Eurozone

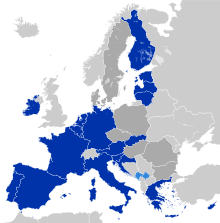

The group of EU countries that have the euro as their official currency is referred to as the euro zone (officially also euro currency area or euro area ) . The euro zone consists of 19 EU countries and is therefore referred to as Euro-19 . Lithuania last adopted the euro as its official currency on January 1, 2015.

The 19 countries of the euro area are:

- Belgium, Germany, Estonia, Finland, France, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovakia, Slovenia, Spain and the Republic of Cyprus.

Of the remaining eight EU countries, seven are obliged to introduce the euro as soon as they meet the agreed convergence criteria . Denmark can introduce the euro, but does not have to, which means it has a de jure exit option. The same was true for the former EU member United Kingdom .

The European Central Bank is responsible and responsible for the monetary policy of the euro zone . Together with the national central banks of the countries in the euro zone, it forms the Eurosystem . Within the framework of the Eurogroup, the states of the eurozone coordinate their tax and economic policies with one another, but without formal decision-making powers.

Use of terms and demarcation to the European Economic and Monetary Union

The term Eurozone itself does not appear in the founding treaties of the European Union ; its members are only referred to as “member states whose currency is the euro” ( Art. 136 ff. TFEU ). The Publications Office of the European Union does not use the term either, but instead uses the euro area or euro area to refer to “the countries participating in the euro as a whole”. In common usage, however, the term Eurozone has become established in German .

The term European Economic and Monetary Union (EMU) is sometimes used synonymously . However, this expression denotes a policy area of the EU in general. Formally, all EU member states are members of the EMU, whereby those countries that have not introduced the euro are referred to in the text of the treaty as “member states for which an exception applies” ( Art. 139 ff. FEU Treaty ).

Sometimes the euro zone is also used in a broader sense for all states that use the euro, even if they are not EU members. They either have a currency agreement with an EU member state, unilaterally introduced the euro as their currency, or they have linked the rate of their currency to the key currency, the euro.

Eurozone in the strict sense

The euro area

In a narrower sense, the euro zone comprises those member states of the European Union that have introduced the euro as their currency. To do this, they had to meet the EU convergence criteria that are intended to harmonize the eurozone in terms of economic policy. On January 1, 1999, when the euro was introduced as book money , eleven of the then fifteen member states met these criteria . Greece announced in 2000 that it also met the criteria and joined the euro area on January 1, 2001.

- Introduction of the euro with euro coins and banknotes as the official currency

- on January 1, 2002 in the twelve countries of Belgium , Germany , Finland , France , Greece, Ireland , Italy , Luxembourg , the Netherlands , Austria , Portugal and Spain

- on January 1, 2007 in Slovenia

- on January 1, 2008 in Malta and the Republic of Cyprus

- on January 1, 2009 in Slovakia

- on January 1, 2011 in Estonia

- on January 1, 2014 in Latvia

- on January 1, 2015 in Lithuania

However, there are some areas of the Member States that do not use the euro or only use it to a limited extent. This applies, for example, to Büsingen , a German exclave in Switzerland , where the euro is the official currency, but the Swiss franc is actually used.

Another exclave in Switzerland is the Italian municipality of Campione d'Italia . Campione is economically well integrated into Switzerland. The Swiss franc is the official currency.

In addition, none of the outer regions of the Netherlands (former Netherlands Antilles ) uses the euro, but the US dollar or local currencies linked to it. Some French outside areas in the Pacific use the CFP franc , which is, however, firmly pegged to the euro.

