Commerzbank

| Commerzbank Aktiengesellschaft | |

|---|---|

|

|

|

| Country |

|

| Seat | Frankfurt am Main |

| legal form | Corporation |

| ISIN | DE000CBK1001 |

| Bank code | 500 400 00 |

| BIC | COBA DEFF XXX |

| founding | February 26, 1870 |

| Website | commerzbank.de |

| Business data 2019 | |

| Total assets | 463.6 billion euros (2019) |

| insoles | 309.3 billion euros (2019) |

| Employee | 48,512 (2019) |

| management | |

| Board |

Martin Zielke ( Chairman ) |

| Supervisory board |

Hans-Jörg Vetter ( Chairman ) |

The Commerzbank Aktiengesellschaft is a universal bank operating German bank based in Frankfurt am Main . In the 2018 financial year, it was the fourth largest in Germany in terms of total assets . Commerzbank is a member of the Cash Group . With a stake of over 15 percent, the Federal Republic of Germany is the largest single shareholder through the Financial Market Stabilization Fund ( SoFFin ).

history

Founding years and the rise to a major bank (1870–1923)

On February 26, 1870, Hanseatic merchants , merchant bankers and private bankers founded the Commerz- und Disconto-Bank in Hamburg.

The founding consortium included:

- Theodor Wille ( Theodor Wille , Hamburg)

- Carl Woermann ( C. Woermann , Hamburg)

- Albrecht Percy O'Swald ( Wm. O'Swald & Co. Hamburg)

- Carl Georg Heise ( Carl Geo. Heise , Hamburg)

- Conrad Hinrich Donner ( Conrad Hinrich Donner , Altona)

- Georg Hinrich Hesse ( Hesse, Newman & Co. , Altona)

- Jacques Emile Louis Alexandre Nölting ( Emile Nölting & Co. Hamburg)

- Ludwig Erdwin Amsinck ( LE Amsinck & Co. New York)

- Siegmund Warburg ( MM Warburg & Co. , Hamburg)

- Leopold Lieben ( Bankhaus Lieben Königswarter , Hamburg)

- Adolph BH Goldschmidt (Bankhaus BH Goldschmidt , Frankfurt am Main)

- Alexander Mendelssohn ( Bankhaus Mendelssohn & Co. , Berlin)

The aim was to provide Hamburg trade with new financial resources and to facilitate trade, especially international business. In 1873 the subsidiary London and Hanseatic Bank was founded in London for the same purpose . She was active until the First World War . In Germany, Commerz- und Disconto-Bank was initially only represented in Hamburg. In 1874 she moved into the bank building on Neß designed by Martin Haller , which was used by Commerzbank until it was sold in 2016.

At the end of the 19th century, Germany developed into a powerful industrial nation. The expansion of the business activities of the Commerz- und Disconto-Bank must be seen against this background. In addition to trade finance and the lending business with small and medium-sized enterprises, it established close relationships with the key industries of the time at the beginning of the 20th century.

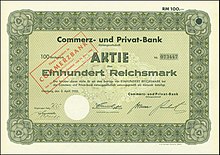

The former headquarters on Kassel Königsplatz is still used by Commerzbank today. With the takeover of the Frankfurt bank J. Dreyfus & Co. in 1897, the bank set up its first branches outside Hamburg in Berlin and Frankfurt am Main. After the takeover of Berliner Bank in 1905, the business focus shifted to Berlin, the capital of the German Empire . By 1923, the bank had bought 46 regional institutions and private banking houses and thus rose to become a major national bank. Following the merger with the Mitteldeutsche Privat-Bank from Magdeburg in 1920, the Commerz- und Disconto-Bank changed its name to Commerz- und Privat-Bank Aktiengesellschaft . It now had 284 branches across Germany, mainly in northern, western and central Germany.

Hyperinflation, the Great Depression and the Third Reich (1924–1945)

After overcoming hyperinflation , German credit institutions had to present an opening Goldmark balance sheet on January 1, 1924 . The Commerz- und Privat-Bank valued their previous capital of 700 million marks in the course of this with 42 million gold marks . In the years that followed, the economic situation apparently recovered from the effects of the wave of inflation. In 1927, Commerz- und Privat-Bank set up a foreign agency in New York . The Commerz- und Privat-Bank continued to expand. In 1929 two major banks merged: Commerz- und Privat-Bank and Mitteldeutsche Creditbank from Frankfurt am Main merged. As a result of the merger, the Commerz- und Privat-Bank expanded its branch network, primarily to include new locations in Hesse and Thuringia.

In 1931, during the currency and banking crisis ("twin crisis"), several banks, including Commerz- und Privat-Bank , got into a difficult situation ( German banking crisis ). In order to save the banks, the government under Chancellor Heinrich Brüning decided in February 1932, among other things, to merge the Commerz- und Privat-Bank with the Barmer Bankverein , which had a dense branch network in northern and western Germany. A capital increase carried out at the same time led to a partial nationalization of the new bank. The Reich and the state discount bank had a 70 percent stake in the bank. In 1937 these shares were sold again to private shareholders.

During the National Socialist dictatorship, the Commerz- und Privat-Bank, like other banks and companies, adapted to the political primacy. The business policy of the institute remained guided by economic motives, while the bank refrained from excessive expansion. In opposition to the austerity policy of the Brüning era, the chairman of the supervisory board Franz Heinrich Witthoefft and the spokesman for the board of directors Friedrich Reinhart of the Commerz- und Privat-Bank supported the so-called industrial proposal in November 1932 , calling on President Paul von Hindenburg to appoint Adolf Hitler as Chancellor . After the seizure of power in 1933, the pressure also increased on the banks to displace Jewish citizens from their positions. Jewish members of the supervisory board and executive board had to resign from their offices. From 1938 onwards, there were no more Jewish employees working at the Commerz- und Privat-Bank.

The Commerz- und Privat-Bank also took part in the process of Aryanization operated by the National Socialists . Like other banking institutions, it brokered “Jewish” companies to customers or other interested parties who wanted to take them over. The aim of the bank was to maintain business relationships with the companies concerned. More precise figures are not available, but according to recent research, given their around 360 branches and numerous medium-sized customers, it could be around 1,000 "Aryanization" agencies.

The “Eleventh Ordinance to the Reich Citizenship Law” stipulated that the German Reich automatically became the owner of the property of emigrated, deported and deceased Jews. From 1941 onwards, all banks were obliged to report their assets to the German Reich.

In 1940 the bank changed its name. From Commerz und Privat-Bank Commerzbank Aktiengesellschaft was. From 1939 to 1944 Commerzbank opened several new branches and subsidiaries in countries occupied by the German Reich , including Czechoslovakia , Poland , Belgium , Estonia and Latvia . In the Netherlands she took over the “Jewish” banking house Hugo Kaufmann & Co's Bank . The basis here was less ideological than economic interests. Without expansion abroad, the bank threatened to lag behind its competitors. Shortly before the end of the war, Commerzbank relocated its headquarters from Berlin to Hamburg for security reasons.

Splitting, new beginning and beginning internationalization (1945–1969)

With the end of the Second World War in 1945 and the division of Germany into four zones of occupation , the bank loses its branches and branches in the Soviet zone of occupation and East Berlin . The branches there - almost 45 percent - will be closed and expropriated without compensation. In the western zones of occupation, the big banks are smashed and their business activities are restricted to one zone of occupation. By order of the American military government , Commerzbank was split up into nine regional successor institutions in 1947.

- American zone of occupation:

- Central German Creditbank in Frankfurt

- Bank association for Württemberg-Baden in Stuttgart

- Bavarian Disconto-Bank in Nuremberg

- Bremer Handelsbank in Bremen

- French zone of occupation:

- Mittelrheinische Bank in Mainz

- British Zone of Occupation:

- Bank Association West Germany in Düsseldorf

- Hansa Bank in Hamburg

- Merkur Bank in Hanover

- Holsten Bank in Kiel

Nevertheless, normal business activity was practically impossible for banks, as confidence in the Reichsmark continued to decline in the post-war years. The currency reform on June 21, 1948 and the introduction of the D-Mark was a new beginning for Commerzbank as well. In 1949 the Allied powers and the Berlin magistrate allowed banking activities in West Berlin again . As a result, Bankgesellschaft Berlin AG , the tenth regional group of the former Commerzbank, started its business activities. In 1952, the “Law on the Branch Area of Credit Institutions” made it possible for the nine West German regional groups to merge to form three successor institutions: Commerz- und Disconto-Bank AG in Hamburg, Bankverein Westdeutschland AG in Düsseldorf and Commerz- und Credit-Bank AG in Frankfurt. In 1956, the “Law on the Abolition of Restrictions on the Branch Area of Credit Institutions” came into force and enabled the three sub-institutions to be merged to form Commerzbank Aktiengesellschaft. This was completed in October 1958 with effect from July 1, 1958 when the Commerzbank-Bankverein in Düsseldorf took over the two sister institutions. The newly founded credit institution is entered in the Düsseldorf commercial register on November 4, 1958 under the old name Commerzbank AG . At that time, the bank had around 7,700 employees and 185 branches in western Germany. The Berlin Commerzbank AG was only merged with the parent company in 1992 after the German reunification.

