Hypo Alpe Adria

| Hypo Alpe-Adria-Bank International AG | |

|---|---|

|

|

| Country |

|

| Seat | Klagenfurt am Wörthersee |

| legal form | Corporation |

| founding | 1896 as (Kärntner Landes-Hypothekenanstalt) |

| resolution | 2014 Conversion to Heta Asset Resolution AG as a bad bank |

| Website | www.hypo-alpe-adria.com |

| management | |

| Corporate management |

Alexander Picker |

The Hypo Alpe Adria was a banking group based in the Austrian state of Carinthia , the State Mortgage Institution was founded in 1896 from the emerged Carinthia. The bank was nationalized in 2009 and withdrew its banking license in 2014. The remaining assets will be sold under the name Heta Asset Resolution AG . The Alpe-Adria-Bank International AG (HBInt) Hypo was the holding company of operating in Southeastern Europe , Hypo Group Alpe Adria (HGAA) ; the Hypo Alpe-Adria-Bank AG (HBA)the Austrian subsidiary. In total, the group was active with 384 branches in 12 countries (including Austria, Italy, Slovenia, Croatia, Serbia and Montenegro, Bosnia and Herzegovina) and was the sixth largest financial institution in Austria in terms of total assets.

After the bank was sold by Carinthia to BayernLB in 2007, after extensive expansion, massive financial difficulties arose within two years: After the bank no longer had the equity necessary for accounting and there was a risk of insolvency , the Republic of Austria took over in December 2009 100% of the shares and thus became the sole owner in the course of a nationalization process . This made Hypo Alpe Adria the second Austrian bank, after the community financier Kommunalkredit Austria , to be nationalized from 2007 onwards since the beginning of the financial crisis . In the fall of 2014, the group was broken up by the republic and all remaining stocks were converted into mining companies. The Southeast Europe business is sold.

Corruption suspected

The bank is suspected of having been significantly involved in numerous financial and corruption scandals in Austria and Croatia since 1999 . In Germany, Austria and Croatia, the judicial authorities have initiated investigations against employees and business partners of the bank. In Austria, for example, to come to terms with the past, a separate police unit, SOKO Hypo, was founded, whose work was supported by a CSI Hypo set up by the Ministry of Finance. The CSI was dissolved in 2012, the investigations are being continued by the bank's forensics department. So far (as of May 2013) 74 statements of facts have been submitted to the public prosecutor in Austria alone; the stated amount of damage is at least 670 million euros. In addition, so far there have been five committees of inquiry to clarify political responsibility - one in Munich (Bavaria), two in Klagenfurt (Carinthia), and two in the Austrian parliament. In parallel to the processing of criminal allegations, the nationalization is also occupying the EU Commission. Today's Heta Asset Resolution AG is a wind-down company owned by the Republic of Austria. It has the legal mandate to utilize the non-performing part of Hypo Alpe Adria, which was nationalized in 2009, as effectively and value-preserving as possible. The recovery is to be accomplished as quickly as possible within the scope of the dismantling objectives.

In September 2013, the EU Commission approved a plan for the orderly liquidation of the Austrian bank Hypo Alpe Adria (HAA) at the time. In July 2014, the Austrian National Council passed the Hypo Special Act. This created the basis for deregulating and creating the dismantling unit of Hypo Alpe-Adria-International AG. In accordance with EU law, the wind-down company is not allowed to conduct deposit business itself or hold shares in banks. For this reason, the Southeastern Europe banking network including a separate control holding company in Austria and the Italy division, which is currently being wound up, were spun off from the former Hypo Alpe-Adria-International AG.

On October 30, 2014, Hypo Alpe-Adria-Bank International AG announced the termination of the license granted under the Banking Act (BWG) to operate banking transactions. At this point in time, Hypo Alpe Adria was renamed the settlement company Heta Asset Resolution . Before that, the Balkan network, which was ready for sale, was temporarily transferred to the ÖIAG subsidiary Fimbag (the Southeast European holding company including the six Balkan banks). The deregulation decision of the financial market supervisory authority is thus released.

Since then, Heta Asset Resolution has been continued as a wind-down unit owned by the Republic of Austria in accordance with Section 3 of the Federal Act on the Creation of a Wind-Down Unit (GSA) and, on the legal mandate, is to utilize the portfolio of Hypo Alpe Adria, which was nationalized in 2009, as effectively and value-preserving as possible. The Heta Asset Resolution AG has local subsidiaries in Austria, Italy, Slovenia, Croatia, Bosnia and Herzegovina, Serbia, Montenegro, Macedonia, Bulgaria, Germany and Hungary. Ongoing banking business has ceased since the break-up.

On December 23, 2014, the Balkan subsidiaries went to a bidding consortium made up of the US fund Advent and the Eastern European bank EBRD. In accordance with EU requirements, the network was to be re-privatized by mid-2015. Until the closing, the Balkan subsidiaries operated under the name Hypo Group Alpe Adria AG. The SEE banking network comprises six bank holdings in five countries in Southeastern Europe (Slovenia, Croatia, Bosnia and Herzegovina, Serbia, Montenegro) with total assets of around EUR 8.4 billion, 245 branches and 1.15 million customers.

history

Beginnings of the Kärntner Landes-Hypothekenanstalt

The bank was founded in 1896 by the state of Carinthia as a state mortgage company. At that time - and in some cases later - a state mortgage company was established in every Austrian federal state. The main task was the financing of public institutions, the housing construction business and the issuing of mortgage Pfandbriefe and municipal bonds . In 1920 the savings business was started. In 1924 the Landes-Hypothekenanstalt became a public credit institution and in 1928 the State of Carinthia assumed full liability for the institution. From 1929 it was the only paying agent in the country.

Second Republic, conversion to a group of companies

In 1962 the company moved into the new business premises in Domgasse and from 1970 branches were gradually built in larger Carinthian towns. In 1980 the name was changed to Kärntner Landes-Hypothekenbank and the bank became a universal bank in 1982 . In 1988 the bank took the first international expansion step with a leasing company in Udine . In 1991, the banking business was incorporated into a newly founded stock corporation , Hypo-Alpe-Adria-Bank International AG , while the bank itself continued to exist as a public holding company called Kärntner Landes- und Hypothekenbank Holding (Kärntner Landesholding) . In 1992, along with the Province of Carinthia, the Grazer Wechselseiten Versicherung took part as a second shareholder with a stake of 48%. At that time, Wolfgang Kulterer joined the bank's board of directors. The balance sheet total in 1992 was 1.87 billion euros. Kulterer persistently pushed ahead with the expansion together with his board colleague Jörg Schuster. After the collapse of Yugoslavia , they concentrated on the successor states, in 1995 the institute was converted into Hypo Alpe-Adria-Bank AG (HAAB) and in 1999 the modern new Hypo-Alpe-Adria-Center was opened on Alpe-Adria-Platz in Klagenfurt. Supported by the guarantees of the federal state of Carinthia, the balance sheet total in 2005 was 24.23 billion euros.

Hypo Alpe Adria since 2006

In 2006 the company name of the group was changed to Hypo Group Alpe Adria (HGAA). A new logo was designed to emphasize the internationality of the former Landesbank. It showed the silver-gray Alps above , the deep blue Adriatic below .

From October 2, 2006, the bank was under the leadership of Siegfried Grigg . The deputy head of GraWe replaced Wolfgang Kulterer , who had resigned after the turmoil surrounding the bank's speculative losses in the amount of 328 million euros. Kulterer became chairman of the board. Before that, Grigg worked for Hypo co-owner GraWe for 25 years; he was also a Hypo Supervisory Board member and a member of the credit committee for six years . Around this time, the guarantees that the State of Carinthia had assumed for the Pfandbriefe issued reached their highest level of around 24.7 billion euros.

On December 15, 2006, the group of investors led by the Luxembourg-based Berlin & Co. Capital Sarl, under the leadership of the 49-year-old German asset manager Tilo Berlin , acquired 4.76% of the Hypo-Group Alpe Adria. This happened as part of the first tranche of a capital increase (125 million euros). Most of the money probably came from wealthy Austrian and German families. On March 1, 2007, the second tranche of the capital increase (a total of 250 million euros) was completed. The new ownership structure was therefore as follows: Kärntner Landesholding 44.91%, Grazer Wechselseite 41.45%, Berlin & Co. 9.09% and the in-house employee foundation 4.55%.

On May 17, 2007, it was announced that BayernLB would take over a majority stake in Hypo Group Alpe Adria. The sale of 50% plus one share was contractually sealed on May 22, 2007. BayernLB paid over EUR 1.6 billion for this. The Kärntner Landesholding sold almost 25% and retained 20% and received around 800 million euros. The state thus redeemed the convertible bond of EUR 550 million due in 2008. The employee foundation still held 3% and the Grazer Wechsels Zeiten Versicherung separated from 15%, leaving 26%. Hypo boss Berlin sold his entire stake down to 1%. As of June 1, 2007, Berlin took over as CEO of Hypo Group Alpe Adria. The previous chairman of the board, Grigg, returned to the Grazer Wechselseite. After the capital increase was completed in 2008, BayernLB held 67.08%, Grazer Wechselseite 20.48%, KLH Group / Kärntner Landesholding 12.42% and Hypo Alpe-Adria-Arbeiter Privatstiftung 0.02%.