Members

The official designation for statistical measurements are:

- EA-11: First countries 1999/2000 (AT, BE, DE, ES, FI, FR, IE, IT, LU, NL, PT)

- EA-12: First countries 2001 and when cash was introduced in 2002 (EA-11 + GR)

- EA-13: from 2007 (EA-12 + SI)

- EA-15: from 2008 (EA-13 + CY, MT)

- EA-16: from 2009 (EA-15 + SK)

- EA-17: from 2011 (EA-16 + EE)

- EA-18: from 2014 (EA-17 + LV)

- EA-19: since 2015 (EA-18 + LT)

It is also Euro-11 etc. common, since 2015 Euro-19

| Euro-19 | |||

|---|---|---|---|

| country | introduction | Residents | Exceptions 1 |

|

|

January 1, 1999 | 11,467,923 (2019) | |

|

|

83,019,214 (2019) | Büsingen am Hochrhein (in fact) 2 | |

|

|

January 1, 2011 | 1,324,820 (2019) | |

|

|

January 1, 1999 | 5,517,919 (2019) | |

|

|

67,028,048 (2019) |

|

|

|

|

January 1, 2001 | 10,722,287 (2019) | |

|

|

January 1, 1999 | 4,904,226 (2019) | |

|

|

60,359,546 (2019) | Campione d'Italia 2 | |

|

|

1st of January 2014 | 1,919,968 (2019) | |

|

|

January 1, 2015 | 2,794,184 (2019) | |

|

|

January 1, 1999 | 613,894 (2019) | |

|

|

January 1, 2008 | 493,559 (2019) | |

|

|

January 1, 1999 | 17,282,163 (2019) |

former Netherlands Antilles : 4

|

|

|

8,858,775 (2019) | ||

|

|

10,276,617 (2019) | ||

|

|

January 1, 2009 | 5,450,421 (2019) | |

|

|

January 1, 2007 | 2,080,908 (2019) | |

|

|

January 1, 1999 | 46,934,632 (2019) | |

|

|

January 1, 2008 | 875,898 (2019) |

|

|

|

approx. 341,925,000 | ||

Eurozone economy

The following table shows the development of the harmonized index of consumer prices in the euro zone:

| Year (middle) | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 |

|---|---|---|---|---|---|---|---|---|---|---|

| Harmonized consumer index in percent | 1.0% | 2.0% | 2.8% | 1.9% | 1.9% | 2.5% | 2.0% | 2.5% | 1.9% | |

| Increase based on one euro in 1998 | 1.00 € | € 1.01 | € 1.03 | € 1.06 | € 1.08 | € 1.10 | € 1.13 | € 1.15 | € 1.18 | 1.20 € |

| Year (middle) | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Harmonized consumer index in percent | 4.0% | −0.1% | 1.5% | 2.7% | 2.4% | 1.6% | 0.5% | 0.0% | 0.2% | 1.5% |

| Increase based on one euro in 1998 | € 1.25 | € 1.25 | € 1.27 | 1.30 € | € 1.34 | € 1.36 | € 1.36 | € 1.36 | € 1.36 | € 1.38 |

| Year (middle) | 2018 | |||||||||

| Harmonized consumer index in percent | 1.8% | |||||||||

| Increase based on one euro in 1998 | 1.40 € | |||||||||

Eurozone in a broader sense

States and territories outside the EU that use the euro as their currency

Some countries outside of the European Union also use the euro as their currency. At the time of the introduction of the euro, some of these mostly very small states had agreements with an EU member state on monetary union ; in some cases they unilaterally renounced the introduction of their own currency and instead allowed the euro to circulate as a foreign currency (so-called euroization ). The countries that use the euro outside the EU do not participate in the Eurosystem or the Eurogroup. The European Central Bank also does not formally take into account the economic situation in these countries when determining its monetary policy.

With formal agreements

| State / Territory | introduction | agreement | Residents |

|---|---|---|---|

|

|

(Jan. 1, 1999) April 1, 2012 |

June 30, 2011 Jan. 26, 2016 |

76,177 (2019) |

|

|

Jan. 1, 1999 | Dec 24, 2001 Oct 13, 2012 |

38,300 (2019) |

|

|

Jan. 1, 1999 | Oct 29, 2010 | 9,793 (2016) |

|

|

Jan. 1, 1999 | Dec 31, 1998 | 6,008 (2016) |

|

|

Jan. 1, 1999 | Nov 29, 2000 March 27, 2012 |

34,590 (2019) |

|

|

Jan. 1, 1999 | Dec. 29, 2000 Dec. 17, 2009 |

605 (2017) |

Several states and dependent territories outside the EU use the euro as their official currency. For an introduction that includes the right to mint your own coins, an agreement must be concluded with the EU and a country in the euro zone.

