Bitcoin

| Bitcoin | |

|---|---|

|

|

|

| symbol | BTC |

| Publishing year | 2009 |

| founder | Satoshi Nakamoto (pseudonym) |

| Start date | January 3, 2009 |

| White paper | "Bitcoin: A Peer-to-Peer Electronic Cash System" |

| Circulation supply | 18,660,000 (as of March 20, 2021) |

| Maximum supply | 21,000,000 or 20,999,999.97690000 |

| Blockchain | 401 GB (as of 07/2021) |

| Mining | SHA-2 56 |

| Code repository | https://github.com/bitcoin/bitcoin |

| Website | www.bitcoin.org |

Bitcoin is the first and world's strongest crypto currency based on a decentralized booking system . Payments are legitimized cryptographically ( digital signature ) and a computer network equal computer ( peer-to-peer ) settled. In contrast to what is customary in the classic banking system , subsequent settlement between the parties involved is neither necessary nor possible with these cash movements .

etymology

The compound is made up of “ Bit -” as a unit of measurement for the amount of data in digital data and “coin” ( German “Münze” ), ie “digital coin”.

General

Proof of ownership of Bitcoin is stored in personal digital wallets . The price of a Bitcoin to legal tender (fiat money) follows the principle of price formation on the stock exchange.

The Bitcoin payment system was invented by Satoshi Nakamoto, who appears under a pseudonym, in 2007, who described it in a publication in November 2008 and published an open source reference software for it in January 2009 . The Bitcoin network is based on a decentralized database managed jointly by the participants, the blockchain , in which all transactions are recorded. With the help of cryptographic techniques , it is ensured that valid transactions with Bitcoins can only be carried out by the respective owner and that monetary units cannot be spent more than once. In contrast to the issue of new banknotes by a central bank, new Bitcoin units are created through the computer-based solution of cryptographic tasks, known as mining , although the maximum amount is limited to 21 million Bitcoins. Most of them have already been created.

History and course development

|

US dollar / Bitcoin |

first reached |

days needed |

|---|---|---|

| 0.1 | Oct 9, 2010 | - |

| 1 | Feb 9, 2011 | 184 |

| 10 | Jun 2, 2011 | 113 |

| 100 | Apr 1, 2013 | 699 |

| 1,000 | Nov 27, 2013 | 210 |

| 10,000 | Nov 29, 2017 | 1,463 |

| 20,000 | Dec 16, 2020 | 1,113 |

| 30,000 | Jan. 2, 2021 | 17th |

| 40,000 | Jan 8, 2021 | 6th |

| 50,000 | Feb 16, 2021 | 39 |

| 60,000 | 13th Mar 2021 | 25th |

| Bitcoin | U.S. dollar | date |

|---|---|---|

| 1 | 64,748.91 | April 14, 2021 |

The concept of Bitcoin was suggested in a 2008 white paper by Satoshi Nakamoto on a mailing list about cryptography . So far it has not been known whether Satoshi Nakamoto is the name of a real person , a pseudonym or a collective pseudonym for a group of people. Bitcoin is the first successful attempt to establish digital cash. Since the 1990s, attempts have been made in the context of the cypherpunk movement to create a digital equivalent of cash with the help of cryptographic processes. After various centrally organized attempts - such as eCash by David Chaum - failed, a few Cypherpunks in the late 1990s thought about methods to create a digital transaction system that worked without a central authority. Hal Finney's Reusable Proof of Work, Wei Dais b-money and Nick Szabos bit gold were important forerunners of Bitcoin, even if they never got beyond the state of a theoretical sketch.

With the Bitcoin whitepaper, Satoshi presented the first fully formulated method to generate a purely decentralized transaction system for digital cash. In a forum he writes:

“The core problem with conventional currencies is the level of trust it takes to make them work. The central bank must be trusted not to devalue the currency, but the history of fiat money is full of betrayal of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it in waves of credit bubbles with a small fraction of cover. We have to trust the banks with our privacy, trust that they don't give identity thieves the opportunity to empty our accounts. Their massive additional costs make micropayments impossible.

A generation earlier, users of time-sharing computer systems faced a similar problem. Before the advent of strong encryption, users had to rely on password protection for their data and trust the system administrator to keep their information confidential. This privacy could be revoked at any time if the administrator determined that it was less important than other concerns, or at the direction of his manager. But then strong encryption became available to the masses of users and trust was no longer necessary. Data could be secured in a way that made it impossible for third parties to access it - for whatever reason, with any good excuses, or whatever.

It's time we did the same with money. With an electronic currency that is based on cryptographic evidence and does not require trust in middlemen, money is safe and can be transferred effortlessly. "

The Bitcoin network was created on January 3, 2009 with the creation of the first 50 Bitcoin and the generation of "Block 0", the so-called Genesis Block. In its only transaction, the Coinbase , the following message was encoded:

The Times 03 / Jan / 2009 Chancellor on brink of second bailout for banks

" The Times January 03, 2009 British Treasury Secretary on the verge of a second bailout for banks."

This quotes the front page headline of the British newspaper The Times on January 3, 2009 and alludes to the banking and financial crisis that began in 2007 . A few days later, the first version of the Bitcoin reference software Bitcoin Core was published under the pseudonym "Satoshi Nakamoto" .

Starting time until 2011

The first exchange rate for Bitcoin was $ 0.07 and was calculated by New Liberty Standard based on the production costs for mining. According to this calculation, one dollar could have bought about 13.10 bitcoins.

Bitcoins initially had no quantifiable value in other currencies. In 2010 the first exchange rates were negotiated by people in the Bitcointalk forums, the first exchange of goods for Bitcoin took place on May 22, 2010; 2 pizzas were traded for 10,000 Bitcoin. The exchange rate from US dollars to Bitcoins was mostly only in the single-digit range until the end of 2011, i. In other words, apart from a sharp rise in the price in June 2011, one received a Bitcoin for less than 10 US dollars. The exchange rate is subject to strong fluctuations from the start.

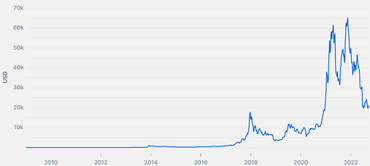

Rapid increase in 2012–2017

In the course of 2012, an upward trend set in, which noticeably intensified at the beginning of 2013. This drove the price to over $ 200 in mid-April. After setbacks in the meantime, Bitcoin exceeded the US $ 1,000 mark for the first time on November 30, 2013, but then fell, accompanied by the bankruptcy of the Bitcoin trading platform Mt.Gox , to below US $ 250 by the beginning of 2015 it slowly began to rise again in October 2015. In early 2016 it was trading at just under $ 450 and continued to rise until it closed the year at just under $ 1,000. In 2017, Bitcoin recorded the highest inflow of capital so far. The rapid price development accelerated before the start of the Bitcoin futures in mid-December. Almost $ 20,000 was hit on December 17th. The year 2017 ended with a balance of approximately 14,000 US dollars.

Since 2018

In 2018 things went downhill with fluctuations. At the end of November, the price fell below $ 4,000. In mid-December 2018, a low was marked at around $ 3,200. A recovery set in in early April 2019, topping the $ 5,000 mark again. According to experts, Facebook's plan for its own internet currency helped push Bitcoin back above the $ 10,000 mark in June 2019. After reaching a peak of almost 13,000 US dollars, the price fell again. The year 2019 ended with a total of about 7,200 dollars.

Since 2020

The price initially rose in 2020, and the $ 10,000 mark was exceeded again in February. The crash of the world stock exchanges in March as a result of the corona pandemic was followed by Bitcoin down to around 4,000 dollars. Like the stocks, it recovered and, accompanied by the usual fluctuations, rose again to US $ 10,000 in July, below which it only fell below for a brief period in early September. From the beginning of October things went up steeply. At the end of November, the all-time high of 2017 was just exceeded and in mid-December the price rose above $ 20,000 for the first time. Bitcoin passed the $ 25,000 mark on December 26, 2020.

