Maximum

Coordinates: 50 ° 5 ′ 19 ″ N , 8 ° 32 ′ 6 ″ E

| Hoechst Aktiengesellschaft

|

|

|---|---|

| legal form | Aktiengesellschaft (until 2005) |

| founding | January 2, 1863 |

| Seat | Frankfurt-Höchst , Germany |

| management | Jürgen Dormann (1998) |

| Number of employees | 96,967 (December 31, 1998) |

| sales | 43,704 million DM (1998) |

The Hoechst AG - to 1974: Hoechst AG, vorm. Master Lucius & Brüning - in Frankfurt am Main was one of the three largest chemical and pharmaceutical companies in Germany . It was founded in 1863 in Höchst am Main , then in Nassau , and grew into a global company until the First World War . 1925 merged it with other companies to IG Farben AG and was established in 1951 after the unbundling newly founded IG Farben.

Through company takeovers and investments in new products, Hoechst grew into a large corporation. In the mid-1950s, annual sales exceeded one billion DM for the first time , and in 1969 the mark of 10 billion DM. In the early 1980s, Hoechst was the world's largest pharmaceutical company in terms of sales. At the beginning of the 1990s the group reached its greatest expansion with 180,000 employees, an annual turnover of 47 billion DM and a profit of over four billion DM.

In 1994 the realignment and restructuring of Hoechst AG began. The former main factory became the Höchst Industrial Park in 1997 . After being transferred to a holding company , Hoechst AG merged with Rhône-Poulenc in 1999 to form Aventis S.A. with headquarters in Strasbourg and spun off the remaining chemical activities in Celanese AG.

share

Hoechst AG belonged to the DAX from its first calculation in 1988 until September 20, 1999 and remained listed on the Frankfurt Stock Exchange as the German intermediate holding company of Aventis until the end of December 2004 . After the merger of Aventis with Sanofi-Synthélabo to form Sanofi-Aventis in 2004, the name Hoechst disappeared from the public for good.

Name and company logo

The term Farbwerke Hoechst has always been in use colloquially since the company was founded and was only officially included in the company name from 1951. It is derived from the company headquarters in the formerly independent town of Höchst am Main. The spelling without umlaut was always in use in the company, because the internationalization of corporate business had been successful well before the First World War.

Shortly after the establishment of a “ Tea Dye Factory Master Lucius & Co ” (1863), the name changed to “ Color Works Master Lucius & Brüning ” (1865). After the transformation into an AG with the name “ Farbwerke vorm. Meister Lucius & Brüning AG “(1880) the stylized lion with the initials ML&B appeared on the first pharmaceutical packaging (Antipyrin, 1883). This oldest company logo shows a lying lion, the Nassau heraldic animal, which holds a coat of arms with the intertwined initials MLB (Meister, Lucius & Brüning) in its right paw . According to archival documents, it is said to have been in use as early as 1877.

Shortly before the merger of all chemical companies in an "IG-Farbenindustrie AG" in 1925, Hoechst used two simplified logos "Hoechst" in a blue circle and "ML&B" in a second circle (Insulin, 1923) on pharmaceutical packaging.

During the IG Farben period 1925–1951, pharmaceutical packaging from Höchst bore the initials “ML&B” in a circle (Novocain) in addition to the manufacturer 's information “ IG-Farbenindustrie AG, pharmaceutical department, store at Höchst ”.

After the liquidation of IG-Farben in 1952, the new company name was “ Farbwerke Hoechst AG vorm. Meister Lucius & Brüning ”and the symbolic representation of the bridge (Nirosan) was used for the first time as a circular logo.

As early as 1947, the Frankfurt lecturer Richard Lisker designed a logo for the group consisting of the tower and bridge , a stylized representation of the Behrens building , which is now a listed building.This design with a center-centered representation of the bridge and tower was revised in 1951 by the Frankfurt graphic artist Rober Smago. The tower now moved to the left, while the bridge rose to the right. This final symbol was trademarked in 1952.

The Behrens building with tower, administrative building

In 1966, Hoechst succeeded in "squaring its own circle", the circular logo sank into a square border. The area gained should attract attention in an intense blue. This final symbol was trademarked in 1966. In this form, the trademark was to be seen as an advertising sign at numerous pharmacies well into the 21st century.

In 1974 the group renounced the naming of historical founding names and simplified the company name to Hoechst Aktiengesellschaft . The signature "Hoechst" with the logo from 1966 on the right served as a signet.

In 1997 the Hoechst Managementholding-Gesellschaft had the Wuppertal designer Hans Günter Schmitz create a new company symbol to differentiate it from the former Hoechst AG . After two and a half years of “development work”, the logo “Hoechst” with a simple, superscript square on the right was now used as the logo. Critics jokingly described the new logo in letters to the editor as fitting the new corporate culture - small-minded and a bit aloof . According to the company's presentation, the new logo should symbolize positive associations such as potential for ideas, quality, further development and creativity. Only Frankfurters could relate to the tower and bridge, which symbolize the Behrens building in the main plant. Hoechst is not from Frankfurt, but an international company.

Ironically, the legal successor Sanofi-Aventis still claims to maintain the old trademark rights from 1966 and legally prevents use by third parties. To reinforce these claims, in 2011 a “Hoechst GmbH Frankfurt” registered the 1966 logo again as its own word and image mark. In 2015, the successor companies still have the Hoechst logo embossed on Urbason tablets.

Company history

1863 to 1914

On the morning of January 2, 1863, the tea dye factory Meister, Lucius & Co. , founded by Carl Friedrich Wilhelm Meister , Eugen Lucius and Ludwig August Müller, started operations. The company premises were located directly on the banks of the Main in the small town of Höchst , which has been a district of Frankfurt am Main since 1928 . Although the founders were citizens of the Free City of Frankfurt , they founded their company in the neighboring Duchy of Nassau , which, in contrast to the anti-industrial trade and financial center of Frankfurt, promoted the settlement of industrial companies.

After Müller's departure in 1865, the previous Technical Director Adolf von Brüning took over his shares. He is therefore often referred to as a founding member. Since Brüning's entry, the company has operated as Farbwerke Meister, Lucius & Brüning .

The factory initially produced the tar colors, which were called tar colors in the second half of the 19th century . In contrast to other dyes of the time such as indigo or madder, they could be obtained inexpensively from coal tar , a waste material from coke production . Initially, the factory produced fuchsine and aniline, and from 1864 also the aldehyde green (a derivative of fuchsine) developed by Lucius and Brüning. This was the first green textile dye that retained its color even under gas light. When it was possible to win the French Empress Eugénie as a customer and to deliver large quantities of Höchst dyes to the textile industry in Lyon , this brought the breakthrough for the newly founded company.

In 1869, the Farbwerke brought the red dye alizarin ( madder red ) onto a highly competitive market. Thanks to a new patented process by Ferdinand Riese, it quickly became the most successful product. Immediately, production began to be relocated to a site about one kilometer downstream, which offered considerably more space for new factories. The new factory, soon popularly known as the Red Factory, completed in 1874, was later expanded in several stages and today forms the Höchst Industrial Park .

In order to provide for the rapidly growing number of workers and their families, the founders developed a series of company social benefits that were exemplary for the time. The relief fund for sick workers , founded in 1874, was a company health fund that also provided social security for workers and their relatives in the event of accidents, disability, occupational diseases , old age and death. The company medical service was a pioneer in research into occupational diseases. From 1874 to 1875, the first workers' apartments were built in the Seeacker settlement in Höchst, later also in Unterliederbach and in the Zeilsheimer Colonie settlement . In 1879 Brüning set up the Kaiser Wilhelm Augusta Foundation , a pension fund for Höchst workers, which also granted mortgage loans for house building; Today, as the highest pension fund VVAG, it finances real estate on the open market at low interest rates .

In 1880 the small company became the Farbwerke vorm. Master Lucius & Brüning AG , which soon extended its value chain. Since 1881 the Rotfabrik has also been producing preliminary products such as inorganic acids, and in 1883 the production of synthetic drugs began . The first successful medicines from the Farbwerke were the analgesic and fever- lowering antipyrine and an immune serum against diphtheria developed by Emil von Behring . In 1897 pyramidone (aminophenazone) was added, which was about three times more effective than antipyrine.

In the years leading up to World War I, the company grew into a global corporation that exported 88 percent of its production. Production facilities were also built abroad, first in Moscow in 1878 , in Creil near Paris in 1883 and in Ellesmere Port near Manchester in 1908 . In 1900 the Farbwerke founded a new plant in Gersthofen near Augsburg. The water power of the Lech was used for the energy-intensive synthesis of indigo .

