European Central Bank

| Headquarters |

Frankfurt am Main , Germany |

| founding | June 1, 1998 |

| president |

Christine Lagarde France |

| country | Belgium , Germany , Estonia , Finland , France , Greece , Ireland , Italy , Latvia , Lithuania , Luxembourg , Malta , Netherlands , Austria , Portugal , Slovakia , Slovenia , Spain , Cyprus |

| currency | |

| ISO 4217 | EUR |

| Currency reserves | EUR 75.3 billion (2020) |

| Website | |

| predecessor |

|

| List of central banks | |

The European Central Bank ( ECB ; English European Central Bank , ECB ; French Banque centrale européenne , BCE ) based in Frankfurt am Main is an organ of the European Union . It is the common monetary authority of the member states of the European Monetary Union, founded in 1998, and forms the European System of Central Banks (ESCB) with the national central banks (NCB) of the EU states .

The work and tasks of the ECB were first defined in the Maastricht Treaty of 1992; Since the Treaty of Lisbon 2007, it has formally had the status of an EU body ( Art. 13 EU Treaty ). The most important provisions for their functioning can be found in Art. 282 ff. FEU Treaty ; its statutes are appended to the contract as Protocol No. 4. In November 2014, the ECB was also entrusted with the supervision of systemically important banks in the euro area under the Single Banking Supervision Mechanism (SSM) . The ECB is a supranational institution with its own legal personality.

From 1998 to 2014 the Frankfurt Eurotower was the seat of the European Central Bank. In November 2014, the headquarters were relocated to the new building of the European Central Bank . This was opened on March 18, 2015 amid protests that were accompanied by serious riots, after four years of construction in the Ostend district of Frankfurt .

background

A central bank is an institution that is responsible for monitoring the banking system and regulating the amount of money in an economy. The European Central Bank (ECB) takes on these tasks in the euro area. As part of European unification , some states decided to introduce a common currency, the euro . In the creation of the single currency and the framework for a joint had money and monetary policy to be created. The European System of Central Banks (ESCB) was established for this purpose . This system includes the old national central banks (NCB) of all EU countries and the newly established European Central Bank. Since not all EU states participate in monetary union, there is also the Eurosystem in addition to the ESCB, in which , in addition to the ECB, only the NCBs of the countries in the euro area in which the euro was actually introduced are involved. Most of the tasks of the ESCB are carried out by the ECB. Your main goal is price level stability . To the extent that this is possible without prejudice to this goal, the ESCB supports general economic policy in the European Union.

tasks and goals

Since a central bank is not an ordinary bank, but has to lead the monetary policy of a country, it should pursue two important goals. The first goal, usually also the main goal, is price level stability . It is important to avoid large fluctuations in the value of money. The target variable is inflation (inflation rate). The second goal of a central bank is a balanced economic development in the respective country. This important secondary objective of monetary policy is to avoid a recession . The economic development is measured by the capacity utilization of an economy. The central banks pursue these goals by raising or lowering the price for lent money (changing the key interest rate), i.e. by influencing the economy. Thus, a central bank can influence both inflation and economic development.

The objectives and tasks of the ESCB and its main body, the ECB, were laid down in the Treaty establishing the European Community. They are explained in detail in the Statute of the European System of Central Banks (ESCB) and the European Central Bank (ECB), which is annexed to the FEU Treaty as Protocol No. 4. The primary goal is to ensure price level stability in the euro area; This is specified as an increase in the harmonized index of consumer prices (HICP) for the euro area of below but close to two percent compared to the previous year. Another aim is to support economic policy in the European Community with the aim of a high level of employment and sustained growth, as far as this is possible without endangering the price level stability .

The basic tasks can be found in Art. 127 (2) TFEU :

- Definition and implementation of monetary policy (see "Monetary Policy Instruments"),

- Execution of foreign exchange transactions ,

- Management of the official foreign reserves of the member states ( portfolio management ),

- Providing the economy with money , in particular promoting smooth payment transactions.

The ECB also has other tasks:

- Approval of the issuance of euro paper money - the issuance itself is carried out by the national central banks,

- Supervision of credit institutions and contribution to the stability of the financial markets ,

- Advice to the community and national authorities, cooperation with other international and European bodies,

- Collection of the statistical data necessary for the fulfillment of their tasks,

- Preparation of a central bank balance sheet .

organs

The executive bodies are the national central banks of the participating states. These are subject to the regulations of the ESCB. It is important that they are independent of instructions from national governments and are only subordinate to the ECB. The ECB has two decision-making bodies, the Council and the General Council, and an executive body, the Executive Board.

ECB President

The President of the European Central Bank is the Chairman of the Executive Board and represents the ECB externally. He is elected by the European Council for a term of eight years with no re-election.

Wim Duisenberg (1998-2003), ( Netherlands)

Jean-Claude Trichet (2003–2011) ( France)

Mario Draghi

(2011-2019) ( Italy)

Christine Lagarde (2019-) ( France)

ECB Executive Board

| Period | Board member |

|---|---|

| 1998-2002 |

|

| 1998-2003 |

|

| 1998-2003 |

|

| 1998-2004 |

|

| 1998-2005 |

|

| 1998-2006 |

|

| 2002-2010 |

|

| 2003-2011 |

|

| 2003-2011 |

|

| 2004–2012 |

|

| 2005-2011 |

|

| 2006-2011 |

|

| 2010-2018 |

|

| 2011-2019 |

|

| 2011-2019 |

|

| 2012-2014 |

|

| 2012-2020 |

|

| 2014-2019 |

|

| since 2012 |

|

| since 2018 |

|

| since 2019 |

|

| since 2019 |

|

| since 2020 |

|

| since 2020 |

|

The Executive Board manages the business of the ECB and also takes care of the implementation of the decisions of the Governing Council and forwards the necessary instructions to the national central banks, which have to implement the decisions. The body consists of the president, a vice-president and four other members. The directorate itself determines the distribution of tasks to the individual members. The best-known function is responsible for economic analysis, the owner of which is usually referred to as the chief economist .

Christine Lagarde has been President since November 1, 2019 . She replaced the Italian Mario Draghi . Vice-president is the Spaniard Luis de Guindos . The other directors are currently Fabio Panetta , Yves Mersch , Isabel Schnabel and Philip R. Lane (Chief Economist).

The term of office of a board member is eight years; re-election is not permitted. The length of the first terms of office was staggered in order to avoid that all members resign at the same time.

New members are recommended by the finance and economics ministers of the participating countries. After non-binding votes in the Economic Committee of the European Parliament and the plenary session of the Parliament, they are elected by the European Council by a qualified majority on the recommendation of the Council of the EU ( Art. 283, Paragraph 2, Subparagraph 2 TFEU ). The election of new members usually takes place before the term of office of the predecessor expires, so that a seamless transition can take place. There was a longer vacancy in 2012, when the finance ministers of the euro zone were only able to agree on a successor to José Manuel González-Páramo, who left on May 31, in July and the selected candidate Yves Mersch was then blocked by the European Parliament, which agreed campaigned for the appointment of a woman to the post. In November 2012 the European Council decided to appoint Mersch to the Board of Directors on December 15, 2012, contrary to the non-binding vote of the Parliament.