In December 2008, after the financial crisis had taken full effect from 2007 , the Federal Ministry of Finance promised that Hypo Group Alpe Adria would receive EUR 900 million in participation capital from the bank aid package of the Republic of Austria. The core capital ratio of Hypo rose to 8.4% at the end of 2008. Hypo should pay a dividend of 8% annually in profitable years and meet certain requirements. At the end of April 2009, CEO Tilo Berlin resigned after differences with Hypo's majority owner BayernLB. As of June 1, 2009, the previous ÖVAG General Director Franz Pinkl was appointed as his successor . In mid-November 2009, the bank announced that it needed a substantial external capital injection for the second time within a year so that it would not fall below the required minimum equity limit of 8% because of the high write-downs required for bad loans in Southeastern Europe. There was talk of a capital requirement of at least 1.5 billion euros.

Nationalization

On December 14th, 2009, after a nightly marathon meeting - “the night of the long knives” - between the Republic of Austria (negotiator: Finance Minister Josef Pröll and State Secretary Andreas Schieder ) and BayernLB under the Bavarian Finance Minister Georg Fahrenschon , the State of Carinthia under governor Gerhard Dörfler and Grazer Wechselseiten Versicherung came to the following agreement: 100% of the bank was taken over by the Republic of Austria at the symbolic price of four euros. The prerequisite for this was that BayernLB bring in 825 million, Carinthia 180 million and Grazer Wechselseiten 30 million euros into the bank. The Republic of Austria had to contribute up to 450 million euros through the 15 billion euro banking package.

After a crisis meeting of the cabinet of the Bavarian Prime Minister Horst Seehofer that followed , the CEO of BayernLB, Michael Kemmer , had to resign with immediate effect. The European Commission approved on 23 December 2009, the nationalization of HGAA by Austria. At the same time it was announced that the bank had to submit a comprehensive restructuring plan to the EU by the end of March 2010. On January 8, 2011, the Austrian news magazine profil published the secret share purchase agreement between the Republic of Austria, Bayerische Landesbank and Hypo Alpe Adria to save the bank. According to this, the Bayerische Landesbank had purposefully driven its own subsidiary to the brink of bankruptcy from November 2009 and the Austrian taxpayer had secured investments in the billions. In fact, in the controversial contract, the Republic granted the Bavarians extensive control rights over the future co-creation of the company and at the same time waived the usual betterment clause. In addition, despite the precarious situation, the repayment of Bavarian loans in the amount of 3.1 billion euros was guaranteed, should Austria “sell its majority stake in the bank or split the bank” - i.e. separate it into a bad bank and a good bank. The EU sees these guarantees as illicit aid; A legal dispute between the federal government and the EU has therefore been underway since autumn 2012. Critics agree that Austria negotiated poorly. The figures make this clear: While BayernLB only had to contribute 825 million euros to the restructuring of Hypo, Austria brought in 1,150 million euros after the government aid of 900 million euros that had already been paid to save the bank from insolvency. Another 700 million euros could flow in 2013; in addition, the state of Carinthia had to raise 180 million.

Nonetheless, nationalization was defended as "without alternative", as the former Finance Minister Josef Pröll emphasized on June 15, 2011 during his interrogation in the Carinthian Committee of Inquiry - the political analysis of the 2007 Hypo sale: a Hypo bankruptcy would have been like "Lehman 2"; at the end of 2009 you had "your back against the wall". This was primarily due to the “unimaginable” billions of liabilities of the state of Carinthia for Hypo. The lawyer responsible for the contract negotiations and President of the Financial Procuratorate , Wolfgang Peschorn , also defended the nationalization as a witness: They did not allow themselves to be ripped off and tried to exhaust all legal possibilities against Bavaria.

A year later, in 2012, Peschorn finally admitted in the German magazine Spiegel that the republic had been deceived by the Bavarian previous owners about many points: “It is as if we had received a car with the note 'No major problems' and then discovered that the whole chassis is rusted. ”But nobody wanted to be responsible for the billion-dollar debacle. Ex-Finance Minister Pröll only vaguely remembered the nationalization in civil proceedings in April 2013 before the Vienna Commercial Court, saying that he had relied on experts. According to witnesses, these were Peschorn and Alfred Lejsek from the Ministry of Finance. The public prosecutor's office in Klagenfurt has initiated investigations against twelve people involved in the nationalization negotiations on suspicion of breach of trust, falsification of accounts and abuse of office based on reports from National Council member Stefan Petzner. Among other things, ex-minister Pröll, ex-bank boss Franz Pinkl and financial procurator's president Peschorn were named as suspects, and a complaint was made against Peschorn because of an alleged false statement before the Carinthian investigative committee.

In January 2010 a new supervisory board was appointed. Johannes Ditz was elected chairman and Rudolf Scholten deputy chairman, other members are Helmut Draxler and Alois Steinbichler. In March 2010, the supervisory board appointed the bank's new management board. The former head of KPMG Austria, Gottwald Kranebitter , became chairman of the board .

On April 5, 2011, the bank announced that it would delete the name Group from the logo as part of a new advertising campaign .

Protest action

On the night of March 17, 2016, activists attached an 18-meter-long poster with the inscription “Thank you Jörg! Forever in your debt ”, on the exterior of the Heta headquarters. During the day the activists, who call themselves Haider's heirs , made the following statement:

“ In the following we want to comment anonymously on the 'Thank you Jörg' banner campaign. Thanks to the media picking up on the image, the campaign received a great response within a very short time, combined with controversial opinions. The insolvency negotiations have been going on for some time and Carinthia does not have a bright future in view of its economic situation. For us, the main aim of this campaign is to address the political paralysis that is coupled with a lack of public political criticism to which our population has apparently fallen prey. The hypopleite is very clear, a chain of collective failures. Besides Jörg Haider, other names would deserve their place on the banner. The slogan, however, was chosen deliberately to draw attention to the largely prevailing Carinthian refusal mentality. This is probably also the result of a permanent assignment of victim roles to which the population has felt for years. 'If Jörg were still alive, he would not have allowed that!'. These statements are often heard and underline what we believe to be an underage attitude towards political victimization. We now have to accept this debacle and apparently face the consequences. However, we should at least recognize it as a memorial of a doomed FPÖ policy in order to learn from the past in the future. Qualified resistance, often requires populist measures! "

Organization of Hypo Alpe Adria

(all information according to official presentation)

| Hypo Alpe-Adria-Bank International AG | |

|---|---|

| legal form | Corporation |

| founding | 1896 |

| Seat | Klagenfurt am Wörthersee , Austria |

| management | Alexander Picker |

| Number of employees | 584 (December 31, 2012) |

| Branch | Financial services , administrative activities, holding company |

| Hypo Alpe-Adria-Bank AG | |

|---|---|

| legal form | Corporation |

| founding | 2004 |

| Seat | Klagenfurt am Wörthersee , Austria |

| Number of employees | 453 (December 31, 2012) |

| Branch | Universal bank |

Hypo Alpe-Adria-Bank International and Hypo Alpe-Adria-Bank Austria are members of the Association of Austrian State Mortgage Banks .

The management

In January 2010 a new supervisory board was appointed. Johannes Ditz was elected chairman and Rudolf Scholten deputy chairman, other members are Helmut Draxler and Alois Steinbichler. In April 2013 it is announced that the two heads of the Austrian financial market participation company FIMBAG, Klaus Liebscher and Alfred Wala, will be delegated to the supervisory board. At the same time, Gottwald Kranebitter's mandate as chairman of the board was extended to a further three years, as were the board contracts of Wolfgang Edelmüller, Rainer Sichert and Johannes Proksch. Kranebitter, formerly head of the auditing firm KPMG, was appointed to the board of the bank in March 2010. On June 3, 2013, Johannes Ditz resigned as chairman of the supervisory board of Hypo Alpe-Adria-Bank International AG with immediate effect because, according to his own statements, he did not agree with the government's concept for the future of the bank. He was officially followed on Friday, June 21, 2013 by FIMBAG boss Klaus Liebscher as the new chairman of the supervisory board. Gottwald Kranebitter announced his resignation on July 2, 2013 and left the company on August 28, 2013 following the publication of the 2013 half-year results of Hypo Alpe-Adria-Bank International AG. As the reason for the resignation, Kranebitter cited the several months of public discussion of closure scenarios and undifferentiated cost speculation, which, according to him, had massively damaged large parts of the renovation work over the past three years and badly affected the economic situation of the healthy parts of the bank. On December 20, 2013, the bank announced that Alexander Picker will be appointed as the new CEO of Hypo Alpe-Adria-Bank International AG on January 1, 2014. Alexander Picker is a banker with extensive Balkan experience and before joining Hypo he worked for UniCredit / Bank Austria in Russia, Poland, Serbia and Kazakhstan for many years.