In 1904, Farbwerke Höchst and Cassella Farbwerke formed a dual alliance through mutual capital links and supply relationships , which in 1907 became a triple alliance with the accession of the Kalle Chemical Factory in Biebrich .

In 1904, Friedrich Stolz synthesized adrenaline in the laboratories of the Farbwerke . It was the first hormone whose structure was precisely known and which could be produced in pure form. 1905 developed Alfred Einhorn with novocaine , the first non-addictive local anesthetic . In 1910, the color works in Höchst began producing the Salvarsan, developed by Paul Ehrlich a year earlier . In the anniversary year of 1913, the company, which was still majority owned by the founding families, had a global turnover of 100 million. It employed around 9,000 people in Höchst alone.

1914 to 1952

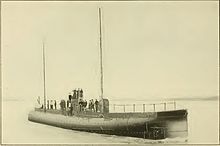

The First World War marked a turning point for the export-oriented company, which influenced the company's development for the next thirty years. The foreign organization, patents and trademarks were expropriated, large parts of the world market were lost forever, as the war opponents built up their own industries. 3,237 of the 9,200 employees at the Höchst plant were called up in 1914, 547 of whom died in the war. The development in the main plant was shaped by the switch to war production. Ammonia , nitric acid and ammonium nitrate took the place of dyes and medicines . Because so many workers were called up for military service, there was a shortage of skilled workers. The supply of raw materials suffered from the British naval blockade . Nevertheless, the first German commercial submarine, Germany , managed to supply the USA twice with products from Hoechst AG (including Alizarin and Salvarsan) by 1916.

| year | Employee |

|---|---|

| 1914 | 9,200 |

| 1915 | 6,000 |

| 1917 | 15,000 |

| 1919 | 10,000 |

| 1922 | 14,600 |

| 1929 | 11,000 |

| 1933 | 8,000 |

| 1944 | 11,784 |

In 1916 Hoechst was a founding member of the interest group of German tar paint factories , a cartel that was supposed to coordinate the supply of raw materials, production control and sales strategies of the companies involved under the conditions of the war economy. In the 50-year contract, General Director Adolf Haeuser had ensured that Hoechst and Kalle received the same share of the profit as BASF and Bayer, although Hoechst had lagged behind in growth in the last years of peace and the technical lead of BASF in high-pressure synthesis and modern infrastructure of the Bayerwerk Leverkusen had nothing to oppose. The companies of the interest group remained independent.

The end of the war and the Treaty of Versailles put new burdens on the Farbwerke: The plant was occupied by French troops in 1918 , coal and raw materials shortages, forced transfers and a shortage of foreign currency hampered the realignment and re-entry into the world market. Instead of war production of explosives that had recently identified 70% of sales, is now presented medicines, fertilizers and pesticides as reparation ago.

The traditional Hoechster pain relievers Antipyrin and Pyramidon were supplemented by Novalgin in 1922 , and in 1923 the Farbwerke became the first German company to produce insulin under license.

From 1920 to 1924, Peter Behrens built the technical administration building , which is now one of the most important expressionist industrial buildings in Germany. During the construction period, increasing inflation in Germany led to labor disputes over wage and working time issues. As a result, there were demonstrations and riots at the plant in the summer of 1920 and autumn 1921. At the height of inflation in November 1923, a worker made 10 billion marks an hour; lunch in the factory kitchen cost 4.5 billion marks. For the financial year 1923, neither sales nor profits could be determined and no dividends could be paid.

In 1925, the Farbwerke merged to form IG Farbenindustrie AG . Due to Haeuser's skilful conduct of negotiations, the Farbwerke brought in 27.4 percent of the share capital of the IG as Bayer and BASF, the rest came from the three smaller shareholders AGFA, Griesheim-Elektron and Weiler-ter Meer. IG Farben concentrated its investments in new products, such as Buna , Fischer-Tropsch synthesis and synthetic fibers , on the new Central German plants, where brown coal was an inexpensive raw material base. As a result, the traditional main factory of Farbwerke Höchst was somewhat sidelined, sales stagnated and the number of employees fell. Together with the Fechenheim, Griesheim, Offenbach and Behring factories in Marburg, the plant formed the Mittelrhein , later Maingau, operating group . The new plant manager was Paul Duden , who was promoted to the IG Farben board.

In 1930 the French administration ended and the consequences of the global economic crisis hit the inking plants. Large parts of the dye production were relocated to other locations in the following years, and new facilities for the production of solvents and polymers were built . The downsizing at the main plant in Höchst was partly due to early retirement, but also to layoffs . In order to mitigate the social consequences, an emergency community of employees of IG Farbenindustrie AG Werk Hoechst , which had existed since 1931, collected donations in order to make support payments to the needy. In the spring of 1931, the plant management introduced short-time work . The weekly working time was reduced to 40 hours. It was not until the end of 1936 that normal working hours of 48 hours a week were reintroduced.

When the National Socialists came to power in 1933, IG Farben was also brought into line , which met with little resistance in the company. Plant manager Ludwig Hermann , who had been in office since January 1, 1933, developed into an enthusiastic supporter of Hitler . On August 1, 1935, he was allowed to join the NSDAP with special permission from the Gauleiter , despite the ban on membership at the time . Between 1933 and 1938, all Jewish employees had to leave the company. The Jewish supervisory board members, including Carl von Weinberg and Frankfurt honorary citizens Leo Gans and Arthur von Weinberg , were also expelled from their offices.

With the four-year plan of 1936, preparations began for a renewed warfare under the conditions of autarky of raw materials essential to the war effort. At the beginning of the Second World War in 1939, numerous permanent employees were called up for military service and later replaced by prisoners of war , foreign and forced laborers . In October 1944 the workforce at the Höchst plant numbered 11,784, of which 3,021 were forced laborers (2302 men and 719 women) and 142 prisoners. During the war, a total of around 8,500 people from almost all occupied European countries were forced into forced labor at the Höchst plant, where they lived in their own camp under harsh conditions and mostly inadequate nutrition.

The war events hardly affected the factory, although the city of Frankfurt was regularly the target of Allied air raids on Frankfurt am Main , especially from autumn 1943 . Only on June 29, 1940, some high-explosive bombs hit the site during an air raid , one of which hit the Behrensbau . Otherwise, Höchst and BASF were spared air strikes.

In 1937 the chemists Otto Eisleb and Otto Schaumann succeeded in synthesizing pethidine , an opioid that was introduced in 1939 under the brand name Dolantin . During the war it was produced in large quantities as a morphine substitute for the Wehrmacht . The methadone ( 2-dimethylamino-4,4-diphenylheptanone- (5) ) synthesized by Max Bockmühl and Gustav Ehrhart in Höchst in 1939 did not get beyond the stage of clinical testing during the war.

In 1943, the Höchst plant supplied preparations for pharmaceutical experiments by the SS in the Buchenwald concentration camp , in which prisoners were deliberately infected with typhus . Numerous test subjects died in these experiments. Plant manager Carl Lautenschläger had initially requested the clinical trials in order to be able to test the active ingredients acridine granulate and ruthenol developed in Höchst, but had the deliveries stopped after he was able to conclude from the reports that the trials violated laws and professional medical rules.

In 1942, attempts to manufacture penicillin began . They were successful, but a production facility planned as a result could no longer go into operation before the end of the war. In January 1945 production partially came to a standstill due to a lack of coal. On March 27, 1945, production was completely stopped.

On March 28, 1945, American troops, coming from the west and Oppenheim, occupied the deserted and undestroyed factory premises and immediately requisitioned the IG Farben building , the casino and the company medical department. Shortly after the Höchst plant was occupied, the first operations started up again, especially insulin production, which is essential for diabetics. Due to a lack of coal, some production plants had to be closed again and again in the first post-war winters; in some cases they were used for the production of everyday products such as floor wax or custard powder.

On July 5, 1945, the military government ordered in its Order No. 2 to Act No. 32 the confiscation of the entire IG-Farben property. The works were placed under Allied military administration. By April 1946, around 380 executives who had been members of the NSDAP and its organizations had been dismissed, including works manager Lautenschläger, his deputy chief engineer Jähne and the later CEO of Hoechst, Karl Winnacker . Lautenschläger and Jähne came before the Nuremberg War Crimes Court in 1947 in the IG Farben trial, together with 21 other senior employees of IG Farben . The court acquitted Lautenschläger on July 30, 1948 for lack of evidence. Jähne was sentenced to one year and six months in prison for looting and robbery.

