the oil price in December 2015 to below USD 30 per barrel (Brent). The reason for the continued high production is the increasing extraction of crude oil in the USA by fracking. Added to this are the relatively low production costs after the commissioning of many production sources and the lower demand due to lower economic growth, especially in China and Latin America. At an oil price of USD 30 per barrel, the operating costs of only six percent of global production can no longer be covered. As a result, it makes more sense for many companies to continue operating existing funding sources.

Highs

Previous highs of the oil types Brent and WTI in US dollars and euros per barrel.

| Type of oil | currency | Price / barrel | date |

|---|---|---|---|

| Brent | U.S. dollar | 147.40 | July 11, 2008 |

| Euro | 97.21 | 14 Mar 2012 | |

| WTI | U.S. dollar | 147.16 | July 11, 2008 |

| Euro | 92.90 | July 3, 2008 |

Annual development

The following are the annual high, low and closing levels for Brent and West Texas Intermediate (WTI) oils in US dollars per barrel. The annual performance is also shown in percent. The data for the US light oil WTI relate to the monthly average prices as published by the oil producers until 1982, then to the prices of the oil futures for WTI in Cushing , which were traded in 1983 on the New York Mercantile Exchange (NYMEX) started. Cushing, Oklahoma, is where physical US light oil is formally offered against the NYMEX future.

|

|

See also

literature

- Rainer Karlsch, Raymond G. Stokes: Factor Oil. The mineral oil industry in Germany 1859–1974 . Verlag CH Beck , Munich / Nördlingen 2003, ISBN 3-406-50276-8 .

- Bernd Meyer : Effect of a rise in oil and gas prices on the German economy . In: Economy and Statistics . No. 2 , 2008, ISSN 0043-6143 , p. 175–177 ( PDF, 2 MB - published by the Federal Statistical Office ).

Web links

- current oil price (Brent & WTI)

- Price formation on the crude oil market (December 2004) (published by the Mineralölwirtschaftsverband e.V .; PDF file; 414 kB)

- Analysis of the oil price development according to supply and demand factors (April 2008), IMF World Economic Outlook 2008 (English; PDF file; 6.03 MB)

Individual evidence

- ↑ P. Horn Sell, R. Mabro: Oil Markets and Prices: The Brent Market and the Formation of World Oil Prices . Oxford University Press, Oxford 1993.

- ^ R. Bacon, S. Tordo: Crude Oil Prices - Predicting Price Differentials Based on Quality . The World Bank Group, October 2004, Note Number 275

- ↑ Z. Wang: Hedonic prices for crude oil. In: Applied Economic Letters. 10, 2003, pp. 857-861.

- ↑ a b c d Price formation on the crude oil market. ( Memento of August 8, 2007 in the Internet Archive ) (Ed.): Mineralölwirtschaftsverband e. V. 12/2004

- ↑ International Energy Agency Oil Prices and Refinery Activity (PDF; 95 kB)

- ↑ z. B. Paul JJ Welfens: Fundamentals of Economic Policy: Institutions - Macroeconomics - Political Concepts. Springer 2007, 147: "On the oil market, the global interplay of supply and demand forms the market price."

- ↑ Friedemann Müller: Strategic conditions for the use of world energy reserves: Energy security and international security policy. In: Stefan Leible, Michael Lippert, Christian Walter (eds.): Securing the energy supply on globalized markets. Mohr Siebeck, Tübingen 2007, pp. 29–46, 31: “On the other hand, the oil price is ... very decoupled from (marginal) production costs ... Different ... in the development of global supply and global demand. The supply depends very much on existing and developing investments as well as the secured reserves, which can be measured relatively precisely. Global demand develops depending on economic growth. "

- ↑ Lonnie K. Stevans, David N. Sessions: Speculation, Futures Prices, and the US Real Price of Crude Oil. July 2, 2008. SSRN

- ^ S. Devarajan, AC Fisher: Hotelling's 'Economics of Exhaustible Resources': Fifty Years Later. In: Journal of Economic Literature. vol. XIX, March 1981, pp. 65-73.