Buildings and sponsorship

The headquarters of Hypo Alpe Adria, designed by the American architect Thom Mayne , is located in the Carinthian capital, Klagenfurt am Wörthersee, at Alpen-Adria-Platz. The building was sold to a Swiss real estate company at the end of November 2018, and the parties have agreed not to disclose the purchase price.

- Hypo Group Arena from 2009 to 2010, stadium in Klagenfurt, Austria (today's name Wörthersee Stadion )

- Hypo Group Tennis International from 2006 to 2008, tennis tournament in Pörtschach, Austria

Financial affairs about the Hypo Alpe-Adria Bank

Financial affairs at Hypo Alpe Adria have been reported since 2004. In June 2007 further inconsistencies became known through a rough report from the Austrian National Bank. These range from inadequate due diligence and dubious property sales to suspicion of money laundering . The Croatian journalist Hrvoje Appelt , who first reported on the corruption affair around Hypo, describes the bank as “one of the largest criminal organizations in Croatia - with a powerful political background and protection from the highest level”.

Balance sheet falsification in the course of speculative losses

In March 2006, the BAWAG affair caused quite a stir among the Austrian public. A little later it became known that Hypo Alpe-Adria-Bank also had to take into account a significant loss for the bank of around 328 million euros in the balance sheet through risk speculation, which was not done in time in 2004. In this case, too, the Financial Market Authority (FMA) started an investigation. At the end of March, the auditor Deloitte withdrew the certificate for the 2004 balance sheet. In April 2006, the FMA filed a complaint against the management of Hypo Alpe-Adria-Bank for falsifying accounts .

In order to avoid being removed from office by the FMA, the previous chairman of the board, Wolfgang Kulterer, stepped down and switched to the position of chairman of the bank's supervisory board. Since, according to the Corporate Governance Code, such a change would only have been possible after a waiting period of three years, the Supervisory Board of the Carinthian State Holding, with the votes of BZÖ and ÖVP representatives, had the relevant passage deleted from the bank statutes on August 16, 2006 .

Kulterer was finally sentenced in November 2008 before the Klagenfurt Regional Court for falsifying accounts to a fine of 140,000 euros. He defended himself that the incorrect accounting was "economically correct, but legally incorrect" and pleaded guilty. The proceedings against his board colleague Günter Striedinger were continued separately. Thomas Morgl , who was also accused , received a diversion .

Loss of speculation

On January 11, 2010, it became known that Hypo was speculating hundreds of millions of euros in the tax haven Jersey . According to this, the bank had raised € 75 million in speculative capital on the Channel Islands in 2001 and 2004 . At the end of 2005, the Carinthian bankers and Deutsche Bank founded HB International Credit Management in Jersey via the US tax haven Delaware . This then financed two subsidiaries named Carinthia I and II. The latter invested in papers of different credit ratings, which in turn were issued by two special companies of Deutsche Bank. In the course of the financial crisis in 2007, HB International Credit Management suffered losses of 210 million euros. At the time it was invested in toxic securities with EUR 842 million.

In a second attempt in 2007, HB International Credit Management was again provided with 400 million euros by Hypo and Deutsche Bank. Due to the ongoing financial crisis, Hypo had to write off 56 million euros again in 2008. In addition, there were losses from the bankruptcy of Lehman Brothers and three Icelandic banks, in whose products investments were also made.

Share spam affair of the Liechtenstein subsidiary

In August 2007, reports The Vancouver Sun , that Hypo Alpe Liechtenstein AG, by the end of 2007, a wholly owned subsidiary of Hypo Group Alpe Adria, the Financial Services Authority of British Columbia was excluded temporarily from trading, as these between 1 Nov 2006 and 31 August Traded spam stocks in 2007 . The penny stocks in question were advertised for purchase in spam emails. Since Hypo Alpe Liechtenstein AG, at the request of the tax authorities - and with reference to banking secrecy in Liechtenstein - did not want to disclose on whose behalf it had traded these shares, it was finally on May 20, 2008 "for all time" from the securities and foreign exchange business in British Columbia excluded. According to the Austrian news magazine Profil , “in civilized parts of the world” it is probably unique “for a bank to be forever prohibited by a financial supervisory authority”. HGAA now only holds a minority share of 49% in the Liechtenstein subsidiary.

Suspicion of insider trading in the sale to BayernLB

On January 1, 2010 the Süddeutsche Zeitung reported that the suspicion of insider trading in the sale of HGAA to the Bayrische Landesbank had been confirmed. According to this, Tilo Berlin's group of investors is said to have already known when purchasing the 9.09% stake in HGAA that the bank would be taken over by BayernLB a little later at a higher price. As early as January 31, 2007, there is said to have been a secret round of talks about the planned sale at BayernLB's Munich headquarters, attended by bank managers Werner Schmidt and Wolfgang Kulterer, confidante of Carinthian Governor Jörg Haider , who died in October 2008 , and Tilo Berlin were present. So far, Schmidt, Kulterer, Berlin and Haider had claimed as witnesses in an investigative committee of the Carinthian state parliament that they only learned of BayernLB's interest in Hypo Alpe Adria from March 2007. In fact, the investor group was able to resell its stake in Hypo Alpe Adria after only a short time on May 22, 2007 with a high profit of 170 million euros.

Members of the investor group

It is not entirely known which investors have participated directly or indirectly in Project Knox of the Luxembourg special purpose vehicle Berlin & Co. Capital Sarl . Tilo Berlin stated in several interviews that between 30 and 50 investors were involved in the form of profit participation certificates. According to a Hypo employee, there will be 47, including the private foundation of Ingrid Flick, the widow of Friedrich Karl Flick , whose board member and managing director was Wolfgang Kulterer until 2010. Kulterer himself should also be among the investors. Some people participated indirectly in the deal, for example through the investment company Kingsbridge Capital in Jersey, which belongs to the Austrian Hardt Group . Its owner, the Viennese investment banker Alexander Schweickhardt, has already confirmed the stake. According to the Austrian news magazine Format, the former Austrian Finance Minister Karl-Heinz Grasser was also there. During his tenure, he is said to have invested half a million euros indirectly through the Swiss trust company Ferint AG , without reporting this to the President of the Court of Auditors in accordance with the Incompatibility Act. Grasser had his lawyer deny the reports. On March 26, Format published a confidential audit report from the Oesterreichische Nationalbank (OeNB), in which Grasser's transactions are documented in detail. The Financial Market Authority (FMA), which commissioned the study, then initiated a special investigation. It will be checked whether Ferint AG and Karl-Heinz Grasser have violated Section 40 of the Banking Act. The “due diligence requirements for combating money laundering and terrorist financing” are laid down in it. It is the presumption of innocence.

On January 14, 2010, the Austrian news magazine profil published a list of 46 investors that Tilo Berlin had drawn up himself and submitted to the Carinthian state government. The document is said to have been seized in the course of a house search that the Munich public prosecutor's office had carried out in Vienna law firms and at Tilo Berlin's headquarters in autumn 2009. Originally, 47 people were mentioned due to an erroneous double count.

|

|

|

|

|

In the course of the investigation, two journalists were interrogated by the Austrian public prosecutor's office at the request of the Munich public prosecutor's office without any legal basis. The two journalists are said to have violated German Section 353d of the Criminal Code ( forbidden communications about court hearings ). Since there is no such offense in Austria, there is no administrative assistance agreement. For this reason, the Austrian judiciary is accused of an attack on the freedom of the press by the international journalists' organization Reporters Without Borders . The public prosecutor's office, which admitted errors, promised to destroy the minutes.

Suspicion of hidden party funding

When Hypo was sold to BayernLB, several million euros are said to have flowed to the Carinthian government parties Die Freiheitlichen in Kärnten (formerly Carinthian BZÖ) and ÖVP . According to newspaper reports, Die Freiheitlichen in Carinthia should have received EUR 27 million and the ÖVP around EUR 13 million.

The bank's generous loans to Die Freiheitlichen in Carinthia of 2.6 million euros and to the BZÖ Parliamentary Club of 892,000 euros are undisputed . The Carinthian SPÖ borrowed 1.25 million euros from Hypo.

Under the governor at the time, Jörg Haider , the state of Carinthia assumed liability for the bank, the amount of which, as later became known, amounted to up to EUR 24.7 billion. That corresponds to over eight times the Carinthian state budget. The state receives an annual liability commission for this. In 2003, for example, Hypo transferred 8.2 million to the state of Carinthia. In total, Carinthia earned 48 million euros in the period from 2002 to 2007. Carinthia had the guarantee commission up until 2010 advanced by the bank in one fell swoop, thus securing a loan from Hypo in the amount of 58 million euros. According to the Greens, 20 million euros of this should have flowed into the election campaign of the “big parties”.

At the end of 2009 the liability, which did not appear in the Carinthian budget estimate for 2010, was 19 billion euros. In January 2011, the new head of the bank, Gottwald Kranebitter, spoke of a liability of 20 billion euros or 36,000 euros per Carinthian for bonds that have to be repaid by 2017.