Since 2021

Bitcoin passed the $ 30,000 mark on January 2, 2021. Just a few days later, it briefly exceeded $ 40,000. After Tesla, Inc. announced an investment of $ 1.5 billion in Bitcoin in February 2021 , the price shot to new highs. The previous all-time high was reached on April 14, 2021 at $ 64,748.91. But then Bitcoin lost about half of its value again and in mid-2021 was quoted at roughly the same level as at the beginning of the year.

On June 8, 2021, the parliament of El Salvador passed a law introducing the cryptocurrency Bitcoin as an additional official national currency, with the votes of the ruling party Nuevas Ideas led by President Nayib Bukele . This process is so far unique in the world. A period of 90 days has been set for the central bank and the financial market regulator to implement the changeover. In addition, El Salvador wants to start mining bitcoins as soon as possible. For this purpose, clean and renewable energy from geothermal energy from the country's volcanoes is to be used.

functionality

Bitcoin can be used as payment system be considered as monetary unit as a distributed configuration in a computer network using a native software manages and scooped is. The system is based on a decentralized database managed jointly by the participants , in which all transactions are recorded in a blockchain . The only condition for participation is a Bitcoin client or the use of an online service provider that provides the appropriate functionality. As a result, the Bitcoin system is not subject to any geographical restrictions - apart from the availability of an Internet connection - and can be used across borders.

Bitcoin payment system

The Bitcoin payment system consists of a database , the blockchain , a kind of journal in which all Bitcoin transactions are recorded. The Bitcoin payment system uses a peer-to-peer network to which all participating computers connect using a program. All Bitcoin transactions are recorded in this Bitcoin network . The blockchain is stored redundantly and decentrally on all Bitcoin nodes, managed and continuously updated via the Bitcoin network.

To use the Bitcoin system for payments, a digital wallet is (English Wallet ) and requires an Internet connection. Bitcoin wallets are available as desktop applications such as B. Bitcoin Core and Electrum as well as web applications . In addition, it is also possible to use hardware wallets, separate devices that e.g. B. can be connected to a computer via USB and offer increased security in many scenarios. There are also online services that offer to manage users' digital wallets. The personal wallet contains cryptographic keys to authorize payments. While in the early days of Bitcoin, users managed their keys directly (e.g. as a list in a file or on paper), due to the error-proneness of this process, deterministic wallets have become established today in which the user only has to memorize a secret phrase (“ Seed ”) from which any number of private keys can be determined deterministically using an algorithm. The digital wallet must be protected against loss, spying and malware .

Payments are made to pseudonymous addresses, hash values of public keys, which are generated by the wallet software on the basis of the secret keys it manages. Bitcoin does not allow the trading partners to be identified. However , the system does not guarantee complete anonymity either, since the chain of all transactions is publicly recorded in the transaction history and it is in principle possible to link Bitcoin addresses with identifying information. As with payments with commodity money , a Bitcoin transaction cannot be revoked once it has been confirmed by the network. The first confirmation of a payment takes an average of ten minutes, but in individual cases or if only very low fees are paid, it can take several hours. As the time elapses, further confirmations are added in the form of found blocks, which increase the liability of the payment. A fee can be paid to carry out a payment, whereby payments with higher fees are preferred.

Bitcoin, the virtual monetary unit

The virtual currency and billing unit Bitcoins is created , stored and managed in a decentralized manner in a computer network . Bitcoins can be broken up into smaller units to allow for smaller transactions . The satoshi is the smallest unit of the cryptocurrency Bitcoin. It is named after Satoshi Nakamoto , the creator of the protocol. The ratio of Satoshi to Bitcoin is 100 million Satoshis to one Bitcoin.

In simple terms, bitcoins are exchanged electronically between the participants. Their possession is evidenced by the possession of cryptographic keys. Every transaction of monetary units is provided with a digital signature and recorded in a public database , the blockchain , operated by the entire network .

Bitcoin monetary units can currently also be exchanged for other means of payment and currencies on special - mostly unregulated - online exchanges , similar to the foreign exchange market .

New units of crypto money are gradually being created by what is known as mining . The Bitcoin participants can participate in the generation by using computing power . All participants compete for an amount that is distributed to one of the participants about every ten minutes, as well as for the acquisition of the transaction fees. The result of the complex calculation is used to confirm third-party payments and secure the operation of the Bitcoin network. The maximum amount of money is set by the network protocol at almost 21 million (20,999,999.97690000) units and cannot be influenced by individual participants.

properties

- Counterfeit security

- A forgery of units or transactions is not possible with the means available at the moment (2017) due to the asymmetric cryptographic procedure used , which generates and verifies digital signatures . The blockchain prevents the same bitcoins from being issued twice. An attacker would have to spend on average more computing time than all honest Bitcoin participants combined to create an alternative blockchain with a different transaction history. However, this only applies to transactions that have already been confirmed.

- Cost and speed of execution

- Payments can be processed between the parties without the involvement of financial institutions. In order for a transaction to be confirmed, the creator specifies a fee, which he usually makes dependent on the load on the network. At a time of high utilization (as of December 2017), this was around € 19.50 (with a Bitcoin rate of € 13,000 and 1.5 mBTC per 266 byte transaction). In the past, this transaction fee was significantly lower and fell significantly again in 2018. If a higher fee is selected, this can accelerate the confirmation process through a higher priority in the calculation, while the omission of the fee - which is technically still possible in some cases - extends the duration of the confirmation or makes the execution of the transaction unsafe. The fee is credited to the participant ("miner") who creates a new block with this transaction. This is to prevent the network from being overloaded with a large number of small transactions. In the long term, these fees are planned as a reward for maintaining the network by providing computing power.

- The confirmation of a payment takes as long as the creation of a new block, i.e. an average of 10 minutes. However, there is no immediate consensus in the system about a single confirmation. Each further confirmation, which again takes about 10 minutes, increases the likelihood that the payment will be retained permanently. After six consecutive confirmations, a payment is deemed to be sufficiently binding.

- Decentralization

- Due to the peer-to-peer structure, the system is completely decentralized , similar to systems like BitTorrent . Influence on the money supply would require that the majority of the mining computing power is carried out with modified software, otherwise a fork of protocol and payment unit that is not generally recognized would arise.

- Scarcity

- The maximum possible number of all Bitcoins is 21 million; since “lost” bitcoins cannot be replaced, the actual number of bitcoins in circulation will remain well below this value, even if all bitcoins have been mined. Bitcoins therefore have the property of scarcity . By halving the block reward for calculating a new block after every 210,000 blocks, the supply of new bitcoins also decreases (see section Mining ), which (in the event that demand continues to increase) leads to an additional shortage of supply.

- The stock-to-flow ratio can be used to determine the scarcity of a good. The amount of goods in circulation (the “stock”) is divided by the annual production rate (the “flow”). The quotient indicates the number of years it takes at the current production rate to produce the amount of the respective good in circulation.

- In 2019, Bitcoin had a stock-to-flow value of 56. (For comparison: the value for gold was 62.)

- Spelling, symbols and presentation

- Based on the three-letter codes of ISO 4217 , BTC is the abbreviation for the currency unit. Some websites use the Thai baht฿ ( U + 0E3F ) symbol , which is a B with a vertical bar, and the two-dash spelling is also used. The fragments of a bitcoin, i.e. the smallest subdivision of 1 / 100,000,000 that can be represented in the current protocol, were named "Satoshi" in honor of the inventor.

- Irreversibility of transactions

- Payments with Bitcoin that have been confirmed in the blockchain cannot be reversed. This is an advantage for the seller in online trading , as it is not possible to reverse payments in the case of fraudulent purchases.