After the seizure, the American authorities initially planned to split the Höchst plant into around five independent companies, a pharmaceutical, a dye, an organic and inorganic chemical, a plant protection product and a fertilizer production facility. However, it turned out to be technically impossible to disentangle the infrastructure and the production network of the plant that had grown over the course of seventy years. Therefore, these plans were abandoned in the spring of 1947, as was the planned dismantling of the IG Farben works in Offenbach and Griesheim . From August 1947, the Höchst plant operated as Farbwerke Hoechst US Administration . Sales reached 77 million Reichsmarks , of which 24 million each with drugs and chemicals, 17 million with dyes, 6 million with fertilizers and 5 million with pesticides. Foreign sales amounted to 200,000 Reichsmarks, and dyes and chemicals were exported to five neighboring countries.

Also in 1947, the first version of the later world-famous company logo Turm und Brücke was created for the technical administration building designed by Peter Behrens .

The currency reform on June 21, 1948 and the gradual abolition of compulsory farming began what would later become the so-called economic miracle . Shortly after the currency reform, the non-profit construction of company apartments began to alleviate the housing shortage caused by the destruction of the war and the admission of refugees. In 1949 the American control authority approved the establishment of the first foreign branch in Switzerland .

In 1950 penicillin production started at the Höchst plant, with a capacity sufficient to supply the entire German market. In addition to the American High Commissioner John Jay McCloy, Frankfurt's Lord Mayor Walter Kolb as well as representatives of the Hessian state government and the federal government took part in the inauguration . The company now traded as Farbwerke Hoechst, formerly Meister Lucius & Brüning US Administration . The turnover in Höchst grew from 163 million DM (1949) to 253 million (1950).

Law No. 35 of the Allied High Commission created the prerequisites for the unbundling of IG Farben, that is, for the establishment of successor companies. The main focus was on the occupation zones . The Farbwerke Hoechst Aktiengesellschaft, formerly Meister Lucius & Brüning , founded on December 7, 1951, finally comprised most of the IG Farben plants located in the American zone; In addition to the Höchst plant, these were the Griesheim, Offenbach, Gersthofen and Gendorf plants and, as subsidiaries, Knapsack-Griesheim AG, the Bobingen plant (where production of the synthetic fiber Perlon began in 1950 ), the Behring plants in Marburg , and Kalle AG in Wiesbaden and shares in Wacker Chemie and Sigri (today's SGL Carbon ).

1952 to 1974

On January 1, 1952, IG Farben went into liquidation and from then on called itself IG Farbenindustrie AG iL. Its only task was to administer old claims and to take over the legal consequences of the crimes committed during the time of National Socialism , while its successor companies were in control should develop freely. From 1950 to 1953 , a model trial was conducted before the Frankfurt am Main regional court for the compensation of forced laborers during the Nazi era ( Norbert Wollheim versus IG Farbenindustrie AG iL). The process ended in the second instance before the Higher Regional Court in Frankfurt am Main in 1958 through a global settlement , which provided for the payment of a total of 30 million DM by IG Farbenindustrie to several thousand former slave laborers.

In the first business year of 1952, the Farbwerke employed 15,000 people in the parent company and almost 27,000 in the group. The turnover was about 750 million DM, of which about 20 percent was achieved in export. In 1952, Hoechst acquired the Dortmund chemical plant manufacturer Uhde . The initial capital of only DM 100,000 was set at an extraordinary general meeting on March 27, 1953, retroactively to January 1, 1952, at 285.7 million. This corresponded to the valuation of the property, plant and equipment brought in from IG Farben in the contribution agreement of March 26, 1953. A dividend of four percent was paid on equity in the first financial year . This made Farbwerke Hoechst, next to BASF and Bayer, the smallest of the three big IG Farben successors.

Despite tough negotiations, the Farbwerke did not succeed in reintegrating the Cassella works , which had been associated with Hoechst since 1904 , into the group. The inking works had to be content with a minority stake of just over 25 percent. BASF and Bayer also received the same share.

Karl Winnacker was the first chairman of the board of directors of Farbwerke Hoechst (1952 to 1969), and Hugo Zinßer was chairman of the supervisory board . Each of the 12 board members initially received a monthly salary of DM 6,000. All investments over DM 5,000 first had to be approved by the control authority. It was not until March 27, 1953 that the company was finally released from Allied control. In the same year, American Hoechst Co. was founded in Somerville (New Jersey) as the first foreign subsidiary with the help of German chemists.

From 1955 to 1963, Friedrich Jähne was chairman of the supervisory board. After his conviction in the IG Farben trial, he was released from prison at the end of 1948.

In 1956, Rastinon and Euglucon , the first oral anti-diabetic drugs, came on the market. They belonged to a new class of active ingredients, the sulfonylureas , which the Hoechst research department succeeded in producing together with Boehringer Mannheim . As a gift for the 600th anniversary of the city of Höchst, the Farbwerke built a public swimming pool, the Silobad . Also in 1956 Hoechst donated the University of Frankfurt on the occasion of the founding of the Institute of Nuclear Physics of the research reactor Frankfurt , in 1958 went as a second nuclear reactor in the Federal Republic of Germany in operation.

In 1957, Hoechst was the first European company to install a computer system. The mainframe computer of the type IBM 705 , equipped with thousands of electron tubes , belonged to the most powerful category of data processing systems for commercial and scientific tasks at the time. Its core memory could store 20,000 characters and its central processing unit carried out 400 multiplications per second. It remained in use until the early 1960s.

By the end of the 1950s, sales tripled to 2.7 billion marks, and the number of employees in the group rose to over 50,000. The growth was driven by a large number of new products, especially synthetic fibers ( Trevira ) and plastics . Hoechst has been producing polyvinyl chloride since 1954, and since 1955 also polyethylene under the brand name Hostalen using the Ziegler-Natta process . The prerequisite for the new productions was the conversion of the raw material supply from coal chemistry to petrochemistry . In the past, the acetylene required was obtained from carbide , the production of which required a lot of electrical energy. In 1955, a cracking plant for heavy crude oil, the so-called coker , was built in Höchst . The plant could deliver around 20,000 tons of ethylene per year, along with methane , ethane and propylene . With its 100 meter high column and a constantly burning torch at the top, it was a landmark of the Höchst plant for around 20 years. In another plant, the high-temperature pyrolysis , it was possible to produce acetylene from light petrol in addition to ethylene. The Farbwerke thus had a raw material base from which, in addition to plastics, acetaldehyde , acetic acid , vinyl acetate and Mowiol as well as products derived from them such as the preservative sorbic acid could be produced.

Since the Höchst plant had meanwhile reached its capacity limits and there was only free space for an expansion south of the Main , the central works bridge was built in 1960 . A waterworks and the main laboratory, inaugurated in September 1960, were the first buildings in the new Südwerk, which grew rapidly and has since absorbed a large part of the investments.

In 1961 a new production facility started operations in Kelsterbach , a few kilometers from Höchst . At the new site, that of the neighboring Caltex - refinery in Raunheim was supplied with precursors which produced inking maximum and Ticona , a joint venture between Hoechst and Celanese , under the brand name Hostaform mainly plastics for technical applications.

To celebrate its centenary in 1963 left the Hoechst the Centennial Hall building. In the anniversary year, the Farbwerke Hoechst AG employed 63,000 people, including 8,000 abroad, and achieved an annual turnover of 3.5 billion DM, 41 percent of which in over 70 countries outside Germany. 230,000 shareholders, including around 20,000 employee shareholders, shared the share capital of DM 770 million. The dividend had risen to 18 percent, but the equity base and profitability were well below those of comparable American companies.

In 1964 Hoechst took over the majority of the capital of Chemische Werke Albert in Mainz-Amöneburg , where, in addition to pharmaceuticals, mainly synthetic resins were produced. Production of Hostaflon began at the Gendorf plant . The diuretic Lasix , which was introduced for the first time , became one of the main sales drivers of the Hoechst pharmaceuticals division for many years.

In 1965, Hoechst made major investments in environmental protection systems for the first time. The first stage of biological wastewater treatment went into operation in the main plant, at that time the first biological wastewater treatment plant for industrial wastewater in Europe. Hoechst's foreign organization, which now covers around 120 countries, has been divided into numerous national companies that bundle the activities of all divisions in the respective country. In the same year, the group became a shareholder in Höchst Porcelain Manufactory ; the stake ended when the company was restructured in 2001.

The group continued to grow in 1966 with the commissioning of the fiber factories in Bad Hersfeld and Spartanburg ( South Carolina ), the Vlissingen factory for the production of phosphorus products and the takeover of the majority of Spinnstoffabrik Zehlendorf AG in Berlin . In 1967 Hoechst took over Süddeutsche Zellwolle AG in Kelheim and Reichhold Chemie AG in Hamburg . In the same year the new pharmaceutical production H600 went into operation in the main factory, one of the largest factory buildings in Europe. For the first time, more than half of the sales revenue of DM 6.6 billion at the time was achieved abroad. The weekly working time had meanwhile dropped to 41.25 hours. New elements of the company's social policy, such as a performance-related annual bonus and home financing, supplemented the traditional instruments, e.g. B. the construction of company apartments or the loyalty bonus paid according to seniority. From 1969 onwards, the workers were no longer paid by wage packet , but rather cashless and monthly.