On July 4, 2012, criminal proceedings against Martinz and tax advisor Dietrich Birnbacher began at the Klagenfurt Regional Court on suspicion of infidelity. On July 25, 2012, Birnbacher admitted to the court that it had been agreed to pass on parts of his fee (which he had previously admitted, far excessive) to the ÖVP under Martinz and the then BZÖ under Jörg Haider (today Die Freiheitlichen in Kärnten , FPK) . On the same day Martinz announced his resignation as ÖVP regional party leader; he announced that he would be leaving the ÖVP and admitted the act of illegal party financing after he had repeatedly denied it. Martinz denied that (as claimed by Birnbaumer) the former Interior Minister Ernst Strasser was involved.

The news of the events caused horror, Federal President Heinz Fischer spoke of a "political swamp". The federal government was considering a motion to dissolve the Carinthian state parliament. The public prosecutor's office for corruption initiated investigations against Provincial Councilor Harald Dobernig (FPK) and three experts on suspicion of contributing to the breach of trust. Investigations against Uwe Scheuch (FPK), Provincial Councilor Uwe Scheuch (FPK), who was only recently sentenced to a conditional prison sentence, are being examined. The Carinthian governor Gerhard Dörfler (FPK) described the allegations against Martinz, Scheuch and others as "human hunt" and rejected calls for new elections. The Kleine Zeitung reported that files were being shredded in Uwe Scheuch's office, but withdrew the report “so as not to intervene in investigations by the authorities”.

A special state parliament session was held on July 27, 2012. In the course of the debate, there were gross disagreements and abuse. For example, FPK MP Grebenjak gestured to a member of the Greens to air her T-shirt. A new election proposal was resolved in the budget committee. The FPK threatened to prevent votes on the new election application by constantly leaving the plenary.

In addition to Josef Martinz's complete withdrawal from politics, the investigations led to the resignations of Uwe Scheuch (FPK), Achill Rumpold , Stephan Michael Tauschitz and Thomas Goritschnig (all ÖVP) from their posts.

On October 1, 2012, Josef Martinz was sentenced to five and a half years of unconditional imprisonment, Dietrich Birnbacher to three years of imprisonment, including two years, Hans-Jörg Megymorez to three years imprisonment and Gert Xander to two years imprisonment in the first instance for infidelity .

Share carousel in Liechtenstein

On May 24, 2012, the Klagenfurt Regional Court received the first high prison sentences in the Hypo-Causa: The two former board members Wolfgang Kulterer and Günter Striedinger as well as the Klagenfurt lawyer Gerhard Kucher and the tax advisor Hermann Gabriel were suspected of breach of trust or the Contributor sentenced to several years imprisonment - Kulterer takes 3 ½ years, Striedinger and Kucher 4 each, Gabriel 4 ½ years. The judgments are not final. The two bank advisors, Kucher and Gabriel, are accused of having developed a complicated share structure in 2004 with which they were able not only to gain financial advantages through a network of foundations in Liechtenstein, but also to Hypobank through a "classic circumvention business", as the judge said The reasons for the judgment described having raised non-existent capital. The two board members Kulterer and Striedinger would have known about the preferred share deal and should never have allowed him as experts. According to the public prosecutor's office, the Hypo itself suffered a loss of 5.49 million euros as a result of the malversations. Surprisingly, the bank was referred to civil law action in the criminal proceedings with its claims - a damage claim for 48 million euros is pending at the Vienna Commercial Court.

Bad loans

Styrian Spirit

The dismantling part of Hypo in 2013 amounts to more than ten billion euros - the majority of this is due to bad loans, which are said to have been granted frivolously, especially in Eastern Europe, but also in Austria, and without sufficient credit checks or seizures. Among other things, ex-board member Wolfgang Kulterer was sentenced again to 2 ½ years in prison for infidelity in 2013 because he, together with the former Hypo-Austria board member Gert Xander and an authorized signatory, had given the airline Styrian Spirit a two million euro loan in 2005 - despite warnings in front of the company's ailing financial position and without collateral. The Styrian Spirit suffered a financial crash landing, the Hypo was left with two million euros in damage. Kulterer had always referred to having acted only on behalf of the late Carinthian Governor Jörg Haider. Haider would have wanted to revive the Carinthian economy with the regional airline - regardless of the economic difficulties of Styrian Spirit. In the first trial in 2011, Kulterer and his co-defendants were therefore acquitted by Judge Norbert Jenny; however, the Supreme Court ordered the proceedings for breach of trust to be re-conducted. This ended under judge Christian Liebhauser with convictions, which are fought by the defendants.

Project Skiper

Günter Striedinger is also said to have made a lasting contribution to the collapse of assets at Hypo with a number of dubious loans. From 2000 onwards, he was considered the mastermind for Croatia in the bank, where he was primarily responsible for large-scale projects such as the Skiper hotel complex in Savudrija in Istria, financing by the Croatian companies AB Maris and Darija, or the Jaklan tourism project, which the investigative authorities were responsible for on suspicion of criminal activities to be examined. Striedinger is also repeatedly associated with the imprisoned Croatian general Vladimir Zagorec. One insider reported that both Striedinger and Kulterer had excellent contacts with Croatian customers and that funds were often secretly transported in suitcases in Learjets . In Freyenthurn Castle near Klagenfurt, there is said to have been a short-term safe for cash transfers. In total, Hypo brought in more than 30 reports against its former board member, Striedinger.

The Consultants Affair

In 2007, before Bayern got on board, Hypo sold the so-called Hypo Consultants, which included real estate and projects with a financing volume of 225 million euros. The deal with the Croatian Auctor Group was celebrated as a success and led to the distribution of a special dividend of 50 million euros in 2008 to the former owners of the Province of Carinthia, Grazer Wechselseite and the Berlin Group. But the supposedly huge business turned out to be a failure: Because the Auctor or its successor companies had outstanding debts of more than 250 million euros, which had to be written down by Hypo. In 2011, the bank therefore filed a civil suit against the beneficiaries of the dividend and ten former bank managers and supervisory board members such as Wolfgang Kulterer, Siegfried Grigg and Othmar Ederer. The loans would have been improperly granted; the profits would have been faked and the special dividend would have been illegal.

Debt relief for FPÖ politicians

In 1997 the bank forgave the FPÖ National Councilor Heinz Anton Marolt the equivalent of 2.18 million euros in debt. In 2010, therefore, an investigation was initiated against Kulterer on suspicion of breach of trust. It was discontinued in January 2014 due to a lack of demonstrable intent.

Refurbishment and restructuring

CSI Hypo

After nationalization at the end of 2009, Finance Minister Josef Pröll announced the founding of his own CSI Hypo in February 2010 on a trip to Mumbai, India, in front of Austrian journalists. A 100-strong team of forensic, economic and legal experts should "turn every receipt twice" in order to find out the causes of the rapid decline in wealth and the whereabouts of the money. This special unit was called CSI in reference to the popular TV crime series - a marketing gag, as critics believe. The Green finance spokesman Werner Kogler warned that a CSI could easily become a "file number Hypo unsolved". The President of the Financial Procuratorate Wolfgang Peschorn was appointed head of the CSI, but the Graz attorney Guido Held appeared as spokesperson. Held came under fire because he also acted as the bank's legal representative and brought legal remedies against investigative activities such as house searches, seizures or opening accounts. The plan was for CSI Hypo to be able to present results in 2010.

However, the investigation stalled after a few months, and there were repeated arguments between the CSI director and bank manager Gottfried Kranebitter. Kranebitter publicly complained that he felt limited in day-to-day banking operations and attempts to restructure the company and get it ready for sale; the CSI also publicly insisted on precise investigations regardless of the financial market and the tense situation of Hypo. There were no results; A newspaper report about a Bosnian prisoner who had offered himself as a hypo spy and at least got an appointment with an officer of the special commission provided amusement: he offered to sneak into the "hypo underworld" for a corresponding salary. The chairman of the supervisory board, Johannes Ditz, also repeatedly urged the CSI to cease operations due to the mishaps.

This finally happened in May 2012. A so-called external authorized coordinator was used to transfer the previous CSI to the company - Forensics department. It is Georg Krakow, formerly a public prosecutor in the Bawag affair and then head of cabinet under Justice Minister Claudia Bandion-Ortner. He and his team should process more than 1,100 individual cases and prepare data from 4.7 million documents with special electronic software. The bank's obligation to come to terms with its past was enshrined in the statutes; “Forensics” controls this activity at home and abroad, with the focus on investigative work in Liechtenstein and on the issues of BayernLB equity, consultants and preferred shares. At the end of 2012, 74 statements of facts with a total damage amount of around 670 million euros were submitted to the responsible public prosecutor's offices in Germany and abroad. In addition, 5 civil proceedings against former decision-makers and third parties with a total value of around 107.0 million euros are pending in the civil courts in Austria in 2013.

The small report

In August 2011, the Graz court appraiser and auditor Fritz Kleiner was commissioned by the owner Republik and the bank to prepare an expert report on BayernLB's time. At the end of April, Kleiner, who was also hired as a court expert in the Bawag scandal, presented more than 700 pages of expertise in which he discovered several points that had not been considered so far. On the one hand, he strongly criticizes the work of Tilo Berlin as CEO of the bank, who had been inactive and received completely excessive payments. “Bayern wanted the bank at all costs; when they finally got them, however, they were mismanaged. And Kleiner ascribes this to one person above all: Tilo Berlin ”, cited the media.