- However, once incorrectly transferred money cannot be returned by a central authority. Within the Bitcoin system, the recipient is anonymous and cannot be contacted. If a payment is made in error, one is therefore either dependent on the recipient having disclosed his identity outside the Bitcoin system or generally showing goodwill and transferring the unexpected deposit back to his account. The accidental entry of incorrect addresses due to typing errors is prevented by evaluating a checksum .

Distribution of credits

One problem with the introduction of Bitcoin as a currency was the initial distribution of the monetary units. In contrast to Bitcoin, modern state and private currencies are covered by a promise to pay by the issuing body. Since Bitcoin was initially not trusted as a new means of payment and the return is not guaranteed by any party, Bitcoins were initially practically worthless. Due to the lack of goods against payment in Bitcoins, it was initially not usable either.

In the case of Bitcoin, new units are distributed according to a principle that rewards the support of the network by providing computing power (see section Mining ). Another characteristic of the system is that fewer and fewer monetary units are generated over time. This enabled the participants to generate monetary units much faster and with less effort in the initial phase of the system. As time goes on and the number of participants or computing power increases, it becomes increasingly difficult for the individual participant to generate Bitcoins.

A high six-digit number of Bitcoins (estimates range from 600,000 to 1,000,000) was generated in the early days by Bitcoin inventor Satoshi Nakamoto, but has not been used since his retirement from the Bitcoin project. Cameron and Tyler Winklevoss stated in April 2013 that they had acquired 1% of the Bitcoins that existed at the time (approx. 100,000).

Investment company Grayscale Bitcoin Trust manages the largest publicly known amount at ₿ 654,885. The publicly registered company MicroStrategy inc. is invested with ₿ 91,579.

In March 2019, almost 16% of all Bitcoins were held by 100 addresses or around 41% of all Bitcoins by 1900 addresses. However, this statistic is not very meaningful for the distribution of credits, as on the one hand individual addresses can represent the credits of numerous individuals (cold storage of file sharing platforms), on the other hand the credits of individual entities can be distributed over several addresses.

The UTXO concept (see section Transactions) can be used to analyze certain behavior patterns of the addresses in more detail. The so-called UTXO Age Distribution Chart is a stacked area diagram in which all available Bitcoins are shown in differently colored age classes (layers) and describes their change or movement behavior as a function of time. This makes it possible to clearly determine at any point in time how many Bitcoins have not been transferred and for how long. In May 2020, a total of 63% (approx.11,577,261) of all Bitcoins in circulation (approx.18,376,700) had not been moved for over a year. Although this does not provide any further conclusions about the actual distribution of the assets, it does show the economic behavior of the investors. This shows what percentage of the Bitcoin is held or moved by the respective owners.

Anonymity versus pseudonymity

Bitcoin addresses like bc1qj5swkkkk50ymyeqx2em906jfft86ptd4xs8wwf are public key hash values that can be understood as pseudonyms . As such, they cannot be directly assigned to the real identities of payers and payees. Bitcoin transactions are therefore not more precisely traceable without further information and guarantee partial anonymity. In addition to pseudonymity, a further requirement is necessary for complete anonymity: the lack of traceability ( unlinkability ). This means that transactions of a specific user or his interactions with the system cannot be linked to one another. If, for example, a Bitcoin address is used frequently, or payment transactions from unknown addresses are carried out together with addresses that are already known, there are starting points for traceability. A de-anonymization of the processes on the Bitcoin blockchain is then partly possible.

Basically, Bitcoin builds on the established infrastructure to guarantee anonymity on the Internet and offers far better protection of privacy than conventional payment methods. However, the anonymity granted by Bitcoin is limited and does not inherently provide any reliable protection against professional investigative methods. In order to conduct business, one of the business partners usually has to give up at least some of his anonymity. All transactions between two addresses are publicly logged and are permanently stored in the entire network. Subsequent recipients of partial amounts can, for example, name the last owner to authorities, who can then follow the chain of transactions.

Therefore, Bitcoin does not necessarily prevent evidence of illegal transactions. In particular, investigating authorities can obtain and link access to Internet connection data , mail items, virtual fingerprints (browser profiles) and contact details from earlier or later participants in a transaction chain. If a connection to a person is created at one point, for example through an intercepted shipment of goods or a service provided, all transactions to the assigned address can be followed up. The options for tracking transactions are therefore much more extensive than with cash. In addition, operators of exchanges that allow Bitcoin to be exchanged for other currencies are usually subject to anti- money laundering regulations. In addition, the operators of exchanges, for example, do not feel obliged to release credit that may have been acquired illegally.

An experimental analysis of payment flows in the Bitcoin system showed that it is practically possible to assign the origins of transaction chains to relevant known address pools. This is shown using payments to Wikileaks. On the other hand, even if large amounts were involved, it was not possible to use public data to reliably identify people who illegally transferred credit by spying on the assigned keys. However, attempts are being made to make such an analysis more difficult by anonymizing the processing of Bitcoin transactions via the Tor network . The attempt is made to use so-called Bitcoin mixers or tumblers (to tumble), which resemble a black box , to transform "dirty" Bitcoins into untraceable Bitcoins.

Security aspects

Security against data loss and data spying

While almost all transactions are publicly stored in the blockchain , the possession of Bitcoins is proven by private keys that are only accessible to the owner. If the key is lost, the associated bitcoins are lost for both the owner and the entire network. The amount of money, which is limited to 21 million Bitcoins, is reduced by such amounts, but these remain valid indefinitely if keys are found.

By spying on the keys, an attacker also gains access to the credit. It cannot be ruled out that such bitcoins, which are colloquially called “stolen”, can be assigned in later transactions, but these (analogous to money) are regarded as fungible and identification of the “thieves”, similar to cash, is only possible in exceptional cases.

Backup in daily use

The latest software allows the electronic wallet to be encrypted. Although this protects against theft of the computer in use, it does not necessarily prevent it from being compromised by malware and keyloggers . If a used computer is stolen, the thief cannot do anything with crypto currencies if he does not know the password or the seed phrase.

Another security strategy is to use a so-called cold wallet for storage. Access to the cold wallet is not required to receive a credit, but it is necessary for outgoing transactions.

Storage on non-electronic media

The private keys for the credit do not necessarily have to be stored on an electronic medium. They can also be sent to an address whose private key is only stored in physical form, e.g. B. by writing it down on a piece of paper (also called a paper wallet ). This key can be imported at any time by a bitcoin software in order to spend the bitcoins.

In addition to paper wallets, for example, coins and records were made that contain a key with a certain amount of bitcoins and can be exchanged as practically as cash. Conversely, however, they also entail the same risks as cash, e.g. B. Destruction or Loss.

Bitcoin software integrity

The integrity of the software can be checked because it is available as open source software in the source code. The authenticity of downloaded binary releases is checked using the digital signatures customary in the FLOSS community and the comparison of cryptographic hash functions .

Some wallets offer deterministic builds.

Business Signatures

In the Bitcoin system, each participant can create an unlimited number of Bitcoin accounts without being checked or monitored in any way by an independent body. In connection with the technical property of the irreversibility of transactions, depending on the framework conditions, fraud scenarios or manipulations are conceivable, such as the exchange of the Bitcoin address in electronically sent invoices through man-in-the-middle attacks , invoice forgery or fraudulent agreements on receipt of payment. This susceptibility is inherent in principle: Since Bitcoin does not rely on institutions such as banks or courts to which trust is delegated, trust between the business partners must also be established individually.

In the case of more extensive transactions with trading partners who are still unknown to each other, it can be safer if the recipient address can be verifiably traced. For person-to-person financial transactions, Bitcoin-OTC was established at an early stage, a GnuPG-based Web of Trust , the use of which, however, is technically relatively demanding.

Newer Bitcoin clients offer a function for this, with which text messages can be signed by the sender using strong asymmetric encryption using a publicly known address belonging to him. Conversely, the recipient can check the affiliation to this address in the Bitcoin software. The integrity of the public address can, in turn, be proven using the decentralized Web of Trust from GnuPG or a hierarchical public key infrastructure and (for websites) using SSL certificates .