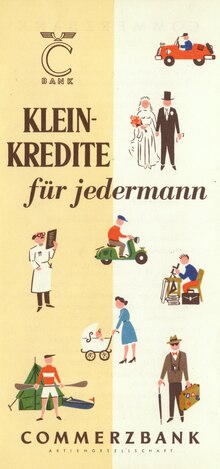

Since it was founded, Commerzbank has been primarily active in business customer business; business with private customers was added from around 1900. In the era of the economic boom and the rising prosperity of the “new middle class”, private customer business became even more important in the 1950s. From 1958 banks were allowed to set up branches without an official needs test, which Commerzbank used immediately. In 1962 it had exceeded its pre-war level with 372 branches. In 1959, Commerzbank, together with Deutsche Bank and Dresdner Bank, launched the “small credit for everyone” on the market. In addition, Commerzbank started building mortgage lending for private customers in 1968. In 1969 Commerzbank had more than 1 million private customers for the first time.

The 1950s and 1960s were also characterized by the beginning internationalization of the financial sector. Commerzbank was particularly active in this. In 1952 she opened her first foreign representative office in Rio de Janeiro after the Second World War. Representative offices followed in Madrid (1953), Amsterdam (1955), Beirut (1957), Johannesburg (1958) and Tokyo (1961). In 1962, Commerzbank shares were listed on the London Stock Exchange as the first share in a German financial institution. In 1967 Commerzbank was also one of the founding members of Commercial Bank Ltd. in London and opens a representative office in New York . A little later, in September 1971, the representative office was converted into a branch and was the very first branch of a German credit institution in the USA. By 1969 Commerzbank had nine foreign representations and four foreign participations. In the same year, Luxemburg Commerzbank International SA (CISAL) was established, which was Commerzbank's largest subsidiary for many years.

Increasing internationalization (1970–1989)

The 1970s and 1980s were characterized by international cooperation and global expansion . In 1970 Commerzbank and Crédit Lyonnais agreed on a cooperation that was expanded when the Banco di Roma joined the Europartner group in 1971 . In 1973, Banco Hispano Americano joined the Europartners group as the fourth member. As part of this European banking cooperation, Commerzbank introduced the “Quatre Vents” logo in 1972, which it used until mid-2010. The Crédit Lyonnais only used this logo until 2004. The Europartners group itself split up in 1992 by mutual agreement.

In 1971 Commerzbank was the first German credit institution to set up an operational branch in New York. This was followed by branches in London (1973), Chicago (1974), Paris (1976), Brussels and Tokyo (1977), Antwerp (1978), Hong Kong (1979), Madrid (1980), Barcelona (1981) and Los Angeles ( 1985). In addition, representative offices began operations in Singapore (1970), Copenhagen and Tehran (1974), Cairo (1975), Moscow (1976), Jakarta (1977), Toronto (1979) and Beijing (1982). In addition, Commerzbank was involved in a large number of start-ups and equity investments abroad. She founded subsidiaries in Southeast Asia, the Netherlands, Switzerland and the USA in order to ensure international business activity and enable global cooperation. In addition, Commerzbank was traded internationally on an increasing number of European stock exchanges: Paris (1971), Brussels and Zurich (1973), Luxembourg and Amsterdam (1974) and finally Tokyo (1986).

New for the customer in the 1970s was the introduction of the Eurocheque , which Commerzbank promoted with several European banks. Customers were now able to withdraw cash with a check card in 30 European countries . The Eurocheque card with magnetic stripe for use at ATMs was launched in 1981. In 1982, Commerzbank set up its first Eurocheque ATM in Frankfurt. By 1989 Commerzbank had over three million customers, for whom more than six million accounts were kept. In 1974 Commerzbank moved into the new headquarters in Frankfurt am Main, the "two-pane house" designed by Richard Heil .

Development in the East, further internationalization and entry into online banking (1990–1997)

As early as the 1950s, Frankfurt was increasingly becoming Germany's most important financial center. After Commerzbank had relocated more and more central departments to the Main metropolis, it finally moved the legal headquarters from Düsseldorf to Frankfurt in 1990 .

In 1990, German reunification gave West German banks new business opportunities in the new federal states. While Deutsche Bank and Dresdner Bank acquired stakes in the former State Bank of the GDR , Commerzbank decided early on to set up its own branch network. In January 1990 she set up a liaison office in East Berlin and on June 30, 1990, the German Federal Foreign Minister Hans-Dietrich Genscher opened her first bank branch in the GDR in Halle . At the end of 1990 Commerzbank had 51 branches and more than 100,000 customers in the new federal states. Klaus-Peter-Müller , who was appointed to the board on November 1, 1990, was in charge of developing the business . The German reunification in 1992 also led to the integration of the Berlin Commerzbank into the parent company.

In the early 1990s, Commerzbank succeeded in significantly increasing its earnings. Nevertheless, the share price was comparatively low, which led to a cost reduction in connection with downsizing. This once again improved the earnings situation. Commerzbank then offered its shareholders the prospect of a higher dividend .

Commerzbank continued the internationalization strategy introduced in the two previous decades into the 1990s. She opened up the new market in Central and Eastern Europe through start-ups and acquisitions. 1992 opened a branch in Prague , 1993 a subsidiary opened in Budapest . In 1994 Commerzbank initially took over 21 percent of the Polish state bank Rozwoju Eksportu SA (BRE-Bank), a business customer bank to support the Polish export industry. Commerzbank later increased its stake gradually to around 70 percent.

During these years numerous new branches and subsidiaries were established worldwide: in Singapore (1990), Gibraltar (1991), Tokyo (1992), Dublin (1994), Hong Kong (1994), Shanghai (1994), Johannesburg / South Africa (1995), Mumbai (1995), Singapore (1995), Labuan / Malaysia (1996) and Belgium (1997). In addition, the bank opened an office in Brussels (1992), the seat of the European Commission . As a result, as well as through the acquisition of numerous stakes in banks, real estate and corporations worldwide, Commerzbank was able to better support its German business customers in their expansion plans worldwide.

In the 1990s, the institute earned around two thirds of its earnings abroad. CEO Martin Kohlhaussen still demanded more performance, especially from the sales of the domestic branches. The company wanted to significantly increase the return on equity in order to be better able to compete internationally. Because of its comparatively low international balance sheet total , Commerzbank was considered a takeover candidate in the 1990s. In fact, the institute succeeded in noticeably increasing the number of customers. The institute generated more profit with fewer branches. At the same time, the bank created innovative new offers, for example for withdrawing cash at petrol stations and online banking for business customers. The outsourcing of employees to a temporary employment agency, however, was received critically by the public. During this time, Commerz Grundbesitz-Investmentgesellschaft was founded in Wiesbaden (1992), which manages the open-ended real estate fund Haus-Invest, acquired a majority stake in Hypothekenbank Essen AG (1994), and CommerzLeasing und Immobilien GmbH was founded (1995).

When Comdirect Bank GmbH was founded in 1995, Commerzbank entered the emerging direct banking market . Comdirect began as a direct bank and discount broker, went public in 2000 and today has a universal banking license with more than 2.8 million private customers. The parent company also got into online banking in 1997.

1994–1997 Commerzbank built the Commerzbank Tower in Frankfurt am Main, in which important central departments were brought together. In 1998 she also opened a representative office in the capital Berlin at Pariser Platz in Berlin-Mitte. She had already acquired the property in the immediate vicinity of the Brandenburg Gate in 1995.

Investment banking and growth through acquisitions (1998–2007)

After Commerzbank had acquired stakes in numerous foreign credit institutions and insurance companies in the course of the 1990s, it bought around 30% of the Korea Exchange Bank in 1998 . She wanted to participate more in the development of the emerging Asian markets.

Commerzbank has been active in the capital market business since the first few years of the Federal Republic of Germany. It participated in issues and IPOs for German and international companies as well as for the public sector.

In the 1990s, Anglo-Saxon banks in particular concentrated on global investment banking with increasingly ambitious profit targets. In the course of the “ New Economy ” boom at the turn of the millennium , Commerzbank also wanted to benefit from it. Falling prices on the stock exchanges and a downturn in the real economy ended this chapter quickly. In 2004 Commerzbank reversed some of its global ambitions. It completely gave up the publicly controversial proprietary trading of banks with customer funds and limited itself to providing investment banking services for its predominantly German business customers. This involved cutting 900 jobs and reducing the number of investment banking locations to Frankfurt, London and New York.

Takeover rumors

After the failure of the merger between Deutsche Bank and Dresdner Bank in early 2000, Commerzbank was seen as the most promising candidate for a takeover of Dresdner Bank. One of the options discussed was the establishment of a large financial group with the involvement of Allianz . Ultimately, the plans failed because it was not possible to bring together the different interests of everyone involved. The decisive factor here was the conflict over the valuation of Commerzbank and Dresdner Bank in the course of the merger. Commerzbank insisted on a merger among equals. The Dresdner Bank management did not accept this. Both banks then emphasized their independence.