As an auditor, Kleiner's assessment that BayernLB had been planning to exit Hypo for some time caused a stir. Because shortly before the takeover by the Austrian state, the Germans cut credit lines in the three-digit million range at Hypo in 2009. At the end of 2009, the Klagenfurt Institute was saved from bankruptcy through nationalization. According to Kleiner, the Bavarians had already decided a year earlier to part with the Austrian subsidiary - as stated on page 566 of the report: "According to statements by Kurt Fahrenschon, the then Prime Minister of Finance, the medium-term perspective at the board meeting on 29 November 2008 decided to part with Hypo and abandon the Eastern European strategy. ”However, state aid from the republic was granted in consideration of the Bank's activities in Eastern Europe and the Group's systemic importance in Eastern European countries. At the time, the Austrian National Bank still classified Hypo as “not distressed in the sense of immediately necessary rescue measures”.

On the other hand, the Kleiner report showed that BayernLB's credit lines of € 3.1 billion, which ran until 2014, should not be seen as a loan to the former subsidiary Hypo, as stipulated in the nationalization agreement, but as a substitute for equity. As a result, the bank neither has to service the current interest from it nor replace the capital. According to the expert opinion, around 2.9 billion euros flowed between February and October 2008 - cash for every use in the loan agreements. If the money was used to cover losses, "SU knew about it," a newspaper quoted from Kleiner's report. Hypo therefore commissioned another expert.

Dispute with Bavaria

BayernLB only had a brief guest appearance as the owner of Hypo Alpe Adria: from 2007 until the nationalization in 2009. During this time, Bayern, according to their own statements, sunk 3.7 billion euros in tax money in the Kärntner Bank. As stipulated in the nationalization agreement, a further 3.1 billion euros are loans that were distributed to the ailing subsidiary in several tranches between March 2008 and June 2009. By December 2012, Hypo had served these controversial loan repayments including the interest burden - due to the Kleiner report, the payments were finally stopped: the bank informed the Munich-based company via letter that Hypo and the Republic of Austria, as the new owner, were assuming equity that the Bavarian mother pumped into the Hypo. According to Paragraph 1 of the EKEG (Equity Replacement Act), she declared the money that had flowed as a replacement for equity and cited the fact that the 3.1 billion had flowed in times of crisis. That means they cannot be repaid. BayernLB responded to the suspension of payments with a lawsuit at the Commercial Court in Munich, demanding 2.3 billion including interest charges. “I want my money back”, said the Bavarian Finance Minister Markus Söder to the Austrian Finance Minister Maria Fekter during a visit to Vienna. The quote is an allusion to the sentence with which the British Prime Minister Margaret Thatcher negotiated the so-called British discount at the EU.

The short-term owner BayernLB is also taking action against its former daughter on another front: A lawsuit is pending at the Vienna Commercial Court against the Hypo Employee Private Foundation (MAPS), from which BayernLB bought shares in 2007 in two tranches for 117 million euros. BayernLB felt that the deal had been deceived because it had been denied the equity-damaging subsidiary agreements on preferred shares. The lawsuit was originally brought in for 50 million euros, but was then reduced to ten million euros because of the high litigation risk and immense procedural costs. It is regarded as a test balloon: If BayernLB were successful with its claims against MAPS, it could sue the other sellers - the state of Carinthia, Grawe and Tilo Berlin's group of investors - to reverse the transaction.

reorganization

As a result of the nationalization, a new management was installed by the new sole owner, the Republic, which has a clear mandate to restructure the banking group. According to the bank, the basis for this is a “four-pillar strategy” with the aim of restructuring Hypo Alpe Adria economically and making individual areas fit for the market and thus salable again. According to the bank, state and federal guarantees to the extent of 5 billion euros have been reduced from 21 to 16 billion euros since the nationalization; in the same period, the bank has shrunk by over 7 billion euros or just under a fifth to a balance sheet total of 33 billion euros is then around the size of 2006. With the sale of the two aluminum processing companies TLM ‐ TVP and Aluflexpack in Croatia, Hypo Alpe Adria withdrew entirely from the industrial sector in 2012. The strategic pillars Austria (HBA), Italy (HBI), Southeastern Europe (SEE) and dismantling ( HETA Asset Resolution ) were created for the targeted implementation of the restructuring . While the pillars Austria, Italy and SEE have undergone a fundamental restructuring to restore profitability, the pillar wind-down accumulates all non-strategic assets that are processed according to plan and in a value-conserving manner.

“ Heta Asset Resolution ” thus includes all parts of the company that can no longer be privatized, such as bad loans, bankruptcy investments and real estate that is currently unusable. A reduction should be "capital-friendly", but will take years. The volume of this “bank dump” from leasing and old investments is 11.7 billion euros. CEO Gottwald Kranebitter has already called for a so-called “bad bank” to be set up for this “scrap part” in order to free the operational area from contaminated sites. In a strategy paper in April 2013, the Austrian National Bank rates the total risk of loss for the owner Republic in the event of the liquidation of Hypo at up to 16 billion euros.

On October 30, 2014, the banking license of the former Hypo Alpe Adria, which now operates as “ Heta Asset Resolution ”, expired . The Italian subsidiary is also subordinate to the Ministry of Finance as "HBI-Bundesholding AG", while the Balkan stakes were transferred to FIMBAG until the sale .

Sales processes

Subsidiary banks

The EU Commission's guidelines for nationalization provide for rapid liquidation and dismantling. In the case of Hypo, the Austrian subsidiary is considered profitable. In 2012, Hypo Bank Austria (HBA) was able to generate a profit of 17 million euros for the second year in a row with total assets of 3.8 billion euros. Their book value is 150 million euros. In order to make the company with 14 branches more attractive to buyers, the HBA's non-strategic business portfolio was spun off into the parent company Hypo Alpe Adria Bank International AG in September 2012. This was the "bride dressed up", as newspapers report. On May 31, 2013, it was announced that Hypo Bank (HBA) had transferred EUR 65.5 million to Anadi Financial Holdings Pte. Ltd of the British citizen with Indian roots, Sanjeev Kanoria , has been sold. With the bank, he not only acquired the Austrian branch network, but also a European banking license and the right to issue Pfandbriefe. When the contract was signed, the investor particularly emphasized the strong commitment to the region and the development potential of Hypo in Carinthia. Anadi Financial's future involvement promises Hypo in Carinthia the opportunity to offer new products in other markets and to expand and further consolidate its market position, promised Kanoria in Vienna. According to the chairman of the supervisory board, Johannes Ditz, the fact that the bank had to be sold well below book value was to blame for the months-long discussion about Hypo. “The bank is being ruined,” he complained. The sale of Hypo Austria alone would cost at least 30 million euros.

The sale of Hypo Italy, the purchase price of which is around 350 million euros, and the reprivatisation of Hypo's Eastern European banking network are even more difficult: for the SEE network consisting of Slovenia, Croatia, Bosnia and Herzegovina, Serbia and Montenegro the reprivatisation process started; Due to the banking crisis, the subsidiaries were initially considered slow-moving , but were finally sold to a consortium made up of the US fund group Advent and EBRD in the winter of 2014 and have since operated under the Addiko Bank brand .

Real estate deals

In the course of the restructuring, the bank has to part with its extensive real estate portfolio. One of the most spectacular deals concerns Velden Castle , which was bought by Playboy photographer Gunter Sachs in July 2005 under Wolfgang Kulterer and Jörg Haider in order to turn the fallow Wörthersee jewel into a 5-star deluxe hostel. The bank invested more than 120 million euros in the renovation work and ongoing hotel operations before the hotel was sold to the Amisola Group on July 29, 2011 after a failed deal with the Italian Ugo Barchiesi. Behind the real estate investor is Billa founder Karl Wlaschek , who has personal memories of Schloss Velden: Here he played as Charly Walker in a band before he became a department store tycoon. The rumored purchase price for the castle is said to be 48 million euros. The luxury hotel is run by the Falkensteiner Michaeler Tourism Group .

Ghost ships

“Hypo ghost ships” made headlines in the Adriatic. According to initial fears of the CSI, every fifth ship financed by the bank would have disappeared. In 2012, CEO Gottwald Kranebitter gave the all-clear: Of 2000 yachts, only twelve remained undetectable; the whereabouts and financing of all others were clarified.

Griss commission

After the demand for a parliamentary committee of inquiry failed to find a majority in the Austrian National Council on several occasions , even though a corresponding online petition had been signed by more than a hundred thousand citizens, the government set up a committee of inquiry on March 25, 2014, headed by the former president of the Supreme Court , Irmgard Griss , investigated the events around Hypo Alpe Adria starting May 1, 2014. Other members of the commission were Manuel Ammann , Carl Baudenbacher , Ernst Wilhelm Contzen and Claus ‐ Peter Weber. In June 2014, the five members of the Griss Commission met for their first meeting in Vienna, their investigations were subject to official secrecy . The costs for the commission should be less than half a million euros, the final report was presented in December 2014. The commission came to the conclusion that the nationalization of the bank in 2009 was not without alternative and sees a failure of all control bodies. In the years that followed, the decision to found a bad bank had been postponed again and again for political reasons, and therefore acted too late. In March 2015, the Austrian Court of Auditors published an audit report and also sees inadequate supervision by the participating supervisory bodies FIMBAG , OeNB , the financial market supervisory authority and the Ministry of Finance .