Debtor risk in financial transactions

However, there is an increased risk for providers who trade Bitcoin for money. Here z. B. the receipt of a payment by credit card (so-called "soft" means of payment) no protection against the payment being reversed after the Bitcoin transaction. In these cases, the seller has practically no way of enforcing his claim. In addition, services such as PayPal or Skrill explicitly prohibit such transactions in their general terms and conditions and the seller must expect his account to be frozen and credit withheld.

Scalability

The existing Bitcoin network is only scalable to a limited extent . Limiting factors for the individual participant are the bandwidth for receiving and forwarding transactions and blocks, the CPU performance for verifying incoming transactions and blocks and the storage capacity for storing the blocks. If one of the factors exceeds the capacity of an individual participant, this participant can no longer participate in the system.

The inventor and original main developer of Bitcoin, Satoshi Nakamoto , described simplified Bitcoin clients ( light wallets ) in the whitepaper , which do not carry out a complete check of the block contents, but only have to download and check 80 bytes per block ( block header ). Payments can be checked using a compact proof without knowing the entire block content ( Simplified Payment Verification ). With such a design it would be possible to process a large number of transactions via a small network of particularly powerful Bitcoin nodes.

An important limiting factor is the capacity of the blockchain itself. Satoshi Nakamoto built a block size limit of 1MB into the reference implementation in 2010 on the advice of Hal Finney . It limits the maximum number of transactions to approximately 7 transactions per second. The limit was implemented to prevent possible attacks on the network with excessively large blocks. At the time, Bitcoin was hardly widespread, so the number of transactions was far below the limit. As Bitcoin's popularity grew, so did the number of transactions, so there were more and more periods when the blocks were full and there was a backlog of unconfirmed transactions. The backlog of unconfirmed transactions can be recognized by the size of the mempool. If the capacity of the overall system is exceeded, the time it takes to confirm a transaction increases. Participants will need to increase transaction fees in order to have their payments processed preferentially.

Against this background, there was a heated debate in the Bitcoin community about the right approach to better scaling, which resulted in a hard fork and only leveled off in 2017.

On the one hand, the development team of the reference implementation Bitcoin Core rejected a significant increase in the block size limit. Instead, the Softfork SegWit ( Segregated Witness ) was supported, which, in addition to an indirect, moderate increase in the block size, above all provides the basis for "off-chain" solutions that aim for better scaling by reducing the number of transactions that are based on must be stored in the blockchain. The best-known of these off-chain solutions, also known as “Layer 2” technology based on the OSI model , is the Lightning network , a Bitcoin-based network of payment channels between participants, through which payments can be processed and only in some Transactions arise that have to be stored on the Bitcoin blockchain.

The other side of the debate, including Roger Ver and Bitmain , which was behind a significant portion of the mining computing power, advocated scaling Bitcoin by increasing the block size. In order to increase the block size limit from 1 MB to 8 MB, the hard fork Bitcoin Cash was created on August 1, 2017 . On May 15, 2018, the block size was expanded to 32 MB by another hard fork. This made 167 transactions per second possible. Further adjustments to the block size are planned at regular intervals.

technology

Peer-to-peer network

Bitcoin's full nodes are connected via a peer-to-peer network. Blocks, transactions and various other messages are exchanged via this. A single Bitcoin client maintains a fixed number of currently 8 outgoing connections and a variable number of up to 117 incoming connections. This creates an unstructured overlay network in which all Bitcoin nodes are connected to one another. In some situations, the information from outgoing connections is processed preferentially because it is more difficult for an attacker to control them.

In order to connect to the Bitcoin network, the Bitcoin software needs to know the IP addresses of other Bitcoin nodes. The Domain Name System is used for the initial search for other nodes ( bootstrapping ) . The Bitcoin client resolves a domain name in order to obtain the IP addresses of several other Bitcoin nodes. The domain names used for bootstrapping are firmly integrated in the Bitcoin software and the services are operated by members of the Bitcoin community. Bitcoin nodes that are already connected exchange known IP addresses with one another. If the bootstrapping fails, the Bitcoin client accesses a list of Bitcoin nodes provided.

Transactions and blocks are distributed within the network using a flooding algorithm and are sent via TCP as standard . The sending of new blocks found through mining is particularly time-critical, since the other Bitcoin miners would temporarily waste their computing power on an older version of the blockchain if there were delays caused by the network transmission. Therefore, there are various technical measures to accelerate the sending of blocks, such as the UDP- based FIBER network used by miners or the concept of "compact blocks", in which the individual nodes themselves parts of new blocks from transactions stored in the mempool to speed up the transmission and reduce the amount of data sent over the network.

In addition to the actual so-called mainnet, there is a so-called testnet with a separate blockchain, which is suitable for testing new functions or for experimenting. The testnet has been reset twice so far. The main differences to the mainnet are the adjustment of the difficulty and the price of Testnet Bitcoins. Testnet Bitcoins can be obtained free of charge over the Internet, as they have in fact no value.

Blockchain

The blockchain (German "blockchain") is the journal in which all Bitcoin transactions are recorded. It consists of a series of data blocks in which one or more transactions are summarized and provided with a checksum . New blocks are created in a computationally intensive process called mining and then distributed to participants over the network .

The transactions of a block are hashed in pairs using a Merkle tree and only the last hash value , the root hash , is noted as a checksum in the header of the block. The blocks are then concatenated using this root hash. Each block contains the hash of the entire previous block header in the header, so the sequence of the blocks is clearly defined. In addition, the subsequent modification of previous blocks or transactions is practically impossible, since the hashes of all subsequent blocks would also have to be recalculated in a short time. The first block in the blockchain is predefined and is called the genesis block .

The blockchain currently has a size of over 310 GB (as of November 2020). It has to be downloaded in full by newly joining Bitcoin nodes and, as a rule, also checked for validity. In addition, the Bitcoin software contains a permanently integrated list of well-known blocks from the past that must match the downloaded blockchain. The original paper described the possibility of saving storage space by removing older transactions from the blocks and only keeping the header with the root hash. However, this functionality has not yet been implemented in the Bitcoin Core , so that the entire transaction history can be traced back to the beginning.

When creating blocks (also called mining ) it can happen that several Bitcoin nodes create a valid new block at the same time. If the other participants receive more than one valid new block, they decide which block to take over. Usually this is the first block received. In rare cases, there can be a fork in the blockchain in which the chain branches and both branches are continued with valid new blocks. In such a case, the fork with the longer chain will eventually prevail because it is assumed that the majority of the participants are behind it. The transactions in the discarded branch of the fork or the mined blocks become worthless, which calls into question the auditability (auditor) of the blockchain.

The first transaction in a block contains the transfer of the newly generated bitcoins and the transaction fees. The amount of newly generated bitcoins is currently limited to 6.25 bitcoins per block. If a bitcoin node tries to generate more bitcoins than it is entitled to, its block will not be accepted by other bitcoin nodes. Originally 50 bitcoins were generated per block. That number halves every 210,000 blocks, which is roughly four years, so the maximum number of bitcoins that can ever be generated is set at 21 million. Since a Bitcoin (in the current Bitcoin Core version) can be divided into 100 million units (Satoshis), the total number is 2.1 · 10 15 , i.e. H. 2.1 quadrillion discrete units.

Bitcoin addresses

In order to receive a Bitcoin address, the participant's Bitcoin client must first generate a key pair. The key pair consists of a public and a private key. The private key is a generated random number and is stored in the wallet. It is used to sign transactions, i. H. outgoing payments (analogous to the signature on a transfer form), and should be kept secret. At the same time, the loss of the private key also means the loss of the associated bitcoins. The public key does not need to be saved as it can be calculated from the private key (see ECDSA # key generation ). Bitcoin uses the elliptic curve cryptosystem ECDSA in the standardized 256-bit configuration secp256k1 .