Due to the limit of six members, not all EU countries can be represented on the Board of Directors at the same time. There is no legal regulation on how the seats are distributed among the states. The large euro countries Germany, France, Italy and Spain each claim one of the six seats on the board of directors, the remaining two seats are occupied alternately by smaller countries. This principle was broken in 2012 after the departure of the then Spanish representative José Manuel González-Páramo , when, instead of a Spaniard again, a Luxembourger, Yves Mersch , was appointed to the board of directors.

Governing Council

The Governing Council includes all members of the Executive Board and also all presidents of the national central banks of the (as of June 2018: 19) member states participating in the euro. It is the highest decision-making body of the ECB. It sets the guidelines for monetary policy and the key interest rates and provides central bank money . The debates are confidential, but the Council may decide to publish them. It usually meets every 14 days.

| Christine Lagarde , President of the ECB | Luis de Guindos , ECB Vice-President | Fabio Panetta , board member |

| Yves Mersch , member of the board of directors | Isabel Schnabel , board member | Philip R. Lane , Board Member (Chief Economist) |

| Pierre Wunsch ( Belgium ) | Jens Weidmann ( Germany ) | Madis Müller ( Estonia ) |

| Gabriel Makhlouf ( Ireland ) | Yannis Stournaras ( Greece ) | Pablo Hernández de Cos ( Spain ) |

| François Villeroy de Galhau ( France ) | Ignazio Visco ( Italy ) | Constantinos Herodotou ( Cyprus ) |

| Mārtiņš Kazāks ( Latvia ) | Vitas Vasiliauskas ( Lithuania ) | Gaston Reinesch ( Luxembourg ) |

| Mario Vella ( Malta ) | Klaas Knot ( Netherlands ) | Robert Holzmann ( Austria ) |

| Carlos Costa ( Portugal ) | Boštjan Vasle ( Slovenia ) | Peter Kažimír ( Slovakia ) |

| Olli Rehn ( Finland ) |

Since January 2015, voting within the council has been based on the so-called rotation principle . Here, the member countries to 6.5 for her to GDP and 1/6 to their share in the total aggregated balance sheet of the monetary financial institutions ( Monetary Financial Institution classified MFI). The five largest of these countries (as of January 2019: Germany, France, Italy, Spain and the Netherlands) form Group 1 and receive four fixed voting rights in the Governing Council, which rotate between them on a monthly basis. The remaining eleven voting rights change monthly between the remaining countries (currently 14) that make up Group 2.

If the number of member countries of the Eurozone reaches 22, the second group is further subdivided: In the half of all member countries following the largest five countries then rotate eight voting rights (new second group), between the remaining, smallest countries (new third group) rotate three Voting rights. Even after the introduction of the rotation principle, the representatives of all member countries remain entitled to attend the meetings of the Governing Council; the voting members will each continue to have one vote.

The members of the ECB Executive Board have permanent voting rights.

When it comes to decisions about the ECB's capital and income, the Council makes decisions today, as it did after the introduction of the rotation principle, with weighted votes. The weighting is based on the share in the subscribed capital; the members of the board of directors have no vote. For the qualified majority two-thirds of the capital and the majority of are NCBs necessary.

General Council of the ECB

The General Council consists of the President and Vice-President of the ECB as well as the Presidents of the national central banks of all (2020: 27) EU member states (Articles 44–46 of the Statute of the ESCB and the ECB). It participates in the collection of statistical data and advises on the admission of further countries to the monetary union. The council usually meets once a quarter. A member of the European Commission and the President of the Council can attend the meetings without voting rights.

The General Council will only exist as long as there are EU member states that have not yet introduced the euro.

staff

In addition to temporary workers and external consultants, the ECB employs staff on a permanent and temporary basis. Employees hired before 2004 received permanent contracts from the start; In 2004, the personnel policy was changed to the effect that new employees are only hired with fixed-term contracts, sometimes with the option of converting them to an open-ended contract.

Monetary policy

Monetary Policy Goals

The ECB uses its monetary policy instruments in order to achieve the objective of price stability set out in the EC Treaty. She defines this as growth in the harmonized HICP consumer price index in the euro area, which should be below, but close to, two percent per year. This means that inflation should be kept below 2%. The ECB tries to keep the inflation rate close to but below 2% per year. The monetary policy strategy was set by the Governing Council in October 1998. The secondary objective is to support the general economic policy of the EU.

The two-pillar strategy

In order to achieve the inflation target, it pursues a so-called two-pillar concept.

As the first pillar (economic analysis), it observes the inflation development itself and variables that have an impact on inflation, such as:

- Wages and salaries

- Exchange rate development

- long-term interest rates

- Measures of economic activity

- fiscal policy indicators

- Price and cost indices

- Corporate and consumer surveys

As the second pillar (monetary analysis), it publishes a reference value ( M3 assuming an increase in real domestic product of 2% to 2.5% and a decrease in the velocity of money by 0.5% to 1%) for the desirable M3 monetary development, but the does not represent a target value, but rather information about deviations. The aim is to identify dangers to price stability in the medium term. Criticism: The assumption of the declining speed of money circulation is not completely secured.

The advantage of this strategy is that the ECB can react flexibly to market requirements. In a bad economic situation , for example, it can lower interest rates and give more money to the commercial banks, i.e. pursue an expansive monetary policy , since the dangers of inflation are low due to the low economic growth . Then banks can refinance more easily, so more loans are granted and interest rates are lowered, which stimulates investment and consumption. In a high economic , however, there is a danger that there will be a stronger inflation. Then the ECB operates a contractive (restrictive) monetary policy , that is, it allocates less money and increases its interest rates, making it more difficult to grant loans and making investments more expensive. All of this always applies on the assumption that the current inflation does not suggest any other policy: If inflation is high during a period of economic weakness, the ECB should still not lower its interest rates.

Criticism of the ECB's monetary policy

The ECB was and is criticized for its monetary policy. The following aspects are mentioned in this context:

- Criticism of the purchase of government bonds, including Greek, Italian, Spanish and Portuguese bonds, on the secondary market (i.e. not purchase from states directly, but from banks) by the ECB in 2010 and 2011. According to Art. 123 TFEU, “the direct acquisition of Debt instruments of [Member State governments] banned by the European Central Bank ”. It is controversial whether the purchase of these bonds on the secondary market cannot be interpreted as not “direct” but as indirect.