Parliamentary committees of inquiry

Between November 2006 and July 2007, at the request of the Greens, SPÖ and FPÖ, a committee of inquiry was held in the Austrian Parliament on the subject of financial market supervision, BAWAG, Hypo Alpe-Adria and other financial service providers . Martin Graf (FPÖ) chaired the meeting .

On February 26, 2015, the parliamentary Hypo Committee of Inquiry began to investigate political responsibility for the events surrounding the Hypo Group Alpe-Adria . This is the 22nd Committee of Inquiry of the Second Republic and the first to be set up by the opposition, having only been able to do so since 2015.

Negotiations with the EU

Time pressure for Austria

The schedule for the necessary restructuring measures is causing problems with the EU, which sees nationalized banks as a distortion of competition and allows only tight deadlines for reprivatisation. In 2008 the bank applied for state aid for the first time under the Bavarians. For EU competition commissioner Joaquín Almunia, the five-year period for reprivatisation has already started. He calls for a quick break-up and the “emergency sale” of the subsidiary banks in 2013. In a letter on March 14, 2013, he informed Finance Minister Maria Fekter that he “had strong doubts about the validity of the HGAA business model” and “no decision in favor of the HGAA can suggest ", as the news magazine" Profil "quotes. "The sum of already received and now requested further capital measures ... make Hypo Alpe-Adria one of the most subsidized banks in the European Union. I must also remind you that this is one of the longest cases that we have had to grapple with since the financial crisis hit. From the beginning we heard assurances from Austria that the bank had started a comprehensive restructuring. “Austria asked for more time for the restructuring measures. After all, the republic did not take over Hypo until the end of 2009; the new management only started in spring 2010. Breaking it up, as requested by Almunia by the end of 2013, would cost around 16 billion euros in the worst-case scenario. The bank would have to carry out emergency sales, refund all state aid and waive the guarantees of the federal government - this would no longer allow operational business and liquidation would be unavoidable. In order to prevent this, a separate task force was set up in May 2013 to negotiate with Brussels. On September 3, 2013, the European Commission announced in a press release that the restructuring plan submitted by the Federal Ministry of Finance complies with the applicable EU state aid regulations. According to the plan, the marketable parts of the bank will be sold while the remaining, non-profitable parts will be wound up in an orderly process. A purchase agreement for the Austrian subsidiary was signed in May, and the network of south-eastern European banks is to be sold by June 30, 2015 at the latest.

Warranty dispute

Another aspect of the Hypocausa caused tension between Vienna and Brussels. On July 25, 2012, the EU Commission qualified a financing guarantee from Austria to BayernLB as state aid. This refers to the guarantees that the republic assumed in the course of nationalization for 3.1 billion euros. The federal government has brought an action for annulment against this state aid decision at the EU Court of Justice: one was not heard in the state aid proceedings; In addition, the EU Commission had not dealt with the question of whether the money was equity or debt.

Processing of Heta

On March 1, 2015, the federal government decided not to make any additional money available to Heta. The bad bank Heta is now handled by the Financial Market Authority; A moratorium was imposed on their debts until May 31, 2016.

The settlement is based on the Bank Restructuring and Settlement Act, which has been in force since January 1, 2015, with which private creditors can also be included.

Austrian mortgage banks (Hypo Tirol, Hypo Niederösterreich, Hypo Steiermark - via the Pfandbriefstelle) as well as the German banks Commerzbank , Pfandbriefbank , Düsseldorfer Hypothekenbank , NordLB and Dexia Kommunalkredit were affected by this payment stop .

The also affected Erste Abwicklungsanstalt (the Badbank of WestLB ) wants to sue Heta.

In June 2015, Berlin Hyp , Helaba, HSH Nordbank and Norddeutsche Landesbank sued the Bad Bank of Hypo Alpe Adria for repayment of a total of EUR 218 million.

November 2016 it is discussed in the media that a new building with a total of 400 employees will be built in Klagenfurt (topping-out ceremony June 2016, planned commissioning May 2017) in Klagenfurt to bring together 3 tax authorities - tax office, a body of the tax court and financial police Heta (ex Hypo Alpe Adria, once housed 1000 employees) would be federally owned. The new building will be built by a private property developer from Klagenfurt and then rented. The Ministry of Finance explains that the tendering and allocation will take place in 2015, that the former Hypo headquarters did not apply and that the current solution would be the cheapest for taxpayers, without naming specific prices. The Ministry of Finance would also have no access to the ex-Hypo building. The offices of the remaining 300 Heta employees in this building, the office space of which is described as twisted, has been brought together to make it easier to find a (partial) tenant.

On December 14, 2016, the responsible state parliament committee decided that the state of Salzburg should sell its last 8.16% stake in Salzburger Hypo Bank to the majority owner Raiffeisenlandesbank Oberösterreich. Most of the proceeds of 11.3 million euros (7.7 million euros) are paid as a payment for liabilities to Heta-Bank that was decided at the same time, in order to avoid the litigation risk.

See also

literature

- Renate Graber, Andreas Schnauder: Hypo Alpe Adria files - From the money machine to the billion-dollar grave. Those responsible, profiteers, backgrounds . Linde Verlag, Vienna 2015. ISBN 978-3-7093-0578-2

Web links

- Hypo Alpe-Adria-Bank AG

- Hypo Alpe-Adria-Bank International AG

- Report to the committee of inquiry to review the sale of shares in HGAA by the Kärntner Landesholding. Presented by the chairman of the investigative committee LAbg.Rolf Holub on the website of the Carinthian Greens, February 7, 2012 (PDF; 5 MB)

- meinparlament.at Answers from Austrian politicians on Hypo Alpe-Adria-Bank

- Speech of February 21, 2014 in the Austrian parliament online on Youtube as a "coherent diagnosis" of the financial affairs of the Hypo Alpe-Adria-Bank by the MP Werner Kogler .

- Report of the independent investigation commission for the transparent investigation of the incidents around the Hypo Group Alpe ‐ Adria , December 2, 2014 (PDF; 2.7 MB, 394 pages)

- Report of the Court of Auditors: Hypo Alpe-Adria-Bank International AG: Nationalization , March 2015

Individual evidence

- ↑ Billion Grave Hypo: A drama in five acts diepresse.com, accessed on December 7, 2016

- ↑ a b Report of the independent commission of inquiry for the transparent clarification of the incidents around the Hypo Group Alpe-Adria . Report of December 2, 2014, pdf, 394 pages, accessed on December 13, 2014

- ↑ a b Conny Bischofberger: The discoverer of the hypo scandal. ( Memento from March 26, 2010 in the Internet Archive ) Kurier , January 13, 2010

- ^ A b Norbert Mappes-Niediek : Austria: Buy, sell, disappear. Die Zeit No. 25, June 14, 2007

- ↑ Investigations against Hypo subsidiary. ORF , January 14, 2010

- ↑ a b c d e Hypo Alpe Adria Group Annual Report 2012 ( Memento of the original dated December 5, 2014 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. (PDF; 1.6 MB) Retrieved March 15, 2013.

- ↑ a b Heta Asset Resolution - Mission Statement. Retrieved May 4, 2018

- ^ "Legal basis." Heta Asset Resolution, January 29, 2015

- ^ "Hypo Alpe-Adria-Bank International AG: Termination of the banking license and continuation as a dismantling unit." Press release, October 30, 2014

- ^ "Hypo Alpe-Adria-Bank International AG: Termination of the banking license and continuation as a wind-down unit." Heta Asset Resolution, October 30, 2014

- ↑ "Hypo Alpe-Adria-Bank International AG: Termination of the banking license and continuation as a wind-down unit." Heta Asset Resolution, October 30, 2014

- ↑ "Sales negotiations on the SEE network with Advent International and EBRD concluded." Heta Asset Resolution, December 23, 2014

- ↑ according to § 8a Banking Act, Federal Law Gazette No. 64/1979 in the version of the Federal Law, Federal Law Gazette No. 325/1958

- ^ Causa Hypo: How it all began, ORF Carinthia, February 17, 2014

- ↑ Hypo-Bank became “Hypo Group Alpe Adria”. ORF Carinthia, August 31, 2006

- ↑ Hypo Alpe-Adria-Bank International AG: Capital increase successfully placed - the bank receives 125 million euros. December 19, 2006

- ↑ Thomas Cik: Hypo investors out of cover! Kleine Zeitung , December 31, 2009

- ↑ Hypo Alpe-Adria-Bank International AG: Capital increase successfully completed. OTS press portal, March 1st, 2007

- ^ New Hypo boss Tilo Berlin. ORF, May 3, 2007

- ↑ Hypo Alpe-Adria-Bank International AG: Hypo Group Alpe Adria: Owners decide on capital increase. OTS, December 5, 2007