The Bitcoin address is a short form (fingerprint) of the public key and encoded with Base58 . To calculate the address, two cryptological hash functions are applied to the public key one after the other (here:) . In addition to the resulting 160-bit hash value ( public key hash ), the address also contains a further 32-bit long hash value that is used to identify transmission or typing errors , as is the case with a checksum .

RIPEMD-160(SHA-256(pubkey))

There are 3 types of addresses:

- P2PKH or Legacy address (old address format) is the first version of a Bitcoin address that starts with the number "1" and has 26 to 36 characters. The average fee for sending from a P2PKH address is usually higher than sending from a Segwit address because transactions with stale addresses are larger. Example: 1HHRPAXhiMGRXh1HakrCVyukAU2TBcvrDa

- P2SH The new address type has a similar structure to P2PKH, but starts with "3" instead of "1". P2SH offers more complex functions than the previous address type. In order to spend bitcoins sent via P2SH, the recipient must provide a script that matches the script hash and data, which makes the script true. However, an ordinary user just needs to know that using this type of address instead of P2PKH, the average transaction fee will be lower. Example: 3GL1MMJvw99DbrzoPQYhu7H5Zv2S8ykvPy

- P2WPKH or Bech32 is an advanced address type used to reduce blockchain block sizes to speed up transaction response time. Addresses start with "bc1" and are longer than P2PKH and P2SH. Bech32 is the native Segwit addressing format (although P2SH can also be a Segwit address), which is why it usually refers to the use of Segwit addresses. The advantage is the lowest transaction sending fee and the high processing speed. The disadvantage of such addresses is that they are not yet supported by all wallets and systems. Example: bc1qj5swkkkk50ymyeqx2em906jfft86ptd4xs8wwf

Transactions

The transfer of Bitcoins between the participants is processed in "transactions" that work for the user in a similar way to a bank transfer . The sender only needs to know the Bitcoin address (comparable to the account number or IBAN ) of the payee; confirmation of this is not necessary. The Bitcoin addresses can be generated by a Bitcoin client if required. The payee therefore does not have to be connected to the network. The sender only needs to connect briefly to send the transaction.

A reverse processing of transactions is excluded once they have been added to the blockchain . It is also not possible to withdraw credit from an account, as is the case with direct debit .

However, the payment sender can change a transaction initiated by him up to this point in time. The problem with this is that so much time can pass between the initial triggering of the transaction and its manifestation in the blockchain that Bitcoins can no longer be used as an instant payment method. At least the payee would have to take the risk of a total failure of the payment if he for his part z. B. delivers goods before the transaction is verifiably completed.

Transaction costs

There are fees when transferring bitcoins. These are currently at least 1,000 Satoshi (= 10 µBTC = 0.01 mBTC = 0.00001 BTC). On the one hand, the fees are charged in order to give the participants involved in the mining a reward for processing the transaction. On the other hand, the charges are intended to prevent the network from being deliberately overloaded with transactions . The amount of the required fees depends on the size of the transaction (in bytes), it does not depend on the value of the bitcoins transferred.

The transferring participant can set the transaction fees he is willing to pay himself. The higher this value, the faster the transaction is confirmed. When they form new blocks, the miners usually select those transactions from the “mempool” of unconfirmed transactions that have the highest transaction fee. A selection is necessary because the number of transactions that fit in a block is limited by an upper limit. As a result, the required transaction costs are not constant over time, but depend on the size of the mempool and thus on the current utilization of transactions set by other participants.

Process of a transaction in detail

Strictly speaking, there are no accounts in the Bitcoin system that can have a credit. The "credit" shown by the Bitcoin client or other wallet programs are incoming credits to the Bitcoin addresses from the user's Bitcoin wallet that have not yet been transferred (so-called unspent transaction outputs , UTXOs).

Each transaction contains at least one input (consisting of a transaction hash and an index), at least one output (recipient address and the corresponding amount) and other fields for signature and administration. Credit can be combined from several addresses and divided among several addresses. The amount of the specified entries will be fully credited to the target addresses in the specified amount. If “change” remains, the sender must include its own address in the outputs. It is also possible to have a transfer signed by several participants (e.g. in the case of an escrow service).

Finally, the entire transaction is signed with the sender's private key, which authenticates it and protects it from changes. The transaction is then transferred to the peer-to-peer network and distributed using a flooding algorithm . The sender sends his transaction to all Bitcoin nodes connected to him in the network. These verify the signature and check whether the transaction is valid. They then forward the transaction to the Bitcoin nodes connected to them. This is repeated until the transaction is known to all Bitcoin nodes in the network. As soon as the transaction has arrived at a node operated by a miner, the latter can include it in the blocks it has generated.

example

Participant A has previously transferred an amount to participant B, which he now wants to transfer to participant C. For this purpose, participant B creates a transaction that receives the credit from participant A as input and has the address of participant C as output.

To prove that he is the owner of the bitcoins that A transferred to him, B writes his full public key and input transaction into the new transaction. His Bitcoin address can be calculated from the public key and thus it can be proven that the amount was previously transferred to him by A.

As the payee, participant B specifies the Bitcoin address of participant C and the amount that he would like to transfer C.

Finally, participant B signs the transaction with his private key and transmits it to the network.

Mining

By Mining new blocks are created, and then to block chain added. New bitcoins are issued through new blocks and some of the new or pending transactions are confirmed at the same time. Up to November 2012, 50 bitcoins were paid out with each new block, 25 until July 2016, 12.5 until May 2020 and 6.25 since then. In this way there is a decentralized creation of money . The process is very computationally intensive, and in return the participant who generates a valid block receives the scooped bitcoins and the fees from the transactions included as a reward. After a new valid block has been found, like unconfirmed transactions, it is distributed to all Bitcoin nodes in the network as a new, longer valid blockchain using a flooding algorithm. Mining in the Bitcoin system also solves the problem of the Byzantine generals in this way : Since there is no central authority that certifies the participants, the Bitcoin nodes do not trust each other in principle. The problem for every Bitcoin node is to find out which blocks or which blockchain is the "right" one, i. H. trusted by the majority. Valid blocks are only created through computationally intensive mining. Every Bitcoin node trusts the longest valid block chain, as it has the most computing power behind it and therefore the majority of participants are assumed.

Proof of work

Practically the entire computing power of the Bitcoin network is devoted to solving cryptographic tasks, the proof of work. Their purpose is to ensure that the creation of valid blocks is associated with a certain amount of effort, so that a subsequent modification of the block chain, as for example in the scenario of a 51% attack , can be practically excluded. Due to the difficulty, miners join together to form "mining pools" in order to receive payments despite these high requirements in terms of power consumption, the provision of expensive hardware and / or hardware that is under their own control. The largest proportion of the mining pools are located in China, which is also where most of the miners - or around 75% of the computing power - of the cryptocurrency are located.

The proof of work with Bitcoin is to find a hash value that is below a certain threshold. The threshold is inversely proportional to the mining difficulty. The threshold value can be used to regulate the effort required to solve the proof of work, because the lower this value, the less likely it is to find a suitable hash. The hash is calculated by applying the cryptological hash function SHA-256 twice to the start area of a block (block header).

The process works as follows:

- Initialize block, calculate the root hash of the block from transactions

- Calculate hash value:

h = SHA256(SHA256(block header)) - If so

h >= Schwellwert, change the block header and go back to step 2 - Otherwise (

h < Schwellwert): Valid block found, stop calculation and publish block.

To ensure that a hash value can be found below the specified threshold, there are various fields in the block header whose value can be changed. The Nonce field exists especially for this purpose .