In any case, commercial banks and insurance companies can sell their bonds to the ECB, which means that the risk of sovereign default is largely transferred to the ECB and its national banks. Due to the escalation of the euro crisis, some observers anticipate that purchases of government bonds by the ECB as the only available immediate option to combat the crisis will increase in volume. These views led to the resignation (announced on September 9, 2011) of the chief economist of the ECB, Jürgen Stark , who sees the purchase as limited in time and volume, as the ECB's balance sheet cannot be expanded indefinitely. A message from Welt am Sonntag of January 7, 2012 was published in most newspapers:

“[...] in fact, according to research by 'Welt am Sonntag', the central bank has given the crisis states a lot more money - through financing the banks there. They have borrowed around 209 billion euros in bonds that are backed by nothing other than a guarantee from their shaky home countries. Of this, papers worth more than 100 billion euros could be held by the ECB. "

- Criticism of the TARGET2 system: Hans-Werner Sinn criticizes the fact that the TARGET2 system has become a permanent source of funding for other euro central banks for the Deutsche Bundesbank during the euro crisis .

- The bonds bought up prevent the bankruptcy of institutions and the end of the bad investments and undesirable developments associated with them. The conservation of natural resources continues to be sacrificed to economic growth. Climate change is only a consequence. Where is this going to lead? Most of the securities bought up are nothing more than junk papers anyway.

The “claims within the euro system (net)” rose to 338 billion euros by the end of 2010. The Bundesbank claims against the ECB under Target2 amounted to 326 billion euros at that time. In December 2011 they rose to 495 billion euros. In 2006, before the outbreak of the financial crisis , the total claims were only 18 billion euros. From the perspective of the Deutsche Bundesbank, this does not result in any increased risks.

- Criticism of the second pillar: On the one hand, the ECB is criticized for not reaching the monetary reference value it has set itself too often (for example, the growth of the M3 money supply in recent years has mostly been well above the targeted 4.5%). On the other hand, the criticism is directed against the monetary pillar as such; The general informative value of the money stock M3 is questioned by various economists.

- Criticism of the inflation target: Some voices criticize the inflation target of two percent as too low. You refer to the tendency towards higher inflation rates in the USA (combined with higher economic growth). Some call for a higher inflation target (up to 3.5%). They hope or believe that a more expansionary monetary policy could help the low-growth euro area to recover.

- Criticism of the activities of the ECB: In the first few years of its existence, the ECB was often criticized for its inadequate communication policy: it too often leaves market participants in the dark about their future course and thus creates uncertainty. However, many central banks (including the US Fed ) are criticized for similar behavior. In addition, the transparency of the ECB's decisions has increased significantly in recent years (due in part to greater experience). In addition, some observers criticize the ECB for its monetary policy being too restrictive. The ECB, for example, did not change its key interest rate , the main refinancing rate, between mid-2003 and the end of 2005 and thus pursued a much less expansionary monetary policy than the Fed (which changed its key interest rate several times in each of the years). The ECB was praised by others for its reliable, predictable and unpredictable monetary policy.

- Criticism of neglecting monetary stability.

- With the launched in June 2016 program to purchase corporate bonds (Corporate Sector Purchase Program - CSPP) the ECB reducing the already low level of liquidity in the market for corporate bonds on and disadvantage also small and medium enterprises without direct access to the capital market.

In October 2019, Kai-Oliver Knops presented an expert opinion that declared the ECB's negative interest rate policy to be illegal. In addition to the lack of legitimation by the EU institutions (neither the EU Parliament nor the EU Commission were heard and there was no formal legal justification), there was a lack of legitimation by the member states. Knops explained that the ECB's negative interest rates are not interest rates, but EU taxes . However, only the member states of the EU are allowed to levy taxes, not the EU itself. According to the Bundesbank, the German banks lost around 2.4 billion euros in 2018 as a result of the ECB's negative interest rate policy.

Instruments

| interest rate | height |

|---|---|

| European Central Bank (valid from: September 18, 2019) | |

| Deposit rate (deposit facility) | −0.50% |

| Base rate (main refinancing operations) | 0.00% |

| Marginal lending rate (marginal lending facility) | 0.25% |

| Swiss National Bank (valid from: June 13, 2019) | |

| SNB policy rate | −0.75% |

| Federal Reserve System (effective March 16, 2020) | |

| Federal funds rate target range | 0.0 to 0.25% |

| Primary Credit Rate | 0.25% |

| Bank of Japan (effective December 19, 2008) | |

| Discount rate (basic discount / loan rate) | 0.30% |

| Bank of England (effective March 19, 2020) | |

| Official Bank Rate | 0.1% |

| Chinese People's Bank (valid from: February 20, 2020) | |

| Discount rate (one-year lending rate) | 4.05% |

The ECB has a number of instruments at its disposal to carry out its tasks (see above). The greatest importance is attached to its monetary policy instruments, since with them it seeks to achieve its most important goal of ensuring price level stability.

The ECB can only directly influence the interest rates in the business between it and the commercial banks (so-called central bank interest rates ). Since the latter usually pass on more favorable or less favorable financing conditions to their customers, the market interest rates also change in response - above all the short-term interest rates on the money market , but possibly also the long-term interest rates on the capital market .

In addition to the instruments, the associated public relations work, as described in the section #Control and transparency , also has an impact on the financial markets.

Open market operations

Clearly the most important open market business of the ECB is the main refinancing instrument (main tender) with a share of around 70% . This is an instrument of open market policy in which the commercial banks receive central bank money from the ECB in exchange for interest payments in an auction process. The auction process has been carried out using variable rate tenders since 2000 . The central bank money offered is allocated to the highest-bidding commercial banks. For better orientation, the ECB sets a minimum bid interest rate. This minimum bid interest rate (also the main refinancing rate) is often referred to as the key interest rate of the ECB due to its importance . The transactions take place once a week. Their duration is also one week. To combat the financial crisis from 2007 onwards , the ECB has been lending money back to the fixed rate tender since October 15, 2008 .

The three other open market operations of the ECB are longer-term refinancing operations , fine-tuning operations and structural operations . However, these are not used for monetary policy purposes, but rather aim to provide commercial banks with the necessary liquidity.

Standing facilities

The standing facilities consist of the marginal lending facility and the deposit facility . The standing facilities provide commercial banks with the option of drawing liquidity on their own initiative against payment of interest via the marginal lending facility until the following business day, or investing it via the deposit facility. These options are not limited by volume, but typically have an unattractive interest rate. Because of their unlimited availability, the interest rate for the marginal lending facility represents a maximum and the interest rate for the deposit facility a minimum rate for overnight money in the money market. The interest rate of these transactions is decisive for the interest rates of banks on savings accounts and customer loans. Standing facilities determine the limits of the money market rates for overnight money. They roughly correspond to the former discount and Lombard rates of the Bundesbank.

Forex market intervention

The ECB also intervenes on the foreign exchange market from time to time in order to stabilize the monetary policy course and to dispute the sales policy. However, interventions are a very seldom used (in 2004 not at all) instrument of the ECB. According to the ECB, it should only be used if there are major exchange rate mismatches that endanger either the ECB's inflation target (as a primary monetary policy objective) or economic stability in the euro area (as a secondary objective).

Reserve

The ECB requires commercial banks to hold minimum reserves in current accounts with the national central banks. These currently amount to one percent of the banks' deposits and bonds. However, in contrast to the main refinancing instrument , standing facilities and foreign exchange market intervention, the minimum reserve is more of a regulatory instrument than a monetary policy instrument, as it only provides the framework for the other instruments. In contrast to the minimum reserve of the former Deutsche Bundesbank, the minimum reserve of the ECB earns interest.