Monaco, San Marino and Vatican City

Until the introduction of the euro, these countries used their own currencies, which were linked to the currency of the neighboring country in a 1: 1 ratio and were in circulation there on an equal footing. San Marino and the Vatican had their currencies pegged to the Italian lira and Monaco used the Monegasque franc pegged to the French franc .

These countries have agreements with the EU and the Member States: San Marino and the Vatican with Italy and Monaco with France, which allow them to use and mint a limited number of euro coins (with their own national motifs on the reverse). Your coins are valid throughout the euro area. However, they are not allowed to print banknotes.

Andorra

Andorra had de facto the French franc and the Spanish peseta as currency until January 1, 2002, the date when euro cash was introduced in the euro area , but never had an agreement with Spain or France . Negotiations with the European Union on the official status of the euro in Andorra started in 2004, but no agreement could be reached for years. Andorran banking secrecy was the biggest obstacle. Finally, on June 30, 2011, the currency agreement was signed, which came into force on April 1, 2012. It was not until November 20, 2013 that the Andorran government passed the decrees required under the currency agreement to implement European standards. At the beginning of December 2013, the EU gave the green light for the minting of Andorran euro coins, which were first issued on December 29, 2014. The right to mint has an annual volume of 2.4 million euros.

Saint-Pierre and Miquelon, Mayotte

Currency agreements were also concluded for two French overseas territories : Saint-Pierre and Miquelon off the coast of Canada and Mayotte in the Indian Ocean , which were not part of the EU when the euro was introduced, were nevertheless allowed to use the euro as currency from the start. However, you are not allowed to mint your own coins.

Since Mayotte became the 101st department of France on March 31, 2011 and an overseas territory of the European Union on January 1, 2014 , it has officially been part of the euro area since then.

Saint Barthélemy

As of January 1, 2012, the French island of Saint Barthélemy is no longer part of the European Union as an Associated Overseas Territory ( OCT ) , but retains the euro as legal tender due to a treaty between France and the EU.

Without any formal agreement

| State / Territory | introduction | takeover | Residents |

|---|---|---|---|

|

|

Jan. 1, 2008 | informal | 15,500 (2011) |

|

|

Jan. 1, 2002 | informal | 1,798,506 (2018) |

|

|

Jan. 1, 2002 | informal | 622,359 (2018) |

- With the introduction of the euro in the Republic of Cyprus, the British military bases Akrotiri and Dekelia , which used the Cyprus pound as their currency before the introduction of the euro , also adopted the euro as their currency. The military bases are overseas territories of the United Kingdom , but have never been part of the EU and are under military jurisdiction. Regardless of their case law, the introduction of the euro was carried out in accordance with the case law of the Republic of Cyprus.

- Montenegro and Kosovo have been using the euro since its inception; before that, their currency was the German mark , which had replaced the Yugoslav dinar . When the D-Mark was replaced by the Euro, they took over the Euro through unilateral euroization . There is no agreement with the ECB on the use of the euro. In Kosovo there is also the Serbian dinar in circulation, which is used in areas with a predominantly Serbian population.

- The introduction of the euro in Montenegro and Kosovo brought economic benefits for the countries. For this reason, the Commissioner for Economic and Monetary Affairs Joaquín Almunia encouraged the introduction of the euro in small states. The then President of the European Central Bank Jean-Claude Trichet made it clear that the ECB - which does not support the unilateral introduction of the euro - sees no reasons for introducing the euro in other countries.

- Since the suspension of the Zimbabwean dollar in April 2009, the euro has been legal tender in Zimbabwe (Africa) alongside the US dollar and the South African rand .

States and territories that have pegged their currency to the euro

Some countries have pegged their currency to the euro at a fixed exchange rate . In economic terms, this has similar effects to the unilateral introduction of the euro, but the continued existence of a nominally separate currency would make it easier to break this link in the event of a monetary policy reorientation.