- ^ PS Dasgupta, GM Heal: The optimal depletion of exhaustible resources. In: Review of Economic Studies, Symposium, 1974. pp. 3-28.

- ^ NV Long: Resource extraction under the uncertainty about possible nationalization. In: Journal of Economic Theory. vol. 10, no. 1, February 1975, pp. 42-53.

- ^ R. Pirog: World Oil Demand and its Effect on Oil Prices. CRS Report for Congress, Congressional Research Service, The Library of Congress, June 9, 2005, Order Code RL32530

- ^ Anne-Marie Brook, Robert Price, Douglas Sutherland, Niels Westerlund, Christophe Andre: Oil Price Developments: Drivers, Economic Consequences and Policy Responses. December 8, 2004. OECD Economics Working Paper No. 412, SSRN

- ↑ N. Krichene: World crude oil and natural gas: a demand and supply model . Energy Economic, Volume 24, Issue 6, November 2002, pp. 557-576.

- ^ L. Hunt, G. Judge, Y. Ninomiya: Underlying trends and seasonality in UK energy demand: a sectoral analysis. In: Energy Economics, Issue 25, estimate the long-term price elasticity of demand in their model, based on data for the UK energy market for the years 1971–1997, to be −0.23. D. Gately, H. Huntington: The asymmetric effects of changes in price and income on energy and oil demand. In: The Energy Journal. 2002, 23 estimate long-term price elasticity of demand in their model, which is based on data for the above Period, for OECD countries to −0.64 and non-OECD countries to −0.18. Similar results come from M. Pearan, R. Smith, T. Akiyama: Energy Demand in Asian Developing Economies. A World Bank Study, Oxford University Press, 1998.

- ↑ International Energy Agency: Medium-Term Oil Market Report 2009 (PDF; 3.2 MB) p. 104.

- ^ L. Hunt, G. Judge, Y. Ninomiya: Underlying trends and seasonality in UK energy demand: a sectoral analysis. In: Energy Economics. Issue 25, estimate the long-term income elasticity of demand in their model, which is based on data for the UK energy market for the years 1971–1997, at 0.56. D. Gately, H. Huntington: The asymmetric effects of changes in price and income on energy and oil demand. In: The Energy Journal. 2002, 23, estimate the long-term price elasticity of demand in their model, which is based on data for the above Period, for OECD countries to 0.56 and non-OECD countries to 0.53. For the Asian countries and fast-growing emerging economies, D. Gately and H. Huntington as well as M. Pearan, R. Smith, T. Akiyama: Energy Demand in Asian Developing Economies. A World Bank Study, Oxford University Press, 1998 at values around 0.95–1.2

- ^ Donald FF Larson: Uncertainty and the Price for Crude Oil Reserves . September 1996. World Bank Policy Research Working Paper No. 1655, SSRN

- ^ H. Hotelling: The economics of exhaustible resources. In: The Journal of Political Economy. Vol. 39, 1931, pp. 137-175.

- ^ RCA Minnitt: Frontiers of usefulness: The economics of exhaustible resources. In: The Journal of The Southern African Institute of Mining and Metallurgy. Vol. 107, August 2007, Refereed paper

- ↑ C.-Y. Cynthia Lin: Hotelling Revisited: Oil Prices and Endogenous Technological Progress. Mimeo . Harvard University.

- ↑ G. Farell, B. Kahn, F. Visser: Price determination in international oil markets: developments and prospects. South African Reserve Bank Quarterly Bulletin, March

- ^ PR Krugman: The energy crisis revisted. In: New York Times. 2000.

- ↑ AF Alhajji, D. Huettner: OPEC Crude and World Markets from 1973 to 1994: Cartel, Oligopoly or Competitive? In: Energy Journal. Volume 21, No. 3, 2000, pp. 31-60.

- ↑ SG Gulen: Is OPEC a Cartel? Evidence from Cointegration and Causality Tests. In: The Energy Journal. Vol. 17, Number 2, 1996, pp. 43-57.