Unreserved Monetary Policy Operations (OMT)

According to its own statements, the ECB bought government bonds for EUR 16.5 billion within a few days in May 2010. The decision, which contradicts previous positions of the bank, was defended by the then ECB President Jean-Claude Trichet as a consistent response to a rapidly changing crisis situation. However, it remained politically controversial afterwards.

Purchase of securities

Since 2009, the ECB has launched various programs to buy securities such as government and corporate bonds on the primary and secondary markets .

independence

With the aim of being able to better carry out its main task of ensuring price level stability, the ECB was promised independence from political and other influences in order to prevent conflicts with the interests of politicians. There are generally four types of independence.

Operational or functional independence

It means that the ECB is free to choose which method to use to carry out its mandate. However, Article 127 (1) of the TFEU and the ECB's statutes stipulate price stability as an objective of European monetary policy for the ECB. In this respect, operational independence only relates to the implementation of the target (including the determination of inflation that is compatible with price stability), but not to the definition of the target itself. In this respect, the ECB is far less independent than the US Federal Reserve System .

Institutional independence

It means that the ECB and the national central banks are not allowed to receive any instructions from politics. The Maastricht Treaty , signed in 1992 , stipulated that no loans were to be granted to the public purse (state). This is to prevent the autonomy from being undermined by the obligation to grant loans to the state. The ECB is thus not allowed to finance the budget deficits of the Community or a member state. However, during the euro crisis the ECB bought government bonds on the secondary market , not directly from the states but from banks (including Greece, Spain, Italy).

Financial independence

| Country | Participation (percent) |

|---|---|

|

|

2.48 |

|

|

0.86 |

|

|

1.49 |

|

|

18.00 |

|

|

0.19 |

|

|

1.26 |

|

|

14.18 |

|

|

2.03 |

|

|

1.16 |

|

|

12.31 |

|

|

0.60 |

|

|

0.28 |

|

|

0.41 |

|

|

0.20 |

|

|

0.06 |

|

|

4.00 |

|

|

1.96 |

|

|

5.12 |

|

|

1.74 |

|

|

2.60 |

|

|

2.27 |

|

|

0.77 |

|

|

0.35 |

|

|

8.84 |

|

|

1.61 |

|

|

1.38 |

|

|

13.67 |

|

|

0.15 |

Financial independence consists in the fact that the ECB has its own budget and can decide for itself how to use the funds with which it is provided by the member states. Private banks have only minimal influence over the European Central Bank. The ECB capital of 10.83 billion euros (as of the end of 2014) is held exclusively by the 28 central banks of the European Union. The national central banks are not all publicly owned (example: Deutsche Bundesbank, Austrian National Bank: 100% state; other examples: Greek National Bank or Italian National Bank: mostly private). The central banks of the euro countries hold 70.39% of the ECB's capital and have paid it in at 100%. The non-euro countries own 29.61% which is only 3.75% paid. Theoretically, this capital participation has no influence on the personnel policy at the ECB.

Personal independence

To guarantee the independence of the management staff,

- a member of the Governing Council can only be removed by the European Court of Justice for serious reasons at the request of the Governing Council or the Executive Board ;

- No member may take on other employment, either for a fee or free of charge, without express special approval. This is to avoid conflicts of interest.

- a second term of office is excluded for members of the Board of Directors.

- senior executives are elected for a long period (ECB directors eight years, governors of the national central banks at least five years).

- this must be professionally suitable and personally independent.

Capital and currency reserves

The subscribed capital of the ECB amounts to 10.82 billion euros (as of early 2015). It was paid in by the national central banks, which are subscribers and holders. The share that an NCB must pay in in the total capital is determined by a key which is divided equally between the share of the respective member state in the population of the Community in the penultimate year before the establishment of the ESCB and the share of the respective member state in the gross domestic product of the Community at market prices in the five years preceding the penultimate year prior to the establishment of the ESCB . The weight percentages are updated every five years or when the EU is expanded , most recently on January 1, 2009. The Deutsche Bundesbank has the largest share at around 18%. In addition to the euro area NCBs, which pay in all the capital, the other EU Member States' NCBs must pay in a certain percentage of their subscribed capital as a contribution to the operating costs of their participation in the ESCB. This was initially 7%, and since the end of 2010 it has been 3.75%.

Furthermore, the ECB receives currency reserves with an equivalent value of up to 50 billion euros from the NCB of the euro zone , with around 40 billion euros currently being transferred. The reserves are held and deployed solely by the ECB; they continue to be managed by the NCB. Above a certain size, transactions with the reserves require the approval of the ECB. Each NCB's contribution to the amount corresponds to its share of the subscribed capital, with the NCB receiving a credit from the ECB equal to the value of its contribution. 15 percent of the amount was paid in gold reserves , the rest in US dollars or Japanese yen .

At the end of 2007 [obsolete] , 79.7% of the currency reserves were held in dollars and 20.3% in the Japanese yen. In 2006, the share of dollar reserves was 83%, that of the yen was 17%.

According to Art. 33 of its statutes, up to 20% of the profits generated by the ECB are transferred to its reserve fund; the excess profit is distributed annually to the shareholders, i.e. the national central banks, in accordance with their paid-up shares in the ECB's share capital. Losses of the ECB are financed from the reserve fund or, where applicable, from the income generated by the national central banks as a result of their performance of monetary policy tasks within the ESCB.

Supervision of credit institutions and control of financial market stability

Together with the NCBs and EU competent authorities, the ECB monitors developments in the banking and other financial sectors , for which the ESCB Committee on Banking Supervision was established (but it does not monitor individual banks). To this end, the resilience and weaknesses of the financial sectors are assessed. Five business areas of the ECB, financial stability (as coordinator), economics, financial market control, international and European relations, payment systems, are involved in the monitoring. The results are published twice a year. The ECB also advises national and EU-level authorities on setting financial provisions and prudential requirements and promotes cooperation between the relevant EU authorities and central banks.

According to the Statute of the European System of Central Banks and the ECB, the ECB can perform special tasks in connection with the supervision of credit institutions and other financial institutions with the exception of insurance companies . However, banking supervision initially remained with the member states, in Germany the Federal Financial Supervisory Authority , which is supported by the Deutsche Bundesbank . From November 2014, as part of the creation of the European Banking Union and the associated Single Banking Supervision Mechanism (SSM) , the ECB took over the supervision of banks in the euro area, whose total assets account for over 30 billion euros or 20 percent of a country's economic output.

The ECB currently controls 177 banks in the euro area .

Control and Transparency

The ECB is under the control of democratic institutions and the public. To this end, the ECB has to fulfill reporting obligations. It is a quarterly report on the activities of the Eurosystem, a consolidated statement every week and an annual report on its activities and the monetary policy of the current and the previous year. The European Parliament, the European Commission, the European Council and the Council of the European Union receive the annual report.