- The Cape Verde currency is pegged to the euro because the Cape Verde escudo was pegged to the Portuguese escudo before the euro was introduced .

- In an agreement with Portugal, São Tomé and Príncipe has pegged its currency, the Dobra , to the euro from the beginning of 2010.

- The CFA and Comoros francs used in former colonies of France and the CFP francs used in the French overseas territories in the Pacific are pegged to the euro as they were previously pegged to the French franc.

- Before the introduction of the euro , the currency of Bosnia and Herzegovina , the convertible mark , was pegged to the German mark, which was replaced by the euro.

With Bulgaria a EU member state has tied its currency at a fixed exchange rate to the euro. The lev , the Bulgarian currency, was pegged to the German mark at a ratio of 1: 1 in 1999 , so that the currency today has a fixed exchange rate of 1.95583 BGN = 1 EUR. However, the introduction of the euro itself has so far failed due to Bulgarian inflation, which is too high to meet the EU convergence criteria . In addition, accession to Exchange Rate Mechanism II is a prerequisite for the introduction of the euro, which was announced on July 10, 2020.

The Lithuanian litas was pegged to the US dollar from 1994 to 2002. In February 2002, before Lithuania joined the EU, this bond was changed to euros at a rate of EUR 1 = LTL 3.4528. As of January 1, 2015, Lithuania became the 19th member of the euro area.

EU countries that have pegged their currency to the euro with certain exchange rate ranges

Some EU member states have pegged their currency to the euro within a certain exchange rate range . They participate in a process whereby their central banks must intervene if the exchange rate deviates by more than a certain percentage from a previously established central rate . This is the so-called Exchange Rate Mechanism II (ERM II), which was introduced when the euro was introduced in 1999 as the successor to the European Monetary System founded in 1979 . A country's participation in ERM II for at least two years is a prerequisite for introducing the euro.

From January 2015 to July 2020, only Denmark had its national currency linked to the euro via ERM II (fluctuation range: ± 2.25%). Bulgaria and Croatia were added in July 2020.

With Greenland and the Faroe Islands, two non-EU members also indirectly participate in ERM II. In Greenland, the Danish krona is used, in the Faroe Islands the Faroese krona , which is linked 1: 1 to the Danish krona. On March 29, 2005, a statement by the Danish government made it clear that in the event of Denmark joining the euro zone, the Faroe Islands (analogous to Greenland) can keep the krona if they so choose. According to the will of the Sjálvstýrisflokkurin party, however, it could turn out the other way round: while the Danes were against joining the euro zone, the Faroe Islands applied to join in August 2009.

| Members of the Exchange Rate Mechanism II | |||||||

|---|---|---|---|---|---|---|---|

| country | currency | ISO 4217 | Central rate (1 EUR =) |

Guaranteed exchange rate range |

ERM II accession | Embargo period for euro introduction |

(Planned) introduction of the euro |

|

|

Bulgarian lev | BGN | 1.95583 | ± 15% (both sides) | July 10, 2020 | July 10, 2022 | 2022 |

|

|

Danish crown | DKK | 7.46038 | ± 2.25% (both sides) | January 1, 1999 | expired | no current plans |

|

|

Croatian kuna | HRK | 7.53450 | ± 15% (both sides) | July 10, 2020 | July 10, 2022 | 2022 |

Non-EU countries that previously pegged their currency to the euro via exchange rate limits (Switzerland and Liechtenstein)

From 2011 to 2015, Switzerland , together with Liechtenstein , which also uses the Swiss franc , used an independent way of preventing its own currency from strengthening too much.

In view of the devaluation of the euro with the debt crisis , the rate, which had fallen to 1 euro = CHF 1.0451 (August 10, 2011), was felt to be intolerable because it paralyzed Switzerland's exports. The Swiss National Bank (SNB) subsequently set a minimum exchange rate on September 6, 2011, which is CHF 1.20. To achieve this, the franc was deliberately devalued by scooping up money and buying euros until the desired rate was reached. "The National Bank will enforce the minimum exchange rate with all consistency and is ready to buy unlimited foreign currency," announced the SNB. The aim is "a clear and permanent weakening of the Swiss franc". This measure was purely national and took place without any consultation with the ECB (and was therefore not an actual coupling). Switzerland had already supported the euro before, but gave up in 2010.