- ↑ C. Loderer: A Test of the OPEC Cartel Hypothesis: 1974-1983. In: Journal of Finance. Vol. 40, Number 3, 1985, pp. 991-1008.

- ^ John L. Simpson: Market Efficiency and Cartel Behavior in Oil Prices. June 16, 2004. SSRN

- ↑ P. Berkmen, S. Ouliaris, H. Samiei: The Structure of the Oil Market and Causes of High Prices. Research Department (In consultation with other Departments, in particular the International Capital Markets Department) International Monetary Fund, September 21, 2005.

- ^ Michael W. Masters: Testimony before the Committee on Homeland Security and Governmental Affairs United States Senate. May 20, 2008.

- ↑ Lonnie K. Stevans, David N. Sessions: Speculation, Futures Prices, and the US Real Price of Crude Oil. July 2, 2008.

- ↑ See MS Haigh, NE Boyd, B. Buyuksahin: Herding Amongst Hedge Funds in Futures Markets. April 2007 SSRN

- ↑ Such as See, e.g., John R. Graham: Herding among investment newsletters: Theory and evidence. In: Journal of Finance. 1999, Vol. 54, pp. 237-268.

- ^ A b David Scharfstein, Jeremy Stein: Herd behavior and investment. In: American Economic Review. 80 (3), 1990, pp. 465-479.

- ↑ Russ Wermers: Mutual fund herding and the impact on stock prices. In: Journal of Finance. 54, 1999, pp. 581-622.

- ↑ S. Bikhchandani, D. Hirshleifer, I. Welch: A Theory of Fads, fashion, custom, and Cultural Change as Informational Cascades. In: The Journal of Political Economy. Vol. 100, No. 5, Oct. 1992, pp. 992-1026.

- ↑ a b c Interagency Task Force on Commodity Markets Releases Interim Report on Crude Oil, US Commodity Futures Trading Commission ( Memento of December 11, 2008 in the Internet Archive )

- ↑ J. Amuzegar: OPEC and the dollar dilemma . Foreign Affairs. 56, July 1978, pp. 740-750.

- ^ E. Mileva, N. Siegfried: Oil market structure, network effects and the choice of currency for oil invoicing. Occasional paper. European Central Bank 2007.

- ↑ Page no longer available , search in web archives: Tecson: Oil price graph in euros and US dollars

- ↑ a b c A. Breitenfellner, JC Cuaresma: Crude Oil Prices and the Euro-Dollar Exchange Rate: A Forecasting Exercise. Working Papers in Economics and Statistics, University of Innsbruck, 2008.

- ↑ S. Schulmeister: Globalization without global money: the double role of the dollar as national currency and as world currency and its consequences. In: Journal of Post Keynsian Economics. 22, 2000, pp. 365-395.

- ↑ KC Cheng: dollar depreciation and commodity prices. In: IMF, (Ed.), 2008 World Economic Outlook. International Monetary Fund, Washington DC, pp. 72-75.

- ↑ CFTC Charges Optiver Holding BV, Two Subsidiaries, and High-Ranking Employees with Manipulation of NYMEX Crude Oil, Heating Oil, and Gasoline Futures Contracts

- ^ F. Drudi, M. Massa: Price Manipulation in Parallel Markets with Different Transparency. In: Journal of Business. 78, 2005.

- ↑ M. Angeles de Frutos, C. Manzano: Trade Disclosure and Price Dispersion. In: Journal of Financial Markets. 8/2005

- ^ R. Jarrow, P. Protter: Large Traders, Hidden Arbitrage, and Complete Markets. In: Journal of Banking and Finance. 29/2005

- ^ M. Liski, JP Montero: Discussion Paper No 12 / June 2004. Helsinki Center of Economic Research, Discussion Papers, ISSN 1795-0562