Further takeovers followed in 1968, including a majority stake in the French pharmaceutical company Roussel Uclaf , which specializes in hormones , the Düsseldorf cosmetics company Marbert and the Farbwerke Schröder & Stadelmann in Lahnstein . In 1969, world sales exceeded the DM 10 billion threshold for the first time. Rolf Sammet became chairman of the board as successor to Karl Winnacker.

On January 1, 1970, the Farbwerke were able to take over the shares of the other Farben successors in Cassella in a transaction called land consolidation by the press . In return, Hoechst sold its shares in the Hüls chemical works to Bayer. There was also an exchange of holdings between Bayer and BASF. This ended the last capital links between the color successors.

On January 1, 1970, the company reorganized. The company now had 14 business areas. The internal cross-sectional functions such as procurement, human resources and finance and accounting were designated as departments , of which engineering was the largest. The foreign representations were bundled in national or regional companies. Each of the 14 or so members of the Executive Board was responsible for several business areas, departments or regions. This organizational structure remained in place until the beginning of the 1990s.

In 1970, Farbwerke Hoechst introduced the 40-hour week. At DM 10 per share at a nominal value of DM 50, the dividend reached a level that was not reached again until 1985. As early as 1971, the release of the exchange rate from DM to US dollars led to a decline in profits, despite increasing sales, so that the dividend had to be reduced to 7.50 DM. In 1972 the Hoechst Group employed 146,300 people and achieved an annual turnover of DM 13.6 billion. For the first time, this included Herberts GmbH in Wuppertal , a manufacturer of car paints with around 5000 employees worldwide, and the fiber works Ernst Michalke GmbH & Co. in Langweid am Lech . The newly launched Trental for circulatory disorders soon became the drug with the highest sales in the pharmaceutical sector for many years.

1974 to 1990

In 1974, the company gave up its old name, Farbwerke Hoechst AG, formerly Meister Lucius & Brüning , and since then has operated as Hoechst Aktiengesellschaft . In the same year Hoechst took over 56 percent of the French pharmaceutical company Roussel-Uclaf . The first oil crisis in 1973 brought significant cuts due to the rise in the price of raw materials and the economic crisis that set in the following year, forcing the company to rationalize. In the second half of 1974, Hoechst introduced short- time work for the first time for around 5,000 employees in the fibers, paints and coatings business units. In the same year, infotec GmbH , which emerged from Wiesbaden-based Kalle , launched the Infotec 6000, Europe's first digital fax machine . The technology of the Infotec 6000 was the basis for the still valid G3 fax standard.

In 1975 Hoechst shut down its own petrochemical plants for ethylene supply and acquired a quarter of the shares in the refinery company UK Wesseling . Since then, the Höchst and Kelsterbach plants have been supplied with raw materials by a pipeline that runs from Rotterdam along the Rhine to Ludwigshafen.

The deepening recession of 1975 resulted in a slump in profits despite rationalization and short-time work, which was hardly made up in the following years. Although world sales had meanwhile risen to DM 20.7 billion, the dividend had to be reduced from DM 9 in the previous year to DM 7. The Group's return on equity was only 5.8 percent, but rose again to 11.1 percent in the following year. In 1975 the group employed 182,470 people worldwide.

After an increase in profits and dividends in 1976, only 6 DM could be distributed again for 1977. Consolidated profit had halved to DM 304 million with almost constant sales. The fiber sector alone recorded losses of DM 241 million, but paints and plastics also suffered from the weakening of the global economy. In the fiber sector, there were production shutdowns, e.g. B. the plants for the production of Perlon threads at the subsidiary Spinnstoffwerke Zehlendorf in Berlin. Business recovered in 1978 and 1979, so the dividend for 1979 could be increased again.

From 1979 onwards, newly developed bio-high reactors for biological wastewater treatment were built in various German plants. The 15 to 30 meter high structures allowed the wastewater to be cleaned more effectively, while at the same time requiring less energy and space than the earlier concrete basins.

Claforan , a parenteral cephalosporin , introduced in 1980 , became a successful antibiotic and in the 1990s replaced Trental as the top-selling drug from Hoechst.

At the beginning of the 1980s, sales rose to over DM 34 billion due to the high raw material prices. However, the annual surplus fell. The year 1982 in particular turned out to be one of the weakest fiscal years with only 317 million marks. The weak development was mainly due to the plastics and agriculture sectors.

In 1982 Kuwait took over a stake of almost 25 percent in Hoechst AG. At the French subsidiary Roussel-Uclaf, which the left coalition government under Prime Minister Pierre Mauroy wanted to be nationalized , an agreement was reached by negotiation. Hoechst only had to reduce its stake from 57.9 percent to 54.5 percent.

At the 1983 Annual General Meeting, representatives of alternative groups appeared as opponents for the first time. They accused the administration of insufficient environmental protection efforts and demanded that a dividend be waived and that the "entire balance sheet profit be used for environmental protection purposes". There was tumult among shareholders. The police temporarily took one of the opponents into custody.

In the same year the company announced that the expenditure for research, investments and operating costs had reached a new high of 1.2 billion DM. In order to initiate a “socially acceptable downsizing”, Hoechst offered early retirement to older workers aged 58 and over for the first time .

In 1984, Hoechst separated from its stake in UK Wesseling and took over all the shares in Ruhrchemie in Oberhausen . After sixty years, the production of fertilizers from ammonia and nitric acid was shut down in the main plant . Until then, the yellow plume of smoke from the nitric acid factory had been a landmark of the Höchst plant.

Also in 1984 an application was made to build a plant for the production of human insulin using a biotechnological process from genetically modified coli bacteria at the Höchst plant. The completion and approval of the plant was delayed due to the unclear legal situation and the resistance of the red-green state government, which was in office from 1985. Only after the Frankfurt Administrative Court had dismissed pending lawsuits in 1990, the plant could be put into operation in 1998. This delay, which was very costly at DM 300 million, meant that other locations were henceforth favored by the group management for similar projects.

The pension fund , previously reserved for employees , was also opened for workers in 1984. 80 percent use the new offer.

In 1985, Wolfgang Hilger succeeded Rolf Sammet, who has been in office since 1969 . In 1986, Hoechst had to withdraw the antidepressant Alival, introduced in 1976, from the market because of suspected serious side effects. After a fire accident on November 1, 1986 in the Schweizerhalle chemical works near Basel, in which the fire water leaked into the Rhine and caused serious fish deaths, the chemical industry came under public criticism. Hoechst responded by publishing environmental protection and safety guidelines for the company's goals.

At the beginning of 1987, Hoechst took over the US chemical company Celanese Corporation for more than DM 5 billion and merged it with the American Hoechst subsidiary to form the Hoechst Celanese Corporation . At the time, it was the largest foreign investment by a German company. Jürgen Dormann , who was responsible for the USA at the time, characterized this with the words " The advance into a new dimension, quantitatively and qualitatively" . After the takeover, the US market reached the same size as the German market with 25 percent of the group turnover of 37 billion DM. With the takeover, Hoechst achieved a stronger market position, especially in technical fibers and organic chemicals. The microfibres Trevira Finesse and Trevira Micronesse were introduced into the textile industry, initially mainly for sportswear. The sweetener acesulfame ( Sunett ), discovered by chance in 1967, was approved in many countries after the toxicological tests had been completed.

Due to the Montreal Protocol of September 16, 1987, which restricted the use of fluorochlorohydrocarbons , which were held responsible for the ozone hole first observed in 1977 , Hoechst, as the largest European manufacturer of CFCs, offered to take back used refrigerants in a closed circuit . Hoechst rejected requests to cease production. It was not until 1990 that the company announced, following a public campaign against CEO Hilger, that it would gradually cease production by 1995, five years before the date set in the Montreal Protocol.

The collective wage agreement concluded in 1987 abolished the different wage and salary systems for blue-collar and white-collar workers and created a uniform system of 13 wage levels. The in-house collective bargaining agreement negotiated between Hoechst and the chemical-paper-ceramics union supplemented the collective bargaining agreement with its own wage levels that are higher than normal wages and that rise with increasing length of service.

On January 17, 1987, Rudolf Cordes, head of the Hoechst branch in Lebanon, Syria and Jordan, was abducted by a Hezbollah group called Fighters for Freedom . The kidnappers wanted to force the release of Mohammed Ali Hamadi , who was arrested on January 13, 1987 at Frankfurt Airport . While Siemens employee Alfred Schmidt, who was also abducted shortly after Cordes , was released in September 1987, Cordes was only released on September 12, 1988 after 605 days of being held hostage.