Level of difficulty

The difficulty of the task is dynamically regulated in the network in such a way that a new block is generated on average every ten minutes. In other words, as the computing power of the network increases, solving the task becomes more and more complex. The probability of a participant to find the right solution is proportional to the computing power used. All 2016 blocks recalculate all Bitcoin nodes independently of one another the level of difficulty of mining and adapt them to the current computing power of the entire system so that a new solution is still found about every ten minutes. 2046 blocks correspond to about 2 weeks with constant hash performance. Solutions that do not correspond to the current level of difficulty will not be accepted by other Bitcoin nodes.

Specialized hardware

Mining on the processor of a commercially available computer has never been profitable - except for a short time at the beginning. Mining was therefore only worthwhile for graphics processors or specialized (dedicated) hardware such as FPGAs . As less and less bitcoins were generated per unit of computing power on graphics processors and the share of electricity costs increased, FPGAs have been used more and more since the end of 2011. These combine high hardware costs and low power consumption with a very high computing capacity in relation to a specific computing requirement for which they were produced. In the meantime, hardware components such as ASICs have almost completely replaced FPGAs, as their performance is significantly higher.

At the end of January 2013, the first executable, commercially available ASIC systems for mining bitcoins appeared. With these it is possible to mine Bitcoins around 50 times faster ( Engl. : To mine ) than before with GPU based systems. The power consumption, which makes up a considerable part of the costs, is, however, significantly lower. The result was that the difficulty of mining increased so much that GPU-based mining (like CPU-based systems before) became largely uneconomical within a few months. The ASICMiner Block Erupter USB shown in the picture in 130 nm chip technology , which were widespread in mid to late 2013, deliver around 333 megahashes per second (Mhash / s) and work with an efficiency of 130 megahash per joule (Mhash / J). Mining hardware in 28 nm technology, which became available from mid-2014, delivers ten times the efficiency of around 1.3 gigahash per joule (Ghash / J) or more. Ultra-efficient ASIC mining hardware in 28 nm technology with 6 Ghash / J (0.19 J / Ghash) was already announced for 2015, before the entry into the even more efficient 14 nm chip technology for ASIC mining hardware expected for 2016.

Since then, the trend has been towards centralized cloud mining as a risky capital investment . The providers of this cloud mining operate their data centers in Iceland , for example , because electricity there is very cheap and the possibilities for efficient cooling of the thousands of ASIC mining computers are very good. That could threaten the formerly secure, decentralized Bitcoin mining model and make a 51% attack more likely.

Forks

A protocol change is introduced as a so-called fork. A distinction is made between two types: Protocol changes that introduce additional rules are referred to as soft forks , and loosening of the rules is referred to as hard forks . The difference becomes noticeable when operating the node software: An older version of this software is compatible with soft fork blocks, but cannot check the new rules. Hard fork blocks, on the other hand, require a software update, after which the new rule set can be checked completely. Since the first block, 16 soft forks and 3 hard forks have been carried out at Bitcoin.

Forks (or chain splits) are also events in which a blockchain splits and both inventory books are continued independently of one another. This usually happens when a protocol change is not generally supported but is still being continued. By dividing the blockchain into two separate histories, a Bitcoin can also be used in both payment systems after a chain split. So every owner of a Bitcoin got a Bitcoin Cash at the time of the Bitcoin Cash Fork. When making a transaction, after a chain split, however, it is necessary to check whether there is protection against replay attacks .

Well-known chain splits of Bitcoin are:

- Bitcoin Cash : Split at block 478558.

- Bitcoin Gold : Split at block 491407.

- Bitcoin SV : Split at block 556766 of Bitcoin Cash.

Bitcoin technology in other projects

Since Bitcoin's reference implementation ( Bitcoin Core ) is under the MIT license , the source code can also be used for other programs. In the case of Namecoin, a distributed Domain Name System (DNS) ( .bit ) was created. It is also possible without great effort to create a Bitcoin copy with possibly slightly changed parameters and a separate blockchain. The best-known independent currencies, which are based on the code base of Bitcoin Core, but have a separate blockchain and some have additional functionality, are Litecoin , Zcash and Dogecoin .

Bitcoin is an elementary part of the trusted-time stamping implementation Originstamp.

Acquiring and managing bitcoins

Local Bitcoin software or an online platform can be used to receive and transfer Bitcoins .

Bitcoins can be exchanged for other currencies, electronic money or paysafecards either at online exchanges or individually . There are usually fees that vary depending on the provider. In the case of online exchanges , the operator of the exchange is the trading partner to whom the customer also entrusts his money. The trading fees are typically around 0.2–1% of the amount exchanged.

The exchange exchanges have not yet been regulated , but are mostly subject to conditions to make money laundering more difficult , e.g. B. in the form of payout limits or know-your-customer principles. Proof of identity is usually required to trade larger amounts.

Deposits and withdrawals are made with Bitcoins directly by transferring to or from the customer's wallet at the provider. With other currencies, deposits can often be made as SEPA transfers. Credit with the exchange operator can be paid out to your own bank account, but additional fees may apply. However, there are also decentralized exchanges (DEX) where Bitcoins and other cryptocurrencies can be traded completely anonymously. An example of this is bisq.network, an open-source software that trades Bitcoin's P2P over the Tor network .

Securing the deposits is not mandatory and is left to the respective provider. The professionalism and seriousness of the providers varies greatly. Since large amounts and the easy mobility of Bitcoins provide a strong incentive for attackers to hack platforms with high credit balances, there have been serious break-ins in the past, in which customers sometimes lost all of their deposits. Due to frequent problems in the area of information security, some exchanges advertise improved security and in some cases offer certification of their websites, two-factor authentication procedures , liability for lost deposits and even regular deposit insurance for fiat amounts of money.

There are also services that, as exchange offices, offer a direct exchange of common currencies, e-currencies, and paysafecards into bitcoins. The rates are predetermined, the fees included are higher than with the exchanges and amount to around 1.5 to 5%. These services typically do not require registration, so you can quickly purchase the bitcoins and have them transferred to your wallet.

There are virtual "trading venues" where interested parties can register offers to buy and sell. The transaction takes place (as is often the case with internet auction platforms) between two private individuals. Some providers secure transactions unilaterally by depositing the bitcoins to be sold and only release them when the seller confirms receipt of payment. With this form of trading, there is a certain risk for both the buyer and the seller that the trading partner or the trustee will not behave honestly.

# bitcoin-otc (IRC channel)

The oldest purchase option is an IRC channel called "# bitcoin-otc", where exchange offers between private individuals can be registered. Trust is created through a GnuPG -based rating system. This medium is technically comparatively demanding.

Local directories

There are also z. B. with the websites localbitcoins.com regionally structured directories of people who offer Bitcoins in their place of residence for exchange for cash, for example as the operator of an Internet café . The vast majority of Bitcoin users worldwide are (as of the end of 2012) in the USA, Canada, Western Europe, Australia and the East Asian Pacific countries such as Japan, but there are also countries such as Malaysia, South Africa, Saudi Arabia, Venezuela and Brazil Exchange options.

Two-factor authentication on Bitcoin exchanges

One of the risks of using Bitcoin exchanges and trading platforms is spying on passwords by guessing or cracking weak passwords or malware in the form of keyloggers . For this reason, two-factor authentication is generally used in current online banking , for example in the form of a password in combination with mTAN . Such protection through implementations such as Google Authenticator or YubiKey is now also offered by numerous file sharing sites . Due to the lack of central regulatory bodies, every operator is free to decide whether and for which two-factor authentication he decides: Sites like Bitpanda, Bitcoin.de or Coinbase z. B. combine the log-in process with confirmation by mobile phone number, while others, such as BTCoin.Systems, rely on the mTAN that is common for online banking.

Bitcoin wallets

A Bitcoin wallet is special software for the Bitcoin system. The wallets differ in terms of the number of functions and the handling of the blockchain . This represents a directory of all previous transactions which, when fully downloaded, requires over 190 gigabytes of storage space and a correspondingly long time.