In addition to this control, the work of the ECB is also subject to the supervision of external auditors who check the annual accounts, the European Court of Auditors , which checks the efficiency of the administration, and internal control bodies. These include one

- internal auditing, which reports directly to the board of directors and which works according to guidelines customary in the industry, as well as a

- Internal control structure for which each organizational unit, such as a department or directorate, is responsible. In order to prevent the use of inside information , there are so-called Chinese walls , for example between the business areas for the implementation of currency policy and the areas for currency reserve and equity management.

A code of conduct applies to the employees of the ECB and the members of the Governing Council, according to which the employees are not allowed to engage in insider dealing. An ethical counselor should provide guidance on professional conduct and confidentiality. On January 1, 2002, an internal data protection officer was appointed by decision of the European Parliament . The Internal Audit Committee carries out audits on behalf of the Governing Council. He is responsible for the entire ESCB and coordinates the revisions. To combat fraud, the ECB has been controlled by the European Anti-Fraud Office (OLAF) since 2004 . Since 1999 she had her own anti-fraud program and an anti-fraud committee, as she did not want to be controlled by OLAF because of her independence. The Commission appealed against this decision to the European Court of Justice and was won. The Court stated that the ECB was "inserted into the framework", but that the legislature had to ensure that independence was maintained.

The ECB endeavors to create transparency of its own accord, i.e. to provide the public and the markets with important information about its strategy, assessments, monetary policy decisions and its procedures in an open, clear and timely manner. The ECB wants to convey to the public which goals it is pursuing with which means. The transparency, which is also considered necessary by most of the other central banks, is intended to strengthen the credibility and thus the effectiveness of monetary policy.

Transparency relies on credibility, self-discipline and predictability. Credibility is to be achieved through comprehensive and clear information to the public about the mandate and tasks of the ECB as well as its fulfillment. In addition to its assessment of the economic situation, the ECB also publishes its views on the limits of monetary policy. The transparency is intended to bring self-discipline and consistency in monetary policy, as the work of the decision-makers can be checked more easily.

To make its decisions predictable, the ECB publishes its assessment of economic developments and its monetary policy strategy. This makes monetary policy measures predictable, and expectations are formed more efficiently and correctly on the market. Correct expectations reduce the time between measures being taken and their effects, the adjustment to economic developments is accelerated, and the effectiveness of monetary policy is increased.

History and foundation

1951 to 1979

In 1951, a new era began with the establishment of the Coal and Steel Community after the Second World War. The Treaty of Rome in 1957 was a further step towards European unification. The goal at that time was a trade union and a common agricultural market; a monetary union was not considered necessary for this. In addition, the Bretton Woods system was an international currency system that was still functioning well at the time . A currency union was first discussed in 1962 after the so-called Marjolin Memorandum of the European Commission .

The first institution for cooperation between the national central banks of the member states of what was then the European Economic Community (EEC) was the Committee of Governors of the Central Banks, established in 1964. The history of the European Monetary Union began in 1970 with the Werner Plan , which for the first time provided for the establishment of a European Monetary Union, but failed. In 1972, the European Exchange Rate Union began with fixed exchange rates between the currencies of some European countries, with maximum fluctuations of ± 2.25% allowed. In 1979, the association was replaced by the European Monetary System , one of whose goals was to pave the way for a monetary union. The exchange rates and a range for fluctuations were also set here; the national central banks had to secure the exchange rates by intervening in the foreign exchange market . Membership in the European monetary system was a prerequisite for admission to the monetary union, with the beginning of which the monetary system ended.

1980 to 1999

The Single European Act took up the goal of a monetary union and currency issues became a competence of the European Community. In 1989, the then President of the Commission, Jacques Delors, presented a new plan for a monetary union that became the basis for the European Economic and Monetary Union (EMU). In 1991 in an intergovernmental conference, parallel to the conference on the establishment of the political union, the institutional structure for the monetary union was created through the amendment of the EEC Treaty. The treaty amendment, including the Protocol on the Statute of the European System of Central Banks and the European Central Bank and the Protocol on the Statute of the European Monetary Institute , became part of the Treaty on European Union signed in 1992 .

The establishment of economic and monetary union should take place in three stages. In the first stage, the Committee of Governors was given new responsibilities. Through it, closer cooperation in the field of monetary policy should take place, with the aim of price stability . Furthermore, the committee had to identify questions to be clarified, create a plan for dealing with problems by the end of 1993 and distribute the tasks to subcommittees and working groups established for this purpose.

On January 1, 1994, the second stage of monetary union began with the establishment of the European Monetary Institute. The tasks of the institute were to strengthen the cooperation of the national central banks, to coordinate their monetary policy more closely and to carry out the preparatory work for the establishment of the European System of Central Banks (ESCB), for the implementation of a single monetary policy and for the creation of the single currency. The institute served as a forum for monetary policy consultations, while interventions in the foreign exchange market continued to be the responsibility of the national central banks. With the second stage of EMU, none of the national central banks were allowed to grant loans to public authorities. In addition, all central banks had to become independent of political and other influences by the end of the second stage.

In December 1995 the European Council announced the plan for further action based on the preparatory work of the EMI and confirmed the introduction of the new currency, which had now been given the name of the euro , in 1999. The EMI received the preparation of the Exchange Rate Mechanism II as a new task . In 1996 the Stability and Growth Pact was created , the aim of which, analogous to the objectives of the ECB, is the stability of the euro, but the pact has no direct impact on the ECB. On May 1, 1998, the Council of Ministers decided that eleven countries had met the criteria for participation in monetary union. Specifically, these were Belgium , Germany , Finland , France , Ireland , Italy , Luxembourg , the Netherlands , Austria , Portugal and Spain . At the same time, the Council agreed on the people they wanted to propose for the Executive Board of the ECB. The appointment was made on May 25th with effect from June 1st by the governments.

On June 1, 1998, the ECB succeeded the European Monetary Institute, which had completed all tasks on time. In October, the ECB set out its monetary policy strategy , which should bring stability and confidence in the ECB and the euro. The ECB took over the implementation of the single monetary policy with the beginning of the third and final stage on January 1, 1999. The last step towards the common currency was the introduction of the euro as a means of payment on January 1, 2002.

In 1998, Wim Duisenberg was elected President of the European Central Bank against French competitor Jean-Claude Trichet . However, he stated at the outset that he would probably not remain in office for the full eight-year term.

2000s

In 2001 the Council of the ECB received the European Banker of the Year award , which is presented annually by a group of business journalists.

On his 68th birthday, Wim Duisenberg announced his resignation from the presidency on July 9, 2003. The EU finance ministers refused his request and wanted him to remain in office until his successor was properly appointed in autumn 2003. His successor on November 1, 2003 was his former competitor Jean-Claude Trichet President of the ECB, who held the office until the end of October 2011. In 2007 Trichet was named European Banker of the Year .

On June 3, 2009, the first warning strike in the ECB's ten-year history took place. Employees, represented by the International and European Public Services Organization ( IPSO ), gathered 90 minutes in front of the main building in Frankfurt to draw attention to a lack of employee rights and to demonstrate against changes to pensions that had been decided a month earlier. At the same time, the ECB was called upon to start collective bargaining with the union, which the bank has so far refused.