The business years 1988, in which Hoechst celebrated its 125th anniversary, and 1989 were the most economically successful business years in the history of Hoechst AG. In 1989 the group's turnover was almost 46 billion DM. The profit before income taxes rose to 4146 million DM, at the time the highest profit ever achieved by a listed German company. The return on equity also reached a high of 19.1 percent (1988) and 17.9 percent, respectively.

The DAX , which was introduced on July 1, 1988, included Hoechst AG with a weighting of 3.03 percent.

The transformation into a strategic management holding company

1990 to 1994

| year | Employee | Sales worldwide | Sales in Germany |

|---|---|---|---|

| 1989 | 169.295 | 45.898 billion DM | 10.465 billion DM |

| 1990 | 172,900 | 44.862 billion DM | |

| 1991 | 179,332 | 47.186 billion DM | 11.644 billion DM |

| 1992 | 177,668 | 45.870 billion DM | 11.354 billion DM |

In 1990 the Hoechst Group employed 172,900 people with annual sales of DM 44.862 billion. The scope of consolidation was increased by increasing two minority interests: the shares in the cosmetics manufacturer Schwarzkopf were increased from 49 percent to 77 percent, and in the phosphate manufacturer BK Ladenburg from 50 percent 100 percent. The infotec branded office and facsimile business was sold to the Dutch HCS Technology NV.

After the record year 1989, earnings before taxes collapsed in the following year with stagnating sales by 20 percent to 3.215 billion DM (1990). With the cessation of fertilizer production in Oberhausen and carbide production in Knapsack , two traditional product lines were given up. In the former GDR , the Hoechst subsidiary Messer Griesheim took over 14 locations for the production and sale of technical gases.

In the following financial years, the group's pre-tax profit fell by around 20 percent, with sales remaining largely constant at around DM 46 billion, from DM 2.562 billion (1991) to DM 2.108 billion (1992) to just DM 1.227 billion in 1993. The dividend of the Hoechst share (50 DM nominal value) therefore had to be reduced from 13 DM (1989) to 12 DM (1991) and 9 DM (1992) to finally 7 DM per share. The Group's return on equity fell to 5.5 percent. As a result, the stock market price, which was already low by international standards, fell further. The entire group was valued at less than DM 11 billion on the stock exchange at times, with equity capital of DM 13.7 billion. This meant that there was a theoretical risk of a hostile takeover , for which there were examples in the Anglo-Saxon region. In 1993 , the British ICI , under pressure from a minority shareholder, spun off its pharmaceutical and agricultural business and floated it on the stock exchange as an independent company ( Zeneca PLC ).

Hoechst was, however , protected from an actual takeover attempt by its shareholder structure - Kuwait and an investment company controlled by the Hoechster Hausbank together held more than a third of the shares - and the behavior of the German banks at the time, which regularly exercised their custodian voting rights in the interests of management. In order to improve the share price development, the company relied on the commitment of foreign investors. In October 1991, Hoechst shares were listed on the Tokyo Stock Exchange, and the Board of Directors indicated that they would also aim for a listing in New York as soon as the hurdles that existed at the time due to different accounting regulations allowed this.

The weak business development was not only due to economic and currency-related cycles, but also indicated structural and innovation weaknesses in the company. The pharmaceutical sector, still world market leader in the early 1980s, had fallen significantly behind competitors such as Merck & Co. and Glaxo ten years later . The market share was below two percent, particularly in the important pharmaceutical markets of the USA and Japan. To make matters worse, a license applied for in 1984 for the genetic insulin production developed by Hoechst at the Höchst plant lasted several instances until 1990; the approval was only given after the Bundestag had passed the new genetic engineering law, so that Hoechst lost market share to foreign competitors. The market launch of the genetically engineered insulin was delayed not only due to the political and legal disputes, but also due to changes in the production process.

At the beginning of 1991, Hoechst subdivided the 16 business areas with around 25,000 products into around 100 business units that were responsible for results and that were supposed to develop their own strategy options. All essential decisions, e.g. B. for investments and portfolio adjustments, but continued to fall at the corporate level. These included production shutdowns (e.g. for the intermediate product resorcinol and an outdated chlor-alkali electrolysis in Höchst, chlorinated polyethylene in Gersthofen and detergent phosphates in Knapsack), replacement investments (mainly abroad, e.g. for the production of polyethylene and polypropylene, whereby obsolete plants in Germany were abandoned) and a concentration of pharmaceutical research on a few promising areas of work. The last year in office of CEO Wolfgang Hilger was also overshadowed by a serious loss of public confidence after a series of incidents. Within the executive board with twelve members, a weak majority gradually developed in 1993 in favor of a new group strategy favored by Dormann. Opponents like Utz-Hellmuth Felcht resigned from the board.

1995 to 2000

In April 1994 Jürgen Dormann took over the chairmanship of the board. All predecessors such as Wolfgang Hilger , Rolf Sammet or Karl Winnacker had a classical chemical education, Dormann did not. Under the motto Hoechst Aufbruch 1994 , he set a series of change processes in motion in the company, which he had already initiated by the end of 1993. For the first time the group published a return target: 15 percent net return on equity in the mean of an economic cycle ; in individual business areas, 20 percent net return on equity was set as the target for 1995. At the same time, a series of structural and portfolio changes began, in which the role of Hoechst AG as the parent company of the group was pushed back. Within Hoechst AG, the matrix organization made up of divisions , national companies and the departments / central departments , known as staff and central functions, has been in effect since 1969 . So far, future board members have been recruited from central departments, which is why they were appropriately called “goldfish pond”.

| ZDA | - Central management department |

| ZSV | - Central Secretariat Board |

| ZÖA | - Central Public Relations Department |

| I + K | - Central Information and Communication Department |

| RE | - Central Audit Department |

| AVI | - Department VI (Directors) |

| AVI | - Department VI |

| VK | - Sales coordination |

| FRW | - Finance and accounting |

| RPSV | - Law, patents, taxes, insurance |

| FO | - research |

| TW | - Technical plant management |

| PSW | - Human resources and social affairs / plant administration |

| BE | - procurement |

| IW | - Engineering technology |

| VK | - Sales coordination |

Instead of 16, the new organizational chart contained only seven business areas with 30 instead of 120 business units; instead of the departments, there were service units that were supposed to offer their internal services on market terms. With the exception of the Höchst, Gendorf, Knapsack and Kalle plants, all plants were assigned to just one division. Dormann announced that Hoechst will part with all business activities in which it is not one of the three leading providers in Europe, Asia and America.

At the beginning of 1995 Hoechst announced that it would merge the subsidiary Cassella AG with Hoechst AG and settle the remaining outside shareholders. The Cassella subsidiary Riedel-de Haën AG was sold to Allied Signal (the industrial chemicals division ) and Sigma-Aldrich (the laboratory chemicals division). The previous cosmetics division (GB M) was dissolved: Marbert GmbH from Düsseldorf was sold to Perform, the Cassella subsidiary Jade Cosmetic GmbH in Frankfurt-Fechenheim to L'Oréal and the Schwarzkopf company to Henkel . In particular, the takeover of Jade brought Dormann a lot of public criticism, because the new owner only continued the brand name and stopped production in Fechenheim. Overall, the restructuring of Cassella and the cosmetics division reduced the number of jobs in Fechenheim between 1993 and 2001 from 2,800 to around 1,100. Dormann justified his strategy by stating that structural change was inevitable and that Hoechst could only keep pace with competition by concentrating on core businesses; Even the divisions to be transferred could only develop successfully in a different business environment.

Also in 1995, Hoechst sold the plant construction company Uhde to Krupp , the ceramic manufacturer CeramTec to Dynamit Nobel and the phosphate manufacturer BK Ladenburg to Rotem-Amfert-Negev . The subsidiary SGL Carbon was floated on the stock exchange as a stock corporation in several tranches in 1995 and 1996. Hoechst brought the loss-making business with textile dyes into a newly established joint venture with competitor Bayer , DyStar . This open break with tradition, the original core business of Farbwerke Höchst , also provoked public criticism. On the other hand, the resolute restructuring of the Dormann Group at the end of 1995 earned it the title of Manager of the Year . The group turnover rose in 1995 to over 52 billion DM (1995), the group profit before taxes to 3954 million and in the following year even to 5146 million. In both years, Hoechst achieved the target it had set for itself with a return on equity of 16 percent.