The wallet (English for “purse” or “purse”) symbolizes a kind of virtual purse that contains a participant's bitcoins. However, since Bitcoins only exist and can be transferred within the blockchain, the wallet is more comparable to a credit card that contains certain data with which the customer can make payments, but does not contain any money itself.

The wallet is a digital keychain with which a user proves that he owns a certain amount of Bitcoins and allows him to transfer them. The addresses for receiving payments are generated from the keys. Any number of keys - and thus addresses - can be generated.

There are several Bitcoin wallets for smartphones with additional functions that are useful for mobile operation. The apps typically download a reduced version of the blockchain after installation. A Bitcoin address of the wallet on the smartphone can be displayed as a QR code . This contains a special Uniform Resource Identifier with the required Bitcoin address and the amount. QR codes can be scanned with the phone's camera to make payments. It is also possible to send payments later when there is currently no internet connection. In addition, there are options for securing the wallet.

Comparison of relevant Bitcoin wallets

| Surname | developer | programming language | Operating systems | License | Remarks |

|---|---|---|---|---|---|

| Bitcoin Core | Satoshi Nakamoto and others | C ++ | Windows , Linux , macOS | MIT license | Reference implementation, also known as Bitcoin-Qt , manages the entire blockchain , therefore initially long loading time (approx. 260 GB via P2P; as of February 2020). |

| Electrum | Thomas Voegtlin | python | Windows , Linux , macOS , Android | No loading of the blockchain necessary, as access is via the appropriate server. Use of credit on several devices, wallets are generated from a seed (can be used as a brain wallet ). | |

| Wasabi wallet | zkSNACKs | .NET | Windows , Linux , macOS | Privacy wallet with CoinJoin implementation and the focus on coin mixing, coin control via the Tor network and fungibility of bitcoins. | |

| Bitcoin wallet | Andreas Schildbach | Java | Android , Blackberry OS | GPLv3 | Only available as Android and Blackberry apps. Emphasis on ease of use and high security, is independent of servers and web services. |

Web-based and hybrid wallets

There are also a large number of web services that offer an online wallet. In this case, the access data is not stored on the user's hardware, but with the online wallet provider; the security of the credit depends entirely on the server-side security and the (difficult to verify) trustworthiness of the provider. A malicious provider or a server security breach can result in trusted bitcoins being stolen. An example of such a security breach is the case of Mt.Gox in 2011. This led to the meme "Not your keys, not your bitcoin".

An alternative, for example for mobile platforms for which no regular Bitcoin client is offered, are hybrid wallets. With these, the code to be executed is loaded from the provider's server, but the secret keys are encrypted and transmitted on the client side .

Professional wallets (crypto custodians)

The professional custody of crypto values for third parties in Germany has been a financial service since January 1, 2020 . This means that custodians are supervised by the Federal Financial Supervisory Authority (BaFin). Since the regulation applies to all companies that actively participate in the German market, it is assumed that there will be a sharp increase in license applications.

distribution

Payment transactions

As with currencies, according to estimates from 2014, bitcoins could also be used to pay for goods or services. At the beginning of March 2015, 6,284 locations such as shops or hotels that accepted Bitcoin as a means of payment were entered in the OpenStreetMap database. For the German market alone, there were more than 100 acceptance points from a wide variety of industries in 2016.

The largest online services that accepted Bitcoin as a means of payment in 2015 included the social news aggregator Reddit , Microsoft Account, Overstock.com , Dell , Expedia and Threema . The blog hosting WordPress .com accepted Bitcoins as payment option by the end of February 2015. Some pizza ordering services accepted in 2013 Bitcoins by further gave orders to large delivery, as food delivery services for restaurants. In 2017 you could still order pizza with Bitcoins, but according to a research in the Washington Post from the beginning of December 2017 , the price for a pizza was 8.70 US dollars for customers who paid with US currency while Bitcoin payers with 0.0036 Bitcoin had to pay the equivalent of 34.12 US dollars at the time. In March 2019, the largest online retailer in Switzerland, Digitec Galaxus , started accepting Bitcoin and some other crypto currencies in the two online shops digitec.ch and galaxus.ch.

Furthermore, payment in Bitcoins was offered in 2013 by some game developers, municipal services, hotels or various tour operators. Bitcoins were occasionally used in the first quarter of 2013 for the purchase of cars and houses or for rent payments. In 2015, the Museum of Applied Arts (MAK) in Vienna was the first museum to use Bitcoins to purchase a work of art for the museum collection.

Bitcoin donations are accepted by NGOs such as WikiLeaks . In addition, the currency is accepted for the purpose of micropayment by organizations that support various charitable purposes, as well as given away as recognition for creative content on the web . Bitcoins are also used as a stake for games of chance.

Due to the pseudonimity serve Bitcoins also of money laundering , the ransom demands for encryption Trojans as well as a number average for weapons, pornography , illegal drugs and fraud goods to contract killings over darknet markets .

On June 8, 2021, the legislative assembly of El Salvador passed a law with which the country was the first in the world to recognize Bitcoin as another official means of payment with effect from September 7, 2021.

In August 2021, Worldline, in cooperation with Bitcoin Suisse, activated Bitcoin payments on their POS terminals .

trade

On December 10, 2017, Bitcoin futures began trading on the US futures exchange CBOE , and one week later on the CME . On the one hand, fluctuations in the price of bitcoins can be hedged, and on the other hand, you can participate in price increases or losses of bitcoins without being the owner of bitcoins. The CBOE future comprises one bitcoin, the CME contract has a volume of five bitcoins. At the CBOE, the price on the Gemini cryptocurrency exchange is used , while the CME forms a reference price from the quotations on the four exchanges Bitstamp , GDAX , IiBit and Kraken .

Users

In September 2011, a participant in the Bitcoin community estimated the number of different Bitcoin nodes that were active within one day at 60,000. The estimate was based on the evaluation of certain messages in the peer-to-peer network. By October 2012, the number determined using this method had fallen to just under 20,000. The researchers Dorit Ron and Adi Shamir analyzed the transaction graph in May 2012 and determined a number of 2.4 million independently used addresses. This number represents an upper limit of the users who have carried out a Bitcoin transaction up to that point in time. The most active individual users were the Deepbit mining pool and the Mt.Gox trading platform , responsible for eleven percent and seven percent of all Bitcoin transactions. The reference software Bitcoin Core (also known as Bitcoin-Qt ) achieved around 70,000 downloads per month at the end of 2012 and around 270,000 downloads in March 2013. The number of users of the My Wallet online service was given as 80,000 in December 2012.

The reddit group / r / bitcoin reached 10,000 users in September 2012, 20,000 users in March 2013 and 107,000 users in February 2014. A survey by the blog netzpolitik.org in January 2013 showed that 5.5% of readers would pay for donations using Bitcoin, while the alternatives Flattr and PayPal achieved 33.0 and 27.7%, respectively.

A 2015 study by the University of Münster found that typical Bitcoin users are between 25 and 44 years old and have a technical job. Bitcoins are mainly used to pay or to speculate. The most important motivation of the users is the joy in experimenting with an innovative system. According to this study, illegal applications only play a minor role, although it must be taken into account that they are not representative of the international Bitcoin scene for only around 100 people surveyed, 60% of whom come from Germany.

According to the blockchain analysis company Glassnode , the number of active wallet addresses peaked at 140,000 in 2011. The number grew to over 6 million by the end of 2017, but fell again to half in 2018. By the end of 2020, over 6 million active addresses had been registered again.