On November 1, 2011, Mario Draghi replaced Jean-Claude Trichet as President of the ECB.

Draghi was replaced as ECB President on November 1, 2019 by Christine Lagarde.

"Expanded asset purchase program" for the purchase of euro securities in January 2015

On January 22, 2015, the Central Bank Council of the ECB announced that it would spend EUR 60 billion per month on the purchase of securities from March 2015 onwards ( Expanded Asset- Purchase Program (EAPP) ). The purchases should continue until at least September 2016, which would correspond to a total volume of 1.1 trillion euros. This decision was justified by the fact that the inflation rate in the euro zone is at an all-time low and there is therefore a risk of deflation . That is why "decisive monetary policy measures are required" ( this situation required a forceful monetary policy response ).

The goal is to raise the inflation rate back towards two percent and to lower interest rates in order to promote investment, consumption and economic growth in the euro zone. This monetary policy, which in English-speaking countries under the name quantitative easing ( " QE is known"), met with some economists approval. Reference was made to the example of the United States, which according to many economists was saved from sliding into recession by a similar program of bond purchases by the Federal Reserve Bank between 2009 and 2014 with a volume of US $ 3.5 trillion.

The Italian Finance Minister Pier Carlo Padoan welcomed the ECB's decision as “good for Europe” and spoke of an “injection of confidence into the markets”. Other economic experts criticized the decision. The main reason for the rejection was the fear that this would ease the pressure for necessary economic and socio-political reforms in the southern European crisis countries, but also in France. This would not solve the real problem of the euro area, namely the lack of competitiveness. Fears have also been expressed that this major program would overshoot the target and fuel inflation far more than intended. Among the opponents of the ECB bond purchase program was the President of the Bundesbank and thus a member of the ECB Council Jens Weidmann .

On the evening of the announcement, the euro fell to an eleven-year low of 1.1367 US $ / euro and also fell against the pound sterling. The acting chief economist of the German Commerzbank Jörg Krämer warned of a currency war as a result of the devaluation of the euro triggered by the program: The devaluation policy of the ECB is straining relations with the USA and the Asian countries ; the weakening of their own currency does not solve the competition problem of many countries in the euro area.

The day after the announcement of the purchase program, it became known that there was no vote in the Governing Council on the unprecedented purchase program.

Towards the end of the 45th World Economic Forum in Davos , which was taking place around the same time, the American investor and dollar multi- billionaire George Soros criticized the fact that the program announced by the ECB would intensify the global divide between rich and poor, in particular give massive support to shareholders and keep wages below wages Pressure will hold.

In a ruling on May 5, 2020 , the Federal Constitutional Court (BVerfG) upheld four constitutional complaints from 2015 and 2016 against the government bond purchase program. According to the judgment, the decisions of the ECB on the government bond purchase program are incompetent. This program - also known as the Public Sector Purchase Program (PSPP) - forms part of the EAPP. The European Court of Justice (ECJ), however, ruled on 11 December 2018 that an audit found nothing to affect the validity of the ECB Decision on the PSPP. In its reasoning for the judgment, the Federal Constitutional Court found "that actions and decisions of European organs are obviously not covered by the European order of competencies" and for the first time in its history opposed a decision of the European Court of Justice. The view of the European Court of Justice is "methodologically simply no longer justifiable". They could therefore not be effective in Germany. It is true that no prohibited public financing was identified, but in order for Germany to participate in the program, the ECB would have to give better reasons in future as to why bond purchases are proportionate. According to the ruling, the Bundesbank is prohibited from participating in further bond purchases for three months if the ECB does not justify the bond purchases during this period.

A few days later the ECJ pointed out in a press release that judgments of the ECJ were binding and that only the ECJ could determine whether an EU body was violating EU law. Wolfgang Schäuble stated that the ruling jeopardized the existence of the euro, but at the same time emphasized that "as finance minister, he was not always in agreement with the decisions of the ECB - with all due respect for its independence". The ECB must strictly limit itself to its mandate and should not interpret it too broadly, which is why the judgment of the Federal Constitutional Court is “not easy to refute”. EU Commission President Ursula von der Leyen said she wanted to examine infringement proceedings against Germany. Friedrich Merz referred to the right and the duty of the national constitutional court to “review the actions of the organs and institutions of their respective member state against the standards of national constitutional law”.

The decision of the BVerfG does not affect the financial aid programs that the ECB has set up in the context of the COVID-19 pandemic .

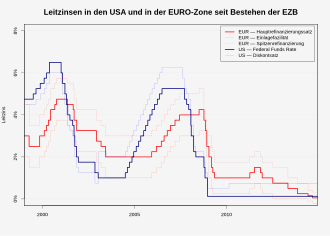

Development of interest rates

The following table shows the interest rates that the ECB has set since 1999. The changes are given as a percentage per year. Before June 2000, the main financing transactions were fixed by variable rate tenders . This was done through variable rate tenders, according to the figures in the table, which depends on the minimum interest rate, the possibility of business partners and the amount of offers.