Partial takeover of Schmidtbank

In 2004 Commerzbank took over parts of the financially troubled Schmidtbank from Hof (Saale) with 70 branches and around 360,000 customers.

BRE Bank - expansion of participation

In 2003 Commerzbank took over the majority in the Polish BRE Bank . At the same time, Commerzbank also planned to grow in smaller markets such as Romania . Income from Central and Eastern Europe should grow by around 50% over the course of two years. However, this could not be achieved due to losses at BRE Bank. In addition, Commerzbank began to relocate back office activities and IT services to Poland and the Czech Republic .

Joined Bank Forum / Ukraine

In autumn 2007 Commerzbank acquired 60 percent plus one share in the Ukrainian “ Bank Forum ”, which is one of the top ten in its country. However, Commerzbank sold the bank again in 2012.

Foundation and takeover of Eurohypo

In 2001 the Deutsche Bank , Dresdner Bank and Commerzbank decided to merge their mortgage banks Eurohypo , Deutsche Hypothekenbank and RHEINHYP under the name of the Deutsche Bank subsidiary Eurohypo. Eurohypo commenced business operations in the second half of 2002. After the collapse of the dot-com bubble and the subsequent turbulence in the financial markets, Commerzbank had to make high write-downs on its stake in the subsidiary in 2003. At times, the major shareholders waived their dividends in order to improve Eurohypo's financing. In order to strengthen the company's independence, Eurohypo planned to go public .

Despite initial difficulties, Eurohypo developed into an important component in Commerzbank's income statement. The bank therefore stopped the IPO planned for 2005 and prepared the takeover of Eurohypo itself. The return to government and real estate finance meant a decisive change in corporate strategy, which aroused skepticism among analysts and investors. In November 2005 Commerzbank finally announced the complete takeover of Eurohypo and acquired the shares in Deutsche and Dresdner Bank. This made Commerzbank the second largest German bank. The credit institute carried out a capital increase for financing. Even after the takeover, Eurohypo remained largely independent. The real estate business developed into an important pillar of the group.

Dresdner Bank takeover, financial crisis and its consequences (2008-2013)

History and takeover announcement

In the course of 2008, calls from politics for a national banking champion became louder and louder. A major merger between Commerzbank, Dresdner Bank and Postbank was also discussed. The alliance , which took over Dresdner Bank in 2001, a bancassurance group to create, was ready to give her daughter back. A merger between Commerzbank and Dresdner Bank was already considered likely in the middle of the year.

After months of negotiations, Commerzbank announced the takeover of Dresdner Bank on August 31, 2008. It was the largest merger of two credit institutions in Germany and a milestone in the reorganization of the German financial sector . Allianz put the purchase price at around 9.8 billion euros , with the company assuming a risk of loss of up to 975 million euros. In the first step, Commerzbank should initially acquire around 60% of Dresdner Bank. The purchase price was to be paid partly in cash, partly in newly issued Commerzbank shares and partly by transferring the Commerzbank fund subsidiary Cominvest. The aim was for Allianz to have a stake in Commerzbank of almost 30 percent.

Financial crisis and renegotiations

Two weeks after the announcement of the takeover, the US Federal Reserve and the US government refused to support the US investment bank Lehman Brothers during the US real estate crisis and subprime market crisis . This led to the bankruptcy of Lehman and subsequently to a global economic and financial crisis ; the markets were in a "shock paralysis".

During renegotiations at the end of November 2008, Allianz therefore lowered the takeover price to 5.5 billion euros. In addition, the takeover from the second half of 2009 was brought forward to January 2009. The lower purchase price arose because Allianz's stake in the new Commerzbank was determined by the acquisition of a certain number of shares and not by an absolute total price. Because the Commerzbank share price has fallen sharply , the purchase value has also decreased .

For analysts and investors the merger of Commerzbank and Dresdner Bank came after the outbreak of the global economic and financial crisis, more and more criticism. Because the transaction burdened considerably the rates of all participating companies . Because Dresdner Bank's higher credit risks became apparent at the end of 2008 , Commerzbank had to make use of the state special fund for financial market stabilization (SoFFin). After the federal government and the European Commission had agreed on the details of the aid, Commerzbank received a silent participation of 8.2 billion euros. Commerzbank emphasized that SoFFin's participation had become necessary due to the devaluation of the banks and not due to the takeover of Dresdner Bank itself. At the turn of the year 2008/2009, the bank had to ask for further state aid. The Federal Republic of Germany then acquired 25% of Commerzbank plus one share. SoFFin's silent participation increased to around 16.4 billion euros.

Integration in 1,000 days

Commerzbank has been the sole owner of Dresdner Bank since January 12, 2009 and holds 100 percent of the shares. The merger of Dresdner Bank with Commerzbank was entered in the commercial register on May 11, 2009. Dresdner Bank ceased to exist after 139 years. After it had already decided not to lay off for operational reasons with the announcement of the handover , in March 2009 it concluded a reconciliation of interests and a social plan with the employee committees , which included the reduction of around 9,000 jobs and an agreement on a new organizational structure for the headquarters.

The “Dresdner Bank” brand was gradually abandoned, with the new Commerzbank taking over individual elements of the Dresdner Bank. On October 28, 2009 Commerzbank presented the new company logo . It is similar to the Dresdner Bank logo, the “Ponto Eye” named after Jürgen Ponto , but is colored yellow and has a slightly three-dimensional effect. In mid-2010, all Dresdner Bank branches were renamed Commerzbank locations. Of the former 1,540 locations, 300 locations where the Commerzbank and Dresdner Bank branches were in the immediate vicinity were closed. To this day, however, there is still a Dresdner Bank branch in Dresden for trademark protection reasons.

Dresdner Bank owned an extensive art collection. Commerzbank caused a stir in public when it sold the masterpiece “L'Homme qui marche I” by Alberto Giacometti . She raised just over £ 65 million for the sculpture and donated the proceeds to German museums and a company-owned foundation. She also left parts of the rest of the collection to various German museums.

Roadmap 2012

Commerzbank repositioned itself as a lesson from the financial market and economic crisis and the integration of Dresdner Bank. With the “Roadmap 2012” Commerzbank wanted to further strengthen its private and business customer business in Germany. The focus should now be on a profitable customer bank, while parting with other activities that were not part of the core business .

To this end, Commerzbank set up an internal bad bank at the end of March 2009 , into which it outsourced toxic or non-strategic Commerzbank securities, primarily from the areas of commercial real estate and ship financing , amounting to around 55 billion euros. This also affected Eurohypo . This volume was reduced to 12.0 billion euros by September 30, 2011. In 2012 the decision was finally made to completely dismantle all commercial real estate financing and ship financing activities and to wind up Eurohypo. It operated under the name Hypothekenbank Frankfurt from August 31, 2012 until its dissolution in May 2016 . The Greek debt crisis had an unexpectedly strong impact on Commerzbank's profitability , especially in the years 2010 to 2012. After the difficulties in individual countries had an impact on other markets, Commerzbank announced radical austerity measures and temporarily stopped granting new loans, with the exception of Germany and Poland .

Repatriation of SoFFin's silent participations

On May 27, 2011, the bank completed the integration of Dresdner Bank after 1,000 days. In April 2011 she began to repay SoFFin's silent participations . It financed this, among other things, with one of the largest capital increases in German history: the volume of around 14 billion euros was made up of eleven billion euros from the capital increase and three billion from the bank's reserves . The SoFFin also received a special payment of around 1 billion euros from the bank's equity as compensation for lost future interest. In turn, he participated in the bank's capital increases to get his 25% stake plus one share. The move met with criticism from many shareholders, but was ultimately approved by the general meeting .

In 2013, Commerzbank transferred the remaining 1.6 billion euros to SoFFin as well as 750 million euros for the silent participations of Allianz SE . For this purpose, the bank carried out a capital reduction in the course of a share consolidation at a ratio of 10: 1 and a subsequent capital increase with subscription rights of 2.5 billion euros. In the course of this measure, the federal government's share of shares fell from 25 to around 17% of the share capital, whereby the federal government gave up its blocking minority of 25 percent. The bank has thus repaid all of the silent participations to the federal government unexpectedly early. Regardless of this, the federal government remains the bank's largest shareholder with around 17%.

Commerzbank 2012–2019

The decade after the takeover and integration of Dresdner Bank brought far-reaching changes for Commerzbank. They were caused by the increasing digitization of all areas of public life. Against this background, there were several trends that overlapped and intensified: Since around 2012, so-called “fintechs” have been providing technological innovations in the banking business. At the same time, the large American Internet companies offered banking services and thus competed with traditional banks. In addition, the importance of mobile communication increased significantly. In 2018, over 80% in Germany had a smartphone . This also increased customer expectations for products and services from banks and triggered a fundamental change in business processes in the industry. Commerzbank countered this technological change with several successive strategy programs.