- ^ Franz Pinkl new CEO. The press, April 1, 2008

- ↑ Christian Höller: Bavaria is demanding 500 million euros for Hypo. The press, November 20, 2009

- ↑ Bank for three euros. ORF, December 14, 2009

- ↑ Wilfried Eckl-Dorna: The long, deep fall of the Austrian Hypo Alpe Adria-Bank. Eckldorna, January 7, 2010

- ↑ Michael Nikbakhsh, Ulla Kramar-Schmid : Hypo exclusive: The secret purchase agreement with the Bayerische Landesbank. Profile, January 8, 2011

- ↑ Androsch: "Petzner and Söder should be quiet". ( Memento from December 16, 2012 in the Internet Archive ) Wirtschaftsblatt , December 14, 2012

- ↑ Press conference - annual results 2012. At braintrust.at

- ↑ Bankruptcy would have been “Lehman 2” for Pröll. Der Standard, June 15, 2011

- ^ Walter Mayr: Austria - The Alpine War. Der Spiegel , April 23, 2012

- ↑ BayernLB process - problems at Hypo evident in summer 2009. ( Memento of the original from April 14, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Format, April 9, 2013

- ^ Hypo Kärnten: Justice investigates Josef Pröll. Der Standard, December 21, 2012

- ↑ Petzner demanded resignation Peschorns. ORF Carinthia, December 14, 2012

- ↑ Hypo Alpe-Adria-Bank International AG: Hypo Alpe Adria launches new advertising across the group. (No longer available online.) April 5, 2011, formerly in the original ; Retrieved February 11, 2013 . ( Page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice.

- ^ Heta protest poster: "Thank you Jörg!" Kleine Zeitung , March 17, 2016, accessed on March 26, 2016.

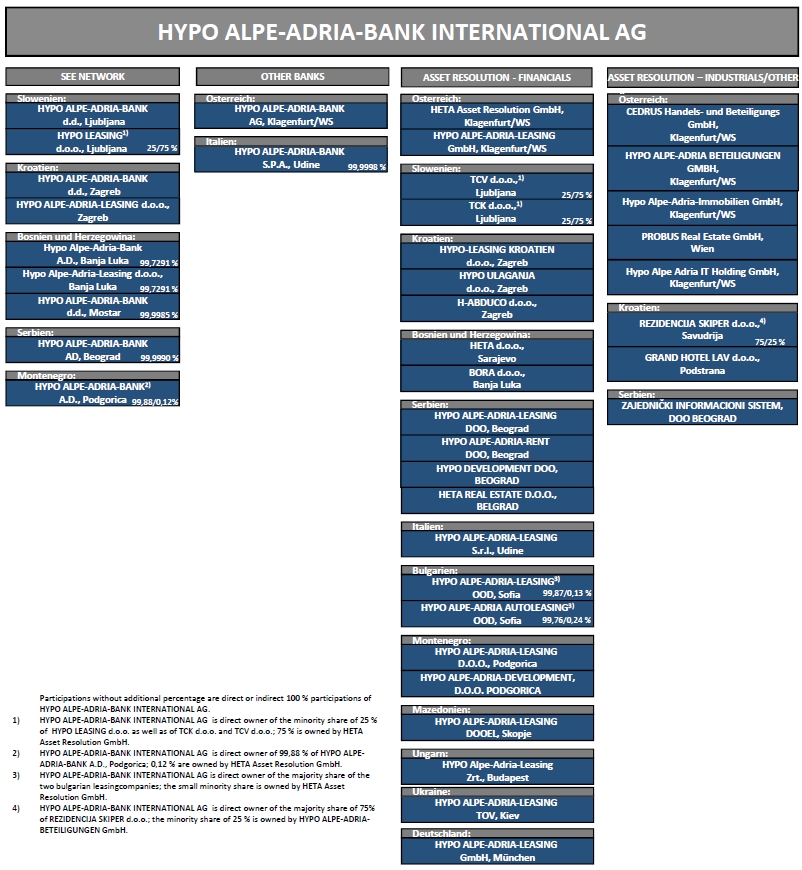

- ↑ Hypo Alpe Adria Group Structure 2012. ( Memento of the original from May 14, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Retrieved March 15, 2013.

- ↑ Liebscher and Wala join Hypo-Kärnten's supervisory board. Kleine Zeitung , April 4, 2013

- ↑ Hypo Board of Management reappointed - The four-person board of Hypo Alpe Adria will remain at the top for another three years. Courier, March 11, 2013

- ↑ Ditz resigned as chairman of the supervisory board. ( Memento from September 17, 2014 in the Internet Archive ) Kleine Zeitung , June 3, 2013

- ^ Liebscher since Friday Chairman of the Hypo Supervisory Board. Small newspaper , updated June 21, 2013

- ↑ Gottwald Kranebitter resigns. ( Memento from October 1, 2014 in the Internet Archive ) Kleine Zeitung , July 2, 2013

- ↑ Eva Gabriel: Farewell letter Gottwald Kranebitter. Small newspaper , updated September 2, 2013

- ↑ Picker new boss at Hypo Alpe Adria. Der Standard, December 20, 2013 (accessed on January 16, 2014)

- ↑ Hypo headquarters sold to Schweizer AG on ORF-Kärnten on November 30, 2018, accessed on December 1, 2018

- ^ Martin Fritzl: National Bank: Serious allegations against Hypo Kärnten. The press, June 17, 2007

- ↑ Hypo boss cannot switch to the supervisory board. ORF Carinthia, August 8, 2006

- ↑ The way for culters in the supervisory board is paved. ORF Carinthia, August 16, 2006

- ^ Hans Leyendecker , Klaus Ott : Hypo Alpe Adria - Harakiri in the Alps. Süddeutsche Zeitung, 9./10. January 2010

- ↑ Heavy fine for ex-Hypo boss Kulterer. The press, November 18, 2008

- ↑ Renate Graber, Andreas Schnauder: Hypo speculated hundreds of millions on Jersey. Der Standard, January 11, 2010

- ^ David Baines: Officials hit offshore bank with cease-trade order. ( Memento of the original from December 9, 2007 in the Internet Archive ) Info: The archive link was automatically inserted and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. The Vancouver Sun , August 30, 2007

- ^ David Baines: Trading ban on foreign bank won't stop the bad guys from finding a replacement. ( Memento of the original from May 31, 2008 in the Internet Archive ) Info: The archive link was automatically inserted and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. The Vancouver Sun, May 30, 2008

- ↑ Uwe Ritzer : Banks - BayernLB subsidiary helps rip off . In: Süddeutsche Zeitung . July 31, 2008

- ↑ Klaus Ott: BayernLB - Suspicion of insider deals. Süddeutsche Zeitung, 2./3. January 2010

- ↑ Renate Graber, Bettina Pfluger: Tilo Berlin and his Carinthian Fort Knox. Der Standard, October 16, 2009

- ^ ÖVP wants to review party finances. Der Standard, January 3, 2010

- ↑ Ashwien Sankholkar : Thanks to Wolfgang Kulterer and Tilo Berlin, Flick did good business with Hypo. ( Page no longer available , search in web archives ) Info: The link was automatically marked as defective. Please check the link according to the instructions and then remove this notice. Format, June 19, 2012

- ↑ Investigations against Flick Foundation. The press, September 2, 2012

- ↑ Miriam Koch, Ashwien Sankholkar: Profiteers of the Hypo sale to Bavaria: How the deal was threaded by Berlin. ( Memento of the original from January 30, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Format, June 19, 2012

- ↑ Prominent profiteers in hypo sales. Der Standard, January 8, 2010

- ^ A b Ashwien Sankholkar: The circle of hypo investors is expanding: Karl-Heinz Grasser was also involved in the deal. ( Memento from January 17, 2010 in the Internet Archive ) Format, January 14, 2010

- ↑ a b Ashwien Sankholkar: Grasser's million dollar deal: KHG received Hypo funds through a complex trust system. ( Memento of March 28, 2010 in the Internet Archive ) Format, June 19, 2010

- ↑ 46 investors on the list. ORF, January 15, 2010

- ↑ Michael Nikbakhsh, Ulla Kramar-Schmid: Hypo Alpe-Adria: profil publishes a complete list of the Tilo Berlin investor group. ( Memento of the original from January 17, 2010 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Profile, January 14, 2010

- ↑ Grasser is said to have made some money from the sale of Hypo. Der Standard, January 14, 2010

- ↑ Andrea Hodoschek: A Safe Bank for High Profit Courier, October 11, 2015

- ↑ What the public prosecutor doesn't want to know. In: addendum.org. November 22, 2017, accessed January 22, 2020 .