Legal issues

US Financial Regulations Guidelines

On March 18, 2013, the Financial Crimes Enforcement Network (FinCEN), a division of the US Treasury Department , issued a report regarding the classification of centralized and decentralized virtual currencies for a status as "Money Service Businesses" (MSB). This included digital currencies and payment systems that are not issued by any government agency. Virtual currency users have been classified as unrestricted for MSBs. Organizations that produce virtual currencies or act as payment service providers, on the other hand, would be subject to the regulations for MSB payment service providers, which in particular provide for reporting and accounting obligations to curb money laundering. Literally interpreted, this could also affect people who mine Bitcoin: “… a person that creates units of convertible virtual currency and sells those units to another person for real currency or its equivalent is engaged in transmission to another location and is a money transmitter. "

Furthermore, organizations were named as payment service providers and exchange services that use virtual currencies for payment services. Since this classification would also apply to people who operate Bitcoin mining on a very small scale, the guidelines (which have no legal character) have been criticized by the Bitcoin Foundation , an advocacy group for Bitcoin users, as being too extensive.

Overall, however, the guidelines improve legal certainty, as the fundamental legality of using Bitcoin is obviously no longer in doubt and Bitcoins were classified as a means of payment or currency by a government agency for the first time.

Tax handling

In Germany Bitcoin neither legal tender even e-money , foreign exchange or varieties , but it is after the determination of the Federal Financial Supervisory Authority (BaFin), a unit of account (English unit of account ), which can be used in "multilateral netting circles" and thus financial instrument within the meaning of the German Banking Act (KWG). This was also confirmed in August 2013 by a request from MP Frank Schäffler to the Federal Ministry of Finance: Bitcoin is a kind of “ private money ”. This is contradicted by the 4th Criminal Senate of the Berlin Chamber of Commerce in its judgment of September 25, 2018. According to the Chamber, Bitcoin cannot be a unit of account because it lacks stable value and general recognition. BaFin thus classifies Bitcoins as units of value comparable to foreign exchange. Furthermore, profits from the Bitcoin sale are a private sale and are subject to income tax in accordance with Section 23 of the Income Tax Act (EStG) . Losses resulting from a private sale after the speculation period has expired can no longer be offset against profits.

Transactions carried out in Bitcoin are subject to normal tax obligations; they are not suitable for evading sales tax. An exchange of Bitcoins for other means of payment - and vice versa - is VAT-free according to Art. 135 Paragraph 1 Letter e of the Value Added Tax System Directive (VAT Directive).

In Austria, Niko Alm submitted a parliamentary question to Finance Minister Michael Spindelegger on May 23, 2014 regarding the tax and legal handling of Bitcoin. The answer said that trading bitcoins can be “taxable and taxable”. There is no “speculation tax” to be paid if you have owned Bitcoins for more than a year.

The US Internal Revenue Service issued a statement in 2014 that Bitcoin should be taxed as property. If no exceptions are created for small amounts, this classification has the disadvantage that even with small businesses such as B. the purchase of a cup of coffee for all users extensive accounting obligations exist in order to determine accruing capital income. From 2013 to 2015, between 800 and 900 customers reported profits from bitcoin transactions with the US IRS, while around 14,000 people made bitcoin transactions for more than 20,000 US dollars on the Coinbase trading platform at that time. Therefore, in November 2017, the tax authorities legally forced Coinbase to hand over the identity and account information of all customers who were doing business of $ 20,000 or more at the time.

In Japan, Bitcoin profits are subject to a tax rate of up to 55% as “other income”.

The ECJ declared on October 22nd, 2015 that there is no VAT when buying and selling units of the virtual currency 'Bitcoin'. The German Federal Ministry of Finance confirmed the content of the judgment to the highest state finance authorities on February 27, 2018.

Legal classification of Bitcoin in the EU

While the individual member states of the European Union are basically free to issue their own rules for Bitcoin, Directive 2018/843 / EU (update of the 4th Money Laundering Directive, often also referred to as the 5th Money Laundering Directive) for the first time has a uniform and EU-wide legal basis for the classification of Bitcoin.

Article 3 (18) of the 5th Money Laundering Directive defines the term virtual currency. According to this provision, it is: “ A digital representation of value that has not been issued or guaranteed by any central bank or public body and is not necessarily linked to a legally defined currency and which does not have the legal status of a currency or money , but is accepted as a medium of exchange by natural or legal persons and which can be transmitted, stored and traded electronically ”.

This definition does not refer to a specific technology. The authors of this legal definition under Union law, however, primarily had blockchain technology in mind and bitcoin as an archetypal expression. The legal definition has thus been written based on Bitcoin. Bitcoin are therefore a virtual currency in the sense of the definition cited above.

From the cited legal definition it can be seen that virtual currencies are designated as a medium of exchange by the European legislator. The legal opposite to the medium of exchange is the means of payment. It is no coincidence that the legal definition speaks of a medium of exchange and not of a means of payment. An earlier definition proposal by the European Commission still explicitly used the term means of payment. Payment is the fulfillment of a monetary debt and means of payment is everything that can be used for it. As a result, the property of exchange medium can best be described in negative terms: medium of exchange is everything that is accepted to fulfill a debt and is not a means of payment. Bitcoin is thus a medium of exchange.

Founding of corporations using cryptocurrencies

Since summer 2017, it has been possible in Switzerland to set up stock corporations and limited liability companies with the most important crypto currencies - above all Bitcoin. Since then, the formation of a corporation has been recognized in practice, especially with Bitcoin and Ether. Cryptocurrencies can be used in application of the provisions for contributions in kind in accordance with Art. 628 ff. OR to provide share capital or ordinary shares. This basically works with all crypto currencies that can be accounted for as assets according to Art. 958 ff. OR.

Controversies and Risks

No money functions

Axel A. Weber , former President of the Deutsche Bundesbank , denies Bitcoin fulfilling basic currency functions. Bitcoin is only a transaction currency, said Weber at a conference in Zurich in October 2017. The most important function of a currency is that it can be used to pay and that it is accepted everywhere. It should also be a store of value - but Bitcoin is not all of that. The main characteristic of money - the use as a medium of exchange - is not given with Bitcoin according to the prevailing view. Bitcoin and other cryptocurrencies also fail to meet the requirements of the two ruling schools on the creation and nature of money - namely intrinsic value according to the orthodox and state acceptance according to the heterodox school.

Financial risks

The purchase of significant amounts in Bitcoins has so far been a high-risk investment. The journalist Timothy B. Lee, who invested in bitcoins, named the following risks in 2013:

- Irreversible losses through malware, loss of data or intrusions into online exchanges. According to studies from 2017, around a third of all trading platforms for crypto currencies have been hacked since 2009.

- Strong restrictions through state regulation as a measure against money laundering

- Overloading the capacity of the system, which could, at least at times, make transactions slow and small transactions very expensive

- Too little commercial use compared to the rising price and the associated high expectations

- Targeted market manipulation by large market participants. These might not be punishable in Germany, as Bitcoins are not legally considered securities or investments.

Legitimacy of a non-central money creation

If the payment unit is established and a trade takes place with it, money is actually created , which in the case of central bank money traditionally represents a monopoly of the central banks , in the case of credit and book money, however, takes place primarily through the commercial banks . An increase in the amount of money compared to the value of goods (whether through cash or credit money ) tends to lead to inflation at a given velocity ( see: quantity theory , neutrality of money ). This goes hand in hand with a loss of purchasing power of existing credit - and always a transfer of assets to the money-issuing body. In the case of Bitcoins, this source of income would not be available to central banks. Therefore, for example, the German interest group “ Bundesverband Digitale Wirtschaft ” denies the legitimacy of non-central money creation. In contrast, bonus and credit systems such as frequent flyer miles , Linden Dollars , Facebook credits or Payback cards are not affected by this legitimacy problem.

The aforementioned banknote monopoly is supported today by the status of legal tender and, in the EU, by the Coin Act of 2002. These legal norms do not contain a ban on alternative currencies. However, a new currency is extremely difficult to introduce due to the network effects of the established currencies.

Proponents and users of Bitcoin took the view in 2011 that the decoupling of money creation from central power structures would bring about a democratization of the monetary system. The replacement of the existing, essentially credit-based system, in which money is always burdened with interest on debt, is also seen in some cases as desirable.

Electricity consumption and pollution