In July 1995 Hoechst took over the American pharmaceutical company Marion Merrell Dow (MMD) for 7.1 billion DM and until the end of 1996 managed all pharmaceutical units of the group, in addition to the pharmaceuticals division of Hoechst AG, the subsidiaries Roussel-Uclaf in France and the Behringwerke in Marburg to form the new Hoechst Marion Roussel division . The pharmaceutical business was therefore given ever greater weight within the portfolio. A large part of the sales came from older, no longer patented drugs. Despite a research budget of 1.6 billion DM annually, there was a lack of new drugs with high sales potential, so-called blockbusters , and 80 percent of the operating profit of Hoechst AG was still generated in Europe, where there was hardly any growth potential, especially in the chemical sector. The number of employees had dropped to 120,000.

“The 1995 financial year turned out to be very successful for Hoechst with high profit growth. Interestingly enough, areas that Dormann actually wanted to separate from the group achieved particularly positive business development. At the same time, the integration of the pharmaceutical company Marion Merrell Dow caused major problems and was associated with high costs. "

In 1996 Hoechst therefore developed the strategy of transforming the company into a Strategic Management Holding and, following the example of Novartis, focusing on the life sciences , i.e. pharmaceuticals and agriculture. In order to play an active role in the expected consolidation of the pharmaceutical market, for example through takeovers or mergers, the chemicals business should be separated. At the end of 1996 the board of directors and the supervisory board decided to sell the specialty chemicals business to the Swiss company Clariant for a 45 percent stake in Clariant. The sale took effect on July 1, 1997. Clariant thus also took over a large part of Hoechst's global infrastructure with numerous plants and national companies. At the same time, Hoechst spun off all remaining operational businesses of Hoechst AG into independent companies: the polyethylene business into Hostalen GmbH, the European polypropylene activities into Targor GmbH, a 50-50 joint venture with BASF. These two companies are now part of Lyondellbasell Industries. The organic base chemicals were transferred to Celanese GmbH. The four locations of Gendorf , Höchst , Knapsack and Wiesbaden used by several business areas were converted into industrial parks with the newly founded operating companies InfraServ Gendorf , Infraserv Höchst , InfraServ Knapsack (today YNCORIS) and InfraServ Wiesbaden . For tax reasons, the companies were given the legal form of a GmbH & Co. KG , in which the limited partner's shares were divided among the major users of the location. InfraServ Verwaltungs-GmbH , a subsidiary of Hoechst AG , became the personally liable partner of all local companies . As a visible sign of the break with the past, Hoechst replaced the well-known corporate symbol tower and bridge with a simple black or blue square. From 1998 the group parent company Hoechst AG consisted only of the Corporate Center , a management staff with around 200 employees.

Despite the transformation into a management holding company, Hoechst was initially unable to find a suitable partner for the life science business. Exploratory talks with Bayer were unsuccessful because Bayer refused an equal merger of equals and insisted on the leadership role. At the beginning of 1997 Hoechst also lost the confidence of the analysts after the company surprisingly had to report a loss of 300 million DM in the pharmaceutical sector for the last quarter of 1996. The pharmaceutical business also declined in 1997 and 1998, although at the beginning of 1997 Hoechst had taken over the remaining 43 percent of the shares in Roussel-Uclaf for 5.4 billion and had received market approval for the European Union for the genetically engineered insulin under the brand name Insuman . The overall result of the group was thus far below expectations and behind the development of the other IG color successors Bayer and BASF , which are still regarded as benchmarks . Profit before tax fell from DM 5,146 million (1995) to DM 3,157 million (1997) or 3,103 million (1998), the return on equity from 16.5 percent to 9.5 percent or 11.3 percent.

A restructuring project in pharmaceutical research that was started as a result led to the targeted cost savings, but triggered considerable protests among the workforce. In the Höchst Industrial Park, pharmaceutical research workers and managers expressed their displeasure in public demonstrations on Monday . The planned IPO of the pharmaceutical division was then canceled, instead Hoechst looked again for a merger partner.

In mid-1998, Dormann and the CEO of Rhône-Poulenc , Jean-René Fourtou , began negotiations. On December 1, 1998, the two companies announced their planned merger. In preparation for the merger, Hoechst sold Hostalen to Elenac , a joint venture between BASF and Shell, in October 1998 . The Wuppertaler Herberts GmbH (Autolacke) was sold to DuPont , the remaining Clariant stake was brought to the stock exchange through a bookbuilding . The polyester fiber business combined in Trevira GmbH went to KoSa, a joint venture between the American Koch Industries, Inc. and the Mexican Saba. The protected brand name Trevira and the business with high-performance polyester fibers and filaments were sold separately and are now owned by the Indian Reliance Group . The previous joint venture Hoechst Diafoil (polyester films) was taken over by Mitsubishi Chemical Corporation.

Finally, Hoechst brought the rest of the chemicals business , which was combined in Celanese AG, to the stock exchange in a so-called spin-off . For every 10 Hoechst shares, shareholders received one Celanese share.

In 1999 Hoechst was one of the 16 founding members of the foundation initiative of the German economy , which raised half of the capital of the foundation “Remembrance, Responsibility and Future” . The main task of the foundation was to compensate former forced laborers from the time of National Socialism. The Hoechst Foundation , founded in October 1996 and endowed with 50 million euros, serves to promote music, theater, art and literature (fine arts), social projects with a focus on health care (Civil Society) as well as science, research and teaching (Science ) . In 2000, she was in Aventis Foundation ( Aventis Foundation renamed).

In 1999, Hoechst, which now essentially consisted of the pharmaceutical sector and the agricultural subsidiary Hoechst Schering AgrEvo , merged with Rhône-Poulenc to form Aventis ; the merger took the form of a public takeover offer in October 1999 by Rhône-Poulenc payable in shares of Rhône-Poulenc (where Rhône-Poulenc was also renamed Aventis). The merged company, at the time the second largest pharmaceutical company in the world by sales, was based in Strasbourg and was listed on the Paris Stock Exchange. The management of the pharmaceutical division was relocated to Frankfurt, the agricultural division in Lyon . Dormann had advocated this construction, since he saw the merger as the only European perspective for Hoechst. Hoechst AG was retained as an intermediate holding company and bundled all of Aventis' German subsidiaries. The share continued to be listed in Frankfurt, but was only rarely traded, as less than four percent of outside shareholders remained. The Hoechst brand, which was traditionally seen at many pharmacies, was gradually abandoned in favor of the new Aventis company logo.

At the end of 2003 the companies of the Hoechst group (as a 98.1% subsidiary of Aventis AG) still employed 15,900 people.

The development since Aventis was founded

In addition to the pharmaceutical and agricultural divisions, Hoechst had brought in a number of investments into the merger, which were sold in the following years. The financial investors Allianz Capital Partners and Goldman Sachs took over the 66.6 percent stake in Messer Griesheim in 2001 . In 2005, Wacker Chemie AG bought back a 50 percent stake from Hoechst's successor, Sanofi-Aventis, which had been owned by the Farbwerke since 1921.

In mid-2004, Aventis merged with the French pharmaceutical company Sanofi-Synthélabo . The new company Sanofi-Aventis became the largest pharmaceutical company in Europe. The merger came after Sanofi-Synthelabo on 26 January 2004 with the support of its major shareholders and the French government in Paris and Exchange AMF had addressed a letter addressed to Aventis shareholders (hostile) takeover offer.

After the takeover, Sanofi-Aventis decided to settle the remaining Hoechst shareholders and take Hoechst AG off the stock exchange. At the last shareholders' meeting of Hoechst on December 21, 2004 in Wiesbaden , the remaining 2 percent of shares were sold by small shareholders to Aventis for € 56.60 each (“squeeze-out”). This result of the two-day meeting amounts to 600 million euros. The actions brought against the resolution of the general meeting were settled in July 2005 by way of a settlement. Sanofi-Aventis took over the entire share capital of Hoechst and canceled the annual general meeting planned for July 29th . In October 2005, Hoechst changed its legal form from a stock corporation to a limited liability company . Today Hoechst GmbH is an intermediate holding company within the Sanofi-Aventis-Group without any operational business.

The largest site of Sanofi-Aventis is still the Höchst industrial park , for which Hoechst AG's development since the end of the 1990s has been generally beneficial. More than 300 million euros have been invested annually in the Höchst industrial park since 2000, which is more than in the best years of Hoechst AG. The number of jobs rose from around 19,000 at the end of the 1990s to around 22,000 in 2005, including around 8,000 at Sanofi-Aventis; in September 2011 the figure was 7 360. In November 2011 it was announced that 333 positions in research and development are to be cut.

The further development of the Höchst industrial park is hardly dependent on Sanofi-Aventis. The largest investment projects between 2008 and 2011 with a total volume of more than one billion euros were the construction of a substitute fuel power plant and the new construction of the Ticona plant, which had to give way to the expansion of Frankfurt Airport .

The Farbenstrasse and the Farbwerke S-Bahn stop are still a reminder of the origins of Hoechst AG.