| date | Deposit facility |

main refinancing transactions |

Marginal lending facility |

|---|---|---|---|

| Jan. 1, 1999 | 2.00 | 3.00 | 4.50 |

| Jan. 4, 1999 | 2.75 | 3.00 | 3.25 |

| Jan. 22, 1999 | 2.00 | 3.00 | 4.50 |

| Apr 9, 1999 | 1.50 | 2.50 | 3.50 |

| Nov 5, 1999 | 2.00 | 3.00 | 4.00 |

| Feb. 4, 2000 | 2.25 | 3.25 | 4.25 |

| March 17, 2000 | 2.50 | 3.50 | 4.50 |

| Apr 28, 2000 | 2.75 | 3.75 | 4.75 |

| June 9, 2000 | 3.25 | 4.25 | 5.25 |

| June 28, 2000 | 3.25 | 4.25 | 5.25 |

| Jan. 9, 2000 | 3.50 | 4.50 | 5.50 |

| Oct 6, 2000 | 3.75 | 4.75 | 5.75 |

| May 11, 2001 | 3.50 | 4.50 | 5.50 |

| Aug 31, 2001 | 3.25 | 4.25 | 5.25 |

| Sep 18 2001 | 2.75 | 3.75 | 4.75 |

| Nov 9, 2001 | 2.25 | 3.25 | 4.25 |

| Dec 6, 2002 | 1.75 | 2.75 | 3.75 |

| March 7, 2003 | 1.50 | 2.50 | 3.50 |

| June 6, 2003 | 1.00 | 2.00 | 3.00 |

| Dec 6, 2005 | 1.25 | 2.25 | 3.25 |

| March 8, 2006 | 1.50 | 2.50 | 3.50 |

| June 15, 2006 | 1.75 | 2.75 | 3.75 |

| Aug 9, 2006 | 2.00 | 3.00 | 4.00 |

| Oct 11, 2006 | 2.25 | 3.25 | 4.25 |

| Dec 13, 2006 | 2.50 | 3.50 | 4.50 |

| March 14, 2007 | 2.75 | 3.75 | 4.75 |

| June 13, 2007 | 3.00 | 4.00 | 5.00 |

| July 9, 2008 | 3.25 | 4.25 | 5.25 |

| Oct 8, 2008 | 2.75 | 4.75 | |

| Oct 9, 2008 | 3.25 | 4.25 | |

| Oct 15, 2008 | 3.25 | 3.75 | 4.25 |

| Nov 12, 2008 | 2.75 | 3.25 | 3.75 |

| Dec 10, 2008 | 2.00 | 2.50 | 3.00 |

| Jan. 21, 2009 | 1.00 | 2.00 | 3.00 |

| March 11, 2009 | 0.50 | 1.50 | 2.50 |

| Apr 8, 2009 | 0.25 | 1.25 | 2.25 |

| May 13, 2009 | 0.25 | 1.00 | 1.75 |

| Apr 13, 2011 | 0.50 | 1.25 | 2.00 |

| July 13, 2011 | 0.75 | 1.50 | 2.25 |

| Nov 3, 2011 | 0.50 | 1.25 | 2.00 |

| Dec 8, 2011 | 0.25 | 1.00 | 1.75 |

| July 11, 2012 | 0.00 | 0.75 | 1.50 |

| May 2, 2013 | 0.00 | 0.50 | 1.00 |

| Nov 13, 2013 | 0.00 | 0.25 | 0.75 |

| June 11, 2014 | −0.10 | 0.15 | 0.40 |

| Sep 10 2014 | −0.20 | 0.05 | 0.30 |

| Dec 9, 2015 | −0.30 | 0.05 | 0.30 |

| March 16, 2016 | −0.40 | 0.00 | 0.25 |

| Sep 18 2019 | -0.50 | 0.00 | 0.25 |

literature

- Andreas Wagener : The European Central Bank . Westdeutscher Verlag, Wiesbaden 2001, ISBN 3-531-13647-X .

Web links

- European Central Bank website

- Consolidated weekly return of the Eurosystem ( balance sheets as PDF in all euro languages, current and archived, but the page itself is in English)

- National central banks in the EU (English)

- The history of the European Central Bank - dates, facts, background: January 1, 1990 to March 1, 2014 by Northwestern University Knight Lab (a joint initiative of the Robert R. McCormick School of Engineering and Applied Science and the Medill School of Journalism, Media, Integrated Marketing Communications)

Individual evidence

- ↑ European Central Bank: European Central Bank: 03/2020. Retrieved May 15, 2020 .

- ↑ New ECB building , ECB, (accessed on March 2, 2015)

- ↑ Eurogroup proposes Mersch for ECB executive board. In: The world . July 9, 2012, accessed January 1, 2014 .

- ↑ Mersch moves up to the ECB Executive Board. tagesschau.de, November 23, 2012, accessed on November 23, 2012 .

- ^ Members of the Governing Council. Retrieved November 10, 2017 .

- ↑ Allocation of tasks in the ECB Executive Board. Retrieved January 3, 2012 .

- ↑ Rotation of voting rights in the Governing Council. Retrieved January 12, 2016 .

- ↑ Ansgar Belke, Dirk Kruwinus (2003): Enlargement of the EU and reform of the Governing Council: Rotation versus Delegation , Hohenheim discussion article No. 218/2003 (PDF; 399 kB)

- ^ The General Council of the ECB. Archived from the original on February 3, 2014 ; accessed on January 23, 2014 .

- ↑ Nina Luttmer: Interview union IPSO: "Employees have no say in the ECB". Frankfurter Rundschau, June 14, 2015, accessed on January 27, 2016 .

- ↑ Workload: ECB union warns of problems with banking supervision. Spiegel online, March 7, 2014, accessed January 27, 2016 .

- ^ European Central Bank: Monetary Policy. Retrieved April 16, 2018 .

- ↑ Article 127 (1) Treaty on the Functioning of the European Union (Consolidated Version) (PDF) . In: Official Journal of the European Union . C 326, October 26, 2012, pp. 47–390, here p. 102.

- ↑ Cf. Norbert Häring, Dorit Heß, Michael Maisch: “Is it good if the ECB buys government bonds?” Handelsblatt (online edition) May 10, 2010

- ↑ a b Cf. “Sharp criticism: Wulff finds ECB bond purchase legally questionable” ( Memento from September 11, 2011 in the Internet Archive ) FTD.de August 24, 2011

- ↑ Cf. “Target loans, current account balances and capital movements: The ECB's rescue package - Ifo Working Paper No. 105 by Hans-Werner Sinn and Timo Wollmershäuser” June 24, 2011

- ↑ See Sebastian Dullien, Heike Joebges: “Don't be afraid of ECB purchases of government bonds” International Policy Analysis, Friedrich-Ebert-Stiftung, November 2011 (PDF; 90 kB)

- ↑ Jürgen Stark: “That cannot be the task of a central bank” , wiwo.de, December 19, 2011, accessed on March 21, 2015

- ↑ Crisis states guarantee the ECB new billion-dollar risks , welt.de, January 7, 2012, accessed on March 21, 2015

- ↑ Hans-Werner Sinn: “The risky credit replacement policy of the ECB” , Frankfurter Allgemeine Zeitung, May 4, 2011, No. 103, p. 10

- ↑ Hans-Werner Sinn: “Ticking Time Bomb - What Merkel and the Bundesbank are hiding: The rescue package will not save the euro - but it burdens Germany with enormous risks” , Süddeutsche Zeitung, April 2, 2011, No. 77, p. 24 (modified Version)

- ↑ Konrad Handschuch: “Ifo Head Sinn: Criticism of Crisis Aid from the Deutsche Bundesbank” , wiwo.de, accessed on February 21, 2011

- ↑ Hans-Werner Sinn: "Target balances, foreign trade and money creation" ( Memento from January 30, 2012 in the Internet Archive ), Ifo Schnelldienst 64 (09), 2011, pp. 23-25 (www.cesifo-group.de, accessed on July 20, 2011)

- ↑ Hans-Werner Sinn and Timo Wollmershäuser: "Target loans, current account balances and capital movements: The ECB's rescue package" , Ifo Working Paper No. 105 (www.cesifo-group.de, accessed on July 20, 2011)

- ^ "Euro crisis: ECB rescue package and Target balances", contributions by Sinn u. a.