Strategic agenda

The Strategic Agenda 2016 formulated in November 2012 was still influenced by the global financial crisis . The bank claimed to have learned from the mistakes of the past. "" There can no longer be 'business as usual' in the banking industry. Regaining the trust of customers will be the most important task of all banks in the coming years, "says CEO Martin Blessing for the entire industry. Commerzbank announced until Investing around two billion euros in its core business in 2016 and wanting to set up a modern multi-channel bank for private customers. Commerzbank cut 1,800 jobs in branch business by the end of 2015. The bank declared high customer satisfaction to be the top priority of its work In Focus Money's annual banking test , Commerzbank made a leap from last to first place in terms of advisory quality : In Switzerland, it opened six branches for business customers in 2013 and 2014 in Basel , Bern , Lausanne , Lucerne , St. Gallen and Zurich .

Strategies 4.0 and 5.0

In May 2016, the previous Board Member for Private Customers, Martin Zielke, took over as CEO, and in September 2016 announced a radical restructuring of the group in response to the challenge of digitization. The bank is to be converted into a digital technology company with a focus on private and business customers, restrictions on investment banking and the automation of 80 percent of the previously manual business processes. This would mean cutting 9,600 jobs by the end of 2020. In September 2019, Commerzbank presented a further development of the previous program under the name Commerzbank 5.0 to accelerate digitization. At the same time, there will be cuts in the branch network, which the bank will reduce by around 20 percent to 800 branches, and around 2,300 full-time jobs will be cut.

Commerzbank since 2020

In July 2020, the chairman of the board, Martin Zielke, and the chairman of the supervisory board, Stefan Schmittmann, announced their resignation. Previously, there had been differences of opinion between the company management and major shareholders about the upcoming restructuring of the group.

Controversy and investigation

Aid to tax fraud

In February 2015, the tax investigators and the public prosecutor's office searched Commerzbank's headquarters on suspicion of aiding and abetting tax fraud by the Luxembourg subsidiary Commerzbank International in connection with the Panamanian mailbox company Mossack Fonseca . The bank is said to have enabled its customers to avoid tax payments by moving assets overseas. The Cologne District Court ordered the bank to pay a fine of 17.1 million euros. The court upheld the bank's cleansing of black money accounts and illegal tax operations.

In June 2020 the FAZ reported that the British financial market regulator FCA had fined Commerzbank 38 million pounds (42 million euros) for deficiencies in the anti- money laundering business policy. "Commerzbank London was aware of these weaknesses and it has failed to take sensible and effective steps to remedy the shortcomings," the agency wrote, according to the newspaper.

Dividend arbitrage on tax fraud

On May 2, 2016, the research network consisting of Handelsblatt , Bayerischer Rundfunk , Washington Post and the US non-profit foundation ProPublica announced their data analysis on the so-called dividend arbitrage. With cum / cum deals , banks helped their customers avoid capital gains taxes running into the millions. Commerzbank in particular is said to have done this frequently in the past.

Cooperation with armaments manufacturers

In 2008, Commerzbank adopted a binding internal company directive on arms deals. This includes u. a. the financing of the delivery of arms and armaments to conflict and tension areas. In a 2016 study, the Facing Finance association found that Commerzbank was circumventing its guideline itself by taking detours by not excluding services for conglomerates and having ThyssenKrupp , Krauss-Maffei Wegmann and Rheinmetall as customers who deliver weapons to areas of tension.

Economic indicators

| year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income statement in million euros | |||||||||||||

| Net interest income | 4,729 | 7,189 | 7,054 | 6,724 | 5,539 | 6,148 | 5,607 | 5,779 | 5,077 | 4,201 | 4,748 | ||

| Commission income | 2,846 | 3,722 | 3,647 | 3,495 | 3.191 | 3.215 | 3,205 | 3,424 | 3,212 | 3,178 | 3,089 | ||

| Other income | −692 | 395 | 12 | −2,316 | 50 | −12 | −451 | 60 | 790 | 778 | 367 | ||

| Total income | 6,433 | 10,948 | 12,671 | 9,889 | 9,901 | 9,269 | 8,754 | 9,762 | 9,399 | 9,163 | 8,570 | ||

| Risk provision / risk result | 1,855 | 4.214 | 2,499 | 1,390 | 1,660 | 1,747 | 1,144 | 696 | 900 | 781 | 446 | ||

| Administrative expenses | 4,956 | 9.004 | 8,786 | 7,992 | 7,025 | 6,797 | 6,926 | 7.157 | 7,100 | 7,079 | 6,879 | ||

| other effort | 25th | 2,389 | 33 | 0 | 311 | 493 | 61 | 114 | 756 | 808 | |||

| Profit before tax | −403 | −4,659 | 1,353 | 507 | 905 | 232 | 623 | 1,795 | 643 | 495 | 1,245 | ||

| Income taxes | −465 | −26 | −136 | −240 | 796 | 65 | 253 | 618 | 261 | 245 | 268 | ||

| Group result | 62 | −4,633 | 1,489 | 747 | 109 | 167 | 370 | 1,177 | 382 | 250 | 968 | ||

| further key data | |||||||||||||

| Balance sheet total ( billion euros) | 625.2 | 884.1 | 754.3 | 661.8 | 635.9 | 549.7 | 557.6 | 532.6 | 480.5 | 452.5 | 462.4 | ||

| Equity (billion euros) | 19.9 | 26.6 | 28.7 | 24.8 | 27 | 26.9 | 27 | 30.4 | 29.6 | 30th | 29.2 | ||

| Return on equity in% | −2.6 | −7.6 | 4.5 | 1.7 | 4.1 | 2.5 | 2.5 | 6.5 | 4.7 | 5.5 | 5.4 | ||

| Employee | 43,169 | 62,671 | 59.101 | 58,160 | 53,601 | 52,944 | 52.103 | 51,305 | 49,941 | 49,417 | 32,584 | ||

| - of which in Germany | 39,947 | 46,478 | 45,301 | 44,474 | 42,857 | 41,113 | 39,779 | 38.905 | 37,546 | 36,917 | 29,528 | ||

| Branches | 1,966 | 1,530 | 1,527 | 1,516 | 1,484 | 1,373 | 1,390 | ||||||

| - of which in Germany | 1,537 | 1,535 | 1,477 | 1,200 | 1,200 | 1,194 | 1,145 | 1,000 | 1,000 | 1,000 | |||

(Sources: Commerzbank corporate reporting)

The earnings figures shown in the bank's income statement are net values. The net interest income is the balance of interest income and interest expenses. Net commission income includes the bank's income from consulting services and fees for processing transactions for third parties as well as other services such as asset management and brokerage. The expenses directly related to these transactions are deducted from this. The trading result is the balance of the purchase and sales values of foreign exchange and securities for your own account. Here, too, the directly attributable expenses are directly deducted. The other non-interest income mainly includes income from participations and financial investments as well as from the sale of assets that were not acquired for direct resale.

The provisions for risks include risks from the lending business and is closely related to the net interest income. Administrative expenses not only fluctuate with the number of employees, but are also significantly influenced by the performance-based variable remuneration of employees, especially in the retail business. The non-interest-related expenses consist of the bank's material expenses. The major items included here are the costs of the buildings, IT expenses and purchased services.

Group structure

Commerzbank is a stock corporation under German law . Its object is the "operation of banking and financial services of all kinds and of other services and transactions associated therewith". This also includes investments in other companies. The company may realize the business purpose itself or in cooperation with third parties. It is entitled to all transactions and measures that are suitable to promote the business purpose. The Commerzbank announcements are made in the Federal Gazette , unless domestic or foreign laws stipulate otherwise.

Commerzbank is managed by the Federal Financial Supervisory Authority as a CRR credit institution . Since the introduction of the European Banking Authority , it has been monitored by the European Central Bank (ECB). Commerzbank is not one of the globally systemically important banks .

Share and shareholders

The share capital of Commerzbank is divided into around 1.25 billion to bearer unit shares with the nominal value of one euro. After the global financial crisis in 2007, the share price recovered in the course of 2009 and rose to over 50 euros, but then fell in the following years and reached an interim low of 5.79 euros in 2013. The last capital increase took place in 2015. On August 3, 2016, a share cost only 5.20 euros. The shares are traded on the German stock exchanges and via Xetra and are listed in the MDAX .

With a stake of over 15%, the Federal Republic of Germany is the largest single shareholder through the Financial Market Stabilization Fund ( SoFFin ). The remaining 85% are considered to be free float . BlackRock and Cerberus each have a stake of around 5% in Commerzbank. Other institutional investors together come to around 55%. Around 20% of Commerzbank shares are owned by private investors (as of May 2018).

management

Board

According to the Articles of Association , the Commerzbank Board of Management consists of at least two members. The committee is currently made up of five men and two women: Martin Zielke has been chairman since May 2016, and he was responsible for business with private customers before he was appointed to this position on the board. Also represented on the board are: Roland Boekhout (corporate customers), Jörg Hessenmüller ( Chief Operating Officer ), Markus Chromik ( Chief Risk Officer ), Bettina Orlopp ( Chief Financial Officer ), Michael Mandel (private and corporate customers), Bettina Orlopp ( Compliance , Legal and Human Resources) and Sabine Schmittroth ( Compliance , Legal and Human).