- ^ Eisenberger, Herzog Rechtsanwalts-GmbH: Friedrich Klausner not a member of the Hypo-Alpe Adria investor group. January 15, 2010

- ↑ § 353d: Prohibited communications about court hearings. juris

- ^ Hypo case: journalists questioned without legal cover. ORF, September 23, 2010

- ↑ Hedi Schneid: The Hypo case: Mr. Berlin and his investors. Die Presse, January 2, 2010

- ↑ Federal states are liable for banks with 64 billion euros. The press, December 16, 2009

- ↑ a b Carinthia is liable for mortgage debts until 2017. Upper Austrian News , January 4, 2010

- ^ Andreas Schnauder: Hypo opened money tap for the parties. Der Standard, January 12, 2010

- ↑ Hanno Mußler: Hypo Alpe Adria: “A special kind of money distribution machine ”. Frankfurter Allgemeine Zeitung , January 15, 2011

- ↑ Martinz pleads “not guilty”. ORF Carinthia, July 4, 2012

- ↑ Josef Martinz resigns as the Carinthian ÖVP boss. In: Small newspaper . April 23, 2020, accessed February 12, 2013 .

- ^ Martinz: resignation as ÖVP chairman. In: ORF Carinthia. July 25, 2012, accessed February 12, 2013 .

- ↑ bang in Carinthia: Birnbacher and Martinz confess party funding, € 100,000 ÖVP, FPK was 500,000. In: The Standard. July 25, 2012, accessed February 12, 2013 .

- ^ Elisabeth Steiner: Carinthian VP chief Martinz falls over illegal party financing. In: The Standard. July 25, 2012, accessed February 12, 2013 .

- ↑ Martinz: "Didn't give any party donations". (No longer available online.) In: Der Standard. July 25, 2012, archived from the original on December 1, 2012 ; Retrieved February 12, 2013 . Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice.

- ↑ Andreas Koller : Fischer expects further resignations. Salzburger Nachrichten , July 26, 2012

- ^ SPÖ and ÖVP are considering a motion to dissolve the Carinthian Landtag. Der Standard, July 26, 2012

- ^ Investigations against Provincial Councilor Dobernig for breach of trust. Der Standard, July 26, 2012

- ↑ Causa Birnbacher: Investigations against Uwe Scheuch? The press, July 26, 2012

- ↑ Dörfler: "Human hunt is unbearable". The press, July 26, 2012

- ↑ Investigations against FPK politicians, new elections required. ( Memento from October 29, 2013 in the Internet Archive ) Kleine Zeitung , July 26, 2012

- ^ Special state parliament meeting after political earthquake. Kleine Zeitung July 27, 2012

- ^ Antonia Gössinger: New elections in Carinthia are getting closer. Kleine Zeitung , July 27, 2012

- ^ ÖVP Carinthia: Rumpold, Tauschitz and Goritschnig resigned. . Der Standard, August 2, 2012

- ^ Birnbacher trial ends with guilty verdicts for all defendants. Der Standard, October 1, 2012

- ↑ Martina Leingruber: Causa Birnbacher: Five and a half years imprisonment for Martinz. The press, October 1, 2012

- ↑ Stefan Melichar: Infidelity in a preferred share deal - Kulterer & Co condemned. Wiener Zeitung, May 24, 2012

- ↑ Hello Hypo: Credit on Haider's call. ( Memento from September 29, 2014 in the Internet Archive ) Kleine Zeitung , February 24, 2011

- ↑ Styrian Spirit: Prison sentences for Kulterer and Xander. Der Standard, February 8, 2013

- ^ Striedinger first accuser. Der Standard, February 4, 2010

- ↑ Hypo-Insider burdens Kulterer and Striedinger heavily. The press, August 22, 2010

- ↑ Hypo is suing for 50 million euros. Kleine Zeitung , March 22, 2012

- ↑ a b The Hypo-Connection of the family of “Dschungelcamp” star Larissa Marolt , Format , 23 January 2014

- ↑ Kulterer is said to have waived millions of FP politicians ( Memento from September 28, 2014 in the Internet Archive ), In: Kleine Zeitung , September 22, 2010

- ^ Hypo gifts to liberal politicians , In: news.at , September 25, 2010 (accessed on January 20, 2014)

- ↑ Larissa Marolt, her father and the matter with the Hypo-Kredit ( Memento from January 25, 2014 in the Internet Archive ) , wirtschaftsblatt.at , January 23, 2014

- ^ Hypo: Hotel loan proceedings closed , kaernten.orf.at , 23 January 2014

- ↑ Hypo Alpe Adria: A clear case for CSI Hypo. The press, February 19, 2010

- ^ Petra Pichler: Interim balance sheet of the CSI Hypo - Criminal Organization in the Game. ORF, June 2, 2010

- ↑ For money and a car - Häfnbruder wanted to work for SOKO as a “hypo spy”. Kronenzeitung, April 20, 2012

- ↑ Affair: During the clean-up work around the Hypo there are more shadows than light - there will be further reports according to Kulterer. Format, November 14, 2011

- ↑ Berlin did not perform well. Kleine Zeitung , May 8, 2012

- ↑ Christian Höller: Scandal Bank: Are Bavaria to Blame for the Hypo Debacle? The press, September 17, 2012

- ↑ Credit dispute between Hypo and BayernLB escalates. Der Standard, December 14, 2012

- ↑ BayernLB is suing ex-group subsidiary Hypo Alpe Adria. Süddeutsche Zeitung, December 13, 2012

- ↑ Ex-boss Schmidt sees a breach of trust by Hypo. Kleine Zeitung , May 2, 2013

- ^ Maria Fekter and the Hypo Alpe-Adria. ( Memento of the original from June 6, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. Profile, April 30, 2013

- ↑ Hypo Alpe Adria no longer exists , salzburg.com from October 30, 2014

- ^ Hypo special law - dismantling Hypo Italy in future with seat in Vienna , TT.com

- ↑ Hypo Austria sale well advanced. , ORF Carinthia ( Memento from August 15, 2007 in the Internet Archive )

- ↑ State guarantees remain valid. ORF, May 31, 2013

- ↑ Ditz: Hypo is talked to pieces. Der Standard, May 29, 2013

- ↑ Hypo Carinthia wants to control sales itself - privatization: Austria subsidiary vies for buyers, Italian and Balkan subsidiaries are slow-moving. Courier, March 11, 2013

- ↑ Insider: Balkan daughters of Hypo go to Advent ( Memento from October 30, 2014 in the Internet Archive ) ,wirtschaftsblatt.at from October 30, 2014 - accessed on October 30, 2014

- ↑ Hypo Alpe Adria sells Schlosshotel Velden. ( Memento of the original from September 25, 2013 in the Internet Archive ) Info: The archive link was inserted automatically and has not yet been checked. Please check the original and archive link according to the instructions and then remove this notice. hypo-alpe-adria.com, July 29, 2011

- ↑ Kerstin Wassermann, Manfred Schumi: "Only" 12 yachts gone - the "Hypo-Geisterflotte" has appeared again. Kronenzeitung, June 12, 2010

- ^ Hypo-U committee rejected again orf.at

- ↑ Hypo petition has passed the 100,000 mark derstandard.at

- ↑ Irmgard Griss: Head of the Hypo Commission oe1.orf.at, accessed on June 6, 2014

- ↑ Hypo Commission submits to official secrecy derstandard.at

- ↑ Hypo investigation commission investigationskommission.at, accessed on December 3, 2014

- ↑ "No previous censorship": Griss wants to present the report this year diepresse.com

- ↑ Griss wants to limit costs for commission wienerzeitung.at, accessed on June 6, 2014

- ↑ Hypo: Failure on all lines diepresse.com, accessed on December 7, 2014

- ↑ Hypo commission report: There was no alternative to nationalization derStandard.at, accessed on December 2, 2014

- ↑ RH report locates “multi-organ failure” orf.at

- ↑ HYPO ALPE – ADRIA – BANK INTERNATIONAL AG: Nationalization - short version ( Memento of the original from March 20, 2015 in the Internet Archive ) Info: The archive link was inserted automatically and not yet checked. Please check the original and archive link according to the instructions and then remove this notice. rechnungshof.gv.at; Report of the Court of Auditors pdf, accessed on March 20, 2015

- ↑ Hypo investigation committee has started work . Austrian Parliament; February 26, 2015

- ↑ Wirtschaftsblatt: Hypo-U Committee: All facts, all names - all hope ( Memento from March 7, 2015 in the Internet Archive ). Article dated February 24, 2015, accessed March 7, 2015.

- ↑ Hypo Alpe-Adria: “Very unfortunate story”. Profile, May 4, 2013

- ↑ State aid: Commission approves plan for the orderly liquidation of Hypo Group Alpe Adria. EU website, EU Press releases database, September 3, 2013 (accessed on January 16, 2014)

- ↑ Austria is suing for EU aid decision. Der Standard, September 27, 2012

- ↑ a b The state drops Hypo Die Presse, March 2, 2015

- ↑ Heta: Deutsche Banken und Hypos bleed , Der Standard, March 18, 2015

- ↑ WestLB's “Bad Bank” is considering a lawsuit , Kleine Zeitung , April 16, 2015

- ↑ Handelsblatt June 18, 2015: Dozens of creditors are suing the Austrian crisis bank

- ↑ Finanz is building new instead of moving into Hypo orf.at, November 8, 2016, accessed November 8, 2016.

- ↑ State of Salzburg sells last Hypo shares orf.at, December 14, 2016, accessed December 15, 2016.