- ↑ When the Commodity Futures Trading Commission examined the books of the Vitol Group, a company that does not actually deal with the actual supply of fuels, in August 2008, it found that Vitol, at least at one point in July 2008, accounted for 11% of all owned oil contracts regulated on the New York Mercantile Exchange. This discovery showed how an individual speculator can exert tremendous influence over the oil market without the knowledge of regulators. In addition, data from the CFTC showed that a significant amount of trading activity is concentrated in the hands of a few speculators. The CFTC also found that speculators and their customers account for about 81% of all oil contracts on NYMEX. This is a much larger proportion than previously assumed by the agency. Some experts blame these companies for the volatility in oil prices. CFTC documents show Vitol was one of the most active traders of oil on NYMEX when prices hit record highs. For example, on June 6, 2008, Vitol had contracts totaling 57.7 million barrels of oil - about three times the amount the United States uses every day. Washington Post regarding Vitol

- ↑ L. Nyantung Beny: Do Insider Trading Laws Matter? Some Preliminary Comparative Evidence. In: American Law and Economics Review. 7, 2005.

- ^ MK Brunnermeier, LH Pedersen: Predatory Trading. In: Journal of Finance. 60, 2005.

- ↑ a b c d R. J. Weiner: Sheep in wolves' clothing? Speculators and Price Volatility in Petroleum Markets. In: The Quarterly Review of Economics and Finance. Vol. 42, 2002, pp. 391-400.

- ^ B. Jordan, S. Jordan: Salomon Brothers and the May 1991 Treasury Auction: Analysis of a Market Corner. In: Journal of Banking and Finance. 20, # 1, January 1996, pp. 25-40.

- ↑ https://www.handelsblatt.com/finanzen/maerkte/devisen-rohstoffe/oel-saudi-arabien-rechnet-mit-weiterem-abbau-der-weltweiten-oel-reserven/24509716.html

- ↑ OPEC apparently cancels top meeting next week | 04/10/19. Retrieved April 11, 2019 .

- ↑ OPEC website (English): https://www.opec.org/opec_web/en/ , accessed on June 22, 2019

- ↑ F. Vorholz: Junk ware oil. In: Zeit Online. 18 Dec 2015.

- ^ A b Daniel Yergin: The price. The hunt for oil, money and power . S. Fischer, Frankfurt 1993.

- ^ BP: Workbook of historical data ( Memento of July 3, 2008 in the Internet Archive )

- ↑ Energy: Forests in the tank. In: Der Spiegel. 12/2006, March 20, 2006.

- ^ Federal Reserve Bank of St. Louis: Spot Oil Price: West Texas Intermediate

- ^ Rainer Karlsch, Raymond G. Stokes: Factor oil. The mineral oil industry in Germany 1859–1974 . Publishing house CH Beck, Munich 2003.

- ↑ IMF: World Economic Outlook (PDF; 6.3 MB), April 2008, p. 56.

- ↑ Record price at $ 132 - experts warn of dramatic oil shortages. In: Spiegel online. May 21, 2008.

- ↑ Oil price reaches new record. ( Memento from January 21, 2009 in the Internet Archive ) In: Tagesschau. February 19, 2008.

- ↑ That is why the oil price is skyrocketing. In: Spiegel online. October 20, 2009.

- ^ Energy Information Administration, US Oil Inventories

- ↑ Oil price above $ 120 for the first time since August 2008. In: Handelsblatt. April 4, 2011.

- ↑ Brent price up by a quarter: Speculation about the oil price. In: Telebörse. March 26, 2012.

- ↑ Oil prices continue to plummet. on: finanzen.net , December 14, 2015.

- ↑ Gerald Braunberger: High debts depress the oil price. FAZ, February 9, 2015, accessed on February 10, 2015 .

- ↑ Energy expert Werner Zittel on the causes and effects of the rapidly falling oil price. ( Memento from February 5, 2015 in the Internet Archive ) (Werner Zittel)

- ↑ Oil price falls below $ 30. 15th January 2016.

- ↑ finanzen.net

- ↑ Who's afraid of cheap oil? In: The Economist . January 23, 2016 ( economist.com ).

- ↑ a b Stooq: Oil price in USD (Brent) - historical prices

- ↑ a b Stooq: Oil price in USD (WTI) - historical rates

- ^ Finances.net: Oil price in EUR (Brent) - historical prices

- ↑ Finanz.net: Oil price in EUR (WTI) - historical prices