The company archive was managed from 2000 to 2009 by HistoCom GmbH, which also published numerous publications on the company's history. On September 2, 2009, HistoCom GmbH was reintegrated into Hoechst GmbH. The Hoechst AG company museum was located in the Old Castle in Höchst until the end of 2006 . It is to get a new place in the Bolongaropalast . The exhibition Timeline at the visitor reception of the Hoechst industrial park documents the history of Hoechst AG and the Höchst industrial site.

Important products and processes of the business areas

| product | Period |

|---|---|

| Paints and pigments | |

| Fuchsine , aldehyde green | from 1863 |

| alizarin | from 1869 |

| Eosin , methyl violet , methyl green | from 1874 |

| Patent blue , auramine , rhodamine | from 1888 |

| indigo | from 1900 |

| Thioindigo and other vat colors | from 1905 |

| Hansa yellow - first organic pigment | from 1908 |

| Naphtol AS pigments | from 1912 |

| Remazol and other reactive dyes | from 1954 |

| Medicines - active ingredient (trade name) | |

| Dimethyloxyquinicin (antipyrine) | 1883 |

| Aminophenazon (pyramidon) | 1897 |

| adrenaline | 1904 |

| 4-aminobenzoic acid 2- (N, N-diethylamino) ethyl ester (novocaine) |

1905 |

| Arsphenamine (salvarsan) | 1910 |

| Metamizole (Novalgin) | 1922 |

| insulin | 1923 |

| Pethidine (Dolantin) | 1939 |

| penicillin | 1945 |

| Methadone (polamidon) | 1949 |

|

Tolbutamide (Rastinon) , glibenclamide (Euglucon) |

1956 |

| Furosemide (Lasix) | 1964 |

| Pentoxifylline (Trental) | 1974 |

| Nomifensin (Alival) | 1976-1986 |

| Cefotaxime (Claforan) | 1980 |

| Tiaprofenic acid (surgam) | 1981 |

| Ofloxacin (Tarivid) | 1985 |

| Terfenadine (Teldane) , (in USA: Seldane ) | 1985–1998 (withdrawn in USA) |

| Roxithromycin (Rulid) | 1988 |

| Ramipril (Delix, Tritace ), (in USA: Altace ) | 1990 |

| Cefpodoxime (Orelox) | 1992 |

| Cephalosporins Cefodizim (Modivid) , Cefpirom (Cefrom) |

1993 |

| Fexofenadine ( Telfast ), (in USA: (Allegra) ) | 1995 |

| Glimepiride (Amaryl) | 1996 |

| Leflunomid (Arava) | 1999 |

| Food additives | |

| Sorbic acid and sorbates | 1958 |

| Acesulfame (Sunett) | 1987 |

Since the 1970s, Hoechst had a very complex structure made up of 16 business areas ("GB"), which were designated with letters and each stood for a production division. Business units ("BU") are the business units (sub-units) of a GB.

- A: chemicals

- B: Engineering plastics

- C: agriculture

- D: Fine chemicals and colors (Note: this refers to dyes, color pigments)

- E: Surfactants and auxiliaries

- Q: Fibers and fiber intermediates (with six BU's)

- G: paints and synthetic resins

- H: plastics and waxes

- J: Slides

- K: Information technology

- L: Pharma

- M: Cosmetics companies (Marbert, Jade, Schwarzkopf GmbHs)

- N: Plant engineering (UHDE GmbH)

- O: carbon products ( SIGRI GmbH )

- P: Welding technology, industrial gases (Messer Griesheim GmbH)

- S: Technical ceramics (Hoechst CeramTec AG)

There was also a summarizing rough division into "business areas":

- Chemicals and paints division: GB's A + D + E

- Business field fibers: GB F

- Polymers business area: GB's B + G + H + J

- Agriculture business area: GB C

- Health business area: GB's L + M

- Technology business area: GB's K + N + O + P + S as well as others

Most of the businesses had a very wide range of products. Marketing , product management , sales organization and customer service were organized on a division-specific basis. In some cases, there were still special sales organizations for individual product lines within the divisions, as sausage casings that were to be sold to medium-sized meat processing companies, for example, required a different form of customer service than polyester films for the production of sound carriers and video tapes.

Most of the products were delivered to industrial processors or subsidiaries. With the exception of medicines, Hoechst did not manufacture any products for end users. Subsidiaries mostly took over the assembly of the products for end users with well-known brand names, e.g. B. Glutolin ( paste ), Trevira or Hostalen .

In 1995 the organizational structure of Hoechst AG was fundamentally revised and activities remaining after outsourcing were reduced to seven business areas:

Chemicals (GB A)

In 1995 the Chemicals division achieved sales of DM 5,391 million with 9,900 employees, 25 percent of which with inorganic chemicals (chlorine, fluorine, sulfur and phosphorus compounds), 19 percent with methanol , formaldehyde and acrylates , 19 percent with oxo products and amines , 37 percent with acetyl compounds . The chemicals sector had been one of Hoechst's most important sales and earnings drivers for many years. Numerous processes had been developed or used for the first time at Hoechst, including the Wacker-Hoechst process for the production of aldehydes and the high-temperature pyrolysis of light gasoline carried out from 1959 to 1975 . Many production processes took place in several processing stages, e.g. B. the production of vinyl acetate from acetic acid , which was obtained by oxidation of acetaldehyde . Some of the products in the chemicals division were required by other business divisions of Hoechst AG for further processing, for example vinyl acetate for the production of polyvinyl acetate and polyvinyl alcohol or acetic acid for the production of ketene , diketene and sorbic acid .

An important product in the chemicals sector were the chlorofluorocarbons (CFCs) produced from the mid-1960s to 1994 , which were used as refrigerants and propellants under the brand name Frigen until the danger of halogenated hydrocarbons for the ozone layer was recognized. As a replacement, Hoechst developed the chlorine-free refrigerant 1,1,1,2-tetrafluoroethane (R134a) and, for medical aerosols, heptafluoropropane (R227). This product line was based on chloralkali electrolysis using the amalgam process and methane chlorination , for which Hoechst had developed its own process using a loop reactor . Since 1970 the production of fluoroaromatics has been relocated to the subsidiary Riedel-de Haen, fluoroaliphatics remained at the Höchst plant.

Technical plastics (GB B)

The engineering plastics division formed its own division, which achieved sales of DM 1,441 million in 1995. The division's products included POM ( Hostaform , 45% of sales), thermoplastic polyesters such as PBT ( Celanex , Vandar , 12%), fluoropolymers such as PTFE and PCTFE ( Hostaflon , 17%), ultra-high molecular weight polyethylene ( Hostalen GUR , 7%), PPS ( Fortron , 4%), the liquid crystal polymer Vectra LCP (7%) and cyclo-olefin copolymers (Topas) .

Specialty chemicals (GB D)

This area had the broadest product range of all. Even after the sale of Riedel-de Haën AG, he achieved the second highest turnover with 8,160 million DM and employed 27,865 people. The largest contribution to sales was made by surfactants and auxiliaries, including detergent ingredients ( TAED , SKS-6 ), superabsorbents , glycols for use as brake and hydraulic fluids or antifreeze and de-icing agents, corrosion protection and drilling fluids.

Polymers, including polyvinyl acetate (Mowilith) , polyvinyl alcohol (Mowiol) and methyl cellulose (Tylose ) , contributed 14 percent to sales of the Specialty Chemicals division . Other sales drivers were pigments (16%), fine chemicals (11%), printing technology (10%), textile dyes (7%), additives for plastics processing (5%), masterbatches (4%) and food additives (2%).

Fibers (GB F)

The fibers division was the world's largest manufacturer of polyester and acetate fibers. It comprised the six business units “Fiber Preliminary Products”, “High Strength”, “Spunbond”, “Monofilament”, “Fibers” and “Filaments”. The BU Fiber Preliminary Products (800 employees, 300,000 t / y 1994) supplied not only the other BUs but also external industrial customers with approx. 25% of the polyester chip quantities produced. Their European pre-product plants were located in the Offenbach and Gersthofen plants, in the Münchsmünster plant and at Hoechst Guben, in the Netherlands (Vlissingen) and Portugal (Portalegre).

The 1995 annual turnover of the GB Fibers was 7,195 million DM, which was achieved with 21,445 employees, about half of them with textile fibers. Sales were broken down into the areas of polyester ( Trevira , 54%), polyamide (16%), polyacrylic (10%), other synthetic fibers (9%) and cellulose fibers (10%).