On January 15, 2015, politics was abandoned again. The reason given was that the effort had grown due to the weak euro.

| Countries with unilateral exchange rate fluctuation limits to the euro | |||||

|---|---|---|---|---|---|

| country | currency | ISO 4217 | Central rate (1 EUR =) |

criteria | Period |

|

|

Swiss franc | CHF | ≥ 1.20 | Lower limit SNB | September 6, 2011 to January 15, 2015 |

States that have pegged their currency to the euro via a currency basket

Various countries outside the European Union have tied the exchange rates of their currencies to currency baskets, in which the euro is involved alongside other currencies. This applies, for example, to the Moroccan dirham , whose exchange rate is 80% dependent on the euro and 20% on the US dollar .

From 2004 until at least 2010, the Russian ruble was also pegged to a basket of currencies that was 45% dependent on the euro and 55% on the dollar.

Similarly, the Chinese renminbi was already dependent on a basket of currencies that included the euro, albeit at a significantly lower level than the US dollar.

The Special Drawing Right (SDR) of the International Monetary Fund is also linked to a currency basket in which the euro is represented (in addition to the US dollar, the Japanese yen and the British pound as additional currencies) in the period 2011 to 2016 with a weight of 37 , 4% and from October 2016 with 30.9%.

Overview

| category | Residents | Countries and territories |

|---|---|---|

| EU members using the euro (Euro-19) | 342 million | Belgium, Germany, Estonia, Finland, France (including overseas territories belonging to the EU ), Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovakia, Slovenia, Spain and the Republic of Cyprus |

| Other European countries and areas using the euro | 2.6 million | Andorra, Kosovo, Monaco, Montenegro, San Marino and Vatican City |

| Non-EU areas outside Europe that use the euro | 0.02 million | Saint-Barthélemy , Saint-Pierre and Miquelon , French Southern and Antarctic Lands ( de jure , as only temporarily inhabited by station staff) and Clipperton Island ( de jure , as uninhabited), British 'sovereign base areas' Akrotiri and Dekelia |

| EU members whose currency is firmly pegged to the euro | 7.0 million | Bulgaria |

| Other European countries whose currency is tied to the euro | 3.5 million | Bosnia and Herzegovina |

| African countries whose currency is firmly pegged to the euro | 176 million | CFA franc BEAC / BCEAO : Benin , Burkina Faso , Cameroon , Central African Republic , Chad , Ivory Coast , Equatorial Guinea , Gabon , Guinea-Bissau , Mali , Niger , Republic of the Congo , Senegal and Togo |

| 1.6 million | Cape Verde , Comoros and São Tomé and Príncipe | |

| Oceanic areas whose currency is firmly pegged to the euro | 0.6 million | CFP Franc : French Polynesia , New Caledonia and Wallis and Futuna |

| EU members whose currency is pegged to the euro with exchange rate margins | 10.0 million | Denmark, Croatia |

| total | 543 million | 46 states and 8 territories |

Possible enlargements of the euro area

Extensions via ERM II

Of the 27 EU countries, 19 have introduced the euro as their currency, three countries (Bulgaria, Denmark and Croatia) are currently participating in ERM II. This leaves five countries as future candidates for participation in ERM II.

| Candidates for accession to the Exchange Rate Mechanism II | |||

|---|---|---|---|

| country | currency | ISO 4217 | Planning / assessments |

|

|

Zloty | PLN | Joining in the medium term not planned; no opt-out |

|

|

Romanian leu | RON | Euro accession planned for 2024 d. H. Accession to ERM II by 2022 at the latest |

|

|

Swedish crown | SEK | Joining in the medium term not planned; no opt-out |

|

|

Czech crown | CZK | Joining in the medium term not planned; no opt-out |

|

|

Forints | HOOF | Joining in the medium term not planned; no opt-out |

With the exception of Denmark, all EU countries are obliged to introduce the euro and thus also to join ERM II beforehand. Before leaving the EU, the United Kingdom was also exempt from the obligation to join the euro and was never a participant in ERM II.