Supervisory board

The Commerzbank Supervisory Board consists of 20 people. The articles of association stipulate an equal cast of representatives of the shareholders and employees. The body currently consists of twelve men and eight women. The Chairman of the Supervisory Board has been Hans-Jörg Vetter since August 4, 2020.

Holdings

All companies that are directly or indirectly controlled by Commerzbank are included in the consolidated financial statements . The most important domestic holdings are the Comdirect Bank , in which it holds over 90 percent of the shares, and the wholly owned subsidiary Commerz Real . There are six major subsidiaries abroad, including the Polish Mbank . The Neugelb Studios are a wholly owned subsidiary of the house - marketing agency Commerzbank, which was founded in the 2016th

Locations

The head office is in Frankfurt am Main and is largely divided between the Commerzbank Tower (including the seat of the Management Board) in the city center , the Gallileo high- rise in the Bahnhofsviertel and Mainzer Landstrasse . The service center opened in 2001 (including information technology ) is located outside the city center on Mainzer Landstrasse and is the largest location with over 4,000 jobs. It is home to the largest dealer hall in Europe, which can accommodate around 500 people.

With over 800 branches , Commerzbank operates a Germany-wide branch network, consisting of large flagship and small city branches. The so-called "flagship" branches are mainly located in larger cities in order to offer a full range of advice. In the much smaller so-called “City” branches, the focus is on personal contact and advice on basic products. Outside Germany, Commerzbank has locations in around 50 countries. This means that it is active in all important industrial and emerging countries . There are 23 branches abroad, as well as representative offices and subsidiaries.

Customers

Commerzbank serves around 8.3 million customers; its domestic subsidiary Comdirect Bank has another 2.7 million customers. The subsidiary Mbank SA also looks after around 5.6 million customers in Poland , the Czech Republic and Slovakia . In September 2019, Commerzbank announced that it wanted to merge with Comdirect Bank and sell Mbank. Commerzbank served around 160,000 wealthy customers in 2019. From 2016 to 2019 Commerzbank gained around 1.3 million private customers. It maintains a worldwide customer network of 2,500 correspondent banks . Commerzbank handles around 30 percent of Germany's foreign trade finance .

Marketing and Sponsorship

In the wake of the financial crisis and partial nationalization , the bank lost public confidence. At the end of 2012, the bank started an advertising campaign in which it was open to past mistakes and wanted to promote it as a fair and competent financial service provider . Other banks sharply criticized this approach.

Company logo

The bank's first logos consisted of the abbreviations CDB for Commerz- und Disconto-Bank (before 1920) and CPB for Commerz- und Privat-Bank (1920 to 1940). The letters were intertwined and often surrounded by a circle, on which the company of the bank stood. At the beginning of the 20th century, red and black CPB emblems were used on seal stamps to securely seal envelopes, which were part of the corporate image in general from the 1920s.

After the new company Commerzbank Aktiengesellschaft was adopted in 1940, a “C” with Mercury wings on the sides was introduced as the logo , which was in use until the 1970s. The Hanseatic origin of the financing of the trade was emphasized.

As part of the founding of the Europartner Group, Commerzbank introduced the dynamic “Quatre Vents” logo (vents, French for wind direction) in 1972, which consists of four angles with rounded corners, which are aligned inwards towards a circle, and one stylized Wind rose is modeled after.

On October 28, 2009, Commerzbank presented its new “merged” logo, consisting of corporate colors yellow and gray and the slightly retouched “Ponto-Auge” logo of Dresdner Bank by Jürgen Ponto .

Soccer

Commerzbank is continuing the Green Band initiated by Dresdner Bank in 1986 for exemplary talent development in the association . The bank has been a sponsor of the German Football Association from 2008 until at least the end of July 2024 . Commerzbank has been involved in the DFB junior coach training program since 2013. It also promotes women's football. From 2005 to 2016 she was the main sponsor of the 1. FFC Frankfurt . Commerzbank has been a sponsor of Eintracht Frankfurt from 2002 to at least 2020, and from July 1, 2005 to June 30, 2020 it held the naming rights to the former Waldstadion in Frankfurt.

Climate and environment

Commerzbank supports the goal adopted at the UN Climate Change Conference in Paris in 2015 of limiting global warming to less than two degrees Celsius compared to the start of industrialization . The bank signed the UN Global Compact back in 2006 . At the national level, Commerzbank has supported the German Sustainability Code (DNK) since 2013 .

Sustainable financing

In the 1980s, Commerzbank began financing projects in the field of renewable energies , and in 2003 it created a competence center in Hamburg for this purpose . In addition, Commerzbank is issuing sustainable bonds, so-called green bonds , in 2018 with a volume of around 11 billion euros. In October 2018, it issued its own green bond with an issue volume of 500 million euros.

Internal environmental management

Commerzbank's efforts to ensure sustainable corporate governance have resulted in a number of sustainability indices. In 2019, Commerzbank was listed in the “Global 100 Most Sustainable Corporations in the World Index” (G100) by Corporate Knights and was ranked 67th. By November 2019, almost 600,000 square meters of forest had already been reforested through newly set up electronic mailboxes in online banking . Commerzbank in Germany has been getting its electricity exclusively from renewable energy sources since 2013. In 2013 Commerzbank was also listed in the top 20 in Bloomberg's “World's Green Banks” ranking for the first time .

In 2014 Commerzbank was one of the first major German companies to enable its employees to use bicycles , pedelecs and other e-bikes as part of a leasing model .

Memberships

- Commerzbank is a member of the Federal Association of German Banks and the Employers' Association of the Private Banking Industry . V. (AGV banks).

- Commerzbank is a member of the Cash Group ATM network .

- Commerzbank is a founding member of the German Competence Center against Cyber Crime (G4C).

- Commerzbank is a member of the UN Global Compact

Others

Commerzbank has been a premium partner of the German Football Association (DFB) since 2008 and is also active as a shirt sponsor of the 1. FFC Frankfurt . She acts as the main sponsor of the Girls Wanted project and thus complements her commitment to women's football and the promotion of young talent in popular and competitive sports .

According to information from the Frankfurter Allgemeine Zeitung in July 2013, Commerzbank was considering downsizing the Group's executive board from nine to seven members and reducing the number of more than 50 divisional boards. In the first half of 2013, the Management Board reached an agreement with the Works Council to cut 3,200 of the 28,000 jobs in Germany by 2016. At the headquarters in Frankfurt 1,400 of 10,000 jobs will be cut.

In August 2018 it was announced that Commerzbank had examined whether it should set up a new European digital bank together with its Polish subsidiary MBank, but would not continue these plans. The planned bank had become known under the project name Copernicus and would then have been able to advertise for customers in EU countries in which Commerzbank has not yet been represented.

Former chairman or spokesman after 1945

Spokesman for the Board of Directors:

- 1952 to 1958 Fritz Höfermann (Bankverein Westdeutschland AG, Düsseldorf), Wilhelm Nuber (Commerz- and Credit-Bank AG, Frankfurt am Main), Robert Gebhardt (Commerz- und Disconto-Bank AG, Hamburg)

- 1958 to 1961 Hanns Deuss

- 1961 to 1969 Will Marx (for Northern Germany)

- 1961 to 1973 Paul Lichtenberg (for West Germany), Ernst Rieche (for South Germany)

- 1973 to 1976 Paul Lichtenberg (for southern and western Germany)

- 1976 to 1980 Robert Dhom

- 1981 Paul Lichtenberg

- 1991 to 2001 Martin Kohlhaussen

- 2001 to 2008 Klaus-Peter Müller

- 2008 to 2009 Martin Blessing

Chairman of the Board of Management:

- 1981 to 1991 Walter Seipp

- May 7, 2009 to April 30, 2016 Martin Blessing

literature

- Commerzbank AG (Ed.): 100 Years of Commerzbank 1870–1970. Fritz Knapp, Frankfurt am Main 1970.

- Commerzbank AG (Ed.): The bank - service providers in transition. 125 years of Commerzbank. Fritz Knapp, Frankfurt am Main 1995, ISBN 3-7819-0544-6 .

- Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 .

- Ludolf Herbst, Thomas Weihe (ed.): The Commerzbank and the Jews 1933–1945. Beck, Munich 2004, ISBN 3-406-51873-7 .

- Hans-Dieter Kirchholtes: Jewish private banks in Frankfurt am Main. 2nd Edition. Waldemar Kramer, Frankfurt am Main 1989, ISBN 3-7829-0351-X .

- Detlef Krause: The beginnings of Commerz- und Disconto-Bank in Hamburg. In: Bank historical archive . Volume 23, 1997, pp. 20-55, ISSN 0341-6208 .

- Detlef Krause: The foreign branches of Commerzbank from 1870 to the 1960s. In: Bank historical archive. Volume 1, 2003, ISSN 0341-6208 .

- Detlef Krause: The historical archive of Commerzbank AG. In: Archive and Economy. Volume 23, 1990, S, 52-56, ISSN 0342-6270 .

- Detlef Krause: The “Commerz- und Disconto-Bank” in Berlin. From the branch to the head office of a major bank. In: Kristina Hübener, Wilfried G. Hübscher, Detlev Hummel (eds.): Banking on the Havel and Spree. History - Traditions - Perspectives. Verlag für Berlin-Brandenburg, Potsdam 2000, ISBN 3-932981-39-1 , pp. 157-189.