Synthetic resins (polycondensates) (GB G)

With Hoechst's participation in Chemische Werken Albert AG, Wiesbaden, the group expanded its portfolio to include polymeric coating materials in 1964. In 1967 the takeover of Reichhold Chemie AG in Hamburg-Wandsbek followed. Initiated by the personal contacts of Albert and Reichhold, Hoechst acquired shares in the Austrian Vianova Kunstharz AG in Graz from 1969 and incorporated this synthetic resin producer completely into the G division of Hoechst AG until 1976. The main customers for synthetic resin products were all European automobile manufacturers and the industrial paint industry. Following the competitor BASF, Hoechst consistently built up an empire of paint and varnish manufacturers.

- In 1968 Hoechst took over the Schröder and Stadelmann AG paintworks in Oberlahnstein . The company had existed here as a manufacturer of earth and mineral paints since 1871 and started manufacturing semi-finished products for thermoplastics in 1954. In 1975, Hoechst began producing masterbatches for coloring polyolefin plastics and synthetic fibers. In 1991, Hoechst relocated the headquarters of its masterbatch business to Lahnstein. The plant has belonged to Clariant GmbH since 1997.

- In 1969, Hoechst took over the Austrian STOLLLACK AG in Guntramsdorf. It goes back to the founding of the paint and varnish factory Peter Stoll in 1890. Since 1999 sold to DuPont Performance Coatings, since 2013 to the private equity fund Carlyle Group .

- 1970 Berger, Jenson & Nicholson Ltd , the second largest British paint and varnish company , was already represented in 25 countries with 42 paint factories. It was founded in 1790. Sold to Williams Holdings since 1988.

- 1970 the small, innovative Dutch company Wagemakers Lakfabrieken NV, founded in Breda in 1884 . At the same time, the small paint factory Wilhelm Urban & Co. in Wehlheiden, which became known for its ( Kassler brown ) earth color.

- In 1971 initially 25%, then in 1974 the remaining 75% of Spies, Hecker & Co., Cologne, which in 1978 became 'Dr. Kurt Herberts & Co. GmbH 'was incorporated.

- In 1972 Hoechst also took a majority stake in the paint manufacturer Dr. Herberts & Co GmbH in Wuppertal. The company was founded in 1866 by Otto Luis Herberts as a varnish and lacquer boiler. 1999 sold to DuPont Performance Coatings, 2013 to the private equity fund Carlyle Group .

- 1974 Flamuco GmbH in Munich and Stuttgart as a varnish and paint manufacturer with a paint specialist chain . The Swiss subsidiary Flamuco-Merz AG in Pratteln was incorporated into Hoechst AG in 1984 as Spies Hecker AG . Since 1999 sold to DuPont International Operations Sàrl.

Starting in 1970, water-soluble resins were developed for their own synthetic resin production based on classic phenol, polyester, epoxy, acrylic and alkyd resins, primarily for anaphoretic dip painting, five years later for cataphoretic dip painting (resydrol). Additional production capacities (approx. 250,000 tpy worldwide, market share approx. 30%) were created at foreign locations. In addition to competitor BASF, the American PPG Industries Lacke GmbH , which had previously taken over the German manufacturer Wülfing, offered comparable automotive coating systems in Europe . In automobiles today, a cataphoretic deposition is carried out on the body as the first layer, the second layer is based on alkyd resins and the outer skin is sealed with an acrylic resin. UP resins are used in large quantities in wind turbines.

On October 1, 1995, Hoechst outsourced its synthetic resin business as Vianova Resins GmbH , which was founded in 1998 by an investment bank consortium ( Deutsche Bank and Morgan Grenfell Equity Partners), in 2000 by Solutia , in 2002 by UCB (Union Chimique Belge) and most recently in 2005 by Cytec (USA) was acquired. In 2012, Cytec spun off its synthetic resin business through the private equity fund Advent International . It has been operating as Allnex (Belgium) since 2013 .

Plastics (polymers) (GB H)

The plastics division employed 5,335 people in 1995 and achieved sales of 3,603 million DM. As early as 1955, Hoechst was the first company in Europe to manufacture polyethylene (Hostalen) using the Ziegler-Natta process, and from 1958 also polypropylene (Hostalen PP) . From 1985 Hoechst carried out research in the field of metallocene catalysts ; However, the developments were no longer ready for the market before the redesign of Hoechst. Hoechst generated around a third of sales in the Plastics division with films, including polypropylene films, polyester films and rigid PVC films (for example for credit cards or furniture coatings).

Information technology (GB K)

In 1972 the information technology division was founded at Kalle AG. The Europe-wide distribution of photocopiers was started. In 1974 Infotec was the first in Europe to introduce the fax machine into the fax market with the Infotec 6000 digital fax machine. The technology of the Infotec 6000 was the basis for the Group 3 standard that is still valid today. In 1987 the first digital copier Infotec 5020 followed. In 1990 Infotec was sold by Hoechst AG to the Dutch HCS group.

Pharma (GB L)

Following the takeover of Marion Merrell Dow (MMD) in 1995, the pharmaceuticals division achieved annual sales of DM 11.5 billion, with MMD having been included since the middle of the year.

Some of the top 10 drugs have been produced for decades. The list of the top-selling products of the Pharmaceuticals division for the financial years 1990 to 1998 comprises a total of 15 drugs, five of which were in the top 10 over the entire period and two were taken over by MMD. The share of the top 10 in total pharmaceutical sales was between 34.9 and 43.6 percent in all years, with an average of 39.4 percent.

| Active ingredient ( trade name ) | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | Total turnover million DM |

Share of sales % |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pentoxifylline ( Trental ) | Circulatory disorders | 593 | 658 | 670 | 633 | 585 | 637 | 701 | 715 | 467 | 5,659 | 5.8% |

| Cefotaxime ( Claforan ) (a) | antibiotic | 684 | 675 | 584 | 603 | 589 | 468 | 503 | 543 | 452 | 5.101 | 5.2% |

| Diltiazem ( Cardizem ) | Ca anthagonist (high blood pressure) | 681 | 1,418 | 1,478 | 1,433 | 5.010 | 5.1% | |||||

| Furosemide ( Lasix ) | Diuretic | 381 | 403 | 400 | 370 | 381 | 371 | 449 | 454 | 444 | 3,653 | 3.7% |

| Glibenclamide ( Daonil ) | diabetes | 382 | 439 | 528 | 541 | 342 | 285 | 361 | 347 | 325 | 3,550 | 3.6% |

| Roxithromycin ( Rulid ) | antibiotic | 189 | 277 | 349 | 413 | 441 | 451 | 419 | 455 | 422 | 3,416 | 3.5% |

| Ramipril ( Delix , Tritace ) | ACE inhibitors (high blood pressure) | 224 | 292 | 351 | 479 | 609 | 710 | 2,665 | 2.7% | |||

|

Terfenadine ( Teldane ) and Fexofenadine ( Telfast ) |

Antihistamines (antiallergics) | 334 | 748 | 548 | 853 | 2,483 | 2.5% | |||||

| Metamizole ( Novalgin ) | Non-opioid analgesic | 191 | 208 | 228 | 253 | 253 | 322 | 347 | 387 | 2,189 | 2.2% | |

| Ofloxacin ( Tarivid ) (b) | antibiotic | 204 | 237 | 237 | 252 | 274 | 297 | 1,501 | 1.5% | |||

| Disopyramide ( Rythmodan ) | Cardiac arrhythmias | 171 | 202 | 184 | 228 | 253 | 242 | 1,280 | 1.3% | |||

| ( Human insulin ) | diabetes | 136 | 153 | 173 | 308 | 770 | 0.8% | |||||

| Factor VIII | Blood coagulants | 147 | 162 | 200 | 209 | 718 | 0.7% | |||||

| Tiaprofenic acid ( surgam ) | Non-steroidal anti-inflammatory drug | 170 | 186 | 356 | 0.4% | |||||||

| Propentofylline ( hextol ) | Alzheimer's disease | 212 | 212 | 0.2% | ||||||||

| Top 10 | 3,044 | 3,363 | 3,520 | 3.711 | 3,585 | 4,072 | 5,674 | 5,793 | 5,801 | 38,563 | 39.4% | |

| Other | 5,021 | 5,647 | 5,916 | 6.226 | 6,691 | 6,362 | 7,346 | 8,179 | 7,936 | 59,324 | 60.6% | |

|

(a) 1980, withdrawn from the French subsidiary Roussel Uclaf.

(b) Licensed product from Japan.

|

||||||||||||

The list of the 10 top-selling drugs from Hoechst had three particularly high-growth drugs:

- Diltiazem ( Cardizem , product acquired from MMD)

- Terfenadine ( Teldane ) (from Hoechst) and further development fexofenadine ( Telfast , Allegra , from MMD)

- Ramipril ( Delix , Tritace , von Hoechst)

Their patents expired between 1999 and 2005.

Plants and subsidiaries