A special case is the potential member Sweden , which until further notice is deliberately violating one of the convergence criteria. Although the other convergence criteria would allow the introduction of the euro, Sweden refuses membership in ERM II. It was announced that it would only want to introduce the euro after a positive referendum . Strictly speaking, this behavior violates the Maastricht Treaty as Sweden, unlike Denmark, does not have an official opt-out. Nevertheless, it is tacitly tolerated by the EU Commission, since the euro was only introduced in 1999, but Sweden joined the EU in 1995. However, the Commission has also indicated that for those countries which only joined the EU after 1999, the introduction of the euro was "part of the overall package" and an "unofficial opt-out" based on the Swedish model will therefore not be accepted would.

Special case of the Turkish Republic of Northern Cyprus

A special case is the Turkish Republic of Northern Cyprus , which regards itself as an independent state and officially uses the Turkish Lira , while from the EU's point of view it is part of the Republic of Cyprus and thus part of the Eurozone. In fact, both currencies are in use, with the euro being seen as a means of promoting intra-Cypriot trade and reducing dependence on Turkey .

Scenarios for an exit from the euro zone

As a result of the Greek sovereign debt crisis , there has been speculation since 2012 about a colloquial “ Grexit ”, ie Greece's exit from the euro zone. Entry into the euro zone is, however, "irrevocable" according to Art. 140 Para. 3 of the Treaty on the Functioning of the European Union .

literature

- Alexander Schellinger, Philipp Steinberg (ed.): The future of the euro zone. How we can save the euro and hold Europe together. transcript, Bielefeld 2016, ISBN 978-3-8376-3636-9 .

Web links

Individual evidence

- ↑ The euro is there, the prosperity is missing. In: tagesschau.de . January 1, 2015, accessed January 1, 2015 .

- ↑ Countries, languages, currencies. In: Interinstitutional Rules for Publications. Publications Office of the European Union , accessed on 6 January 2011 .

- ↑ See EUabc.com: Eurozone .

- ↑ ECB: First cash changeover (2002)

- ^ ECB: The euro cash changeover in Slovenia

- ^ ECB: The euro cash changeover in Malta

- ↑ ECB: The euro cash changeover in the Republic of Cyprus

- ↑ ECB: The euro cash changeover in Slovakia

- ^ ECB: The euro cash changeover in Estonia

- ↑ Information from the municipality of Büsingen on the currency ( Memento from August 24, 2014 in the Internet Archive )

- ↑ Glossary: Euro area enlargements , Eurostat, epp.eurostat.ec.europa.eu.

- ↑ a b c d e f g h i j k Population on January 1st (since 2008), Eurostat, epp.eurostat.ec.europa.eu.

- ↑ Euro area (changing composition) - HICP - Overall index, Annual rate of change, Eurostat, Neither seasonally or working day adjusted

- ↑ Currency agreement between the European Union and the Principality of Andorra (PDF; 778 kB), accessed on January 2, 2012.

- ↑ Amendment to the annex to the currency agreement between the European Union and the Principality of Andorra , accessed on July 22, 2016

- ↑ Monetary Agreement between the Government of the French Republic and the Government of His Highness the Prince of Monaco , accessed April 15, 2014

- ↑ Monetary Agreement between the European Union and the Principality of Monaco , accessed on April 14, 2014

- ↑ Monetary agreement between the EU and the French Republic on keeping the euro in Saint-Barthélemy , accessed on January 12, 2014

- ↑ a b c Legal populations of foreign collectivities in 2016 , INSEE; accessed on August 13, 2019.