- Herbert Wolf: The end of private banking activities in Central Germany, illustrated using the example of Commerzbank. In: Bank historical archive. Volume 16, 1990, pp. 116-125, ISSN 0341-6208 .

- Herbert Wolf: The reprivatisation of Commerzbank in 1936/37. A masterpiece by the young Hermann Josef Abs. In: Bank historical archive. Volume 1, 1996, ISSN 0341-6208 .

- Herbert Wolf: Not fish nor meat - On the history of four post-war branch groups of Commerzbank. In: Bank historical archive. Volume 1, 1994, ISSN 0341-6208 .

Web links

- Literature by and about Commerzbank in the catalog of the German National Library

- Commerzbank website

- Commerzbank in the BaFin company database

Individual evidence

- ↑ a b Master data of the credit institute at the Deutsche Bundesbank

- ↑ Rembert Schneider: “The bank at your side” often went its own way . In: Börsen-Zeitung . February 17, 1995, p. 5 .

- ↑ a b c d Annual Report 2019 , accessed June 3, 2020

- ↑ Michael Brächer: Commerzbank boss Martin Zielke: A banker as an advocate for customers. In: Handelsblatt. September 6, 2017, accessed May 6, 2018 .

- ^ Carsten Burhop: The foundation of the Commerz- und Disconto-Bank in 1870. Stock banks as pillars of the universal banking system. In: Key Events in German Banking History. Edited by the Institute for Bank History Research. Franz Steiner, Stuttgart 2013 (pp. 155-165), ISBN 978-3-515-10446-3 , pp. 157 f.

- ↑ Detlef Krause: The Commerz- und Disconto-Bank 1870-1920 / 23: banking history as system history. Stuttgart 2004, p. 55.

- ↑ Detlev Krause, Katrin Lege, Ulrike Zimmerl: The Commerzbank am Neß in Hamburg. 140 years of building history in pictures. (= Publications of the Eugen Gutmann Society. Volume 10). Henrich Edition, Frankfurt am Main 2016, ISBN 978-3-943407-73-0 .

- ↑ Ulrich Gassdorf: Commerzbank sells area in the best city location. In: Hamburger Abendblatt. June 3, 2015, accessed October 23, 2019 .

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 16-25.

- ^ Detlef Krause: Stations in Commerzbank history. In: The Bank - Changing Service Providers 125 Years of Commerzbank. Fritz Knapp, Frankfurt am Main 1995, pp. 322-331.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 39-41.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 53.

- ↑ Johannes Bähr, Bernd Rudolph: Finanzkrisen 1931 2008. Edited by the Eugen Gutmann Society, Munich 2011, pp. 99–101.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 60-61.

- ↑ Ludolph Herbst, Thomas Weihe: The Commerzbank and the Jews 1933-1945. Munich 2004, pp. 74-137.

- ^ Dieter Ziegler: The Commerzbank 1870 to 1945. Development and assertion as a large branch bank. In: Stephan Paul, Friederike Sattler, Dieter Ziegler: One hundred and fifty years Commerzbank 1870–1945. Munich 2020, p. 167 ff.

- ↑ Bernhard Lorenz: The Commerzbank and the "Aryanization" in the old Reich. A comparison of the network structures and scope of action of large banks in the Nazi era. In: Vierteljahrshefte für Zeitgeschichte. 50th year, issue 2, April 2002, pp. 237–268.

- ^ Hannah Ahlheim: The Commerzbank and the confiscation of Jewish assets. In: Ludolf Herbst, Thomas Weihe (ed.): The Commerzbank and the Jews 1933–1945. CH Beck, Munich 2004, ISBN 3-406-51873-7 , pp. 138-172.

- ↑ Christoph Kreutzmüller: Dealers and sales assistants: the financial center Amsterdam and the major German banks (1918-1945). 2005, ISBN 3-515-08639-0 . ( books.google.de The dissertation was created as part of the project directed by Ludolf Herbst on the “History of Commerzbank 1870–1958” review . H-Soz-u-Kult )

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 70-81.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 83-84.

- ↑ Herbert Wolf: The foundation is laid: 1945–1975. In: The bank - service providers in transition. 125 years of Commerzbank. Fritz Knapp, Frankfurt am Main 1995, pp. 14-47.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 88-89.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 99-101.

- ↑ Simon Gonser: Capitalism discovers the people. How the major German banks came to their private customers in the 1950s and 1960s. Oldenburg 2014, p. 174 ff.

- ↑ Herbert Wolf: The foundation is laid: 1945–1975. In: The bank - service providers in transition. 125 years of Commerzbank. Fritz Knapp, Frankfurt am Main 1995, pp. 31-32.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 102-114.

- ↑ Herbert Wolf: The foundation is laid: 1945–1975. In: The bank - service providers in transition. 125 years of Commerzbank. Fritz Knapp, Frankfurt am Main 1995, p. 36.

- ↑ Herbert Wolf: The foundation is laid: 1945–1975. In: The bank - service providers in transition. 125 years of Commerzbank. Fritz Knapp, Frankfurt am Main 1995, p. 33.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 109.

- ^ Journal for the entire credit system. 1st October 1971.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 117.

- ↑ Nathalie Brafman: Le Crédit lyonnais veut faire oublier son passé sulfureux en se dotant d'un nouveau nom. In: Le Monde. August 25, 2005, accessed November 14, 2019 .

- ↑ 148 years of Commerzbank. From the shine of days gone by. ARD Börse, accessed on November 13, 2019 .

- ^ History of Commerzbank 1970–1989. Commerzbank AG, accessed on November 12, 2019 .

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 118-154.

- ^ Christian Berg, Detlef Krause, Stefan Stein: Banks in transition. Technology at Commerzbank from 1870 until today. (= Publications of the Eugen Gutmann Society. Volume 13). Frankfurt am Main 2019, p. 107 f. and pp. 124-127.

- ^ History Global Tower. GEG German Estate Group AG, accessed on November 14, 2019 .

- ↑ Volker Fischer: Bank architecture as an expression of corporate culture. In:: Commerzbank AG (Ed.): The bank - service providers in transition. 125 years of Commerzbank. Frankfurt am Main 1995 (pp. 240-265), pp. 258 f.

- ^ Detlev Krause: Stations in Commerzbank history. In: The bank - service providers in transition. 125 years of Commerzbank. Fritz Knapp, Frankfurt am Main 1995, p. 329.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 154.

- ^ Engagement in the East a German locational advantage. Commerzbank boss sees stable conditions as a prerequisite for foreign investments. In: Der Tagesspiegel . March 30, 1996.

- ↑ Commerzbank expands board . In: Handelsblatt . October 25, 1990, p. 16 .

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 162.

- ↑ Commerzbank cuts jobs . In: Der Spiegel . August 2, 1993, p. 81 .

- ↑ Addition of crumbs . In: Der Spiegel . May 31, 1993, p. 122 .

- ↑ Commerzbank cuts jobs . In: Der Spiegel . August 2, 1993, p. 81 .

- ↑ A super win . In: The daily newspaper . April 16, 1994, p. 6 .

- ↑ Commerzbank delights shareholders: Higher dividend promised, extraordinary income. In: Der Tagesspiegel . November 24, 1994.

- ↑ Commerzbank opens an office in Bangkok . In: Handelsblatt . October 15, 1990, p. 12 .

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 162.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 154-174.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 162.

- ↑ Commerzbank opens a representative office in Taipei . In: Börsen-Zeitung . September 10, 1996, p. 6 .

- ↑ Commerzbank increases its involvement in Hungary . In: Handelsblatt . October 7, 1996, p. 18 .

- ↑ Commerzbank expands business in Prague . In: Börsen-Zeitung . October 17, 1996, p. 5 .

- ↑ Commerzbank mainly earns abroad . In: Börsen-Zeitung . March 27, 1996, p. 5 .

- ↑ Commerzbank wants to significantly increase returns . In: Handelsblatt . May 9, 1996, p. 21 .

- ↑ Commerzbank wants to play in the first European league . In: Welt am Sonntag . April 13, 1997, p. 59 .

- ↑ The prospective buyer . In: Bonner General-Anzeiger . June 25, 1998, p. 14 .

- ↑ Share of the week: Commerzbank remains merger candidate . In: WirtschaftsWoche . May 7, 1998, p. 192 .

- ↑ Commerzbank: Profit up with fewer branches . In: The daily newspaper . November 7, 1997, p. 8 .

- ↑ Banks: Convenient and Cheap . Commerzbank: downsizing through temporary work. In: Der Spiegel . August 10, 1998, p. 76 .

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , pp. 162-172.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 168.

- ↑ Commerzbank subsidiary Comdirect wins customers, but has a problem. Handelsblatt , accessed on October 31, 2019 .

- ↑ Comdirect Bank renamed to AG . In: Handelsblatt . November 16, 1999, p. 24 .

- ↑ Comdirect becomes an AG . In: WirtschaftsBlatt . November 16, 1999, p. 1 .