- ↑ ECB and Climate Change.html The ECB and Climate Change , welt.de, December 7, 2019

- ↑ see monthly report of the Bundesbank March 2011 pages 34 and 35 ( Memento from September 15, 2011 in the Internet Archive )

- ↑ Statistics of the Deutsche Bundesbank: Time series EU8148: External position of the Deutsche Bundesbank in the ESCB / claims within the ESCB / other claims (net), as of: November 10, 2011 ( Memento from August 1, 2012 in the web archive archive.today )

- ↑ Statistics of the Deutsche Bundesbank: Time series EU8141: External position of the Deutsche Bundesbank in the ESCB / Claims within the ESCB / total, as of: September 12, 2011 12:42 p.m. http://www.bundesbank.de/Navigation/DE/Statistiken/ statistiken.html? first = 1 & open = & func = row & tr = EU8141 & showGraph = 1 ( Memento from May 27, 2013 in the Internet Archive )

- ↑ ( Page no longer available , search in web archives: Press release of the Deutsche Bundesbank of February 23, 2011 )

- ↑ Paul Kirchhof : money property and monetary policy , FAZ, January 13, 2014 page 7

- ↑ Michael Rasch: Lack of buyable government bonds: The ECB in a quandary. In: Neue Zürcher Zeitung . July 20, 2016. Retrieved August 23, 2016 .

- ↑ Michael Rasch: Corporate bonds: the ECB buys negatively yielding bonds on a large scale. In: Neue Zürcher Zeitung . August 4, 2016. Retrieved August 23, 2016 .

- ↑ Kristina Antonia Schäfer: "Minus interest rates are a hidden tax - and therefore illegal" wiwo.de of October 2, 2019

- ↑ ECB turns money market upside down due to crisis , Der Standard , October 9, 2008

- ^ So Duden, Basic Knowledge School: Economy , Berlin, Mannheim, 2001, ISBN 3-411-00251-4 , p. 213

- ↑ ECB Notches $ 20.4 Billion in Bond Purchases. The Wall Street Journal. Europe. May 18, 2010.

- ^ Jack Ewing, Steven Erlanger: Trichet Faces Growing Criticism in Europe Debt Crisis. The New York Times , May 20, 2010.

- ^ Brian Blackstone: After Debt Crisis, New Tension Between ECB, Germany. The Wallstreet Journal , May 29, 2010.

- ↑ Bundesbankers suspect a French plot , spiegel.de of May 29, 2010

- ↑ ecb.europa.eu

- ↑ Capital subscription of the ECB , official information from the ECB for capital subscription

- ^ Adaptation of the ECB's capital subscription key and the contribution from Slovakia , press release of the European Central Bank, January 1, 2009

- ↑ Overview on the ECB website

- ↑ ECB increased holdings of Japanese yen in 2007 , Reuters India, April 21, 2008

- ↑ Banking supervision - Money laundering prevention procedures too weak . In: Reuters . January 28, 2020 ( reuters.com [accessed January 28, 2020]).

- ↑ a b Corporate management and control (ECB website)

- ↑ cf. Total assets of the European Central Bank since 1999 ( Memento from 20100602084223)

- ↑ a b European Banker of the Year ( Memento from November 11, 2011 in the Internet Archive ) in: Maleki Group , accessed on December 7, 2010.

- ↑ 2009-05-27 IPSO Press Release ( memento from January 19, 2012 in the Internet Archive ) , ipso.de (PDF; 103 kB), May 27, 2009

- ↑ Cerstin Gammelin, Markus Zydra: ECB: Draghi goes, Lagarde takes over. Retrieved January 28, 2020 .

- ↑ tagesschau.de: Euroschau to Lagarde: Bonjour Madame! Retrieved January 28, 2020 .

- ↑ ECB Briefing February 2015: "The ECB's Expanded Asset Purchase Program - Will quantitative easing revive the euro area economy?"

- ↑ ECB press release of January 22, 2015 "ECB ANNOUNCES EXTENDED ASSET PURCHASE PROGRAM"

- ↑ 22 January 2015 - ECB announces expanded asset purchase program. ECB, January 22, 2015, accessed on January 22, 2015 .

- ↑ Jeff Kearns: The Fed Eases Off: Tapering to the End of a Gigantic Stimulus. Bloombergview.com, November 7, 2014, accessed January 23, 2015 .

- ↑ a b c ECB unveils massive QE boost for eurozone. BBC News, January 22, 2015, accessed January 22, 2015 .

- ↑ Jana Randow: Europe's QE Quandary: Why the ECB is Finally Buying Bonds. Bloombergview.com, January 22, 2015, accessed January 23, 2015 .

- ↑ Jens Weidmann: The Anti-Draghi. Zeit online, January 22, 2015, accessed January 22, 2015 .

- ↑ Economist warns of currency war ( memento from January 27, 2015 in the web archive archive.today ), Badische Zeitung , January 25, 2015

- ↑ Philip Plickert : What is going on behind the doors of the Governing Council , FAZ.net, January 23, 2015

- ↑ Hans-Jürgen Maurus: WEF Davos - Federal Finance Minister Schäuble pinches - Soros on German potholes ( Memento from 7 July 2015 in the Internet Archive ). Deutschlandfunk , January 23, 5:11 p.m.

- ↑ a b Federal Constitutional Court: ECB takes “note” of the judgment. In: deutschlandfunk.de. May 5, 2020, accessed May 5, 2020 .

- ↑ a b Resolutions of the ECB on the government bond purchase program incompetent. In: Press release No. 32/2020. Federal Constitutional Court, May 5, 2020, accessed on May 5, 2020 .

- ↑ Judgment of the Court of Justice (Grand Chamber) of 11 December 2018 in case C ‑ 493/17. In: InfoCuria. Retrieved May 9, 2020 .

- ↑ https://www.bundesverfassungsgericht.de/SharedDocs/Pressemitteilungen/DE/2020/bvg20-032.html

- ↑ "The Bundesbank is therefore prohibited from implementing and enforcing Decision (EU) 2015/774 and the subsequent Resolutions (EU) 2015/2101, (EU) 2015 after a transition period of no more than three months, which is necessary for coordination in the ESCB / 2464, (EU) 2016/702, (EU) 2017/100 and the decision of September 12, 2019 by making portfolio-expanding bond purchases or participating in a further expansion of the monthly purchase volume, if not the Governing Council in a new resolution clearly demonstrates that the monetary policy objectives pursued with the PSPP are not disproportionate to the associated economic and fiscal policy effects. ” BVerfG, judgment of the Second Senate of May 5, 2020 - 2 BvR 859/15 - Rn. (1-237)

- ↑ Cerstin Gammelin, Wolfgang Janisch: ECB judgment: The European Court of Justice speaks up. In: sueddeutsche.de. May 8, 2020, accessed May 9, 2020 .

- ^ Cerstin Gammelin, Wolfgang Janisch: After the Karlsruhe ECB judgment: Schäuble sees the euro in danger. In: n-tv.de. May 8, 2020, accessed May 9, 2020 .

- ↑ Federal Constitutional Court: Merz criticizes von der Leyen's reaction to the ECB ruling. In: zeit.de. May 12, 2020, accessed May 13, 2020 .

- ↑ European Central Bank, Key ECB interest rates (English)

- ↑ The ECB announced on December 22, 1998 that between January 4 and January 21, 1999, there would be a narrow corridor of 50 basis point interest rates for the marginal lending facility and the deposit facility in order to transition to the ECB interest rate regime bridge.

Coordinates: 50 ° 6 ′ 34 ″ N , 8 ° 42 ′ 9 ″ E