- ↑ Statement of the ECB on the currency regime in the French areas of Saint-Pierre-et-Miquelon , accessed on January 12, 2014

- ↑ Monetary Agreement between the Republic of Italy and the Republic of San Marino , accessed April 15, 2014

- ↑ Monetary Agreement between the European Union and the Republic of San Marino , accessed on April 14, 2014

- ↑ Monetary Agreement between the Italian Republic and the Vatican City State, represented by the Holy See , accessed April 15, 2014

- ^ Currency Agreement between the European Union and the Vatican City State , accessed on April 14, 2014

- ↑ Vite da laici in Vaticano… , Corriere della Sera on June 4, 2017 (Italian); accessed on August 13, 2019.

- ^ The euro outside the euro area

- ↑ Official Journal of the European Union, October 5, 2012: Entry into force of the currency agreement with the Principality of Andorra (PDF; 604 KB), accessed on January 1, 2014.

- ^ Agreements concerning the French territorial communities

- ↑ Decision of the European Council of October 29, 2010 to change the status of the island of Saint-Barthélemy vis-à-vis the European Union (2010/718 / EU) , accessed on January 5, 2012

- ↑ Monetary Agreement between the European Union and the French Republic on the retention of the euro in Saint-Barthélemy after its status against the European Union , accessed on January 5, 2012

- ↑ a b c d The World Factbook , CIA; accessed on August 13, 2019.

- ↑ The Times , December 27, 2007: Euro reaches field that is for ever England

- ↑ International Herald Tribune , January 1, 2007: Euro used as legal tender in non-EU nations ( Memento of January 28, 2007 in the Internet Archive )

- ↑ KOUCHNER SIGNS REGULATION ON FOREIGN CURRENCY ( Memento from December 2, 2008 in the Internet Archive )

- ↑ Euro contenders: introduction of the euro in Bulgaria , accessed on August 20, 2007

- ↑ Euro wanted as currency in Faroe Islands. Retrieved March 26, 2011 .

- ↑ Uppskot til samtyktar um at taka upp samráðingar um treytir fyri evru sum føroyskt gjaldoyra. (PDF; 32 kB) Retrieved on March 26, 2011 (Faroese).

- ↑ http://www.ecb.int/stats/exchange/eurofxref/html/eurofxref-graph-chf.en.html

- ↑ Press release of the Swiss National Bank of September 7, 2011 (PDF; 57 kB), accessed on March 25, 2013.

- ↑ Central bank sets minimum exchange rate: Swiss francs pegged to euros , tagesschau.de, September 6, 2011; Quotes ibid

- ↑ End of minimum exchange rate: Swiss central bank drops the euro. In: Spiegel Online . January 15, 2015, accessed June 9, 2018 .

- ↑ L'Économiste , Comment le dirham est-il coté? .

- ↑ Online-artikel.de, January 15, 2010: About Moscow's dissatisfaction with the ruble exchange rate ( Memento of 23 January 2010 at the Internet Archive ).

- ↑ a b European Commission www.ec.europa.eu, accessed on December 1, 2010.

- ↑ Poland wants to stay out of the euro zone. In: newsburger.de. August 22, 2019. Retrieved August 25, 2019 .

- ↑ Government wants to introduce the euro by 2024. February 1, 2019, accessed on February 9, 2019 .

- ^ Stefan Menzel, Helmut Steuer, Matthias Thibaut: The Czech Republic and the Scandinavians resist. In: handelsblatt.com . December 29, 2010, accessed February 16, 2015 .

- ↑ Still no recommendation to introduce the euro. December 12, 2018, accessed July 11, 2020 .

- ↑ András Szigetvari: "Euro-accession not before 2020". In: derstandard.at . March 2, 2011, accessed February 16, 2015 .

- ↑ International Herald Tribune , In north Cyprus, the Turkish lira is the official currency, but euro is embraced ( Memento of December 8, 2008 in the Internet Archive )

- ↑ August 30, 2013, Münster: Workshop on “Parallel currencies to the euro” ( Memento from March 4, 2016 in the Internet Archive ) pdf 185 kB, accessed on May 23, 2015

- ↑ Jörg Haas: Risk Grexit: Caution when negotiating, policy paper No. 126 of the Jacques Delors Institute Berlin of February 16, 2015, p. 4 ( PDF ( Memento of July 1, 2015 in the Internet Archive ))