- ↑ Comdirect Bank now AG . In: Börsen-Zeitung . November 17, 1999, p. 7 .

- ↑ Frankfurt's largest celebrates its anniversary . The 259 meter high Commerzbank Tower was opened 20 years ago. In: Frankfurter Neue Presse . May 16, 2017, p. 10 .

- ^ History of Commerzbank. Commerzbank AG, accessed on October 31, 2019 .

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 176.

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 .

- ↑ Commerzbank cuts investment banking. In: world. September 30, 2004, accessed December 3, 2019 .

- ↑ Does the merger fail because of Commerzbank's demands? In: Spiegel Online. July 11, 2000, accessed December 3, 2019 .

- ↑ Commerzbank confirms takeover of Schmidt Bank. Frankfurter Allgemeine Zeitung , February 25, 2004, accessed on November 11, 2019 .

- ↑ Commerzbank buys Schmidtbank branch business. In: handelsblatt.com. February 25, 2004, accessed January 1, 2019 .

- ↑ Commerzbank wants majority in BRE Bank . In: Börsen-Zeitung . September 12, 2003, p. 17 .

- ↑ Commerzbank is considering outsourcing to Poland . Strong growth planned in Eastern Europe - financial institution has its sights on the Romanian market. In: The world . September 3, 2004, p. 14 .

- ↑ Commerzbank is considering relocating back office activities to Poland . Expansion to Romania - Earnings from Eastern European business are expected to grow by 50 percent by 2006. In: Börsen-Zeitung . September 3, 2004, p. 3 .

- ↑ Commerzbank suffers from Poland subsidiary. Bre-Bank cancels the dividend after a high loss . In: Financial Times Germany . February 8, 2005, p. 15 .

- ↑ Commerzbank discovers Eastern Europe. Group examines relocation of IT functions to Poland and the Czech Republic - expansion in Romania . In: Financial Times Germany . September 3, 2004, p. 19 .

- ↑ Detlef Krause: Commerzbank 1870-2010. A journey through time. (= Publications of the Eugen Gutmann Society. Volume 5). Eugen Gutmann Society, Dresden 2010, ISBN 978-3-9812511-4-2 , p. 196.

- ↑ Commerzbank takes over Ukrainian bank. In: Handelsblatt. September 18, 2007, accessed December 3, 2019 .

- ↑ Commerzbank completes sale of Bank Forum to the Ukrainian Smart Group. Commerzbank AG, October 30, 2012, accessed on December 3, 2019 .

- ↑ Establishment of Eurohypo AG sealed. Dresdner, Deutsche and Commerzbank want to reduce their stake in the medium term. In: Der Tagesspiegel . November 7, 2001, p. 22 .

- ↑ New hypo giant Eurohypo starts in the second half of 2002 . In: Börsen-Zeitung . November 7, 2001, p. 19 .

- ↑ Liberation against billions . In: Börsen-Zeitung . November 13, 2003, p. 17 .

- ↑ Major shareholders feed Eurohypo . In: Financial Times Germany . March 10, 2004, p. 17 .

- ↑ Eurohypo is now closer to going public . In: Börsen-Zeitung . November 14, 2003, p. 19 .

- ↑ Commerzbank can do without Eurohypo . In: Financial Times Germany . August 17, 2005, p. 18 .

- ↑ Commerzbank stops Eurohypo IPO . In: Handelsblatt . August 25, 2005, p. 1 .

- ↑ Commerzbank is preparing to take over Eurohypo . In: Handelsblatt . November 15, 2005, p. 15 .

- ↑ Commerzbank is facing a change of strategy . In: Handelsblatt . November 16, 2005, p. 20 .

- ↑ Interest in Commerzbank meets with skepticism . In: Financial Times Germany . November 15, 2005, p. 18 .

- ↑ Commerzbank takes over Eurohypo . In: The world . November 16, 2005, p. 1 .

- ↑ Commerzbank becomes the second largest German bank . In: Der Tagesspiegel . November 16, 2005, p. 17 .

- ↑ Eurohypo should remain independent: Commerzbank does not want to incorporate new subsidiary . In: Financial Times Germany . November 17, 2005, p. 1 .

- ↑ Commerzbank bundles its real estate activities . In: The world . January 3, 2007, p. 23 .

- ↑ Dresdner test balloon from Commerzbank . In: The Standard . April 15, 2000, p. 32 .

- ↑ a b Allianz sells Dresdner Bank to Commerzbank and becomes the largest shareholder in the new bank. Allianz Group, August 31, 2008, accessed June 25, 2018 (press release).

- ↑ Storm in the tower . In: Financial Times Germany . January 7, 2009, p. 23 .

- ↑ Allianz sells Dresdner Bank to Commerzbank and becomes the largest shareholder in the new bank. August 31, 2008, accessed June 25, 2018 (press release).

- ↑ Commerzbank merges with Dresdner Bank - takeover in several stages . In: Börsen-Zeitung . August 30, 2008, p. 1 .

- ^ Theurer / Fehr : For 9.8 billion euros: Commerzbank takes over Dresdner Bank. In: FAZ August 31, 2008, accessed on September 29, 2017 .

- ^ Dorothea Schäfer: Agenda for a new financial market architecture In: DIW : Wochenbericht, December 17, 2008.

- ^ Johannes Bähr, Bernd Rudolph: Finanzkrisen 1931 2008. Munich 2011, p. 194ff.

- ^ Commerzbank and Allianz: Details of the deal. In: handelsblatt.com. September 1, 2008, accessed March 6, 2019 .

- ↑ Commerzbank / Allianz: The Dresdner deal is saved. In: manager-magazin.de. November 18, 2008, accessed March 6, 2019 .

- ↑ Commerzbank gets Dresdner cheaper . In: Financial Times Germany . November 27, 2008.

- ↑ The sad trio. Commerzbank, Dresdner Bank and Allianz united in the crash . In: The daily newspaper . November 1, 2008, p. 11 .

- ↑ Agreement with Soffin: Commerzbank's rescue package is ready. In: handelsblatt.com. December 19, 2008, accessed January 1, 2019 .

- ↑ Clear the way for state aid: Brussels and Berlin apparently come to an agreement in the dispute over Commerzbank aid amounting to 8.2 billion euros . In: The daily newspaper . December 11, 2008, p. 9 .

- ↑ Commerzbank does not pay Dresdner with state money . In: The world . December 1, 2008, p. 12 .

- ↑ State should finance the purchase of Dresdner Bank: Buyer Commerzbank is negotiating with the bank rescue fund Soffin about further state aid . In: The daily newspaper . January 8, 2009, p. 8 .

- ↑ Commerzbank is partially nationalized. ZEIT ONLINE GmbH, May 4, 2009, accessed on November 11, 2019 .

- ↑ Make little out of a lot: the taxpayer wants to see something for the billions he gives to Commerzbank. Should he too, says their boss. He tells his shareholders something else. In: Financial Times Germany . January 26, 2009, p. 15 .

- ↑ Business register. Bundesanzeiger Verlag, accessed on January 1, 2019 .

- ↑ Business register. Bundesanzeiger Verlag, accessed on January 1, 2019 .

- ↑ Last branch of Dresdner Bank opened. In: Focus Online. FOCUS Online Group GmbH, September 27, 2010, accessed on November 11, 2019 .

- ^ Rose-Maria Gropp: Record sum for Giacometti: The victory of the thin man. In: FAZ Frankfurter Allgemeine Zeitung GmbH, February 4, 2010, accessed on November 11, 2019 .

- ↑ The new Commerzbank. (PDF) Commerzbank AG, accessed on November 11, 2019 .

- ↑ Commerzbank founds internal "Bad Bank". In: Handelsblatt. March 27, 2009. Retrieved June 25, 2018 .

- ↑ Commerzbank plans garbage dump ( memento from July 30, 2012 in the web archive archive.today ), Financial Times Deutschland , from February 5, 2009.

- ↑ Interim report as of September 30, 2011 (PDF) Commerzbank AG, November 4, 2011, p. 18 , accessed on November 8, 2019 .

- ↑ Harald Freiberger: Eurohypo - a bank is disappearing. In: Süddeutsche Zeitung. March 31, 2012, accessed November 8, 2019 .

- ↑ Greek crisis halves Commerzbank profit. Spiegel online, February 23, 2012, accessed November 8, 2019 .

- ↑ n-tv.de: Earning money without government aid: Commerzbank can get started. n-tv Nachrichtenfernsehen GmbH, May 6, 2011, accessed on October 12, 2017 .

- ↑ Commerzbank pays the taxpayers. In: Süddeutsche Zeitung. March 13, 2013, accessed November 11, 2019 .

- ↑ BigTechs are attacking the banks. In: The Bank Blog. November 16, 2019, accessed December 3, 2019 .

- ↑ Wirecard in the Dax, 13 TecDax values in the MDax. In: manager magazin. September 24, 2018, accessed December 3, 2019 .

- ↑ Commerzbank will invest more than EUR 2.0 billion in its core business by 2016. Commerzbank AG, November 8, 2012, accessed on December 3, 2019 .

- ↑ Commerzbank will invest more than EUR 2.0 billion in its core business by 2016. Commerzbank AG, November 8, 2012, accessed on December 3, 2019 .

- ↑ Best bank. (PDF) In: Focus Money Service. July 11, 2014, accessed December 3, 2019 .

- ↑ Commerzbank wants to expand business with Swiss medium-sized companies. In: Neue Zürcher Zeitung. November 19, 2013, accessed December 3, 2019 .

- ↑ Martin Zielke becomes the new head of Commerzbank. In: Frankfurter Allgemeine Zeitung. March 6, 2016, accessed December 3, 2019 .

- ↑ Commerzbank strengthens profitability through focus and digitization. Commerzbank AG, September 30, 2016, accessed on December 3, 2019 .

- ↑ Commerzbank cuts 4,300 jobs, closes 200 branches and integrates Comdirect. In: handelsblatt.com. September 22, 2019, accessed December 3, 2019 .

- ↑ sueddeutsche.de July 3, 2020 / Meike Schreiber: surprising double resignation

- ^ Hans Leyendecker , Bastian Obermayer , Klaus Ott : Luxemburg - tax affair shakes Commerzbank. In: Süddeutsche Zeitung . February 25, 2015, accessed October 12, 2017 .

- ↑ Aid to tax evasion: Commerzbank has to pay a fine of 17 million euros. Handelsblatt, January 16, 2016, accessed on January 19, 2020 .

- ↑ Philip Plickert, Hanno Mußler: million penalty for Commerzbank in the UK. Lack of money laundering control. FAZ.NET (Economy Department), June 17, 2020

- ↑ Taxes: Commerzbank back in twilight. Deutsche Welle, May 2, 2016, accessed on May 2, 2016 .

- ↑ Commerzbank AG: Commerzbank AG - Positions & Guidelines. December 9, 2019, accessed January 19, 2020 .

- ↑ The Arms of My Bank. FACING FINANCE eV, 2016, accessed on January 20, 2020 .

- ↑ Annual Report 2008. (PDF; 5.3 MB) In: Corporate Reporting 2009 . Commerzbank AG, March 27, 2009, p. 325 , accessed on October 13, 2017 .

- ↑ Annual Report 2009. (PDF; 6.2 MB) In: Corporate Reporting 2010 . Commerzbank AG, March 24, 2010, p. 330 , accessed on October 13, 2017 .

- ↑ Annual Report 2010. (PDF; 8.4 MB) In: Corporate Reporting 2011 . Commerzbank AG, March 29, 2011, p. 390 , accessed on October 13, 2017 .

- ↑ Annual Report 2011. (PDF; 10.3 MB) In: Corporate Reporting 2012 . Commerzbank AG, March 29, 2012, p. 377 , accessed on October 13, 2017 .

- ↑ Annual Report 2012. (PDF; 17.9 MB) In: Unternehmensberichtammlung 2013 . Commerzbank AG, March 19, 2013, p. 359 , accessed on October 13, 2017 .

- ↑ Annual Report 2013. (PDF; 8.7 MB) In: Corporate Reporting 2014 . Commerzbank AG, March 21, 2014, p. 345 , accessed on October 13, 2017 .

- ↑ Annual Report 2014. (PDF; 7.3 MB) In: Corporate Reporting 2015 . Commerzbank AG, March 18, 2015, p. 347 , accessed on October 13, 2017 .

- ↑ Annual Report 2015. (PDF; 9.1 MB) In: Corporate reporting 2016 . Commerzbank AG, March 11, 2016, p. 351 , accessed on October 13, 2017 .

- ↑ Annual Report 2016. (PDF; 4.1 MB) In: Corporate reporting 2017 . Commerzbank AG, March 23, 2017, p. 324 , accessed on October 13, 2017 .

- ↑ Annual Report 2017 (PDF) Commerzbank, March 26, 2018, accessed on May 6, 2018 (7.6 MB).

- ↑ a b Investor Relations. Commerzbank, accessed on February 14, 2019 .

- ↑ a b c d Articles of Association. (PDF) Commerzbank, May 24, 2016, accessed on July 4, 2018 .

- ↑ Company database . Federal Financial Supervisory Authority, accessed on July 4, 2018 .

- ↑ Stephan Engels: 100 days Eurobank supervision . In: Frankfurter Allgemeine Zeitung . March 2015.

- ↑ ECB monitors 21 German banks. In: Wirtschaftswoche. June 27, 2014, accessed July 4, 2018 .

- ^ Update of Group of Global Systemically Important Banks (G-SIBs). (PDF) Financial Stability Board, November 1, 2012, accessed July 4, 2018 .

- ↑ 2017 List of Global Systemically Important Banks (G-SIBs). (PDF) Financial Stability Board, November 21, 2017, accessed July 4, 2018 .

- ↑ Current price development. Commerzbank, accessed on February 14, 2019 .

- ↑ Commerzbank bolsters its capital base . In: The world . April 29, 2015, p. 13 .

- ↑ Michael Hedtstück: Commerzbank surprises with capital increase. In: Finance Magazin. April 28, 2015, accessed August 1, 2018 .

- ^ Commerzbank Aktiengesellschaft. In: DGAP. EQS Group, accessed August 31, 2018 .

- ↑ Deutsche Börse is converting indices today . In: Bielefelder Tageblatt . September 24, 2018, p. 27 .

- ↑ MDAX current. In: Frankfurt Stock Exchange. Retrieved September 24, 2018 .

- ↑ Fabian Strebin: Commerzbank: Is the federal government getting out? In: The shareholder. August 4, 2017, accessed August 31, 2018 .

- ↑ Commerzbank: Half a billion building loans . In: Rheinische Post . March 6, 2018, p. 29 .

- ↑ Shareholder structure. Commerzbank, accessed on September 1, 2018 .

- ↑ Hanno Mussler: The Commerzbank board is becoming even more female. In: FAZ website. FAZ, September 26, 2019, accessed on July 14, 2020 .

- ↑ Martin Zielke becomes head of Commerzbank . In: Berliner Morgenpost . March 7, 2016, p. 6 .

- ↑ Michael Brächer: Commerzbank boss Martin Zielke: A banker as an advocate for customers. In: Handelsblatt. June 9, 2017. Retrieved August 25, 2018 .

- ↑ Andreas Kröner: Commerzbank recruits ING manager Boekhout. In: Handelsblatt. Holtzbrink Group, July 11, 2019, accessed on July 14, 2020 .

- ^ AJ: New Commerzbank COO: Jörg Hessenmüller. In: IT finance magazine. Joachim Jürschick, December 6, 2018, accessed on July 14, 2020 .

- ↑ Commerzbank appoints Chromik as Chief Risk Officer . In: Börsen-Zeitung . November 5, 2015, p. 16 .

- ↑ Hanno Mussler: Bettina Orlopp is Commerzbank's new CFO. In: FAZ Net. FAZ, September 25, 2019, accessed on July 14, 2020 .

- ↑ Björn Godenrath: Almond and Orlopp the Commerzbank Board . In: Börsen-Zeitung . March 8, 2016, p. 16 .

- ↑ Hanno Mussler: The Commerzbank board is becoming even more female. In: FAZ website. FAZ, September 26, 2019, accessed on July 14, 2020 .

- ↑ Supervisory Board. Commerzbank, accessed on August 31, 2018 .

- ↑ Commerzbank Supervisory Board elected: Schmittmann Chairman. In: The world. May 8, 2018, accessed September 2, 2018 .

- ↑ Commerzbank with comdirect takeover in the second attempt at the destination. In: Finanz.net . January 3, 2020, accessed January 3, 2020 .

- ↑ Annual Report 2017 (PDF) Commerzbank, March 26, 2018, pp. 55, 161 , accessed on July 4, 2018 .

- ↑ Nina Kirst: When a bank sets up a service design agency. In: page-online.de. March 9, 2017. Retrieved September 23, 2019 .

- ↑ Imprint. Commerzbank, accessed on January 21, 2019 .

- ↑ Freddy Langer: Germany's seven wonders of the world: Burn on, my light. In: Frankfurter Allgemeine Zeitung. November 17, 2017. Retrieved October 27, 2018 .

- ^ Commerzbank Tower. City of Frankfurt am Main, accessed on October 29, 2018 .

- ^ Gallileo. City of Frankfurt am Main, accessed on October 29, 2018 .

- ↑ Oliver Teutsch: Commerzbank in Frankfurt: The fear is around. In: Frankfurter Rundschau. October 7, 2016, accessed October 29, 2018 .

- ↑ Commerzbank with a new service center . In: Handelsblatt . August 24, 2001, p. 23 .

- ↑ Volker Schmidt: Commerzbank opens Europe's largest dealer hall . In: Frankfurter Rundschau . August 24, 2001, p. 29 .

- ↑ commerzbank.de

- ↑ Hanno Mussler: Commerzbank opens new flagship branches. In: Frankfurter Allgemeine Zeitung. May 23, 2016, accessed October 20, 2018 .

- ↑ Commerzbank: Slimmed-down city branches are starting up. In: Der Tagesspiegel. December 5, 2016, accessed October 20, 2018 .